Issues of formation and use of financial resources of the social welfare system (case study of the Komi Republic)

Автор: Tikhomirova Valentina Valentinovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 5 (47) т.9, 2016 года.

Бесплатный доступ

Currently, the social welfare system in the Komi Republic and in the Russian Federation on the whole is undergoing gradual reforming, the main goals of which are as follows: improving the quality of life; supporting the poor and vulnerable segments of the population; mitigating possible negative consequences of reforms; improving pension provision; further improvement of targeted social assistance; streamlining social benefits; development of the social services market. In this regard, the study of methodological basis for the formation and use of financial resources of the social welfare system becomes more and more important. The goal of this work is to develop theoretical and methodical approaches to the improvement of financial mechanism for the social welfare system in the region. The paper considers the formation and use of financial resources for social protection of population in the Republic of Komi. The author reveals specifics of formation of budgets of all levels and the powers of federal and regional authorities in the field of mutual responsibility...

Financial resources, social protection, types of social protection, targeted social assistance

Короткий адрес: https://sciup.org/147223869

IDR: 147223869 | УДК: 36 | DOI: 10.15838/esc.2016.5.47.9

Текст научной статьи Issues of formation and use of financial resources of the social welfare system (case study of the Komi Republic)

The concept “financial resources”, which is widely used in the economic literature, has a variety of meanings – from the amount of cash on bank accounts and other account to other balance sheet indicators of enterprises [17].

The term “financial resources” has different interpretations in the wide use of this category in the economic science and in practice. The Financial and Credit Dictionary considers financial resources as the funds at the disposal of the state, enterprises, economic organizations and institutions, and these funds are used to cover the costs and establish various funds and reserves [25].

Financial mechanism is a set of methods, forms and types that help organize financial relations, i.e. the creation, distribution, redistribution and use of funds of financial resources. Financial mechanism refers to the superstructure category and it is an integral part of financial policy.

In order to reveal the specifics of functioning of social welfare system, it is of great importance to define the term “social protection”, its specific forms and types of financial protection.

Scientific literature lacks a universally accepted understanding of social protection and its basic forms.

Research into the concept of “social protection” abroad has a much longer history than in the Russian science. For the first time the term “social security” was officially introduced in the USA in the framework of development of social programs under the policy of the New Deal implemented by Franklin D. Roosevelt in 1935 [27, 29]. Later, in the 1940s, in the documents of the International labour Organization, it became the basis of all concepts and recommendations on social policy. It is thanks to the ILO study that the term “social security” became widespread around the world, and the social standards developed by the ILO are still relevant.

The definition given by the ILO was later reflected in the documents of the European Union – the European Code of Social Security (1968), Charter of the Fundamental Social Rights of Workers, Green (1992) and White (1994), books on European social policy, European Code of Social Security (1968), Social Policy Protocol (1991) and other documents of the EU and the World Health Organization (WHO), the International Social Security Association (ISSA) and other organizations. Recently, along with the term “social security”, the concept of “social protection” is used more and more frequently in Europe [30].

In Russia, some researchers distinguish three main forms of social protection:

social insurance, social assistance and state support. Others call them differently: degrees, types, directions; others vary the adjectives “state” and “social”; others use similar terms: for example, instead of assistance, they use the terms aid or guardianship, instead of state support – social guarantees, etc.[3, 5, 12, 16, 26].

There exist other points of view. So, the team of authors under the supervision of V.G. Popov considers social maintenance to be an intermediate link between social protection, on the one hand, and social assistance and social support. Social maintenance, in their interpretation, represents one of the units of social protection of the population, but it has more narrow parameters of action; as for social assistance and social support, they belong to the blocks of social maintenance [15].

V. Roik points out not three but five main institutional forms of social protection: 1) state social assistance to persons who lack the necessary capacity to work, place of work, and sources of income and are not able to provide for their existence; 2) state social maintenance of service persons, employees of internal affairs agencies, tax service, public servants and some other categories of citizens taking into account the specific nature of their work in fulfilling the important functions of the state; 3) mandatory social insurance as a form of social protection of economically active population from the risk of loss of income due to disability or loss of job; 4) the system of voluntary personal (collective) insurance for employees (accident, medical and pension provision); 5) the system of social protection of workers organized by enterprises and employers: medical and health care, payment for housing, transport, education and cultural services, and corporate pension payments [13].

