Integrated assessment on corporate performance efficiency: theoretical and practical problems

Автор: Peleckis Kstutis, Slavinskait Neringa

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 2-1 (11), 2014 года.

Бесплатный доступ

Короткий адрес: https://sciup.org/140124501

IDR: 140124501

Текст статьи Integrated assessment on corporate performance efficiency: theoretical and practical problems

Though today’s companies operate in highly dynamic environment, the evaluation of the effectiveness of the main performance always remains as one of the fundamental of each business areas. The company’s performance assessment is like a clock, which shows today’s business situation, trends in development and helps company to decide where to go further. There are calculated a lot of company’s performance evaluation methods and indicators in scientific literature and in practice, but for today there is an integrated company’s main performance assessment, which include not one, but several methods.

Recently, in order to deal with both, theoretical research and practical challenges, there are applied multi-criteria evaluation methods (Figueira et al ., 2005). This is because of the universality of these methods, because when applying multicriteria evaluation method it is easy to quantify any complex phenomenon, expressed by many indicators. These methods have the advantage that a single generalised indicator combines both maximizing and minimizing indicators, expressed by various dimensions, i.e. those who grow, in some cases the situation of phenomenon is getting better, in other cases-getting worse. Such combination is possible because of normalization of indicators, when all the indicators are transformed into dimensionless, which are comparable with each other (Ginevičius, Podvezko, 2007). In other words, multi-criteria assessment methods are used as decision support system. There has been solved a lot of challenges, concerning technical and social issues, based on these methods. The major part is devoted to deal with the construction issues, such as investment efficiency in individual housing construction business (Ustinovičius et al ., 2005, (a)), evaluation of construction contracts (Podvezko et al ., 2010), selection of rank mode (Ustinovičius et al ., 2005 (b)), evaluating construction comany‘s financial standing (Ginevičius, Podvezko, 2006), the comparison of several real construction variants, office repair and realization options (Ustinovičius et al ., 2006), setting the construction place for commercial facilities (Larichev et al ., 2003; Zavadskas et al ., 2009), management of vocational training quality (Andriušaitienė et al ., 2008), the evaluation of government aid to business (Ginevičius et al ., 2008), the comparison of Baltic States level of development (Tvaronavičienė et al ., 2008), evaluation of tax system (Bivainis, Skačkauskienė, 2009), evaluation of financial system (Žvirblis, Buračas, 2010), evaluation of product quality (Pabedinskaitė, Vitkauskas, 2009), evaluation of company‘s potential competitiors (Žvirblis et al ., 2008), evaluation of company‘s environmental components (Žvirblis, Zinkevičiūtė, 2008), evaluation of Lithuanian banks‘s reliability (Ginevičius, Podvezko, 2008) and other evaluations.

Recently, companies apply a wide spectrum of different methods and techniques in order to assess the main operating activities. It can be seen some kind of evolution in the basic performance evaluation. Some companies use traditional methods and calculate the financial indicators, the other use to create new systems of how to evaluate company‘s performance and, in this way, adapt to changing business conditions. EVA (economic value added), MVA (market value added), SVA (shareholder value added), system of balanced indicators, ABC and flow method are widely applicable, but there is no such indicator system, which could define the effectiveness of company‘s performance in one indicator.

The results of the article are novel because of multicriteria evaluation system, which allows to assess the effectiveness of the company‘s basic performance in one indicator. Besides, this system can be algorithmicised and included in the perspective computerised business management subsystems and systems.

The object of this research is the effectiveness of the main performance in alcohol industry.

The purpose of this paper is to evaluate the effectiveness of the main performance in alcohol industry by using multi-criteria methods.

The methods of the research include scientific literature analysis, economic indicator analysis, multi-criteria evaluation of the main performance, analysis of quantitative evaluation methods.

