Investments of banks in securities: the essence and development trends under current conditions

Автор: Mazikova Ekaterina Vladimirovna, Yumanova Natalya Nikolaevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Critical economic issues

Статья в выпуске: 6 (42) т.8, 2015 года.

Бесплатный доступ

The implementation of modern banking activities involves the realization of investments. Investment is a complex discussion economic category, characterized by a number of features. The types and forms of investment are manifold and can be transformed with account of the state of the economy and the level of development of industrial relations. The faster growth of the financial sector in the economy has stipulated the development of financial investment. Banks as financial and lending institutions actively make financial investments in securities. Banks' investment in securities pursues a number of purposes which determine the selection of securities for investment and their quality. The article identified the targets of bank investments in securities and their development trends under current conditions on the basis of the analysis of the actual data for 2010-2014. Negative revaluation and the actual decrease in the value of corporate securities of Russian issuers reduce their commercial appeal...

Investments, securities, commercial banks' investments in securities, debt obligations, lombardlist, bank liquidity, earnings, shares of subsidiaries and associated companies

Короткий адрес: https://sciup.org/147223781

IDR: 147223781 | УДК: 336.71 | DOI: 10.15838/esc/2015.6.42.11

Текст научной статьи Investments of banks in securities: the essence and development trends under current conditions

The development of the Russian financial market and the situation in the national banking sector actualize the issue of banks’ investment in securities. Attracting funds of population and economic entities, commercial banks should place resources in terms of profit, liquidity, risks mitigation and assets diversification. Investment of commercial banks, including investment in securities, meets these requirements. The effective management of banks’ investment in securities requires determination of the essential aspect and identification of the features of investment process development in modern conditions.

Investment is one of the most debated concepts in both scientific literature and modern economic practice.

Originally investment (it. Investition – lat. investio – attire, apparel) is inputs of capital for profit [2, p. 84].

Foreign dictionaries of economic and financial terms also state that Investment (Engl.) – investition (German) – inversion (Spanish) is purchase of means of production; acquisition of capital for the purpose of earning revenue. In a general sense it is inputs in the securities [1, p. 103].

Various aspects of investment, investment activity were studied in the works of J.M. Keynes, J. Sachs, G.N. Mankiw, K.R. Macconnell, W. Sharpe, J. Schumpeter, P. Samuelson, L. Mises, J. Clark, M. Porter, etc.

Many researchers rightly believe that investment plays an important role in boosting economic processes and achieving sustainable economic growth (E. Domar, R. Harrod, W. Solow, J.M. Keynes, L. Erhard, W. Sharpe, I. Lipsits, A. Bulatov, A. Shakhnazarov, A. Andrianov, E. Rumyantseva, and others) [13, p. 9].

In modern economic literature there are various definitions of “investment” that reflect the ambiguity of interpretation and understanding of their economic substance. This is largely “caused by different methodological approaches of different authors and economic evolution, specifics of stages of historical and economic development, dominant forms and methods of management [4, p. 14].

The development and complication of economic relations produce the diversity of investment activity forms, investment types, with each having specific features.

The review and systematization of definitions “investment” proposed by various authors allows us to identify characteristic features of investment as an economic category:

-

1. Costs character – every form and type of investment involves costs, placement, inputs of capital [12].

-

2. Target character – investment as a special form of injecting always has a certain goal: attainment of profit and (or) achievement of another useful effect [7].

-

3. Urgency, urgent character – investment always involves a certain period of capital allocation. It is necessary to specify that unlike loans and credit relations the period of investment can be initially undetermined; however, to “invest” means to “leave money today to get a large sum in the future” [16, p. 17].

-

4. Risky character – as any efficient operation, investment involves risk, i.e. the possibility (probability) not to achieve objectives and instead of profit incur losses or receive a negative overall effect. “Two factors are usually associated with this process – time and risk” [16, p. 18]. However, it is worth emphasizing that risk is a probabilistic characteristic, and not every investment yields losses or has negative outcomes (effects) for an investor.

-

5. Innovative character – there is a possibility to develop and improve activity, create new qualities, technologies, and products due to received profit or other beneficial effects from investment activities.

The last 20–30 years observe the spread of financial investment in the world economy, that is inputs of capital in financial instruments, mainly securities.

Financial investment involves purchase of reliable stocks, bonds [12, p. 87].

