Концепции оптимизации структуры капитала компаний: перспективы развития

Автор: Дороган Н.Д.

Журнал: Теория и практика сервиса: экономика, социальная сфера, технологии @tps-esst

Рубрика: Государственное и муниципальное управление

Статья в выпуске: 4 (22), 2014 года.

Бесплатный доступ

Короткий адрес: https://sciup.org/14876093

IDR: 14876093

Текст статьи Концепции оптимизации структуры капитала компаний: перспективы развития

Финансовый кризис, поразивший большинство экономически развитых стран в 20082009 гг., показал, что компании, использующие различные структуры капитала в своей деятельности, по-разному пережили возникшие трудности. Это обстоятельство наводит на мысль, что выбор определенной структуры капитала компании по-разному сказывается не только на результативности ее деятельности, но и на ее финансовой устойчивости. Обзор литературы по теории и практике корпоративного финансового управления показывает, что исследования по проблеме оценки влияния структуры капитала компаний на их результативность и устойчивость в условиях российской экономики пока недостаточны. Целью статьи является демонстрация альтернативной концепции трехмерной оптимизации левериджа, которая объединяет жизненный цикл компании с традиционной моделью оптимизации левериджа по критерию минимизации средневзвешенной стоимости капитала (WACC) с учетом результатов анализа наработок ученых в этой области корпоративных финансов.

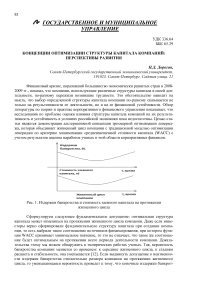

Рис. 1. Издержки банкротства и стоимость заемного капитала на протяжении жизненного цикла

Сформулируем следующее фундаментальное допущение: оптимальная структура капитала может изменяться на протяжении жизненного цикла компании. Даже если инвесторы верно сформировали фундаментальную структуру капитала при создании компании, то есть выбрали такое соотношение источников финансирования, при котором функция WACC принимает минимальное значение, то это не означает, что такое же соотношение будет оптимальным на протяжении всего периода деятельности компании. Доказательства этому мы можем обнаружить в эмпирических работах ученых. Так, вероятность банкротства компании меняется со временем: к середине жизненного цикла, к стадиям расцвета и стабильности, она уменьшается [12]. Если выдвинуть допущение о неизменности издержек банкротства относительно размера компании на протяжении жизненного цикла, то уменьшающаяся вероятность приведет к тому, что конечные издержки банкрот- ства также снижаются по мере развития компании. Стоимость заемного капитала уменьшается по мере развития компании, к стадиям, соответствующим середине жизненного цикла [5; 6; 7; 17]. Это обстоятельство позволяет сделать заключение о том, что динамика как издержек банкротства, так и стоимости фондирования заемными средствами на протяжении жизненного цикла компании имеет одинаковую структуру (рис.1).

