Inefficient vat administration as a threat to Russia's economic security

Автор: Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Management issues

Статья в выпуске: 2 (26) т.6, 2013 года.

Бесплатный доступ

Under the conditions of constant budget deficit and high debt burden, the search for funding sources of Russia’s economic growth has become an acute issue. One of such sources is value-added tax (VAT), which forms over 50% of the federal budget tax revenues. At the same time, the current system of VAT administration does not meet the requirements of the country’s economic development. The possibility of legal tax refund can lead to tax evasion, the extent of which is estimated at about two trillion rubles. At that, tax management measures concerning VAT, despite the high costs of their implementation, do not bring the desired effect. By analyzing VAT administration practice, the author proposes a set of measures that will provide, through the introduction of amendments in tax legislation, a significant increase of budget revenues from value added tax.

Vat, tax administration, export vat refund, optimization of privileges and exemptions

Короткий адрес: https://sciup.org/147223443

IDR: 147223443 | УДК: 336.271

Текст научной статьи Inefficient vat administration as a threat to Russia's economic security

Value added tax was introduced in 1992 to replace the then turnover tax.

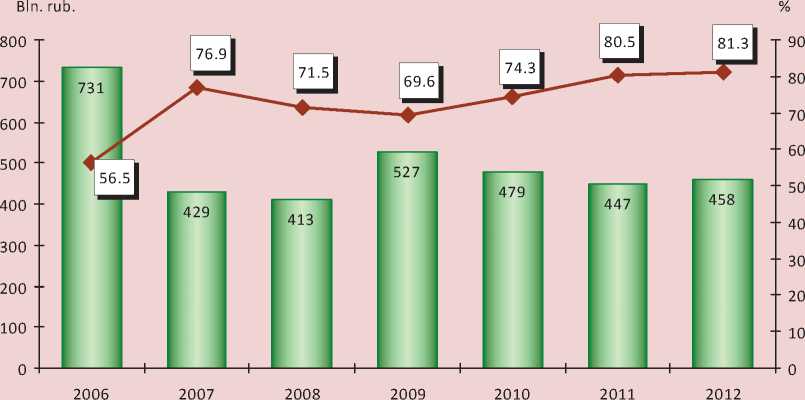

VAT is a systematically important tax that provides 40 – 50% of the federal budget revenues. An important fiscal peculiarity of this tax consists in the fact that, due to a wide-scale tax base, it is less susceptible to market fluctuations of prices for raw materials and energy than other taxes, which is proved by a rather stable dynamics of VAT share in the federal budget revenues (fig. 1). VAT collecting is based economically on the act of goods turnover rather than the financial result, the fact that distinguishes VAT from profit tax to the advantage of the former.

At the same time, VAT administration is connected with serious problems. Being an organizational and managerial system of implementing tax relations, tax administration comprises regulation and control methods, the use of which is intended to ensure planned tax revenues in the budget. However, the value added

Figure 1. Dynamics of VAT revenues to the federal budget of the Russian Federation in 2000 – 2011

Bln. rub. In % to federal budget revenues*

* Excluding the revenues from foreign economic activity. Sources: Treasury of Russia; author’s calculations.

taxation methodology contains a contradiction, because tax base is determined by the amount of revenue or profit from the realization of the entire aggregated value1, rather than the amount of value added, this was the essence of transition from turnover tax to VAT.

A well-known indicator of VAT administration quality is represented by the tax collection coefficient, which represents the ratio of the amount of actually received VAT to the amount of tax debt (fig. 2). This coefficient can also indicate the efficiency of the fiscal function of VAT, because debt is an important budget reserve that remains unrealized.

In 2006 – 2012, the dynamics of VAT collection rate was similar to the dynamics of tax arrears. The obtained values of the coefficient indicate that there are certain reserves for increasing VAT collection rate to 20% due to the elimination of existing debt.