1 .The Concept of Core Performance Efficiency

There can be found a lot of different definitions for the word ‘efficiency’ in scientific literature. Performance efficiency is identified as the effective use of resources, when the desirable result is achieved at the lowest possible expenditure, or when we reach maximum possible result by using available resources. The achieved results are measured by effect and effectiveness. These company’s performance indicators are closely related. However, according to K. Lukoševičius and other authors (2005), we need to distinguish these two definitions. Effect economically is the result of the effect of company‘s economic activity, which is often expressed in terms of value. Meanwhile, the term efficiency means the efficiency of company‘s performance, expressed by the ratio of achieved results and expenditures in order to get these results. Therefore, the effectiveness of the main activities is the level of using manufacturing resources, which ensure maximum results.

The evaluation of company‘s principal performance efficiency is important not only in the current state analysis, but also in analysing business prospects, identifying the reserves and opportunities of operational improvement. However, there is no one opinion in scientific literature to identify by what indicators or criteria the effectiveness of company‘s principal performance has to be evaluated and how to do it best, so this work will do the integrated evaluation of company‘s main performance efficiency by using not only financial, but also non-financial indicators.

1. Multi-criteria Evaluation Phases of Company‘s Core Activity

The absence of summative indicator in company‘s core performance evaluation leads companies to look for more effective ways to improve their situation. The solution of difficult social, economic, organisational management challenges are multi-criterion dimension: the company‘s main performance efficiency is evaluated not by one single indicator, but according to several independent and unrelated indicators. In this connection, it is important to select all the company‘s operational efficiency descriptive indicators.

The analysis of A. Žvirblys, I. Mačerinskienė, and A. Buračas in their work ‘The Principals and Basic Models Evaluating the Potential of Companies‘s Competitior‘ showes that there are three basic criteria: activity‘s financial efficiency, financial compatibility and the balance of cash flow, but this paper deals only with the effectiveness of company‘s core performance, tehrefore, there will be analysed narrower group of indicators. There will be distinguished partial criteria in this article, made up of primary indicators. Primary indicators were selected after analysing several authors‘s works. (Gronskas, 2008; Juozaitienė, 2007; Kancerevyčius, 2009; Lukoševičius et al ., 2005; Mackevičius, 2007).

When comparing several companies‘s efficiency according to several indicators, there can be applied special methods, which allow to enter those rates into one (Belli et al ., 2004). This may be the sum or product of individual indicators (summative index is additive or multiplicative combination of partial indicators). However, generally, the selection of indicator of such efficiency is one of the most important and difficult stage of decisions quest, whis requires not only experience and knowledge of the subject area, but also the creative elements.

Recently, for both theoretical research and practical tasks solution multicriteria evaluation methods are increasingly used, which, by their nature, are fairly universal. This means that they make it possible to quantify any complex phenomenon, expressed by a number of indicators. Multi-criteria company‘s core performance evaluation methods can be classified into two groups:

-

1. Simple (geometric average, SAW sum of indicator meanings and weight products and unit sum);

-

2. Complex (TOPSIS, ELECTRA, PROMETHEE, VIKOR, complex proportional, simplify complex and other methods).

These methods were also analysed by Parkan, Wu (2000), Zhang (2003), Macharis (2004), Opricovic, Tzeng (2004) and others.