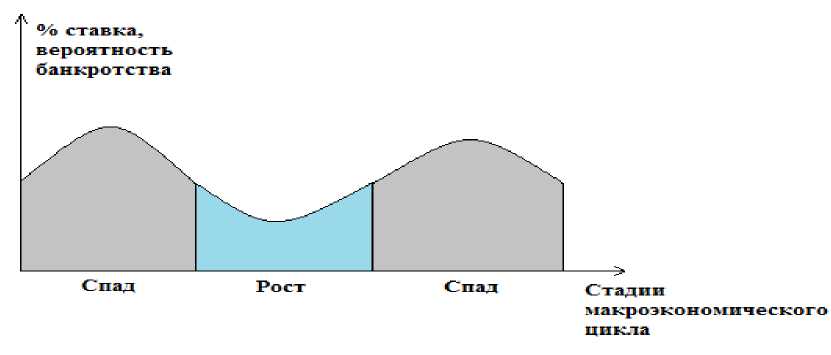

По сути, стоимость заемного капитала снижается из-за уменьшающихся рисков банков при кредитовании компаний на более поздних стадиях жизненного цикла. Положение компании более устойчиво, генерируется значительный свободный денежный поток, компания располагает более ликвидными залогами, приобретенными в процессе деятельности. Помимо заемного, компания в своей деятельности применяет в качестве источника финансирования и собственный капитал. Для оценки средневзвешенной стоимости капитала WACC следует проанализировать, как меняется вторая компонента, стоимость собственного капитала, на протяжении жизненного цикла. Ответ на этот вопрос содержится в одном из немногих доступных на настоящий момент исследований, работе М. Хасана [9]. На основе выборки австралийских компаний за 1991 – 2012 гг. ученый заключает, что стоимость собственного капитала также неодинакова для различных стадий жизненного цикла: уменьшение наблюдается на стадиях роста и зрелости, рост – на стадиях создания и спада. Таким образом, стоимость собственного капитала на протяжении жизненного цикла также имеет U-образный вид. Сделанные выводы позволяют построить теоретическую плоскость для WACC в трехмерном пространстве (рис. 2).

Рис. 2. Трехмерная модель WACC с учетом жизненного цикла компаний

На рис.2 представлена трехмерная модель WACC, в которой для упрощения, во-первых, оптимальная структура капитала на протяжении жизненного цикла не меняется, во-вторых, присутствует классический минимум средневзвешенной стоимости WACC. С учетом того, что на стадиях расцвета и стабильности достигается и минимум стоимости привлечения собственных и заемных средств, теоретически WACC на протяжении жизненного цикла приобретает форму заштрихованной плоскости. Следует подчеркнуть, почему правильнее сразу рассматривать трехмерную плоскость. Современные методики оптимизации обладают той особенностью, что практически полностью опираются только на будущие данные. Таким образом, практически ежегодно, а то и чаще, финансовым аналитикам приходится пересматривать данные, добавляя более свежую, актуальную информацию в закладываемую модель. Здесь оценка оптимальности представляет собой своеобразную непрерывную линию, которая все время перемещается вперед по мере устаревания информации финансовых рынков.

Анализ эмпирических работ также свидетельствует о том, что структура капитала компаний претерпевает существенные изменения на протяжении жизненного цикла. В большинстве исследований установлено, что леверидж компаний уменьшается по мере достижения компаниями стадий расцвета и стабильности, т.е. поддерживается паттерн по- ведения «высокий – низкий – высокий долг» [13; 14; 18]. При условии, что такое долгосрочное изменение соответствует фундаментальной (оптимальной) структуре капитала, получается, что при прочих равных условиях на стадиях расцвета и стабильности ценность собственного капитала в глазах акционеров становится ниже, чем заемного (рис.3). На рис.3 по центру проведены две линии, разделенные плоскостью, обозначенной желтым цветом. Первая линия, проведенная по центру и соответствующая левой границе плоскости, обозначает оптимум структуры капитала, которая не меняется на протяжении жизненного цикла. Таким образом, она представляет ситуацию, в которой сохраняется примерный «паритет» в стоимости заемного и собственного капитала, происходит их равномерное снижение по мере приближения к середине жизненного цикла. Правая линия соответствует реально наблюдаемой картине в большинстве эмпирических исследований, которая соответствует паттерну поведения долговой нагрузки согласно теории иерархии. Смещению оптимума вправо на центральных стадиях жизненного цикла соответствует «проседание» линии WACC вправо, т.е. меньшая ценность собственного капитала. С одной стороны, это очевидно, поскольку при относительно высоком денежном потоке и чистой прибыли не все собственники стремятся использовать заемные средства для поддержания и развития компании. С другой стороны, использование собственных средств в такой ситуации может свидетельствовать об отсутствии других инвестиционных проектов с более высокой маржей.

