“Live and learn”: conceptual discourse on people's financial literacy

Автор: Belekhova Galina V., Kalachikova Olga N.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Theoretical issues

Статья в выпуске: 6 (60) т.11, 2018 года.

Бесплатный доступ

In modern social reality, well-being of individuals, including their financial well-being, is increasingly becoming a zone of personal responsibility. At the same time, in the Russian context, the majority of people remain almost entirely dependent on wages as the only source of income. This fact, along with a low level of financial literacy, is an actual risk for individuals and the financial system of the country. Consequently, the importance of adequate financial knowledge, skills and actions within the financial education and training system is increasing. This brings to the fore the task of revealing “weak spots” in financial literacy and identifying vulnerable population groups so as to develop effective management decisions; this can be done with the help of well-elaborated tools used to study financial literacy. The goal of our paper is to carry out critical analysis of available theoretical and methodological approaches to the study of people's financial literacy...

Financial literacy, financial knowledge, financial skills, monetary attitudes, sociological tools, international experience in assessing financial literacy

Короткий адрес: https://sciup.org/147224107

IDR: 147224107 | УДК: 330.59 | DOI: 10.15838/esc.2018.6.60.9

Текст научной статьи “Live and learn”: conceptual discourse on people's financial literacy

One of the main criteria of public administration efficiency in modern Russia is its ability to improve citizens’ life quality, satisfying their interests on the basis of increasing real incomes and providing sustainable economic growth [1, p. 48]. In this regard, both in government programs, in separate Presidential decrees, concerning questions of national security of the country, considerable attention is paid to the task of assessing life quality of citizens and provision of a positive impact on it [2, p. 125]. In the global economy context, when changes in the financial intermediation system and the capital accumulation structure boost international investment activity, enhance financial globalization and lead to world economy financialisation [3, pp. 32-33], the financial sector begins to exert an increasing influence on the content and priorities of economic policy. In this context, as the Deputy Minister of Finance of the Russian Federation S.A. Storchak rightly noted, “to a great extent the growth of prosperity and the enhancement of well-being of citizens depend on the level of financial literacy of the general population, their readiness to make independent and carefully considered decisions related to the management of household budgets1”.

The positive effect of financial literacy on various financial decisions and behavior models has been confirmed by repeated empirical evidence. Increased financial literacy has been shown to have a positive impact on pension and life planning (Clark et al., 2012), participation in the stock market (van Rooj et al., 2011), personal savings (Jappelli and Padula, 2013), proper use of debt (Stango and Zinman, 2009) and credit cards (Xiao et al., 2012; Norvilitis et al., 2006) [4]. A correlation between financial knowledge and wealth has been established (van Rooj et al., 2012) [4]. In other words, having sufficient financial knowledge and skills, people can receive significant benefits both in the short and long term [4].

The surveys regularly conducted by the National Agency for Financial Studies (NAFI) show that moderate self-assessments of financial literacy prevail among the Russians – about a half assesses their knowledge and skills as satisfactory (44% in 2010, 51% in 2016, 47% in 2018), while the majority does not take into account revenues and expenditures (69% in 2010, 72% in 2016, 60% in 2018) and only a third compares terms of financial services (30% in 2010, 32% in 2016, 36% in 2018)2. International data prove the problem scale. According to the reports of the Organization for Economic Cooperation and Development (OECD), which reflect research results for the G20 countries (including Russia), the overall financial literacy level in these countries amounted to 12.7 points out of 21 possible points3. On average, less than half of adults (48%) in the G20 countries were able to correctly answer 70% of financial knowledge questions; only 3 out of 5 households (60%) indicated that they had a family budget; a small proportion of respondents (15%) noted that they used independent sources to compare financial products and organizations; a quarter of households (25%) did not always pay their bills on time; more than a third of those surveyed faced a situation where their living expenses exceeded their income in the last 12 months4.

Financial literacy is a universal problem with no universal solution. On the one hand,

“any healthy economy is interested in literate, and therefore prosperous and predictable consumers of financial services”5. Therefore, the vast majority of G20 countries are implementing national strategies to improve financial literacy (Canada, France, Turkey, India, Brazil), and some of them are already implementing updated strategies (Japan, Australia, USA, UK)6. On the other hand, despite long history of the research in the financial literacy phenomenon, in foreign and domestic science and practice there is no common understanding of its essence, standardized tool for its evaluation and clearly defined effective measures to improve it.

Measurement of the population’s financial literacy level is included in the priority tasks of the countries seeking to develop effective national strategies and programs for its improvement, provide effective financial education and assess its impact at the national level. Thus, in the joint project of the RF Ministry of Finance and the World Bank “Promoting financial literacy of the population and the development of financial education in the Russian Federation” and in the “Strategy for improving financial literacy in the Russian Federation for 2017–2023” (approved by the RF Government Order No. 2039-p of September 25, 2017) the task of conducting a comprehensive large-scale assessment and monitoring of the level of financial literacy and financial behavior of the population is an essential condition for achieving the main goal – creation of an integrated infrastructure and a system of quality financial education to encourage financially literate behavior of the population as a necessary condition for households well-being and sustainable economic growth provision. The program documents thoroughly prove the relevance of the work to improve financial literacy of the population, define the category of “financial literacy” and disclose a list of basic indicators to assess its level.

In our view, the problem is not that in the scientific literature and management, financial literacy as an economic category does not contain a unified definition and a single measurement tool that would have acceptable reliability7. The tasks, relevant and significant in theoretical and practical terms, are the following: search, comparison and identification of the most objective and reliable definitions and methods to measure financial literacy, improve comparability of various surveys results on the basis of universal indicators and measurement methods.

