Institutional reasons for economic problems in Russia's local self-government

Автор: Dyadik Vladimir Vladimirovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Problems of municipal entities

Статья в выпуске: 4 (22) т.5, 2012 года.

Бесплатный доступ

The article is devoted to the study of institutional reasons for economic problems of local self-government in Russia. The results proving the inconsistency between the actual incentives of regional authorities and goals of territorial development have been obtained upon analyzing the execution of consolidated budgets of RF subjects. The article defines the principal trends of formal state institutions’ modernization; the implementation of these directions will raise the interest of RF subjects’ administration in the development of local self-government’s economic base.

Local self-government, state institutions, municipal budgets

Короткий адрес: https://sciup.org/147223365

IDR: 147223365 | УДК: 338.24:352(470)

Текст научной статьи Institutional reasons for economic problems in Russia's local self-government

A great number of theoretical and empiric studies are devoted to the problems of effective distribution of revenues between the levels of the state system. This issue is especially acute in the context of the “region – municipal entity” relationships. Nation-wide shortage of financial resources in municipalities jeopardizes the sustainability of local communities’ functioning and development, and discredits the very idea of local self-government. It is noteworthy, that political and economic top management officials at all types of national municipal entities unanimously declare the lack of funding to be the challenge number one [2].

Why do Russian municipalities experience a shortage of revenues, is this state of affairs normal or should it be changed? Scientists, politicians, managers, practicing economists have been widely discussing this issue.

The opinions, expressed by different parties, vary significantly. Some argue for the complete approval of the “transfer” funding of municipal economy and assume this concept as the only right one. Others strongly reject the existing organizational model of Russian local self-government in general, and its funding system in particular. Each viewpoint has its reasoning.

The main argument, supporting the idea of the revenues’ withdrawal from the local level and their further redistribution, has economic grounds and is based on the fact that the revenue potential of municipalities is extremely heterogeneous. Even the neighbouring settlements of the same type can have an absolutely incomparable economic base. Disproportions in economic potential of the settlements of different types are even more pronounced. Given this state of affairs, the uniform standards of revenues inflow from the same sources create distortions in the fiscal capacity of municipalities. A logical solution to the problem, successfully implemented in most Russian regions, is the centralization of a large part of the revenues from municipalities and their subsequent “return” through the system of inter-budget transfers.

However, the transfer model of financing will inevitably create risks of economic and political dependence of local self-governing bodies on regional authorities. Therefore, the main argument of its opponents is the thesis concerning the necessity to observe the constitutional principles of self-sufficiency of local self-government and its independence from state authorities.

Unfortunately, the economic basis for implementing the idea of fiscal independence of local self-government is clearly insufficient. Given the limited list of revenue sources, which local budgets possess by authority of law, it can be stated that for them the only alternative to a strong subsidy-based dependency is the right to claim a part of regional budget revenues.

Obviously, the transfer of a part of the RF subject’s budget revenues “downward” is the most civilized and democratic way of strengthening the economic foundation for local self-government. The ideas of budget decentralization are fully consistent with the ideas of administrative decentralization, proposed by the President in his Address to the Federal Assembly and the Session of the State

Council in December 2011. But the question arises concerning the willingness of the RF subjects to give the municipalities something above the minimum that the latter obtain in accordance with the Budget code. This article presents an attempt to answer this question, search for the systemic causes of the economic problems of domestic local self-government. It also provides the substantiation of proposals on modernization of institutional structure that is the source of these problems.

Research methodology

The sub-federal level of the state hierarchy, as well as all the municipal entities of the subject function on the economic basis of a region’s consolidated budget. The minimum rates of deductions into local budgets are established in the Budget code. At the same time, the RF subjects have a legitimate opportunity to replace subsidies by the additional rates of individual income tax deductions. They also possess the right to establish the uniform rates of distributing all kinds of tax revenues, subject to be transferred to the region’s consolidated budget, between their own and local budgets.

