Key trends of investment development in the Arctic zone of the Russian Federation in 2008–2017

Автор: Natalia A. Serova, Sergey V. Gutov

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 34, 2019 года.

Бесплатный доступ

This article is devoted to the study of the investments and their transformation in the Arctic zone of the Russian Federation in the conditions of the crisis of the last decade. Current studies indicate the occurred as a result of economic shocks aimed at the implementation of the state Arctic policy, as well as the need for financial and technological constraints that require a retrospective analysis of investment activity in the Arctic zone. The study of investments in the Arctic zone of the Russian Federation in 2008-2017 has four stages identified: 2008–2010; 2011–2012; 2013–2014; 2015–2017. One may see that investments in the Russian Federation are due to quite sharp fluctuations and their uneven distribution across regions. The most significant volumes of Russian investments in the first phase were typical for regions partially located in the Arctic zone of the Russian Federation, and now — for entirely Arctic areas. The same situation was until 2014 with foreign investments in the Arctic. However, after the start of the “sanctions war,” we observed a turning point. Foreign investments in the Arctic areas of the Russian Federation significantly decreased. The decline continues to this day. Predicted options for further investment development in the Arctic zone of the Russian Federation have an adverse scenario for the national economy.

The Arctic zone of the Russian Federation, state Arctic policy, priority investment projects, crisis, international sanctions, investment processes

Короткий адрес: https://sciup.org/148318490

IDR: 148318490 | УДК: 330.322, 332.14, 338.23 (320.322+332.14+338.23)(985) | DOI: 10.17238/issn2221-2698.2019.34.77

Текст научной статьи Key trends of investment development in the Arctic zone of the Russian Federation in 2008–2017

The Arctic is one of the most resource-rich regions in the world, incl. hydrocarbons, which is of fundamental importance for the world community in the context of the gradual exhaustion of the continental resources. According to geologists, the Arctic disposes of about a quarter of global oil and natural gas reserves. Almost 75% of them are on the shelf of the Arctic Ocean [1, Gautier D.L., Bird K.J., et al.]. At the same time, the Russian Federation enjoys the most significant resource potential in the Arctic. The principal reserves of which are on the Arctic continental shelf (mainly in the waters of the Barents, Pechora and Kara seas). According to Russian scientists, “the reserves of oil, natural gas, and gas condensate in the Russian Arctic basin are comparable to the hydrocarbon provinces of the Middle East and Western Siberia and are more than 280 billion tons” [2, Kontorovich A.E.]. Also, the Arctic is rich with the other natural resources: the largest deposits of tin, nickel, lead, manganese, diamonds, etc.

∗ For citation:

Intensive reduction of sea ice, significantly accelerated over the past 30 years [3, Mokhov I.I.; 4, Barber D., Lukovich J. et al.; 5, Carr J., Stokes C., Vieli A.; 6, Winski D., Osterberg E., et al.; 7, Zheng W., Pritchard M. et al.] has opened up new opportunities for offshore mining and navigation development along the main Arctic transport corridors: the Northern Sea Route and the Northwest Passage. Thus, according to forecasts of American researchers from the University of California L. Smith and S. Stephenson, “due to the melting of an unprecedented amount of Arctic ice, the transport corridors in the Arctic Ocean will become more accessible by 2020, and shipping will be year-round by 2050"[8, Smith L., Stephenson S.].

Thus, the new resource and logistical opportunities opening in the Arctic were the immediate cause of a surge in interest worldwide for this unique macro-region and naturally led to increased international competition for the development of the Arctic. It has led to the urgent need to develop a fundamentally new state policy of Russia concerning its Arctic territories.

The main directions of the new state policy of Russia in the Arctic

The most active settlement and industrial development of the Russian North and the Arctic territories was carried out in 1920 – 1980. However, the collapse of the centralized Soviet system and the sharp deterioration of the socio-economic situation in the country led to the closure of the northern programs, cuts in benefits and guarantees for citizens living and working in the North, reducing funds for certain sectors of the economy [9, Ponomarev I.A.], mass migration and, the collapse of the social infrastructure [10, Korchak E.A.]. In 1998–2000, the authorities tried to exercise the state Arctic policy (e.g., the draft law “On the Arctic zone of the Russian Federation” and the first edition of “Fundamentals of the state policy of Russia in the Arctic”), but they were unsuccessful.

