Instruments and principles of reallocating budgetary resources in the region

Автор: Pechenskaya-polishchuk Mariya A.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 2 т.13, 2020 года.

Бесплатный доступ

The article is devoted to studying the reallocation of budgetary resources at the intraregional level. The author has made a hypothesis that the existing instruments and principles of reallocating budgetary resources in the region hinder the effective use of the local budgetary system's capacity for developing the fiscal capacity of the entire region. The work is aimed at justifying the key principles and instruments of the modern public regional policy in the field of the intraregional reallocation of budgetary resources for developing the region's fiscal capacity. The Russian regions have become the object of the study covering the period from 2005 to 2018. In order to reveal statistical regularities, the researcher has used general scientific methods based on the official data from the Federal Treasury, the Ministry of Finance, Rosstat, regional authorities and local government bodies. The works of leading Russian and foreign scientists have composed the theoretical basis of the study. In the course of the research the author has identified the trends of budgetary reallocation in the region, as well as proposed the directions of improving its efficiency, including the set of instruments for strengthening the income basis of local budgets and the research and methodological justification for using the budgetary reallocation instruments in the region. The scientific novelty of the results includes the justification of applying the instruments and principles of the modern public regional policy in the field of the intraregional reallocation of budgetary resources, which, unlike the existing ones, rely on the effective use of the local budgetary system's capacity for developing the fiscal capacity of the entire region. The materials of the present article can be used in the educational sphere, as well as in the activities of public authorities and local government bodies.

Municipal development, local government, municipal units, stimulation, fiscal federalism, equalization, differentiation, fiscal capacity, reallocation

Короткий адрес: https://sciup.org/147225455

IDR: 147225455 | УДК: 336.02 | DOI: 10.15838/esc.2020.2.68.5

Текст научной статьи Instruments and principles of reallocating budgetary resources in the region

Introduction to agenda . Developing the fiscal capacity of regions according to the principle of synergetic multiplicative effect greatly depends on using the capacity of municipal units. Indeed, in developed countries sustainable municipal growth, which comprises increasing the efficiency of using territories’ capacity, including the budgetary one, has been recognized as the most important driver of economic growth [1–4], allowing to find the integrated solution of solving important tactical and strategic tasks.

The high relevance of developing the local economy and municipal finance within the unprecedented era of rapid urbanization has been stressed in the new Urban Development Programme of the UN General Assembly up to 2030 [5]. In his address to the Federal Assembly in 2018 the President V.V. Putin has reminded about the need of solving the economic growth issues in Russia through municipal development. A.D. Nekipelov, the academician of the Russian Academy of Sciences, has noted that it is necessary slightly to push the development of economy through restructuring all mechanisms of its functioning both at the macro- and micro-levels [6]. In the studies of many national and foreign scientists [7–10] the role of micro-level is assigned to municipal units as the fundamental element of the state’s administrative-territorial system. The reason for this is that local government, firstly, is the population’s way of adapting to changing political, economic, social and other living conditions, and, secondly, according to the subsidiarity principle, allows to take into account the resources, conditions, particular characteristics of territories, needs and interests of people for the most effective and optimal solution of the state’s tasks.

No wonder that the municipal level is responsible for creating and maintaining conditions contributing to the reproduction of human capital, as evidenced by concentrating in local budgets more than 60% of expenditures for the social sector (pre-school and general education, physical education and mass sports, social security of the population).

It is quite obvious that municipal development should be based on the growth of financial resources, first of all, on budgetary ones. Through the inter-budget federal and regional policies the municipal development priorities are set and the optimal stimulating and support instruments are identified. Within the conditions of fiscal federalism, the solution of overwhelming number of the region’s socio-economic tasks, in particular, ones of a strategic nature, is possible only by joining efforts of different management levels. According to the experience of developed countries, in the stable market economy interbudget relations contribute to forming fairly independent regional and local budgets, taking into account territorial needs [11]. The special significance regarding the influence of budget revenues allocation parameters along the vertical management on the fiscal capacity has determined the relevance of the study. Within the research the author has proposed a hypothesis that the existing principles of reallocating budgetary resources in the region hinder the effective use of the local budgetary system’s capacity for developing the fiscal capacity of the entire region. Therefore, justifying the instruments and principles of the modern public regional policy in the field of the intraregional reallocation of budgetary resources for developing the region’s fiscal capacity is the aim of the study. In order to achieve it, it is necessary to identify trends and propose directions for improving the efficiency of budgetary reallocation in the region.

Theoretical aspects of reallocating budgetary resources at the regional level. The value created in the economy passes the stage of primary allocation according to the laws of material production and objective market needs. Subsequently, the imperative state influence, which more clearly outlines the emerging secondary reallocation, referred as the budgetary one, is added to the process of allocating the created value. As N.A. Istomina rightly remarks [12], compared to the primary one, the budgetary allocation can be characterized not only by planning, forecasting and payments control, but also by establishing the goals and directions of allocation, and the size of reallocated funds, etc. The majority of researchers share the same opinion that budgetary reallocation should be considered from the position of using budgetary opportunities in accordance with public needs, priorities, statutory functions and powers. Therefore, this indicates that the inefficient reallocation of budgetary resources between the region and municipal units has a negative impact on the multiplicative extension of fiscal capacity of the entire region.

Various aspects of intraregional budgetary reallocation are studied in academic literature. Some papers (for example, the works of A.V. Starodubtsev, W. Nordhaus, I. Marques, E. Nazrullaeva, A. Yakovlev, S. Ansolabehere, J.M. Snyder, M. Vaishnav, N. Sircar [13–17]) are devoted to the impact of electoral cycles and political priorities on budget resources allocation. In others [18–20] the attention is paid to the management of territorial development through the budgetary reallocation instruments, including budget investment, financial aid and own (tax and non-tax) revenue sources. Statistical estimates testify that budget investments comprise only 1–5% of local budget expenditures, while inter-budget transfers often generate over 60% of local budget revenues, the size of which directly depends on the volume of own revenues. The present circumstance increases the relevance of studying the last instrument of budgetary reallocation.

It is worth noting that in most developed countries the municipal units have formed mainly under the influence of market forces; consequently, budgetary reallocation has served to satisfy the increasing needs of society and production. In centrally-controlled economy of the USSR, the formation of municipalities took place under the conditions of restrictions on industrial construction according to the general settlement scheme, which in a number of cases led to inertia in developing the industry and reduced the possibility of its progressive transformation [21].

