Management of vertically integrated systems formation and development in the Russian economy

Автор: Kozhevnikov Sergei Aleksandrovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Socio-economic development strategy

Статья в выпуске: 6 (48) т.9, 2016 года.

Бесплатный доступ

The article reviews the essence, nature, features and basic approaches to the interpretation of vertical integration. It proves that one of the key conditions for modernizing and neo-industrializing domestic economy and transforming Russia into an industrialized country is overcoming technological fragmentation of business entities, as was the case in the Soviet Union and is now observed in the developed countries. In this situation, it is vertical integration which can ensure the diversification and restructuring of the economy, the linkage between the extractive and processing industries. Based on the results of analyzing the activities of major multinational corporations (Royal Dutch Shell, Sinopec Corp., Valio Ltd. etc.) it has been proved that these integrated systems supply competitive products with high degrees of processing and serve as growth drivers in developed economies. To justify this, the author calculated the companies' value added multiplier. Currently, vertically integrated systems such as PhosAgro PJSC, LUKOIL PJSC, Miratorg agro-industrial holding company, KamAZ OJSC, Arkhangelsk pulp and paper mill PJSC operate in various economic sectors...

Vertical integration, vertically integrated systems (vis), value added chains, value added multiplier, corporation

Короткий адрес: https://sciup.org/147223897

IDR: 147223897 | УДК: 334.75 | DOI: 10.15838/esc.2016.6.48.3

Текст научной статьи Management of vertically integrated systems formation and development in the Russian economy

Over the past century, one of the main trends in the functioning of developed economies (the USA, Germany, France, Japan, China, etc.) is the active development of integration processes which currently form the basis of major multinational companies [9]. Thus, in the USA, the image of the industry is formed by about a hundred of highly integrated multi-industry corporations (General Motors, Du Pont, General Electric, Ford Motors, AT&T, etc.). Each of them consists of 25 industries; 35 corporations operate in 32 industrial sectors and 10 of them – in 50 industries. According to official data, such companies account for 55–60% of GNP; they employ 45% of the total number of the employed in the economy; about 60% of total investment is allocated to these corporations. Moreover, by the end of the 1960s, integrated enterprise in Canada and the US produced more than 90% of poultry products, in the Netherlands – 90%, in Belgium – 70%, in Germany and France – 60% [12].

The key feature of these actors increasing their competitiveness in national and world markets is the creation of a unified processing chain of value added within a single organizational structure. This contributes to cost minimization and improvement of profitability by using internal transfer prices and eliminating the “double marginalization” effect characteristic of a disintegrated economy; to the concentration and rational use of production, money and commodity capital, increase in its reproduction rates; and innovations [1, 4]. Such large companies constitute a source of employment; contribute significantly to GDP of these countries, budget system occupancy and socio-economic development of the territory as a whole. In this regard, the formation of vertically integrated systems and their effective development management is an important scientific and practical objective.

This was the purpose to many studies on this issue. Among them are works of famous foreign scientists such as M. Adelman, S. Grossman, R. Coase, G. Muller, L. Fisher, J. Spengler, O. Williamson, K.R. Harrigan, O. Hart, etc. The issues of vertical integration were also considered by domestic scientists: A.Ya. Butyrkin, M.M. Voronovitskii, S.B. Gal’perin, S.S. Gubanov, E.F. Gershtein, V.O. Ivanova, A.P. Kohno, R.M. Lapkin, M.V. Molokhovich, E.V. Neprintseva, etc.

At the same time, it should be noted that the formation and functioning of VIS in the Russian economy is characterized by some features which were determined by the conditions of their formation. Such processes were most widely carried out in the 1990s during the implementation of the privatization policy in accordance with the federal and regional regulatory legal acts. The companies under establishment included the enterprises acquired by an owner at a lower price; their structure often did not allow to fully realize the benefits of vertical integration of capital since this association required the use of assets availability for the project’s initiator, rather than the economic principle (technological inclusion of business entities). For this reason, the performance of these companies is often very low, their activity is not transparent enough, and the contribution to the development of their service area is very insignificant [2, 3, 8, 22].

