Localization of foreign production as a tool to develop the export base of the Russian Federation

Автор: Lavrikova Yuliya G., Andreeva Elena L., Ratner Artem V.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Socio-economic development strategy

Статья в выпуске: 3 (63) т.12, 2019 года.

Бесплатный доступ

The relevance of our paper lies in the fact that in the conditions of the “new normality” of the world economy and amid international competition and protectionist measures, developed partner countries of Russia replace imports with localization of production. The main idea and goal of the paper is to substantiate the essence of the strategy of localization of foreign production for various stages of geo-economic development and the implications for the national economy. Its scientific novelty consists in the fact that it develops theoretical provisions that identify motives for the use of the strategy of foreign production localization by host economies at various stages of geo-economic development; the paper also classifies and assesses possible effects that a country obtains in the process of localization (on the example of Russia). We use the following research methods: analysis of localization experience of different groups of countries; synthesis of the experience of localization of foreign production in Russia in terms of using the institutional framework to promote localization and systematization of localization effects based on the analysis of the opinions of its participants and content analysis of press releases about their activities (companies included in the rating of major companies operating in Russia, and the list of special investment contracts); statistical analysis of the relative scale and some effects of localization; and analysis of the regulatory framework. The analysis has revealed that in the context of global challenges for foreign companies the localization of production in Russia, involving exports, becomes a way to preserve their positions in the Russian market. It provides the Russian economy with a number of positive effects, both quantitative (growth of investments, production and export volumes, tax revenues, and the number of jobs) and qualitative (inflow of technologies and specialists; import substitution, contribution to the revival of manufacturing; diversification of production and exports; training of local specialists, development of local production of components; improving the competitiveness of products produced in Russia and the image of Russian territories and participating companies). The results allow us to move toward the formation of a comprehensive vision in assessing the impact of the institutional factor on the foreign economic activity of territories.

Localization of foreign production, localization motives, export-oriented localization, positive effects of localization, expanding production and export, technologies and brands, institutional support of localization, import substitution

Короткий адрес: https://sciup.org/147224184

IDR: 147224184 | УДК: 339.9, | DOI: 10.15838/esc.2019.3.63.2

Текст научной статьи Localization of foreign production as a tool to develop the export base of the Russian Federation

In the context of global challenges facing the world economy, which include a slowdown in its growth, drop in oil prices, exchange rates fluctuations, international trade and technological competition, and protectionist restrictions (sanctions, additional tariff restrictions), the countries that export goods to the Russian market experience a decrease in the volume of supplies. For example, the ratio of the volume of imports in 2014–2017 from Germany, The Netherlands, Italy, the United States, the Republic of Korea, Japan, France and the UK, taken together, to the volume of 2009–

2013 was1 3 to 4. Given the interest of foreign partners in their presence on the Russian market, and due to the policy of import substitution implemented in the country, import supplies are replaced by the localization of foreign production in the Russian territory, i.e. trade exports to Russia are transformed into production investments in the Russian Federation. Although Russian exports in 2017–2018 increased 1.6-fold (exceeding the value of 2015) and provided the maximum level of balance observed earlier), its high-tech component remains low and comprises 6.5% of total exports, although exports of machinery and equipment increased by 16%2 in 2017. In the context of stimulating non-resource exports in the Russian economy, localized production in some cases becomes export-based. Thus, in the Russian strategy for development of exports, for example the automotive industry, until 2025 it takes into account, among other things, the prospects for the production of car models designed for the international market (within the framework of foreign production localized in Russia). The goal of our paper is to substantiate the essence of the strategy for localization of foreign production for various stages of geo-economic development and the resulting effects on the national economy. Achievement of this goal assumes the implementation of the following tasks:

– to develop the localization theory in relation to the motives of host and investing countries in the localization of foreign production;

– to develop a model for representing potential effects of localization on the host economy;

– to assess these effects partially on examples from the Russian economy.

Finding solutions to these tasks provides for a research methodology that involves the following: analysis of theoretical and analytical literature on localization; analysis of the experience of localization of developing and developed countries; generalization of localization experience, including the experience of using the institutional framework to stimulate export-oriented localization, based on the analysis of opinions and practices of its participants; analysis of the extent of localization and systematization of its effects on the host economy based on the analysis of the activities of the largest representative offices of foreign companies operating in Russia (selected from the “Expert” rating) and other foreign companies (selected from the list of special investment contracts) on the basis of content analysis of press releases; statistical analysis of the relative scale and some effects of export-oriented localization.

The scientific novelty and significance of our work are as follows: we develop theoretical positions on the motives for the use of the strategy of localization of foreign production by host economies of different levels in the context of global challenges; we also develop a model for potential effects obtained by the country in the process of localization; in addition, we carry out selective assessment of these effects on the example of the Russian economy.

Theoretical bases of localization of foreign production

Localization refers to the placement of foreign production in the country (under the leadership of the parent foreign company), using raw materials and/or components and labor force of the host country. The localization process involves several stages: the presence of the coming counterparty only as exporter; minimal relocation of production and functions; transfer of key functions [1, pp. 64–65]. V.B. Kondrat’ev notes that production localization may have the following goals related to the development of the national economy: creating new jobs and stimulating business, forming high-tech industries, and ensuring long-term growth [2, p. 67].

