Minimum escaped savings and financial liquidity in mathematical representation

Бесплатный доступ

This paper discusses the velocities of the minimum escaped concerning financial liquidity. This implies that the conduct of the money cycle in normal circumstances is examined, considering the velocity of minimal level managed to escape cash reserves and the acceleration of cash flow. As a result, the money cycle determines how the economy works. As a result, it is reasonable to reach conclusions about consumer spending and investment in each economy. A Q.E. approach framework is used for this assessment.

Cycle of money, mixed savings, financial liquidity

Короткий адрес: https://sciup.org/170204236

IDR: 170204236 | УДК: 336.76; 336.741.236.5 | DOI: 10.5937/ekonsig2401001C

Текст научной статьи Minimum escaped savings and financial liquidity in mathematical representation

The issue of savings is a key point in managing an economy. Why is that? The answer comes from the Cycle of Money theory. The answer is that savings do not always have a positive role in an economy. An economy needs savings, as long as they are made within the domestic financial system. If such savings take place outside the domestic financial sys- tem, then things are different. The Cycle of Money theory distinguishes between enforcement savings and escape savings. Enforcement savings are savings that keep money within the financial system, and escape savings are those that leave the domestic financial system. The behavior of the money cycle once combined with the velocity of minimum escaped savings and the ve- locity of financial liquidity is investigated in this paper. This work approaches the attitude of the money cycle and how it works through the Q.E. method, as well as conclusions about consumption and investments in that case. In addition, after analyzing the model, the characteristics of the velocity of minimum escaped savings and the velocity of financial liquidity were discovered. As determined by the minimum escaped savings, the money stays in the country's economy and is not saved in tax havens. Mixed escaped savings, on the other hand, are savings in which some of them remain in the country's economy while others leave to be saved in tax havens (Aakre & Rübbelke, 2010; Ewert, Loer, & Thomann, 2021; Persson & Tinghög, 2020;

Agreements among both respondents encountered in the process determine how profits and losses are allocated. Contract modifications should be noted in the agreements. That's why the tax office should conduct regular audits. Agreements must be specified regularly to be comparable. The arm's length principle necessitates regular checks of companies involved in financial activities. The cost-sha- ring is then based strictly on a review process of tested parties' corporates (GVELESIANI, 2019; Kana-nen, 2012; Marques, 2019; Silva, Silvestre, & Amaral, 2020; Spiel, Schober, & Strohmeier, 2018; Vic-tral, Grossi, Ramos, & Gontijo, 2020). The purpose of governed contract businesses is to deal with taxation issues related to their activities. As a result, the arm's length principle should cover the requirements for firms operating in contracts with tax offices (Arabyan, 2016; Challoumis, 2019a; Johnston & Ballard, 2016; Leckel, Veilleux, & Dana, 2020; Maier, 2012; Martin & Freeland, 2021; Nowlin, Gupta, & Ripberger, 2020; Suslov & Basa-reva, 2020;

Controlled transaction companies should be informed that the tax department is examining them under the situation of approximately equal modifications (Haskel Lucchese Pir-cher, 2020; Ribašauskiene et al., 2019; Ruiz, Jurado, Moral, Uclés, u = s(zf + Zd) (1)

z = |Z- 1| (2)

The sign u symbolizes the comparability analysis's impact factor, which can be any technique. A coefficient with a value number between 0 and 1 is denoted by the symbol z. The theory's effect on the s determines what value might be received (using the best method rule). The symbol f represents the cost of producing goods, while the symbol d signifies the cost of distributing goods:

uc = zf + Zd (3)

b= (p-uc)*j 1 (4)

In the preceding equation, the symbol b represents the amount of taxation that should be paid by the company engaged in financial activities under the arm's length principle. The factor of tax liabilities that can be overlooked by assigning profits and losses is known as the uc. In addition, j 1 is indeed the tax rate ratio.

v = p*j2 (5)

The denoted v in the preceding formula represents the tax rates that should be paid by controlled payment businesses when the fixed length concept is applied (Challo-umis, 2019b, 2020b, 2020a, 2021b, 2021a, 2022c, 2022a, 2023c). Then, in the particular instance of the fixed length principle, j2 is indeed a tax rate ratio:

v > b (6)