The aim of the study is to identify and critically analyze theoretical and methodological approaches to understanding the nature and measurement of financial literacy. This makes it possible to form a kind of reference and information field for further work on this issue (in particular, for the development of the author’s tools for assessing financial literacy of the population for the purpose of interregional research). It should be made clear that the study undertaken seeks to consider key approaches, i.e., our research interest is focused on those developments that 1) have proven themselves and found multiple applications in scientific and management activities, 2) are well documented (i.e., methodological materials are in the public domain), 3) have features of novelty (i.e., contain either new methods of measurement, or new approaches to the operationalization of the concept, etc.), 4) are aimed at studying personal finance and/ or household finance.

Naturally, the economic literature has various reviews of theoretical and methodological foundations of the research in financial literacy8. But in a rapidly changing economic context, some of the used issues (i.e., aspects of financial literacy under consideration), first, may become unnecessary and do not correspond to real conditions, and second, they may change their content and be incorrectly interpreted by research participants. In addition, taking into account the emergence of new needs and new financial tools, new issues and indicators should be supplemented, commented on, tested and put right. There is another important point, especially relevant in the Russian reality: in the absence of a single national monitoring and choice of the research tools available to regional authorities, expert communities and researchers a “fresh” look at methodological approaches to the measurement of financial literacy will be very useful, namely for regulators and private initiatives that deal with issues of improving financial literacy of the population, develop and implement programs of financial education, based on sociological surveys of the population.

Financial literacy of the population: essence and factors

Conceptualization of the term is the most important stage in the construction of methods to measure an economic phenomenon. At the same time, one of the features of analyzed financial literacy studies is that in many of them the term is not conceptually defined, but is derived from the context of empirical research as a set of several components. For example, according to the meta-analysis of 71 studies on financial literacy conducted by the Professor at Texas Tech University, S. Huston (2010), almost three quarters of the studies did not specify the term; others used definitions with different elements (e.g., knowledge, ability, skill, action, result) [5, p. 303].

Another feature is that most researchers use a broad approach to the definition of financial literacy, implying “knowledge and skills in the finance sphere to be applied in daily life and bring positive financial results” [6, p. 131-132]. This implies a third feature: along with a broad approach, studies have narrower definitions that reveal certain aspects of financial literacy and are often used interchangeably (e.g. financial knowledge, financial competencies, financial capability, financial awareness, financial education9). Researchers from the USA and Australia use the category “financial literacy”, scientists from the UK and Canada, as well as specialists from the World Bank – the category “financial capability” [7; 8]. In Russian studies, as well as in works of the Organization for Economic Cooperation and Development (OECD), the category “financial literacy” (FL) in its broad interpretation prevails. On the one hand, the lack of a single FL concept limits the possibility of comparative analysis both for individual components and the overall level of financial literacy. This is a kind of critical barrier, as all other tools development stages depend on the availability of a clearly defined concept [5, p. 305]. On the other hand, the creation of a unified concept of financial literacy is objectively difficult due to the complexity of the phenomenon itself, the diversity of initial theoretical prerequisites and research tasks. Therefore, in our opinion, the task to develop a common interpretation of financial literacy, used for empirical studies of different levels and directions, seems archaic, while the formation of conceptually homogeneous and internally consistent theoretical and methodological approaches to the study of financial literacy of the population is a very relevant area of scientific research.

Summarizing, we note that, according to most researchers, financial literacy is not limited to simple knowledge and understanding of some financial notions and concepts, general awareness of certain financial products and the situation in the economic sphere. It involves presence of real experience and applied skills in the financial market, certain attitude to money and other assets and conscious understanding of financial goals and objectives. The most commonly used conceptual and operational definitions of financial literacy are given in Table 1 .

The table presents approaches to the definition of financial literacy. Another “pole”, especially in foreign studies, is financial capability, the concept, originally elaborated in the UK and currently actively developed by

Table 1. Interpretation of the category “financial literacy” (FL)

The financial literacy concept includes several aspects: financial knowledge (ANZ, 2005; Hung et al., 2009; FINRA, 2010; Gallery, 2010; Huston, 2010; Remund, 2010; OECD,

2013); financial experience (Orton, 2007; FINRA, 2010; OECD, 2013); ability to use various financial concepts and tools (Hung et al., 2009; Huston, 2010; Remund, 2010); ability to make adequate financial decisions (Remund, 2010; OECD 2013); attitudes to the use of financial tools (Orton, 2007); people’s trust in financial transactions (Huston, 2010; Remund, 2010; OECD, 2013); real financial behavior (Orton, 2007; Huston, 2010) [7, pp. 38-39]. There are various groups of presented spheres: for example, A. Zait and P.E. Bertea (2014) group them under five measures: (1) knowledge of financial concepts and products (variable “financial knowledge”); (2) communication skills regarding financial concepts (variable “financial communication”); (3) ability to use knowledge for making necessary financial decisions (variable “financial ability”); (4) effective use of various financial tools (variable “financial behavior”); (5) people’s confidence in their previous financial decisions and actions (variable “financial trust”) [7, p. 39].