It seems that it is possible to identify the motives of host economies (taking into account the level and priority needs of their development) in the context of trends (including challenges) in the world economic development.

According to the analysis, in the context of the growing international division of labor since the second half of the 20th century, the incoming contractor was interested in the access to raw materials and low labor costs. Developing countries found it important to intensify their economic development and raise their technological level and competitiveness through investment (Tab. 1) . In 1985–2015, in Japanese firms, the share of production moved to developing and other countries increased from less than 1/20 to 1/4 [3, p. 21]. The number of cars produced in foreign branches of German companies exceeded their production rate in Germany since 2010, and the ratio was 9.5 to 5.7 million units in 2015 [4, pp. 89-91]. China represents the most striking example of the host country. For example, China bought the first high-speed trains from Germany, then they were produced with German participation in China, and then China began to produce and export its own high-speed trains.

Another case is the experience of developed countries, such as the United States. As a result of the internationalization of production, by the time of the beginning of today’s recession of the world economy, the country lost part of its industrial base; this fact affected its socio-economic well-being, and reshoring became relevant. In general, in 2008–2009, the countries of the world, both developing and developed, implemented more than a hundred projects within the framework of the localization course, and the United States ranked second in this regard [2, p. 67].

Russia has a special type of localization, when global challenges in the development of world economic relations, largely induced by the global recession, lead to increased international competition and protectionist sentiments (sanctions, additional trade duties). Their impact on national economies was expressed in increasing import dependence and limiting foreign economic relations with developed countries, which caused the need (for example, in Russia) for import substitution and the formation of prerequisites for optimal integration into the international division of labor, among other things, through localization. The selected stages of global economic development and their inherent motives of localization are presented in Table 1 .

An important point is the export orientation of foreign direct investment (FDI). There is a common situation when a certain share of exports belongs to imported components, especially in small economies and in the sectors that are highly integrated

Table 1. Motives for localization of foreign production

|

Period |

Stage of world development |

Host countries |

Motive |

|

Since the second half of the 20th century |

Intensive production and investment internationalization |

Developing |

Need for investment and technology for host countries; access to raw materials and low labor costs for investor countries |

|

Since 2008 |

“The great recession” (“the new normality”) |

Developed |

Return of the productions taken out abroad in connection with the need to locate the process of production closer to the place of consumption; this is also done to reduce expenses on labor remuneration at the expense of automation |

|

Since the mid-2010s |

Development of advanced production technologies and growth of protectionist sentiments |

Affected by sanctions and protectionist restrictions (in particular, Russia) |

Import substitution, including export-oriented import substitution for host countries; maintaining positions in developed markets for investor countries |

|

Source: own compilations. |

|||

into the world economy (e.g. electronics) [5, p. 17]. Moreover, in foreign literature there is even the concept of export-oriented FDI (T.T. Nguyen-Huu, M. Nguyen-Khac). In the framework of (conventional) vertical FDI multinational (MNCs) produce intermediate goods to be exported back to the investor country or other countries for the assembly of final products. In the case of export-oriented FDI multinational corporations produce finished goods to serve end users in third countries. For example, Samsung’s representative office in Vietnam is the country’s largest exporter (18% of exports); Intel’s production in Vietnam provides up to 4/5 of the world’s volume of semiconductor chips [6, pp. 2-23]. In the structure of sales of foreign FDI affiliates of Japanese MNCs, exports to third countries (excluding the country of localization) comprise 36.1% (for comparison: exports to Japan – 9.4%) [3, p. 24]. It is noted that developing countries often position themselves as “export platforms” [7, p. 29]. So, as A.J. Hagan and J.C. Rogers emphasize, in the 20th century, during the period of active industrialization, Asian economies chose a model based on the promotion of exports. The primary criterion for the choice of foreign investments was their ability to organize exports [8]. The example of Norway, Brazil and Kazakhstan is provided; their course of localization requirements is aimed at creating domestic technological leaders – a potential base for further development of the market that leads to exports, as well. Often, the purpose of localization requirements is to harness some training and innovation processes in order to facilitate the development of new products (including those with export potential) [9, p. 53]. Research works based on econometric analysis conclude that the presence of companies with foreign investments has a favorable relationship with the costs of local enterprises entering international markets [10, p. 115].

However, researchers note that localization has a number of disadvantages for the host economy:

– strong competition effect [7, p. 23]; for instance, T.T. Nguyen-Huu and M. Nguyen-Khac note that it was typical of foreign export-oriented firms in Vietnam in 2000–2012 [6, p. 23], and this effect even exceeded the effect of direct demand for local resources);

– price increase;

– in some cases, foreign producers move only low- and medium-tech production to the host country, while high-tech links remain in the investor country [11, p. 5]. Thus, the analysis on the example of ECOWAS relations with the EU shows that the multinational presence in the ECOWAS region corresponds to an increase in exports (from ECOWAS to the EU) of primary sector goods, a decrease in exports of intermediate goods and has no effect on exports of finished goods [12, p. 128]. In addition, the difficulties of localization also include the fact that foreign companies require their usual level of management, developed service of their products and its proximity to the places of operation [13, p. 188].