A.V. Krestov builds a chain according to the increase in the quality and quantity of social services: social support, social assistance, and social protection; he includes in the latter term the network of in-patient institutions of social protection, medico-social expertise, employment service, pension provision, and the service for work conditions and labor protection [9]. T.S. Dymnich distinguishes forms of social protection such as social insurance, state social maintenance, and social services [4]. S.A. Yushkova considers the following forms: social maintenance, social assistance, social support and rehabilitation, social work, social benefits and the system for social monitoring of social protection [25]. Yu.A. Kosarev and N.V. Kuzyutkin speak about social insurance and social assistance [7, 10]; E.A. Nezhivenko – about social care provision, social services and social assistance [21]. G.S. Korepanov agrees with the latter option, but supplements it with social support and stresses that these activities are implemented in a variety of instrumental forms [6]. N.N. Abakumova and R.I. Podovalova define four subsystems of social protection: state social care provision, state, collective social insurance and private insurance [1].

The authors of the textbook “Social work: theory and practice” edited by E.I. Kholostova and A.S. Sorvina say that the leading organizational-legal forms of the social welfare system are pension provision, provision of social benefits and privileges to the most needy categories of the population, state social insurance, and social services [17].

S.V. Tetersky, the author of a textbook on social work, puts social protection on a par with other “special mechanisms of social policy implementation”: social services, social rehabilitation, social assistance and self-help [18].

M.I. Liborakina considers social protection to be a function of the social sphere along with social insurance, social care provision and social support, and social services, in her view, are a mechanism that helps implement all these functions [11]. S.A. Shedenkov considers social protection (as well as social care provision, social insurance, donations, and social work) a type of social support [23].

Despite the diversity of viewpoints about the forms of social protection, almost all these definitions highlight forms such as social insurance, social assistance, social support, social care provision, social services, and social work.

In our opinion, major role in the financial mechanism of social protection belongs to economic methods. The main economic methods can include the introduction of a system for minimum socio-economic guarantees. In this case, the minimum subsistence level secured in legislation is of crucial importance. To implement social protection, the following economic methods are applied: the range of state benefits to certain categories of citizens, the system of benefits and compensations determined by the legislation.

The content of the social welfare system is revealed most fully by its forms. Forms of social protection express a particular combination of specific activities, actions, measures, methods of using financial resources of the subjects of social protection in accordance with emerging relevant tasks [19].

