Inflow of foreign direct investments in Russia's regions: potential and risk factors

Автор: Izotov Dmitrii A.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Regional economy

Статья в выпуске: 2 (62) т.12, 2019 года.

Бесплатный доступ

The Russian economy is closely integrated with the world capital market and at the same time possesses visible regional differences in the dynamics of foreign direct investment (FDI). The goal of our research is to carry out quantitative assessment of the factors that promote the inflow of FDI to Russia's regions in 2011-2017 within the framework of aggregated and private indicators of risk and potential. The estimates we have obtained indicate that the aggregate investment potential has a positive impact on FDI inflows to the regions. We find out that as the risks for the domestic economy increase, the statistically significant inverse correlation between FDI inflows and the aggregate investment risk index ceased to be observed since 2014, alongside the remaining visible convergence between Russia's regions on this indicator. Our estimates suggest that without overcoming the high risks generated by the national economy as a whole, the reduction in aggregate risks between Russia's regions does not play a significant part in increasing FDI inflows. In accordance with our assessment, we determine that the regional dynamics of FDI inflows in 2011-2017 was explained by some private indicators of investment risk and potential, which, in general, had a reverse and direct impact on the dependent variable, respectively. The specific characteristics of Russia's regions significantly adjusted the importance and the ratio of FDI attraction factors, so the obtained values of the corresponding elasticities indicated a difference rather than a commonality of private indicators of risk and potential, the indicators that drive the inflow of direct investment to the Far East compared to other regions of Russia. This fact probably confirms the need for differentiated policies to attract FDI to the economy of the Far East in comparison with other regions. Since our research reflects the relative impact of risk and potential factors on FDI inflows for Russia's regions that exist in the single institutional and economic space, the estimates we have obtained can be supplemented by a more detailed study of the role of Russia's potential and risk compared to other national economies.

Foreign direct investment, investment potential, investment risk, aggregate and private indicators, elasticity, fixed effects, Russia, region, far east

Короткий адрес: https://sciup.org/147224170

IDR: 147224170 | УДК: 330.322 | DOI: 10.15838/esc.2019.2.62.3

Текст научной статьи Inflow of foreign direct investments in Russia's regions: potential and risk factors

Exchanging direct investment between economies is a key element of global investment cooperation. Being the most important source of technology and productive experience, foreign direct investment1 (FDI), ceteris paribus, can have a long-term positive impact on the development of the national economy through various channels [2] contributing to the expansion of its foreign trade, employment growth, human capital development and overall productivity. From this point of view, assessment of the factors determining the dynamics of attracting FDI is an important research problem.

The Russian economy is closely integrated with the world capital market in terms of FDI, despite the fact that Russia is among the countries with high risks for economic activity. In 2011–2017, FDI inflows into the domestic economy amounted to about 1.7% of GDP, which was below the global level (2.1%). It is assumed that the reduction of risks can positively affect the growth of the Russian economy and attract FDI.

Research on FDI factors is based on various postulates, including interdisciplinary ones, demonstrating a variety of assessments. At the same time, there are at least two main approaches to the assessment of the factors that explain the dynamics of direct investment between economies. By analogy with trade interactions in the framework of the first approach, when studying direct investment flows, the gravitational dependence of mutual investments between economies is estimated. So far, a large number of studies have been accumulated that explain and predict the dynamics of direct investment on the basis of the gravitational approach for both the national [3] and regional levels [4].

The second approach is to identify key institutional and macroeconomic variables that explain the dynamics of investment flows. In this case, statistics of aggregate investment interaction of the economy with the outside world are sufficient to obtain quantitative estimates. Institutional variables in empirical studies under the second approach are usually identical to investment risk factors as a component of the so-called “investment ratings” of economies of various levels, which are regularly published by international (World Bank, Heritage Foundation, etc.) and many national specialized organizations and rating agencies. These ratings are based on recommendations for assessing the risk of the country [5], in the economy of which the investor intends to invest. In turn, in studies of this kind, it is important to assess the investment potential of certain economies determined by the size of their market, the purchasing power of the population, the availability of natural resources, etc. On the basis of estimates of this kind of ratings, describing both general and specific types of investment risks and potential, a sufficient number of empirical studies have been accumulated; the studies are devoted to: the causality between the flow of FDI and indicators of potential and risk [6]; the influence of constituent elements of the risk on aggregate FDI flows [7] or specific types of FDI [8]; community [9] in the framework of the various aggregates of national economies and the differences [10] between the groups of countries from the point of view of the impact of risks and potential for attracting FDI; the impact of risks impeding FDI on economic growth [11]; the relationship between the exports of direct investment abroad and risk [12]. Among the basic hypotheses of this kind of research, the presence of a direct relationship between the dynamics of investment interactions with indicators of investment potential and the inverse relationship between the flow of FDI and indicators of investment risk is tested. In most studies, these hypotheses are confirmed.

As is the case regarding Russia, the analysis of the available results of empirical studies of FDI factors should take into account that the dynamics of its macroeconomic indicators are characterized by significant volatility. Therefore, for different time periods, the results may differ from each other significantly. For example, when analyzing the impact of FDI on economic growth for one period, this relationship was not statistically confirmed [13], and for another time period, on the contrary, the direct impact of FDI on economic growth was found [14].

For the Russian economy, prospective estimates of drivers of FDI inflows and exports of direct investment abroad were obtained within the framework of the first approach

(based on the application of gravity dependence) for both the national [15] and regional [16] levels. These studies determine that the actual values of foreign investment in Russia are significantly inferior to the potential values, and for the Eastern regions of the country the factor of remoteness from the capital was not significant.