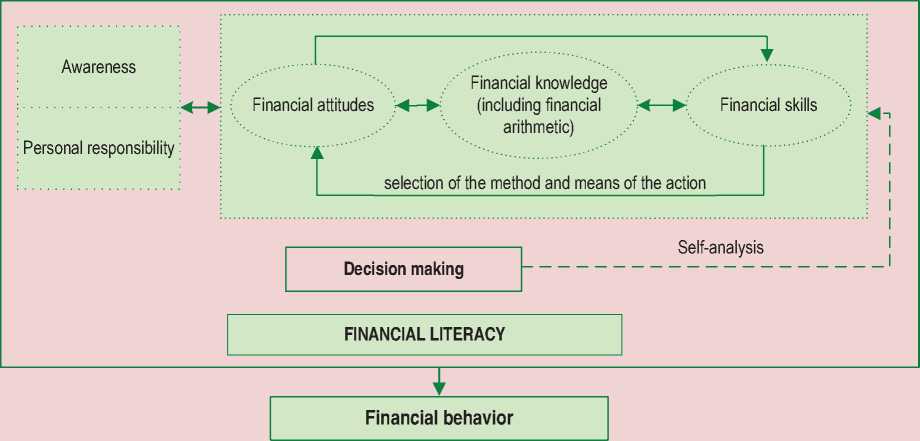

The synthesis of research and authors’ contemplations help form conceptual understanding of financial literacy ( figure ) and single out its components:

-

• financial knowledge (basic and specific/ advanced) – information about the financial system and related aspects, “fixed in person’s memory and consciously perceived” [15];

-

• financial skills – actions to manage monetary and other financial resources for specific tasks, formed through repetition and characterized by a high degree of development;

-

• financial attitudes – predisposition to the perception and behavior in relation to objects and situations, associated with personal finance [16, p.19]. They are responsible for the formation of people’s needs in financial services and understanding of the consequences of their actions [9, p. 94]. Attitudes depend on

Figure. Conceptual scheme of financial literacy

Source: compiled by the authors.

situational and circumstantial factors, are less stable than individual features [14, p. 344].

Thus, we will define financial literacy as a person’s ability to combine knowledge, skills and attitudes, as well as awareness, responsibility and relations, which helps him/her to make sensible financial decisions to ensure his/her own material well-being11. Therefore, financial literacy, combining cognitive, activity and value-motivation components, is manifested in specific financial decisions and actions, collectively forming financial behavior.

Qualitative study of the FL measurement method requires consideration of the factors (independent explanatory variables) that affect its level and implemented financial behavior. Including these factors in the FL measurement tools helps make a more reliable assessment and determination of the points of management efforts application (for example, in the framework of financial education programs or increasing financial products availability for specific population groups). It is best to present possible factors through empirically established relationships.

It is quite natural that the strongest relationships are found between FL and income and education levels. The poorest strata of society are at the greatest risk of adverse financial events, as, having little or no financial “reserves”, they are most vulnerable to the consequences of economic crises and shocks [17]. For example, in the UK repossession cases are more likely to occur in areas with the lowest employment rates and lower middle income level12. In the US people with a low socio- economic status often have to sale mortgaged property, than their richer fellow citizens [14, p. 345; 17].

When the level of education increases, financial literacy goes up [18]. According to researches, college graduates are more likely to form savings and less likely to use expensive borrowing [12]. Bernheim, Garrett and Maki (2001) show that the presence of school financial education significantly raises households’ savings and an overall wealth level over a lifetime [19; 20, p. 971].

Demographic factors have a significant impact on financial literacy. The studies of Lusardi and Mitchell (Lusardi and Mitchell, 2014) disclose an undulating relationship between age and financial literacy, which implies a lower level in the young and older age and a higher level in middle age [12; 21, p. 48]. For example, the survey carried out among older people (60+ years) by FINRA indicate that more than half of them have made unsuccessful investments, and every fifth has been misled or deceived, when interacting with financial agents [12].

There are interesting findings in terms of gender: women are more emotional about money and less “rational” in their financial behavior [22, p. 707], and, according to Chen and Volpe (2002), Lusardi et al. (2010) and Agarwalla et al. (2015), have lower levels of financial literacy compared to men [21, p. 48].

There is a positive impact of marital status on financial literacy, as married people try to manage their finances and be sensible, when spending money [21, p. 49].

Since people receive financial knowledge not only from official educational networks, but also from interaction with socialization agents, such as friends, family and the media, it is quite natural that the processes of primary and secondary socialization have an important impact on people’s attitude to money and their financial literacy level. In particular, children acquire many monetary habits from their parents, but in general a parental factor (level of education, social and political values) affects children’s practice of savings in adulthood [22, p. 707, 711]. The family has a strong influence on financial knowledge [23]. College students who describe their parents as an important source of financial information tend to have strong financial knowledge and best financial practices. [4]

Financial literacy is affected by cognitive and behavioral variables, such as cognitive and mathematical abilities, financial socialization (Shim et al., 2009; Hira et al., 2013; Grohmann et al., 2015) [21, p. 49]. Gerardi, Goette, and Meier (2013) estimate that population groups with highest mathematical abilities are about 20% less likely to default on mortgages than those with lowest mathematical abilities [12]. According to Christelis et al. (2010), who studied relations between cognitive abilities and equity capital, the tendency to directly or indirectly invest in stocks (through mutual funds and retirement accounts) is closely related to mathematical abilities, verbal skills (i.e. ability to clearly express thoughts), and fluent use of special terminology [24; 25, p. 2780].

Thus, it can be stated that studies of financial behavior and financial literacy often do not make a clear and unambiguous distinction between knowledge, literacy, abilities and capability, since these concepts are closely interrelated and are therefore primarily used as equivalents. Financial literacy and financial capability studies are the most common. Focusing on the tradition of research in the sphere of personal finance and financial literacy established in the national science, as well as taking into account the approved

Strategy for improving financial literacy in the Russian Federation for 2017–2023, in our study we rely on a broad approach to understanding financial literacy and believe that it covers financial knowledge, skills, attitudes, personal responsibility, implemented in certain financial actions in order to ensure material well-being. Nevertheless, it should not be forgotten that differences in the definitions of concepts imply potential problems with the interpretation and comparison of individual studies results.