The tax on corporates that take part in transfer pricing controlled transactions under the fixed length criterion is higher or equal to the tax on businesses that take part underneath the arm's length concept (Abate, Christidis, & Purwanto, 2020; AICPA, 2017; Bartels, 2005; Fernando, 2022; Hussain, Mehmood, Khan, & Tsimisaraka, 2022;

Schwanitz, 2017; Mohindra, 2007; OECD, 2020; Oueslati, 2015; Stone, 2008) As a result of the fixed length essence, managed money transfer enterprises can address the profitability issues presented. As a result, the tax department must deal with the effects of transfer pricing on worldwide tax revenue.

It is a completely theoretical case study to represent the difference between the two cases. The following section discusses the money cycle theory. The methodology is the Q.E. technique and its econometric approach.

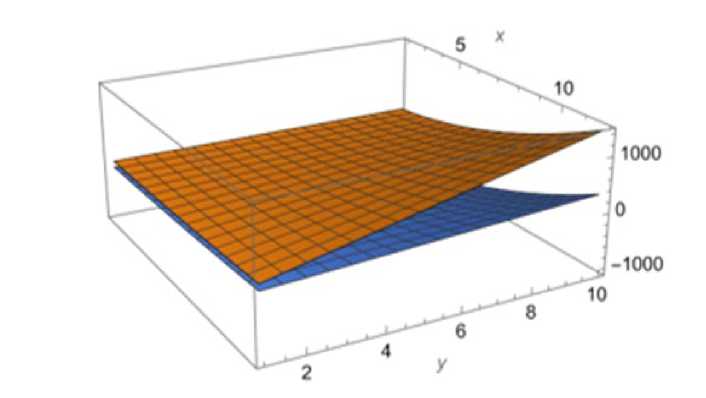

Figure 1: Fixed length principle and Arm’s length principle

Fig. 1 depicts the operation of the fixed length theory and its amount assessment for defining the model's behavior. The brown color represents the case where the fixed length is applied, and the blue line is the arm’s length principle, for the case where p is represented by a case study of v = x2*j2, and b= (x2-uc)*jv

-

2. Lterature Review

-

3. Materials and methods

A state's public sector includes the central government, local governments, and social security organizations. The role of the public sector in ensuring the smooth operation of the economy is critical. The public sector's functions include providing public goods and services, providing an institutional framework that ensures the smooth operation of the economy, and, more broadly, ensuring social balance and economic prosperity. For better implementation of the foregoing, the state employs a variety of policies, which will be discussed further below. The state can affect an economy's total expenditure, output, and income by changing one or more of its budget sizes. It accomplishes this by pursuing fiscal policy, i.e. changing public policy. However, not all figures have the same economic impact. As a result, the state must make the necessary changes to these figures, always concerning the economic conditions that prevailed at the time. As a result, given the circumstances, the state can pursue either an expansionary or a restrictive fiscal policy.

The public sector of a state is responsible for providing public goods and services, providing an institutional framework that ensures the smooth operation of the economy, and ensuring social balance and economic prosperity. The state can affect an economy's total expenditure, output, and income by changing one or more of its budget sizes. It can pursue either an expansionary or a restrictive fiscal policy, and changes must be implemented in advance of undesirable phenomena such as a recession. Monetary policy involves actions taken by the government to influence the amount of money in the market, such as open market policy, minimum liquidity ratio, discount rate, and standing facilities.

The concept of small and mediumsized enterprise is a much-debated concept from every angle, economic, political, and social. What is remarkable in the category of SMEs is the large number of them at all stages of the production process (primary, secondary, tertiary production). Therefore, small and medium-sized enterprises are a link in the whole structure of the economy and developed countries. Its importance is great since it contributes decisively to social balance, employment, the maintenance of conditions of competition, the introduction of innovations, and generally to the dynamic progress of the economy. Tax revenues are equivalent to the cash reserves that business owners could realize if taxes have been managed to avoid. How these savings are distributed differs from context to context. The company's benefits can then be handled in a completely different manner, as they've been saved or taxed. The money cycle theory explains when savings stimulate economic growth and when taxes help the economy. Savings must be classified into non-savings (or managed to escape savings) as well as returned savings for this determination (or enforcement savings). For this analysis, the following equations are shown:

a = as+ at (7)

|

xm = m — a |

(8) |

|

m = p + ap |

(9) |

|

p = Z^ o ^ . |

(10) |

|

ap = zm=o aP j |

(11) |

|

cm = dxm/dm |

(12) |

|

ca = dx m /da |

(13) |

Cy Cm Ca (14)