As part of the second approach to the study of the drivers of FDI inflows and exports of direct investments abroad for the Russian economy, i.e. the indicators of investment risk and potential, the assessment was carried out for Russia as a whole [17], but in most cases – for its regions. Considering the Russian regions in the early 2000s, it has been found that the factors that can be attributed to the investment potential of the territories contributed to the attraction of FDI [18], and the variables associated with institutional risks restrained their inflow [19].

In the case of the Russian economy, the focus of research has subsequently shifted toward studying the differences in the behaviour of different types of FDI and the impact of factors that form the basis of modern governance institutions. For the regional level, the specifics of attracting FDI by different types were studied, in particular by belonging to the so-called “fictitious direct investment” from abroad2. Since the risks of investing in the Russian economy are high compared to most countries of the world [20], a significant share of total FDI in Russia has fallen to the share of “fictitious direct investment”, which according to the studies [21] go to the regions rich in natural resources and to the regions with a high index of perception of corruption, focusing on the implementation of less technological projects in contrast to other FDI. Further, based on the statistics of FDI distribution by industry and assessment of the lagging influence of institutional factors, it has been shown that in the case of improving the quality of public administration institutions, the inflow of foreign capital to the Russian regions could increase [22].

Almost all studies of the Russian economy have found a statistically significant deterrent effect of variable risk on FDI inflows and a stimulating effect of investment potential on such flows. It should be noted that in the above studies for the Russian economy, the drivers of FDI inflows were estimated on the basis of Rosstat data, which differ significantly from modern statistics generated by the Central Bank of Russia due to the fact that these institutions use of different methods of data collecting. On the basis of the current data generated with the help of the balance of payments method, drivers of FDI inflows have not been investigated. The estimates were made for the dynamics of FDI inflows prior to the events of 2014, the consequences of which are likely to have a long-term impact on the intensity of attracting foreign capital to Russia3. As a result, there was an outflow of various types of capital from the Russian economy, and its assets significantly decreased in price.

The Russian economy, which has been characterized by high investment risks that were partially offset by the growth of the domestic market, now faces structural and institutional constraints. As uncertainty for economic agents increased, FDI inflows began to decline. At the same time, Russia is characterized by a variety of territorial socio-economic subsystems with significant differences in the specifics of FDI inflows.

As a hypothesis, it can be assumed that, despite the high risks and reduced potential for the Russian economy as a whole, the decrease in certain investment risks and the increase in potential at the regional level can have a positive impact on FDI inflows. Probably, at the level of regional subsystems, a single space of the national economy can distort the impact of a number of socio-economic processes, so different parts of the country may have differences in terms of factors that explain the attraction of foreign capital4. Perhaps, despite the high aggregation of FDI inflows attracted to Russia, the dynamics and regional distribution of this indicator can be explained by investment risk and potential indicators, which have the opposite and direct impact on foreign investment inflows, respectively.

It should be noted that over the past decade, the Russian government has begun to pay increased attention to the development of the regions of the Far East, which, in turn, despite a number of serious problems, have opportunities for development on the basis of available abundant natural resources and proximity to dynamically developing countries. It seems that attracting FDI can be one of the most important elements in accelerated development of the economy of this macroregion. On this basis, we can assume that there are visible differences between the regions of the Far East and the rest of Russia’s regions in the potential and risk factors that explain FDI inflows.

The purpose of our study is to assess the drivers of investment potential and risk that influenced the attraction of FDI in the Russian regions in 2011–2017. The algorithm of the study includes the following stages: definiing an applied model for quantitative assessment, choosing and harmonizing statistical data; assessing the drivers of FDI inflows to the Russian regions (for the entire array of regions; for Far Eastern regions5; for Russian regions, excluding the Far East).

Assessment methodology and statistics

According to a number of studies [23; 24; 25], it is assumed that the dynamics of FDI inflows can be explained by inverse relationship with investment risk factors and direct relationship with potential factors. Based on this, the function of dependence of FDI inflows on the parameters of investment potential and risk of Russian regions can be represented as follows:

FD1 = f(-±-, POTENTIAL), (1) KloK where FDI is an indicator reflecting FDI inflows; RISK – investment risk parameters; POTENTIAL – investment potential parameters.

The dependence (1) is estimated using regression analysis methods. It is linearized by the following logarithm:

logFD1it = p0-pnLogR1SKit +

-

+ PmLogPOTENT1AL it + E it , (2)

where FDIit is the amount of FDI inflows that the i-th region received in year t (in current prices, million USD). β n – elasticity coefficients of FDI inflows to the i -th region in year t for the corresponding investment risk indicator;

β m – elasticity coefficients of FDI inflows to the i-th region in year t for the corresponding investment potential indicator.

As for FDI statistics, until 2013 it is formed on the basis of special forms that enterprises filled in; the forms were accumulated in the regional offices of Rosstat. The balance of payments methodology is then used to collect FDI statistics6. As a result, two temporary sets of FDI statistics – those generated by Rosstat and the Central Bank – are not comparable, since their values differ significantly (Rosstat data are much smaller [26]). The most affordable way to obtain this kind of assessment is to use the Central Bank’s statistics on attracted FDI for the period 2011–2017 in the framework of operations in Russian constituent entities in which residents are registered according to the balance of payments data. Thus, for objective reasons, there is no possibility of disaggregation of the FDI indicator by industry, geographical structure, and consequently, by institutional characteristics.

At the first stage of our study we used the rating indicators of investment risk of Russian regions, which are evaluated by Expert Rating Agency7 with the involvement of a pool of experts from representatives of domestic and foreign businesses operating in Russia; we also used the indicator of the potential that reflects the size of the economy – GRP in constant prices8. These indicators were used to explain the dynamics of FDI inflows to the Russian regions in a number of other empirical studies [19; 21].

At the second stage more specific indicators can be applied to examine in more detail the impact of risk and capacity indicators on FDI inflows. Disaggregation of indicators of investment risk and potential of Russian regions was carried out on the basis of the methodology for ranking the investment attractiveness of Russian regions by RAEX-Analitika company [27].