The most significant parameter of VAT administration quality, applied in the world practice, is the efficiency ratio (Co-efficiency), which shows what percentage of the base (final consumption) is effectively taxed, and is calculated by the formula:

Co-efficiency =

VAT collections

VAT standard rate x final consumption

The increasing value of the coefficient (at a maximum, equal to 1) indicates a high quality of tax administration.

Using the data of the Treasury of Russia and Rosstat, the author makes an attempt to evaluate the efficiency of VAT administration in the Russian Federation (tab. 1).

The assessment results showed a significant reduction of VAT efficiency ratio – from 0.52 in general for 2000 – 2007 to 0.43 for 2008 – 2011, which indicates the decline in VAT collection, and hence the low quality of the tax administration mechanism. It should be noted

Figure 2. Dynamics of the arrears of VAT payable to the budget and VAT collection rate in 2006 – 2012

I1 Arrears, bln. rub. ♦ Collection coefficient, %

Source: Federal Tax Service of Russia; author’s calculations

Table 1. Assessment of VAT administration efficiency in 2000 – 2011

What is the reason for such a low quality of VAT manageability in the Russian Federation?

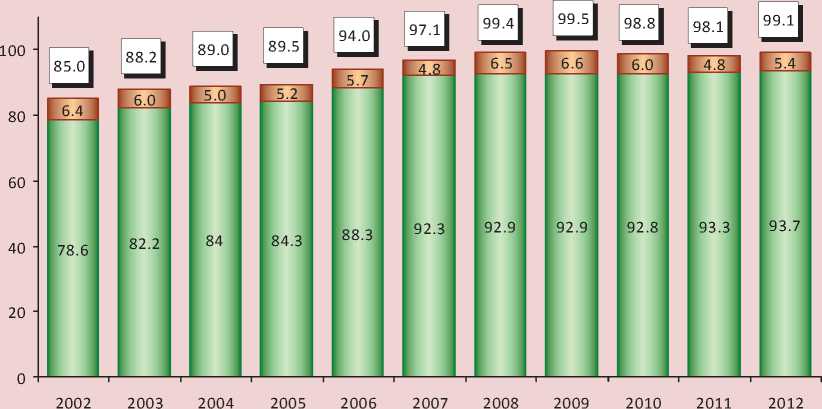

The fact is, that the tax structure that allows many of tax preferences2 to be applied, leads to a significant reduction of budget funds. The share of tax deductions and refunds in the amount of VAT, calculated on the tax- able objects, reached 99% in 2012 against 85% in 2002 (fig. 3).

Moreover, with the overall increase in the added value, the growth rates of VAT deductions exceeded the growth rates of accrued tax (fig. 4).

According to the forecast of the Russian Federation Finance Ministry, the share of tax deductions alone will amount to an average of 93% in 2013 – 2015. Therefore, while preserving the existing tendencies of increasing exemptions and refunds, the volume of tax deductions can, in the medium term, achieve the total volume of accrued VAT, which contradicts the essence of the tax and poses a threat to the country’s economic security.

Figure 3. Share of tax deductions and refunds in the amount of calculated VAT in 2002 – 2012, %

□ Tax deductions □ Refunds

Source: author’s calculations based on the data by the Federal Tax Service of Russia.

Figure 4. Dynamics of growth rates of accrued VAT and tax deductions in 2003 – 2012, % to the previous year

I----1 Accrued VAT I----1 Tax deductions * Gross value added, trln. rub.

Sources: Rosstat; Federal Tax Service of Russia; author’s calculations.