The α is for escaped savings for the savings that are not returning to the economy, or these amounts of money come back after a long run period. The as is about the avoided savings from transfer pricing activities. The αt. is for avoided savings from transfer pricing activities considering any other commercial activity. The αt. is for commercial activities from unchecked transactions. The m is for financial liquidity. The ц is for consumption. The ap is for the enforcement savings, which arrive from the residents as well as small and medium businesses. The xm is for financial liquidity. The cm is for the velocity of financial liquidity. The ca is for the velocity of escaped savings. Thus, the cy is the cycle of money. As a result, the money cycle or cycle of money reveals an economy's level of dynamic and robustness. Then there are the fundamentals of the money cycle.

Residents, small and medium-sized businesses, and individuals substitute the services and property of companies that save money but do not invest or consume it correspondingly in the economic system. As a result, the businesses of the transactions are the primary source of savings. The country's economic declining economic dynamic is due to escaped savings. The key point of escape savings is that the companies responsible for controlled transactions of transfer pricing are held liable for the non-reentry of these financing into the market. This scenario contributes to a lack of cash flow in an economy.

Citizens or small and medium-sized businesses do not substitute controlled transactions when it is not possible to provide that added value to the products and services. This is particularly true for manufacturing and research facilities. As a result, even if they engage in controlled transactions, these cases should indeed be taxed as uncontrolled transactions following relevant tax policy (using the fixed length principle). Enforcement savings account for the economy's high economic dynamic. As a result, citizens' and small and medium-sized businesses savings, investments, and consumption are the elements that result. The velocity of highly liquid assets indicates how fast the economy improves or declines in robustness. And there is an index that measures how much a country's economy is. The velocity of managing to escape future earnings is how fast nonreturn savings are lost inside the market because of a lack of investments or consumption. The economic situation is reflected in the money cycle. The overall economic dynamic, as well as the level of well-structured taxation. If this indicator is high, the economy is likely to be strong; otherwise, financial cash flow is limited.

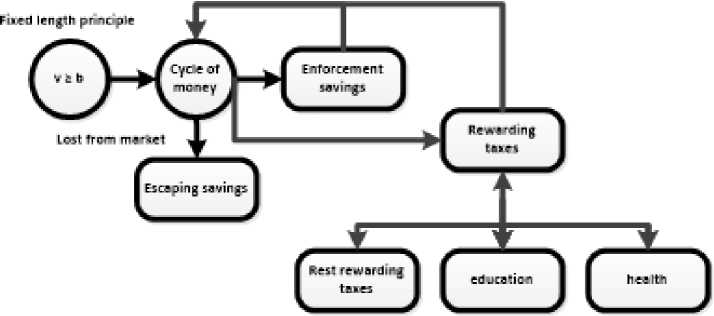

Controlled transactions, according to the theory of the money cycle, include other cases of price fixing but any form of profit and loss administering to avoid taxation. Unchecked transactions are private businesses of citizens, small and me- dium-sized businesses, industrial plants, research institutions, or any type of commercial activity which can be substituted for transactions by corporations (Challoumis, 2018a, 2020a; Kominers, Teytelboym, Kongats, McGet-rick, Raine, Voyer, Onur Kulaç, 2017; Romme Silva et al., 2020; Sultana, Or Rashid, Akter Eva, ciple, which enables low taxation of unchecked transactions and increased taxes of controlled transactions, the money cycle expands. It should be noted that when uncontrolled exchanges are regarded, the same thing happens in terms of financial liquidity for citizens and smaller businesses. Tax incentives have three major impact factors. Rewarding taxes are the only ones that have an immediate and significant impact on any economy's market. These factors are related to education, each society's health system and the ones left relevant to the structural economics of the previous two criteria. Then, utilizing all of the variables:

As a result, whenever there is a tax system, like the fixed length prin-

Return to enerNel

Figure 2 : The Money Cycle with Rewarding Taxes

The prior scheme portrays the money cycle along with all the beneficial tax factors. Then, for the tax breaks:

dp= aT + dn *hn +dm*hm (14)

ar > an*hn > am*hm (15)

The previous two formulas made use of those factors., which are the ap, aT , an , hn,am and hm. The aT is for the rest rewarding taxes. The an is for education and any technical knowledge. The am is all about health any of it pertinent and appreciative of this topic. The hn, and hm, are the health coefficient values and the health benefit aspect correspondingly.

Minimum savings and financial liquidity application:

dr = ami + X n=1 (« r ) j (16)

as = Zm=i(as)k dp= E"=i(«p)/ = « + an*hn +am*hm (18)

at = Zv=i(«£)v a = «s + «t= Zm=i(as)k + T.^«t)v (20)

m = dp + Ez=1mz

0< ami < 1

From this point, it seems that both elements of recapitalization and reinvestment are important, as it is concluded that industries and large enterprises in general engaged in the primary sector have a mixed character. Of course, there is a basic condition, it is that they do not carry out controlled transactions. If they participate in controlled transactions, then their savings are mainly non-supportive and therefore belong to the excess savings. Thus, in the case of industrial units which do not participate in triangular transactions, it is considered that their savings are partly supportive, and partly deferred savings (generally economic units which are not substituted by medium or mediumdynamic economic data). Also, if it is considered that companies engaged in product research and development have a large volume of transactions, then it is understood that they are substituting medium-dynamic research units that would have boosted savings. For this reason, it is considered that this type of savings belongs to mixed savings. They have characteristics of both boosting savings due to their research nature, but also excessive savings because they concern a large volume of transactions.

In the previous equations the ami which represents mixed savings. The purpose of mixed savings is to represent the fact that factories, research and development centers, and other organizations have all escaped savings at the same time. The remaining symbols are already known. The general equilibrium velocities of the money cycle will be discussed in the section that follows.

The velocity of the escaped savings: са Са0 * ^(ст Ст0 ) (23)

суа = b1[(са - Са0 ) + Суа0 ] ± b2 ( ~ ) ± Ь з (1/1п са) (24)

b 1 , b2, b3 = 0 and xt > 0, where i=1,2 (25)

In the prior equations the са0 and the ст0 are accordingly the initial values of the velocity of escaped savings and the cycle of money. Furthermore, cy represents the general equation of the escaped savings. The following equations for accepting financial liquidity:

сут

b4[(ст Ст0 ) + Сут0 ] ± b5(1/

С т ) ± Ь6(1/1П с т ) (26)

liquidities can thus be defined by two concrete equations.

С уа = b3( 1/1пС а ) (29)

сут b5(1/ст ) (30)

-

4. Results

The results are determined based on the prior mathematical equations and the following coefficients table:

Table 1 : Compiling coefficients

|

αs |

0.6 |

|

αt |

0.7 |

|

μ |

0.9 |

|

αp |

0.8 |

|

αs |

0.6 |

|

αt |

0.7 |

|

μ |

0.9 |

|

αp |

0.8 |

The behavior of the money cycle is presented using the Q.E. method:

b4, b5, b6 = 0 and xt (27)

X t > 0 , where i=1,2 (28)

The general form of the velocity of the cycle of money. The coefficients of b 1 , b2, b3 took two of them one constant value xt, and the other one is zero. The same happens with the coefficients of b4, b5, b6 which also two of them take one constant value xt and the other one is zero. All possible combinations of velocities of escaped savings and financial Ekonomski signali 10

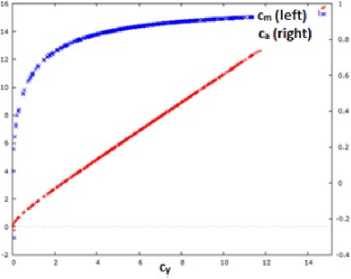

Figure 3 : Cycle of money with its velocities

According to the previous figure, the cash cycle is connected to a velocity of minimal level escaped cash reserves and the velocity of cash flow. As a result, financial liquidity has a performance and ultimately, whereas minimum escaped savings has a negative velocity. While the velocity of minimum escaped earnings previously had a greater impact on the money cycle, it is eventually determined also that the velocity of financial liquidity has a significant impact than the velocity of lower limit managed to escape savings (which here is approximately equal to zero the escaped savings). When the escaped savings approach zero, the money cycle begins, denoting that the fiscal economy has hit its zenith.