According to this methodology, regional investment risk consists of the following private risks (groups of indicators9): economic, socio-demographic, financial, managerial, environmental and criminal. The indicators describing economic risk include statistics that characterize financial loss of organizations, the share of loss-making enterprises, the degree and proportion of depreciation of fixed assets, the profitability of goods sold, both in aggregate form and by economic activity. Socio-demographic risk is characterized by indicators in the field of healthcare, labor market tensions, living standards, the number of internally displaced persons, mortality, the number of road accidents, as well as ethnic characteristics of the region. Financial risk reflects the overall level of financial stability of the business, including the financial performance of organizations, debt of organizations and individuals on loans and deposits in rubles and foreign currency, the level of accounts payable and receivables, including overdue. Management risk is reflected in the relative number of employees of state bodies and local governments, the ability to attract investment in fixed assets estimated through their relationship with GRP, the quality of budget planning and execution, as well as the current debt burden of regional budgets, the degree of their dependence on transfers from the federal budget, the ability to provide a minimum level of necessary social services. Indicators characterizing the environmental risk reflect the level of environmental pollution through emissions into the air, discharges of contaminated wastewater into surface water bodies, etc. Criminal risk characterizes the level of crime, both in aggregate form and for various types of offenses.

Similarly, the investment potential of the regions is characterized by the following components of its potential: natural resource (availability of basic types of natural resources); demographic and labor (population size, population density, size of the labor market and its quality characteristics); production (indicators characterizing the volume of production of goods and services by economic activity); consumer (people’s income and consumer spending); infrastructure (density of roads, access to the Internet, cost of fixed assets, power plants, commissioning of houses, etc.); innovation (the volume of innovative goods, works and services, the number of employees in research organizations, financial costs of R&D, the number of patent applications, their issuance, etc.); institutional (performance results of small enterprises, the number of enterprises and organizations, features of economic activity of joint ventures and enterprises related to private property, the volume of services provided by financial and insurance organizations, etc.); financial (budget revenues, balanced financial result of organizations, income accumulated by the population); tourist (number of hotels and restaurants, tourist flow). Due to the fact that FDI are accumulated in the regions in most cases with the purpose of exporting products outside the territory of their operation, usually abroad, the list of indicators of the investment potential of the region is expanded to include data on the openness to the markets that are external for Russia; these data are reflected in the ratio of trade indicators with foreign countries to GRP and the amount of foreign workforce attracted.

Thus, the basic set of variables for the second stage included more than 800 indicators that reflect private indicators of risk and potential of the Russian regions based on the data of Rosstat, Expert Rating Agency, the Central Bank, the Ministry of Finance, the Treasury, as well as various relevant ministries and departments of Russia. The initial set of indicators is presented by statistics for seven years (2011–2017) for 82 subjects of the Russian Federation (regions)10.

Results of assessing the drivers of FDI inflows into Russian regions

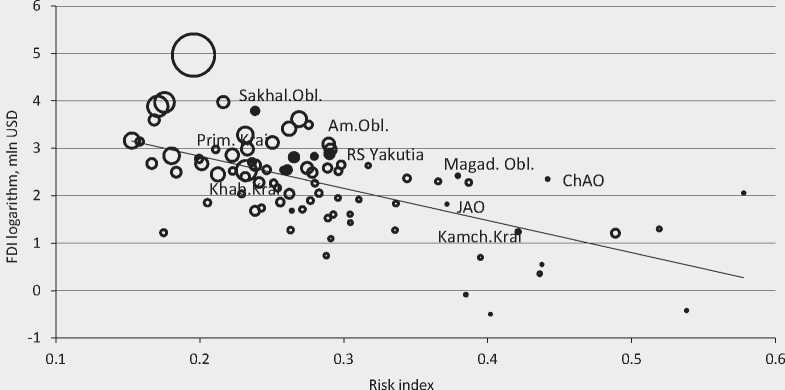

Assessing the drivers of FDI inflows into Russian regions: risk index and real GRP. The dispersion charts indicate that there exists an inverse relationship between FDI inflows and the investment risk index and a direct relationship for the potential indicator (both for the whole population and for the regions of the Far East). This, in turn, suggests that investment risk and potential indicators may have a statistically significant impact on FDI inflows into Russian regions over the period under review (Figure) .

The risk index and the flows of FDI into the Russian regions

Note. The figure presents average values of the indicators for 2011–2017. The size of the circle corresponds to the size of GDP (in prices of 2011, mln RUB). Far Eastern regions are indicated as black circles.

Source: Rosstat, calculations by Expert Rating Agenxy and the Central Bank of Russia.

Table 1. Results of assessing the drivers of FDI inflows into Russian regions: the risk index and the real GRP