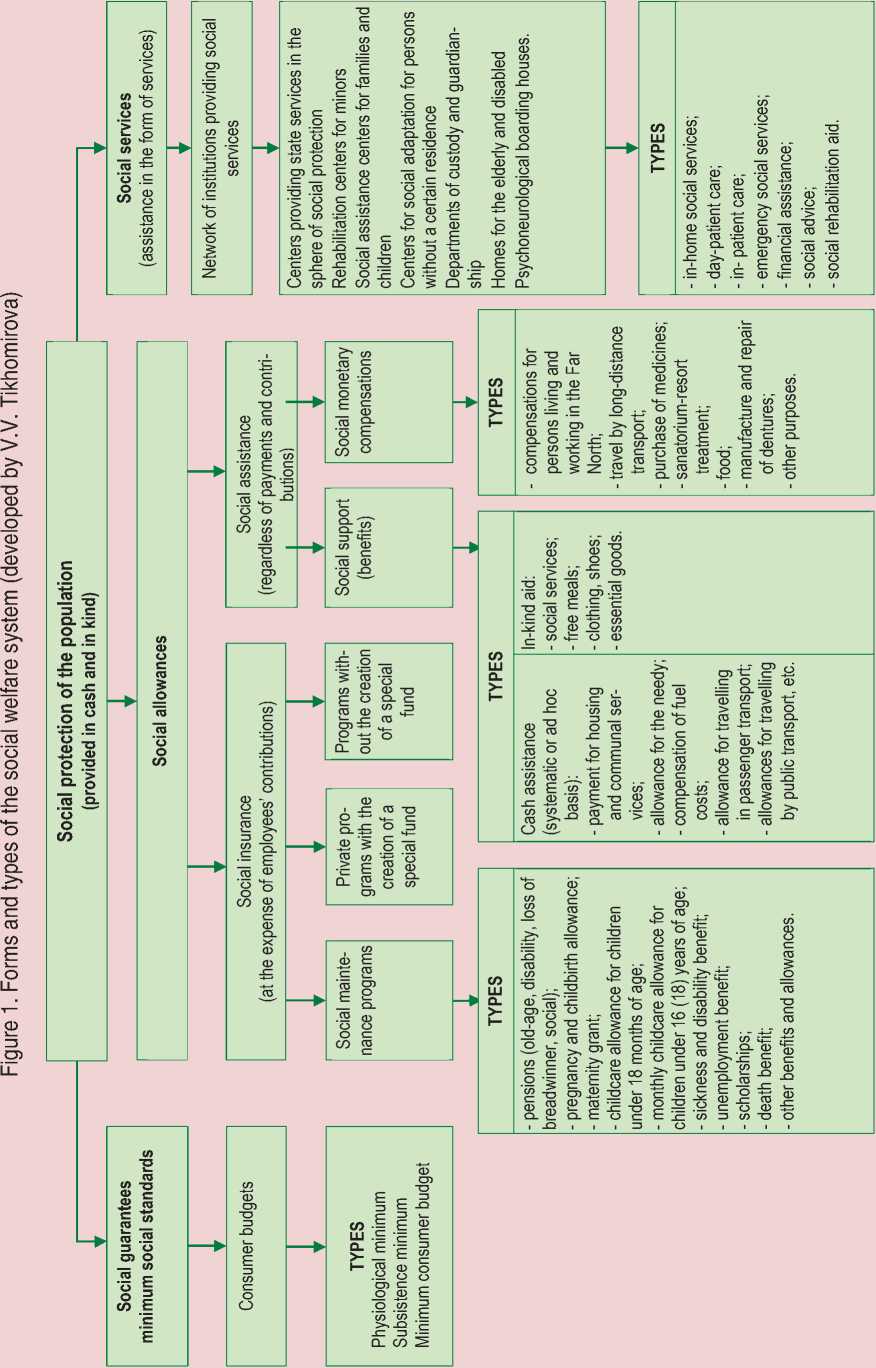

On the basis of the System of National Accounts [14], which in terms of methodology focuses on a single international standard, we have developed a structure of forms and types of social protection, which are the basis of its financial mechanism (Fig. 1.):

-

1. State social guarantees and minimum social standards.

-

2. Social allowances (social insurance allowances and social assistance allowances).

-

3. Social services.

We propose to consider social protection as a financial category, which helps organize the redistribution of financial resources emerging in the formation of centralized and decentralized financial resources, through a set of forms and types of social protection aimed to ensure its targeted provision.

Hence the main way to improve the financial mechanism and organizational forms of managing the social welfare system will be the targeted allocation of financial resources.

When the content and forms of social protection are considered, social protection is understood as the “legally established system of social guarantees and mechanism for their implementation, which provides any member of society with a decent standard of living and a right to exercise their basic social and civil rights” [24].

Currently, the basic state social guarantees are contained in the Constitution, the Labor Code of the Russian Federation and are also stipulated in international documents such as ILO Recommendations.

Social guarantees are the basis upon which social protection system in any

country operates. Social guarantees are mechanisms of long-term action provided by law. State social guarantees are based on minimum social standards. Minimum social standards are rules and regulations established by the Legislation of the Russian Federation, they determine the minimum level of social protection. By consolidating the vital minimum social standard in the law “On the state minimum standards”, the state makes it mandatory to provide and use by authorities at all levels.

Objectives of the financial mechanism are to provide a process of formation, distribution, redistribution and use of funds of financial resources.

Formation of financial resources for the social protection system is based on social obligations of the state. These obligations can be defined as a set of public goods that the state undertakes to make available to its citizens, this set being stipulated by the Constitution. These sources are based on the redistributive and savings principles. In order to implement social guarantees the state uses primarily the redistributive principle, i.e. budgetary resources.

The Budget Code of the Russian Federation is the main regulatory act, which establishes legal basis for the functioning of Russia’s budgetary system. there are 250 bills that have been elaborated for the purpose of dealing with the financial crisis and providing social protection to the population of the Russian Federation.

Major sources of formation of financial resources of the social protection system include the consolidated budget of the Russian Federation, which consists of the federal budget; budgets of 85 constituent entities of the Russian Federation; local budgets.

The implementation of social protection depends on the availability of financial resources. It is no coincidence that the attention of researchers is attracted to the issues of formation and use of resources allocated to social protection of the population.