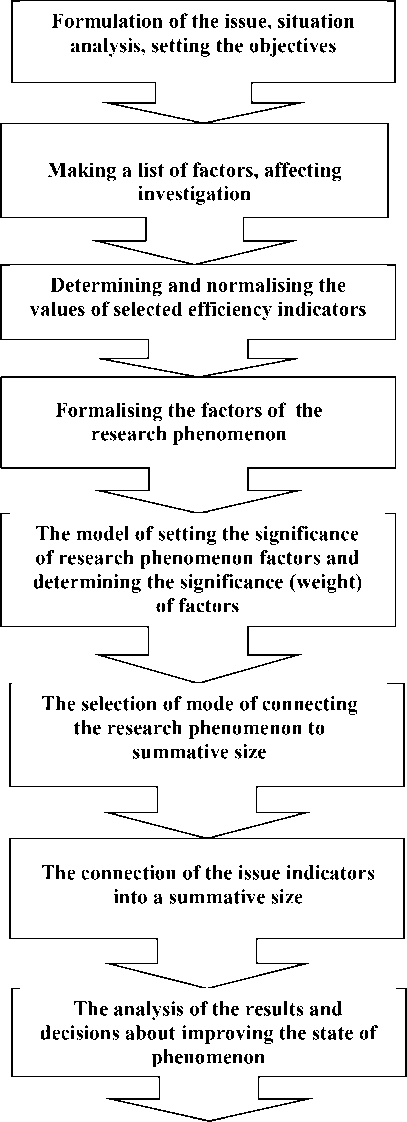

Regardless of the issue, there are certain stages, specific to the assessment of the effectiveness of the main performance, starting with the formulation of the research problem, establishing the object and purpose of the research and finishing with the determination of quantitative expression of investigated phenomenon and analysis of the results (1pav.):

First stage. Identifying and formulating the problem (problems), the object of the research, analysing influencing factors of the efficiency of company‘s core performance, setting the purposes of assessment (Tamošiūnienė, 2006).

The object of this paper is the evaluation of the effectiveness of core performance in alcohol industry, and the purpose of the research is quantitave evaluation of the effectiveness of companies‘s core performance, on purpose to define in a single indicator.

Second stage. Identifying all the factors that can affect the investigated object in the aspect of research purposes. Making a list of factors, which affect the efficiency of company‘s main performance, forming a system of factors, which affects company‘s core performance, with reference to analysed literature.

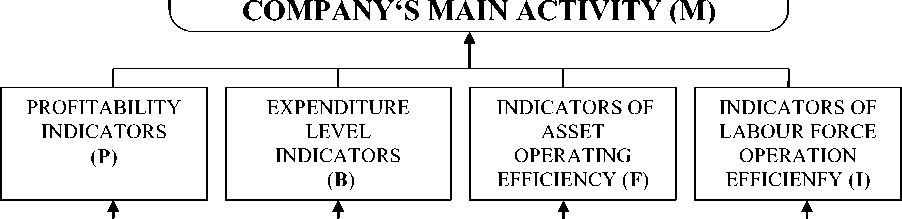

The company‘s main activity is a complex phenomenon and it is impossible to describe in one size, indicator, because it is difficult to find such a feature, which covers all the aspects of the analysed phenomenon. The factors, included in the efficiency evaluation of company‘s main performance, are connected to certain groups, highlithing the indicators of profitability, cost, the effectiveness of operating wealth and the efficiency of labour exercise.

Joint-stock profitability, own-stock profitability, gross margin, net profitability, activity profit, wealth profitability and short-term asset profitability are assigned to profitability indicator group . Cost level group includes the level of sales cost, activity cost for one litas of sales revenue, the cost of financial and investment activity for one litas of sales revenue and the level of the cost of investment activity. Asset efficiency group consists of resource turnover, working capital turnover, short-term asset turnover, long-term asset turnover, total asset turnover and receivable debt turnover. And labour force efficiency group includes sales and gross profit volume for one employee.

In order to describe properly and to evaluate correctly the efficiency of company‘s core performance, it is important to assess a bigger part of factors, because if you analyse only few factors, there is a danger to overlook some important aspects of company‘s activity that affect the overall aefficiency of company‘s core business. However, a large number of factors has a negative side, because it is difficult to formalise such factors or assess their weight (importance), for it requires a long time and financial resources. At this stage, there are established quantitative expressions (indicators), which affect company‘s core business.

Each of the analysed indicators has their own relative information – net profit shows how much net profit accrue to one sale litas, the gross margin shows how much gross profit accrue to one sale litas, etc. To select and systematise the indicators, following selection principals are reccomended to be applied:

-

a) the indicators have to be simple and plain in their composition and mathematical algorithm;

-

b) the indicators has to be widely used in practice and be known for various company‘s participants;

-

c) it is necessary to assess the reliability and particularity of the information, used to calculate indicators;

-

d) it is necessary to establish a minimum and maximum number of a set of evaluation indicators. With a large number of indicators, it is recommended to rate them.