Nevertheless, we should pay attention to the positive effects. Thus, in the case of the food industry (2018), we note that the strategies of foreign MNCs in Russia are characterized by great flexibility, which gave them the opportunity to reduce the undesirable impact of sanctions on them; and direct their procurement policy toward the development of local production [14, p. 42]. In general, the processing industries of foreign and joint property have a positive trend of increasing the level of localization [15, p. 53].

Table 2. Distribution of special investment contracts with the participation of localized foreign production, broken down by types of industry

Production of machines: – combines, tractors – metal-cutting machines Production of vehicles: – automobiles (2) – trucks (2) – light motor vehicles (2) Production of equipment: – pump installation – components for aircraft industry – components for wind power (2) Pharmaceutical industry: – medicines for the treatment of cardiovascular, cancer and other diseases – innovative insulin Compiled with the use of the source: List of special investment contracts. Ministry of Industry and Trade. 17.11.2018. available at: (accessed: 29.1.2019); websites of companies; press releases in the media.

Thus, localization of production from abroad is very common. Both investing and receiving countries have motives for it. We can identify several trends in localization process with different motives and directions. An important point is the export orientation of FDI. At the same time, localization entails both positive effects and risks for the host economy. In total, the positive effects appear insufficiently studied; there is no systematic representation in this regard.

Localization in Russia: institutional environment

In the context of global challenges (recession of the world economy, global technological and economic competition, increased protectionism), the Russian economy finds itself in difficult conditions: it has to optimize participation in the international division of labor, in particular, reduce import dependence, technical and technological backwardness, develop production, including diversified production, provide export guarantees, create new jobs and increase budget revenues. Under these conditions, the policy of import substitution and promotion of noncommodity exports was chosen.

In terms of the conditions for attracting foreign production potential, the Russian economy is attractive for developed countries (costs are lower), although it may be inferior to neighboring economies: for example, China, where the cost of labor is low; Kazakhstan, where VAT is lower; Belarus, which is geographically closer to the European market. But still foreign companies are stimulated by the desire to maintain their position in the large and developed Russian market in the conditions of reducing Russian imports from developed countries.

One of the state tools to promote localization for large projects is a special investment contract (SPIC, No. 488-FZ of December 31, 2014 “On industrial policy in the Russian Federation”), which provides that an investor who invests a sufficient amount of funding in the organization of production, supports it for a certain period and receiving in return benefits (preferences) and a guarantee of stability. At present, Russia has already concluded almost a dozen SPICs with companies with foreign participation (Tab. 2). Conceptually, SPIC is a tool to promote export activities [16, p. 75].

SPICs are concluded by companies from G7 countries (Germany, Japan, UK, France, USA) and other developed European countries (Denmark, Spain), as well as the Republic of Korea.

Naturally, localization requirements create limiting conditions for the presence of foreign companies in the Russian market. According to foreign companies, it is not easy to find suppliers of the necessary quality components in the required quantity due to the fact that foreign manufacturers have their own specific models of components. For example, in 2017, Schaeffler – the world’s leading supplier of systems for industry and automotive equipment – considered the possibility of cooperation with 700 local (Russian) suppliers, but only a small part of them could meet the requirements for the company’s plant in Ulyanovsk3. Besides, enterprises are not always able to find funds for investments in such amounts as are necessary for SPIC. At the same time, it was decided to optimize the SPIC tool: on the one hand, to strengthen the selection criteria (to increase the validity period and the required minimum investment), on the other hand to increase benefits4. However, these requirements serve to protect domestic producers from excessive competition. Naturally, localization forms of a smaller scale also contribute to import substitution (for example, A.M. Volkov gives a number of examples from the Nordic countries [17].

According to the opinion of representatives of Russian “engineering” representative offices of German companies in the Sverdlovsk Oblast (voiced at the 2018 conference on Russian-German economic cooperation), the potential for development of Russian-German industrial cooperation lies in the presentation of investment needs and advantages of Russian territories and in the constructive presentation of the opportunities of German business in the part related to the provision of capital, relevant technologies to interested Russian companies and training their employees. According to scientific literature, clearly defined criteria for localization can be one of the incentives for foreign companies to participate in the localization of production in Russia [18, p. 30].

As shown by the review and analysis of cases of export-oriented localization of foreign production, the products they produce in Russia are more often sent to neighboring countries, primarily to partner countries in the Customs Union; this fact indicates the positive impact of the removal (reduction) of trade barriers and harmonization of infrastructure and customs and economic regulation within the EAEU. As noted by representatives of Russian divisions of foreign companies, it helps optimize business and commodity flows5.

The places for localization of foreign production are often focused on the availability of sites with complete infrastructure for the location of production. Thus, the production of Mercedes-Benz is created in the Industrial Park “Esipovo” (Moscow Oblast) [19, p. 87], the German company WIKA opened the production of metrological equipment in the Industrial Park “Indigo” in 2017 (minpromtorg.gov.ru. 27.09.17), BMW plans to carry out localization of production in an industrial park with the use of privileges of the special economic zone in the Kaliningrad Oblast ( Rossiiskaya gazeta , 15.02.18). Twelve industrial parks and one SEZ were established in the Kaluga Oblast; this fact, together with the establishment of agencies and funds to attract foreign and Russian investors was an important factor in attracting foreign companies and contributed to the adaptation of the cluster model (a cluster of automotive industry, a cluster of pharmaceuticals and biotechnology were established) [20, pp. 82-85]). In the Sverdlovsk Oblast, where production cooperation with German companies is represented actively, the companies Uralchimplast and Huettenes-

Albertus Chemische Werke GmbH carried out the localization of joint production of non-stick coating for the foundry industry of the companies in the Chemical Park “Tagil” in 2016 (mvs.midrual.ru, 20.07.2017). The choice of special supporting infrastructure demonstrates the effectiveness of its incentives. Geographically export-oriented localized foreign production covers a number of Russian regions; this fact indicates a certain distribution of production attractiveness among the Russian territories.

