Methods of quantitative analysis and forecasting of financial risks in corporate governance

Автор: V.F. Smolyarchuk

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 5 (123), 2025 года.

Бесплатный доступ

The article explores modern methods of quantitative analysis and forecasting of financial risks in corporate governance. It describes key approaches such as Value-at-Risk, stress testing, and scenario analysis, along with their application in times of economic instability. The study focuses on mathematical models that allow more accurate forecasting of potential losses and enhance business resilience. Theoretical and methodological foundations, as well as practical aspects of integrating quantitative methods into strategic company planning, are discussed. Particular attention is given to the integration of quantitative risk assessment models into corporate decision support systems, enabling the development of adaptive management strategies based on predictive data.

Financial risks, forecasting, Value-at-Risk, stress testing, scenario analysis, mathematical modeling

Короткий адрес: https://sciup.org/170209253

IDR: 170209253 | DOI: 10.24412/2411-0450-2025-5-375-381

Текст научной статьи Methods of quantitative analysis and forecasting of financial risks in corporate governance

Under the conditions of modern economic volatility, corporate governance is faced with increased financial risk. Precarious macroeconomic tendencies call for the creation and implementation of the necessary means of risk prediction. The classic qualitative analysis methods are not sufficiently accurate and sensitive, so that quantitative methods have to be utilized. In the current work, modern quantitative approaches to financial risk assessment and prediction are considered, allowing not only the calculation of potential losses but also the use of the obtained information in the strategic management of the company.

The research goal is systematizing quantitative methods of analysis used in forecasting financial risk in corporate governance. Following the framework of the study, the theoretical and methodological grounds of simple methods of risk appraisal are examined, compared with one another, and efficient means of their application in different business contexts are established. In addition, the study quantifies the extent to which quantitative approaches help companies manage financial difficulties.

This article focuses on the study of classical and modern mathematical models applied in risk forecasting. Special emphasis is placed on methods such as Value-at-Risk (VaR), stress testing, and scenario analysis, which are widely used in corporate practice.

The scientific novelty of this paper lies in the identification of specific shortcomings of widely used risk assessment techniques (e.g., VaR, stress testing) during periods of macroeconomic turmoil and in the systematic proposal for their improvement by integrating adaptive models such as GARCH and certain machine learning methods. In contrast to previous research, this paper focuses on the conceptual shift from static to adaptive risk management systems and the importance of hybrid methodologies in fortifying strategic corporate decisions when there is uncertainty.

Theoretical foundations of financial risk assessment

One of the central elements of business sustainability control in modern corporate governance is financial risk management. Successful analysis of it is based on the use of mathematical and statistical methods, including economic theory, probabilistic methods, and optimal control techniques. The basis for these types of approaches emerged at the intersection of economic theory, probabilistic methods, and optimal control techniques. Particularly, the classical theory of portfolio investment by G. Markowitz was the basis for further quantitative risk analysis techniques development. Later, risk assessment models became extensively used in strategic planning of companies, due to the need to improve financial results predictability [1].

Modern techniques of forecasting are based on various theoretical concepts. One of them is the theory of random processes, which is used to explain time series of financial data. In particular, models such as autoregressive modeling conditional heteroscedasticity (GARCH) allow us to take into account volatility variability, which is crucial for the estimation of asset risk. Another significant approach is the use of stochastic optimization methods that allow us to take into account the uncertainty of future financial streams. In addition, machine learning (ML) algorithms capable of handling large amounts of data and identifying complex patterns in market trends have become increasingly relevant in recent years [2].

Methodological basis of quantitative risk analysis consists of the use of traditional statistical methods and higher-level mathematical modeling . The importance of quantitative methods stems from the ability of such methods to minimize subjectivity in managerial decisionmaking. In contrast to expert judgments, quantitative methods are based on standardized models, guaranteeing better forecasting accuracy and greater transparency for the process of risk management. In practice, the most effective approach is a mix of various methods, which allows you to take into account a wide range of possible risks and increase the credibility of forecasts.

Quantitative methods for financial risk assessment

Efficient corporate financial management requires the use of dependable and adaptive quantitative methods for assessing risk. The most widely used methods are VaR, stress tests, and scenario analysis. They all possess their own methodological features, advantages and disadvantages, which determines their applicability in different situations.

Method VaR is one of the fundamental quantitative risk analysis tools. It allows you to express the maximum potential losses of a financial asset or portfolio over a given time horizon at a set level of confidence probability. For example, if the 95%-VaR for a portfolio is 5 million units, then there is a 95% probability that losses will be no more than the stated amount within the stated horizon [3]. The most popular techniques of VaR calculation are the parametric method, the historical modeling method, and the Monte Carlo method. The first makes the assumption of normality in returns and thus is easy to apply but not as good in situations involving non-linear risk. Historical modeling is based on real observed changes in prices but does not predict extreme future events. The Monte Carlo method uses random price scenario generation to allow complex distributions but is computationally costly.