Increased international competition for the development of the Arctic marked the beginning of a new stage in Russia's state Arctic policy. In 2008, the “Fundamentals of the state policy of the Russian Federation in the Arctic for the period up to 2020 and beyond” were adopted. The main goal of the new Arctic policy was “integrated socio-economic development of the Arctic zone of the Russian Federation through the use of the Northern Sea Route as a single national transport route of the country and the expansion of the resource base to meet the country's needs for hydrocarbons and other types of strategic raw materials.” Later, the Strategy for the Development of the Arctic Zone of the Russian Federation and Ensuring National Security for the Period up to 2020 was approved, the land areas of the Russian Arctic were defined, and the State Program for the Socio-Economic Development of the Arctic Zone of the Russian Federation was adopted. 2020 (from now on — the Program), with the adoption of which the Arctic zone of the Russian Federation was allocated as an independent object of government and socio-economic development.

The principal mechanism for the implementation of the Program is the supporting development zones, based on the existing administrative and territorial division of the Arctic zone of the Russian Federation (Fig. 1). In the support areas, it is planned to implement complex invest- ment projects that ensure the interconnection of measures for the development of the Arctic transport system, energy infrastructure, industrial facilities, etc.

Fig. 1. The Northern Sea Route and the placement scheme for the support zones in the Arctic (shown as numbers).

The majority (about 40%) of the 145 projects completed or planned for the Arctic are associated with the extraction and processing of mineral resources, primarily hydrocarbons. 18% of the projects are related to the modernization and development of the Arctic transport system, incl. the Northern Sea Route — a connecting element of all eight support zones. We also note the special significance of projects for the development of industry and energy (more than 10%). Extreme natural and climatic conditions of the Arctic make the reliable and uninterrupted operation of heating systems essential [11, Bejan A.V.; 12, Pobedonostsev V.V., Pobedonostsev G.M.]. Today we can highlight several priority projects (“anchor” project) of intersectoral and interterritorial nature and capable of having an impact not only on the development of specific Arctic territories but also on the entire Arctic zone of the Russian Federation (the cost of these projects is at least 100 billion rubles). These projects have two global interrelated directions that determine the strategic priorities of the state Arctic policy [13; 14, Balobanov A.E., Vorotnikov A.M., Mayorov S.V.; 15, Serova N.A., Serova V.A.; 16, Biev A.A.]:

-

• creation of large mineral resource centers. It is planned: to complete the Yamal LNG and Arctic- LNG-2 projects (Yamalo-Nenets support zone); to develop the minefields of the Usinsk coal deposits (Vorkuta support zone); to create new hydrocarbon production centers (Chukotka support zone); to construct a mining and enrichment plant for the extraction and processing of lead-zinc ores of the Pavlovskoye deposit (Pavlovskoye project) (Arkhangelsk support zone); to create a coastal support base for offshore projects in the Barents, Kara and Pechora seas (Kola support zone), etc.

-

• modernization and integrated development of the Arctic transport system, incl. service support for the Arctic marine economy. It is planned to complete a transcontinental project for the development of the Northern Sea Route — a connecting element of all eight reference zones; a complex of interregional infrastructure projects for the creation

of new transport corridors of the Northern latitudinal way (Yamalo-Nenets support zone) and Belkomur (Arkhangelsk and Vorkuta support zones), the Murmansk transport hub project (Kola support zone), construction and modernization projects for the seaports of Sabetta, Murmansk, Arkhangelsk , Indiga, Tiksi and others, airport, road and rail infrastructure of the Arctic regions.

However, the external negative phenomena of the last decade, which have had a significant impact on the entire Russian economy, can significantly slow down or suspend the ambitious development plans, but the most difficult for the development of the Arctic zone of the Russian Federation. The crises of 2008 and 2014 showed the vulnerability of the domestic economy due to its export orientation and a strong dependence on foreign financial resources and international markets, causing not only a vast outflow of capital, but also a drop in demand for almost all Russian commodity exports [17, Andreeva E.S.; 18, Tetushkin V.A.; 19, Safina R.S., Kurzina I.M.]. These circumstances predetermined the need to study investment trends in the Arctic zone of the Russian Federation, whose economy is mostly based on export-oriented extraction industries.