Assessing the contribution of localization to the development of the Russian production and export base

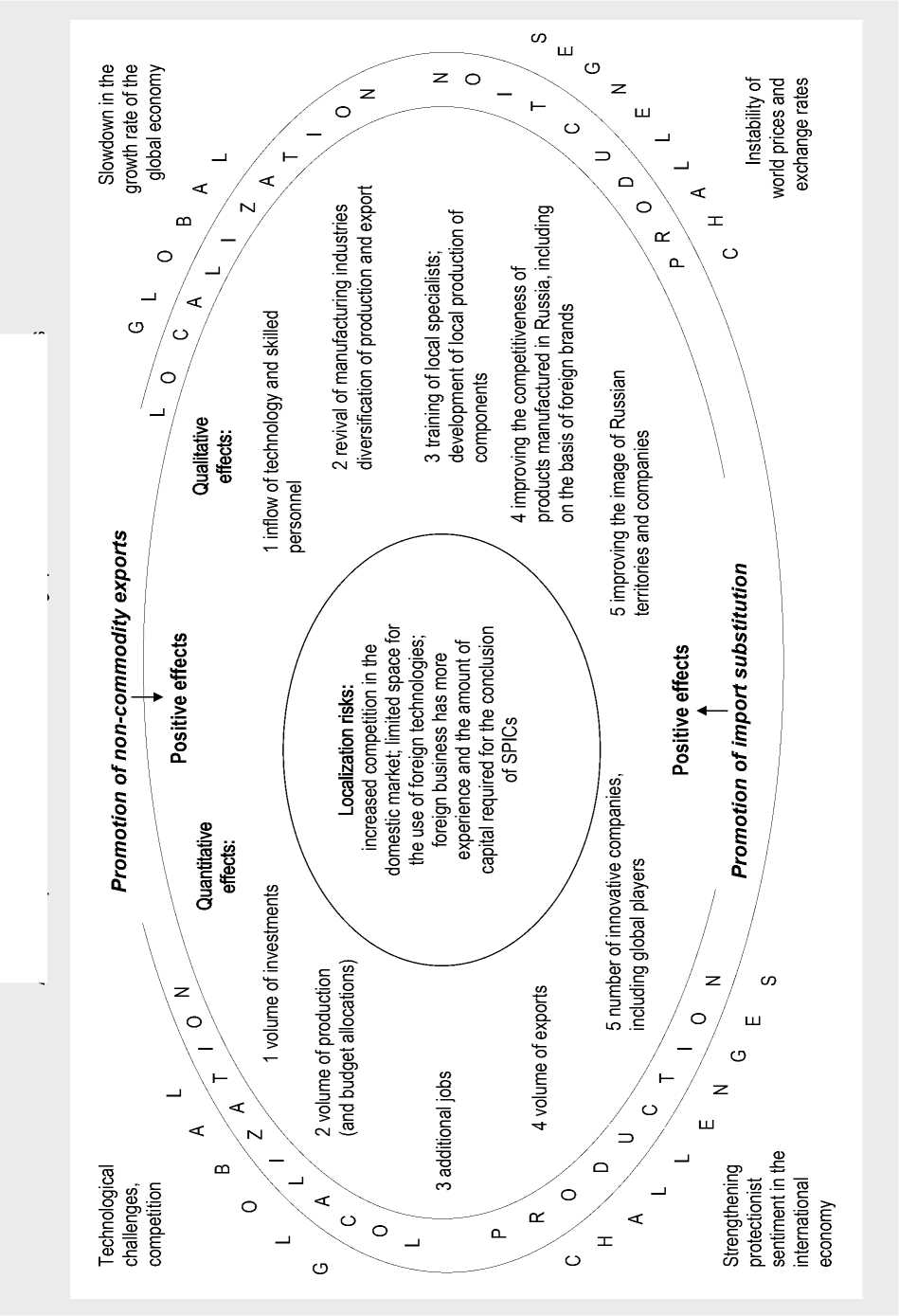

It is important to consider what effects the localization of foreign production brings, including the effects for Russian exports; i.e. whether this localization of foreign production in Russia is to some extent export-oriented. The Figure shows a model of possible effects arising in the course of response to global challenges in terms of promoting localization. For the purposes of the analysis, we took the rating of major Russian companies in terms of sales (the rating was built by the analytical center “Expert”) for 2017; the rating takes into account the representative offices of foreign companies. Since the subject of the study is export-oriented localization, then we chose the following companies from the rating:

– foreign companies that have representative offices in Russia;

– those that have not only sales, but also production offices;

– those carrying out or planning to carry out export (from Russia) of the production made in Russia .

Let us consider the effects highlighted in the Figure in more detail.