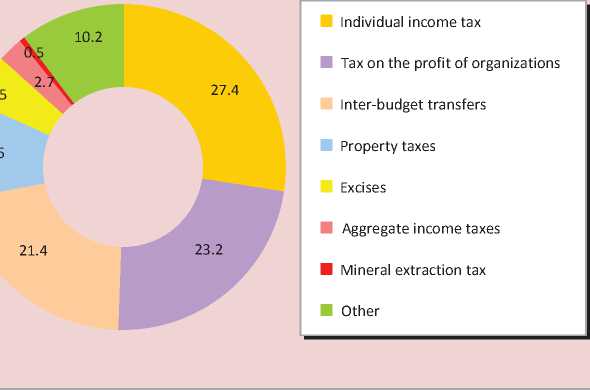

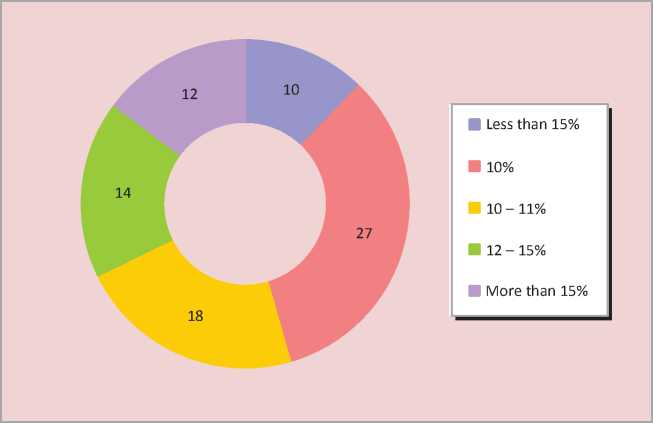

At present, the most significant sources of tax revenues for the consolidated regional budgets (in descending order of importance) are: individual income tax, tax on the profit of organizations, property taxes, excise taxes, aggregate income tax, mineral extraction tax (fig. 1) 1. Concerning any of these types of revenues, regional authorities are entitled to decide on transferring a certain part of it to the municipal level. The present study analyzes the results of execution of consolidated budgets of 83 RF subjects (excluding federal cities of Moscow and St. Petersburg) regarding the realization of this right by the regions.

In the course of the analysis, the data on actual inflow of revenues, in the context of each of the selected sources, into the regional budget

Figure 1. Integrated structure of revenues of the consolidated budgets of RF subjects in 2010, %

and into the consolidated budget of municipal entities located on its territory were compared pairwise. The obtained ratios were compared with the minimal rates of tax revenues inflow into the local budgets set by the Budget code, and in case of exceeding of the latter, the fact of transferring the additional revenues by the region to the local level was registered.

In order to ensure the transparency of the obtained results, it is necessary to make some methodological clarifications. Firstly, it should be noted that the results of analyzing the rates of individual income tax distribution have a certain consolidation error, as additional rates for the tax inflow into local budgets, established in accordance with part 2 of article 58 of the RF Budget code, may be different for different municipalities of one and the same region. Secondly, in the revenue group “Excise taxes on excise goods (products), produced on the territory of the Russian Federation” (hereinafter – excises), data on budget execution are also analyzed in aggregation, which eliminates the possibility of considering the revenue inflow rates separately for each of the excises types. However, as the ultimate goal of the research is to draw conclusions on transferring additional revenues to municipalities, the mentioned assumptions can be considered as insignificant, since part 3 of article 58 of the RF Budget code sets the minimum level for additional rates of individual income tax inflow, and the excises are fully attributed to the revenue sources of the regional budgets. Therefore, the fact of additional revenue transfer to the local level can be registered in the first case by comparing the data on actual execution of regional and local budgets with the aggregated2 minimum inflow rates, and in the second case – in any precedent of obtaining revenues by local budgets in the form of excises.

Observations and conclusions

The results of the analysis prove that the main sources of additional revenue inflow into the local budgets in 2010 included individual income tax, tax on the profit of organizations, tax paid according to the simplified taxation system, corporate property tax. The structure of the additional revenues of the municipalities

nationwide and the data on the total number of facts of transferring tax revenues by the regions (by types of taxes) is shown in the diagram in figure 2 .