Methods for measuring financial literacy of the population

The first measure of financial literacy was conducted not long ago – in the early 1990s. Today world practice has various methods for assessing financial literacy, aggregated indicators and synthesis indices are used to compare results. At the same time, the lack of a unified interpretation and a standard financial literacy indicator encourages researchers to create new approaches and tools for its evaluation.

In accordance with the results of S. Huston’s research (2010), nine out of every ten reviewed studies do not disclose a generalized indicator of the financial literacy level and the rest (less than 20%) present individual parameters of financial literacy and a system for results interpretation [5, p. 304]. In this case, mainly four aspects are analyzed (in one or another content): basic knowledge, money management, savings and investments, and risk management. All four aspects of financial literacy are monitored in only 25% of the studies [21].

The key objective of the research in financial literacy of the population (as well as financial capability) is to obtain a consolidated assessment of its “weak areas” and determine target population groups for identification of the need for financial education. Additionally, it is possible to identify weak areas in financial behavior and appropriate (the least financially capable) population groups, as well as topics for financial education and potential channels of financial information provision.

One of the most well-known and widely used methods for assessing financial literacy is developed by Lusardi and Mitchell. It includes 3 aspects: (1) ability to perform calculations related to interest rates (in particular, compound interest calculation); (2) understanding of inflation; (3) understanding of risk diversification [12; 26]. The idea of this approach is as follows: these aspects form the basis of individual decisions on the optimal distribution of income between consumption and savings within the life cycle. The scientists developed a standard set of questions ( tab. 2 ) and firstly tested it in 2004 on a sample of respondents from the United States (aged 50 years and older) in the framework of the U.S. Health and Retirement Study. The method was subsequently used in other studies in the United States, including the 2007–2008 NLSY survey (for young respondents aged 23–28), the RAND American Life Panel, and the Financial Capability Study in 2009 and 2012 [12].

Currently, the described method is widely used in international and national studies, and it is often supplemented by several countryspecific issues13.

In 2010–2011 the OECD presented an international financial literacy survey , organized to help governments and public authorities to “identify national levels of financial literacy”,

Table 2. Method for measuring financial literacy developed by Lusardi and Mitchell (2014)

|

Measured aspect |

Clarification |

Question wording |

|

Calculation of interest |

Measures mathematical literacy i.e. skills of working with data and basic calculations (ability to make calculations related to the calculation of simple and complex percentages). |

Suppose you had 100 US dollars in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow: [more than 102 US dollars, exactly 102 US dollars, less than 102 US dollars? Do not know, refuse to answer] |

|

Understanding of inflation |

Measures basic understanding of the time value of money. |

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, would you be able to buy: [more than, exactly the same as, or less than today with the money in this account? Do not know; refuse to answer] |

|

Understanding of risk diversification |

A complex issue, since it involves knowledge of both financial tools themselves and distribution of risks. |

Do you think that the following statement is true or false? “Buying a single company stock usually provides a safer return than a stock mutual fund” [Do not know; refuse to answer] |

|

Source: compiled by the authors on the basis of the work [12]. |

||

Table 3. Method for measuring financial literacy developed by the OECD (OECD)

Aspect Measured elements Explanation Financial knowledge (at least 6 correct answers to be considered financially literate) Designed to test knowledge of financial terms, principles and processes: - one question is aimed at assessing the skills to perform mathematical calculations related to the time value of money; - three questions determine the ability to calculate interest rates; - two questions relate to the relationship between the value of money and inflation; - two questions measure knowledge of the relationship between risk and return in financial investment strategies. Basic knowledge of financial concepts and ability to apply accounting skills in the financial context ensures that consumers can act autonomously to manage their financial issues and respond to news and events that may have implications for their financial wellbeing. Financial behavior A number of positive and negative behavior forms: - maintaining a family budget; - active savings; - deliberate purchase; - timely bill payment; - monitoring of financial transactions; - definition of long-term financial objectives; - selection of financial products Consumer behavior is what ultimately shapes their financial position and well-being in both the short and long term. The focus here is on the specific financial choices people make, not the context of the action. Attitudes to money and funancing Three questions about attitudes to money and longterm financial planning. Even if a person has sufficient knowledge and ability to act in a certain way, his financial attitudes will influence decisions about whether to act or not. Source: compiled by the authors on the basis of: Measuring Financial Literacy / OECD. URL:

“provide with basic indicators and benchmarks for national [educational] strategies”, and “identify population’s needs, groups with the greatest needs and gaps” [27]. The OECD questionnaire consists of four main parts: the first part includes general socio-demographic and economic issues; the rest three parts focus on measuring financial literacy through financial knowledge, financial behavior and attitudes to money and finance (tab. 3).

The initial version of the toolkit was tested in the international pilot study in 2010 in 14 countries; the last detailed report was published in 2017 and compared the data from 30 countries14.