WACC. °/o *

t, время

D,TD

Рис.3. Смещение оптимума WACC на протяжении жизненного цикла компании

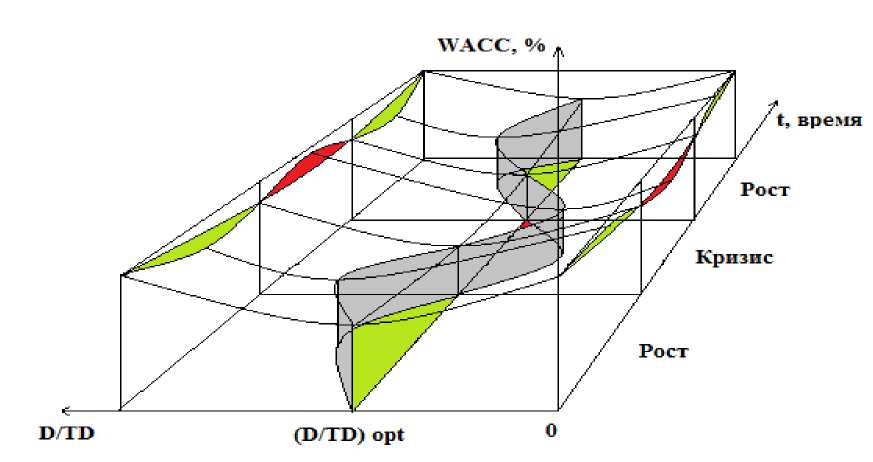

Разобрав базовые изменения в структуре капитала компаний на протяжении жизненного цикла, интересно проанализировать, как меняется леверидж на протяжении макроэкономического цикла в предложенной трехмерной концепции. В большинстве случаев компании действуют в течение нескольких деловых циклов. Фундаментальными факторами, которые влияют на средневзвешенную стоимость капитала, остаются уже рассмотренные выше: издержки банкротства и процентные ставки. Для издержек банкротства обнаружено, что они неравномерно вероятны на протяжении макроэкономического цикла: более высокий уровень банкротств наблюдается во время кризисов экономики [4; 11; 16]. Наоборот, вероятность компании обанкротиться во время макроэкономических подъемов ниже. Таким образом, ситуация, в которой владелец бизнеса имеет большие риски, подразумевает, что она должна компенсироваться соответствующим повышением требуемой доходности по акционерному капиталу, следовательно, при прочих равных условиях цена собственного капитала должна быть выше во времена кризисов экономики и ниже в моменты подъемов. Для второго фактора – процентных ставок по заемному капиталу – зависимость аналогична издержкам банкротства: установлено, что банковские ставки в целом изменяются контрциклически. Таким образом, схожая динамика ставок по собственному и заемному капиталу позволяет построить следующую зависимость (рис. 4).

Рис. 4. Зависимость % ставки и вероятности банкротства от стадии макроэкономического цикла (плоскость WACC0t)

Сопоставим зависимость, приведенную на рис.4, с динамикой структуры капитала, найденной в эмпирических исследованиях. Результаты свидетельствуют о том, что леверидж компаний изменяется проциклически, т.е. уровень долга возрастает во время макроэкономических подъемов и снижается в моменты кризисов экономики [1; 2; 3; 8].

Рис.5. Изменение оптимальной долговой нагрузки с учетом макроэкономического и жизненного циклов компании

Если предположить, что процентные ставки уравновешивают изменение издержек банкротства, то в таком случае оптимальное значение WACC компании во время как подъемов, так и спадов экономики должно составлять примерно одно и то же значение. Тем не менее, данные, полученные в исследованиях, не позволяют доказать подобное предположение. Кроме того, результаты эмпирических работ свидетельствуют, что выгоды от применения «налогового щита» и долговой нагрузки в целом изменяются на различных стадиях макроэкономического цикла [10; 15]. В частности, в исследованиях было обнаружено, что наращивать леверидж целесообразнее и более экономически оправданно на стадии подъема экономики. Это обстоятельство наводит на мысль, что оптимальная структура капитала зависит не только от жизненного цикла, но и от цикла макроэкономического. Действительно, в этом случае должен существовать фактор, который заставляет руководство компаний проциклически менять леверидж. Если предположить, что оптимальная долговая нагрузка является «плавающим» параметром в зависимости от экономической ситуации, то получим, что в случае средневзвешенной стоимости капитала WACC цена собственного капитала яв- ляется более стабильным параметром, в то время как большая чувствительность к восприятию риска по заемному капиталу приводит к тому, что ценность заемного капитала неоднородно распределена на различных стадиях макроэкономического цикла, понижаясь в моменты роста и резко возрастая в кризисы (издержки банкротства перед кредиторами, рис.5). Причем дело, скорее всего, здесь, не только в банковских ставках или доступно-сти/недоступности фондирования, но и в психологических установках владельцев бизнеса. Данные эффекты, безусловно, в перспективе подлежат обособленному изучению.