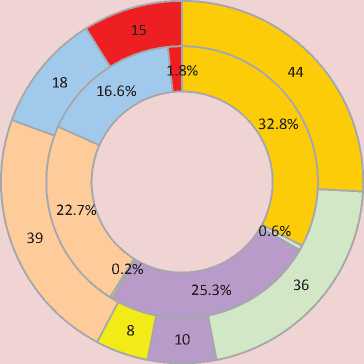

It is interesting to note, that the share of different tax sources in the total volume of revenues additionally transferred to the local level (the inner circle of the diagram) is not always directly proportional to the number of facts of transferring the relevant taxes (outer circle). Due to the difference in the capacity of the tax base, the efficiency of transfer of different taxes varies significantly. So, in respect of individual income tax, tax paid according to the simplified taxation system, and corporate property tax, the number of facts of transferring the revenues is comparable to the position of the source in the structure of revenues. At the same time, the share of unified agricultural tax, excises and mineral extraction tax in the total volume of additionally transferred revenues is much less significant, though the number of transfer facts is relatively large (36, 8 and 15, respectively). A special place is occupied by tax on the profit of organizations.

In 2010, it was a leader concerning the efficiency of transfer to the local level – only 10 facts of its transfer provided municipal budgets with more than a quarter of the total amount of additional revenue.

Calculations show that, in general, the total share of additional revenue in the total revenue of consolidated municipal budgets amounted to 2.91% in 2010. If the potential of this source is compared with the amount of subsidies for municipalities, more than the four-fold gap is observed: at the end of 2010, subsidies amounted to 12.63% of the total revenues of the consolidated budget of all RF municipal entities.

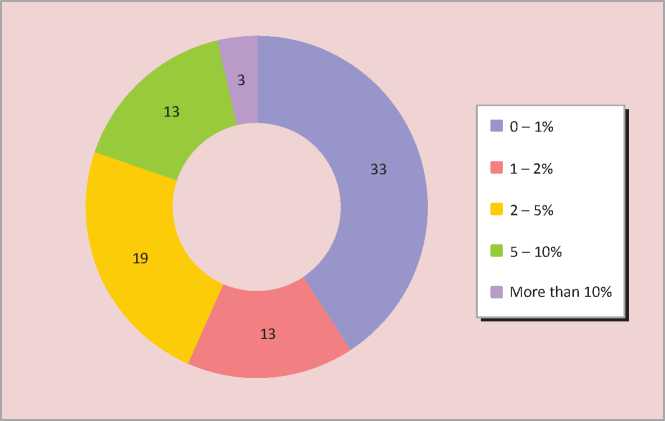

In practice, the share of revenues derived from additional tax sources does not exceed 5% for the local budgets of the overwhelming majority of the regions (65 out of 81, or 80.2%) (fig. 3) . And only 3 RF subjects: Perm krai, the republic of Khakasiya and Krasnoyarsk krai have overcome the 10% threshold. At the same time, in 33 regions, additional revenues accounted for less than 1% of the revenues of municipal budgets.

The data is complemented by the figures characterizing the intensity of regions’ usage of the tax mechanism of providing additional financial support to local self-government. In 2010, 14 regions didn’t use this right at all. 17 RF regions accounted for 1 fact of transferring, 19 – for 2, 18 – for 3, 6 – for 4, 4 – for 5. The Penza oblast, the republics of Altai and Adygea each transferred 6 additional sources of revenues to municipalities.

Individual income tax and tax paid according to the simplified taxation system rank first and second according to the frequency of estab-lishing the additional rates of revenue inflow into local budgets (additional individual income tax was transferred to the local budgets 44 times, tax paid according to the simplified taxation system – 39 times).

Unified agricultural tax ranks third. In 2010, the minimum required rate of its inflow into local budgets was exceeded in 36 RF subjects. However, due to the lesser capacity of this revenue source, the share of additional revenue from unified agricultural tax in the total volume of additional revenues amounted to only 0.6%.

As for corporate property tax, ranking fourth in this list, there were 18 cases of its redistribution in favor of the municipalities in 2010. In total, the share of the above-mentioned sources equals 73.4% of the total volume of municipalities’ additional tax revenues. Since the base of these taxes is relatively stable, the practice of their transfer to the regions “downward” is reasonable and logical. Municipalities get the revenues, the generation of which can be influenced by local authorities.