Stress testing differs from VaR as it focuses on the analysis of extreme events with potentially catastrophic effects to the financial health of the company. Stress testing allows you to predict likely losses as a result of unfavorable macroeconomic or market conditions, for example, a sudden increase in interest rates, currency devaluation, or cash crisis. One such instance is the case of studying the consequences of the 2008 global financial crisis in which huge financial institutions had underestimated the probability of a crisis within the system and had made enormous losses. The key challenge of stress testing is the choice of appropriate scenarios: they should not only look back at past crises but also to future possible new dangers, for instance, disruption due to new technology or geopolitical tensions.

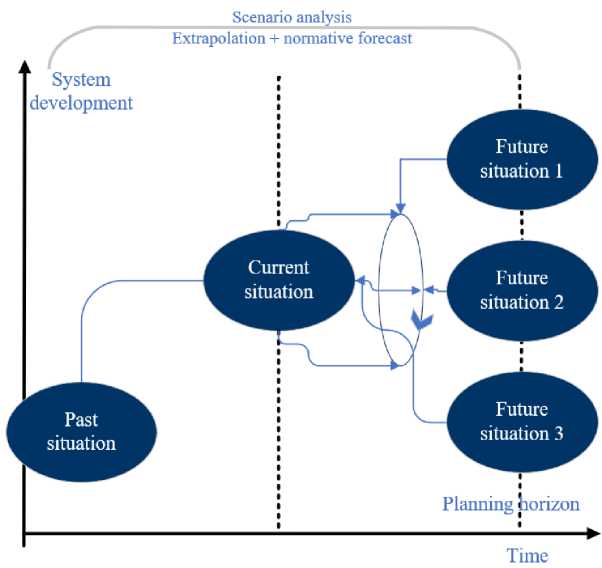

The third most crucial method is scenario analysis, in which various assumed future scenarios are constructed and evaluated for their impacts on the company's finances. Unlike stress testing, scenario analysis considers not only adverse, but also neutral or positive scenarios, thus making it a more general strategic planning tool (fig. 1).

For example, when evaluating an investment project, three scenarios can be considered: simple (normal growth in profit), optimistic (considerable excess of expected profitability), and pessimistic (considerable decrease in profitability). The main advantage of the method is flexibility in assumptions making, but at the same time, it is its disadvantage – subjectivity in the choice of parameters can reduce the accuracy of forecasts.

Figure 1. The method of scenario analysis the principle of operation [4]

Each of these methods individually is well-liked in financial practice today, their predictive potential constrained by their complex risk worlds. Hybridizing these methods takes each of the methods to an advanced level, for example, using scenario analysis together with Monte Carlo simulations as a way to include both structural assumptions and stochastic volatility. Furthermore, there is growing interest in dynamic scenario generation, where scenarios are updated in real time based on incoming financial and macroeconomic data through the use of machine learning algorithms. This allows the model to react to rapidly changing market conditions and reduces the lag between signal and response in risk management. The inclusion of such adaptive mechanisms within the standard risk assessment toolkit is a promising direction for increasing both robustness and strategic relevance of quantitative models.

Applying mathematical models to risk forecasting

Financial risk forecasting is the use of mathematical models to allow you to analyze time series, identify hidden dependencies, and estimate the probability of unfavorable events. One of the key areas is the use of stochastic processes, regression analysis and ML methods that allow for more accurate forecasting of market volatility and potential losses.

Among the best tools for quantitative analysis is GARCH. The model allows you to predict the volatility of assets, taking into account both historical data and random market fluctuations [5]. In contrast to linear models, GARCH takes into account the effect of uncertainty clustering, when times of high uncertainty are followed by spells of relative tranquility. For example, looking at the stock market, you can note that volatility becomes slow to revert to its typical level after heavy falls. Classic methods then lose their accuracy. GARCH models are applied in large quantities by financial institutions for the purpose of quantifying market risk and optimizing investment strategies.

Another important technique is principal component analysis (PCA), which is aimed at reducing the data dimension and identifying the most important factors that affect the risk level. PCA performs particularly well when working with complex financial portfolios with dozens or hundreds of assets. PCA allows you to identify the underlying drivers of volatility and focus on the most important variables, excluding unnecessary data. For example, in the case of foreign exchange market analysis, the PCA can provide that macroeconomic variables such as the level of inflation and interest rates play the most dominant role in determining the volatility of exchange rates, and secondary variables influence only minor fluctuations.