Investments in the Russian Arctic territories in 2008–2017

The heterogeneity of the socio-economic space of the Arctic causes the extreme unevenness of investments in the Arctic territories, which has been repeatedly noted in many works of Russian scientists [20–24]. Significant amounts of Russian and foreign investments, as a rule, fall on highly developed industrial centers. A typical example is the territory of commodity specialization — the Yamal-Nenets Autonomous District, where, despite the economic turmoil of recent years, investments account for about 40% of the total investment in the Russian Arctic (e.g., in 2017 investments in the district made up 39.7% of all investment in the Arctic zone of the Russian Federation) (Table 1).

Table 1

The share of domestic investment in the Arctic zone of the Russian Federation in the total Russian investments, % 10

|

Territories of the AZRF |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Territories that are fully included in the Arctic zone of the Russian Federation |

||||||||||

|

Nenets AD |

1.0 |

0.4 |

0.5 |

0.4 |

0.5 |

0.5 |

0.6 |

0.8 |

0.6 |

0.9 |

|

Murmansk Oblast |

0.5 |

0.5 |

0.4 |

0.5 |

0.6 |

0.5 |

0.6 |

0.7 |

0.6 |

0.7 |

|

Yamalo-Nenets AD |

4.6 |

4.3 |

4.2 |

4.3 |

4.6 |

4.5 |

5.4 |

5.6 |

7.4 |

6.8 |

|

Chukotka AD |

0.1 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

|

Territories that are partly included in the Arctic zone of the Russian Federation |

||||||||||

|

Republic of Karelia |

0.3 |

0.2 |

0.2 |

0.3 |

0.3 |

0.3 |

0.2 |

0.2 |

0.2 |

0.3 |

|

Komi Republic |

1.0 |

1.4 |

1.2 |

1.8 |

1.8 |

1.5 |

1.4 |

1.2 |

1.4 |

0.8 |

|

Arkhangelsk Oblast |

1.7 |

0.8 |

1.1 |

1.2 |

1.3 |

1.2 |

1.1 |

1.2 |

1.1 |

1.5 |

|

Krasnoyarsk Oblast |

2.3 |

3.1 |

2.9 |

2.8 |

3.0 |

2.8 |

2.6 |

2.9 |

2.9 |

2.7 |

|

Republic of Sakha (Yakutia) |

1.8 |

4.4 |

1.4 |

1.7 |

1.6 |

1.4 |

1.3 |

1.4 |

1.9 |

2.4 |

|

Average in the AZRF |

13.2 |

15.4 |

12.1 |

13.2 |

13.9 |

12.7 |

13.4 |

14.2 |

16.2 |

16.1 |

10 Calculated by the author according to the data provided by the Federal State Statistics (Accessed: 23 November 2018).

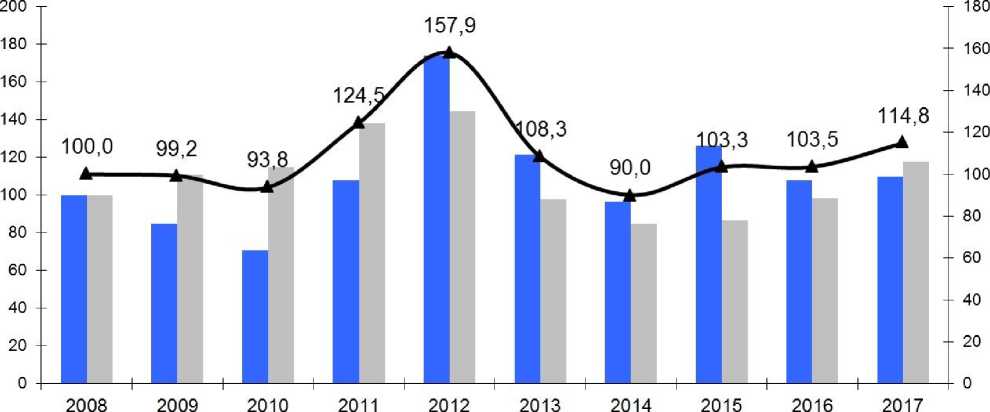

Development of investments in the Arctic zone of the Russian Federation in 2008–2017 took place in a volatile foreign policy and economic environment. Therefore, the dynamics of total Russian investments in the Arctic was unpredictable (Fig. 2).