Individual income tax is, no doubt, the systemic revenue source for the budgets of all types of municipal entities. As an additional revenue source, individual income tax was transferred to the local level 44 times in 2010 and provided 32.8% of additional tax revenues of municipal budgets. At the same time, different regions “shared” this tax with the municipalities extremely unequally (fig. 4) . While in almost half of the RF subjects, municipal budgets received tax revenues in the amounts not exceeding the minimum limit established by the Budget code, the municipalities of other regions received substantial additional revenues.

Figure 3. Distribution of the RF subjects according to the share of revenues on additional rates in the total amount of local budgets revenues

Figure 4. Distribution of the RF subjects according to the share of individual income tax transferred to local budgets in 2010, in accordance with part 3, article 58 of the Budget code of the Russian Federation

The 2010 share of individual income tax inflow into local budgets equaled 30% (for urban districts and the consolidated budgets of municipal districts). Besides, in accordance with part 3, article 58 of the Budget code of the Russian Federation, the RF subjects were to provide unified and (or) additional norms of individual income tax deductions to local budgets in the amount of not less than 10% of the tax inflow into the region’s consolidated budget.

In fact, this goal wasn’t achieved in 10 regions: the Mari El Republic, the Tyva Republic, Krasnodar Krai, Primorsky krai, Kaluga oblast, Kursk oblast, Novosibirsk oblast, Orenburg oblast, Oryol oblast and Chelyabinsk oblast3. In 27 regions, the share of individual income tax, directed to the local budgets above the basic 30 percent ratio, amounted to 10%. That is, the municipal entities of these RF subjects received only the legally stipulated part of the tax. In 18 regions the minimum ratio was exceeded by not more than 1%, in 14 regions – by 2 – 5%, and only in 12 regions – by more than 5%. Thus, despite the absolute “leadership” of individual income tax according to the frequency of its transfer to the local level, the share of transferred revenues in the vast majority of cases remained insignificant.

The fact, that authorities are so cautious in the issues of transferring additional revenue sources to municipalities, is quite understandable. The main risk accompanying the transfer of a part of any tax, even with a relatively homogeneous (in the territorial dimension) base, lies in the danger of increasing disparities in fiscal capacity among municipal entities with different tax potential. Therefore, it can be assumed that the amounts of the additional deductions over any tax should closely correlate with the differentiation level of the corresponding tax base in a particular region. Consequently, on the basis of the thesis concerning the necessity of fiscal capacity alignment, the state authorities of the RF subject should pay the more attention to establishing additional rates, the more heterogeneous is the tax base of municipalities located on its territory.

In the context of this discourse, it is interesting to compare additional rates of individual income tax deductions to local budgets with statistical indicators that characterize the differentiation level of labour remuneration in the regions, - the coefficient of funds and the Gini coefficient4. The value of the correlation coefficient, obtained after comparing the first two data sets, is 0.224, after comparing the set of additional rates and the Gini coefficient, it is 0.195. Oddly enough, not only is there no expected sustainable negative correlation, but, on the contrary, there is a positive relationship between the share of the tax transferred to the municipal level and the degree of differentiation of its base. In all probability, these results do not illustrate any systemic motives of the regional governing bodies, and are a consequence of spontaneous resolutions taken over a number of years.

The practice of transfer to the local level of additional income tax on mineral resources extraction, tax on the profit of organizations and excise tax (15, 10 and 8 cases, respectively) is less common, as can be seen in the diagram in fig. 2. The main reason for a lesser eagerness of the regional authorities to use these sources of consolidated budgets revenues as a means of redistribution, most likely, lies in a “local” nature of the relevant tax base. The values of profit tax inflow ratios into the local budgets range from 5% in the Voronezh and Kaluga oblasts, Krasnodar krai up to 50% in the Magadan oblast. All 8 cases of transferring excise taxes to municipalities, registered in

2010, are connected with the taxation of alcohol-containing products, and the share of its inflow into the local budgets varied from 0.3% in the Yamalo-Nenets Autonomous Okrug up to 12% in the Republic of Adygeya.