Started to change after the collapse of the USSR, the budgetary reallocation at the intraregional level in Russia remained nonformalized up to September 19971. The need of stimulating not only regional, but also municipal development was legislatively confirmed in 2001 with the adoption of the Programme for Budgetary Federalism Development up to 2005. Modern basics of the local budgetary system functioning have been established since 2009 (in a number of pilot regions – since 2006) after the enactment of the Federal Law dated October 06, 2003

No. 126 “On General Principles of Organizing Local Government in the Russian Federation”. The main directions of the Strategy for Spatial Development of the Russian Federation up to 2025 have started to be implemented only since 2019.

Main results and their explanation. As previously noted, the current local budgetary system taking into account different types of municipal units dates back to 2006, this year has become the initial point of the study. It has been marked by some instrumental adjustments in the budgetary reallocation within the regions, which expected to change the number of local taxes (from 5 to 2), and the reduction in the rate of allocations according to certain federal and regional taxes. Thus, the payments for the use of natural resources, income tax allocations, as well as the part of standards on the personal income tax has been transferred from budgetary sources of different types of municipal units to higher budgets (Table 1).

During the transition period of the municipal reform (2003-2009), such measure seems quite appropriate in terms of smoothing the fiscal capacity’s differentiation of municipal units, which are extremely uneven according to the distribution of productive forces and the level of economic development. However, further strengthening of the centralization process, especially relating to the standards of allocations from the budget-forming tax on personal income, has just reduced the financial stability of local budgets under the weak diversification of the tax structure ( Table 2 ). Unfortunately, significant changes in fiscal

Table 1. Changes in the list of tax sources in local budgets of the Russian Federation after the municipal reform, %

|

Tax revenues |

Before the reform |

After the reform |

||

|

Municipal districts |

Settlements |

Urban districts |

||

|

Income tax (rate) |

7 |

0 |

||

|

Personal income tax |

50–70 |

20 |

10 |

30 |

|

Gambling tax |

50 |

0 |

||

|

Vodka excise tax |

35 |

0 |

||

|

Corporate property tax |

50 |

0 |

||

|

Personal property tax |

100 |

100 |

100 |

100 |

|

Land tax |

100 |

100 |

100 |

100 |

|

Payments for the use of natural resources |

65–80 |

0 |

||

|

Unified tax on imputed income |

45–75 |

90 |

– |

90 |

|

Payments for negative impact on the environment |

54 |

40 |

– |

40 |

|

Compiled by: laws on the federal budget for the period of 2003–2007. |

||||

Table 2. Dynamics in the structure of tax sources in local budgets of the Russian Federation, %

|

Tax |

2004 |

2015 |

2018 |

|

Personal income tax |

39.89 |

62.28 |

64.07 |

|

Property taxes |

12.43 |

19.02 |

17.70 |

|

Total income tax |

5.11 |

12.07 |

12.64 |

|

Excise tax |

2.17 |

2.81 |

3.00 |

|

Income tax |

32.83 |

0.93 |

0.73 |

|

Stamp duty |

0.65 |

1.82 |

1.67 |

|

Water tax / Taxes and charges for the use of natural resources |

0.36 |

– |

0.18 |

|

Sales tax (calculated per 2003) |

0.37 |

– |

– |

|

Gambling tax |

0.35 |

– |

– |

|

Gift tax |

0.16 |

– |

– |

|

Calculated by: data from the Federal Treasury. |

legislation, statistical calculation methods and budgetary classification do not give an opportunity to make an accurate assessment of structural shifts in the inter-budget allocation of revenues. But even the approximate estimates allow drawing firm conclusions about the existence of the centralization trend.

Comparing own revenues of local budgets with the GRP value has shown that the smallest part of gross formation belongs to municipal units. Thus, the share of municipal units’ own revenues in relation to the GRP in the Vologda Oblast has decreased from 4.9 to 2.8%, and the share of tax local revenues in the structure of the consolidated budget in the region has reduced from 66 to 18% ( Table 3 ).

The twofold increase of transfer payments has become the result of reducing tax sources of local budgets. If, according to the data from the Federal Treasury, in 2003 their share did not exceed 26%, then during the transition period of the reform (2006–2009) it increased up to 56%, and starting from 2009 it has been steadily comprising more than 60%.

It should be noted that the financial base of the settlement level is mostly forming by reallocating the part of income sources from municipal districts. As a result, the budgetary indicators of municipal districts have changed significantly. Backing off from the average country values, let us give a specific example regarding the one of pilot regions moved to the implementation of the new municipal principles starting from 2006, not from 2009.

Own revenues of all municipal districts of the Vologda Oblast have decreased by three times compared to the preliminary year, and the fiscal capacity of the population with own revenues has reduced by 65% ( Table 4 ). If in 2005 the fiscal capacity indicator of districts in the Vologda Oblast per resident mainly consisted of own revenues, then in 2006, on the contrary, it became largely dependent on the value of inter-budget transfers.

Subsequently, the practice of reallocating budgetary sources among the types of municipalities has been repeated many times. However, the growing need in equalizing fiscal capacity under the conditions of budgetary crises has prevalently become the prerequisite for the intraregional budgetary reallocation in the future.

Table 3. Allocation of own and tax revenues between the budgetary system’s levels as exemplified by the Vologda Oblast