However, according to some economists, one of the key factors in competitiveness of the Russian economy and its modernization on an innovative basis is the formation of the destroyed in recent decades processing chains in the leading economic sectors through the creation of vertically integrated companies, combining all production stages, starting from extraction of raw materials to the sales of finished products with high degrees of processing.

A. Spitsyn [20] believes that “the development of the sector of large vertically integrated economic entities, including inter-state corporations, is a powerful factor in accelerating scientific and technical progress and production modernization”. Yu. Sokolov [19], in his turn, acknowledges that “without large-scale integration of science, extractive and manufacturing sectors, including full manufacturing cycles, activation of investment activity on the replacement of outdated fixed assets cannot be expected”. According to S. Gubanov, neo-industrialization of the Russian economy on the basis of vertical integration is, perhaps, the only way for our country to place itself among the world’s industrialized countries [5, 6]. He believes that the main role in these processes should be attributed to the state, using a set of direct and indirect management techniques.

It should be emphasized that the formation and successful development of integrated business entities implies certain necessary objective preconditions and the creation of favorable conditions (organizational, institutional, economic) for this kind of association.

The main precondition for the process of vertical integration of companies is the assessment of its appropriateness and effective functioning of an already formed VIS. However, in economic science there is yet no unified approach to the definition of the prerequisites for successful creation and functioning management of vertically integrated systems, as well as methodological techniques to assess their effectiveness. These circumstances have contributed to the relevance of studying this issue.

The purpose of the research is the justification of a set of guidelines for managing value added chains formation and development in the Russian economy, the assessment of the effectiveness of these processes through the study of institutional and economic fundamentals of vertical integration, as well as critical analysis of activities of foreign and domestic vertically integrated systems.

Next we will consider the interpretations of the essence, nature and characteristics of vertical integration. In particular, the supporters of the neoclassical economic theory suggest the emergence of integration only in case of continuous technological relations of various production stages in time and space. The representatives of a neo-institutional movement indicate that integration is an effective way to solve the problem of opportunistic behavior of companies and suppliers. In this case the creation of VIS is relevant when such costs are rather significant.

According to S. Gubanov, the essence of vertical integration comes down to natural objective processes of consolidation of ownership and formation of its new macroeconomic forms – state-corporate. However, vertical integration is considered as a system of industrial relations at the neo-industrial level of productive forces development. An essential condition of effectiveness of formation of value added chains combined in one enterprise is, along with the zero return of its units, lack of their economic independence.

In general, the main difference between the existing interpretations of vertical integration lies in different degrees of control of one company over another arising from merging different processing stages of a value added chain. In particular, a number of authors (G. Muller, L. Fisher, etc.) consider vertical integration as a long-term contractual relations between independent entities at different stages of a processing chain. At the same time, there is no merger or change of ownership rights [25, 30]. In the author’s view, this interpretation does not fully reflect the essence and nature of the institution under review, as in this case the problem of opportunistic behavior of counterparties cannot be entirely solved, moreover, zero return of intermediate stages as the basic law of vertical integration is not achieved.

There is another approach to the interpretation of vertical integration (M. Adelman), according to which a key feature of VIS is total ownership control and several production stages. This interpretation is shared by most economists [23]. Such companies are created by merger (takeover).

Adhering to this viewpoint, the author considers vertical integration as economic, financial and organizational merger of business entities which were previously independent and participated in different processing stages of manufacturing process in production, distribution and marketing of products with the purpose of obtaining additional competitive advantages in the market.

Currently, the main forms of vertically integrated structures are holding companies, strategic alliances, vertically integrated concerns, multinational corporations.

Vertically integrated processes in the economy can evolve in the following directions:

-

1) backward (reverse) integration – a business entity assumes or strengthens control over suppliers; this reduces the dependence of production activity on fluctuations of prices of component parts, on possible disruptions of supply, etc.;

-

2) forward (direct) integration – an association with subsequent processing stages of a value chain (consumers of manufactured goods). The company affiliates organizations performing marketing functions (transportation, logistics, service, sales).