^™ Territories which are fully incl. in the AZRF Territories which are partly incl. in the AZRF

* The Arctic Zone of the Russian Federation

Fig. 2. Dynamics of investments in fixed assets in the Arctic zone of the Russian Federation, comparable prices, % to 2008.

In the development of investments 2008-2017, four phases are identified: 1) investment decline 2008–2010 (the beginning of the global financial crisis); 2) investment growth 2011–2012 (recovery period after the global financial crisis); investment decline in 2013–2014 (stagnation of the Russian economy); investment surge 2015–2017 (the beginning of a local crisis of the Russian economy and the “sanctions war”). Let us consider them in detail:

-

1) in 2008–2010, the beginning of the global economic crisis and the sharp fall in world energy prices, investments declined, both in the Arctic zone of the Russian Federation and the country. On average, in the Arctic, the investment decline amounted to 96.9% (95.1% in Russia). The most profound manifestations occurred in the Arkhangelsk Oblast, the Nenets and Chukotka Autonomous Districts (Table 2). The increase in investment was recorded only in the Krasnoyarsk Territory and the Republic of Sakha (Yakutia). It happened due to the ongoing projects and, accordingly, financing of large investment projects in these areas. E.g., in Yakutia, they have the plan for the construction of the Eastern Siberia-Pacific Ocean oil pipeline (ESPO), intended for transporting Siberian oil to the Asia-Pacific region (the project has been running since 2004). In 2009, the first stage ESPO-1 oil pipeline system was completed. In the Krasnoyarsk Territory, the Vankor project aimed at the development of a gas and oil field in the Turukhanskarea (since 2006), made it possible to build more than 200 km of oil pipelines and gas pipelines, 700 km of power lines, about 100 km of roads, 117 oil wells, etc.

Table 2

Growth rates of investments in fixed capital in the Arctic zone of the Russian Federation, comparable prices, in 2008 = 100%2

|

Territories of the AZRF |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Territories that are fully included in the Arctic zone of the Russian Federation |

|||||||||

|

Nenets AD |

36.4 |

40.8 |

39.7 |

49.5 |

51.5 |

62.9 |

80.4 |

66.4 |

109.3 |

|

Murmansk Oblast |

80.9 |

69.7 |

96.6 |

117.2 |

108.7 |

131.6 |

133.9 |

103.3 |

132.2 |

|

Yamalo-Nenets AD |

88.0 |

87.8 |

98.9 |

115.4 |

114.6 |

135.8 |

118.7 |

144.9 |

139.4 |

|

Chukotka AD |

134.5 |

45.6 |

77.6 |

135.3 |

89.7 |

57.5 |

89.8 |

74.4 |

69.9 |

|

Territories that are partly included in the Arctic zone of the Russian Federation |

|||||||||

|

Republic of Karelia |

68.1 |

80.0 |

100.3 |

106.8 |

99.8 |

92.7 |

85.1 |

82.8 |

92.0 |

|

Komi Republic |

123.5 |

123.4 |

206.9 |

217.0 |

173.8 |

169.3 |

126.3 |

142.3 |

89.8 |

|

Arkhangelsk Oblast |

44.3 |

56.0 |

68.3 |

75.5 |

68.1 |

65.6 |

63.9 |

59.1 |

85.7 |

|

Krasnoyarsk Oblast |

117.8 |

130.5 |

150.0 |

175.8 |

168.9 |

156.9 |

151.3 |

155.2 |

151.3 |

|

Republic of Sakha (Yakutia) |

199.5 |

127.3 |

174.2 |

179.5 |

161.9 |

148.6 |

147.7 |

190.5 |

258.0 |

-

2) in the second phase (2011 – 2012), a rapid increase in investment in the Arctic zone of the Russian Federation occurred (the average growth rate was 125.8%, in Russia — 108.8%), due to an unprecedented increase in oil prices and exports of oil and petroleum products. Thus, in 2011, “Russian exports, for the first time, crossed the 500 billion mark, with more than half of export revenue received through the sale of oil and petroleum products” [25, Aganbegyan A.G.]. The highest growth rates were in Chukotka AD (the average growth rate of 172.3%), the Republic of Komi (136.3%) and the Murmansk Oblast (129.9%).