|

Year |

Allocation of own revenues, % to gross regional product |

Allocation of tax revenues, % to consolidated budget |

||

|

Regional budget |

Local budgets |

Regional budget |

Local budgets |

|

|

2004 |

9.4 |

4.9 |

34 |

66 |

|

2005 |

7.9 |

4.2 |

67 |

33 |

|

2006 |

10.7 |

3.0 |

82 |

18 |

|

2007 |

10.9 |

3.8 |

78 |

22 |

|

2008 |

11.7 |

3.9 |

79 |

21 |

|

2009 |

8.9 |

4.2 |

72 |

28 |

|

2010 |

9.8 |

3.8 |

71 |

29 |

|

2011 |

9.1 |

3.6 |

76 |

24 |

|

2012 |

9.2 |

3.3 |

80 |

20 |

|

2013 |

9.2 |

3.1 |

79 |

21 |

|

2014 |

9.0 |

2.9 |

79 |

21 |

|

2015 |

9.0 |

2.8 |

79 |

21 |

|

2016 |

8.9 |

2.8 |

80 |

20 |

|

2017 |

8.8 |

2.8 |

82 |

18 |

|

2018 |

8.8 |

2.8 |

82 |

18 |

|

Calculated by: data from the Federal Treasury and Vologdastat. |

||||

Table 4. Budgetary situation in municipal districts before and after the reform

|

Name |

Own revenues per one resident, rubles |

The share of own income in revenues,% |

||||

|

2005 |

2006 |

2006 to 2005, % |

2005 |

2006 |

2006 to 2005, % |

|

|

Municipal districts of the Russian Federation |

5689 |

1903 |

33 |

62.3 |

17.1 |

27 |

|

Municipal districts of the Vologda Oblast, including: |

5444 |

1885 |

35 |

67.6 |

16.0 |

24 |

|

Ust-Kubinsky |

3777 |

3298 |

87 |

42.3 |

20.0 |

47 |

|

Sokolsky |

5655 |

2499 |

44 |

66.0 |

26.5 |

40 |

|

Mezhdurechensky |

5069 |

1504 |

30 |

55.8 |

21.5 |

39 |

|

Kirillovsky |

5180 |

2569 |

50 |

64.3 |

20.7 |

32 |

|

Babaevsky |

7719 |

2616 |

34 |

78.5 |

21.5 |

27 |

|

Belozersky |

6235 |

2877 |

46 |

81.0 |

21.7 |

27 |

|

Chagodoshchensky |

6527 |

2363 |

36 |

64.1 |

16.9 |

26 |

|

Kharovsky |

4239 |

1743 |

41 |

60.8 |

15.1 |

25 |

|

Gryazovetsky |

6806 |

2264 |

33 |

93.7 |

22.7 |

24 |

|

Sheksninsky |

5182 |

2034 |

39 |

83.5 |

20.0 |

24 |

|

Syamzhensky |

3916 |

1632 |

42 |

52.6 |

11.9 |

23 |

|

Kichmengsko-Gorodetsky |

2924 |

1176 |

40 |

46.5 |

10.5 |

23 |

|

Tarnogsky |

3152 |

1212 |

38 |

42.5 |

9.3 |

22 |

|

Velikoustyugsky |

6647 |

2009 |

30 |

81.5 |

17.7 |

22 |

|

Verkhovazhsky |

3227 |

1168 |

36 |

49.1 |

10.6 |

22 |

|

Vologodsky |

4875 |

1619 |

33 |

78.5 |

16.4 |

21 |

|

Nikolsky |

2587 |

1002 |

39 |

46.1 |

9.4 |

20 |

|

Cherepovetsky |

7646 |

2001 |

26 |

100.0 |

20.2 |

20 |

|

Vozhegodsky |

3668 |

1302 |

35 |

49.8 |

9.9 |

20 |

|

Kaduysky |

12183 |

2570 |

21 |

100.0 |

19.8 |

20 |

|

Totemsky |

7531 |

2133 |

28 |

87.7 |

16.5 |

19 |

|

Vashkinsky |

4134 |

1328 |

32 |

47.0 |

8.8 |

19 |

|

Ustyuzhensky |

3148 |

1256 |

40 |

50.3 |

9.1 |

18 |

|

Vytegorsky |

8487 |

1744 |

21 |

100.0 |

17.2 |

17 |

|

Nyuksensky |

7650 |

1932 |

25 |

78.4 |

13.1 |

17 |

|

Babushkinsky |

3367 |

1148 |

34 |

58.1 |

9.7 |

17 |

|

Calculated by: data from the Federal Treasury and Rosstat. |

||||||

As far as more than 60–70% of tax revenues of local budgets have traditionally been concentrated in the treasury of cities, the mechanism of reallocating their budgetary sources has been exposed to new anti-crisis adjustments2. In 2012, the minimum standards of the personal income tax payments to the budgets of urban districts have been reduced from 30 to 20%, in 2014 – even up to 15%.

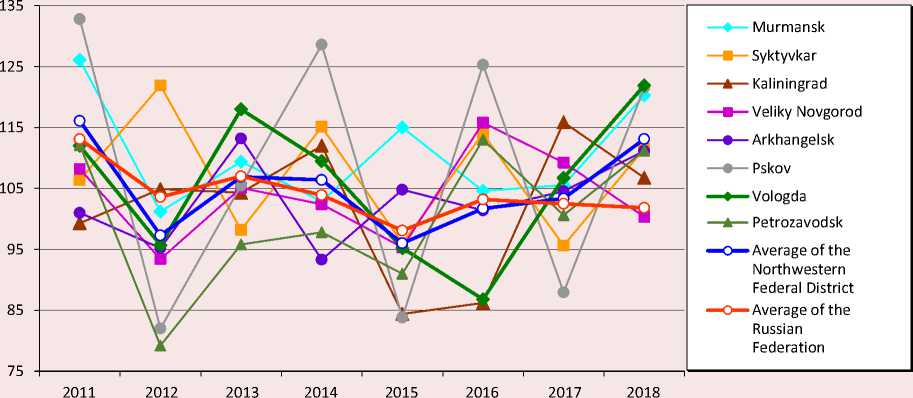

Due to the fact that not all regional authorities have established the minimum standard for urban districts, geographically even for the Northwestern Federal District there has been a significant gap in the dynamics of tax revenues ( Table 5 ).

The role of the personal income tax in forming own budgetary resources of urban districts in Russia has decreased from 64 to 58%, despite the fact that indicators of socioeconomic development showed stable growth. For example, the average wage in Vologda has increased by 45%, but the share of tax in revenues has decreased by 18%. Inter-budget

Table 5. Dynamics of the personal income tax returns to the budgets of urban districts, % to the previous year

|

Territory |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Russian Federation |

104.1 |

111.5 |

80.2 |

100.5 |

104.3 |

106.2 |

117.5 |

|

Northwestern Federal District, including: |

95.6 |

105.5 |

86.1 |

104.3 |

98.0 |

109.5 |

113.8 |

|

Murmansk |

105.5 |

109.9 |

80.2 |

108.0 |

108.4 |

108.0 |

113.1 |

|

Kaliningrad |

113.3 |

91.8 |

100.9 |

99.5 |

107.0 |

105.0 |

112.6 |

|

Pskov |

103.6 |

98.2 |

100.2 |

97.6 |

104.8 |

108.4 |

106.8 |

|

Arkhangelsk |

97.0 |

108.3 |

92.6 |

101.4 |

85.3 |

126.4 |

107.2 |

|

Syktyvkar |

114.8 |

112.2 |

71.8 |

100.9 |

89.9 |

105.1 |

113.7 |

|

Petrozavodsk |

83.6 |

111.8 |

76.5 |

97.5 |

104.7 |

102.2 |

115.8 |

|

Vologda |

53.9 |

109.5 |

79.9 |

113.2 |

91.1 |

109.1 |

149.5 |

|

Veliky Novgorod |

75.5 |

111.5 |

77.7 |

96.4 |

105.5 |

102.5 |

107.7 |

Calculated by: data from the reports of the Federal Treasury; the reports on budget implementation in urban districts; Rosstat; the Federal Tax Service.