Vertical integration can be complete (i.e., all goods manufactured at the first production stage come without sales or procurement) and partial (exists in cases where production stages do not have inner self-sufficiency) [10].

Activation of vertically integrated processes in developed countries is attributable to significant benefits from this kind of association, namely:

-

a) an increase in profits of an integrated system, production profitability due to reducing costs (the problem of “double marginalization”); increased possibilities of using flexible pricing;

-

b) decreased uncertainty in components parts supply, reduced risks of disruptions in their supply;

-

c) reduced transaction costs, minimized risks of opportunistic behavior;

-

d) diversification of production allowing to reduce overall management risks;

-

e) a significant number of other side effects (additional information, optimization of tax burden, etc.).

In order to carry out objective analysis and assessment of the degree of vertical integration of the economy in general and of individual businesses in particular, it is necessary to determine its measurement criteria. In the author’s opinion, the most reasonable, universal approach to the assessment of the degree of vertical integration of the economy, which can be easily put into practice after making the calculations, was developed by S.S. Gubanov in his research. To do this, he used the value added multiplier [4, 6].

In our studies [11], this methodological technique was adapted to the level of economic entities; the value added multiplier is considered as a ratio of aggregate mass of commodities produced by an enterprise and the cost of primary raw material resources introduced into commerce:

VA i =

MCi P i ,

where VAi – value added multiplier of the i -th economic entity;

MCi – aggregate mass of commodities produced by the i -th enterprise (proceeds of sale to third party of products manufactured by an economic entity at all stages of its processing chain);

Pi – cost of primary raw material resources introduced into commerce of the i -th enterprise (cost of raw materials, materials, components which are used as primary resources in production at the first stage of a chain).

The higher the value of the value added multiplier, the more stages of a processing chain and treatment stages the product passes before it is transformed into a final product. Accordingly, the multiplier value for companies manufacturing high value-added products within a unified technological process is significantly higher than for disintegrated entities [11].

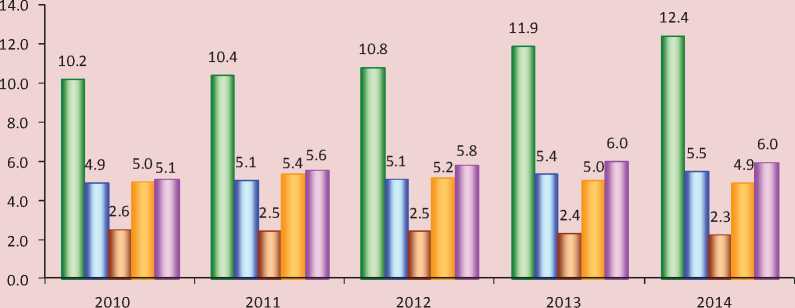

This technique was tested during analyzing the activities of the largest foreign and domestic integrated companies in various economic sectors. For this purpose, financial statements over the past few years have been analyzed. The calculated value added multipliers of foreign VISs are presented in Figure 1 .

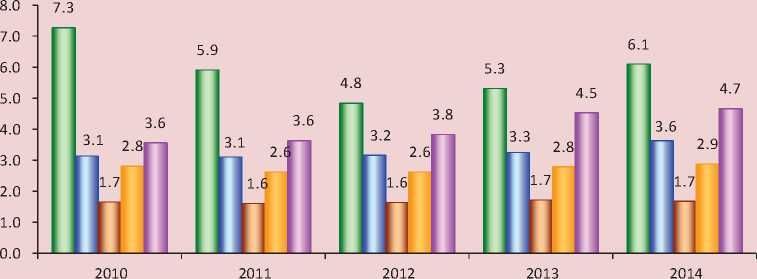

For analysis of the current situation in the Russian economy major domestic VISs were chosen: in the chemical industry – PhosAgro PJSC, in the petrochemical industry – LUKOIL PJSC, in the agroindustrial industry – Miratorg agroindustrial holding company, in mechanical engineering – KamAZ OJSC, in the pulp and paper industry – Arkhangelsk pulp and paper mill PJSC. The dynamics of the calculated value added multiplier of these companies in 2010–2014 is shown in Figure 2.