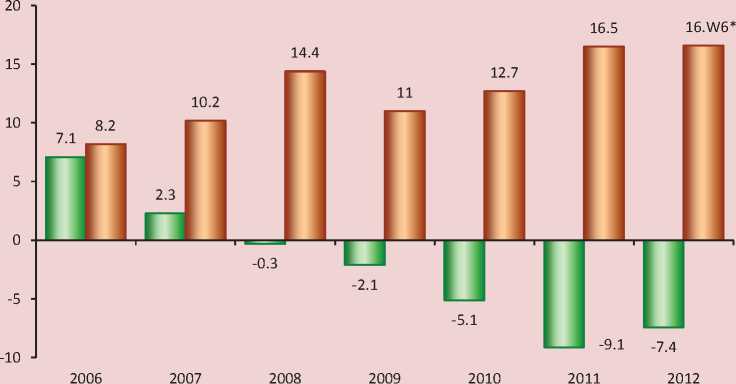

In addition, collected/accrued VAT volumes ratio indicates a negative tendency of increasing number of tax evasions. For instance, the tax revenues accounted for 88% of the planned amount in 2006 and for only 56% in 2012 (fig. 5). This tendency has in many respects resulted from the new order of VAT payment by the accrual method, introduced in 2006, which formalized the taxpayers’ rights to VAT refund if an invoice for the purchase of goods is available, even if the goods have not been paid for.

The refund of VAT on export operations arouses particular concern, as in 2006 – 2012 the volume of indemnifiable taxes amounts to approximately 80% of the amount of VAT received by the budget (tab. 2) .

Before the adoption of the Tax Code, VAT refund was not effected. The introduction of the code established a mechanism of tax calculation and payment, stipulating, at the zero rate of VAT on export sales, the full refund of the tax paid by exporters to their suppliers.

Figure 5. Dynamics of accrued and received VAT* in 2006 – 2012

Biln. rub. %

I J VAT accrued L J VAT received 1— —VAT received to VAT accrued, %

* VAT on the goods, work, and services, realized on the territory of the Russian Federation. Sources: Federal Tax Service of Russia; author’s calculations.

Table 2. Dynamics of VAT collection and refund in 2000 – 2012, billion rubles

|

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

|

VAT revenues* |

270 |

477 |

532 |

619 |

749 |

1026 |

924 |

1390 |

998 |

1177 |

1329 |

1985 |

1886 |

|

VAT refund |

97 |

212 |

239 |

299 |

331 |

455 |

707 |

749 |

1104 |

1149 |

1185 |

1202 |

1558 |

|

In % to revenues |

36.0 |

44.4 |

44.9 |

48.3 |

44.1 |

44.4 |

76.5 |

53.9 |

110.6 |

97.6 |

89.2 |

60.6 |

82.6 |

|

* VAT on the goods, work, and services, realized on the territory of the Russian Federation Sources: Federal Tax Service of Russia; Treasury of Russia; author’s calculations. |

|||||||||||||

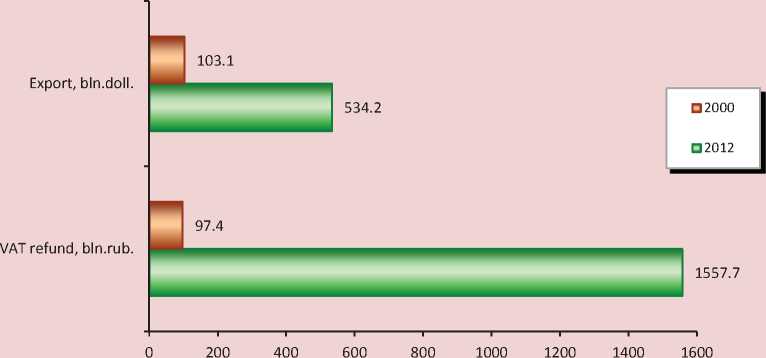

Figure 6. Volume of exports and refund of VAT to exporters in 2000 and 2012

The general condition for applying the zero rate consists in the confirmation of the right by necessary documents.

