M&A trends in global airline industry

Автор: Tsypkina K.Y.

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 4-1 (23), 2016 года.

Бесплатный доступ

Historically, industry participants in the global airline industry have expanded their capacities and networks and were noticed being engaged in price wars in an effort to gain market share. However, the last 10 years of industry are characterized by unstable passenger demand and scattering fuel prices. In this conditions, merger and acquisition (M&A) activity has grown stronger, as now industry participants have moved their attention to cost cutting and excess capacity reduction in an aspiration to improve profitability.

Короткий адрес: https://sciup.org/140119031

IDR: 140119031

Текст научной статьи M&A trends in global airline industry

In latest years the number of Mergers and Acquisitions worldwide grow rapidly. The number of benefits explains this tendency:

-

• M&A allows company to become bigger in size and leapfrog their

rivals in a short period of time, while organic growth takes years;

-

• Obtaining such competitive advantage as wider portfolio of assets;

-

• Obtaining synergies and economies of scale, giving an opportunity to

expand their branch and regional offices network and giving extra manufacturing facilities;

-

• M&A let the company to dominate in their sector.[1]

-

• Rapid expansion of alliances and increased number of M&A deals;

-

• A deepening in the scope and depth of airline cooperation using such tools as codesharing and metal-neutral joint ventures, where airlines become effectively indifferent to which plane or ‘metal’ carries a passenger;

-

• Increased liberalization of international skies facilitates the growth of alliances;

-

• The growth of international airline alliances and domestic airline mergers raises strong competition concerns.

Airline yields have been decreasing or remained stable in real terms that pushes industry to consolidate. For example, real average domestic fares and yields have decreased after industry deregulation and, what is more, increased competition from Low Cost Carriers in domestic markets further erodes real yields and net profits for Full Service Network Carriers.

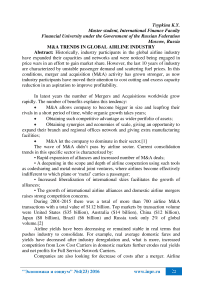

Companies are also looking for decrease of costs after a merger. Airline sector is facing high operating costs and fuel costs in particular. Fuel costs are accounted for 25-40% of airline operating costs and that is why industry is very sensitive to fuel price changes, which in latest years are keep chopping and changing as shown on Graph 1.

Graph 1. Jet fuel and Crude Oil Prices, $, 2008- 2015

Among other costs are labour, depreciation, amortization and rent, maintenance, materials and repairs, landing and terminal fees and other costs.

All in all, airlines benefit from larger networks it gives them cost advantage due to economics of scale and scope and, what is more important, higher demand due to better connectivity, greater range of destinations and increased service frequency and, at the end , increases their profitability.

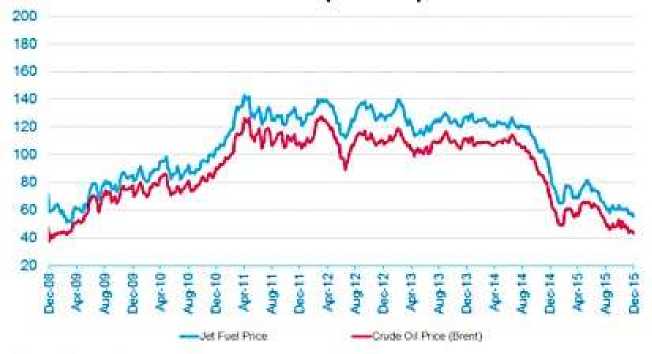

Picture 1 represents the most significant mergers and failures in airline industry.

Picture 1. Airline Industry Consolidation

Airlines (U.S.). It lasted more than 3 years and cost $400 million in consulting and legal fees.

To draw the line, currently instead of engaging in competition, airline companies in the industry are focusing on improving their profitability. Mergers and Acquisitions as well as other consolidation tools are slowly becoming the norm for airline industry participants who are desperately interested in cost cutting and reduction of excess capacity in order to resist the problems of global economy.

Список литературы M&A trends in global airline industry

- Timothy J. Galpin, The Complete Guide to Mergers and Acquisitions: Process Tools to Support M&A Integration at Every Level, 2nd Edition, 2008

- The International Air Transport Association (IATA) Annual Review, 2015 Web: http://www.iata.org/publications/Pages/annual-review.aspx