It should be noted that the values of value added multiplier of LUKOIL PJSC in 2010–2014 are lower than those of many foreign competitors (for example, they exceed 10 in Sinopec, in BP plc. – 6, in Royal Dutch Shell – 5), which in the long-term may become a factor limiting the company’s competitiveness in global markets of energy, and most importantly, petrochemical products. At the same time, over a longer period a decrease in values

Figure 1. Value added multipliers of the largest foreign vertically integrated companies

Sinopec Corp. Royal Dutch Shell Daimler AG BASF SocietasEuropaea BP plc.

Source: Kozhevnikov S.A. Formirovanie tekhnologicheskikh tsepochek dobavlennoi stoimosti v forme vertikal’noi integratsii [Developing technology value chains in the form of form of vertical integration]. Voprosy territorial’nogo razvitiya [Territorial development issues], 2016, no. 3. Available at:

Figure 2. Value added multipliers of the largest domestic vertically integrated companies

□ PhosAgro PJSC □ LUKOIL PJSC

□ KamAZ OJSC □ Arkhangelsk pulp and paper mill PJSC

□ Miratorg agro-industrial holding company

Source: Kozhevnikov S. A. Formirovanie tekhnologicheskikh tsepochek dobavlennoi stoimosti v forme vertikal’noi integratsii [Developing technology value chains in the form of form of vertical integration]. Voprosy territorial’’nogo razvitiya [Territorial development issues], 2016, no. 3. Available at:

of this indicator is observed: from 5.06 in 1999 to 3.6 in 2014. The reasons for this may be some business transformations of a company, an increase in the number of first- and second-processed products in the total volume of the company’s production and the decline in the share of deep processing products.

Relatively low values of the multiplier in KAMAZ OJSC compared to similar foreign companies (e.g., Daimler – 2.0 – 2.5) may indicate the potential for further formation of a unified processing production chain to fully provide the company’s activities with high-quality materials and components, as well as to ensure the company’s own production. It is the formation of a full-cycle vertically integrated system that will help, in the author’s opinion, increase the company’s competitiveness by optimizing production costs.

Further production development and output of higher-processed products, i.e., implementation of forward integration (production of coated paper and other products with high value added) will contribute to the competitive recovery of Arkhangelsk pulp and paper mill PJSC [11].

In general, it should be noted that the value of value added multiplier in the Russian economy is lower than that of developed countries. According to the calculations of S.S. Gubanov and other researchers, this value in our country is about 1.3–1.5 units, in the US – 12.8, in other developed countries – 11–13 units [6, 27].

As judged by these data, the main processing chains in the Russian economy are currently destroyed; the economy is based on a large number of fragmented business entities manufacturing only fewprocessing-stage products within one enterprise. The output of Russian high-tech high value-added products is limited, they are not competitive in world markets compared to the products of major multinational corporations which produce similar products [10, 11].

That is why it is necessary for federal and regional authorities to provide transformational changes of the economy by eliminating its disintegration and restoring processing value added chains in priority economic sectors, as only in this case it will be possible to retool domestic industry and accomplish its neoindustrialization through innovation. In this regard, it is necessary to form and develop vertically integrated systems in priority economic sectors. Concerning VIS, appropriate regulatory framework governing the relations between the authorities, budget system, etc. should be adopted.

In economic science and regulatory legal acts there is a number of different conceptual approaches and methodological techniques for assessing the effectiveness of vertical integration (e.g., approaches based on the transaction cost theory; provision of competitive advantages and the financial management theory; calculation of the value added multiplier of VIS; Altman Z-score, etc.). The development of a unified methodology is complicated by the peculiarities of formation and functioning of the systems under review [13, 14, 15, 16, 18, 21].

Their formation and development requires certain objective preconditions. Therefore, the establishment of VIS should be preceded by analysis of potential effectiveness of integration in the industry and determination of the enterprises most preferred for inclusion into the structure. This raises the need to explore the potential stability of cooperative relations between integrated enterprises, market concentration in the industry, the possible extent of increase of the enterprise’s role in the market, etc.