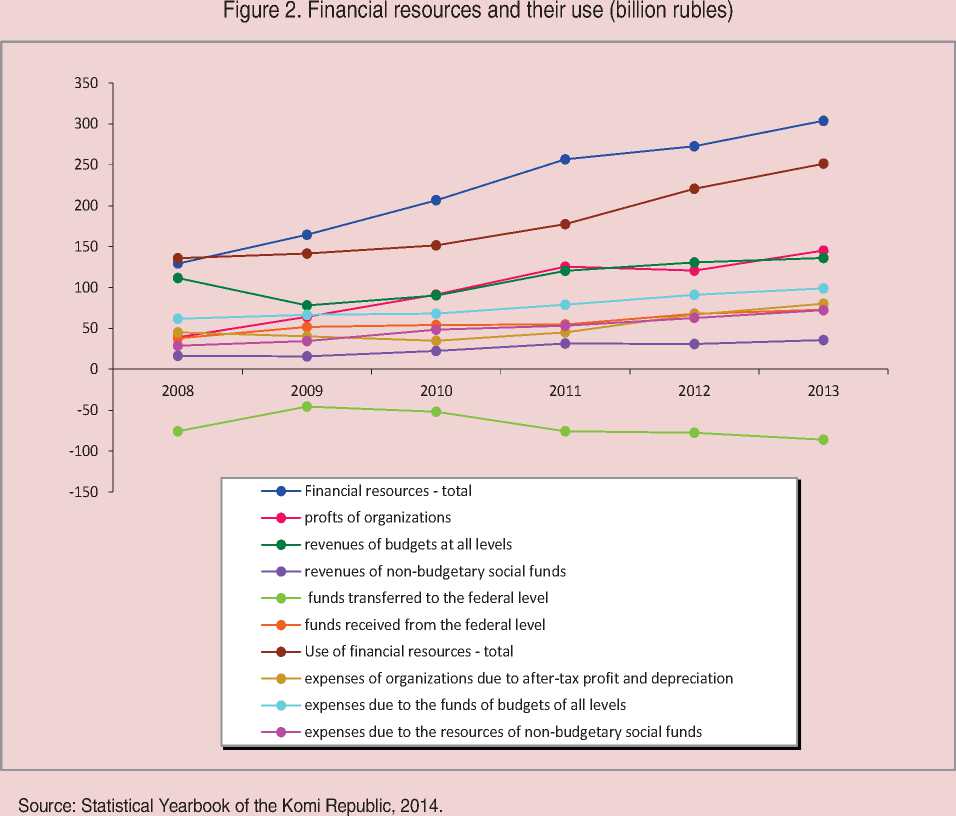

The structure of financial resources of the Komi Republic is determined by the sources from which they are drawn. The Republic has developed positive trends in the formation of financial resources generated in the sphere of financial, non-financial institutions and public administration sector (Fig. 2) .

In 2014, 89% of consolidated budget revenues came from tax and non-tax payments (in 2009 – 78%). The main tax sources of consolidated budget revenues in the Republic were as follows: individual income tax, corporate profit tax and tax on the property of organizations; taken together, they formed 72% of all the

funds (in 2013 – 66%, in 2009 – 61%). Corporate profit tax receipts were by 37% higher than in 2013, property tax receipts – by 31%, individual income tax receipts decreased by 3%. Taxes on goods (works, services), sold (provided) on the territory of the Russian Federation, taxes on the total income increased by 6%, together having formed 9% of budget revenues. A group of non-tax revenues provided 7% of budget funds. Among them, the most significant are the incomes from the use of state and municipal property (98% of revenues by 2013) and payments for the use of natural resources, formed mainly by the allocations that organizations make to pay for a negative impact on the environment (141% to 2013).

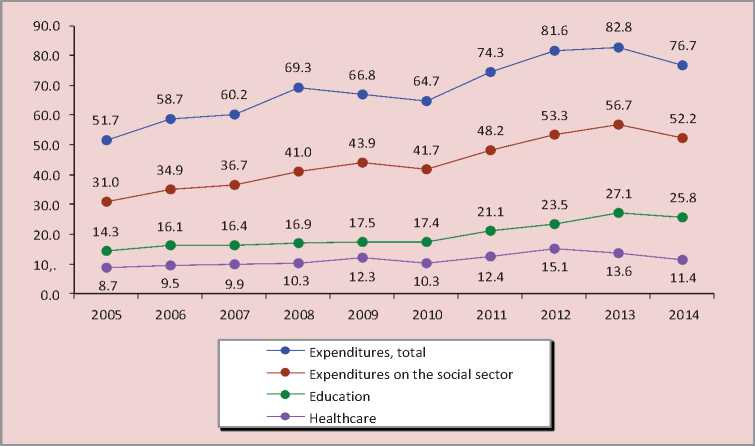

Figure 3. Dynamics of expenditures of the consolidated budget of the Komi Republic, bln rubles*

* In the prices of 2014 (absolute values were indexed to the consumer price index in order to bring them in a comparable form).