In itself VAT refunds to exporters is a conventional world practice in foreign trade operations that stipulate VAT payment on the territory of the importing country. Originally, VAT refund was introduced for avoiding double taxation and ensuring the competitiveness of Russia’s goods abroad. However, Russia started using the VAT refund mechanism to pump out huge budgetary funds, which is proved by the growing imbalances in the growth dynamics of refunded sums and export operations. According to the tax and customs statistics, the amount of VAT refund to exporters increased 16-fold in 2000 – 2012 given a 5.2-fold increase in the export of Russian goods (fig. 6).

The largest exporters account for the major part of refunds. Unfortunately, the absence of appropriate tax reporting has not allowed the exact sum of these VAT refunds to be determined. Meanwhile, the statistics of Russia’s Federal Customs Service (FCS) provides the opportunity for a quantitative evaluation of VAT refund to large exporters.

According to these statistics, the share of natural resources3 and chemical industry products in 2006 – 2012 amounted to an average of 76% in the total volume of goods shipped for export. If we project this indicator onto the total amount of VAT refunds, it turns out that the tax refund to the largest exporters was equal to nearly 6 trillion rubles, or 0.8 trillion rubles annually (tab. 3) .

Judging by the data, about 60% of VAT allocations to the federal budget were reimbursed to several exporters of raw materials and primary processing products3, which actually devalued their role in the formation of aggregated tax. The share of major exporters in the total volume of VAT revenues for the specified period on the average did not exceed 10%. At that, in 2008 – 2012, the arrears of VAT revenues to the federal budget were increasing. Of course, the promotion of commodity exporters that do not face such competition in the external markets, as exporters of finished products do, reduces the opportunities for diversification of export.

Table 3. VAT refunds to large exporters in 2006 – 2012, billion rubles

|

Indicators |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

Volume of export effected by large exporters* |

228.6 |

263.9 |

363.8 |

221.3 |

298.9 |

401.6 |

364.8** |

|

Share in the total volume of RF export, % |

75.7 |

74.9 |

77.7 |

73.4 |

75.4 |

77.8 |

76.4 |

|

VAT refunded to large exporters |

535.1 |

560.9 |

858.0 |

843.0 |

893.2 |

935.5 |

1190.1 |

|

In % to the total amount of VAT revenues |

57.9 |

40.3 |

85.9 |

71.6 |

67.2 |

47.1 |

63.1 |

|

VAT revenues from large exporters |

157.4 |

365.2 |

34.1 |

1.9 |

27.2 |

136.4 |

157.3 |

|

In % to the total amount of VAT revenues |

17.0 |

26.3 |

3.4 |

0.2 |

2.0 |

6.9 |

8.3 |

|

Arrears of VAT revenues by large exporters |

26.9 |

4.5 |

5.8 |

6.8 |

6.7 |

6.9 |

8.0 |

|

* Billion dollars. ** January – November 2012. Sources: Federal Customs Service of Russia; Rosstat, Federal Tax Service of Russia; author’s calculations. |

|||||||

The deterring role of VAT in technological development and the overcoming of structural imbalances in Russia’s economy are proved by the branch-wise structure of VAT revenues, showing that the main burden of the tax payment weighs on the manufacturing industry, which, of course, limits the inflow of investments in production sphere. The most profitable economic sectors4 have minimal debt load. So, for 2007 – 2012, the share of VAT revenues from manufacturing enterprises5 increased from 13.6% to 20.2%, and from the enterprises of extraction industry, on the contrary, decreased from 28% to 10.4%. As for the subjects of financial activities, they accounted for slightly more than 2% of tax revenues (tab. 4).

Chemical and metallurgical industries are the most troubled ones with regard to VAT reimbursement, due to the fact that in 2006 – 2012 VAT refund to these industries manifold exceeded its revenues. As a result, Russia’s consolidated budget has lost 321 billion rubles, or a quarter of the total volume of tax payments received from metallurgical and chemical industries (tab. 5) .

For example, VAT refunds to Novolipetsk Steel (NLMK) alone caused the Lipetsk Oblast in 2008 to gain the status of ‘red’ region in its relations with the federal budget. This means that the amount of money, which the territory’s budget returns, exceeds the amount of taxes this territory allocates to the budget (fig. 7).