According to the Decision of the Council of CIS Heads of Government “On the Interstate Program for Innovation Cooperation of CIS Member-States for the Period until 2020”, “financial investment is a purchase of securities, interest-bearing bonds of federal, sub-federal and municipal loans, shares in the charter capital of legal entities, loans to other legal entities...” [11].

The formation of a transnational global financial system, liberalization and relative accessibility of financial markets and financial tools for vast sectors of the population determine a relationship of investment with financial transactions and securities in the mass consciousness.

In the conditions of the modern financial market one can realize both the passive investment strategy focused on generating revenue in the form of payments on securities (interest, dividends) and the aggressive investment practices involving attainment of profit in the form of a spread (price difference) between the selling price and the buying price of a financial tool. High mobility, volatility of the world financial market gives an opportunity to receive speculative income due to transactions with securities within the same trading day, minimizing the time of investment. Thus, there is short term, mid term, long term and indefinite financial investment. In other words, financial investment acquires a new quality – versatility in terms of capital investment.

Commercial banks, as special financial institutions, act as key operators of the financial investment market. Banks’ investment in securities is a certain direction that has a distinct form of the investment object – securities, indicating its financial basis. It should be noted that the term “banks’ investment in securities” is not defined in the Russian legislation, but the normative documents of the Bank of Russia formalize this notion indirectly and, in fact, equate it to “placement in securities” [9].

According to the academic community representatives, “banks’ investment is placement of bank resources in high-yield securities for extended lengths of time; indirect injections in the economy, which help achieve deconcentration of inputs and gain additional profit” [10, p. 34].

By depositing funds in securities, bank credit organizations pursue multiple objectives:

– attainment of revenue (profit) from investment in securities due to paid interests and dividends and receipt of speculative income due to the increased market value of securities (speculation with securities);

– provision and maintenance of liquidity due to purchased high-quality securities accepted as collateral for loans of the Central Bank and REPO transactions;

– diversification of assets, risk management, carried out through the purchase of highly reliable securities, attributed to riskless assets by the Central Bank – a state regulator;

– obtainment of control over the issuer or significant influence on the activity of the issuer, a joint stock company, by means of forming a portfolio of participation of subsidiaries and affiliated joint stock companies.

These goals are achieved through the use of different securities as investment instruments. The correspondence of bank-investor’s investment objectives and securities, investment instruments, is presented in Table 1 .

The modern economy considers securities passed the listing procedure of the trade organizer and admitted to public circulation on the organized stock market (stock exchange) as liquid. However, the undeveloped stock market with shrinking financial capacity,

Table 1. Objectives and instruments of banks’ investment in securities

In domestic practice, the Central Bank of the Russian Federation (the Bank of Russia) for the provision of liquidity to national credit institutions conducts operations of direct REPO and grants collateral loans. Only securities included in Lombard list1 are accepted as collateral. The Lombard list (changes and amendments) is published in the “The Bulletin of Bank of Russia” and (or) on the official website of the Bank of Russia on the Internet [8].

Forming the Lombard list by including or excluding securities from it, the Bank of Russia exerts a direct impact on the attractiveness of these or those securities as investment targets for banks. This opinion is shared by the experts of the Financial University under the Government of the Russian Federation: “The inclusion of certain securities in the Lombard list lends them more security in the eyes of investors, which is extremely important for banks. The aspect that increases investment attractiveness of the securities included in the Lombard list is that the rest of the securities listed on the balance sheet of the bank are liquid assets. Commercial banks in respect of each acquired security evaluate the ability to: a) quickly realize it on the stock market; b) use it when obtaining loans from the Bank of Russia; C) use it in REPO transactions. These aspects influence the choice of specific securities, banks invest in, in favor of the ones included in the Lombard list” [3].

Securities, securing obligations of commercial banks when obtaining loans from the Bank of Russia and REPO transactions, are transferred to the counterparty, the Bank of Russia, on a reimbursable basis. In the modern domestic practice, banks’ investment in these securities are classified as investments in “securities, transferred to counterparties for operations conducted on a repayable basis, whose recognition was not terminated” [6].

The analysis of Russian banks’ actual investment in securities will determine the investment objectives pursued by commercial banks and the trends of banks’ investment at the present stage.