|

Period |

All regions |

Far Eastern regions |

Other regions |

||||||

|

ОО |

2 |

ОО |

2 |

ОО |

2 |

||||

|

Risk index |

-1.44* |

-1.55* |

-0.64*** |

-3.12* |

-6.00* |

-1.26 |

-1.70* |

-2.90* |

-1.31 |

|

(0.37) |

(0.12) |

(0.31) |

(0.89) |

(1.95) |

(2.06) |

(0.37) |

(0.75) |

(0.89) |

|

|

GRP |

1.64* |

4.54* |

3.66*** |

0.86* |

9.48* |

7.31* |

1.72* |

3.42** |

3.31*** |

|

(0.10) |

(1.31) |

(2.07) |

(0.31) |

(1.58) |

(2.21) |

(0.10) |

(1.65) |

(2.00) |

|

|

Constant |

-17.68* |

-54.10* |

-42.27*** |

-8.72** |

-116.1* |

-84.73* |

-19.31* |

-42.04** |

-39.02 |

|

(1.01) |

(16.30) |

(25.79) |

(3.00) |

(21.37) |

(25.99) |

(1.02) |

(20.34) |

(25.95) |

|

|

Number of observations |

574 |

246 |

328 |

63 |

27 |

36 |

511 |

219 |

292 |

|

Fixed effects for regions |

no |

yes |

yes |

no |

yes |

yes |

no |

yes |

yes |

|

Fixed effects for years |

yes |

yes |

yes |

yes |

yes |

yes |

yes |

yes |

yes |

|

R2 |

0.54 |

0.84 |

0.84 |

0.42 |

0.73 |

0.73 |

0.60 |

0.88 |

0.90 |

|

F-test |

86 |

17 |

22 |

5.1 |

7.0 |

4.7 |

94 |

14 |

26 |

|

p-value |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

Note. Standard error values are given in parentheses; * – p<0.01, ** – p<0.05, *** – p<0.10. Taking into account the fixed effects for the regions, statistically significant estimates of the first differences were obtained only for the period of 2011–2013.

Source: own calculations.

On the basis of dependence (2), the corresponding elasticities were estimated on the basis of panel data with fixed effects for regions and for years (Tab. 1) .

The estimates partially confirmed the assumption of our study: the potential of the regions contributed to the inflow of FDI into them. For 2011–2017, the investment risk index reflected an inverse correlation concerning FDI inflows into Russian regions, but without taking into account regional features. The assessment has shown that since 2014, a statistically significant relationship between FDI inflows and the investment risk rating is no longer observed.

Since 2014, various risks for the Russian economy as a whole have tended to increase, thus it moved into the group of countries with a low quality of institutions and high risks for investment, which are mainly associated with foreign policy risks, law enforcement risks and the economic system. A detailed analysis of the data reflecting the dynamics of the investment risk index for the regions of Russia has shown that its median value was decreasing, i.e. according to this indicator a convergence between Russian regions was observed. This, in turn, is an indirect confirmation of the fact that the reduction of risks within the economic system is not enough to mitigate the significant negative image formed by foreign investors for the national economy as a whole.

In accordance with the estimates, we observed that the Far East was different from other Russian regions from the point of view of influence of the drivers on FDI inflows. The elasticity of FDI inflows in terms of investment risk in 2011–2013 for the Far Eastern regions was more than twice as high as for the rest of the Russian regions. On the one hand, the estimates suggest that in order to increase FDI inflows into the Far East, the risks that impede foreign direct investment should be reduced compared to other more successful regions of Russia. On the other hand, sincec 2014 the index of investment risk was not statistically significant, which indicates the need for evaluation of particular indicators of risk. For the Far Eastern regions, elasticity of incoming FDI in terms of the potential was on average more than two times higher than the value of the elasticity for other Russian regions. And since 2014, the value of this elasticity for the Far East has decreased, and for other Russian regions it remained approximately at the level of previous years. The estimates obtained may indicate that there is a significant difference between the Far Eastern regions and the rest of the regions in the private indicators of investment risk and potential that determine FDI inflows.

Assessing FDI inflows into Russian regions: private indicators of risk and potential. According to the descriptive statistics of the indicators under consideration, there is a high variation between the regions of Russia in a number of indicators related to the dependent and independent variables. Therefore, in order to take into account the specific features of the dependent variable, the evaluation was carried out with fixed effects for both time and spatial objects – regions. An important task was to find such indicators that would be statistically significant for the entire analyzed period of time (2011–2017) both for the whole set of regions and for two groups (Far Eastern and other Russia’s constituent entities)11. The indicators were evaluated according to their statistical significance and content from the whole array of variables. One of the main criteria for the selection of independent factors was the absence of signs of multicollinearity and heteroskedasticity in regressors. The absence of signs of autocorrelation for regression was a secondary criterion.

The evaluation has shown that the inflow of FDI in the regions of Russia for 2011–2017 can be described by only a few partial parameters of risk and potential. Risk factors did constrain FDI attraction, and potential factors (with the exception of attracted foreign workforce) contributed to the inflow of foreign capital into the Russian regio5689ns (Tab. 2) .

According to the calculations, the inflow of FDI into the regions was facilitated by the indicators of innovation potential and foreign trade openness (the ratio of trade turnover with foreign countries to GRP). The indicator of the potential of the economy’s openness to foreign markets – the foreign labor force attracted – was characterized by an inverse correlation with the dependent variable, probably due to the presence of substitution between foreign labor and capital in the market of Russian regions. Indicators relating to criminal, financial, sociodemographic and environmental risks were impeding FDI. The greatest (modulo) values of elasticities were observed in the indicators of criminal and socio-demographic risk. Other indicators, including those characterizing economic and management risk, were not statistically significant.

The next stage of the study was to confirm or deny the existence of a visible difference in the factors determining FDI inflows between the Far East and the rest of the Russian regions. For this purpose, the factors of FDI inflows into the regions of Russia with the exception of the Far East (Tab. 3) and in the Far Eastern regions (Tab. 4) were estimated.