The author assesses the relevance and effectiveness of vertical integration using the techniques mentioned above, using the example of two major joint-stock companies which operated in 2015. One of them, conditionally, is Steel Manufacture PJSC and the other – Mashinostroitel Corporation JSC. These enterprises are at different stages of a unified processing chain from extraction and processing of raw materials to manufacturing of modern engineering products.

The manufacturing process of Steel Manufacture PJSC combines two technological processing stages: primary technological processing includes the extraction and primary processing of natural raw materials (extraction of jaspilite and hard coking coal; manufacturing of iron ore pellets, iron-ore concentrate; coking and thermal coal); secondary technological processing – final product manufacturing from these raw materials: rolled steel, long steel, large-diameter pipes and metal products, weatherresistant automobile parts, materials for mechanical engineering, etc. The customers of Steel Manufacture PJSC in the domestic market are construction companies, tube manufacturing plants, machine-building companies and car manufacturers.

In its turn, Mashinostroitel Corporation JSC, being one of the largest companies in the sector, manufactures engineering products (3rd technological processing) , including modern weapons, and uses the raw materials necessary for this purpose.

However, the company does not have its own production sufficient to provide the manufacturing process with components and other units for engineering products assembly.

Thus, the companies under review have the prerequisites for building cooperation ties. The degree of potential participation of Steel Manufacture PJSC in a unified technological process is very significant: 55% of the total output of the corporation are high value-added produc ts, which will be in demand in mechanical engineering. Therefore, the values of this indicator demonstrate high potential for this association. Current Steel Manufacture PJSC production capacity can fully cover the needs of Mashinostroitel Corporation JSC for metals and components.

Preliminary calculations of integration effectiveness can be done using the Altman Z-score describing financial sustainability of individual enterprises before the merger and the sustainability of an integrated company after the merger.

In general, the Altman Z-score is as follows:

Z = 1.2 X X 1 + 1.4 X X2 + 3.3 X X3 +

+ 0,6 x X 4 + 1,0 x X 5 , (2)

where X1 – ratio of working capital (current assets minus current (short-term) liabilities) to total assets;

-

X2 – ratio of retained earnings (accumulated net income of the corporation that is retained at the end of the reporting period) to total assets;

-

X3 – ratio of earnings before interest and taxes to total assets;

-

X4 – ratio of market value of equity to total liabilities;

-

X5 – ratio sales to total assets.

As a result of calculating the Altman Z-score for a particular company it has been concluded that:

if Z < 1.81 – the likelihood of bankruptcy ranges from 80 to 100%;

if Z = 1.81-2.77 – the likelihood of a company’s bankruptcy is average (35 to 50%);

if Z = 2.77-2.99 – the likelihood of bankruptcy is small (15 to 20%);

if Z > 2.99 – the situation at the enterprise is stable, insolvency risks in the next two years are extremely low.

The forecast precision of this score in a one-year period is 95%, in a two-year period – 83%, which is its definite advantage.

The comparison of the Z-scores before and after the enterprises’ merger helps make a conclusion about the effectiveness of establishing a vertically integrated company. If after the merger the Z-score is increased compared to the Z-score before the merger, it is obvious that the integrated company has greater financial sustainability than individual companies.

The coefficient values for each individual company and for the designed integrated system, which is formed as a result of merging Steel Manufacture PJSC and Mashinostroitel Corporation JSC, are presented in the Table . According to the data in the table, the Z-score of a vertically integrated system after merger is 2.811, i.e. the likelihood of bankruptcy is low – 15–20%. It should be noted that the integration will help increase financial sustainability of the second segment of the system – machine building, but extraction of mineral and metal products manufacturing will slightly decrease their financial sustainability. In this regard, the priority objective at the first stage of formation of a new vertically integrated system is achieving the company’s financial sustainability and cash flow management within the company.