The analysis of the composition and the structure of commercial banks’ investment in securities are presented in Table 2. It should be noted that the structure of banks’ investment in securities is relatively stable – the major share, about 80%, comprises debt obligations. For the period from January 1, 2011 to January 1, 2015 the most noticeable structural changes are observed for investment in equity securities. Thus, the proportion of investment in shares for the purpose of obtaining speculative income decreased by more than 2 times and as of January 1, 2015 it amounted to only 5% of the total investment against 12.2% as of January 1, 2011. On the other hand, banks’ stakes in subsidiaries and affiliated joint stock companies increased – the share of investment Dynamics of RF banks’ investment in reached 14% in 2015 against 6.3% in 2011. securities is presented in Figure 1.

Table 2. Composition and structure of RF commercial banks’ investment in securities (as of January 1, 2011 – January 1, 2015)

|

Securities purchased by banks |

January 1, 2011 |

January 1, 2012 |

January 1, 2013 |

January 1, 2014 |

January 1, 2015 |

|||||

|

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

|

|

Total |

5,829.0 |

100 |

6,211.7 |

100 |

7,034.9 |

100 |

7,822.3 |

100 |

9,724.0 |

100 |

|

Including: debt obligations* |

4,419.9 |

75.8 |

4,676.2 |

75.3 |

5,265.1 |

74.8 |

6,162.9 |

78.8 |

7,651.4 |

78.7 |

|

equity securities |

710.9 |

12.2 |

914.4 |

14.7 |

791.6 |

11.3 |

790.4 |

10.1 |

488.7 |

5.0 |

|

bills (discounting) |

330.0 |

5.7 |

233.9 |

3.8 |

398.8 |

5.7 |

274.1 |

3.5 |

218.0 |

2.2 |

|

shares of subsidiary and affiliated joint stock companies |

368.2 |

6.3 |

387.3 |

6.2 |

579.4 |

8.2 |

594.9 |

7.6 |

1,365.9 |

14.0 |

|

of them: shares of subsidiaries and affiliated credit institutions-residents |

168.4 |

2.9 |

159.3 |

2.6 |

184.2 |

2.6 |

189.2 |

2.4 |

503.4 |

5.2 |

* Debt obligations –volume of investments of credit organizations into debts, which are related to debt securities according to the RF legislation.

Sources: the Bank of Russia data; the authors’ calculations.

Figure 1. Dynamics of RF commercial banks’ investment in securities (as of January 1, 2011 – January 1, 2015)

■ ■ Investment in securities, billion rubles — ■ —Growth rate, %

Source: calculated by the authors according to the Bank of Russia data.

During the study period there is a steady growth in these investments both in absolute terms and relative dynamics. As of January 1, 2012 the index amounted to 106.6% and as of January 1, 2013 – 113.3%. In early 2014, compared to 2013, there was small relative decline – 111.2%. However, as of January 1, 2015 there was a significant increase in investment in securities – 124.3% (9,724 billion rubles). The changes of banks’ investment in securities for the last five years are presented in Table 3 .

In 2011–2014 there was a rise in commercial banks’ investment in securities (growth rate – 166.8%). However, the dynamics of banks’ investment in various securities is diverse. Banks increase investment in subsidiaries and affiliates (by 3.7 times during the study period) and debt obligations (by 1.7 times) rapidly. The boost in banks’ investment in shares of subsidiaries and affiliated credit institutions-residents indicates the formation of banking groups and the consolidation of financial resources of credit organizations. At the same time, banks clearly lose interest in investment in equity securities (shares) and discounting bills.

The dynamics of RF commercial banks’ investment in the portfolios of participation of subsidiaries and affiliated joint stock companies is presented in Figure 2 .

The data show that the volume of Russian banks’ investment increased significantly for the study period. The growth rate amounted to 229.6% as of January 1, 2015. Moreover, investment in shares of subsidiaries and affiliated credit institutions-residents increased by 273.8 billion rubles in the portfolio of Russian banks over the same period and amounted to 503.4 billion rubles. The volume of investment is about one third of the bank’s portfolio of shares of subsidiaries and affiliated joint stock societies.