-

3) in the third phase (2013-2014), investments in the Arctic zone of the Russian Federation experienced a significant decline (the average growth rate was 95.0%, in Russia — 99.7%). The negative growth rate was due to both own insufficient funds and the completion of major investment projects in some territories, and the so-called “base effect.” E.g., in Chukotka, the investment decline was most pronounced. In 2012, the reconstruction of the runway of Anadyr airport was completed, and it affected the growth rate of investments in the following years. Investment growth was observed in the Murmansk Oblast (106.9%), Nenets AD (113.2%) and Yamal-Nenets AD (108.9%). Thus, the main factor of a significant investment inflow in the Murmansk Oblast was the complex development project of the Murmansk transport hub (the cost — 139.02 billion rubles; running since 2014). The project aims to create a year-round deep-sea hub — the center for processing of oil cargoes, transshipment of coal and mineral fertilizers, integrated into the international transport corridors “North-South” and “East — West.” The project includes the construction of new coal, oil, and container terminals, as well as railway entrances (the railway line Vihodnoy — Lavna), reconstruction and modernization of the port of Murmansk and the existing road infrastructure, incl. the reconstruction of the road R-21 “Kola.”

-

4) in 2015 – 2017, despite the ongoing investment decline in the country caused by the geopolitical situation and economic sanctions against Russia, a gradual intensification of investment activity began in the Arctic zone of the Russian Federation (the average growth rate was 106.2%, in Russia — 98.0%). In 2015 the growth of investments was noted only in the Arctic

-

2 Calculated by the author .

territories. It is associated with the significant investment projects in the Arctic (e.g., the construction of the 15-kilometer Usinsk — Naryan-Mar highway in the Nenets Autonomous District, the growth of capital investments in the construction of the Omolon — Anadyr highway in Chukotka, etc.). Other Arctic territories of Russia got positive rates of investment growth only in 2016. Thus, in 2016, the highest rise in investment activity was observed in the Republic of Sakha (Yakutia) due to the construction of the diamond mining enterprise of ALROSA at the Verkhne-Munsky field with a total investment of 62.98 billion rubles. The project is completed at the expense of the company's funds with the involvement of state support (8.5 billion rubles), i.e., a subsidy for compensating the cost of creating transport infrastructure facilities under the target program “Development of the Far East and the Baikal area until 2018.” Investment growth in 2016 in Karelia happened due to the construction of two hydroelectric power plants (Beloporozhskaya HPP-1 and HPP Beloporozhskaya-2). The plants were a part of the project “Reconstruction and construction of small hydropower plants on the territory of the Republic of Karelia.” One more important project — modernization of Segezha pulp and paper mill (investments amounted to 8.5 billion rubles) in the framework of the project “Reconstruction and modernization of enterprises of timber industry complex” of the “Sokol” Group. In the Republic of Komi, the growth of investments was due to the increase in capital investments in the extraction of fuel and energy minerals and the development of pipeline transport (projects for the construction of the system of main gas pipelines “Bovanenkovo — Ukhta” and “Ukhta — Torzhok”).

In the studied period, the growth of investments in fixed assets was observed in the republics of Sakha (Yakutia) and Komi (average growth rates for 2008-2017 amounted to 163.8% and 141.7%, respectively), the Krasnoyarsk Territory (144.0%), as well as the Yamal-Nenets Autonomous District (112.7%) and the Murmansk Oblast (105.2%). At the same time, since 2014, high rates of investment growth were typical only for the Arctic areas. The territories partly included in the AZRF began to reach favorable rates of investment growth only in 2016.