In accordance with the international method developed during the project, the Russia Financial Literacy and Education Trust Fund (under the auspices of the World Bank) calculated the indices of financial capability by ten components15:

-

1. Budgeting.

-

2. Living within means.

-

3. Monitoring expenses.

-

4. Using information.

-

5. Not overspending.

-

6. Saving.

-

7. Covering unexpected expenses.

-

8. Attitude towards the future.

-

9. Not being impulsive.

-

10. Achievement orientation.

In the Russian Federation during the implementation of the project “Promotion of financial literacy of the population and development of financial education in the Russian Federation” the “system of basic competencies” or the “set of financial literacy “standards” was formed, which included: ability to live within means, monitor the state of finances, plan future income and expenses, choose right financial products, search for information and be able to analyze it, understand financial issues16. This was followed by the system (framework) of financial competencies for the RF adult population, consisting of nine subject areas: (1) income and expenses; (2) financial planning and budget; (3) personal savings; (4) lending; (5) investment; (6) insurance; (7) risks and financial security; (8) consumer’s rights protection; (9) general knowledge of Economics and basics of financial arithmetic17.

Based on these developments, the questionnaire of the all-Russian survey was worked out in 2012 and tested in August 2013 (performed by JSC “Demoscope” and JSC “Prognostic solutions”). It is based on the achievements of the project to create a universal method for measuring financial literacy of the Russian Trust Fund and OECD method, as well as the questions asked in some previous Russian studies of financial literacy (knowledge of financial tools, trust in financial institutions and attitudes to paternalism/individualism). As a result, the formed operational model of financial literacy included the following blocks18:

-

1) money management;

-

2) planning;

-

3) choosing between alternatives;

-

4) raising awareness;

-

5) test questions on knowledge about financial products and services;

-

6) contextual variables (a psychological block – attitudes to money, impulsivity, selfesteem);

-

7) contextual variables (an institutional block – trust, paternalism);

-

8) knowledge and skills needs, preferred forms of training;

-

9) socio-demographic and economic profile of respondents.

Numerous “ private” methods to assess financial literacy of the population also find practical application; some of them are presented in Table 4 .

Summarizing the studied methods for FL assessment, it is necessary to highlight the following points. First, the vast majority of methodological approaches to measuring financial literacy are developed and tested under national financial education programs or pension schemes; they essentially estimate FL in a broad sense, that is, as a set of financial knowledge, skills, attitudes and their implementation in specific behavioral practices, in other words, financial literacy is expanded to financial capability. Second, all methods are based on the use of sociological tools and involve the elaboration of questionnaires of varying degrees of detail. Third, the most frequently researched subject areas of FL

Table 4. Private methods to assess financial literacy

|

No. |

Author |

Measured indicators |

|

1. |

Zait A., Bertea P.E. (2014) |

Five indicator variables: (1) financial knowledge; (2) financial communication ability; (3) ability to use financial knowledge for making decisions; (4) actual use of financial tools (financial behavior); and (5) financial trust. Four subject areas: (a) personal budgeting, (b) savings, (c) loans, (d) investments. Three–five questions are considered for each measurement. |

|

2. |

Kiliyanni A.L., Sivaraman S. (2016) |

Four financial literacy indicators: (1) basic knowledge, (2) capital management, (3) savings and investments, (4) risk management. The test of 34 questions is used: 18 multiple-choice questions to assess respondents’ knowledge of 4 specified indicators (subject areas), 1 question for self-assessment of financial literacy, 2 questions to determine respondents’ opinion on the need for financial education; 13 additional questions to determine demographic and socio-economic characteristics of respondents. |

|

3. |

Vashchenko T.V., Ivanova Ya.Ya. Sokol’nikova I.V. (2017) |

Six elements that form financial literacy are estimated:

The criteria test is used for assessment, on the basis of its results 4 degrees of financial literacy are determined: Degree 1 (less than 20 points) – almost complete absence of FL; Degree 2 – 20-45 key) – low level of FL; Degree 3 (46-80 points) – average level of FL; Degree 4 (more than 80 points) – high level of FG. |

|

Sources: compiled by the authors on the basis of [7, 21, 28]. |

||

are basic knowledge of money management (budget and financial planning, understanding of inflation and interest); features of financial products and their use (deposits and savings, investments, loans); risks and protection against them. Fourth, as a way to measure the components of financial literacy and financial capability there are used either criteria (check) tests or self-assessment, but most often they complement each other and are used together. In addition, they make it possible to calculate private (by FL components) and composite (FL general level) indices, thereby increasing the visibility of results interpretation.

Concept of the author’s method to assess financial literacy of the population

Before disclosing the concept of the author’s method to assess financial literacy, we consider it necessary to pay attention to correlation of the concepts “literacy” and “capability”. According to the Large Encyclopedic Dictionary, literacy means a “degree of proficiency in reading and writing in accordance with grammatical norms of the native language. With regard to characteristics of the population, it is one of the basic indicators of its socio-cultural development”19. Literacy interpretation in foreign studies is identical: “Literacy involves the use of printed and written information to function in society, achieve goals and develop cognitive capacity” [5, p. 306].

“The specific content of literacy is historically variable, tends to expand with the growth of social requirements to the development of an individual: from the basic skills of reading, writing, counting – to the possession of a set of different socially necessary knowledge and skills that allow a person to consciously participate in social processes”20. According to the Higher School of Economics experts, “modern literacy” consists of basic instrumental literacy, based on the use of communication tools, and basic special knowledge and skills relevant to human activity spheres (e.g., legal “literacy”, environmental “literacy”, “literacy” in the health field) [29, p. 18].

Capability is considered as the ability to effectively mobilize (choose and use most appropriate) knowledge and skills to solve specific problems [29, p. 15]. Capability as a specific personal quality forms and develops in the process of social activities [30, p. 143]. In addition, capability is a situational category, as it is expressed in the willingness to carry out any activities in specific situations [31, p. 11].