-

5. Discussion

-

6. Conclusion

The minimum escaped savings mean that the money stays in the country’s economic system. This has resulted in lower inflation and higher currency rates as the economy has the full distribution of money and maximum reuse of them, and there is no need to affect the banking system and the banking interest. If the economy has a high lack of money because of high interest rates, then the people will put higher prices to counteract the expensive cost of living, because of the dysfunction in financial liquidity, and the high tax rates. Then, proper reuse and distribution of money allow having lower taxes (and the opposite, meaning that lower taxes secure better liquidity, consumption, and savings, from the distribution and reuse of money). Inflation is a result of there being a lot of money which increases the prices. But inflation is because money is more than the functionality of the economy. This problem is solved by the theory of the Cycle of Money, which says that having a lot of money because of the proper functionality of the economy, resolves the issue, as the problem of inflation stands on the dysfunction between the increased amount of money without adequate functionality. Therefore, this concept states that having a lot of money due to the proper functionality of the economy resolves the issue of inflation, which is based on the dysfunction between the increased amount of money without adequate functionality.

The money cycle determines how the economy works and is used to assess consumer spending and investment in each economy. The velo- city of financial liquidity eventually has a greater impact on the money cycle than the velocity of minimum escaped savings, as demonstrated in this paper. It is concluded that when escaping savings is limited, the economy has the most positive orientation. This means that consumption and investment would be increased to their maximum levels in any economy. However, it is discovered that limited escaped savings convert the logarithmic form of the velocity of escaped savings into a linear form.

Список литературы Minimum escaped savings and financial liquidity in mathematical representation

- Aakre, S., & Rübbelke, D. T. G. (2010). Objectives of public economic policy and the adaptation to climate change. Journal of Environmental Planning and Management, 53(6). Retrieved from https://doi.org/10. 1080/09640568.2010.488116

- Abate, M., Christidis, P., & Purwanto, A. J. (2020). Government support to airlines in the aftermath of the COVID-19 pandemic. Journal of Air Transport Management, 89. Retrieved from https://doi.org/ 10.1016/j.jairtraman.2020.101 931

- Adhikari, A., Derashid, C., & Zhang, H. (2006). Public policy, political connections, and effective tax rates: Longitudinal evidence from Malaysia. Journal of Accounting and Public Policy, 25(5). Retrieved from https://doi.org/10.1016/j.jaccpu bpol.2006.07.001

- AICPA. (2017). Guiding principles of good tax policy: A framework for evaluating tax proposals. American Institute of Certified Public Accountants, 2017(March 2001).

- Arabyan, O. (2016). Public infrastructure policies and economic geography. Glasnik Srpskog Geografskog Drustva Bulletin of the Serbian Geographical Society, 96(1). Retrieved from https://doi.org/10.2298/ gsgd1601093a

- Bartels, L. M. (2005). Homer Gets a Tax Cut: Inequality and Public Policy in the American Mind. Perspectives on Politics, 3(1). Retrieved from https://doi.org/ 10.1017/S1537592705050036

- Challoumis, C. (2018a). Analysis of the velocities of escaped savings with that of financial liquidity. Ekonomski Signali, 13(2), 1–14. Retrieved from https://doi.org/10.5937/ekonsig 1802001c

- Challoumis, C. (2018b). Methods of Controlled Transactions and the Behavior of Companies According to the Public and Tax Policy. Economics, 6(1), 33–43. Retrieved from ttps://doi.org/10.2478/eoik-2018-0003