The reorientation of banks’ investment in debt state securities and portfolios of participation in subsidiary and affiliated joint

Table 3. Dynamics of RF commercial banks’ investment in securities for 5 years

|

Securities purchased by banks |

As of January 1, 2015 to January 1, 2011 |

||

|

Dynamics (+, –), billion rubles |

Growth rate,% |

Change in structure (+, –), % |

|

|

Total |

3,895 |

166.8 |

– |

|

Including: debt obligations* |

3,231.5 |

173.1 |

2.9 |

|

equity securities |

-222.2 |

68.7 |

-7.2 |

|

bills (discounting) |

-112 |

66.1 |

-3.5 |

|

shares of subsidiary and affiliated joint stock companies (participation portfolio) |

997.7 |

371 |

7.7 |

|

of them: shares of subsidiaries and affiliated credit institutions-residents |

335 |

298.9 |

2.3 |

Sources: the Bank of Russia data; the authors’ calculations.

Figure 2. Dynamics of RF commercial banks’ investment in the portfolios of participation of subsidiaries and affiliated joint stock companies (as of January 1, 2011 – January 1, 2015)

■ __ ■ Shares of other subsidiaries and affiliatedjoint stock companies

■ ■ Shares ofsubsidiaries and associated credit institutions-residents

—*— Growth rate of investment in shares of subsidiaries and affiliated joint stock companies, %

Source: calculated by the authors according to the Bank of Russia data.

stock companies and the reduction in banks’ investment in domestic corporate stock market instruments indicate a decline in speculative attractiveness of the Russian stock market and, hence, a decrease in speculative profits of banks-investors. Presumably, this will have a negative impact on banks’ revenue in the short term, but force them to find new sources and instruments to raise their profitability.

The detail analysis of investment in securities will identify the interests pursued by the banks investing in securities more clearly. The composition and the structure of commercial banks’ investment in debt securities are presented in Table 4 .

The presented data characterize the structural changes that occurred during the study period in the portfolio of RF banks’ investment in debt securities. The share of investment in debt securities in the total portfolio was stable. However, there were inner changes. This is observed in the dynamics of investment in debt securities, transferred without derecognition. If as of January 1, 2011 the share of such investment was 6.1%, as of January 1, 2015 it was 43.8%.

Let us describe this indicator dynamics more clearly; its growth rate of amounted to 269.7% as of January 1, 2013 ( fig. 3 ). In the following periods the growth rate remained

Table 4. Composition and structure of RF commercial banks’ investment in debt securities (as of January 1, 2011 – January 1, 2015)

|

Debt securities acquired by banks |

January 1, 2011 |

January 1, 2012 |

January 1, 2013 |

January 1, 2014 |

January 1, 2015 |

|||||

|

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

|

|

Securities purchased by banks, total |

5,829.0 |

100 |

6,211.7 |

100 |

7,034.9 |

100 |

7,822.3 |

100 |

9,724.0 |

100 |

|

Debt securities, total |

4,419.9 |

75.8 |

4,676.1 |

75.3 |

5,265 |

74.8 |

6,162.9 |

78.8 |

7,651.4 |

78.7 |

|

Including: obligations of the Russian Federation |

1,177.5 |

20.2 |

1,496.3 |

24.1 |

945 |

13.4 |

814.1 |

10.4 |

1,268.4 |

13.0 |

|

Liabilities of the Bank of Russia |

588.5 |

10.1 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Obligations of RF subjects and bodies of local self-government |