The company’s long-term sustainability and ability to further develop is evidenced by the values of the calculated value added multiplier. The calculation was based on the following assumptions: Mashinostroitel Corporation JSC production capacity is defined as corresponding to the current level. Therefore, the amount of raw materials produced by Mashinostroitel Corporation JSC and used at this stage

Z-scores of Steel Manufacture PJSC, Mashinostroitel Corporation JSC in 2015 and the designed unified integrated company

|

Financial indicators |

Before merger |

After merger into an integrated company* |

|

|

CD c co CO “3 "aS CD CO |

2 "Z w о E 2 x= о CO ~ О |

||

|

Х 1 |

0.422 |

0.068 |

0.167 |

|

Х 2 |

0.419 |

1.969 |

0.801 |

|

Х 3 |

0.825 |

0.129 |

0.155 |

|

Х 4 |

0.376 |

0.101 |

0.381 |

|

Х 5 |

1.090 |

0.338 |

0.750 |

|

Z before merger |

3.132 |

2.605 |

- |

|

Z1 after merger |

- |

- |

2.811 |

* Coefficients values of a new integrated system were calculated in current US dollars at the time of merger (average figure was used – 65 rubles to 1 US dollar).

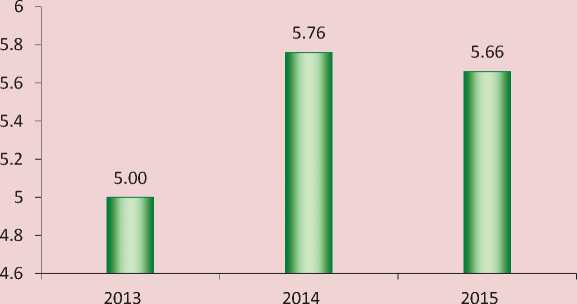

of the processing chain was also adjusted to these needs. Finally, the revenue received by the second segment was not adjusted on the basis of transfer pricing application within the units of the new integrated system because of the inability to determine their reasonable level. It is noteworthy that the values of the value added multiplier of the newly established VIS shown in Figure 3 are higher than the sum of the multiplier values for the VIS segments. For example, in 2015, the value of this indicator for Steel Manufacture PJSC equaled 2.56, for Mashinostroitel Corporation JSC – 2.22 (their total – 4.78), whereas the value for the newly formed company amounted to 5.66. This reflects the synergy effect typical for such systems.

Moreover, the practical application of transfer pricing, the increase in production capacities of the enterprises of the third technological processing will ensure higher values of the value added multiplier.

What does it denote? First, the fact that the company manufactured high value-added products; improves profitability by optimizing production costs; the enterprise is given an opportunity to effectively deal with its rivals based on flexible pricing; additional income can be used in modernization, adoption of innovative technologies and further production development. Second, there is a number of other non-economic effects which help the company remain competitive and maintain its sustained growth in the long term.

Figure 3. Value added multiplier of a new VIS established on the basis of Steel Manufacture PJSC and Mashinostroitel Corporation JSC

Source: calculated by the author.

Thus, the establishment of unified processing chains in the form of vertical integration will provide an opportunity to consolidate and rationalize the use of resources to address critical issues and ensure sustainable economic development of the country.

However, the establishment and development of vertically integrated companies implies the need to develop appropriate public policy which would encourage businesses to participate in the integration processes by means of incentive measures.

The main methods of establishing integrated systems identified on the basis of research of foreign experience (France, Italy, Germany, the USA, the UK,

China, Japan, South Korea) include the state’s buy-out of a controlling interest in the enterprises, financial techniques (state banks control enterprises through financial mechanisms and stimulate their association), government regulation (integration of industries and enterprises into special interest groups), stringent government competition regulation (forcing companies to merge or leave the market), etc.

In other words, the process of VIS establishment and development should be accompanied by the support of authorities (primarily federal and regional) aimed at creating favorable conditions for increasing resource use efficiency of business entities. However, it should be noted that Russia does not currently have the public policy which would promote active integration development.

In the author’s opinion, government support should include informational and institutional control methods and resource-related measures of both indirect (tax incentives) and direct impact (easy-term loans, government financing of efficient and fast-payback investment projects, etc.).