As for mineral extraction tax, the potential recipients of additional revenues are the settlements, fortunate enough to have deposits under exploitation located on their territory. However, it should be noted, that most of the regions, that transferred a part of mineral extraction tax revenues to the local level, exercised this right only in the part concerning tax on the extraction of commonly occurring mineral resources, i.e., as a rule, sand and gravel, raw materials for producing construction materials, water. And only in the Chelyabinsk oblast, the Jewish Autonomous oblast, Zabaykalsky Krai and Altai krai the regional authorities went further and transferred to municipalities a part of the revenues from tax on the extraction of other groups of mineral resources (table) . It is logical to assume, that it is the low cost of commonly occurring mineral resources and, consequently, a narrow tax base of the tax transferred to the local level is the main cause of its low ranking (1.8%) among other additional revenues of the local budgets.

So, some conclusions can be made concerning the major trends in the practice of transferring tax revenues by the regions to the municipal level.

Firstly, this practice is not properly developed yet. Major proof can be found in the fact that in 14 regions no tax was further reallocated in favor of the municipalities, and in 33 regions the share of revenues transferred from regional taxes equals less than 1%.

Secondly, the unsystematic character of measures taken, and, more specifically, absence of tangible (at least, in the framework of express-analysis) economic grounds for their adoption. One of the most obvious evidences is the absence of a sustained negative correlation between the additional rates of

Mineral extraction tax, transferred to the local level in 2010

|

RF subject |

Mineral extraction tax, thsd. rub. |

Including tax on the extraction of commonly occurring mineral resources, thsd. rub. |

Share, % |

|

Republic of Bashkortostan |

49 861 |

49 861 |

100,0 |

|

Udmurt Republic |

6 462 |

6 462 |

100,0 |

|

Chuvash Republic (Chuvashiya) |

10 976 |

10 919 |

99,5 |

|

Sakha Republic (Yakutiya) |

80 515 |

80 515 |

100,0 |

|

Altai Krai |

79 591 |

9 995 |

12,6 |

|

Voronezh oblast |

62 802 |

62 802 |

100,0 |

|

Ivanovo oblast |

12 186 |

12 186 |

100,0 |

|

Smolensk oblast |

18 671 |

18 671 |

100,0 |

|

Tomsk oblast |

10 740 |

10 740 |

100,0 |

|

Chelyabinsk oblast |

258 639 |

73 489 |

28,4 |

|

Yaroslavl oblast |

18 608 |

18 502 |

99,4 |

|

Republic of Adygeya (Adygeya) |

4 945 |

4 945 |

100,0 |

|

Altai Republic |

14 840 |

3 364 |

22,7 |

|

Jewish Autonomous oblast |

1 024 |

0 |

0,0 |

|

Zabaykalsky Krai |

324 063 |

22 250 |

6,9 |

|

TOTAL: |

953 922,58 |

384 700,52 |

40,3 |

individual income tax inflow info local budgets and the indicators of revenues distribution irregularity (the coefficient of funds and the Gini coefficient).

Thirdly, a lack of the regions’ attention to the necessity of analyzing the opportunities for expanding the practice of “downward” transfer of the revenues. This is proved, for example, by the fact, that tax on the extraction of commonly occurring mineral resources is transferred to the local budgets only in 15 RF subjects, while this revenue type is present in the consolidated budgets of 80 out of 83 Russian regions considered in the framework of this study. And the peculiarity of the object of taxation consists in its close relationship with the economy of the local governing level – the work of road repair and construction departments, water services companies, etc., that is a serious reason for raising the issue concerning the expediency of transferring the given source.

The analysis proves that state governing bodies of the RF subjects insufficiently use the opportunities of forming the revenues of municipalities by attracting additional tax sources, and prefer the “transfer” model of municipal economy financing.

In the conditions of moving towards budgetary and administrative decentralization, this stagnant and counterproductive model of inter-budgetary relations is becoming a serious obstacle to the development of the institute of Russian local self-government, reduces municipalities’ motivation to increase their own economic independence and responsibility, and makes them economically and politically dependent on the decisions of the regional state governing bodies.