Quantitative effects:

-

1. Investment (growth of investments) in the manufacturing industry, since production

-

2. Investments contribute to the development of production output. Analysis of the companies shows that in the rating of 400 major companies in Russia in terms of sales (“Expert-400”)7, there are about fifty (58) representative offices of foreign companies. Among these companies, about three dozen (32 companies for which there is information in the media about the presence of production offices in Russia and about their exports; the information on exports from Russia for companies in the rating was taken from Internet press releases: from newspapers, websites of companies and authorities, and information agencies) carried out or considered the option of localization, which also involves exports, or 8.3% of their total number. The calculation according to the data of “Expert-400” shows that the representative offices of these companies provide 4.4% of the total sales of products of all companies in the rating. Revenues to the budget are provided accordingly.

-

3. These industries create additional jobs. Data on the number of employees in the representative offices of these companies in the rating are given only for four cases: in three cases (production representative offices) it is an average of 3.4 thousand people; in the case of a

-

4. Thus, the conditions under which foreign companies find it more profitable to move production to Russia than to import goods into it also stimulate exports from Russia: more than half of the foreign companies the representative offices of which were included in the rating and which have (or organize) production in Russia with the participation of foreign technologies, carried out exports exported from Russia or were going to do it. Some of these companies (7) are among the top 200 largest exporters in Russia8.

localization often refers to this industry. Thus, the total investment broken down by SPICs concluded with foreign companies, presented on the website of the Ministry of Industry and Trade (minpromtorg.gov.ru) (all SPICs from Table 2, excluding two SPICs for the production of motor vehicles, for which there is no data), account for 3.9% of total investment in fixed assets in manufacturing in Russia as a whole6.

A model of possible effects of localization of foreign production in the host countries

trade representative office, it is significantly (in 2.5 times) higher than the average rating (while (according to the company’s website) half of its products sold in Russia is produced in Russia).

According to the review of media sources, some of the companies represented in the “Expert-400” are still planning to export from Russia or have started to export in recent years: for example, KIA, Samsung (washing machines), Hyundai (SPIC), Sanofi (SPIC), Sony Electronics (krasnews.com. 10.02.2015; websites of the companies; vestifinance. ru. 25.12.2018; Rossiiskaya gazeta Special , no. 110, 23.05.2018.; Kommersant. 29.08.2016). Some companies have already established exports: for example, Nokian Tyres, Procter&Gamble, Volkswagen, Toyota) ( Vedomosti. 19.10.2017; TASS. 01.06.2017; Rossiiskaya gazeta . 20.7.2018; Vedomosti . 19.10.2017). Some companies are planning to increase exports. For instance, KAMAZ planned (in 2017) to triple exports in the course of five years; it was assumed that 1/2 of the deliveries will be trucks with Mercedes-Benz cabins and components ( Vedomosti . 17.07.2017); etc. (see Insert).

SPICs, foreign companies – the contractors which are not in the top 400, also for the most part provide for an opportunity to carry out export deliveries (for example, with Mazda-Sollers, VILO RUS, Hamilton-Nauka, Isuzu Sollers, for the construction of Ulyanovsk machine-tool plant, for the production of components for wind power (jointly with Vestas), etc.), or they are already carrying out exports (with Claas) (TASS. 03.09.2016; Kommersant. 19.07.2018 (no. 126); ulgov.ru. 30.09.2016; Kommersant (Samara). 20.02.2018. (no. 31); minpromtorg.gov.ru. 13.10.2017; websites of the companies) (see Insert).

It should be noted that the planned adjustment of the SPIC tool, version SPIC 2.0, in addition to increasing the lower threshold of investment and provision of subsidies, guarantees and benefits and increasing the duration of contracts as well as expansion of the list of industries, differs from the previous version in one more aspect: it gives investors a preference in their shipment of part of the products (not less than 15%) for export ( Expert Online . 22.6.2018). This corresponds to the Decree of the President of the Russian Federation “On national goals and strategic objectives of the Russian Federation for the period up to 2024” dated May 7, 2018 No. 204, which sets the task of creating a high-performance export-oriented sector, primarily in the manufacturing industry and agriculture. According to V.S. Osmakov, Deputy Minister of Industry and Trade, exports currently serve as a key criterion for the competitiveness of projects ( Kommersant, no. 237, 20.12.201, p. 9). If we take the share of 15% as a hypothetical benchmark for assessing the possible exports of companies from the Rating-400, potentially related to export-oriented localization, then their total exports, taking into account the production volume given in the rating, according to our calculations, could amount to 2.4% of all-Russian exports. And these are products of the manufacturing industry.

Examples of obtained and possible positive effects from localization (production output, innovation, export, jobs)

Daimler (including Mercedes-Benz) (SPIC): for a full cycle production to be established in the Moscow Oblast, it was assumed that the planned capacity would be 20 thousand cars (and about a thousand jobs), for the joint production of cabins with KAMAZ (of the most modern generation) – up to 55 thousand cabins (part of them is supposed to be used for export);

Hyundai: the plant in Saint Petersburg has more than two thousand jobs and the capacity of 200 thousand vehicles (SPIC assumes the export of 1/10);

AvtoVAZ (with the participation of Renault): in 2016 shipped 17.3 thousand cars and vehicle sets abroad;

Isuzu-Sollers (SPIC): it is planned to launch a production with the capacity of 47.5 thousand vehicles. The new medium-duty truck, according to experts, will also be exported;

Toyota (branch in Russia): the design production capacity was increased to 100 thousand vehicles by 2016. Export to Kazakhstan has been carried out since 2012. Deliveries to Kazakhstan and Belarus increased by 70% in eight months of 2017.

