Measuring investment risk and reducing it by diversification

Бесплатный доступ

Investing is an unavoidable segment of any business activity. Investment decisions are associated with a certain amount of risk. Risk is a state in which there is a possibility of negative deviation from the desired outcome that we expect and hope for. The sensitivity of investments to certain types of risk depends on the specifics of the investment process, environment, type and size of risk. Higher exposure to risk factors results in higher expected returns. Measuring investment risk and reducing it by the method of diversification is the topic of this paper.

Investments, risk, risk management, diversification, rate of return, beta coefficient

Короткий адрес: https://sciup.org/170204033

IDR: 170204033 | DOI: 10.5937/ekonsig2201039D

Текст научной статьи Measuring investment risk and reducing it by diversification

Investment activity as a process is designed and targeted business activity towards choosing an investment alternative that will maximize yield on invested assets for its ultimate goal.

One of the main characteristics of investing is the time in which this process takes place. The period of time between investments in the present and the effects expected in the future is very long and decisively affects the validity of the investment process.

Business decisions in today's highly turbulent environment occur in

conditions of uncertainty and risk. Therefore, each business activity is characterized by a certain level of risk which, to a greater or lesser extent, affects the effects of investing.

There is no investment that carries no small or greater risk. Therefore, it is important to note the factors affecting crisis states, to assess their impact on the flow and effects of investments.

The work points to possible directions and activities that can effectively maximize effects, reduce risk to the lowest possible extent, with the help of a systemic risk management approach.

1. Recognizing, )ssessing andManaging Investment Risk

Investments are investments that characterize the sub3ect of investment, investment price and risk. [Marić, 2013, 9] Investing is currently entrusting money or other resources with the expectation of future benefits. [Bodie et al., 2008, 2] Every investment decision is made with a certain amount of risk. Risk, its size and origin, is one of the key issues in making any investment decision.

Risk is the possibility of a situation that may adversely affect the business process. In traditional Chinese significance, risk is an ambiguous symbol: "danger" and "opportunity", making the risk a mixture of danger and opportunity. [Damodaran, 2011, 58]

Risk, unlike uncertainty, is a measurable category for an investor. The relationship to risk can be classified into the following categories of behavior: aversion to risk, risk seeking and neutrality according to risk. Most investors have an aversion to risk, so the investment decision is only prepared by investors assuming the demanded rate of yield, which includes itself and the risk-taking fee. It should be noted that some investors in some situations are willing to take risks - and others are not. [Shard et al., 1999, 122]

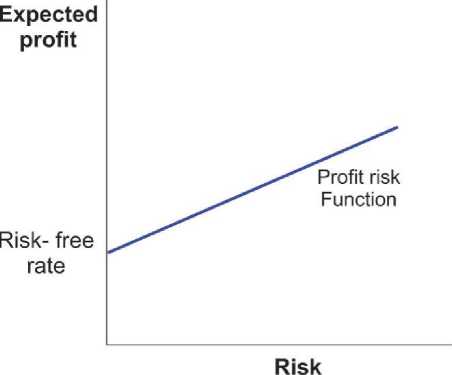

The concept of relationships and functional dependencies between risk and profit is a fundamental sub3ect of the company's finances. )ll financial decisions involve some kind of risk-profit relationship. The higher the risk, the higher the expected profit, and vice versa. )ppropriate assessments and balance of different possible levels and ratios of risk and profit are part of creating a good financial or investment plan for the company. Figure 1shows the risk-profit ratio.

The rate of risk is precisely the kind of rate achieved on the basis of low and/or almost entirely riskless state securities.

Picture No.1. Risk J Profit Ratio

In the case of inventory investment, investorsdemand higher earnings than they would earn from holding so-called speculative stocks. It's compensation, a kind of compensation for a higher level of risk taken. In the event that modern methods of working capital management are applied, the less inventory to hold is the higher theexpected earnings (less working capital is tied).

Investment risk management consists of precisely arranged steps that contribute to better insight into the risks and their potential consequences. It takes place in five ways:

1. Risk avoidance,

2. Risk reduction (hedging 3obs),

3. Risk overeating (but also responsibility),

4. Risk )ssociation (damage dispersion) and

5. Risk transfer (risk is passed on to others).

2. Expected Risk and Profit from Investment

Risk management is an investment recognition and assessment for rational use of all resources in order to minimize the undesirable effects of risk. Risk is a measure of the 3ustification of an investment. Risk management has special methods and strategies.