Sources: Ministry of Finance of the Republic of Komi...; calculations by E.N. Timushev, V.V. Tikhomirova

In 2014, the dynamics of tax revenues was influenced by subdued economic growth, changes in the tax legislation, and completion of major phases of large investment projects on the territory of the Republic. The contribution of the oil factor was less significant than in 2012–2013. Major part of tax revenues was formed by the mining industries, manufacturing industries, organizations carrying out operations with real estate, transport and communications.

In 2014, there was a decrease in the share of transfers to the federal budget mainly as a result of reducing value added tax receipts. The indebtedness of economic entities to the budgets of all levels decreased. The Republic’s consolidated budget was executed with a deficit. The volume of funds allocated from the federal budget was less than in 2013. Tax and non-tax revenues increased. The main expenditure items were education, health care, social policy, and national economy.

When studying budget expenditures, researchers identify social protection with expenditures on social services [2]. During 2005–2014, the share of social expenditures

(including inter-budget transfers of the Federal Compulsory Medical Insurance Fund) in the consolidated budget of the Komi Republic gradually increased from 31.0 to 52.2% of the total costs (Fig. 3) . The dynamics of this expenditure item is formed by the expenditures under the item “Social welfare of the population”, followed by the item “Social services provided to population” and other expenditures. The real annual increase was similar to the rate of inflation, making financing on this item the most stable and independent from the behavior of the total amount of budget expenditures. The drop in 2014 can be explained by the outrunning reduction of costs in comparison with the dynamics of GRP of the Komi Republic.

In 2010–2014 the general dynamics of formation and use of budgetary funds in the Republic was in line with nationwide trends. The rate of growth of consolidated budget revenues in the Republic (145%) slightly lagged behind the increase in the revenues of consolidated budgets of constituent entities of the Russian Federation (150%).

A significant part of the Republic’s budget revenues was formed by tax revenues. In order to form budget resources and use them in the system of social protection, the government redistributes the incomes of different social groups.

The main government tool in this process is taxation of individuals. Here the reform of social tax has a more pronounced effect. In practice, the share of regional budgets in social assistance programs comprises 41%, the share of local budgets is 32%, other sources make up 21%, and the share of the federal budget is only 6%.

Over the past three years, tax remissions from the Republic’s taxpayers to the budgetary system of the country increased by 20%, including in 2014 – by 7%. According to the Department of the Federal Tax Service in the Komi Republic, the receipts on taxes, duties and other mandatory payments to the budget system of the Russian Federation in 2014 amounted to 129.1 billion rubles. Compared to 2013, they increased by 7% (nationwide – by 12%). In 2014, the volume of funds transferred to the federal level, increased by 2%, but the share of transfers declined from 58% in 2013 to 56% as a result of reduction in the receipts of tax on the profit of organizations (in terms of payments to the federal budget) and value added tax.

At the end of the year, the consolidated budget of the Komi Republic received 44% of the funds collected in the region, the general figure for all constituent entities of the Russian Federation is 49%. Payments to the budgets of municipalities decreased by 22% in connection with the change of the standard for deductions of individual income tax in favor of the budget of the Republic.

In 2010–2014, the general dynamics of formation and use of budgetary funds of the Republic was in line with national trends. The growth rate of the Republic’s consolidated budget revenues (145%) slightly lagged behind the increase in consolidated budget revenues in constituent entities of the Russian Federation (150%). Consolidated budget expenditures per resident of the Republic traditionally exceeded the national average. In the period under consideration, the gap between the indicators increased from 16 to 38% and amounted to 88 thousand rubles in the Komi Republic and 64 thousand rubles in Russia as a whole.

Social welfare payments are continuously growing and in 2013 they amounted to 22.5% in the dynamics of monetary incomes of the population (Fig. 4).