Nokian Tyres (branch in Russia): 2/3 of the products are exported;

SPICs on the organization of production of machine tools (with “DMG MORI”) and wind power plants (with Vestas) assume exports of a certain share of production;

Claas (combines and tractors, SPIC): most of the components are supplied to Germany, and some combines – to the CIS;

Procter&Gamble (branch in Russia): about 1/4 of the products produced at a plant in the Tula Oblast are exported;

Samsung Electronics (branch in Russia) started exporting washing machines to Europe (20 countries) in 2016;

In general, Russia ranked 8th in the export of washing machines in 2015;

In the exports of cigarettes, localized production accounted for 3/4 in the 1st half of 2015.

Source: Internet press releases from newspapers, websites of represented companies and authorities, news agencies (REGNUM. 20.06.2017; Vestifinance.ru. 25.12.2018; Vedomosti . 15.08.2017, 19.10.2017, 26.08.2015; Kommersant . 24.05.2018, 19.07.2018 (no. 126); Kommersant (Samara). 20.02.2018 (no. 31), 29.05.2018 (no. 91); ulgov.ru. 30.9.2016; TASS . 1.6.2017; Rossiiskaya gazeta . 24.11.2016).

Table 3. Imports of goods (selectively), for which localized productions are established, basic dynamics (for 2013, according to value), times

|

Commodity group |

2014 |

2015 |

2016 |

2017 |

|

Television receivers |

0.83 |

0.41 |

0.35 |

0.48 |

|

Cars |

0.77 |

0.38 |

0.36 |

0.39 |

|

Pumps and compressors |

0.84 |

0.55 |

0.32 |

0.44 |

|

Railway rolling stock |

0.57 |

0.14 |

0.13 |

0.20 |

|

Calculated with the use of the source: Russian Statistics Yearbook . Rosstat. 2018. Tab. 25.19; 2016. Tab. 26.22. |

||||

Table 4. Growth of industries (selectively), for which there is localization, after the recession of 2014–2015, basic dynamics (by 2013, according to value), times*

|

Commodity group |

2014 |

2015 |

2016 |

2017 |

|

Tractors |

0.88 |

0.72 |

0.83 |

0.96 |

|

Cars |

0.88 |

0.63 |

0.58 |

0.70 |

|

Trucks |

0.74 |

0.62 |

0.67 |

0.79 |

|

Combine harvesters |

0.95 |

0.76 |

1.05 |

1.31 |

|

Washing machines |

1.00 |

0.90 |

1.03 |

1.15 |

|

* For reference: for washing machines, the value as of 2012 – 0.87 – is also significant. Calculation source: Russian Statistics Yearbook . Rosstat. 2018. Tab. 16.36-38; 2016. Tab. 14.47-49. |

||||

Qualitative effects:

-

1. Foreign companies that localize their production in Russia provide an inflow of technologies and highly qualified specialists as carriers of relevant skills. Thus, this applies to the cases of SPIC that involve the development of production that have no analogues in Russia, such as pharmaceutical products (Sanofi-Aventis: the first production of fullcycle insulin), and wind energy (Vestas and VINDAR-RUS) (minpromtorg.gov.ru. 17.11.2018).

-

2. The cases of localization, promoting import substitution, contribute to the revival of Russian manufacturing industries and, thus, to the improvement of the sectoral structure of production and exports (diversification and increase in the degree of processing). Almost all foreign companies that are engaged in the localization, carry out exports or plan to do it and that are included in the Expert-400 Rating and Expert-200 (exports) Rating refer to the manufacturing industry; in 5 cases the share of non-commodities export is almost 100%, The branches include the automotive industry (KIA, Hyundai, Renault, Nissan, BMW, Volvo, Toyota, Volkswagen, Mercedes-Benz), manufacture of machinery and equipment, including electronics (Siemens, LG Electronics, Samsung Electronics, Sony Electronics), tobacco industry, household chemicals (Procter&Gamble, Henkel), pharmaceuticals (Sanofi), production of tyres (Nokian Tyres), cosmetics and perfumes (L’Oreal and L’Etoile); food industry (Nestle, Danon), seed industry (Syngenta), packaging (Tetra Pak), household goods (IKEA, Leroy Merlin). Many of these companies use advanced (innovative) technologies.

-

3. Positive impact of localization consists in the fact that, taking into account the requirements for localization, foreign enterprises are interested in the establishment and development of Russian component production and in the training of local technical and engineering specialists. For example, pilot projects have been launched to connect Russian small and medium-sized enterprises (SMEs) to the supply chains of German corporations, in particular VILO RUS and GEA Refrigeration RUS (equipment for the energy and oil and gas industries). This enables SMEs to benefit from the “dividends” of the success factors of large international business [21, p. 908].

-

4. Participation of foreign technologies and internationally recognized and widely known brands increases the competitiveness of products produced in Russia with their use and facilitates Russia’s entry in the world market. For example, Renault played an important role in the export success of AvtoVAZ ( Vedomosti . 15.08.2017) (see Insert). With global brands, localized foreign productions often have a significant share in Russian exports in the corresponding position, for example, washing machines, cigarettes ( Rossiiskaya gazeta . 24.11.16; Vedomosti . 26.8.2015) (see Insert).