Third stage. Determining and normalising the values of selected efficiency indicators.

It can be expressed by analitical formulae or point systems ( for hardly formulised elements). Normalisation – a transformation of total indicators values into dimensionless (comparable with each other), transforming them respectively (table 1).

Fourth stage. Forming the indicators, reflecting system factors, i.e. the factors are given a formalised expression. It can be expressed by analytical formulae or point systems (for hardly formulised elements) (Andriušaitienė et al ., 2008).

1 pic . Stages of multi-criteria evaluation

(source: created by the author, with reference to Andriušaitienė et al ., 2008;

Tamošiūnienė et al ., 2006)

Fifth stage. Two actions are perform at one time: optional method of setting the significance of phenomenon factors and determination of the significance (weight) of the factors. The values of investigated phenomenon indicators can be defined in to ways:

-

• in one case, if there is such a possibility, they are taken from the reports or other statistical sources;

-

• in other case, if there is no such a possibility, they are indicated by points, based on the selected rating. Usually, this is done by experts.

The selection of the model of identifying the significance of investigation elements depends on many factors, such as how many factors compose a system, at what level a team of experts can be formed, etc. When applying multi-criteria methods, there appears another problem- to identify an evaluation level of experts‘s compatibility and stability. The weight of indicators are often set by professional experts. The values of weights can be further applicable to multicriteria evaluation, if the opinions of the experts are compatible (noncontradictory). The rate of concordance (compatibility) defines compatibility level. In order to calculate the concordance coefficient (W), we should rate the indicators preliminary in point of each expert.

The concordance coefficient is calculated according to the formula that describes the degree of coincidence of individual opinions:

W =

12 S

r

r (m - r Z Tj)

j = 1

Hear are: r – the number of experts, m – the number of valued indicators, S – the sum of indicators rang the sum of the squares of deviations from their overall average, Tj – index of related ranks.

The concordance coefficient W, calculated according to each group of identified factors, shows the adequate compatibility of assessments (W = 0,60 – 0,80).

Sixth stage. Selecting the type of chosen efficiency indicators combination into a summative size (these can be a sum of individual indicators or a product (a summative indicator is additive or multiplicative combination of partial indicators)) and project‘s efficiency indicators are combined into a single summative size. When the efficiency analysis evaluates several indicators, they can be aggregated into a single generalised size or construct purpose trees, i.e. there can be applied special methods that allow to combine them into one (Tamošiūnienė et al ., 2006).

Seventh stage. The indicators of the phenomenon are combined into a summative size: there are carried out practical calculations of multi-criteria evaluation according to selected multi-criteria evaluation method.

Eighth stage. Analysis of the evaluation results and making the decisions about improving the state of the phenomenon on the basis of this analysis.

According to the analysed stages of company‘s core performance multicriteria evaluation, the article will go further with the complex evaluation of core performance in alcohol industry.

3. Complex Evaluation of Core Performance Efficiency in Alcohol Industry

It is approppriate to start to develop evaluation system from establishing the indicators – in order to form such a set of indicators, which would let to evaluate the efficiency of company‘s core activity thoroughly. The scientific literature gives a lot of various indicators of evaluating the effieciency of company‘s main performance, which differs in content, as well as in spread and depth of company‘s performance. The abundance of existing indicators makes fear difficulties in selecting the most appropriate indicators. On the other hand, this abundance lets to create such a set of indicators, which would allow to evaluate the effectiveness of company‘s activity consistently. In general, the scientific literature (Lydeka, Kavaliauskas 2003; Chlivickas, Raudeliūnienė 2008, Tvaronavičienė 2008) identifies main requirements, which are necessary to form a system of evaluation indicators: an influence on the phenomenon, comparison, simplicity (the importance of accessability to necessary data in the empirical study). Of course, it is important to take account of the objectives.