Investment risk management is needed to achieve the best ratio of potential gain and risk taken.

The investor chooses the option of investing based on his sub3ective position on the most acceptable relationship between risk and profit. [Karić, 1995, 91]

The yield (return) from investing in some investments represents all cash payments received on the basis of ownership and changes in the market price, expressed as a percentage of the market price of the investment.

The yield rate is a relative measure of investment yields. The minimum acceptable rate of yield is determined by the estimated capital expenditures. Risk and yield are, as a rule, positively correlated because the market imposes a high capital price on pro3ects deemed risky. Mortgage-backed securities and interest rates on loans are measures of investment risk. [Damodaran, 2011, 59].

It is impossible to predict with certainty the result of any financial or investment decision. Every decision poses a certain risk. Each particular set, the risk group withdraws or has associated, inherent character- istics of the rate of return, i.e. profitability.

)ll important financial decisions must be considered in terms of expected profit and expected risk, as well as their combined influence on the company's market value.

Profit is a key concept in financial and investor decisions. Simply, profit is a reward for investment. The profit from the investment consists of the following sources:

-

a) Recurring cash payments-inflows, called current income.

-

b) Growth (or decline) of the market price of shares, called capital gains (or losses).

Current income, obtained periodically, can be interest, dividend or rent. Capital gains or losses represent a change in the market price of the sub3ect securities. Capitalbased profit is the amount for which the proceeds from the sale of the financial investment listed on the stock exchange exceed the purchase price (cost price) of the securities in the concerned. The loss of capital is the amount for which the market price is less than the purchase price. How the profit on the investment is measured depends primarily on how the observed period during which the investment is held in its possession-portfolio. The expression of return during the period of holding the securities as a financial instrument refers to the total earn- ings derived from the holding and disposal of the sub3ect investment during the period selected.

HpR Current income + capital gain (or loss') Market price

Example:

Let’s look at the investment in shares ) and B during one year of ownership

Table no. 1. Investing in stocks

|

)CTION |

||

|

) |

B |

|

|

Purchase price (at the beginning of the year) |

105 |

105 |

|

Dividend received (during the year) |

15 |

30 |

|

Sales price (end of year) |

120 |

100 |

The current income from investments in shares ) and B during the one-year period is RSD 15 and 30, respectfully. For shares ), capital gain is 15 dinars (120 dinars of sale price - 105 dinars of purchase price). For Shares B, the loss of capital is 5 dinars (100 dinars of sale price - 105 dinars of purchase price).

Combining the profit (or loss) of capital with current income, all for

Table no. 2. Earnings from investing in stocks

|

)CTION |

||

|

) |

B |

|

|

Dividend |

15 |

30 |

|

Gain (loss) of capital |

15 |

(5) |

|

Full-year earnings |

30 |

25 |

The profit on these investments is:

|

15 + (120 - 105) HPR (action Л)= 100 = |

15 + 15 30 = 100 = 100 = 30% |

HPR (action B) =

30 + (100 - 105) 30-5 25

100 100

= 25%

3. Sensitivity of Changes in 0ield on Investments Relative to Market 0ields

) relative risk measure that demonstrates the sensitivity of changes in yield on investments relative to the change in market portfolio yield is beta. It's a relative coinance, a benchmark for the market index.

Beta coefficient is a measure of the change in investment yield relative to the market average. It refers to a change in the investment of average risk in a particular market. It is used as a measure of the sensitivity of yields to corresponding changes in market yields.

Typically, general market risk is measured by beta coefficient, which can therefore be called beta risk. [Brighan, 1989, 410.]

The beta ratio for a particular intended investment measures its contribution to the risk of an investment portfolio. Therefore, beta coefficient is a suitable measure of risk and criteria for decisionmaking in terms of diversified investments. [Karić, 1995, 92]

Beta is calculated by comparing the daily percentage changes in the value of certain securities to changes in the market on the same day.

There is a link between the expected (or requested) profit from the shares and the corresponding beta factor. The following formula is very helpful in determining the expected profit of the shares.

-

r 3 =r f + b (r m J r f )

or in words:

Expectedprofit = Risk-Free Rate + Beta (Market Risk )ward) where is:

-

r 3 = expected (or requested)profit in security

-

r f = risk-free rate on securities

-

r m = expectedprofit based on holding marketportfolio

-

b = beta, indicator ofsystematic risk

The Market Risk Reward (rm - rf), which equalsthe difference between expected profits (rm) and risk-free rates (rf), represents additional pro- fits through which it would receive (absolutely) a safe investment (for example in government bonds) i.e. compensation for accepting existing risk, measured by the beta factor. Therefore, the formula indicates that the expected profit sustained in the given security will be equal to the profit sustained in investments without the risk increased for the accepted risk reward.