-

5. Russian companies that are involved in the value chains of foreign localized production get an opportunity to hire specialists who have gained experience in such industries; thus the companies themselves improve their skills and image. The image of the region that hosts localized production is also improving.

SPICs with foreign companies (Tab. 2), which were concluded since 2016, contribute to the creation and/or modernization of those productions that are designed to solve the problem of import substitution due to a decrease in their volumes: for instance, in 2015, the output of tractors was 1.5 times lower than in 2005, the output of metal-cutting machines – 1.9 times lower than in 20029, etc. For a number of goods for which localized production was created, imports have decreased since 2015 (Tab. 3). At the same time, for a number of goods for which localized production was created, output has been growing, recovering from the recession of 2014–2015 (Tab. 4).

Risks . However, it should be noted that there exist both external and internal risks. Thus, the unfavorable foreign economic climate of Russia, associated with the introduction of sanctions by foreign countries, has an adverse impact on localization. This limits the possibility of attracting technology and investment, and industrial cooperation opportunities, as well. In addition, the area in which foreign technologies are used is limited to specific localizing industries and thus the spread of the modernization effect is limited. As noted in the literature, foreign companies in Russia were in no hurry to invest in the expansion of production, in the creation of a network of research centers and in the development of a network of companies that supply components for the automotive industry. One of the reasons consists in the low output per model. For example, if in China and Brazil the output is 60 thousand units, then in Russia – 27 thousand units [1, pp. 64-65]). In addition, part of the value added effect goes to foreign companies. Therefore, despite the importance of localization, it is still relevant to implement domestic entrepreneurial and managerial potential, capital and technology.

Also, as it was noted in the analysis of the theoretical foundations of localization, domestic producers can find themselves in a situation of increased competition [7, p. 23; 6, p. 23]; in such a situation, the costs and selfcosts of foreign companies are reduced, they obtain a national status for their products, and the quality standards of their products are higher and their brands are more famous, which allows foreign investors to claim a certain share of the market in the host country. In addition, given the presence of large companies abroad and the high exchange rate, foreign business is more likely to enter into SPICs and obtain guarantees and preferences from the government. Although Russian business also enjoys preferential targeted lending and special conditions in technology parks and special economic zones, the development of large companies-leaders in the high-tech sector, including leading global players, remains an urgent task.

Conclusion

Thus, the localization strategy at different stages of global economic development has different motivation. If under the influence of intensive internationalization (from the second half of the 20th century) the motive consisted in the need of host developing countries for investment and technology and the desire of developed countries to obtain raw materials and labor at low costs, then at the stage of the current global recession, developed countries are seeking to return the withdrawn productions against the background of new technologies. In Russia, localization began to spread, on the one hand, due to the desire of MNCs to maintain their positions in the markets in an economic recession, on the other hand, under the impact of domestic government measures for import substitution (for example, SPIC). The development of export by localized companies is stimulated by measures of the host economy aimed to develop non-commodity exports.

In Russia, SPIC acts as an important incentive tool and one of the largest forms of localization of foreign production and provides for the fact that the investor, who gives obligations, including export obligations, receives benefits and a guarantee of stability. Investors are also attracted to sites with ready infrastructure, in particular industrial parks and SEZs, where benefits are provided. According to the analysis of the SPICs, the rating of major Russian companies that takes into account the representation of foreign companies, and information from the press, we see that in the conditions of stimulating import substitution and supporting non-commodity exports, examples of localization are also cases of export-oriented import substitution.

At the same time, localization has a number of positive effects. The quantitative effects are as follows: growing investments and tax revenues, production and export volumes; creating new jobs. The qualitative effects include the inflow of technologies and specialists, import substitution, contribution to the revival of the Russian manufacturing industry, improvement of the sectoral structure of production and export, training of local specialists, development of local production of components, increasing the competitiveness of products produced in Russia, improvement of the image of Russian territories and participating Russian companies.

At the same time, there are certain restrictions on obtaining positive effects and risks associated with an unfavorable external economic climate, limited distribution of the modernization effect and obtaining the effect of value added, as well as competition for domestic producers. The issue concerning the development of national Russian companies on the basis of the implementation of domestic entrepreneurial and managerial potential, capital and technology remains relevant.

Thus, in theoretical terms, the contribution consists in the development of theoretical provisions substantiating the motives for the use of the strategy for localization of foreign production by the host economies at various stages of world economic development from the middle of the 20th century to the present, as well as in the systematization of the effects obtained by the country in the process of localization, and their assessment on the example of Russia. In practical terms, the results can be used in assessing the effects of localization at different levels: federal, regional levels and the level of individual projects.

Список литературы Localization of foreign production as a tool to develop the export base of the Russian Federation

- Podkhalyuzina V.A. On measures to increase the flow of investments into the Russian automobile industry. Vestnik Moskovskogo avtomobil'no-dorozhnogo gos. tekhnich. un-ta=Vestnik of Moscow Automobile and Road Construction State Technical University, 2015, no. 1 (40), pp. 63-67. (In Russian).