- Challoumis, C. (2019a). Journal Association ‘SEPIKE’ Edition 25, October, 2019. Journal Association SEPIKE, 2019(25), 12–21. Retrieved from https://5b925ea6-3d4e-400bb5f3-32dc681218ff.filesusr.com/ugd/b199e2_dd29716b8be c48ca8fe7fbcfd47cdd2e.pdf

- Challoumis, C. (2019b). The Impact Factor of Education on the Public Sector and International Controlled Transactions. Complex System Research Centre, 2019, 151–160. Retrieved from https://www.researchgate.net/publication/350453451_The_Impact_Factor_of_Education_on_the_Public_ Sector_and_International_Co ntrolled_Transactions

- Challoumis, C. (2019c). The R.B.Q. (Rational, Behavioral and Quantified) Model. Ekonomika, 98(1), 6–18. Retrieved from https://doi.org/10.15388/ ekon.2019.1.1

- Challoumis, C. (2020a). Analysis of the Theory of Cycle of Money. Acta Universitatis Bohemiae Meridionalis, 23(2), 13–29. Retrieved from https://doi.org/10.2478/acta-2020-0004

- Challoumis, C. (2020b). Impact Factor of Capital to the Economy and Tax System. Complex System Research Centre, 2020, 195–200. Retrieved from https://www.researchgate.net/publication/350385990_Impact_Factor_of_Capital_to_the_Economy_and_Tax_System

- Challoumis, C. (2020c). The Impact Factor of Education on the Public Sector -The Case of the U.S. International Journal of Business and Economic Sciences Applied Research, 13(1), 69-78. Retrieved from https://doi. org/10.25103/ijbesar.131.07

- Challoumis, C. (2021a). Chain of cycle of money. Acta Universitatis Bohemiae Meridionalis, 24(2), 49–74.

- Challoumis, C. (2021b). Index of the cycle of money - The case of Slovakia. STUDIA COMMERCIALIA BRATISLAVENSIA Ekonomická Univerzita v Bratislave, 14(49), 176–188.

- Challoumis, C. (2021c). Index of the cycle of money - the case of Bulgaria. Economic Alternatives, 27(2), 225–234. Retrieved from https://www.unwe.bg/doi/eajournal/2021.2/EA.2021.2.04.pdf

- Challoumis, C. (2022a). Conditions of the CM (Cycle of Money). In Social and Economic Studies within the Framework of Emerging Global Developments, Volume -1, V. Kaya (pp. 13–24). Retrieved from https://doi.org/10.3726/b19907

- Challoumis, C. (2022b). Index of the cycle of money - the case of Greece. Research Papers in Economics and Finance, 6.

- Challoumis, C. (2022c). Index of the cycle of money - the case of Poland. Research Papers in Economics and Finance, 6(1), 72–86. Retrieved from https://journals.ue.poznan.pl/REF/article/view/126/83

- Challoumis, C. (2023a). Risk on the tax system of the E.U. from 2016 to 2022. Economics, 11(2).

- Challoumis, C. (2023b). The impact factor of tangibles and intangibles of controlled transactions on economic performance. Economic Alternatives, 29(4).

- Challoumis, C. (2023c). Utility of Cycle of Money without the Escaping Savings (Protection of the Economy). In Social and Economic Studies within the Framework of Emerging Global Developments Volume 2, V. Kaya (pp. 53–64). Retrieved from https://doi.org/10.3726/b20509

- Ewert, B., Loer, K., & Thomann, E. (2021). Beyond nudge: advancing the state-of-the-art of behavioural public policy and administration. Policy and Politics, 49(1). Retrieved from https://doi.org/10.1332/030557 320X15987279194319

- Fernando, J. (2022). Gross Domestic Product (GDP) Definition. Investopedia.