Institutional roots of inefficient budgetary decisions

The nationwide scale of the problem of the regions’ unpreparedness (or unwillingness) to abandon the subsidies addiction policy and move on to more advanced methods of providing economic support to the development of local self-government proves the existence of systemic reasons for the current situation. Though understanding the benefits that municipalities will gain after the replacement of subsidies by additional tax sources, the governors, however, refrain from actively implementing the practice of the revenues transfer. Reasons for such behavior are of a pronounced institutional nature, the basis of which, on the one hand, is a set of formal institutions – laws and regulations, governing the work of regional administrations, on the other hand – state ideology developed over the last decade, which is, in fact, an informal institute with its own views on the issues of “what is good and what is bad”.

Federal laws No. 184-FL dated 06 October, 1999 “On general principles of organization of legislative (representative) and executive bodies of state authority of the subjects of the Russian Federation”, No. 131-FL dated 06 October, 2003 “On general principles of organization of local governments in the Russian Federation” and the Budget code of the Russian Federation are the cornerstones of Russian model of administrative-territorial and financial subordination, that determine the legal basis of interaction between the subjects of Federation and municipal entities. The framework, constructed by these legal documents, and replacing the 1990s liberal doctrine of state administration, was created to improve governability and counteract the centrifugal processes posing a threat to the economic security and territorial integrity of the country5. The task of improving governability was reflected adequately in the basic principles, implemented in these laws. They include the centralization of financial resources and the total unification of the revenue sources and powers of the municipalities.

Further application of this management model has revealed a number of significant problems, however, the debates about their inevitability were held ever since the adoption of the laws stated above [8]. But, of course, the main problem of unification lies in the fact that the economic base of municipalities guaranteed by the law is insufficient for the proper fulfillment of the powers assigned to them. And the regions are not in a hurry to expand it, as it was proved in the course of the preceding analysis.

The next important feature of the national state administration model is the conformity of the regional development objectives to the ideology of political, administrative and financial resources and solutions centralization.

Abolition of direct elections of governors, the work on the creation of political vertical at the regional level, participation in priority national projects and other federal initiatives implementation over the last ten years have stimulated regional officials to enhance the role of subordination in relations with local selfgovernment. It should be noted, that the idea of subordination of local self-government to the influence of regional administration tunes in to the nature of subordinated systems in general. Thus, according to J. Stiglitz, “centralized systems are not easily subject to self-restraint. For example, if the central authority has the opportunity to intervene, it is unlikely to decide not to.” [9].

The result of the regional managers’ response to the above mentioned defects of the institutional environment was the emergence of a special system of administrative incentives, alternative to the one officially declared by the state. The main incentives include:

-

• striving for the priority solution of its “own” issues assigned by the federal centre, without due attention to the strategic objectives of regional development; moreover, this decision can often be formal, necessary and sufficient only for the purposes of neat reporting to the “top”;

-

• desire to take over the consolidated budget, that is caused by the lack of own revenues and supported by opportunities in the field of interbudgetary relations regulation, provided by the budgetary legislation to the regions;

-

• aspiration to subordinate the relationships with the municipalities, applying the idea of “vertical power structure” to local selfgovernment.

It is obvious that none of these incentives motivates the RF subjects to transfer additional revenues to the local level in order to strengthen the economic independence of local selfgoverning bodies.

A logical result of the regional managers’ work in the conditions of alternative motivation is the unbalanced financial result of the regional and local budgets execution. According to the results of the budgets execution for 2009, 58 out of 83 RF subjects (70%) stated the regional budget deficit, in 2010, the deficit was observed in 61 RF subjects (73%). The consolidated deficit of municipal budgets in 2009 was observed in 73 (88%) Russian regions, in 2010 – in 74 (89%).

The data proves that, in general, the financial position of the RF subjects is, as a rule, better than that of the municipalities. And in conditions, when regional authorities possess the levers for improving the situation, it is one more evidence of their unwillingness to increase the budget supply of municipalities.

Modernization of formal institutions and new incentives for regions

Institutional underlying reasons for the problems of Russian local self-government require the necessity to find institutional solutions. It seems that the efforts here should be concentrated on regional top managers’ motivation to strengthen the economic base of local self-government. Real incentives are essential, that will encourage the state governing bodies of the RF subjects to transfer additional revenue sources to the local level.