We have previously noted that financial literacy is conceptualized through two aspects – understanding (knowledge of personal finance) and skills (“automatic”, basic actions based on knowledge), while financial capability means not the automatic, but conscious ability to manage financial resources and use financial services, so as to best meet individual needs in the existing socio-economic conditions.

In accordance with the author’s concept of financial literacy, presented in the figure, financial literacy is defined as a measurement of how well a person knows, understands and applies financial information, taking into account motivational and value aspects (i.e. financial attitudes), objectively influencing any human behavior. In other words, we operationalize financial literacy through three components – knowledge, skills, attitudes, putting aside specific financial actions that make up financial behavior in their totality.

Table 5. Concept of the author’s method for assessing financial literacy of the population

|

No |

Subject area of FL |

Component of FL |

Clarification |

|

1. |

Income and expense |

Knowledge |

Understanding how to use income and distribute it to savings and consumption, how to keep financial records, make payments and keep the money safe. Basic knowledge of inflation. |

|

Skills |

Targeted income distribution. |

||

|

Attitudes |

Attitude to money (purpose of life or means of life) and wealth, impulsiveness, propensity to save. |

||

|

2. |

Family budget and financial planning |

Knowledge |

Understanding how to maintain a budget and what is financial planning, understanding of the need to have funds “for a rainy day”. |

|

Skills |

Storage of financial documents, a chosen method of maintaining a family budget, “ability to live within person’s means”, setting of financial goals. |

||

|

Attitudes |

Attitude to the future (i.e. focus on “life today” or long-term planning), presence of long-term goals, desire to achieve goals. |

||

|

3. |

Savings and deposits |

Knowledge |

Understanding of the essence and features of the use of bank deposits; knowledge of the definition of “interest”, knowledge of a deposit insurance system. |

|

Skills |

Interest calculation, bank selection criteria. |

||

|

Attitudes |

Conscious saving, or saving by residual principle, targeted saving or non-targeted saving. |

||

|

4. |

Lending |

Knowledge |

Understanding of the essence and features of the use of bank credit, credit discipline, annuity payments, knowledge of the criteria for choosing a loan. |

|

Skills |

Calculation of credit payment, compliance with credit discipline, use of loans. |

||

|

Attitudes |

Propensity to borrow. |

||

|

5. |

Investments and taxes |

Knowledge |

Understanding of investment principles, knowledge of the ratio of risk and return, knowledge of the types of tax deductions. |

|

Skills |

Calculation of personal income tax, use of investment services, registration of tax deduction. |

||

|

Attitudes |

Presence of long-term goals, desire to achieve goals. |

||

|

6. |

Insurance and pensions |

Knowledge |

Understanding of the basics of pension provision, knowledge of possible ways to accumulate for old age, knowledge of insurance products. |

|

Skills |

Financial provision for old age (income planning), use of insurance products. |

||

|

Attitudes |

Paternalism or self-reliance, propensity for future planning and investment. |

||

|

7. |

Risks and financial security |

Knowledge |

Knowledge of financial risks existence, knowledge of financial pyramid features, knowledge of the ways to reduce risks (diversification), knowledge of human rights organizations. |

|

Skills |

Safe use of bank cards, careful reading of contracts, comparison of services, use of various information sources. |

||

|

Attitudes |

Propensity to deliberate or risky behavior; desire to get information. |

||

|

8. |

Consumer rights protection |

Knowledge |

Knowledge of human rights organizations. |

|

Skills |

Experience in filing a complaint against a financial institution. |

||

|

Attitudes |

Orientation to be informed; life position (active, i.e. it is possible to influence what is happening, or passive, i.e. “everything is determined in life”). |

||

|

9. |

Basics of financial arithmetic |

– |

Financial and mathematical literacy, i.e. ability to use standard mathematical skills in the context of financial resources management, particularly for the calculation of interest, taxes, credit payments, etc. |

|

Source: compiled by the authors. |

|||

We select the category “literacy” instead of “capability” due to several circumstances. First, it is a tradition that has developed in most Russian studies that assess literacy. Second, the approved Strategy and the ongoing joint project of the Ministry of Finance and the World Bank use this category. Third, the terminological phrase “financial literacy of the population”, in our opinion, has become firmly established in everyday life, is widely recognized and, in addition, compared with financial capability, intuitively more understandable to an ordinary consumer of financial services. We emphasize that the adopted definition does not contradict the definitions of “literacy” as such existing in the literature and is consistent with the constructions of “financial literacy” used in other studies.

The choice of specific questions to measure FL components and the development of the method for its assessment should be based on a number of principles:

-

• questions should be sufficient, i.e. fully disclose the subject area and the relevant component of FL;

-

• questions should be measurable;

-

• some questions should be “common”, i.e. repeated in surveys conducted in other regions or in national surveys;

-

• questions should be equally applicable to all population groups.

We use the tools to assess financial literacy developed and used by the OECD21. Subject areas are singled out on the basis of the framework of financial capability of the RF adult population proposed by the RF Ministry of Finance (tab. 5). For each area (with the exception of financial arithmetic) three structural components of FL are measured, such as: financial knowledge, financial skills, and financial attitudes. In order to clarify population’s decisions taken on the basis of financial literacy, it is expected to include questions about savings and credit behavior, use of other financial products, as well as issues related to financial education.

In addition to the main questions to measure financial literacy, the questionnaire includes “explanatory variables”: age, gender, marital status, education, financial situation, employment status.

The questionnaire is compiled using open and closed questions, ordinal and interval scales (for example, the Likert scale) and qualitative questions.