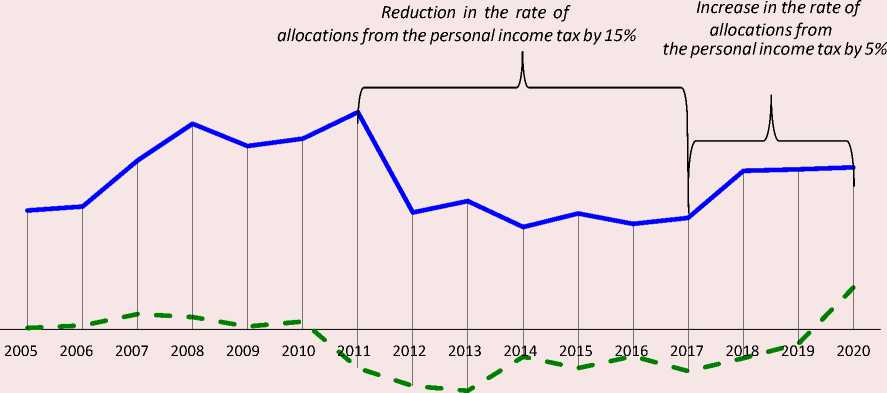

adjustments have led to the fact that out of 5.6 bil. rubles collected from employees of enterprises and organizations of Vologda, only 900 mil. rubles remained in the city budget. In total, during the period of 2011–2016 the similar losses of the city treasury comprised almost 4 bil. rubles, which was equivalent to 34% of tax revenues. In order to solve the issues of local importance, city authorities were forced to increase the debt burden from 13 to 74% and to allocate 618 mil. rubles for maintaining bank credits. Analyzing the trends of the budget’s tax autonomy on the budget-forming tax and the budgetary balance of the city confirms the interconnection of these indicators (Fig. 1).

Figure 1. Correspondence of ratios characterizing the return of the personal income tax into the budget and the size of the budget deficit/surplus of Vologda in 2005–2020

^^^^^^w Budget's tax autonomy ratio by the budget forming tax Indicators of budgetary balance

Table 6. Ratio in own revenues and expenditures of local budgets of the Russian Federation

|

Year |

Ratio in own revenues and expenditures, bil. rubles |

Ratio in own revenues and expenditures, % |

|

2004 |

-2.2 |

75.4 |

|

2005 |

-2.3 |

77.6 |

|

2006 |

-4.2 |

65.8 |

|

2007 |

-7.2 |

45.8 |

|

2008 |

-8.0 |

53.7 |

|

2009 |

-7.7 |

59.5 |

|

2010 |

-6.5 |

57.5 |

|

2011 |

-8.1 |

55.6 |

|

2012 |

-9.9 |

53.5 |

|

2013 |

-7.0 |

63.5 |

|

2014 |

-7.9 |

64.1 |

|

2015 |

-8.6 |

65.7 |

|

2016 |

-8.4 |

63.2 |

|

2017 |

-7.7 |

61.2 |

|

2018 |

-7.9 |

62.9 |

|

Calculated by: data from the Federal Treasury. |

||

The consequences of the budgetary reallocation of the key tax for urban districts have become the decrease of one third of real3 budgetary expenditures, the break of the trend in exceeding own revenues over financial assistance since 2014, and the reduction of the balance indicator ( Table 6 ).

In the end, it influenced the abilities of city authorities to use the fiscal capacity as a tool for improving the population’s living standards and quality of life. Some studies [22–24] confirm that the possibilities of modernizing the economy and social sphere are growing with the strengthening the fiscal capacity of territories, but its extremely unstable level, shown in the figure 2 , cannot contribute to the solution of these tasks so far.

As for the situation in settlements, statistical data are still showing the formal operating among the most budgets. The deficit of own income sources for the performance of expenditure powers is offset by the system of inter-budget transfers (in a number of regions of the Russian Federation more than 95%).

The domestic experience of reallocating budgetary resources within the region shows that the evolution of inter-budget relations at the local level satisfied the principles of income centralization, expenditure decentralization and the priority of equalizing fiscal capacity over stimulating the development of local territories. Following these principles has not allowed regional authorities to reduce the burden of regional budgets significantly during the entire observation period, which is related to the need for free financial assistance to municipal units. Herewith, a large share of transfers has been passed to the execution of delegated powers rather than own ones, and the share of issues regarding the local budgetary balance issues solved at the expense of the banking sector has increased ( Table 7 ).

The main conclusion, which follows from the above-mentioned problems of budgetary reallocation in the regions of the Russian Federation, lies in the inconsistency of used instruments to the current state of the local budgetary system. Despite its deterioration, there are a number of trends in reallocating budgetary funds within the region, permanently supported by public administration instruments.

Figure 2. Dynamics in income fiscal capacity of urban districts of the Russian Federation per capita, % to the previous year

Calculated by: data from the reports of the Federal Treasury; the reports on budget implementation in urban districts; Rosstat.

Table 7. Volume of inter-budget transfers to municipal units in the Russian Federation, %

|

Year |

The share of inter-budget transfers in expenditures of the region’s consolidated budget |

including executing the expenditure powers of the upper levels, % to inter-budget transfers |

The share of bank loans in own revenues of local budgets |

|

2004 |

33.0 |

42.8 |

1.5 |

|

2005 |

35.9 |

58.5 |

1.4 |

|

2006 |

41.0 |

50.1 |

1.3 |

|

2007 |

42.1 |

51.1 |

1.9 |

|

2008 |

37.5 |

49.1 |

1.9 |

|

2009 |

36.3 |

48.7 |

3.6 |

|

2010 |

41.3 |

52.9 |

9.5 |

|

2011 |

40.1 |

54.5 |

18.4 |

|

2012 |

38.4 |

49.5 |

26.2 |

|

2013 |

36.3 |

63.6 |

30.3 |

|

2014 |

39.5 |

67.9 |

40.5 |

|

2015 |

40.0 |

65.4 |

41.1 |

|

2016 |

31.8 |

60.2 |

48.7 |

|

2017 |

30.2 |

61.9 |

47.4 |

|

2018 |

30.9 |

62.0 |

43.8 |

|

Calculated by: data from the Federal Treasury. |

|||

-

1. The instruments of the budgetary reallocation in the region are based on the principle of equalization “from the wealthy people to the poor ones” without building the mechanisms of compensating the falling

out income sources. The same practice was used in 2005–2009 regarding the municipal districts and has been used since 2012 till the present moment concerning urban districts.

-

2. Strategic priorities for spatial development of the Russian Federation up to 2025 and the main directions of the fiscal policy up to 2022 (for example, regarding the cities received the need for strategic development without accompanying budgetary instruments) are weakly correlated.

-

3. The approach to the budgetary reallocation is maintained, in which the expected objective advantages of developing the certain types of municipal units (for example, the administrative factor, concentration of economic, labor and other resources) have become the matter not only for narrowing the tools for attracting budgetary resources at no charge, but also income sources for implementing the equalization function not in addition to the function of stimulating territorial development, but in contrast with it.