Similarly, along with the reduction of the overall tax burden and the increasing arrears in payments in the budget system6, in 2006 – 2011 the volume of VAT submitted to the refund by the largest metallurgical holdings OAO Severstal (Vologda Oblast) and Magnitogorsk Iron and Steel Works (Chelyabinsk Oblast), was 35 and 42 billion rubles, respectively [5].

The scale of refunds to metallurgical and chemical companies indicates the emergence of a kind of business, based on gaining profit from the budget reimbursement of VAT.

Flaws in tax administration with regard to the application of zero rate on export operations are a favourable ground for unjustified claims concerning VAT refund. Meanwhile, the powers of tax authorities to control the legitimacy of VAT refund are reduced mainly to their control over the execution of tax obligations by the exporters’ suppliers. However, such control is hampered by the fact that the supplier’s obligation to direct the VAT received from the exporter to the budget is not even stipulated

Table 4. Sectoral structure of VAT revenues in 2007 – 2012, %

|

Industry |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

Mining operations |

27.9 |

11.9 |

5.8 |

7.4 |

9.8 |

10.4 |

|

Manufacturing |

13.6 |

12.5 |

15.5 |

17.3 |

17.4 |

20.2 |

|

Building |

11.8 |

17.8 |

15.2 |

13.3 |

13.3 |

14.7 |

|

Trade |

6.5 |

9.0 |

11.8 |

13.2 |

16.5 |

12.5 |

|

Transport and communications |

11.8 |

13.8 |

16.8 |

14.6 |

13.0 |

11.9 |

|

Financial activities |

2.1 |

2.7 |

3.8 |

2.7 |

2.1 |

2.1 |

|

Real estate operations |

6.3 |

8.2 |

11.9 |

14.4 |

14.1 |

15.6 |

|

Other |

20.0 |

24.1 |

19.2 |

17.1 |

13.8 |

12.6 |

|

Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

|

Sources: Federal Tax Service of Russia; author’s calculations. |

||||||

Table 5. Balance of VAT received from chemical and metallurgical production in 2006 – 2012, billion rubles

|

Production |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2006 – 2012 |

|

Chemical |

-10.2 |

-10.5 |

-12.9 |

-12.2 |

-13.9 |

-14.7 |

-18.8 |

-93.2 |

|

Metallurgical |

-26.3 |

-25.7 |

-47.4 |

-50.3 |

-39.3 |

-20.5 |

-18.4 |

-227.9 |

|

Total |

-36.5 |

-36.2 |

-60.3 |

-62.5 |

-53.2 |

-35.2 |

-37.2 |

-321.1 |

|

In % to the amount of all the taxes received from these industries |

18.8 |

13.9 |

22.1 |

125.8 |

33.1 |

16.1 |

18.2 |

24.6 |

|

Sources: Federal Tax Service of Russia; author’s calculations. |

||||||||

Figure 7. Tax revenues from the Lipetsk Oblast to the federal budget and VAT refund to NLMK from the federal budget in 2006 – 2012, billion rubles

□Tax revenues in the federal budget □VAT refund to NLMK

* In January – September 2012.

Sources: Federal Tax Service of Russia; OJSC NLMK consolidated statements.

by the tax legislation. Besides, the variety and complexity of the structure of export chains can not always be controlled and it makes it difficult to trace the completeness of VAT payments. Inspections prove that the subjects of such chains often consist of fictitious counterparties (the so-called fly-by-night companies), to which the tax base is shifted through transfer pricing, after that the funds are cashed or transferred to other companies. Along with flyby-night companies, unscrupulous taxpayers employ other schemes of tax minimization, for instance, the forgery of invoices and export documents, overpricing of purchased materials, etc. According to expert estimates, the annual losses of the federal budget caused by such offences amount to 1.5 – 2 billion rubles [9].