The measures of economic impact stimulating businesses to merge in the framework of VIS may include:

-

1. Fiscal policy tools : subsidies from regional budget for partial compensation of loan interest rates; budget loans for business entities and direct state investment in the development of production (including in the form of public-private partnerships); provision of state guarantees; promotion of VIS development on a cost sharing basis with other participants.

-

2. Investment policy tools : investment tax credits; restructuring of economic entities’ accounts payables due to budgets of all levels.

-

3. Tax policy tools : updating tax legislation of the territory the VIS is located; provision of tax incentives (partial or full tax exemption, lowered tax rates, etc.).

When establishing VISs, it is reasonable to involve in management and control both public authorities and coordinating and advisory bodies. Their involvement is required not only at the stage of research and design, but also at the stage of establishment.

In general, integration process management implies extensive use of methods and forms of program-based targeted management, which means that all the subjects involved in the VIS establishment are treated as a single structure with common operating functions.

Thus, the results of the research indicate that one of the key conditions for the modernization and neo-industrialization of the domestic economy, transformation of Russia into an industrialized country is overcoming technological dispersion of economic entities on the basis of vertical integration. This is confirmed by analysis of functioning of the largest foreign VISs which are the economic growth drivers of developed countries. The analysis is based on the use of methodological techniques described in the paper.

The research of domestic companies’ activities has revealed that most of the, are characterized by a sub-optimal level of technological integration. The example of integration of metallurgical and mechanic engineering enterprises shows that there are still many positive internal and external impacts of such association. However, the intensification of these processes implies the need to develop a state policy that would encourage businesses to participate in the integration processes. The article justifies the conceptual framework of the policy.

Список литературы Management of vertically integrated systems formation and development in the Russian economy

- Aushev M. Vertikal'naya integratsiya v zarubezhnoi neftyanoi promyshlennosti . MEiMO , 1995, no. 11.

- Vertikal'naya integratsiya: chemu uchit opyt . Available at: http://finance.obozrevatel.com/business-and-finance/vertikalnaya-integratsiya-chemu-uchit-opyit.htm.

- Gubanov S. Glavy goskompanii: s chem svyazat' ikh voznagrazhdenie? (Opyt politekonomicheskogo analiza) . Ekonomist , 2016, no. 4, pp. 3-4.

- Gubanov S. Neoindustrializatsiya plyus vertikal'naya integratsiya (o formule razvitiya Rossii) . Ekonomist , 2008, no. 9, pp. 3-27.

- Gubanov S. Neoindustrializatsiya Rossii i nishcheta ee sabotazhnoi kritiki . Ekonomist , 2014, no. 4, pp. 3-32.

- Gubanov S.S. Derzhavnyi proryv. Neoindustrializatsiya Rossii i vertikal'naya integratsiya (Seriya «Sverkhderzhava») . Moscow: Knizhnyi mir, 2012. 224 p.

- Ivanova V.O. Osobennosti menedzhmenta vertikal'no-integrirovannoi kompanii . Rossiiskoe predprinimatel'stvo , 2011, no. 11, issue 2 (196), pp. 55-60.

- Ilyin V.A., Povarova A.I., Sychev M.F. Vliyanie interesov sobstvennikov metallurgicheskikh korporatsii na sotsial'no-ekonomicheskoe razvitie: preprint . Vologda: ISERT RAN, 2012. 104 p.

- Kasatkina A.A., Kasatkina A.S. Transnatsional'nye korporatsii: sovremennyi ekonomiko-pravovoi analiz . Zakonodatel'stvo i ekonomika , 2013, no. 9. Available at: http://www.lawecon.ru/zakonodatelstvo/articles/49/913/.

- Kozhevnikov S.A. Institutsional'nye i ekonomicheskie osnovy vertikal'noi integratsii . Problemy razvitiya territorii , 2015, no. 4, pp. 142-156.