COMPLEX INTEGRATED INDICATOR OF ASSESSING THE EFFICIENCY OF

p1 – joint-stock profitability;

p2 – own-stock profitability (ROE);

p3 –gross profitability;

p4 – net profitability;

p5 – activity profitability;

p6 – assest profitability;

p7 – short-term asset profitability;

p8 – long-term asset profitability;

b1 –cost of sales level; b2 – activity‘s expenditure per one litas of sales revenue; b3 – financial and investing activity‘s expenditure per one litas of sales revenue; b4 – financial and investing activity‘s expenditure level;

f1 – resource turnover; f2 – working capital turnover;

f3 – short-term asset turnover;

f4 – long-term asset turnover;

f5 – asset turnover;

f6 – receivable debt turnover;

i1 – sale extent per employee;

i2 – gross market extent per employee;

2 pic. Complex indicators system of company‘s core activity evaluation

(source: created by the author with reference to , 2007; Gronskas, 2008; Kancerevyčius, 2009; Juozaitienė, 2007)

So, in order to make a complex evaluation of the efficiency of company‘s main activity in alcohol industry, primarily there should be distinguished objective groups of indicators, covering the primary financial and non-financial indicators that have a substancial influence on the evaluation. firstly, there are distinguished the indicators of profitability, expenditure level, asset operating efficiency and labour force operation efficiency (Gronskas, 2005; Juozaitienė, 2007; Kancerevyčius, 2009; Lukoševičius et al., 2005; Mackevičius, 2007). It is also important that these groups consist mainly of primary indicators, definable according to each company‘s audited data, presented in each company‘s financial (primarily the balance and profit (loss)) reports (2 picture).

Separate groups of indicators index assessment (based on normalised values of primary indicators) models have and expression, which is given in table 1. In expert way, there are determined such significance coefficients, corresponding to each partial criterion of the general performance evaluation model: hf1 =0,3; hf2 =0,2; hf3 =0,3; hf4 =0,2; after inserting the corresponding values in a model, the following expression is given:

M = 0,3 P + 0,2 B + 0,3 F + 0,2 I , (2)

After making a complex integrated evaluation system concerning the efficiency of company‘s main activity, defining partial criteria and selecting their substantial underlying indicators, we further go to the partial criteria and calculation of primary indicators of normalised values and determination of the significance coefficients.

Table 1. Partial criteria and calculation of primary indicators of normalised values and coefficients of the significance.

(source: created by the author’s, based on calculations)