Example:

)ssume

-

r f = 5%, a r m = 12%.

If the stock has a b = 2,0 then it is

The idea behind this formula is that the relevant risk measure is precisely a beta factor as a factor in individual safety concerns. The higher the beta for certain certainty, the higher the expected profit of investors.

-

r 3 =r f + b (r m + r f )

5% + 2,0 (12%-5%) = 5%+14%=19%

This means that an additional 14% of income can be expected (or required) as a reward for risk in these stocks on top of the 5% profit risk. That's why the expected profit on the stock should be 19%.

The higher the beta, the greater the overall risk of real investment. 0ields on equity of 1 are rising and falling in the same percentage as the market share. Beta is 1 when there is a complete correlation between pro3ect yield and average market yield. In this case, the risk of a particular investment is equal to the risk of a market portfolio. On the contrary, if beta has a value of 0 then there is no correlation between pro3ect yield and market yield.

If an investment has a beta 0 then that means it is not exposed to any systemic risk. If pro3ects have beta greater than 1, then they are offensive investments that are exposed to a greater risk than the market portfolio. In contrast, a pro3ect with a beta ratio of less than no.1 is at lower risk of market risk (defensive investment). [Karić, 1995, 95]

The beta coefficient measures daily percentage changes in the stock value. For example, for the market as a whole, the beta coefficient value is equal to 1, so beta for certain shares is compared to the beta on the market, i.e. the stock index, thus determining the fluctuation of the stock price.

Stock yields, which have beta 2, are twice as variable as market yields measured by some of the stock indexes. For example, if the market's yield surges by 5% you can expect the stock to rise by 10%. However, if there is a 5% drop in the market's yield, the yield on the shares will fall by 10%. [Karić, 1995, 96]

Shares with beta less than 1 per cent are trading at an average of less than any change in the market, and for high beta values, it's the other way around.

The beta coefficient is not a guarantee, because it is based on historical data. )doption of beta for a certain level of risk means that risk assessment is conducted in the context of a particular investment decision and market.

4. Method of Risk -alueInvestment

-)R is defined as the maximum level of loss during a given period of time in market conditions of operations. It provides its users with an insight into the overall risk measure sought by their activity.

The most important task of -aR technology is to set a -aR limit -that is, a value risk that must not be exceeded. There are three methods for calculating -aR: [-u3nović, 2007, 31]

-

1 . Parameter -aR (easily calculated but inaccurate),

-

2 . Historical simulation and

-

3 . Monte Carlo simulation (greater possibility for calculation).

-)R as a statistical risk measure evaluates how much money can be lost on an investment portfolio over a certain period of time.

The characteristics of -aR technology are:

-

- It's using the historical distribution according to market prices,

-

- Using manageable methods,

-

- Benefits of risk factors.

-aR deficiencies are as follows:

-

- With brokers, there is an intensity to invest in financial instruments that show a small amount of -)R, when in fact, they are entering risky assets, because -)R does not show precisely what the level of risk is,

-

- The -)R method is fairly inaccurate and unreliable,

-

- It applies to all levels of risk but with the condition of setting a limit in order for the results to be adequate,

-aR is combined with other methods in today's conditions to obtain adequate risk management instruments.

-

5. Reduction of Risk by Establishing an Investment Portfolio with a Diversification Strategy

One way to reduce investment risk is to diversify investments. [L3utić & Zotović, 1995, 114] Diversification is a term that indicates the formation of portfolios from different assets and instruments, each carrying a certain yield and certain risk. The yield is determined by the rate of yield, the rate of change or return, and in the risk, the measure is the deviation of the rate of yield.

The goal of each management is to achieve the highest rate of yield with the given risk, to find such a portfolio, which carries the lowest risk. )n investor must form such a portfolio whose yields create positive corrals. The weaker the correlation of yields in the portfolio, the more likely it is that some of the risk sustained by a particular investment will always be covered within the portfolio. The unexpectedly low yield sustained from an investment will be covered by a partially high yield of one or more other investments in the portfolio.

Diversification does not always reduce investment risk because the risk of a portfolio depends on the correlation of the yield of the selected investment. In this case, each individual capital owner can diversify their total investments. Instead of investing total capital in an enterprise, an investor can diversify by forming an investment portfolio.