Thus, it is possible to say that investments in the Russian Arctic, despite the negative impact of external factors, has a relatively positive trend (in 2008-2017, the average growth rate of investments amounted to 107.2%, for Russia — 101.1%). Both economic crises made the volume of investments in the economy of the Arctic zone of the Russian Federation fell to a lesser extent than the national average. Expenditures increased faster in the post-crisis periods, due to the large-scale investment projects in some Arctic territories.

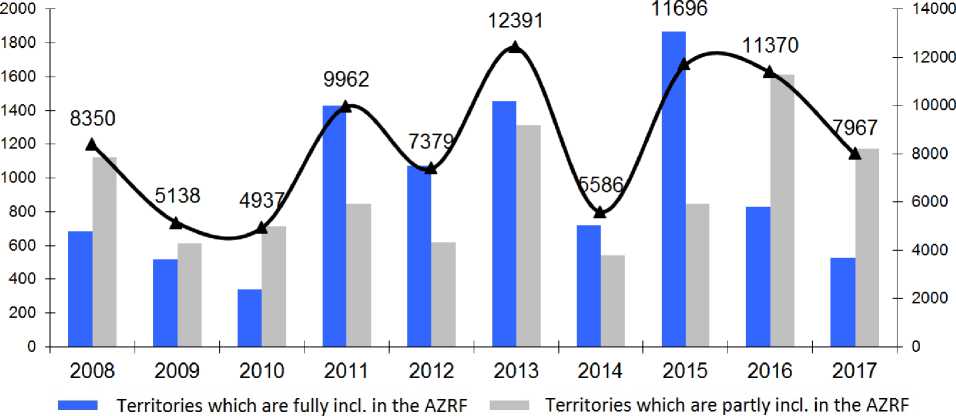

At the same time, the dynamics of foreign investments in the Russian Arctic experienced rather sharp fluctuations and a tendency to decrease (Fig. 3).

* The Arctic Zone of the Russian Federation

Fig. 3. Foreign direct investment, mln. US dollars

The negative impact of the economic shocks of recent years caused the current economic situation. Thus, with the onset of the global financial crisis, along with the fall in world prices for raw materials, the investment opportunities of the Arctic territories declined sharply. The new round of the economic crisis and the introduction of Western sanctions negatively impact on investments in the Arctic. The sanctions implied a ban on the supply to Russia of specialized equipment and technologies of offshore mining. Many foreign companies were forced to suspend or significantly limit participation in the projects on the Arctic shelf.

Despite it, international cooperation in the Arctic continues. Russian-Chinese Arctic partnership notably increased, as evidenced by the active development of the joint Yamal LNG gas project (the Chinese National Oil and Gas Corporation (CNPC) has a 20% share in the project) [26, Rabiya K.]. Besides, China is also interested in Arctic logistics, primarily the Northern Sea Route. It is proposed to link the Chinese megaproject “Arctic Silk Road” to the ТЫК development projects. It suggests that in the medium-term investment activity in the Arctic zone of the Russian Federation will remain at its current level. An adverse scenario of the national economy development, the possibility of the Arctic projects with the participation of European and American investments will significantly reduce (however, this will not affect China's investments). In addition, the volume of budgetary investments in large infrastructure projects and co-financing regional investment development programs in the Arctic regions will be reduced, which will lead to a reduction in the volume and / or postponement of the planned financing of investment projects in the Arctic zone of the Russian Federation sold at the expense of the federal budget.

Conclusion

Investments in the Arctic has always been extraordinarily uneven and unstable. They are directly related to large-scale projects for the extraction and processing of hydrocarbons. In the future, this leads to an investment recession after such projects or their suspension due to exter- nal negative phenomena, incl. stricter sanctions against Russian oil and gas sector. It follows that a balanced investment development of the Arctic zone of the Russian Federation requires large-scale institutional changes in the state Arctic policy and investment policy that will help attract resources and promote their practical use.

Acknowledgments and funding

The article includes the materials prepared in the framework of the state assignment FRC Kola Scientific Center RAS No. 0226-2019-0027.