Table 2. Results of the assessment of FDI inflows into all regions of Russia

|

Variable |

Models |

||

|

1 |

2 |

3 |

|

|

Criminal risk indicator (RISKcrime1) |

-0.94* (0.25) |

-0.92* (0.25) |

-0.89* (0.24) |

|

Financial risk indicator (RISKfin) |

-0.16* (0.04) |

-0.16* (0.04) |

-0.15* (0.04) |

|

Innovation potential indicator (POTENCIALinn) |

0.15* (0.05) |

0.15* (0.05) |

0.16* (0.05) |

|

Indicator of potential of openness to external markets (POTENCIALopen1) |

0.44* (0.14) |

0.42* (0.14) |

0.39* (0.14) |

|

Socio-demographic risk indicator (RISKsoc1) |

– |

-0.95*** (0.49) |

-0.81*** (0.48) |

|

Criminal risk indicator (RISKcrime2) |

– |

-0.54*** (0.32) |

– |

|

Socio-demographic risk indicator (RISKsoc2) |

– |

– |

-0.99** (0.40) |

|

Environmental risk indicator (RISKecol) |

– |

– |

-0.74** (0.31) |

|

Indicator of potential of openness to external markets (POTENCIALopen2) |

– |

– |

-0.61* (0.16) |

|

Constant |

8.08* (1.20) |

13.29* (2.68) |

22.99* (3.36) |

|

Number of observations |

574 |

574 |

574 |

|

R2 |

0.87 |

0.87 |

0.88 |

|

DW |

2.24 |

2.27 |

2.27 |

|

F-test |

34.62 |

34.24 |

35.12 |

|

p-value |

0 |

0 |

0 |

Notes: 1. Tables 2, 3 and 4 show three possible models within the regression dependence (2): the first model is the main one; the second and third models are evaluated to determine the impact of additional independent non-correlated variables on FDI.

-

2. Standard error values are given in parentheses; * – p<0.01; ** – p<0.05; *** – p<0.10. RISKcrime1 – change in the number of registered crimes (murder and attempted murder, lag in % of the previous year); RISKcrime2 – the number of crimes committed by minors and with their complicity (in % of the total number of crimes); RISKfin – the amount of loss of organizations (million dollars); RISKsoc1 – the number of road accidents and victims (per 100 thousand people); RISKsoc2 – the number of registered unemployed (thousand people); RISKecol – emissions of pollutants into atmospheric air from stationary sources (thousand tons); P OTENCIALinn – the volume of innovative goods, works and services (in % of the total volume of shipped goods, performed works and services); POTENCIALopen1 – the ratio of trade turnover with foreign countries to GRP, %; POTENCIALopen2 – the number of foreign labour force, people.

Source: own calculations.

If we compare the results of the corresponding elasticities in Tables 3 and 4 , then we find a difference rather than a similarity between the drivers of FDI inflows into the Far East and other Russian regions. Moreover, if we compare the estimates obtained in Tables 3 and 4 with the estimates in Table 2 (for all regions of Russia), we see the existence of a visible distinction according to independent variables between the two groups of regions.

In terms of explaining FDI inflows into the Far East and the rest of Russian regions, only two factors were common (see Tables 3 and 4). First, it is the indicator of financial risk that impedes FDI inflows and reflects the amount of loss of organizations; this indicator has a large modulus of elasticity for the Far East compared to other regions Based on the dynamics of the loss that organizations experienced in 2011– 2017, we can conclude that for the Far East,

Table 3. Results of the assessment of the drivers of FDI inflows into other regions of Russia

|

Variable |

Models |

||

|

1 |

2 |

3 |

|

|

Criminal risk indicator (RISKcrime1) |

-0.84* (0.26) |

-0.82* (0.26) |

-0.86* (0.26) |

|

Socio-demographic risk indicator (RISKsoc1) |

-1.22* (0.42) |

-1.29* (0.42) |

-1.27* (0.41) |

|

Financial risk indicator (RISKfin) |

-0.10** (0.04) |

-0.10** (0.04) |

-0.10** (0.04) |

|

Indicator of potential of openness to external markets (POTENCIALopen1) |

0.31** (0.13) |

0.32** (0.04) |

0.26** (0.04) |

|

Socio-demographic risk indicator (RISKsoc1) |

– |

-0.82*** (0.48) |

– |

|

Indicator of potential of openness to external markets (POTENCIALopen2) |

– |

– |

-0.55* (0.17) |

|

Infrastructure and production potential indicator ( POTENCIALinfrprod ) |

– |

– |

1.01* (0.33) |

|

Ecological risk indicator ( RISKecol ) |

– |

– |

-0.53*** (0.31) |

|

Constant |

10.65* (1.58) |

14.72* (2.87) |

13.78* (2.96) |

|

Number of observations |

511 |

511 |

511 |

|

R2 |

0.89 |

0.89 |

0.89 |

|

DW |

2.19 |

2.21 |

2.21 |

|

F-test |

41.36 |

41.07 |

41.77 |

|

p-value |

0 |

0 |

0 |

Note. Standard error values are given in parentheses; * – p<0.01; ** – p<0.05; *** – p<0.10. RISKcrime1 – change in the number of registered crimes (murder and attempted murder, lag in % of the previous year); RISKsoc1 – the number of road accidents and victims (per 100 thousand people); RISKsoc1 – the number of road accidents and victims (per 100 thousand people); RISKsoc2 – the number of registered unemployed (thousand people); RISKfin – the amount of loss of organizations (million dollars); RISKecol – emissions of pollutants into atmospheric air from stationary sources (thousand tons); POTENCIALopen1 – the ratio of trade turnover with foreign countries to GRP, %; POTENCIALopen2 – the number of foreign labour force (people); POTENCIALinfrprod – index of physical volume of investments in fixed capital (in comparable prices; in % of the previous year).

Source: own calculations.

this indicator on average restrained the inflow of FDI by 17.3%, for the rest of the regions of Russia – only by 2.4%. The economy of the Far East was very sensitive to the recession in the national economy, which, in turn, restrained the inflow of FDI. From this point of view, the current profitability of business, which is reflected in the minimization of losses12, is one of the key factors in the inflow of FDI into the economy of the Far East, unlike other regions of the country.

Second, the attracted foreign labor force as an indicator of the potential for openness to foreign markets had a deterrent effect on FDI inflows into the Far East and other regions of Russia. According to the estimates, foreign labor and capital are likely to be substitutes: an increase in the number of foreign labor by 1.0% led to a decrease in FDI for the Far East by 1.14%, for the rest of the Russian regions – by only 0.53%. An assessment of disaggregated statistics on FDI and foreign labour by type of economic activity and geographical structure may provide a more detailed analysis of the relationship between these indicators.