- Kozhevnikov S.A. Formirovanie tekhnologicheskikh tsepochek dobavlennoi stoimosti v forme vertikal'noi integratsii . Voprosy territorial'nogo razvitiya , 2016, no. 3. Available at: http://vtr.vscc.ac.ru/article/1885.

- Gushchin V.V., Poroshkina Yu.O., Serdyuk E.B. Korporativnoe pravo: uchebnik dlya yuridicheskikh vuzov . Moscow: Eksmo, 2006. 640 p.

- Kokhno A.P. Metody analiza i otsenki effektivnosti integrirovannykh struktur . "Akademiya Trinitarizma" . Moscow, no. 77-6567, issue 16947, 07.11.2011.

- Lapkin R.M. Instrumentarii formirovaniya i razvitiya vertikal'no integrirovannoi predprinimatel'skoi struktury . Sotsial'no-ekonomicheskie yavleniya i protsessy , 2012, no. 5-6 (39-40), pp. 76-84.

- Molokhovich M.V. Metodicheskie podkhody k otsenke effektivnosti sozdaniya korporativnykh struktur v ovoshchnom podkomplekse APK (ch. 2) . Ekonomika i upravlenie , 2011, no. 4, pp. 109-114.

- Neprintseva E.V., Shubin S.A. Osobennosti otsenki effektivnosti vertikal'no integrirovannykh struktur . Regional'naya ekonomika: teoriya i praktika , 2007, no. 12(51), pp. 76-83.

- Ovchinnikov V.N., Kolesnikov Yu.S., Ketova N.P. Modernizatsiya prostranstvennoi organizatsii ekonomiki rossiiskikh regionov: uchebnoe posobie . Rostov-on-Don: Sodeistvie-XXI vek, 2014. 100 p.

- Pungina V.S., Rozhkova T.A. Otsenka ekonomicheskoi effektivnosti i investitsionnoi privlekatel'nosti vertikal'no-integrirovannykh struktur , 2009, no. 4, pp. 48-58.

- Sokolov Yu. Integratsiya kak uslovie vosproizvodstva promyshlennogo kapitala . Ekonomist , 2006, no. 5, pp. 21-28.

- Spitsyn A. Integratsiya i modernizatsiya ekonomiki . Ekonomist , 2006, no. 5, pp. 3-9.

- Gal'perin S.B. (Ed.), Dorodneva M.V., Mishin Yu.V., Pukhova E.V. Ekonomicheskoe obosnovanie i otsenka effektivnosti proektov sozdaniya korporativnykh struktur . Moscow: Novyi vek, Institut mikroekonomiki, 2001. 51 p.

- Yakutin Yu. Eshche raz k analizu effektivnosti stanovyashchikhsya rossiiskikh korporatsii . Rossiiskii ekonomicheskii zhurnal , 1998, no. 9-10.

- Adelman M. Integration and the antitrust laws. Harvard Law Review, 1949, volume 63, no. 1, pp. 27-77.

- Coase R.H. The nature of the firm. Economica. New Series, 1937, volume 4, no. 16, pp. 386-405.

- Fisher L. Verticale Integration in der nordamerikanishen Landwirtshaft, Berichte iiber Landwirtshaft. Berlin, 1960. 337 p.

- Grossman S., Hart O. The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration. Journal of Polit. Econ, 1986, volume 94, pp. 691-719.

- Input-Output Accounts Data. Bureau of Economic Analysis. Available at: http//bea.gov/industry/io_annual. htm

- Harrigan K.R. Vertical Integration and corporate strategy. The Academy of Management Journal, 1985, volume 28, no. 2, pp. 397-425.

- Hart O., Moore J. Property Right and the Nature of the Firm. Journal of Polit, 1990.

- Miller G. Die landwirtshaftliche Erzeugung in der Vertikalen Integration, Berichte iiber Landwirtshaft. Berlin, 1961. 414 p.

- Spengler J. Vertical Integration and Antitrust Policy. Journal of Political Ekonomy, 1950, volume 58, pp. 347-352.

- Williamson O. Markets and Hierarchies: Analysis and Antitrust Implications. New York: Free Press, 1975.