Список литературы Key trends of investment development in the Arctic zone of the Russian Federation in 2008–2017

- Gautier D.L., Bird K.J., Charpentier R.R., Grantz А., Houseknecht D.W., Klett T.R., Moore T.E., Pitman J.K., Schenk Ch.J., Schuenemeyer J.H., Sorensen К., Tennyson M.E., Valin Z.C., Wandrey C.J. Assessment of Undiscovered Oil and Gas in the Arctic. Science, 2009, no. 324, pp. 1175–1179. DOI 10.1126/science.116946

- Kontorovich A.Je. Neft' i gaz Rossijskoj Arktiki: istorija osvoenija v XX veke, resursy, strategija na XX vek [Oil and gas of the Russian Arctic: the history of development in the XX century, resources, strategy for the twentieth century]. Nauka iz pervyh ruk [Science first-hand], 2015, vol. 61, no. 1, pp. 46–65.

- Mohov I.I. Sovremennye izmenenija klimata v Arktike [Modern climate change in the Arctic]. Vestnik Rossijskoj akademii nauk [Bulletin of the Russian Academy of Sciences], 2015, no. 3, pp. 265–271.

- Barber D.G., Lukovich J., Keogak J., Baryluk S., Fortier L., Henry G. The Changing Climate of the Arctic. Arctic, 2008, no. 61, pp. 7–26.

- Carr J., Stokes C., Vieli A. Three-fold increase in the rate of repulsion of marine glaciers in the Atlantic: 1992–2010. Annals of Glaciology, 2017, no. 58 (74), pp. 7–91. DOI 10.1017/aog.2017.3

- Winski D., Osterberg E., Kreutz K., Wake C., Ferris D., Campbell S., Baum M., Bailey A., Birkel S., Introne D., Handley M. A 400 year ice core melt layer record of summertime warming in the Alaska Range. Journal of Geophysical Research: Atmospheres, 2018, no. 123, pp. 3594–3611. DOI 10.1002/2017JD027539

- Zheng W., Pritchard M., Willis M., Tepes P., Noel G., Benham T., Dowdesl J. Accelerating glacier mass loss on Franz Josef Land, Russian Arctic. Remote Sensing of Environment, 2018, no. 211, pp. 357–375. DOI 10.1016/j.rse.2018.04.004

- Smith L., Stephenson S. New Trans-Arctic shipping routes navigable by mid-century. PNAS, 2013, vol. 110, no. 13, pp. 4871–4872. DOI 10.1073/pnas.1214212110

- Ponomarev I.A. Sever Rossii: puti ego social'no-jekonomicheskogo razvitija [North of Russia: the way of its socio-economic development]. Nacional'nye interesy: prioritety i bezopasnost' [National interests: priorities and security], 2009, no. 5, pp.78–81.

- Korchak E.A. Trudovoj potencial severnyh regionov v ramkah realizacii gosudarstvennoj politiki Rossijskoj Federacii v Arktike [Labor potential of the northern regions in the framework of the implementation of the state policy of the Russian Federation in the Arctic]. Apatity: KSC RAS Publ., 2017, 225 p. (In Russ.)

- Bezhan A.V. Perspektivy teplosnabzhenija zdanij s uchastiem vetrojenergeticheskih ustanovok v Arkticheskoj zone RF [Prospects for heat supply of buildings with the participation of wind power plants in the Arctic zone of the Russian Federation]. Jenergosberezhenie [Energy Saving], 2018, no. 3, pp. 62–72.

- Pobedonosceva V.V. Pobedonosceva G.M. Osobennosti jekonomicheskih i jenergeticheskih strategicheskih napravlenij razvitija regionov Arktiki Rossii [Features of the economic and energy strategic directions of development of the Russian Arctic regions]. Nauka Krasnojar'ja [Science of Krasnoyarsk], 2017, vol. 6, no. 2–2, pp. 119–127.

- Osnovnye aspekty jekonomicheskogo razvitija i upravlenija Arkticheskoj zonoj Rossijskoj Federacii [The main aspects of economic development and management of the Arctic zone of the Russian Federation]. Moscow, Nauchnyj konsul'tant Publ., 2018, 214 p. (In Russ.)