- GVELESIANI, R. (2019). Compatibility problem of basic public values with economic policy goals and decisions for their implementation. Globalization and Business, 4(7). Retrieved from https://doi.org/10.35945/ gb.2019.07.004

- Haskel, J., & Westlake, S. (2021). Capitalism without capital: The rise of the intangible economy (an excerpt). Ekonomicheskaya Sotsiologiya, 22(1). Retrieved from https://doi.org/10.17323/1726-3247-2021-1- 61-70

- Hussain, Z., Mehmood, B., Khan, M. K., & Tsimisaraka, R. S. M. (2022). Green Growth, Green Technology, and Environmental Health: Evidence From High-GDP Countries. Frontiers in Public Health, 9. Retrieved from https://doi.org/10.3389/fpubh.2021.816697

- Johnston, C. D., & Ballard, A. O. (2016). Economists and public opinion: Expert consensus and economic policy judgments. Journal of Politics, 78(2). Retrieved from https://doi.org/ 10.1086/684629

- Kananen, J. (2012). International ideas versus national traditions: Nordic economic and public policy as proposed by the OECD. Journal of Political Power, 5(3). Retrieved from https://doi.org/10.1080/215837 9X.2012.735118

- Kominers, S. D., Teytelboym, A., & Crawford, V. P. (2017). An invitation to market design. Oxford Review of Economic Policy, 33(4). Retrieved from https://doi.org/10.1093/oxrep/g rx063

- Kongats, K., McGetrick, J. A., Raine, K. D., Voyer, C., & Nykiforuk, C. I. J. (2019). Assessing general public and policy influencer support for healthy public policies to promote healthy eating at the population level in two Canadian provinces. Public Health Nutrition, 22(8). Retrieved from https://doi.org/10.1017/S13689 80018004068

- Leckel, A., Veilleux, S., & Dana, L. P. (2020). Local Open Innovation: A means for public policy to increase collaboration for innovation in SMEs. Technological Forecasting and Social Change, 153. Retrieved from https://doi.org/10. 1016/j.techfore.2019.119891

- Leimbach, M., Kriegler, E., Roming, N., & Schwanitz, J. (2017). Future growth patterns of world regions – A GDP scenario approach. Global Environmental Change, 42. Retrieved from https://doi.org/10. 1016/j.gloenvcha.2015.02.005

- Lucchese, M., & Pianta, M. (2020). The Coming Coronavirus Crisis: What Can We Learn? Intereconomics, 55(2). Retrieved from https://doi.org/10. 1007/s10272-020-0878-0

- Maier, E. (2012). Smart Mobility – Encouraging sustainable mobility behaviour by designing and implementing policies with citizen involvement. JeDEM - EJournal of Edemocracy and Open Government, 4(1). Retrieved from https://doi.org/ 10.29379/jedem.v4i1.110

- Marques, E. C. L. (2019). Notes on networks, the state, and public policies. Cadernos de Saude Publica, 35. Retrieved from https://doi.org/10.1590/0102-311x00002318

- Martin, A. S., & Freeland, S. (2021). The Advent of Artificial Intelligence in Space Activities: New Legal Challenges. Space Policy, 55. Retrieved from https://doi.org/10.1016/j.space pol.2020.101408

- Miailhe, N. (2017). Economic, Social and Public Policy Opportunities enabled by Automation. Field Actions Science Reports. The Journal of Field Actions, (Special Issue 17).

- Mohindra, K. S. (2007). Healthy public policy in poor countries: Tackling macro-economic policies. Health Promotion International. Retrieved from https://doi.org/10.1093/heapro/ dam008

- Noland, M. (2020). Protectionism under Trump: The China Shock, Deplorables, and the First White President. Asian Economic Policy Review. Retrieved from https://doi.org/ 10.1111/aepr.12274

- Nowlin, M. C., Gupta, K., & Ripberger, J. T. (2020). Revenue use and public support for a carbon tax. Environmental Research Letters, 15(8). Retrieved from https://doi. org/10.1088/1748-9326/ab92c3

- OECD. (2020). GDP and spending - Gross domestic product (GDP) - OECD Data. OECD Data.

- Onur Kulaç. (2017). An Overview of the Stages (Heuristics) Model as a Public Policy Analysis Framework. European Scientific Journal, 7881(May).