- Kondrat'ev V.B. Local content policy and modernisation. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 2017, vol. 61, no. 1, pp. 67-77. (In Russian). DOI: 10.20542/0131-2227-2017-61-1-67-77

- Tomiura E. Cross-Border Outsourcing and Boundaries of Japanese Firms. Singapore: Springer, 2018. 251 p. Available at: DOI: 10.1007/978-981-13-0035-6

- Zaritskii B.E. The German automotive industry in age of globalization. Mir novoi ekonomiki=The World of New Economy, 2016, no. 2, pp. 88-94. (In Russian).

- Lukyanov S.A., Drapkin I.M. Global value chains: effects for integrating economy. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 2017, vol. 61, no. 4, pp. 16-25. (In Russian). DOI: 10.20542/0131-2227-2017-61-4-16-25

- Nguyen-Huu T.T., Nguyen-Khac M. Impacts of export-platform FDI on the production of upstream industries - Do third country size, trade agreements and local content requirement matter? Evidence from the Vietnamese supporting industries. Economics, 2017, vol. 11, no. 22, pp. 1-31. Available at:

- DOI: 10.5018/economics-ejournal.ja.2017-22

- Ghauri P.N. Multinational enterprises and sustainable development in emerging markets. In: Bergé J.-S. et al. (Eds.). Global Phenomena and Social Sciences. Springer, Cham, 2018. 147 p. Pp. 21-36.

- DOI: 10.1007/978-3-319-60180-9_2

- Hagan A.J., Rogers J.C. Trade models and the multinational corporation: a comparison of Asian and Latin American Experience. In: Hawes J.M., Glisan G.B. (Eds.). Proceedings of the 1987 Academy of Marketing Science (AMS) Annual Conference. Springer, Cham, 2015. 534 p. Pp. 509.

- DOI: 10.1007/978-3-319-17052-7

- Kalyuzhnova Y., Nygaard C.A., Omarov Y., Saparbayev A. Local Content Policies in Resource-rich Countries. London: Palgrave Macmillan, 2016. 235 p.

- DOI: 10.1057/978-1-137-44786-9

- Kadochnikov S.M., Fedyunina A.A. The impact of foreign direct investment on export activity of Russian firms: the size matters. Voprosy ekonomiki=Issues of Economics, 2017, no. 12, pp. 96-119. (In Russian).

- Ettmayr C., Lloyd H. Local content requirements and the impact on the South African renewable energy sector: A survey-based analysis. South African Journal of Economic and Management Sciences, 2017, no. 20 (1). Available at: 10.4102/sajems. v20i1.1538

- DOI: 10.4102/sajems.v20i1.1538

- Onyekwena C., Ademuyiwa I., Uneze E. Trade and foreign direct investment nexus in West Africa: does export category matter? In: Seck D. (Ed.). Investment and Competitiveness in Africa (Book Series: Advances in African Economic, Social and Political Development). Springer, Cham. (Switzerland), 2017. 213 p. Pp. 109-133.

- DOI: 10.1007/978-3-319-44787-2_6

- Finashin A.A. Localization of German companies in Russia. EKO=ECO, 2016, no. 3, pp. 184-189. (In Russian).

- Kheifets B.A., Chernova V.Yu. Global TNCs in Russia under conditions of import substitution. Rossiya i sovremennyj mir=Russia and the Сontemporary World, 2018, no. 4 (101), pp. 30-45. 10.31249/ rsm/2018.04.03. (In Russian).

- DOI: 10.31249/rsm/2018.04.03

- Spitsyn V.V., Ryzhkova M.V. Localization of production at manufacturing enterprises in Russia by forms of ownership. Vestnik Tomskogo gosudarstvennogo universiteta. Ekonomika=Tomsk State University Journal of Economics, 2017, no. 40, pp. 53-55. (In Russian).

- Zav'yalov F.N. (Ed.). Aktual'nye voprosy razrabotki eksportnoi strategii regiona: monogr. [Topical Issues of Development of the Export Strategy of the Region: Monograph]. Yaroslavl: Yaroslav. gos. un-t, 2018. 268 p.

- Volkov A.M. Foreign investments in the economy of Sankt-Petersburg and Leningrad Region. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 2018, vol. 62, no. 6, pp. 67-76. (In Russian).

- DOI: 10.20542/0131-2227-2018-62-6-67-76

- Bel'chenko M.A., Garsiya L.V. The Russian economy under sanctions: vectors of pressure and level of independence. Uchenye zapiski Sankt-Peterb. filiala Rossiiskoi tamozhennoi akademii=Scientific Letters of Russian Customs Academy St.-Petersburg Branch Named after Vladimir Bobkov, 2018, no. 3 (67), pp. 27-32. (In Russian).

- Belov V.B. et al. Germaniya. 2017: monogr. [Germany. 2017: Monograph]. Moscow: In-t Evropy RAN, 2018. 140 p.

- Gutnik A.V., Trofimova O.E. European investment in Kaluga Region: features under sanctions. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 2018, vol. 62, no. 9, pp. 81-87. (In Russian).

- DOI: 10.20542/0131-2227-2018-62-9-81-87

- Andreeva E.L., Simon H., Karkh D.A., Glukhikh P.L. Innovative entrepreneurship: a source of economic growth in the region. Economy of Region (Russia), 2016, vol. 12, no. 3, pp. 899-910.

- DOI: 10.17059/2016-3-24