To carry out a generalized assessment, based on selected components, we calculate several indices of FL: financial knowledge index, financial skills index, financial arithmetic index. Calculation of the financial attitudes index is not provided, as questions on attitudes will be used for in-depth analysis, in particular, selection of population groups in accordance with features of value-motivational attitude to money and other financial resources.

The application of our proposed method for assessing financial literacy of the population is aimed at solving several problems:

-

• identification of “weak areas” of financial literacy of the population in the context of three components (knowledge, skills and attitudes), as well as weak areas of financial behavior;

-

• determination of target population groups for financial education programs and least financially capable population groups for promotional events development;

-

• assessment of the need to provide financial information in the context of specific topics, as well as identification of the most preferred forms / methods for obtaining such information;

-

• study of the features of financial literacy and financial behavior in terms of sociodemographic groups;

-

• study of the relationship between components of financial literacy and financial behavior.

Moreover, if a financial literacy survey is conducted on a permanent basis, it is possible to monitor changes in the level of financial literacy and determine the impact of financial education programs on financial behavior.

Conclusion

People’s financial goals are individual, they are motivated by a life situation and their socioeconomic status22. Therefore, there is considerable heterogeneity in both financial behavior and financial literacy. Economic studies of financial literacy pursue quite obvious goals to identify weak areas in financial knowledge and skills of the population and identify the least financially capable population groups in order to develop effective programs of financial education. However, it is always necessary to remember that it is impossible and even undesirable to make every person a financial expert.

The development of a coherent concept of financial literacy involves a clear interpretation of the term and its corresponding assessment method. The definition of such a complex economic category as “financial literacy” is difficult because of the content itself, the diversity of opinions and research tasks. Therefore, the work on the development of its universal interpretation for the use in empirical studies of different levels and directions seems archaic, while the formation of internally consistent theoretical and methodological approaches to the study and measurement of financial literacy of the population is a very urgent scientific task.

In our study, we propose to consider financial literacy as a person’s ability, involving a combination of knowledge, skills and attitudes, as well as awareness and responsibility, which helps him/her to make informed financial decisions to ensure their own material well-being. The proposed interpretation does not contradict the definitions of “literacy” as such existing in the scientific literature and is consistent with the constructions of “financial literacy” used in other studies.

The key objective of the empirical assessment of financial literacy of the population is to obtain information about its “weak areas” and identify target groups in need of training by financial education programs. These actions can be implemented by analytical structures of regional executive authorities (departments of strategic planning, finance or economic development), research organizations (universities, research institutions, sociological companies) and directly by financial organizations, as well as in the format of interaction of these structures.

The method used to estimate financial literacy should be consistent with the definition and should cover all the components. According to the author’s approach, financial literacy of the population is operationalized through three components – knowledge, skills, attitudes (cognitive, activity and value-motivational components), while specific financial actions that make up financial behavior are set aside. The method for assessing financial literacy developed and applied by the OECD is adopted as a model. Subject areas are singled out on the basis of the framework of financial capability of the RF adult population offered by the RF Ministry of Finance. The method helps obtain composite sociological information on individual components of financial literacy and calculate several private indices of FL (financial knowledge index, financial skills index, financial arithmetic index).

It should be noted that, despite the national monitoring of financial literacy, the implementation of private (local and interregional) studies is very significant. The study of financial literacy based on a regional survey is a more detailed supplement to national and international studies. First, there is an opportunity to pay more attention to certain aspects of financial literacy or certain groups of the population that have unique socioeconomic, demographic or professional characteristics. Second, under “local” studies you can ask narrower, specific questions about the phenomenon under analysis. Third, such studies focus on features that are specific to a local community, largely determine a financial literacy level and are lost in national surveys. Fourth, this kind of research can become regular, i.e., with the interest of regional authorities and the high efficiency of conducted surveys, the latter can be conducted on a permanent basis (with a certain periodicity). Fifth, such research help solve the problem of filling the empirical array of financial literacy of the population with qualitative data, which is a valuable addition to “dry” quantitative indicators.

Список литературы “Live and learn”: conceptual discourse on people's financial literacy

- Ilyin V.A., Povarova A.I. Problems of regional development as a reflection of public administration effectiveness. Ekonomika regiona=Economy of Region, 2014, no. 3 (39), pp. 48-63..

- Rossoshanskii A.I. Methodology for the index assessment of the quality of life in Russian regions. Problemy razvitiya territorii=Problems of Territory's Development, 2016, no. 4 (84), pp. 124-137..

- Khesin E.S. Modern world economy: finances and capital accumulation. Dengi i kregit=Money and Credit, 2016, no. 8, pp. 31-36..

- Hanson T.A., Olson P.M. Financial literacy and family communication patterns. Journal of Behavioral and Experimental Finance, 2018. Available at: https://doi.org/10.1016/j.jbef.2018.05.001 (accessed August 13, 2018).

- Huston S.J. Measuring financial literacy. The Journal of Consumer Affairs, 2010, no. 2, vol. 44, рр. 296-316.

- Kuzina O.E. Financial literacy and financial competence: definition, measurement methods and analysis results in Russia. Voprosy ekonomiki=Economic Issues, 2015, no. 8, pp. 129-148..

- Zait A., Bertea P.E. Financial literacy -conceptual definition and proposed approach for a measurement instrument. Journal of Accounting and Management, 2014, vol. 4, no. 3, pp. 37-42.

- Remund D.L. Financial literacy explicated: the case for a clearer definition in an increasingly complex economy. The Journal of Consumer Affairs, 2010, no. 44 (2), рр. 276-295.

- Belekhova G.V., Kalachikova O.N. Financial literacy of young people (case study of the Vologda Oblast). Problemy razvitiya territorii=Problems of Territory's Development, 2016, no. 5 (85), pp. 90-106..