All mentioned above allows to make a conclusion that the modern public budgetary policy in the field of reallocating budgetary resources within the region is characterized by fragmentation of budgetary reallocation instruments, disagreement in legal and regulatory framework and actions of different management levels, as well as by insufficient accounting of budgetary trends of municipal units and their fiscal capacity. In turn, it does not initiate the multiplier effect of developing the fiscal capacity of the region with using the potential of the local budgetary system. Herewith, the chilling effect of budget reallocation within the region creates serious barriers for developing the fiscal capacity of Russian territories. The disordered short-term targeted processes of shifting budget funds from some types of municipal units to others only exacerbate the general negative trend.

Taking into account the specified circumstance and the results of the study, we consider that the following measures should be essential for improving the efficiency of the budgetary reallocation within the region:

-

1. On the one hand, it is necessary to propose the tools for strengthening the income basis of local budgets (regarding the personal income tax, tax revenues from the property complex, small business taxation).

-

2. On the other hand, it is necessary to strengthen the research and methodological justification of using the reallocation budgetary instruments (concerning the regular accounting of the dynamics in development of the center and periphery).

Instruments regarding the personal income tax

About 50% of local budget’s own revenues comprise the personal income tax. Due to the tax legislation, it is a federal tax, but the powers of its reallocation have been transferred to regional authorities. According to the revealed trends, its inter-budget allocation has become the most unstable one in the tax system. The extremely high dependence on volatility of this source disrupts paying capacity, sustainability and, consequently, security of the local budgetary system.

Due to the European Charter on Local Government, ratified by the Russian Federation in 1998, the financial resources of local government bodies must be commensurate with the powers granted to them by the Constitution and the law. There is no denying that municipalities at the district and settlement levels will not be able to “survive” without stable income sources. At the same time, the practice of personal income tax deductions, permanently reallocated from some types of municipal units to others, creates the problems of balance, debt and social issues, etc. The question is what part of the collected revenues should be taken out of municipal units for their transfer to the regional budget.

The problem regarding the territorial placement of the personal income tax, which is still relevant, should not stay unmentioned. A long time ago foreign countries carried out the tax reform of reallocating the personal income tax from the taxpayer’s workplace to the place of his residence. The obvious arguments in favor of this instrument are the lack of financial resources for the development of infrastructure and the provision of social services to the population guaranteed at the place of residence, the falling out of tax revenues due to the provision of tax deductions for those taxpayers whose place of residence does not coincide with the workplace.

The experience of Germany testifies the possibility of the further reallocation of tax payments to the budget of the place of residence after their initial payment at the workplace [25]. In Russia there is no legal framework for it, but the organizational framework with the existence of taxpayer identification numbers (TINs) and the powers of the Pension Fund to monitor wage contributions from each worker contributes to implementing such instrument of strengthening the income basis of peripheral municipal units.

Instruments regarding tax revenues from the property complex

Local taxes (the personal property tax and the land tax) make an insignificant contribution to the municipal treasury – less than 17% of own revenues. If we refer to foreign comparisons, then the real property tax exists in approximately 130 countries around the world. In the local budgets of some federated states it is the main item of tax revenues: in the USA – about 70–75%, in Canada – up to 80%, in some states of Australia – more than 90%. The potential of property taxes, the particular value of which is their independence from external economic conditions, is quite weakly used in

Russia. It is connected both with problems of their inter-budget allocation and with problems of accounting the tax basis, which reduces the level of tax collection. Herewith, tax collection has the direct influence on the liquidity of the budgetary system and minimization of the risk regarding the lack of free funds for timely payments on debt servicing and redemption. According to the Federal Tax Service, the debt on local tax payments to the budgets of municipal units of the Russian Federation as of January 01, 2019 has comprised nearly 92 bil. rubles, or 44% of the received volume.

The land tax remains rather difficult for performance and the insignificant source of local revenues in the Russian Federation. The Tax Code gives its marginal tax rates, under which the bodies of municipal units can differentiate the amount of tax depending on the categories of land or the permitted use of the land plot (from 0.3 to 1.5%). However, the minimum limit is not defined, which indicates the possibility of a tax rate equal to 0%. As a result, the deputies of representative bodies of the local government, maximally trying to “protect” the interests of taxpayers by reducing the rates, are decreasing the filling of the revenue part of local budgets. It does not have a good impact on municipal development, because it significantly complicates the financing of the sociocultural sphere, housing and public utilities, road maintenance and construction and other expenses, which according to the article 16 of the Federal Law No. 131 should be carried out by local government bodies. In such situation it is difficult to maintain the balance between the interests of taxpayers and the local budget, so applying the instrument of fixing both maximum and minimum limit rates of the land tax should be based on a balanced, economically justified approach recorded in the highest tax document of the country. The establishment of zero rates should comply with the principles of social and economic efficiency.

Regarding the local personal property tax, it is appropriate to fix in the Federal Law No. 122-FZ the limiting deadlines, during which the newly constructed buildings, objects and other structures should be registered. This problem is especially relevant in the case when an extension to the building appears or the new building has been built at the location of the old one, that is, there has been an increase in the object’s cost and, consequently, the tax basis, but the owner is not in a hurry to record it. Simplifying the process and reducing the cost of registration procedures for the execution of documents, establishing the mechanism of bringing individuals to responsibility for avoiding the registration of property rights in real estate units are quite implementable in the Russian legal and regulatory framework as the important measures of increasing the potential of personal property tax.

In the context of increasing the level of collecting local taxes many researchers note the real prospects for the development of property taxation in the Russian Federation. Due to the mentioned above, abolishing the share of the corporate property tax entering the local budgets is considered as a premature and unjustified measure. Meanwhile, such factors as stability of its returns, low mobility of the tax basis and economic efficiency count in favor of attributing this tax. Whereas the organizations use the local infrastructure (in particular roads and utilities), it would be logical to assign the taxes incoming from their property to local budgets. According to the preliminary evaluation, transferring 25% of revenues from the corporate property tax to the local level would increase tax revenues of local budgets by 35%.

The scientific community has repeatedly made proposals of attributing all property taxes to the local status, because it is appropriate to assign all those taxes and charges to local budgets, as the formation of their tax basis can be influenced by municipal authorities and they can be effectively managed by them.

Instruments regarding small business taxation Small enterprises and individual entrepreneurs, as the main tenants of municipal property and land plots as well as the payers of special tax regimes, credited to local budgets according to standards, add 7% on average to the volume of their own revenues. Due to the different standards of allocations from special tax regimes, the contribution of small business to the local budget system is differentiated by the types of municipal units: urban districts contribute about 7% of their own income, municipal districts – 13% ( Table 8 ).