Unfortunately, underdeveloped civil institutions of a modern Russian society don’t provide for the emergence in the near future of this kind of incentives in the course of political discussion and dialogue between the authorities and society. Target-setting function of Russian officials is formed within the boundaries of highly subordinated model of public administration, when all the important decisions are made only with the approval from Moscow.

This peculiarity can’t be ignored. Therefore, in order to make the regions interested in the systemic strengthening of municipalities’ tax base, it is necessary to understand, that at present, the “vertical” way of motivating regional administrations is the only effective one. In order to make the new incentives properly acknowledged and equally effective in relation to state governing bodies in all Russian regions, an issue can be discussed concerning the inclusion of their achievement indicators into the official system of assessing the governors’ work efficiency [6].

As it was proved earlier, the result of the regional elites’ misguided motivation is an apparent insufficiency in the practice of transferring tax revenues “downwards” by the RF subjects, the chaotic decision-making and lack of the regions’ attention to the necessity of analyzing the opportunities of activity in this direction.

The problems define the goals. Modernization of an official mechanism for evaluating the performance of regional administrations should move on to meet these challenges. The main task of the new rules is to make the state authorities constantly concerned about the sufficiency of their own actions aimed at supporting the municipalities with revenues, rather than subsidies. For example, the total volume and number of revenues, additionally transferred by the regions at the local level, as well as the ratio of the volume of revenues, additionally transferred to the local level in the form of taxes and charges, and the total revenues of the municipalities in the form of transfers from the regional budget, not corresponding with the execution of the delegated state-assigned tasks, can become the main directions for monitoring the relevant parameters of the regional budget policy.

It is necessary to point out, that the article is not aimed at discussing methodological peculiarities of developing the specific assessment indicators, as well as working out the concrete proposals for introducing amendments into effective documents. This task is the subject of an independent and serious research. The main purpose of the latter discourse and conclusions is to determine the principal areas of activity of the regional state governing bodies, which should be the focus of attention of the federal centre. Highlighting the issue of local authorities’ financial dependence on the sub-federal level of state government and creating the instruments of official monitoring of the regional administrations’ activities for handling this problem results in a powerful impetus towards increasing the regions’ responsibility for the decisions on the distribution of consolidated budgets’ revenues.

Modernization of the system for official evaluating the performance at the local level can give an impetus to reassessing the regional elites’ mental settings that result in budget resources centralization and “vertical subordination” of the relations between the governing levels.

Its adoption at the regional level implies the abandonment of subordination patterns in the relations between the region and municipalities, liberalization of administrative and budgetary components of “municipal” policy of the RF subject, sustainable development of the local self-government institution in Russia.

Список литературы Institutional reasons for economic problems in Russia's local self-government

- Yevstigneyeva L., Yevstigneyev R. Transformation risks of Russian economy. Voprosy economiki. 2006. No.11.

- Research by the all-Russian public organization “All-Russia Council of local self-government on the subject “Interaction of authorities and society at the local level” with the participation of the High School of Economics. Available at: http://www.vsmsinfo.ru/article.html#n452

- Reports on the execution of consolidated budgets of the subjects of the Federation for 2009 and 2010. Available at: http://www.roskazna.ru/reports/mb.html

- Statistical yearbook “Regions of Russia. Socio-economic indicators. 2009”. Rosstat. Moscow, 2009.

- Statistical yearbook “Regions of Russia. Socio-economic indicators. 2010”. Rosstat. Moscow, 2010.

- The Decree of the President of the Russian Federation dated 28 June, 2007 No. 825 “On estimation of performance of executive power authorities of the subjects of the Russian Federation”, the decree of the Government of the Russian Federation dated 15 April, 2009 No. 322 “On measures on the implementation of the Decree of the President of the Russian Federation dated 28 June, 2007 No. 825 On estimation of performance of executive power authorities of the subjects of the Russian Federation”.

- Shvetsov A. State regional policy: deep-rooted problems and relevant tasks of systemic modernization. Russian economic journal. 2007. No.11 -12.

- Shvetsov A. Spatial parameters of municipal entities: the post-Soviet “seesaw” and economic foundations for the rationalization. Russian economic journal. 2007. No. 3.

- Stiglitz J. Wither Socialism? Cambridge, MA: The MIT Press,1994. Series “The Wicksell lectures”.