- Zelentsova A.V., Bliskavka E.A., Demidov D.N. Povyshenie finansovoi gramotnosti naseleniya: mezhdunarodnyi opyt i rossiiskaya praktika . Мoscow: KNORUS, 2011. 108 p.

- Lusardi A., Mitchell O.S. Financial literacy and retirement preparedness: evidence and implications for financial education. Business Economics, 2007, no. 42 (1), рр. 35-44.

- Lusardi A., Mitchell O.S. The economic importance of financial literacy: Theory and Evidence. Journal of Economic Literature, 2014, vol. 52 (1), pp. 5-44. Available at: http://dx.doi.o DOI: rg/10.1257/jel.52.1.5

- Hung A.A., Parker A.M., Yoong J.K. Defining and measuring financial literacy. RAND Corporation. Working Paper-708, 2009. Available at: https://www.rand.org/content/dam/rand/pubs/working_papers/2009/RAND_WR708.pdf

- Stumm S., O'Creevy M.F., Furnham A. Financial capability, money attitudes and socioeconomic status: risks for experiencing adverse financial events. Personality and Individual Differences, 2013, vol. 54, pp. 344-349.

- Ivanina A.I., Chulanova O.L., Davletshina M.Yu. Modern directions of theoretical and methodological developments in the field of management: the role of soft-skills and hard skills in professional and career development of employees. Naukovedenie: internet-zhurnal=Science Studies: E-Journal, 2017, no. 1, vol. 9. Available at: http://naukovedenie.ru/PDF/90EVN117.pdf (accessed August 27, 2018)..

- Alifanova E.N., Evlakhova Yu.S. Finance and credit analysis of methodological approaches to the development of indicators of financial literacy of the population. Finansy i kredit=Finance and Credit, 2013, no. 12 (540), pp. 18-26..

- Pollack C., Lynch J. Health status of people undergoing foreclosure in the philadelphia region. American Journal of Public Health, 2009, no. 99, рр. 1833-1839.

- Grohmann A., Kouwenberg R., Menkhoff L., 2015. Childhood roots of financial literacy. Journal of Economic Psychology, 2015, vol. 51, pp. 114-133.

- Bernheim B.D., Garrett D.M., Maki D.M. Education and saving: the long-term effects of high school financial curriculum mandates. Journal of Public Economics, 2001, vol. 80, рр. 435-465.

- Sohn S.-H., Joo S.-H., Grable J.E., Lee S., Kim M. Adolescents' financial literacy: the role of financial socialization agents, financial experiences, and money attitudes in shaping financial literacy among South Korean youth. Journal of Adolescence, 2012, vol. 35, pp. 969-980.

- Kiliyanni A.L., Sivaraman S. The perception-reality gap in financial literacy: evidence from the most literate state in India. International Review of Economics Education, 2016, vol. 23, pp. 47-64. Available at: http://dx.doi. org/10.1016/j.iree.2016.07.001 (accessed August 17, 2018).

- Furnham A., Wilson E., Telford K. The meaning of money: the validation of a short money-types measure. Personality and Individual Differences, 2012, vol. 52, pp. 707-711 DOI: 10.1016/j.paid.2011.12.020

- Shim S., Xiao J.J., Barber B.L., Lyons A.C. Pathways to life success: a conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology, 2009, vol. 30 (6), pp. 708-723.

- Christelis D., Jappelli T., Padula M. Cognitive abilities and portfolio choice. European Economic Review, 2010, vol. 54 (1), pp. 18-38.

- Jappelli T., Padula M. Investment in financial literacy and saving decisions. Journal of Banking & Finance, 2013, vol. 37, pp. 2779-2792.

- Lusardi A., Mitchell O.S. (Eds.). Financial literacy and planning: implications for retirement wellbeing. In: Lusardi A., Mitchell O.S. Financial Literacy: Implications for Retirement Security and the Financial Marketplace. Oxford, Oxford University Press, 2011. Рр. 17-39.

- Atkinson A., Messy F. Measuring financial literacy: results of the OECD. International Network on Financial Education (INFE) Pilot Study. OECD Working Papers on Finance, Insurance and Private Pensions No. 15. OECD Publishing, Paris, 2012. Available at: http://dx.doi.o DOI: rg/10.1787/5k9csfs90fr4-en

- Vashchenko T.V., Ivanova Ya.Ya., Sokol'nikova I.V. Financial literacy: assessment and analysis. Konkurentosposobnost' v global'nom mire: ekonomika, nauka, tekhnologii=Competitiveness in the Global World: Economics, Science, Technology, 2017, no. 9 (p.3), pp. 18-21.

- Frumin I.D., Dobryakova M.S., Barannikov K.A., Remorenko I.M. Universal'nye kompetentnosti i novaya gramotnost': chemu uchit' segodnya dlya uspekha zavtra. Predvaritel'nye vyvody mezhdunarodnogo doklada o tendentsiyakh transformatsii shkol'nogo obrazovaniya . National Research University Higher School of Economics, Institute of Education. Мoscow: NIU VShE, 2018. 28 p.

- Lugovaya A.V. Proficiency and competence: about the problem of phenomena comparison and definition. Vestnik Voronezhskogo instituta FSIN Rossii=Proceedings of Voronezh Institute of the Russian Federal Penitentiary Service, 2013, no. 2, pp. 142-144..

- Sergeev A.G. Kompetentnost' i kompetentsii: monografiya . Vladimir: Izd-vo Vladimirskogo gosudarstvennogo universiteta, 2010. 107 p.