Table 8. Contribution of small enterprises to local budgets of the Russian Federation, % from own revenues of budgets

|

Year |

The share of revenues from small enterprises in own revenues of budgets |

||

|

municipal units |

urban districts |

municipal districts |

|

|

2006 |

5.3 |

5.7 |

8.9 |

|

2009 |

4.7 |

5.0 |

7.0 |

|

2012 |

6.4 |

6.9 |

9.0 |

|

2014 |

6.8 |

6.2 |

10.4 |

|

2018 |

7.2 |

7.0 |

13.2 |

|

Calculated by: reports of the Federal Treasury and Rosstat . |

|||

Financial instruments of local government bodies are limited to two key types of stimulating small business development, in relation to which further improvement is appropriate.

-

1) The budgetary subsidy for small enterprises.

According to the Federal Law No. 209-FZ “On the Development of Small and Medium Business in the Russian Federation”, the support of business by local authorities can be conducted through providing subsidies, budgetary investments and municipal guarantees regarding the liabilities of business entities. However, not all Russian municipalities have financial resources for assisting small and medium business, so it is appropriate to consider the issue of comparing small business development indicators, including increasing the contribution to budgets, with the level of stable co-financing of expenses for supporting small business from higher budgets.

-

2) Minimizing the tax burden for small enterprises.

Let us subscribe to the opinion of [26–27] that the tax burden should not be destructive for business, meanwhile, municipal authorities should not neglect the interests of local budgets. In this regard, it is appropriate to monitor the impact regarding the decisions of local government bodies in terms of establishing the value of the ratio correcting the basic revenue position when collecting the unified tax on imputed income from entrepreneurs and organizations on the tax burden. The results of such monitoring will show the dynamics of the tax and the rating according to the level of the tax burden, which, therefore, will reveal the validity of correcting ratios regarding the unified tax on imputed income for their compliance with the economic situation of territories taking into account achieving the balance of interests between small business and local budgets.

Besides, establishing the certain elements of taxation when applying them to micro- and small enterprises4 within the framework of the Tax Code should be included to the competence of local authorities. In particular, the issue of granting the right to determine the amount of potential annual income of the individual entrepreneur, as well as the list of types of business activities due to which using of patent taxation system is permitted, should be taken under consideration. In this regard municipal authorities will be able to take into account the peculiarities and specifics of maintaining business activities within the territory of their municipality more efficiently. Herewith, it is possible to provide the establishment of framework criteria for the amount of revenues at the federal level.

Strengthening the justification of applying the instruments of the budgetary reallocation

It is known that in modern domestic and foreign studies there are different views on the need of stimulating the development of certain types of municipal units, and, consequently, the priority of budgetary reallocation in their favor. Thus, a number of studies testify such a priority in favor of cities as the growth points. For example, the work of [28] shows the significant positive impact of agglomeration effects on macroeconomic indicators of the regions. M. Fujita, P. Krugman and F.J. Venables [29] claimed that the role of development and modernization centers belongs namely to cities, but to a various extent and with different quality of growth. However, as the practice shows, not all cities in modern market conditions are ready for competition regarding labor and economic resources, and therefore cannot increase neither human, nor economic or fiscal capacity [30]. As N.V. Zubarevich noted [31], the equalizing approach to the spatial development, implicating the need for cities to share with the periphery, prevents the implementation of the policy aimed at systemic support of modernizing the economy and human capital of Russian cities. On the other hand, the theory of agglomerations explains the restraining of the periphery’s development due to the concentration of economic activity in the regional center, and the theory of cumulative expansion indicates the dual effect from developing central cities, in particular, the generation of development pulses. Moreover, due to strengthening the relevance of the spatial component of territorial development, in the scientific community and management environment the attention is being increasingly paid to the polar issues: preserving the unique character of small and medium cities, developing large cities and agglomerations, and inequality of “center-periphery”.

In the study [32] it is justified that the processes of concentrating the economic activity along with interregional divergence shape a positive trend of Russia’s spatial development. However, the current budget policy is aimed, on the contrary, at convergence of regional development indicators, which implies compatibility of characteristics regarding the key budgetary instruments (formalized methods of allocating subsidies, standards of tax payments, etc.) with this goal. We are concluding that one of the shortfalls in justifying the instruments of budgetary reallocation is the lack of regular accounting of dynamics regarding the co-development of the region’s center and periphery.

Appealing to the scientific literature, we note that it contains a number of detailed and interesting studies concerning the diffe- rentiation, asymmetry and polarization of intraregional space [33–40] with regard to the diversity of approaches, dynamics analysis and the identified ways of measuring the level of inequality. Therewith, the existing tools in various scientific works (coefficient of variation, Gini index, Theil index, integral estimate, transfer matrix, Markov chains, existence of β- and σ-convergence, etc.) in most cases are used for socio-economic development indicators of urban and municipal districts, slightly concerning budgetary indicators as well. Moreover, compared to the listed tools, in regard to the impact of budgetary reallocation on the fiscal capacity of the region, it becomes significant to study precisely the relative length of the margin between the vectors of the level of fiscal capacity per capita of the center and the periphery. The modern methodology does not contain methodological tools for conducting such measurements. In addition, this methodological gap distorts the possibilities of developing the fiscal capacity of the region, in particular, directly influencing the budgetary reallocation and the possibilities of implementing the incentive function of the inter-budget transfers system.

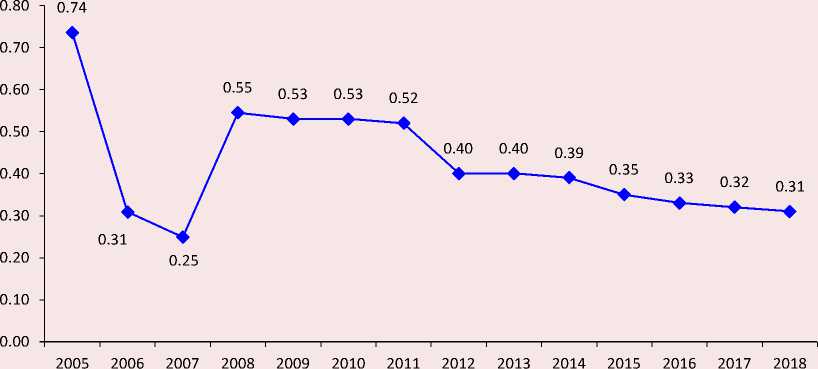

Expanding the tools reflecting the validity of budget reallocation measures through the line “center-periphery”, the so-called Centro-regional Budget Provision Differentiation Index has been elaborated in the study. Let us indicate that centroregional differentiation expresses the differences in volumes of own revenues per capita between the regional center and peripheral municipal units of the same region. The index is based on two economic indices: Herfindahl-Hirschman index (the index for evaluating the degree of the branch’s monopolization, 1945) and Theil index (the index for measuring social inequality, 1967). The developed index (ICRDBP) takes into account absolute indicators per capita and growth rates in the level of fiscal capacity, which increases the accuracy of calculations, because the cities with the lowest indicators per capita can be characterized by higher growth rates.