|

Partial criteria |

Substantial underlying indicators |

A |

B |

C |

D |

Significance coefficients |

|

PROFITABILITY INDICATORS |

p1 |

0,074 |

0,752 |

0,400 |

-0,155 |

0,1 |

|

p2 |

0,175 |

0,508 |

0,786 |

-0,270 |

0,1 |

|

|

p3 |

0,060 |

2,259 |

-0,720 |

1,851 |

0,2 |

|

|

p4 |

0,137 |

0,447 |

0,122 |

-0,060 |

0,2 |

|

|

p5 |

0,130 |

0,432 |

-0,031 |

0,028 |

0,1 |

|

|

p6 |

0,087 |

0,220 |

0,084 |

-0,062 |

0,1 |

|

|

p7 |

0,339 |

0,516 |

0,225 |

-0,251 |

0,1 |

|

|

p8 |

0,117 |

0,383 |

0,133 |

-0,082 |

0,1 |

|

Sum |

1,00 |

1,00 |

1,00 |

1,00 |

1,00 |

|

|

EXPENDITURE LEVEL INDICATORS |

b1 |

0,743 |

0,596 |

0,530 |

0,817 |

0,4 |

|

b2 |

0,239 |

0,388 |

0,388 |

0,165 |

0,3 |

|

|

b3 |

0,018 |

0,016 |

0,082 |

0,018 |

0,2 |

|

|

b4 |

0,941 |

0,000 |

0,912 |

0,406 |

0,1 |

|

|

Sum |

1,00 |

1,00 |

1,00 |

1,00 |

1,00 |

|

|

INDICATORS OF ASSET OPERATING EFFICIENCY |

f1 |

0,411 |

0,137 |

0,128 |

0,379 |

0,1 |

|

f2 |

0,278 |

0,671 |

0,679 |

-0,125 |

0,3 |

|

|

f3 |

0,234 |

0,054 |

0,057 |

0,208 |

0,2 |

|

|

f4 |

0,081 |

0,040 |

0,034 |

0,068 |

0,1 |

|

|

f5 |

0,060 |

0,023 |

0,021 |

0,051 |

0,1 |

|

|

f6 |

0,493 |

0,075 |

0,081 |

0,419 |

0,2 |

|

|

Sum |

1,00 |

1,00 |

1,00 |

1,00 |

1,00 |

|

|

INDICATORS OF LABOUR FORCE OPERATION EFFICIENFY |

i1 |

0,880 |

0,741 |

0,705 |

0,830 |

0,5 |

|

i2 |

0,120 |

0,259 |

0,295 |

0,170 |

0,5 |

|

|

Sum |

1,00 |

1,00 |

1,00 |

1,00 |

1,00 |

The author‘s research investigate 4 companies from the alcohol industry: JSC „Anykščiai wine“ (A), JSC ‘Vilnius Vodka‘ (B), JSC ‘Alita‘ (C) ir JSC ‘Gubernija‘ (D). The calculations are given in table 1.

After giving the counting of partial criteria and primary indicators‘s normalised values and determination of significance coefficients, we will go further with the calculation of the effectiveness of company‘s main activity index and based on 2 formula, we are going to calculate it (table 2).

Table 2 . Calculation of company‘s index value of complex analysis and index of company‘s activity

(source: created by the author, based on calculations)

|

P |

B |

F |

I |

M |

|

|

A |

0,11 |

0,37 |

0,12 |

0,5 |

0,243 |

|

B |

-0,08 |

0,36 |

0,25 |

0,5 |

0,223 |

|

C |

0,04 |

0,34 |

0,25 |

0,5 |

0,255 |

|

D |

0,28 |

0,38 |

0,14 |

0,5 |

0,302 |

So, after the calculations and complex evaluation of effectiveness of every selected company from alcohol industry are done, we can declare that the efficiency of JSC ‘Vilnius Vodka‘ is far behind JSC ‘Gubernija‘ and a little less from other companies, that are analysed here (JSC ‘Anykščiai wine‘, JSC ‘Alita‘). It is well seen, that the group of selected companies has similar expenditure level and labour force operation rates, however, there is a sharp variation on profitability and assset operation efficiency indicators.

Conclusions

Scientific literature and practice, based on similar data, calculate a lot of methods and indicators of how to evaluate company‘s main activity and reveals analogical information, therefore a complex evaluation of the efficiency of company‘s main activity, which includes not one, but a number of methods, and allow to describe situation in one index is quite topical nowadays.

First of all, to make a complex evaluation of companys‘performance efficiency there are distinguished objective indicator groups, covering primary financial and non-financial indicators that have a substantial influence on evaluation. in this connection, it is important to select all the indicators, describing company‘s effectiveness. First of all, there are distinguished partial criteria (objective indicator groups), which include the indicators of profitability, expenditure level, asset operation efficiency and labour force operation efficiency, and then there are selected primary indicators for them.

There is also analysed multi-criteria evaluation system of company‘s effectiveness, holding partial criteria, as well as primary factors, which form them, also allows to describe the efficiency of dairy industry activity and compare companies with each other. Besides, the evaluation system can be applied to various needs of evaluator – index classification into groups gives a possibility to eliminate separate indicators or include new ones, without breaking the system of significance indicators, but harmonising the significance evaluation in the group.

After calculation of selected companies from alcohol industry and complex evaluation of the efficiency of each selected company‘s main activity are done, we can state, that JSC ‘Vilnius Vodka‘ is pretty behind JSC ‘Gubernija‘ and slightly less from other analysed companies (JSC ‘Alita‘, JSC ‘Anykščiai wine‘) according to the effectiveness of companies‘s activity.