Table 4. Results of the assessment of the drivers of FDI inflows into the regions of the Far East

|

Variable |

Models |

||

|

1 |

2 |

3 |

|

|

Criminal risk indicator ( RISKcrime2 ) |

-3.08*** (1.54) |

-3.00*** (1.49) |

-3.22*** (1.48) |

|

Economic risk indicator ( RISKecon ) |

-1.10** (0.50) |

-1.09** (0.48) |

-1.22** (0.48) |

|

Financial risk indicator ( RISKfin ) |

-0.67* (0.18) |

-0.64* (0.17) |

-0.73* (0.17) |

|

Innovation potential indicator ( POTENCIALinn ) |

0.32* (0.10) |

0.30* (0.10) |

0.34* (0.10) |

|

Indicator of potential of openness to external markets ( POTENCIALopen2 ) |

– |

-1.14*** (0.57) |

– |

|

Institutional potential indicator ( POTENCIALinst ) |

– |

– |

7.71** (3.65) |

|

Constant |

12.44* |

22.53* |

-59.80*** |

|

(2.29) |

(5.57) |

(34.30) |

|

|

Number of observations |

63 |

63 |

63 |

|

R2 |

0.82 |

0.84 |

0.84 |

|

DW |

2.38 |

2.49 |

2.52 |

|

F-test |

10.72 |

11.06 |

11.23 |

|

p-value |

0 |

0 |

0 |

Note. Standard error values are given in parentheses; * – p<0.01; ** – p<0.05; *** – p<0.10. RISKcrime2 – the number of crimes committed by minors and with their complicity (in % of the total number of crimes); RISKecon – the proportion of fully worn-out fixed assets (mining activities) (%); RISKfin – the amount of loss of organizations (million dollars); POTENCIALinn – the volume of innovative goods, works and services (in % of the total volume of shipped goods, performed works and services); POTENCIALopen2 – the number of foreign labor force (persons); POTENCIALinst – the number of enterprises and organizations (lag).Source: own calculations.

Further, it is necessary to explain the impact of other factors on FDI inflows for two groups of regions, and in more detail – for the Far East.

As for other regions of Russia (see Tab. 3), FDI inflows were promoted by the indicators of the potential for openness to external markets and infrastructure and production potential; the increase in these indicators by 1.0% led to an increase in foreign capital by 0.3 and 1.0%, respectively13. In addition to the impact of the above-mentioned financial risk indicator and the attracted foreign labor force indicator (as one of the indicators of the potential for openness to external markets), indicators related to criminal, socio-demographic and environmental risks had a deterrent effect on FDI inflows into other regions of Russia. For the regions outside the Far East, the greatest modulo values of elasticities were observed in the indicators of socio-demographic and criminal risk, which, perhaps, should be considered as a reflection of part of the structural and institutional problems in the national economy.

The indicators of criminal and economic risk were the factors that impeded the inflow of FDI into the Far Eastern regions, (see Tab. 4). According to Rosstat, the Far East has long been a leader in the number of offenses per capita. Probably, for this reason, the elasticity of the indicator of criminal risk has a relatively high value (modulo) and it is possible that the decrease (modulo) by 1.0% ceteris paribus is able to have a positive impact on the inflow of FDI, increasing it by 3.2%. However, in this case we should note that the statistical significance of this indicator is relatively low.

The assessment has shown that economic risk for the Far East was represented by only one statistically significant indicator (see Tab. 4), it reflects the proportion of fully depreciated fixed assets in economic activity related to mining. Due to the narrowness of the macro-regional consumer market, FDI is concentrated in the primary economic sector that is mainly associated with the extraction of minerals: fuel and energy (mostly localized in the Sakhalin Oblast and in the Republic of Sakha (Yakutia)) and other mineral resources (precious, nonferrous and ferrous metals). The increase in the extent of depreciation of fixed assets in the field of specialization of most regions of the Far East is an indicator of the subsequent decline of regional economies, which negatively affects the expectations of investors both in Russia and abroad, contributing to the decline in investment activity in the territory. The increase in depreciation of fixed assets in the mining sector also indicates a decline in the competitiveness of the industry, which does not encourage additional flows of financing, including FDI. Perhaps, the dynamics of depreciation of fixed assets in the mining sector is an indirect indicator of the exogenous process for the Far Eastern economy, reflecting the dynamics of the external situation concerning the demand for a range of commodities: for example, since the end of 20141413 due to the fall in world prices for a number of commodities, subsequent investments in the expansion and renewal of production capacities in the Far East have been postponed for some time. In the Far Eastern regions in 2011–2017 the

-

14 In world markets, the downward trend in prices of some commodities (ferrous and non-ferrous metals) has been observed since 2011.

increase in the proportion of fully depreciated fixed assets in the sector associated with the mining operations was on average 6.1% per year, which hampered the inflow of FDI by 7.5% on average.

According to the assessment, the variable that reflects institutional potential had a positive impact on attracting FDI to the Far East (see Tab. 4); this variable is characterized by a change in the number of enterprises and organizations and reflects the development of the process of competition/monopolization in the market of the Far Eastern regions. During the period under consideration, the growth in the number of enterprises averaged 1.0% per year, this fact contributed to an increase in FDI inflows into the Far East by an average of 7.7%. The indicator of innovative potential (the share of innovative goods, works and services1514 in the total volume of goods shipped and works and services performed) for the Far East was statistically significant and had a positive impact on FDI inflows. The impact of this factor is small: a 1.0% increase in the share of innovative products in total shipments contributed to an increase in FDI inflows by only 0.3%. The indicator of innovative potential can be understood as a certain feature of the dynamics of economic development of the macroregion: with the growth of the economy there is a proportional increase in the share of innovative products, probably due to the growth of imports of goods, services and technologies and creation of new goods, works and services on their basis. We should note that after 2014 this figure practically did not increase in all regions of the Far East.