Techniques based on ML demonstrate high effectiveness in financial risk forecasting. For instance, neural networks can reveal complex nonlinear relationships between many market signals and predict crisis events well ahead of their actual occurrence [6]. An effective application is the use of recurrent neural networks (RNN) in time series analysis, where you can take into account short- and long-term tendencies. In the world of banking, such models are being used already to estimate the default probability of lenders, predict the behavior of the stock market and automated asset management.

Modern financial risk prediction techniques include not only the selection of the best individual model, but also their combined application, depending on the time series properties and structure of a company's assets. For instance, blending GARCH models with neural network methods allows describing the asset volatility based on historical data, and then adjusting short-term deviations using recent market indications. This integrated approach is particularly relevant under the conditions of heightened market volatility and can be effectively applied to managing currency risks for export firms or assessing the risk profile of investment portfolios during uncertain interest rate policies.

Besides, the use of PCA is found to be promising not only in factor selection, but also as a preprocessing technique for input variables for neural network models. Both stability and interpretability of forecasting results can be enhanced in corporate risk management applications in this manner. Thus, the integration of mathematical modeling techniques and intelligent data analysis assists in developing more accurate and adaptive forecasting systems, substantiating the practical applicability of the quantitative approach to financial risk management.

Applying the results of quantitative analysis in strategic planning

Wise strategic planning must engage quantitative risk analysis tools in the decision-making process of management. Using such tools allows companies to adjust their financial strategy according to changing conditions in the market, reduce likely losses, and increase business viability. Implementing risk forecast models is particularly relevant in a period of economic uncertainty at a global scale when traditional assessment methods are less reliable (table 1).

Table 1. Financial risk assessment using quantitative methods [7-8]

|

Analysis method |

Application |

Expected results |

Advantages |

Limitations |

|

|

Neural networks |

Identifying patterns in financial data to predict market fluctuations and corporate risks. |

High accuracy in predicting financial trends and anomalies. |

Accounts for a large number of factors and nonlinear dependencies. |

High computational resources required; potential overfitting. |

|

|

Logistic regression |

Evaluating the probability of financial distress or bankruptcy. |

Statistical estimation of financial risk probability. |

Simplicity interpretability. |

and |

Assumes linear relationships, which may not always hold. |

|

Risk rating models |

Assessing the financial stability of companies and projects. |

Classification of financial risks into different categories. |

Simplifies risk classification in corporate governance. |

Does not account for all risk factors comprehensively. |

|

|

Value-at-Risk |

Measuring the potential loss in corporate investments or asset portfolios. |

Quantifying the maximum potential loss at a given confidence level. |

Widely accepted and standardized in financial risk management. |

Assumes normal distribution of returns, which may not always be accurate. |

|

One of the key areas is the optimization of investment portfolios based on quantitative analysis. Methods such as VaR and stress testing allow you to assess the level of portfolio risk under various scenarios, which is critical for asset diversification. For example, financial institutions use combined VaR and GARCH models to predict possible losses and balance the share of high-risk assets. This approach helps to avoid excessive concentration of capital in one industry and minimize the impact of macroeconomic shocks.

An equally significant aspect is the use of quantitative analysis to manage liquidity. In modern companies, much attention is paid to modeling cash flows and forecasting short-term financial needs. For example, the use of stochastic models allows you to estimate the probability of cash gaps and determine the optimal liquidity reserves. In the banking sector, stress testing models are actively used to assess the resilience to sudden capital outflows, which helps to form an adequate strategy for managing liquid assets and liabilities.

In addition, quantitative analysis is used in assessing credit risks . Sophisticated ML methodologies allow companies to ascertain the solvency of borrowers with great accuracy, especially important for investment funds and banks. For example, regression analysis and neural network software analyze a few hundred variables like macroeconomic issues, accounting reports, and customer behavior data to help you identify the potential defaulting borrowers prior to any issues arising. The method significantly reduces the percentage of non-repayments and maximizes the quality of the loan portfolio [9].

In a rapidly changing market situation, adaptive strategic models are assuming greater importance. In such models, quantitative analysis is not only preceding the process of decision but is a part of a continuous management loop. For example, the use of machine learning algorithms makes it possible not only to forecast risks but also to optimize financial strategy parameters in real time on the basis of newly incoming data – an especially valuable capability in situations of high volatility. This plan opens the way for predictive-adaptive management systems, where strategic decisions are investigated not on a preset agenda but according to the actual movement of leading indicators.