284.3 |

4.9 |

223.7 |

3.6 |

98 |

1.4 |

131.8 |

1.7 |

108.9 |

1.1 |

|

issued by credit institutions resident* |

365 |

6.3 |

408.5 |

6.6 |

492.9 |

7.0 |

410.3 |

5.2 |

456.4 |

4.7 |

|

issued by nonresidents* |

718.9 |

12.3 |

839.4 |

13.5 |

791.3 |

11.2 |

883.2 |

11.3 |

1301 |

13.4 |

|

other debt obligations of residents |

901.1 |

15.5 |

997.5 |

16.1 |

863.8 |

12.3 |

687.8 |

8.8 |

666.4 |

6.9 |

|

debt obligations transferred without derecognition |

355.3 |

6.1 |

747 |

12.0 |

2,014.9 |

28.6 |

3,248.9 |

41.5 |

4,261.8 |

43.8 |

|

debt not repaid on time |

12.3 |

0.2 |

12.6 |

0.2 |

8.4 |

0.1 |

6.3 |

0.1 |

5.2 |

0.1 |

|

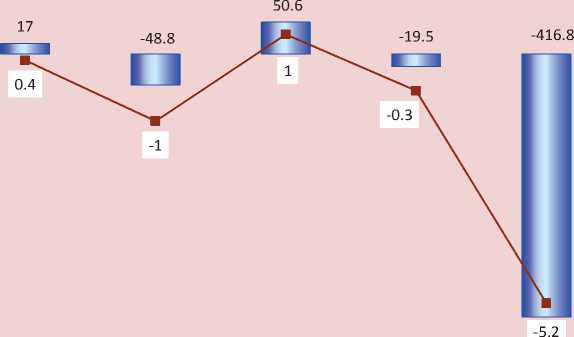

revaluation of debt obligations** |

17 |

0.3 |

-48.8 |

-0.8 |

50.6 |

0.7 |

-19.5 |

-0.2 |

-416.8 |

-4.3 |

* Residents/nonresidents – the notions “residents” and “nonresidents” used for the formation of this table indicators are determined in accordance with the federal law “On currency regulation and currency control” as of December 10, 2003 No. 173-FZ.

** Revaluation of debt obligations (equity securities) – negative and positive difference between the balance sheet value of securities and their current (fair) value.

Sources: the Bank of Russia data; the authors’ calculations.

Figure 3. Dynamics of RF commercial banks’ investment in debt securities (as of January 1, 2011 – January 1, 2015)

■ _ _ ■ Investment in other debt securities, billion rubles

■ ■ Debt securities transferred without derecognition, billion rubles

■ Growth rate of banks' investment in debt securities, %

—*— Growth rate of debt securities transferred without derecognition, %

Source: calculated by the authors according to the Bank of Russia data.

stable – 61% and 31%, respectively. At the beginning of 2015, compared to the beginning of 2011, the absolute increase amounted to 3,906.5 billion rubles.

In the study period there were structural changes, defined by a number of factors. Commercial banks were forced to refuse such an investment instrument as debt obligations of the Bank of Russia due to the termination of the Bank of Russia operations to issue its own bonds. The bonds of the Bank of Russia are widely used in banking practice as a form of collateral in REPO transactions. The termination of their issue and distribution among credit institutions was also aimed at re-orientating commercial banks to invest in government securities and covering the federal budget deficit. Besides, we can observe a comparable growth in the volume and the share of investment in debt obligations of the Russian Federation and debt obligations transferred without derecognition (REPO transactions) (tab. 5). These changes observed in 2011 have been developing in the subsequent years.

During the study period the greatest growth rate (1,199.5%) was observed January 2015 for commercial banks’ investment in debt securities transferred without derecognition, i.e. the securities used in REPO transactions. Debt obligations transferred without derecognition had the greatest share (43.8%) January 1, 2015 in the securities portfolios of commercial banks. The significant amount of banks’ investment in REPO instruments also indicates the national banks’ high demand for the resources of the Bank of Russia and maintaining their liquidity.

The attractiveness of securities for a bankinvestor is largely determined by their market value and the possibilities of securities to increase that value. Securities are financial assets; their market value is determined by a number of factors. The state of the stock market

Table 5. Dynamics of RF commercial banks’ investment in debt securities for 5 years

The revaluation of debt securities purchased by commercial banks in 2011–2014 is presented in Figure 4 . Its data reflect the change in the market value of debt securities in relation to book value – the price at which debt securities were acquired by banks. During the study period there was both positive revaluation – the increase in the market value of bonds and loans (as of January 1, 2011 and January 1, 2013) and the negative revaluation – the decrease in the market prices of debt securities.

The record negative revaluation of debt securities was recorded January 1, 2015 – debt obligations lost 4.6% in value, showing crisis phenomena on the domestic debt securities market.

Figure 4. Revaluation of debt securities purchased by RF commercial banks (as of January 1, 2011 – January 1, 2015)

-50

-100

-150

-200

-250

-300

-350

-400

-450

Jan. 1, 2011

Jan. 1, 2012

Jan. 1, 2013

Jan. 1, 2014

Jan. 1, 2015

■ __ ■ Revaluation of debt securities, billion rubles

— ■ — To book value of purchased debt securities, %

-1

-2

-3

-4

-5

-6

Source: calculated by the authors according to the Bank of Russia data.