The Komi Republic uses treasury technology to bring budgetary funds to specific recipients. In accordance with the program for development of budget federalism in the Russian Federation in

Figure 4. Dynamics of monetary incomes of the population

-

— •— Money incomes - total

-

— •— Entrepreneurial income

-

— •— Labor remuneration

-

— •— Social payments

-

— •— Property income

-

— •— Other incomes

(including shadow wages)

2009 2010 2011 2012 2013

Source: Statistical Yearbook of the Komi Republic, 2014; calculations by V.V. Tikhomirova.

2005 all regional and local budgets shifted to the treasury execution on the basis of uniform federal standards. Treasury system – is a system of comprehensive accounting and control of the movement of budgetary funds from their receipt and up to their usage.

The main functions of this system consist in bringing budget funds to the final recipients according to the law on the budget and control of the target use of budgetary resources. Treasury system uses the principle of cash unity: transfer of all incoming revenues to the single account of the budget and implementation of all expenditures using this account. Budgetary funds, bypassing the accounts of the relevant administrators across the vertical, are brought directly to each budget unit. There was a division of regulatory and executive functions without infringing on the amount of administrative rights, while maintaining the protection of budget funds from unauthorized use.

The research that we have performed shows that the Government of the Komi Republic carries out socially-oriented policy for the purpose of timely issuance of pensions, allowances, compensations and benefits, and this policy helps maintain the necessary social stability.

There are many sources of formation of financial resources for implementing social protection of the population, these sources are interrelated and interdependent and they ultimately form the basis of socio-economic reforms implemented in the country. The state remains the most important guarantor and coordinator of correct and effective use of these sources, identification of new ones and development of those already in use. However, the amount of social payments should be consistent with the financial capabilities of the regions [20].

It is revealed that the most pressing issue that defines the entire character of socio-economic relations between the state and society is the imbalance of financial resources and obligations at all levels of the budgetary system of the Russian Federation. The federal government is to use interbudgetary equalization to enhance the effectiveness of the system of social protection to reduce social differentiation in the interests of poverty alleviation. The balance of all the sources of formation of financial resources for the system of social protection will create a solid basis to enhance the standard of living and quality of life and implement all constitutional rights and freedoms of citizens.

Currently, social development of the country and its individual regions is largely determined by the efficiency of the system of social protection of the population. The mechanism of social maneuvering that artificially regulates the level of wages and prices, employment, quantitative and qualitative components of an average standard of living is recognized as ineffective, because it only reduces social contradictions, but does not stimulate the economy.

Therefore, the primary method of social protection should consist in the targeted provision of social assistance only to those households whose actual consumption is below the subsistence level. People with disabilities or incapacitated persons should be protected by transfer programs for social insurance, social security, and social assistance. Thus we oppose indiscriminate social support (social security) and advocate targeted assistance to those in need.

Efficient measures for promoting people’s activities in the labor market should become the main purpose of social protection. People themselves should make efforts in order to achieve their own financial security and well-being [28, 31].

On the background of the current crisis and in conditions of limited financial resources, conceptual approaches to creating the entire system of social protection (its scope, set of indicators, categories of receivers, financing sources and levels of responsibility), and also quantitative characteristics (number of recipients, amount of support) and direct provision forms (cash, in kind, services) acquire new and crucial importance and require adjustment.

Список литературы Issues of formation and use of financial resources of the social welfare system (case study of the Komi Republic)

- Abakumova N.N., Podovalova R.Ya. Politika dokhodov i zarabotnoi platy . Novosibirsk: NGAEiU; Moscow: INFRA-M, 1999. 224 p..

- Akindinova N., Kuz'minov Ya., Yasin E. Rossiiskaya ekonomika na povorote . Voprosy ekonomiki , 2014, no. 6, pp. 4-17..

- Balikoev V.Z. Kratkii kurs ekonomicheskoi teorii: uchebnik . Moscow: Menedzher, 2003. 328 p..

- Dymnich T.S. Regional'naya model' sotsial'noi zashchity naseleniya (na prim. Mosk. obl.): avtoref. dis.. kand. filosof. nauk . Moscow, 1999. 23 p..

- Kadomtseva S.V. Sotsial'naya zashchita naseleniya: uchebnoe posobie . Moscow: RAGS, 1999. 275 p..