-

15 According to the methodology used to compile this indicator, it includes goods, works and services that are new or have undergone various technological changes over the past three years.

The impact of socio-demographic, management and environmental risks on FDI inflows into the Far East was not found to be statistically significant. We assumed that the inflow of foreign investment will be closely interrelated with the indicators of the intensity of foreign trade activity in the regions of the Far East. However, we have not found such a connection for the Far East, probably due to the fact that the real trade turnover between the macroregion and foreign countries is not fully reflected in the statistics16.

Conclusion

The estimates partly confirmed a number of assumptions of the present study: the investment potential of the Russian regions contributed to the inflow of FDI into them. At the same time, a statistically significant correlation between FDI inflows and the investment risk index ceased to be observed since 2014, because various risks for the Russian economy as a whole began to increase, thus shifting it to a group of countries with low quality institutions and high risks for investment. In terms of the investment risk index, we observe a convergence between the Russian regions. It follows that, in order to increase FDI inflows, an average reduction in aggregate risks between regions is clearly not sufficient to overcome the high risks generated by the national economy as a whole.

The Russian economy is characterized by visible regional differences in the dynamics of direct investment flows from abroad. Regional dynamics of FDI inflows in 201 1–2017 were explained by some private indicators of investment risk and potential, which in general have a reverse and direct impact on the dependent variable, respectively.

The inflow of FDI into the Russian regions was facilitated by the indicators of innovation potential and foreign trade openness. The indicator of the potential of the economy’s openness to external markets – the foreign labor force attracted – was characterized by an inverse relationship with FDI, probably due to the substitution between foreign labor and capital in the market of the Russian regions. The iIndicators relating to criminal, financial, socio-demographic and environmental risks have hampered FDI. The greatest (modulo) values of elasticities were characteristic of criminal and socio-demographic risk indicators.

The specific features of Russia’s territorial subsystems significantly adjusted the significance and ratio of FDI inflows; consequently, the obtained values of the corresponding elasticities indicated a difference rather than a community of private risk and potential indicators explaining FDI inflows into the Far Eastern regions compared to other Russian regions. Probably, this fact confirms the necessity to implement a more differentiated policy to attract FDI in the economy of the Far East compared to other regions.

First, indicators of the potential for openness to external markets and infrastructure and production potential contributed to attracting FDI to other regions of Russia. Indicators related to criminal, sociodemographic and environmental risks had a deterrent effect on FDI inflows in other regions of Russia. For them, the greatest modulo values of elasticities were characterized by indicators of socio-demographic and criminal risk, which can be considered as a reflection of structural and institutional problems in the national economy.

Second, in terms of explaining FDI inflows into the Far East and other regions of Russia, only two factors were described by similar indicators. The financial risk indicator, which reflects the amount of loss of organizations, was the main deterrent to FDI inflows into the Far East, unlike other regions of Russia. It was estimated that foreign labor and capital were probably substitutes.

Third, indicators of criminal and economic risk were factors that impeded FDI inflows into the Far Eastern regions. It is likely that a decrease in the crime rate in the macroregion, ceteris paribus, could have a positive impact on FDI inflows. The economic risk for the Far East was presented as an indicator reflecting the share of fully depreciated fixed assets in economic activities related to mining, being the second most impacting factor limiting FDI inflows.

Fourth, the variables of innovation and institutional potential had a positive impact on attracting FDI to the Far East. The indicator of innovation potential can be understood as a certain feature of the dynamics of economic development of the macroregion, while the impact of this factor was small. The variable of institutional potential, characterized by the dynamics of the number of enterprises and organizations, reflected the development of competition in the market of the Far Eastern regions, contributing to an increase in FDI inflows into the Far East by an average of 7.7% per year. At the same time, it is necessary to identify the process of increasing monopolization of the macroregion’s market, manifested in the replacement of regional business by large federal owners, the reduction in the share of independent small and mediumsized producers in the raw materials industries of the Far East in recent years.

In recent years, business opportunities for foreign direct investors in the Russian market in the existing institutional and market conditions are significantly limited, which is caused, among other reasons, by changing the rules of the game17. As for the fears of the corporate sector that it could suffer from sanctions imposed on the Russian economy, they probably cause the need to register investment flows through offshore territories. However, these risks cannot be identified on the basis of the statistics and tools we use, because these risks are exogenous for spatial objects and represent the general institutional (including sanctions-related) background for the entire Russian economy. This, in turn, is an additional constraint on FDI inflows, which can be explored in detail in a subsequent study. As statistics become available, we find it important to assess the impact of risk and potential on foreign direct investment inflows that are not “fictitious direct investment”, as these investments are expected to be the most sensitive to the volatility of the indicators under consideration.

Список литературы Inflow of foreign direct investments in Russia's regions: potential and risk factors

- Methodology for official statistical accounting of direct investment in the Russian Federation and direct investment from the Russian Federation abroad. Available at: https://www.cbr.ru/statistics/credit_statistics/meth-kom-di. pdf (accessed: 01.03.2019). (In Russian).

- Gorodnichenko Y., Svejnar J., Terrell K. When does FDI have positive spillovers? Evidence from 17 transition market economies. Journal of Comparative Economics, 2014, vol. 42, pp. 954-969. DOI: 10.1016/j.jce.2014.08.003

- Eichengreen B., Tong H. Is China's FDI coming at the expense of other countries? Journal of the Japanese and International Economies, 2007, vol. 21, pp. 153-172. DOI: 10.1016/j.jjie.2006.07.001

- Schäffler J., Hecht V., Moritz M. Regional determinants of German FDI in the Czech Republic: new evidence on the role of border regions. Regional Studies, 2017, vol. 51, pp. 1399-1411. DOI: 10.1080/00343404.2016.1185516

- Bhalla B. How corporations should weigh up country risk. Euromoney, 1983, June, pp. 66-72.

