Legislative support of export-import operations of the enterprises in Ukraine

Автор: Bohdaniuk E.V., Bohdaniuk O.S.

Журнал: Теория и практика современной науки @modern-j

Рубрика: Основной раздел

Статья в выпуске: 11 (65), 2020 года.

Бесплатный доступ

The article deals with the main legal regulation of foreign economic activity in Ukraine, which is considered in the context of three parts: in part of accounting, in the organizational part, in part of taxation.

Foreign economic activity, implementation, accounting and tax aspects, tax legislation, ukraine

Короткий адрес: https://sciup.org/140275122

IDR: 140275122 | УДК: 67.301.21

Текст научной статьи Legislative support of export-import operations of the enterprises in Ukraine

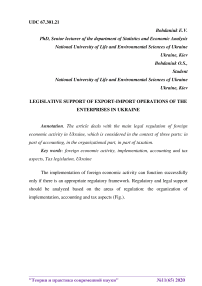

The implementation of foreign economic activity can function successfully only if there is an appropriate regulatory framework. Regulatory and legal support should be analyzed based on the areas of regulation: the organization of implementation, accounting and tax aspects (Fig.).

Regulatory and legal support in part of accounting

-

- Law of Ukraine «Accounting and Financial Reporting in Ukraine»

-Accounting Standard 21 "Impact of changes in exchange rates", etc.

in the organizational

— I --

-

- Economic Code

of Ukraine

-

- The Civil Code of Ukraine

-

- Law of Ukraine "On Foreign Economic Activity", etc.

in part of taxation

-Tax Code of Ukraine

-The procedure for collecting VAT during customs clearance of goods imported into the customs territory of Ukraine, etc.

Fig. Regulatory and legal support of foreign economic activity inUkraine

Consider in more detail the regulatory and legal support in terms of key aspects of foreign economic activity. Foreign economic activity in Ukraine is carried out on the basis of the Law "On Foreign Economic Activity", the Law "On Currency and Currency Transactions", the Law "On Regulation of Commodity Exchange Operations in the Field of Foreign Economic Activity". A separate object of accounting for foreign economic activity is influenced by several blocks of legislation in the field of foreign economic activity. Such objects are goods and services, settlements with counterparties, income and expenses, foreign currency and taxes. Economic legislation regulates the documentation of goods and services subject to customs clearance. The Economic Code of Ukraine contains Section VII "Foreign Economic Activity", which lists the types of foreign economic activity, the basic principles of state regulation of foreign economic activity, licensing and quotas of foreign economic activity, requirements for foreign economic contracts, including their state registration [1].

Goods and services that are subject to customs clearance are also regulated by customs legislation. The beginning of customs clearance begins from the moment of submission by the body of revenues and fees by the declarant of the customs declaration and documents required for customs clearance. Certification by the body of revenues and fees of the fact of acceptance of goods and documents on them for customs clearance is carried out by affixing prints of the relevant customs security or other marks on the customs declaration. Completion of customs clearance is carried out within four working hours from the date of presentation of goods subject to customs clearance, submission of a customs declaration and all necessary documents and information provided for in Articles 257 and 335 of the Customs Code of Ukraine [2].

Settlements with foreign counterparties are regulated by customs legislation, and the Law of Ukraine "On Currency and Currency Transactions". According to it, foreign currency is used in the calculations as a means of payment. Such payments can be made only through authorized banks, and therefore, payments for export-import transactions are made in non-cash form.

In addition, entities must take into account the requirements of Standard 21 "Impact of changes in exchange rates", which determines the methodological basis for the formation of accounting information on foreign currency transactions, the valuation of monetary and non-monetary items, exchange rate differences and reflection of financial statements. units outside Ukraine in the currency of Ukraine.

Tax legislation also has an impact on revenues and expenditures on exportimport operations. According to Art. 140.5.4 of Tax Code of Ukraine, the pre-tax financial result should be increased by 30% of the amount of value of goods imported from a non-resident, which is included in the List of states (territories) that meet the criteria.

Tax legislation regulates settlements with the budget for taxes and payments during export-import operations. According to Art. 185.1 of the of Tax Code of Ukraine, the import of goods into the customs territory of Ukraine and the export of goods outside the customs territory of Ukraine are subject to value added tax. Export transactions are taxed at a rate of 0%, so the tax liability for VAT is zero. Advance payment of the value of goods exported outside the customs territory of Ukraine does not change the value of tax amounts that belong to the tax liabilities of the taxpayer of the exporter (Article 187.11 of Tax Code of Ukraine).

Incoterms 2020 should also be used in the implementation of foreign economic activity. It is a collection of international rules, which has the status of an international normative act in the form of a dictionary. The document contains terms that are widely used in concluding external supply contracts. The main purpose of this document is to standardize international supply agreements to bring them into line with the laws of all countries party to the contract. Incoterms 2020 are currently relevant.

Assessing the legal legislation of Ukraine, we concluded that the excessive number of legal documents, inconsistencies between laws and regulations, instability of the legal framework, lack of clear coordination between the adoption of important state acts governing certain aspects of foreign economic activity weakens the ability to effectively operate sub objects of management.

Список литературы Legislative support of export-import operations of the enterprises in Ukraine

- Валютне регулювання 2019: старi правила на новий лад. URL: https://uteka.ua/ua/publication/commerce-12-ved-ivalyutnye-operacii-7-valyutnoe-regulirovanie %E2%80%93-2019-starye-pravila-na-novyj-lad.

- Валютне котирування Нацiональний банк України: веб-сайт. URL: https://bank.gov.ua/control/uk/publish/article?art_id=123177/.

- Закон України "Про валюту i валютнi операцiї". URL:https://i.factor.ua/ukr/journals/buh911/2018/july/issue-30/article-37942.html.

- Юрок С. Бухгалтерский учет валютных операций. Все о бухгалтерском учете. 2018. №19 (150).