Moreover, a fascinating direction is to combine quantitative methods with interactive scenario planning, where neural network models are used to generate and evaluate a wide range of alternative future scenarios. This enhances corporate resilience to external shocks and allows for proactive development of response mechanisms.

Thus, the use of quantitative analysis in strategic planning provides companies with a powerful instrument to predict and control risks. New mathematical models and algorithms allow us not only to assess probable dangers, but also to find the most effective way to reduce them, which renders the company safer and more competitive in the future.

Integrating quantitative risk models into corporate decision support systems

With the predisposition towards increased complexity and unpredictability in finance, the need to use quantitative models for risk analysis extends beyond analytical operations to the process of operational management. Current enterprise information systems make it possible to integrate such models directly into decision support systems (DSS) in addition to simplifying forecasting processes, it also maximizes the rationality of managerial decisions in real time.

One of the most promising directions is the embedding of quantitative models (GARCH, PCA, neural network-based forecasting models) into corporate systems existing today – ERP, CRM, or BI – to enable monitoring of financial risks on a regular basis and timely response to deviations of target indicators. For example, applying GARCH models in investment control modules allows firms to factor the timing profile of volatility in the measurement of asset returns and also reallocate portfolio composition without resorting to external consultants.

A central duty is to formalize the model output translation into managerial decision-making. In practice, this involves developing regulations and criteria defining how forecasted values affect project valuation, credit levels, or expenditure limits. Table 2 provides a generic template linking risk models to various levels of managerial discretion.

Table 2. Examples of the application of quantitative risk models at different levels of corporate management

|

Management level |

Applied model |

Example of use |

Purpose of integration |

|

Strategic |

PCA + scenario analysis |

Identification of key macroeconomic risk factors. |

Strategic planning. |

|

Tactical (departmental) |

GARCH + stress testing |

Portfolio adjustment based on market volatility. |

Asset and liability management. |

|

Operational (daily) |

RNN / logistic regression |

Monitoring default probability of counterparties. |

Credit limits, real-time deal evaluation. |

The constructed conceptual model of quantitative risk analysis integration into corporate decision support systems consists of four interlinked components: data sources , including financial statements, macroeconomic indicators, and operational transactions; the analytical core , comprising GARCH models for volatility estimation, PCA for dimensionality reduction and factor identification, and neural network algorithms such as RNN for forecasting crisis probabilities; the information-management layer , implemented through ERP or BI systems, which translates model results into managerial signals via visualization and rule-based triggers; and the decision-making unit , which executes strategic or tactical adjustments, including investment limits, asset reallocation, contractual revisions, or liquidity buffer recalculations. This architecture forms a closed loop of «data – analysis – interpretation – action» and provides the foundation for adaptive financial risk management under high uncertainty.

For effective application, organizational and methodological requirements have to be met. Firstly, experts able to interpret model results and report them in a comprehensible manner to managerial personnel must be trained. Secondly, transparency of algorithms is required – particularly for neural network models that fall prey to the «black box» problem. That entails the use of interpretable models or supplementing them with sensitivity analysis tools, feature importance evaluation, and other similar approaches.

The second critical issue is the maintenance of up-to-date data, required for model calibration and training. Effective integration can only be realized with an established data flow between analytical systems and major sources of data (macroeconomic data, financial reports, transaction volumes).

For instance, a mid-sized manufacturing company with exposure across a number of currency zones integrated a hybrid GARCH–RNN model into its ERP for managing exchange rate risk in procurement contracts. The GARCH component tracked clusters of volatility in major currency pairs, and the RNN component revised shortterm forecasts dynamically on the basis of macroeconomic drivers and central bank announcements. When the model identified an impending increase in volatility affecting USD/JPY and EUR/CNY, it automatically triggered an internal alert and provided contract renegotiation scenarios via the DSS interface. The hedge ratios were then real-time recalculated by the financial director without undesirable cost exceedances and without sacrificing budget integrity.

Thus, integrating quantitative models into DSS enables companies to transition from fragmented analysis to structured and forwardlooking financial risk management. This enhances organizational resilience, reduces dependence on subjective judgment, and enables the creation of an adaptive managerial architecture that can react swiftly to external challenges.

Conclusion

The study proved quantitative risk analysis techniques to be the core of corporate governance in the modern corporate world. VaR, stress testing, and scenario analysis are critical tools used for risk assessment and management so that companies can cope with forthcoming situations. Mathematical models in the strategic planning process make forecasting more effective and minimize financial losses. However, while these approaches are very effective, their successful implementation requires taking into account the specifics of each company and synthesizing different methods. Based on the analysis, it can be stated that the combined use of quantitative tools in risk management contributes to the improvement of the stability and competitiveness of the company in the context of global economic instability.