The positive facts include the reduced volume and share of investment in debt securities that are not repaid on time, indicating decreased risks of banks’ investment in securities. The decline in the volume and share of investment in debt securities of residents together with the increase of investment in bonds of resident banks reveals decreased attractiveness of corporate bonds of the non-financial sector. The reduction in the volume of banks’ investment in debt obligations of the RF subjects and local self-government bodies by 2.6 times also shows declined attractiveness of these securities for banks. The significant increase in investment in bonds of nonresidents in 2014 was rather due to the exchange rate dynamics than to the changes in banks-investors’ investment behavior (see tab. 4 and 5, fig. 4).

The analysis of the composition and structure of commercial banks’ investment in equity securities shows that banks’ investment in shares traded on organized stock market are related to the changes in their market value ( tab. 6 ). The adverse changes in the amount and share of banks’ investment in shares occur on the background of general growth of banks’ investment in securities. The revealed trend indicates a loss of banks’ interest in equity securities and requires a detail analysis.

We should take into account that banks’ investment in equity securities differ in nature and investment objectives. Thus, the presence of equity securities, transferred without derecognition in the investment portfolios means that these shares are pledged for loans of the Bank of Russia and used by commercial banks as a means to obtain additional liquidity from the Central Bank.

Table 6. Composition and structure of RF commercial banks’ investment in equity securities (as of January 1, 2011 – January 1, 2015)

|

Equity securities acquired by banks |

January 1, 2011 |

January 1, 2012 |

January 1, 2013 |

January 1, 2014 |

January 1, 2015 |

|||||

|

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

billion rubles |

% |

|

|

Securities acquired by banks, total |

5,829.0 |

100 |

6,211.7 |

100 |

7,034.9 |

100 |

7,822.3 |

100 |

9,724.0 |

100 |

|

Equity securities at current (fair) value, total |

710.9 |

12.2 |

914.4 |

14.7 |

791.6 |

11.3 |

790.4 |

10.1 |

488.7 |

5.0 |

|

Equity securities at book value (without revaluation), total |

673.9 |

11.6 |

929.1 |

15.0 |

810.8 |

11.5 |

807.9 |

10.3 |

411.2 |

4.2 |

|

Credit institutions- residents |

5.7 |

0.1 |

10.6 |

0.2 |

8.5 |

0.1 |

5.1 |

0.1 |

4.1 |

0.04 |

|

non-residents |

50.3 |

0.9 |

78.4 |

1.3 |

82.2 |

1.2 |

94.5 |

1.2 |

84.5 |

0.9 |

|

other residents |

588 |

10.1 |

786.6 |

12.7 |

646.1 |

9.2 |

591.7 |

7.6 |

197.8 |

2.0 |

|

Equity securities transferred without derecognition |

29.9 |

0.5 |

53.5 |

0.9 |

74 |

1.1 |

116.6 |

1.5 |

124.8 |

1.3 |

|

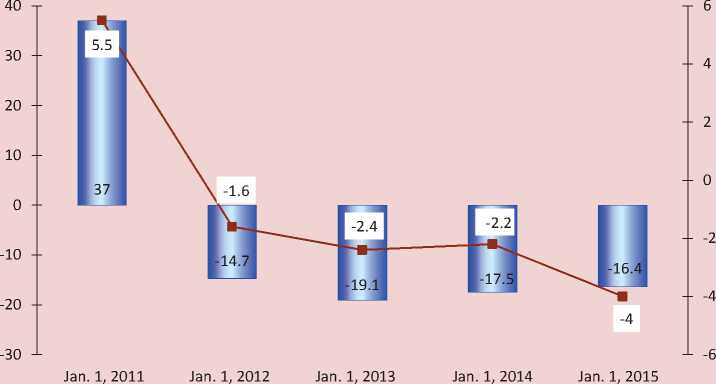

revaluation of equity securities |

37 |

0.6 |

-14.7 |

-0.2 |

-19.1 |

-0.3 |

-17.5 |

-0.2 |

-16.4 |

-0.2 |

Sources: the Bank of Russia data; the authors’ calculations.

Investment in other shares pursue commercial goal – profit. Banks buy shares, anticipating the increase in their market value in the future, in order to resell them at a higher price. It is classified as financial speculation.

Figure 5 shows the dynamics of banks’ investment in equity securities in 2011–2014 taking into account their target investment performance. The analysis of the data reveals that by 2015 banks have significantly reduced investment in other shares that have potential to bring speculative profit. The maximum interest in speculative investment in shares was recorded in 2011 – a period of relative prosperity, when there was growth on the domestic stock market. In 2012 with the growth of negative phenomena in the economy banks started to reduce investment in shares in order to speculate on the stock market. Banks’ investment in equity securities of a speculative nature reached the minimum value in the crisis year of 2014.