- Balabanov A.E., Vorotnikov A.M., Mayorov S.V. The role of transport and logistics infrastructure in the implementation of projects of the support zones for the development of the Arctic zone of the Russian Federation [The role of transport and logistics infrastructure in the implementation of projects of support zones for the development of the Arctic zone of the Russian Federation]. Zhurnal jekonomicheskih issledovanij [Journal of Economic Research], 2018, no. 2, pp. 17–27.

- Serova N.A., Serova V.A. Transportnaja infrastruktura rossijskoj Arktiki: sovremennoe sostojanie I perspektivy razvitija [Transport infrastructure of the Russian Arctic: current state and development prospects]. Konkurentosposobnost' v global'nom mire [Competitiveness in the global world], 2017, no. 12 (59), pp. 1269–1272.

- Biev A.A. Regional'nye investicionnye proekty v Arkticheskoj zone Rossii: formirovanie territorial'noj infrastruktury [Regional investment projects in the Arctic zone of Russia: the formation of territorial infrastructure]. Sever i rynok: formirovanie jekonomicheskogo porjadka [North and the market: the formation of an economic order], 2018, no. 3 (59), pp. 61–69.

- Andreeva E.S. Dinamika investicionnoj aktivnosti v uslovijah jekonomicheskogo krizisa [Dynamics of investment activity in the conditions of economic crisis]. Izvestija vuzov. Investicii. Stroitel'stvo. Nedvizhimost' [Izvestiya Vuzov. Investments. Building. The property], 2016, no. 3 (18), pp. 11–21.

- Tjotushkin V.A. Analiz dinamiki investicionnoj dejatel'nosti v krizisnyh jekonomicheskih uslovijah: mezhdunarodnaja i rossijskaja praktika [Analysis of the dynamics of investment activity in crisis economic conditions: international and Russian practice]. Finansovaja analitika: problemy i reshenija [Financial analytics: problems and solutions], 2016, no. 43 (325), pp. 27–40.

- Safina R.S., Kurzina I.M. Vlijanie mirovogo krizisa 2008–2014 gg. na investicii i investicionnuju privlekatel'nost' Rossii [The impact of the global crisis 2008–2014 on investment and investment attractiveness of Russia]. VJePS [VEPS], 2015, no. 3, pp. 85–89.

- Jekonomicheskaja bezopasnost' i snizhenie neravnomernosti prostranstvennogo razvitija rossijskogo Severa i Arktiki [Economic security and reduction of the uneven spatial development of the Russian North and the Arctic]. Apatity, KSC RAS Publ., 2012, 232 p. (In Russ.)

- Severnye territorii v obshherossijskom, regional'nom, municipal'nom prostranstve [Northern territories in the all-Russian, regional, municipal space]. Apatity, KSC RAS Publ., 2012, 121 p.

- Serova N.A., Emel'janova E.E. Investicionnyj klimat severnyh territorij: regional'nyj i municipal'nyj urovni [Investment climate of the northern territories: regional and municipal levels]. Apatity, KSC RAS Publ., 2015, 164 p. (In Russ.)

- Emel'janova E.E. Vlijanie regional'nyh osobennostej Severa na celi, zadachi i vozmozhnosti realizacii municipal'noj investicionnoj politiki [The influence of the regional characteristics of the North on the goals, objectives and opportunities for the implementation of the municipal investment policy]. Nauka i biznes: puti razvitija [Science and business: ways of development], 2014, no. 5 (35), pp. 79–83.

- Didyk V.V., Serova N.A. Regional'naja investicionnaja politika na Severe Rossii [Regional Investment Policy in the North of Russia]. Prostranstvennaja jekonomika [Spatial Economics], 2005, no. 4, pp. 90–101.

- Aganbegjan A.G. Investicii — osnova uskorennogo social'no-jekonomicheskogo razvitija Rossii [Investments — the basis for accelerated social and economic development of Russia]. Den'gi i kredit [Money and credit], 2012, no. 5, pp. 10–16.

- Rabiya K. Kitajsko-rossijskoe sotrudnichestvo v Arktike: perspektivy razvitija [Chinese-Russian cooperation in the Arctic: development prospects]. Vestnik Moskovskogo gosudarstvennogo oblastnogo universiteta [Bulletin of Moscow State Regional University], 2018, no. 2, pp. 108–128.