According to the Accounts Chamber of the Russian Federation, the unresolved issues concerning the state registration of legal entities greatly contribute to illegal VAT refund through the establishment of sham structures [4].

The materials of the Accounts Chamber inspections suggest that the schemes of illegal VAT refund through such structures are being widely used by taxpayers. For the 2000 – 2011 period, the number of organizations, which have not submitted reports, or presented ‘zero accounting’ reports to tax authorities increased 4.2 times and exceeded two million, i.e. 40% of the total number of organizations registered by tax authorities ( fig. 8 ).

In addition, the present system of export VAT administration is not efficient enough as it causes significant expenses in tax compensation from the budget. In a way, this issue applies to all tax exemptions, but administrative costs are especially noticeable with regard to VAT.

Figure 8. Dynamics of the number of organizations, which have not submitted tax reports, or presented ‘zero accounting’ reports

I-----1 Number of organisations, thsd. units =0=- In % to the number of registered organisations

In order to combat illegal VAT refund, tax authorities have to carry out labour-consuming control activities, which take about a year on average 7 , thus delaying tax refunds to bona fide taxpayers. As a result of untimely VAT refund, the federal budget incurs interest payment losses, the volume of which totaled 10 billion rubles for the 2008 – 2012 period [14].

Value added tax is the most ‘expensive’ tax for fiscal regulations, due to numerous peculiarities and difficulties in determining tax base. According to experts, about 40% of collected VAT is spent on supplying tax inspections, and 60% of the work done by accounting departments of enterprises and organizations is related to tax servicing operations [3].

Without giving too many examples of VAT administration low efficiency, it should be acknowledged that the debate concerning VAT reform has intensified in recent years, which is mainly due to the search of sources of Russia’s modernization.

According to I.A. Mayburov, Doctor of Economics, “at present VAT exhibits the greatest corruption capacity. Without the tax reform, it is impossible to stop the growing flow of budgetary compensation based on various schemes of ungrounded export VAT refund” [10].

Different variants for reforming are suggested, comprising such radical ones as the cancellation of VAT refunds on export goods. N.A. Krichevsky, Doctor of Economics, takes assertive position on the matter. In the article ‘Corruption caused by refund’, he writes the following: “The order to all the political parties: it is your duty to include in the programmes the issue concerning the cancellation of value-added tax (VAT) refund on export of natural resources! The current refund practice violates the Constitution, as well as makes a trillion hole in the federal budget” [8].

M. Abramov, the Vice-President of Expert Analytical Centre ‘Modernization’, holds a similar view point, denoting VAT as the evil root of Russia’s tax system: “It is absurd to encourage exporters for depriving local producers of the opportunity to add their labor cost to the processing of national natural resources and for damaging national wealth”.

According to the ‘FinExpertiza’ company experts, it is necessary to move from offsetrefund tax calculation mechanism to a fundamentally different tax calculation methodology based on the balance method, in which added value, included in the cost of sold products is viewed as tax base. The experts claim that such approach will reduce about one-third of VAT administration costs and to some extent minimizing the risks related to tax evasion [14].

It should be noted that an initiated application of the new VAT calculation methodology provoked sharp disputes among financial services, entrepreneurs and the expert community, in particular. Many believe VAT calculation per direct scheme to be simpler, however, the Finance Ministry of the Russian Federation states that appropriate action will require the whole VAT system restructuring.

According to the author, with VAT levied directly from added value, tax administration procedure will become easier, on the one hand, as accounting records for tax calculation and tax inspections will be the same as for income tax. On the other hand, the direct method of calculation will hardly solve the ‘tax evaders’ issue. The amount of profit and salary budget, which are the major components of added value, is determined by internal (primary) accounting, often provoking negligent taxpayers to diminish this amount for tax calculation purposes.

Direct scheme suggests VAT transformation from indirect to direct taxes, and shadow profit and hidden wages are known to be formed precisely in the field of direct taxation.