Banks’ investment in equity securities transferred without derecognition is characterized by a completely opposite trend. Banks’ investment in shares transferred without derecognition grows steadily throughout the study period. These changes confirm banks’ demand for additional liquidity.

The dynamics of commercial banks’ investment in equity securities for a five-year period is presented in Table 7 .

Figure 5. Dynamics of RF commercial banks’ investment in equity securities (as of January 1, 2011 – January 1, 2015)

■ __ ■ Investment in other equity securities, billion rubles

■ __ ■ Investment in equity securities transferred without derecognition, billion rubles

—□— Growth rate of banks' investment in equity securities, %

—*— Growth rate of banks' investment in equity securities transferred without derecognition, %

Source: calculated by the authors according to the Bank of Russia data.

Table 7. Dynamics of commercial banks’ investment in equity securities for 5 years

|

Equity securities acquired by banks |

As of January 1, 2015 to January 1, 2011 |

||

|

Dynamics (+, –), billion rubles |

Dynamics (+, –), billion rubles |

Dynamics (+, –), billion rubles |

|

|

Investment in equity securities |

-222.2 |

68.7 |

-7.2 |

|

Total book value (without revaluation) |

-262.7 |

61.0 |

-7.4 |

|

Including: credit institutions-residents |

-1.6 |

71.9 |

-0.06 |

|

non-residents |

34.2 |

168.0 |

0 |

|

other residents |

-390.2 |

33.6 |

-8.1 |

|

equity securities transferred without derecognition |

94.9 |

417.4 |

0.8 |

|

revaluation of equity securities |

-53.4 |

-44.3 |

-0.8 |

|

Sources: the Bank of Russia data; the authors’ calculations. |

|||

The increase in the value of equity securities in 2011 was accompanied by the growth of banks’ investment in shares and, vice versa, the negative revaluation of equities observed since 2012 – by the decrease in the volume of banks’ investment in equity securities.

In general, the dynamics of banks’ investment in equity securities was negative in the analyzed period. Nowadays banks consider stocks of domestic companies outside the financial sector as least attractive for investment. It should be noted that the decrease in banks’ investment in securities of domestic companies outside the financial sector occurs in the conditions of Russian economy recession [6]. Investment in shares of Russian companies outside the financial sector decreased by 390.2 billion rubles. The ruble amount of banks’ investment in shares of non-residents – foreign companies – grows, but the share of these securities in the overall financial investment banks is stable. This situation can be associated not so much with the real increase in investment in shares of non-residents, as with the exchange rate dynamics.

There is a significant increase in investment in equity securities transferred without derecognition – by more than 400% over five years. These securities are used as collateral for loans of the Bank of Russia and in REPO transactions.

The data about revaluation of equity securities acquired by banks is presented in Figure 6 .

Since 2012 there has been a negative revaluation of equity securities. In other words, the market value of shares relative to their book value (purchase price) has been constantly decreasing, banks’ investment in equity securities have been depreciating that significantly reduces their attractiveness for investors.

Characterizing banks’ investment in securities in 2010–2014, we can conclude that the banking credit institution, making financial investment, is primarily aimed at ensuring their own liquidity.

A noteworthy fact is that a considerable part of investment resources of Russian banks serves the RF Government debt obligations or the federal budget deficit. Banks use debt

Figure 6. Revaluation of equity securities purchased by RF commercial banks (as of January 1, 2011 – January 1, 2015)

■ __ ■ Revaluation ofequity securities, billion rubles

— ■ — To book valurofacquired equity securities, %

Source: calculated by the authors according to the Bank of Russia data.

and equity securities from the Lombard list of the Bank of Russia to receive loans from the Bank of Russia and in REPO transactions. The negative revaluation and the actual reduction in the cost of equity and debt corporate securities of Russian issuers reduce their commercial attractiveness. Speculative operations of banks-investors on the stock market decline; therefore, the profitability of financial banking investment reduces. Banks increase portfolio participation, raising financial investment in the capital of subsidiaries and affiliated joint stock companies. The results of the analysis obtained during the study allow us to state that in the current period banks’ investment in securities changed goals and transformed from the systemically important assets yielding considerable profit into the mechanism to ensure the liquidity necessary for banks to implement other operations and perform revenue-generating activities. In general, this testifies the decrease in efficiency of banks’ investment in securities. It seems that in the case of maintaining the current course of monetary policy by the Bank of Russia this trend in banks’ investment will continue in the medium term.