- Gokmenoglu K., Kirikkaleli D., Eren B.M. Time and frequency domain causality testing: The causal linkage between FDI and economic risk for the case of Turkey. The Journal of International Trade & Economic Development, 2019.

- DOI: 10.1080/09638199.2018.1561745

- McGowan C.B. Jr., Moeller S.E. A model for making foreign direct investment decisions using real variables for political and economic risk analysis. Managing Global Transitions, 2009, vol. 7, pp. 27-44. Available at: http://www.fm-kp.si/zalozba/ISSN/1581-6311/7_027-044.pdf

- Burger M., Ianchovichina E., Rijkers B. Risky business: political instability and sectoral greenfield foreign direct investment in the Arab world. World Bank Economic Review, 2016, vol. 30, pp. 306-331. lhv030

- DOI: 10.1093/wber/

- Wisniewski T.P., Pathan S.K. Political environment and foreign direct investment: Evidence from OECD countries. European Journal of Political Economy, 2014, vol. 38, pp. 13-23.

- DOI: 10.1016/j.ejpoleco.2014.07.004

- Azzimonti M. The politics of FDI expropriation. International Economic Review. 2018, vol. 59, pp. 479-510.

- DOI: 10.1111/iere.12277

- Nazeer A.M., Masih M. Impact of political instability on foreign direct investment and Economic Growth: Evidence from Malaysia. MPRA Paper 79418. University Library of Munich. Germany. 2017. Available at: https://mpra.ub.uni-muenchen.de/79418/1/MPRA_paper_79418.pdf

- Kurecic P., Kokotovic F. The relevance of political stability on FDI: A VAR analysis and ARDL models for selected small, developed, and instability threatened economies. Economies, 2017, vol. 5, pp.1-21.

- DOI: 10.3390/economies5030022

- Ledyaeva S., Linden M. Determinants of economic growth: empirical evidence from Russian regions. The European Journal of Comparative Economics, 2008, vol. 5, pp. 87-105. Available at: http://eaces.liuc.it/18242979200801/182429792008050105.pdf

- Iwasaki I., Suganuma K. Foreign direct investment and regional economic development in Russia: an econometric assessment. Economic Change and Restructuring, 2015, vol. 48, pp. 209-255.

- DOI: 10.1007/s10644-015-9161-y

- Drapkin I.M., Mariev O.S., Chukavina K.V. Inflow and outflow potentials of foreign direct investment in the Russian economy: numerical estimation based on the gravity approach. Zhurnal Novoi ekonomicheskoi assotsiatsii=Journal of the New Economic Association, 2015, no. 4, pp. 75-95. (In Russian).

- Mariev O.S., Drapkin I.M., Chukavina K.V., Rachinger H. Determinants of FDI inflows: the case of Russian regions. Economika regiona=Economy of Region, 2016, vol. 12, pp. 1244-1252.

- DOI: 10.17059/2016-4-24

- Fabry N., Zeghni S. Foreign direct investment in Russia: how the investment climate matters. Communist and Post-Communist Studies, 2002, vol. 35, pp. 289-303.

- DOI: 10.1016/S0967-067X(02)00012-0

- Kayam S., Yabrukov A., Hisarciklilar M. What causes the regional disparity of FDI in Russia? A spatial analysis. Transition Studies Review, 2013, vol. 20, pp. 63-78.

- DOI: 10.1007/s11300-013-0272-8

- Ledyaeva S. Spatial econometric analysis of foreign direct investment determinants in Russian regions. World Economy, 2009, vol. 32, pp. 643-666.

- DOI: 10.1111/j.1467-9701.2008.01145.x

- Izotov D.A. The Far East. Innovations in public policy. Problems of Economic Transition, 2017, vol. 59, pp. 799-813.

- DOI: 10.1080/10611991.2017.1416839

- Ledyaeva S., Karhunen K., Whalley J. If foreign investment is not foreign: round-trip versus genuine foreign investment in Russia. CEPII Working Papers, February 2013. Available at: http://www.cepii.fr/PDF_PUB/wp/2013/wp2013-05.pdf

- Kuzmina O., Volchkova N., Zueva T. Foreign direct investment and governance quality in Russia. Journal of Comparative Economics, 2014, vol. 42, pp. 874-891.

- DOI: 10.1016/j.jce.2014.08.001

- Topal M.H., Gül Ö.S. The effect of country risk on foreign direct investment: a dynamic panel data analysis for developing countries. Journal of Economics Library, 2016, vol. 3, pp. 141-155.

- DOI: 10.1453/jel.v3i1.771

- Kim H. Political stability and foreign direct investment. International Journal of Economics and Finance, 2010, vol. 2, pp. 59-71.

- DOI: 10.5539/ijef.v2n3p59

- Ramcharran H. Foreign direct investment and country risk: further empirical evidence. Global Economic Review, 1999, vol. 28, pp. 49-59.

- DOI: 10.1080/12265089908449766

- Gladysheva A.A. Data sources in empirical research of FDI in Russia. Vestnik NGUEU=Vestnik NSUEM, 2017, no. 3, pp. 163-182. (In Russian).

- Methodology for making a rating of investment attractiveness of Russian regions by the company "RAEKS- Analitika". Available at: https://raex-a.ru/update_files/3_13_method_region.pdf (accessed: 01.02.2019). (In Russian).

- Kluge J.N. Foreign direct investment, political risk and the limited access order. New Political Economy, 2017, vol. 22, pp. 109-127.

- DOI: 10.1080/13563467.2016.1201802