Anyway, the conception of additive VAT calculation methodology is to be substantiated by preliminary estimates of probable consequences of its application.

It may well be true that VAT administration issues exist not only in Russia. Mass tax evasion is typical even for the European countries with the most developed VAT system. Estimated annual losses caused by tax transgressions in the EU countries amounted to 4.5 billion euro [12].

In world practice, there are various methods to combat illegal VAT refund. In Bulgaria, for example, VAT bank account system has been in operation 8 . In the Philippines and Indonesia, special independent body on VAT refund has been established. In Great Britain, the unification of all VAT rates at 5% level with the maximum rate of 17.5% has been actively lobbied as the most effective solution to the problem. In the Czech Republic and Portugal, all participants of an export chain are deprived of the right to VAT refund once sham contractors are revealed. One has to admit, however, that by now neither Russian, nor foreign legislation have found universal solutions to the problem of illegal VAT refund from the budget. This sort of tax risks induces tax authorities of different countries to actively cooperate in the VAT regulatory sphere.

Based on results of the conducted analysis, the author makes several suggestions to improve the functioning mechanism of export VAT administration.

-

1. In order to stimulate increase in export of high value-added products, it is reasonable to preserve the former VAT refund order for

-

2. It is necessary to introduce the sliding scale of VAT refunds for the exporters shipping low value-added products (semifinished products), and step-by-step abolition of VAT full compensation for raw materials exporters9.

-

3. In order to counteract the creation of ‘grey schemes’, a norm setting the right for the refund of only the real VAT amount paid to the budget should be introduced into the tax legislation. This, in its turn, includes the establishment of an inter-ministerial operational and statistical information sharing system. Increase in the requirements to the minimum level of authorized capital for the banks11, which are an integral part to the tax-evasion schemes with the use of ‘overnight’ shell companies may be a major step forward in that direction.

Table 6. Forecast estimate of potential additional budget revenue due to introduction of differentiated rates on export VAT refund

Indicators

Oil, oil derivatives, gas

Non-ferrous metals, ferrous metals

2013

2014

2015

2013

2014

2015

VAT rates

18%

10%

18%

5%

18%

0%

18%

16%

18%

12%

18%

6%

Export, billion dollars

315.5

324.2

332.5

46.0

50.6

54.0

VAT refund, billion dollars

56.8

31.6

58.4

16.2

59.9

0

8.3

7,4

9,1

6,1

9,7

3,2

Additional budget revenue

billion dollars

25.2

42.2

59.9

0.9

3.0

6.5

billion rubles

816.5

1392.6

2018.6

29.2

99.0

219.1

-

4. Base interest rate cut and the setting of VAT flat rate (e.g.: in the 12 – 16% range) along with the abolition of all tax incentives can be considered as one of the VAT reformation variants. Transition to the flat rate will simplify tax administration, as several rates being in operation complicate tax calculations, increase errors possibility and create additional conditions for ungrounded tax refund realization. Probable VAT revenue decline once the flat rate is set, may be compensated by extending some types of excises and establishing luxury tax.

-

5. It is required to institute a VAT taxpayers registration system that would contribute to a partial solution to the problem of illegitimate tax refund. It might be worthwhile to fix a three-year term since the moment of registration during which the organization has no right to claim tax refund.

-

6. In order to develop efficient electronic workflow system for processing invoices, the norms regulating mandatory transition of all taxpayers to sharing electronic invoices are to be specified in the Tax Code of the Russian Federation. This will enable tax authorities to operatively keep track of invoices within the supply chain from the consumer to the first supplier and to resolve VAT refund issue.

the exporters supplying high value-added products. Such approach will correspond to the strategic objectives of creating modernization economy.

According to the author’s estimates with key industries of Russian exports used as an example, potential additional revenue of the federal budget received due to introduction of differentiated VAT rates for the 2013 – 2015 period will amount to 4575 billion rubles, i.e. 1525 billion rubles annually10 (tab. 6) .