Diversification incorporates new business activities into the business program. Each investor tries to reduce the risk through a suitable portfolio of investments. Because of the risk aversion, the investor would rather form an investment portfolio because it is more favourable for him. The portfolio forms different forms of capital placement. )s sources of portfolio, they can be passive and active investments. While passive investments are reduced to buying stocks, bonds and other securities, active investments are primarily related to real estate purchases. For active investments, it is about investing in risky pro3ects, where investors decide on the ultimate use of capital. [Nickels, 2018, 606]

Diffusion is an investment strategy aimed at reducing investment uncertainty while retaining expected yields. )chieving yield is the main driver of investment activity, and maximizing it, at the given level of risk, is the main goal of each investor.

Diversification is an investment strategy implemented with the aim of reducing the overall variance of portfolia with unchanged expected yields. The simplest way to reduce portfolio risk is to redirect part of your happiness into riskless active. However, this results in a reduction in portfolio risk.

In order to reduce the variance of the portfolio, it is not enough to invest in a large number of securities, but to avoid investing in securities with each other high covariance. [Markowitz, 1952, 77 - 91]

The number of securities within the portfolio required to achieve satisfactory diversification effects depends on the correlation between securities yields. ) positive correlation implies a larger and negative less required number of securities within a diversified portfolio. Too few securities within the portfolio result in potentially high non-systemic risk, while too many securities cause high transaction costs that arise when creating such a portfolio. [Leković, 2018, 184]

Conclusion

)ssessing the effects of investing has great significance when making an investment decision. Management is responsible for identifying investment risk and its potential impact on the business of businesses.

Risk management enables the investor to adapt in time to the impact of environmental factors, to come up with an appropriate strategy to respond effectively to these impacts. The goal of each investor is to maximize yield on invested funds, to achieve as much investment effect as possible in a shorter period of time.

The different types of investment risks that the company faces in its business, management can avoid, overvalue or minimize the risk of investing, all in order to increase the security of the business. Therefore, the task of risk management is to not only prevent risk, if it arises, but also take a number of measures and activities, as well as appropriate strategies to minimize their impact and therefore maximize the effects of investments.

)s for implementing appropriate risk reduction strategies, diversification is a very desirable - but not perfect - method. The benefits of diversifying with expected yield and reducing risk are evident. However, at a time when an investor needs risk protection the most, diversification does not yield the necessary results.

To overcome this, and to reduce the correlation, new assets such as precious metals, real estate, are inserted into the portfolio instead of securities. This is especially evident in times of crisis as optimal assets in the portfolio increase -and therefore portfolio management costs increase.

Список литературы Measuring investment risk and reducing it by diversification

- Arrow, K.J. (1965) Aspects of the theory of risk - bearing. Helsinki

- Bodie, Z., Kane, A., Marcus, A.J. (2008) Essential of investment. McGraw-Hill, 7th th ed

- Brighan, E.F. (1989) Fundamentals of financial management. Chicago: The Dryden Press, Fifth Edition

- Damodaran, A. (2011) Applied corporate finance. New York: John Wiley & Sons, Inc, Third Edition

- Dedović, M., Milačić, S. (2005) Finansijski menadžment. Leposavić: Visoka ekonomska škola strukovnih studija Peć u Leposaviću

- Dedović, N., Dedović, A. (2015) Upravljanje investicijama. Leposavić: Visoka ekonomska škola strukovnih studija Peć u Leposaviću

- Karić, M. (1995) Mjerenje rizika u uvjetima diversificiranih investicija. Ekonomski Vjesnik, br. 1, s. 91

- Leković, M. (2018) Diversifikacija kao investiciona strategija smanjenja rizika ulaganja. Ekonomski horizonti, vol. 20, br. 2, str. 173-187

- Ljutić, Z.B., Zotović, B.M. (1995) Dobit i rizik. Novac i razvoj, 21, s. 114

- Marić, B. (2013) Upravljanje investicijama. Fakultet tehničkih nauka, s. 9

- Markowitz, H.M. (1952) Portfolio selection. Journal of Finance, 7

- Nickels, G.W. (2018) Business times mirror. St. Louis - Toronto - Santa Clara: Mosby Publishing

- Sharpe, W.F., Alexander, G.J., Bailey, J.V. (1999) Investments. Englewood Cliffs, New Jersey: Prentice Hall

- Vujnović, M. (2007) VaR analiza kreditnog potencijala banaka. Zemun: Trag, s. 31