- Korepanov G.S. Regional'naya sistema sotsial'noi zashchity naseleniya (na primere Khanty-Mansiiskogo avtonomnogo okruga): dis.. kand. sotsiol. nauk . Tyumen', 1999. 200 p..

- Kosarev Yu.A. Sotsial'noe strakhovanie v Rossii: na puti k reformam . Moscow: Moskovskii rabochii, 1999. 240 p..

- A.N. Azriliyan (Ed.). Kratkii ekonomicheskii slovar' . Moscow, 2001..

- Krestov A.V. Stanovlenie gosudarstvennoi regional'noi sistemy sotsital'noi zashchity naseleniya (sotsiologicheskii analiz): dis.. kand. sotsiol. nauk . Moscow, 2000. 145 p..

- Kuzyutkin N.V. Organizatsionnye i ekonomicheskie mekhanizmy sovershenstvovaniya sistemy sotsial'noi zashchity rabotnikov (na primere predpriyatii mashinostroeniya): avtoref. dis.. kand. ekon. nauk . Saratov, 2003. 19 p..

- Liborakina M.I. Adresnaya sotsial'naya podderzhka naseleniya. Uroven' mestnogo samoupravleniya . Ed. by A.S. Puzanov. Moscow: Institut ekonomiki goroda, 1998. 104 p..

- Gorelov P.A. (Ed.). Politika dokhodov i kachestvo zhizni naseleniya . Saint Petersburg: Piter, 2003. 653 p..

- Roik V. Sotsial'naya zashchita: soderzhanie ponyatiya . Chelovek i trud , 2000, no. 11, pp. 42-48..

- Sistema natsional'nykh schetov 1993 . Volumes 1, 2..

- Sotsial'naya zashchita naseleniya v regione . Under the general editorship of V.G. Popov. Yekaterinburg: UrAGS, 1999. 352 p..

- Grigor'ev S.I., Guslyakova L.G. (Eds.). Sotsial'naya rabota v sovremennom obshchestve: realii i perspektivy: materialy mezhregional'noi nauchno-prakticheskoi konferentsii “Teoriya, praktika i obrazovanie v sotsial'noi rabote: realii i perspektivy” . Barnaul, 2001. 381 p..

- Sotsial'naya rabota: teoriya i praktika . Executive editors: E.I. Kholostova, A.S. Sorvina. Moscow, 2004. 148 p.

- Teterskii S.V. Vvedenie v sotsial'nuyu rabotu . Moscow: Akademicheskii Prospekt, 2000. 496 p..

- Tikhomirova V.V. Adresnaya sotsial'naya pomoshch' v sisteme sotsial'noi zashchity naseleniya . Syktyvkar, 2013. 138 p..

- Tikhomirova V.V. Metodologiya i mekhanizmy finansovogo obespecheniya sistemy sotsial'noi podderzhki naseleniya regionov zony Severa . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2013, no. 1 (25), p. 123..

- Upravlenie-98 (Upravlenie restrukturizatsiei ekonomiki): materialy mezhdunarodnoi nauchno-prakticheskoi konferentsii. 1998, no. 2, 526 p..

- Rodionova V.M. (Ed.). Finansy . Moscow, 1997.

- Shedenkov S.A. Sotsial'naya zashchita i usloviya mestnogo samoupravleniya: dis. … kand. sotsiol. nauk . Belgorod, 1995. 215 p..

- Shumilin A.P. Stanovlenie regional'noi sistemy sotsial'noi zashchity naseleniya: dis. … kand. ekonom. nauk . Moscow, 2002..

- Yushkova S.A. Struktura i usloviya effektivnoi sistemy sotsial'noi zashchity naseleniya Rossiiskoi Federatsii v usloviyakh sotsial'no-ekonomicheskikh izmenenii: avtoref. dis.... kand. ekon. nauk . Moscow, 1997. 23 p..

- Yakushev L.P. Sotsial'naya zashchita . Moscow, 1998. 156 p..

- Introduction to Social security. Geneva: ILO, 1984.

- Neoconservatism: The Autobiography of an Idea. 1995.

- Marmor T.R., Mashaw J.L. (Eds.). Social security: beyond the Rhetoric of crisis. Princeton: Princeton University Press, 1988. P. 15.

- Social protection in the Member States of the European Union. Luxembourg: Official publications of the European Communities, 1999. P. 12.

- Two Cheers for Capitalism. 1978.