Evidently, the matter concerning tax base broadening and VAT collection improvement goes beyond export VAT refund issues and requires adopting the package of measures to optimize a great number of internal VAT exemptions12.

More than 90% out of the total tax exemptions fall at the financial sector of economy (banks, insurance organizations), the sum of which grew from 0.8 to 4.6 trillion rubles for the 2004 – 2012 period, i.e. almost sixfold (fig. 9) . In fact, acting legislation leaves the financial service sector tax-free, thereby violating the equity principle, one of tax system basic principles. According to the author’s estimates, the abolition of VAT exemptions for subjects of financial activity will add 3 – 5 trillion rubles to federal coffers.

Taking into account VAT administration experience in OECD countries, the author considers it necessary to reduce all the exemptions to standard ones, such as public and quasi-public goods [6].

Enhancing the effectiveness of monitoring functions is to become the essential component of VAT reforming. This can be achieved through establishing the inter-ministerial control system that is to be based on cooperation between tax, law enforcement and customs authorities, and searching for methods assessing tax-evasion risks as the top operating priority.

Figure 9. Dynamics of VAT exemptions for financial activities in the 2004 – 2012 period

I I Number of organisations, thsd. units =0= In % to the number of registered organisations

Sources: Tax Code of Russia; Federal Tax Service of Russia; author’s estimates.

Thus, the issue concerning VAT administration improvement, primarily providing control over tax refund and exemption, becomes a strategic objective of Russia’s economic safety. Legislative adjustment of the functioning VAT regulation system will be a substantial reserve for the federal budget, and will be able to increase annual tax revenues by 4.5 – 5.5 trillion rubles, as estimated by the author.

Список литературы Inefficient vat administration as a threat to Russia's economic security

- Bukina I. Experience of evaluation of efficiency of tax administration abroad. Federalizm. 2012. No. 4. P. 151.

- Drobyshevsky S., Malinina T., Sinelnikov-Murylev S. Main directions of tax system reform in the medium term. Economic policy. 2012. No. 3. P. 20.

- Zaikina O. Direct Сounting. Expert. 2007. No. 43. P. 17.

- Reports of the Accounts Chamber of the Russian Federation on the federal budget performance for the 2000 -2011 period. The Accounts Chamber official website. Available at: http://www.ach.gov.ru/ru/expert/follow-up/

- Ilyin V.A., Povarova A.I., Sychev M. F. The Influence of the interests of metallurgical enterprises owners on socio-economic development. Vologda: ISEDT RAS, 2012.

- Kazakova M., Knobel A., Sokolov I. Quality of VAT administration in OECD countries and Russia. Reform of the Russian system of tax collection. Official website of Institute for the Economy in Transition. Available at: http://www.iep.ru/ru/publikacii.html

- Kinzhabaeva Ye. B. The development of scenario-based approaches to VAT system changes in the Russian Federation. Russian agrofood policy. 2012. No. 5. P. 68.

- Krichevsky N.A. Corruption caused by refund. Moskovskij Komsomolets. 2011. No. 25715. Available at: http://www.mk.ru/politics/russia/article/2011/08/09/613000

- Meloyan V.S., Sattarova N.A. The issues concerning export VAT refund in Russia. Available at: http://www.lawmix.ru/bux/56304/

- Tax planning and taxation optimization. Available at: http://www.pnalog.ru/material/

- Tax Code of the Russian Federation. Computer-based legal research programme ‘ConsultantPlus’.

- Pakhatinsky E.V. The problem of documentary confirmation of exports related to the justification of 0% tax rate when refunding VAT to exporters Finance, money, investments. 2006. No. 5. P. 14.

- VAT administration complexity raises questions. Russian Tax Portal. Available at: http://taxpravo.ru/

- Experts: VAT reforming process is going to be tough for everyone. Available at: http://www.audit-it.ru/news/account/78246.html