The calculation of ICRDBP is supposed to be carried out according to the formula:

Tli[_(BP RtC -BPpi t ) 2 +(:

ICRDBP = V-------------:

n pRC

- BPlit

•pp RC

BPl(t-1)

• -

b|(Bp P, ) 2 + (-

BpPt

' jtr 2 2

-ppP

BPjl(t-1)

Bpljit

BP№-1)

■ )2]

,

where ВР $С — the level of fiscal capacity per capita of the regional center’s population i of own revenues in the year t ;

BPp t — the level of fiscal capacity per capita of the region’s population j without the regional center i of own revenues in the year t ;

BP /(^-1) — the level of fiscal capacity per capita of the regional center’s population i of own revenues in the year t– 1;

BP ^t-1) — the level of fiscal capacity per capita of the region’s population j without the regional center i of own revenues in the year t– 1 .

Interpreting the index values in time series means the strengthening of centroregional differentiation along with the index’s growth and the weakening of centroregional differentiation under the index’s decrease. The graphical interpretation of the index is a curve, whose approaching to the X-axis indicates a convergence process and equalization of fiscal capacity levels at the expense of stimulating its development. The monitoring of the index will allow authorities quantitatively to define the limits and dynamics of centroregional differentiation. It is assumed that the important step in justifying the use of budgetary reallocation instruments should be dividing the centroregional differentiation limits into intervals complying with certain strategic priorities. Moreover, conducting measurements over all Russian regions (due to the specifics, excluding Moscow, St. Petersburg, Sevastopol, the Leningrad and Moscow Oblasts, the Nenets Autonomous District) will allow carrying out their classification. This issue requires

Figure 3. The curve of centroregional differentiation index according to the level of fiscal capacity (using the example of the Vologda Oblast)

Source: compiled by the author.

additional research and calculations, so it will be the subject of our future studies.

Within the current stage of work, the elaborated methodological tools for measuring centroregional differentiation according to the level of fiscal capacity have been tested using the example of the Vologda Oblast as a typical region of the Russian Federation due to most indicators of socio-economic development. The Vologda Oblast, as noted above, in 2006 has moved to implementing the local government reform among the pilot regions. Calculating the index values has shown a remarkable trend to falling of its curve, which indicates the convergence in the levels of fiscal capacity of the regional center and periphery ( Fig. 3 ).

The study of empirical data in the figure has shown the sharp fall in the curve of index in 2006, when among other pilot regions the Vologda Oblast started to implement the organizational and financial reform of the local government basics. The detailed assessments of this process, as well as its comparative calculations over other Russian regions will be carried out at the next stages of studies.

Conclusions. The results of the conducted study reveal that the modern public regional policy regarding the intraregional reallocation of budgetary resources in terms of developing the fiscal capacity of the entire region should correspond to the following key principles.

Firstly, it should correspond to the principle of reimbursement, which shows that the adoption of budgetary standards for some types of municipal units should not significantly reduce the fiscal capacity in others by applying appropriate compensation mechanisms.

Secondly, it should correspond to the principle of differential strengthening of the income basis, which takes into account the peculiarities, trends and historical traditions of the economy management regarding the different types of local territories. For example, in municipal units with the large property complex the main focus has to be established on stability of assigning property taxes (land tax, corporate property tax and personal property tax) to local government authorities. In municipal units with the weak production potential there is no economic sense to fill the budget with minimal volumes of income sources from enterprises, while it becomes important to stimulate the development of small business.

Thirdly, it should correspond to the principle of validity, which indicates the confirmation of certain budgetary reallocations by research and methodological tools.

The results of the presented study contribute to developing the theoretical aspects regarding the reallocation of budgetary resources in the region, which reflected in elaborating the research and methodological justification for applying the budgetary reallocation instruments, as well as in reasoning the principles of modern public policy in the field of the intraregional reallocation of budgetary resources, compliance with which will contribute to the development of the region’s fiscal capacity. The practical significance of the study is due to the possibility of applying the identified positions in the activities of public authorities and local government bodies in solving the problems regarding the reallocation of budgetary resources in the region.

Список литературы Instruments and principles of reallocating budgetary resources in the region

- Azoulay A., Côté J.-G. Les clés du développement économique local Analyse des stratégies de six villes nordaméricaines. Note de Recherche, 2017. Available at: institutduquebec.ca/docs/default-source/recherche/8842_les-cles-du-developpement_idq_br_fr.pdf?sfvrsn=2

- Krätke S. Die globale Vernetzung von Medienzentren. Zur Diversity von Geographien der Globalisierung. Geographische Zeitschrift, 2002, no. 90, рр. 103–123.

- Lockner A.O. Steps to Local Government Reform: A Guide to Tailoring Local Government Reforms to Fit Regional Governance Communities in Democracies. USA, Bloomington: iUniverse, 2013. 621 p.

- Silem A., Fontanel J., Pecqueur B., Bensahel-Perrin L. L’économie territoriale en questions. Paris: l’Harmattan, 2014.

- The New Urban Agenda. United Nations. 2017. Available at: http://habitat3.org/wp-content/uploads/NUAEnglish.pdf

- Nekipelov A.D. Crisis in Russia: Logic of development and alternatives of economic policy. Obshchestvo i ekonomika=Society and Economy, 2009, no. 8–9, pp. 5–21. (in Russian)

- Tatarkin A.I., Gershanok G.A. Methodology for the assessment of local territories’ sustainable development on the basis of measuring socio-economic and ecological capacity. Vestnik Novosibirskogo gosudarstvennogo universiteta. Seriya: Sotsial’no-ekonomicheskie nauki=Vestnik NSU. Series: Social and Economic Sciences, 2006, vol. 6, no. 1, pp. 40–48. (in Russian)

- Odintsova A.V. Spatial economics in the works of French regulation school members. Prostranstvennaya ekonomika=Spatial Economics, 2011, no. 3, pp. 56–70. (in Russian)

- Friederich P., Kaltschütz A., Nam C.W. Recent Development of Municipal Finance in Selected European Countries. The 44th Congress of the European Regional Science Association (ERSA) Oporto, August 25–29, 2004. 53 p.

- Slack E. Guide of municipal finance. Nairobi: UN-HABITAT, 2009. 81p.