Список литературы Investments of banks in securities: the essence and development trends under current conditions

- Bernard Y., Colli J.C. Tolkovyi ekonomicheskii i finansovyi slovar'. Frantsuzskaya, russkaya, angliiskaya, nemetskaya, ispanskaya terminologiya: V -2-kh t . Vol. 2. Translated from French. Moscow: Mezhdunarodnye otnosheniya, 1994 g. 720 p.

- Brandes M. P., Zav'yalova V. M. Russko-nemetskii finansovyi slovar' (na russkom yazyke) . Moscow: Izdatel'stvo: KDU, 2009. -356s.

- Giblova N.M. Gosudarstvennoe regulirovanie investitsionnoi deyatel'nosti kommercheskikh bankov na fondovom rynke: stimuly i ogranicheniya . Bankovskoe pravo , 2015, no. 2, pp. 56-63.

- Igonina L.L. Investitsii: uchebnik . Second edition, revised and supplemented. Moscow: Magistr: Infra-m, 2013. 752 p.

- Ilyin V.A. Ekonomicheskaya politika Pravitel'stva prodolzhaet protivorechit' interesam osnovnoi chasti naseleniya strany . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2015, no. 4 (40), pp. 9-20. Available at http://esc.isert-ran.ru/file.php?module=Articles&action=view&file=article&aid=5179

- Metodologicheskie kommentarii k tablitsam “Obzor bankovskogo sektora Rossiiskoi Federatsii” . Issue 16. Available at: http://www.cbr.ru/analytics/bank_system/print.aspx?file=Metodol_16.htm

- “Ob investitsionnoi deyatel'nosti v Rossiiskoi Federatsii, osushchestvlyaemoi v forme kapital'nykh vlozhenii”: Federal'nyi zakon ot 25.02.1999 № 39-FZ (red. ot 28.12.2013) . Konsul'tantPlyus .

- “Polozhenie o poryadke predostavleniya Bankom Rossii kreditnym organizatsiyam kreditov, obespechennykh zalogom (blokirovkoi) tsennykh bumag”: utv. Bankom Rossii 04.08.2003 № 236-P (red. ot 09.09.2015) . Konsul'tantPlyus .

- Poryadok bukhgalterskogo ucheta vlozhenii (investitsii) v tsennye bumagi i operatsii s tsennymi bumagami. Prilozhenie 10 k Polozheniyu Banka Rossii ot 16 iyulya 2012 goda N 385-P “O pravilakh vedeniya bukhgalterskogo ucheta v kreditnykh organizatsiyakh, raspolozhennykh na territorii Rossiiskoi Federatsii” . Konsul'tantPlyus .

- Raizberg B.A., Lozovskii L.Sh., Starodubtseva E.B. Sovremennyi ekonomicheskii slovar' . Sixth edition, revised and supplemented. Moscow: Infra-M, 2013. 512 p.

- Reshenie Soveta glav pravitel'stv SNG “O mezhgosudarstvennoi programme innovatsionnogo sotrudnichestva gosudarstv-uchastnikov SNG na period do 2020 goda”. Prinyato v g.Sankt-Peterburge 18.10.2011 . Adopted in Saint Petersburg on October 18, 2011]. Konsul'tantPlyus .

- Rosenberg J.M. Investitsii: terminologicheskii slovar' . Moscow: Infra-M, 1997. 400 p.

- Rumyantseva E.E. Novaya ekonomicheskaya entsiklopediya: 4-e izd . Moscow: Infra-M, 2011. 882 p.

- Svedeniya o dvizhenii aktsii i dokhody po nim . Ofitsial'nyi sait Federal'noi sluzhby gosudarstvennoi statistiki . Available at: http://www.gks.ru/free_doc/new_site/finans/fin48.htm

- Struktura vlozhenii kreditnykh organizatsii v tsennye bumagi i proizvodnye finansovye instrumenty. . Ofitsial'nyi sait Banka Rossii . Available at: http://www.cbr.ru/statistics/print.aspx?file=bank_system.

- Sharpe W.F., Alexander G.J., Bailey J.V. Investitsii . Translated from English. Moscow: Infra-M, 2009. 1028 p.