Список литературы Концепции оптимизации структуры капитала компаний: перспективы развития

- Amdur D. A Business Cycle Model of Aggregate Debt and Equity Flows /D. Amdur//Working paper. 2010. Mode of access: http://daveamdur.com/doc/capstructure_10.pdf (accessed: 09.11.2014)

- Begenau J. Firm Financing over the Business Cycle /J. Begenau, J. Salomao//2013. Mode of access: www.stanford.edu/~begenau/BegenauSalomao 2013.pdf (accessed: 09.11.2014)

- Bhamra H.S. Aggregate Dynamics of Capital Structure and Macroeconomic Risk /H. S. Bhamra, L. Kuehn, I. Strebulaev//Working paper. 2008. Mode of access: http://ssrn.com/abstract=1265870 (accessed: 09.11.2014)

- Bhattacharjee A. Macro Economic Instability and Business Exit: Determinants of Failures and Acquisitions of Large UK Firms/A. Bhattacharjee, C. Higson, S. Holly; P. Kattuman//Economica. 2009. No.76. Pp. 108 -131.

- Boot A. Moral Hazard and Secured Lending in an Infinitely Repeated Credit Market Game/A. Boot, A. Thakor//International Economic Review. 1994. Vol. 35, Iss. 4. Рp. 899 -920.

- Bulan L. Firm Maturity and the Pecking Order Theory/L. Bulan, Z. Yan//Working paper. 2010. Р. 14.

- Causholli M. Lending Relationships, IPOs, and the Effect of Auditor Quality on the Cost of Debt /M. Causholli, W.R. Knechel//Working paper. 2006. Mode of accsess: http://business.illinois.edu/accountancy/events/symposium/audit/proceedings/proceedings_2006/papers/Causholli-Knechel.pdf (accessed: 09.11.2014)

- Gertler M. Monetary policy, Business cycles, and the behavior of small manufacturing firms/M. Gertler, S. Gilchrist//Quarterly Journal of Economics. 1994. Vol. 109, Issue 2. Р. 319.

- Hasan M. Corporate Life Cycle and Cost of Equity Capital /M. Hasan, M. Hossain, A. Cheung, A. Habib//Working paper. 2013. Mode of access: http://ssrn.com/ab-stract=2370970 (accessed: 09.11.2014)

- Hess D., Immenkotter P. Optimal Leverage, its Benefits, and the Business Cycle/D. Hess, P. Immenkotter//CFR Working Paper No. 11-12.

- Hol S. The influence of the business cycle on bankruptcy probability/S. Hol//Discussion Papers No. 466. 2006.

- Hovakimian A. Are Corporate Default Probabilities Consistent with the Static Tradeoff Theory?/A. Hovakimian, A. Kayhan, S. Titman//NBER Working Paper No. 17290. 2011.

- Ivanov I. Capital structure determinants of Russian public companies/I. Ivanov//Electronic magazine Corporate finance. 2010. № 1 (13). Рp. 5 -38.

- Kim B. Financial Life Cycle and Capital Structure /B. Kim, J. Suh//Asia-Pacific Journal of Financial Studies. 2009 (August). Mode of access: http://www.apjfs.org/2009/cafm2009/06_02_Financial%20Life%20Cycle.pdf (accessed: 09.11.2014)

- Korteweg A. The Net Benefits to Leverage/A. Korteweg//The Journal of Finance. Vol. 65, No. 6. Рp. 2137-2170.

- Moravec T. The bankruptcy in the Czech Republic -influence of macroeconomic variables /T. Moravec//2013. Mode of access: http://www.slu.cz/opf/cz/informace/acta-academica-karviniensia/casopisy-aak/aak-rocnik-2013/docs-3 -2013/Moravec.pdf (accessed: 09.11.2014)

- Petersen M. The benefits of lending relationships: Evidence from small business data/M. Petersen, R. Rajan//The Journal of Finance. 1994. Vol. 49, Issue 1. Рp. 3-37.

- Pinkova P. Corporate life cycle as determinant of capital structure in companies of Czech automotive industry/P. Pinkova, P. Kaminkova/Acta universitatis agriculturae et silviculturae mendelianae brunesis. 2012. Vol. 60. No. 2. Рp. 255 -260.