- Odintsova A.V. Local governance as a development institution. Federalizm=Federalism, 2015, no. 2 (78), pp. 87–100. (in Russian)

- Istomina N.A. On the budget reallocation and its role in social and economic development of the regions. Finansyi kredit=Finance and Credit, 2013, no. 11 (539), pp. 12–19. (in Russian)

- Starodubtsev A.V. Politicheskaya loyal’nost’ ili ekonomicheskaya effektivnost’? Politicheskie i sotsial’noekonomicheskie faktory raspredeleniya mezhbyudzhetnykh transfertov v Rossii [Political Loyalty or Economic Efficiency? Political and Socio-Economic Factors of Intergovernmental Fiscal Transfers Relocation in Russia]. St. Petersburg: Izdatel’stvo Evropeiskogo universiteta v Sankt-Peterburge, 2009. 28 p.

- Nordhaus W. The political business cycle. Review of Economic Studies, 1975, vol. 42 (2), рр. 169–190.

- Marques II I., Nazrullaeva E., Yakovlev A.A. From Competition to Dominance: Political Determinations of Federal Transfers in Russian Federation. NRU Higher School of Economics. Series EC «Economics». 2011, no. 12, 49 p.

- Ansolabehere S., Snyder J.M. Party control of state government and the distribution of public expenditures. Scandanavian Jounal of Economics, 2006, vol. 108 (4), рр. 547–569.

- Vaishnav M., Sircar N. Core or Swing? The Role of Electoral Context in Shaping Pork Barrel. Working Paper, 2012. Available at: https://nsircar.files.wordpress.com/2013/02/vaishnav_sircar_03-12-12.pdf

- Isaev A.G. Distribution of financial resources within the budget system of the Russian Federation and regions’ economic growth. Prostranstvennaya ekonomika=Spatial Economics, 2016, no. 4, pp. 61–74. (in Russian)

- Il’in V.A., Povarova A.I. Problemy effektivnosti gosudarstvennogo upravleniya. Byudzhetnyi krizis regionov: monografiya [Public Administration Efficiency. Budget Crisis in the Regions: Monograph]. Vologda: ISERT RAN, 2013. 128 p.

- Bukhvald E.M., Pechenskaya M.A. About budgetary constraints of municipal strategic planning. Samoupravlenie=The «Samoupravlenie» journal, 2016, no. 9 (102), pp. 16–19. (in Russian)

- Pechenskaya M.A. Budgets of regional centers in the North-West: Tools for modernization or survival? Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2019, vol. 12, no. 3, pp. 77–90. (in Russian)

- Pechenskaya M.A. Regional development: Goals and opportunities. Finansy=Finance, 2014, no. 10, pp. 22–26. (in Russian)

- Diadik V.V. About problems of strategic planning at municipal level: Russian realities and Scandinavian experience. Regional’naya ekonomika: teoriya i praktika=Regional Economics: Theory and Practice, 2014, no. 6, pp. 53–62. (in Russian)

- Pechenskaya M.A. Development of intergovernmental fiscal relations in Russia in 2000–2015. Problemy prognozirovaniya=Studies on Russian Economic Development, 2017, no. 2, pp. 117–130. (in Russian)

- Kuznetsova O. Interbudgetary relations: parallels between Russia and Germany. Kazanskii federalist=Kazan Federalist, 2006, no. 3 (19), pp. 56–67. (in Russian)

- Osipova A.A., Sidorenko O.V. Small business promotion in the region. Prostranstvennaya ekonomika=Spatial Economics, 2007, no. 2, pp. 61–77. (in Russian)

- Terebova S.V. Small business as the factor increasing the employment rate and incomes of the population. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2013, no. 5 (29), pp. 112–122. (in Russian)

- Mikheeva N.N. Factors of growth of Russian regions: Adaptation to new conditions. Region: ekonomika i sotsiologiya=Region: Economics and Sociology, 2017, no. 4, pp. 151–176. (in Russian)

- Fujita M., Krugman P., Venables F.J. The Spatial Economy: Cities, Regions and International Trade. Cambridge (Mass.), 2000.

- Zubarevich N.V. Cities as centers of modernization of economy and human capital. Obshchestvennye nauki i sovremennost’=Social Sciences and Contemporary World, 2010, no. 5, pp. 5–19. (in Russian)

- Zubarevich N.V. Russian cities as centers of growth. Upravlencheskoe konsul’tirovanie=Administrative Consulting, 2006, no. 2 (22), pp. 113–118. (in Russian)

- Kolomak E. Uneven spatial development in Russia: Explanations of new economic geography. Voprosy ekonomiki=Voprosy Ekonomiki, 2013, no. 2, pp. 132–150. (in Russian)

- Voroshilov N.V., Gubanova E.S. Vnutriregional’naya sotsial’no-ekonomicheskaya differentsiatsiya [Intraregional Socio-Economic Differentiation]. Vologda, 2019. 187 p.

- Evchenko A.V., Stolbov A.G. Upravlenie ekonomicheskim i sotsial’nym razvitiem sub”ekta Federatsii s uchetom vnutriregional’noi asimmetrii: teoriya i praktika [Managing Economic and Social Development of a RF Subject in View of Intraregional Asymmetry: Theory and Practice]. Apatity: KNTs RAN, 2006. 245 p.

- Aleksandrova A., Grishina E. Nonuniform development of municipalities. Voprosy ekonomiki=Voprosy Ekonomiki, 2005, no. 8, pp. 97–105. (in Russian)

- Turgel’ I.D., Pobedin A.A. Territorial differentiation of municipalities’ socio-economic development in RF subjects: experience of variance analysis (case study of Sverdlovsk Oblast). Regional’naya ekonomika: teoriya i praktika=Regional Economics: Theory and Practice, 2007, no. 12, pp. 12–23. (in Russian)

- Gubanova E.S., Kleshch V.S. Methodological aspects in analyzing the level of non-uniformity of socio-economic development of regions. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2017, vol. 10, no. 1, pp. 58–75. (in Russian)

- Popov P.A. Definitions of socio-economic asymmetry of the region’s municipal organizations. Sotsial’noekonomicheskie yavleniya i protsessy=Social-Economic Phenomena and Processes, 2010, no. 5, pp. 85–88. (in Russian)

- Nefedova T.G., Treivish A.I. Strong and weak cities in Russia. Polyusa i tsentry rosta v regional’nom razvitii [The Poles and Centers of Growth in Regional Development]. Moscow, 1998.

- Bufetova A.N. Inequalities in spatial development of regional centers and regional periphery. Region: ekonomika i sotsiologiya=Region: Economics and Sociology, 2009, no. 4, pp. 55–68. (in Russian)