- Oueslati, W. (2015). Growth and welfare effects of environmental tax reform and public spending policy. Economic Modelling, 45. Retrieved from https://doi.org/10.1016/j.econm od.2014.10.040

- Persson, E., & Tinghög, G. (2020). Opportunity cost neglect in public policy. Journal of Economic Behavior and Organization, 170. Retrieved from https://doi.org/10.1016/j.jebo.2 019.12.012

- Pircher, B. (2020). EU public procurement policy: the economic crisis as trigger for enhanced harmonisation. Journal of European Integration, 42(4). Retrieved from https://doi.org/10.1080/07036337.2019.1666114

- Ribašauskiene, E., Šumyle, D., Volkov, A., Baležentis, T., Streimikiene, D., & Morkunas, M. (2019). Evaluating public policy support for agricultural cooperatives. Sustainability (Switzerland), 11(14). Retrieved from https://doi.org/10.3390/su11143769

- Romme, A. G. L., & Meijer, A. (2020). Applying design science in public policy and administration research. Policy and Politics, 48(1). Retrieved from https://doi.org/10.1332/030557319X15613699981234

- Ruiz, J. C., Jurado, E. B., Moral, A. M., Uclés, D. F., & Viruel, M. J. M. (2017). Measuring the social and economic impact of public policies on entrepreneurship in Andalusia. CIRIECEspana Revista de Economia Publica, Social y Cooperativa, 1(90).

- Silva, D. S., Silvestre, B. M., & Amaral, S. C. F. (2020). Assessing the timemania lottery as a sports public policy. Journal of Physical Education (Maringa), 31(1). Retrieved from https://doi.org/10.4025/JPHYSEDUC.V31I1.3131

- Spiel, C., Schober, B., & Strohmeier, D. (2018). Implementing intervention research into public policy - the “I3-approach”. Prevention Science, 19(3). Retrieved from https://doi.org/ 10.1007/s11121-016-0638-3

- Stone, D. (2008). Global public policy, transnational policy communities, and their networks. Policy Studies Journal, 36(1). Retrieved from https://doi.org/10.1111/j.1541- 0072.2007.00251.x

- Sultana, A., Or Rashid, M. H., Akter Eva, S., & Sultana, A. (2020). Assessment of Relationship Among Regional Economic Development Policy, Urban Development Policy and Public Policy. Sumerianz Journal of Economics and Finance, (310). Retrieved from https://doi.org/10.47752/sjef.310.171.177

- Suslov, V. I., & Basareva, V. G. (2020). ECONOMIC DEVELOPMENT AND PUBLIC POLICY: SCANDINAVIA AND SIBERIA. Interexpo GEO-Siberia, 3(1). Retrieved from https://doi.org/10.33764/ 2618-981x-2020-3-1-209-218

- Swanstrom, T., Dreier, P., & Mollenkopf, J. (2002). Economic Inequality and Public Policy: The Power of Place. City & Community, 1(4). Retrieved from https://doi.org/10.1111/ 1540-6040.00030

- Torres Salcido, G., del Roble Pensado Leglise, M., & Smolski, A. (2015). Food distribution’s socio-economic relationships and public policy: Mexico City’s municipal public markets. Development in Practice, 25(3). Retrieved from https://doi.org/10.1080/09614524.2015.1016481

- Ud Din, M., Mangla, I. U., & Jamil, M. (2016). Public Policy, Innovation and Economic Growth: An Economic and Technological Perspective on Pakistan’s Telecom Industry. THE LAHORE JOURNAL OF ECONOMICS, 21(Special Edition). Retrieved from https://doi.org/ 10.35536/lje.2016.v21.isp.a16

- Victral, D. M., Grossi, L. B., Ramos, A. M., & Gontijo, H. M. (2020). Economic sustainability of water supply public policy in Brazil semiarid regions. Research, Society and Development, 9(6). Retrieved from https://doi.org/ 10.33448/rsd-v9i6.3435

- Zamudio, A. R., & Cama, J. L. N. (2020). Assessment of fiscal effort and voluntary tax compliance in Peru. Revista Finanzas y Politica Economica, 12(1). Retrieved from https://doi.org/10.14718/REVFINANZ POLITECON.V12.N1.2020.31 21

- Παπακωνσταντίνου, Α., Κανάββας, Λ., & Ντόκας, Ι. (2013). Οικο- νομία & μικρές επιχειρήσεις. Ινστιτούτο μικρών επιχε- ιρήσεων.