Modeling complex financial sustainability of a corporation in the age of global economic crises

Автор: Malyshenko Vadim A., Malyshenko Konstantin A.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Modeling and forecast of socio-economic processes

Статья в выпуске: 2 (56) т.11, 2018 года.

Бесплатный доступ

Currently, the socio-economic content of the concept of sustainable development in relation to enterprises and corporations is actually replaced by a system of managing financial risks of investment, the effect of which aims to prevent a financial crisis. Major financial strategies ceased to be functional; they acquired a role comparable to the corporate economic strategy, and began to control the establishment of criteria of risks and the feasibility of enterprise’s existence. The goal of the present research is to provide methodological support to the process of returning the priority of the financial concept of sustainable development from the sphere of financial growth (permanent capital growth) to the sphere of financial and economic development, by offering a new analytical tool of strategic level that does not contradict the interests of large businesses in its application. Taking into account the great contribution of transnational corporations to the initiation of global crises implemented with the help of stock market tools, the version of the financial-analytical method (visual modeling), which we present in the paper, reduces the dependence of corporate governance on the financial market assessment and directs risk management process in the field of real capital management of associations of enterprises...

Financial crisis, economic growth, economic development, financial stability, financial modeling, financial condition

Короткий адрес: https://sciup.org/147224033

IDR: 147224033 | УДК: 336.64 | DOI: 10.15838/esc.2018.2.56.9

Текст научной статьи Modeling complex financial sustainability of a corporation in the age of global economic crises

The framework of the theory of economic conventional growth (increase in volumes), growth and development was created by Joseph Schumpeter in the early 20th century [1]. Contributions to the theory of growth and development were also made by Simon Kuznets, Fernand Braudel, Theodore Schultz, Gary Becker, Michael Porter, Nikolai Kondratiev and other scholars [2]. Joseph Schumpeter was the first to introduce the differences between economic growth and development, defined the essence of innovation as the main driver of economic growth. He also defined economic growth as quantitative changes, namely, an increase in production and consumption of the same goods and services over time. Schumpeter formulated economic development as positive qualitative changes, innovation in production, products and services, in management and other spheres of life and economic activities [1]. Mixing the concepts of economic growth and development is the most common mistake made by managers at any level when developing the measures to resist the economic crisis, that is, there is an actual substitution of development with which can be achieved by temporary measures insignificant for the development.

Analyst Alan Reynolds defines crises as follows: “...they are logical, inevitable consequences of interaction of a certain combination of factors. The result of this interaction is neither good nor bad. Negative connotation to the word “crisis” is given by those people who fail to estimate (overestimate, underestimate) the consequences of this combination of factors, or those who are forced “to pay the duties” of an unsuccessful (unrealistic) plan”. Reynolds emphasizes: “The surprise of a crisis is explained by lack of information and knowledge of the processes taking place in a particular area” [3].

According to O.Yu. Maslov, “crisis is an unintended consequence of a long-term interaction of partially controlled or not controlled factors and phenomena that lead to a situation where sustained management by the existing factors for the implementation of goals and objectives set by decision makers becomes impossible” [4].

Experts and analysts identify the following causes of the global crisis:

-

1. Exhaustion of the dominant world paradigm or the crisis of capitalism (civilizational aspect).

-

2. A typical crisis of overproduction (real economy aspect).

-

3. Decaying global monopolies (evolutionary aspect).

-

4. Global imbalances (globalization aspect).

-

5. Exhaustion of the global monetary and financial system based loan interest (civilizational aspect).

-

6. A cyclical crisis: transition from business cycles to bubble cycles.

-

7. Global economy entering the recession phase of Kondratiev wave (cycle aspect).

-

8. Phenomenal expansion of the financial sector (financial aspect), etc. [4].

The identified causes of the global crisis can in fact be considered as a threshold of one event – the phase of “superfinance” in the global economy at the stage of more frequent crises. “Superfinance” in this context is the situation where financial resources cease to serve the economy and the asset value is almost no longer rigidly linked to the value of fictitious capital. The importance of developing the financial sector has become a top priority; finance began to determine the asset value through the system of financial markets (supply and demand for financial tools, rather than for the product). The peculiarity of the society entering the phase of clean finance (let’s call it “super-financing”) as a main separate doctrine of economic life is the emergence of highly innovative financial techniques which cease to be operated by external factors. Moreover, the laws of their life generate the external environment themselves – which in fact means that they achieve their systemand strategic role (mutual penetration and influence of external and internal environment). This should be indicated by a merger of enterprise’s balance sheet assets and liabilities in the methodological and substantive aspect, where each asset is tied to a financial technique of a relevant specialization and leads to the most convenient involvement of any type of assets in the sphere of financial turnover, taking into account the synergy effect of combining all resources of the enterprise and the environment. The complexity of the goodwill category has led to it obtaining the properties of a guarantor of competitiveness while distancing the total asset value from the company’s market value. At the current historical stage of development of finance, this hypothesis is based on the system laws of development of the object “finance-system”, which, having stood out in the subsystem of the economy, have formed their separate and highly organized system of top priority; and the dynamic nature of this process does not weaken, leading to the emergence of new effects (cryptocurrencies, their derivatives, etc.). The problem of sustainability management as a response to the crisis lies in two aspects. The first aspect: an economic crisis is an integral part of the development of an economic entity at any level in the long-term (strategic) prospect. The second aspect: direct consideration of many crisis factors is not actually possible for real crisis management due to their unpredictable effect when combined. The issue is controversial – crises are inevitable but managing them is practically impossible. If we turn to system analysis, the current situation is a system phenomenon of chaos as a contradiction to order. According to the provisions of studying systems – chaos is also systematized, yet science simply has no tools to describe any process, which is why it is considered chaotic.

It can be concluded that a multidimensional system method of financial management of development is required. It should be present in the toolkit of an average financial manager in the form of a simple analysis tool, yet it should be sufficient to ensure that the main processes of financial and economic formation are taken into account, and transform, as it spreads, the entire sphere of risk factor assessment of strategically sustainable development of a modern enterprise.

Developing the main provisions to overcome the last dead-end “destroyer crisis” of the global economy.

Summarizing the above, we can proceed to formulating conceptual provisions to justify the methodological system of destroying the overall generator of the global financial and economic crisis. First of all, it is necessary to define the concept “generator”, which will serve as an object of application of the formed sets of actions and techniques.

The generator of the global financial and economic crisis is a global system phenomenon, which represents a set of methodological distortions of the political and economic correlation between real and financial capital (imputed residual secondary nature of the latter). When it is activated, a complete (in the final crisis) or partial (in temporary crises) loss of confidence in any investment value is observed. The development of “generator’s” action is implemented as a result of ignoring the principle of impossibility to completely predict the probable future and permanent risks (as an adverse outcome) of any financial and economic decision. This fact should be reflected in the adjusted return as the ratio of financial result and mathematical expectation of loss of profit during crises and even basic property (assets). As a result, risks of investment in real capital should be added to financial risks arising from the isolation of the sector and creation of a system of financial institutions whose risk protection mechanisms cease to work in system global economic crisis (this means their limited nature, greater vulnerability, which should be reflected in the emerging attractiveness of investment in real capital). Large corporations can be considered the units of financial crisis development, between which there is a chain collapse in value. A system transition to a lower level (of medium-sized enterprises) will prevent the regional or sectoral crisis from developing into a global one. A prerequisite is the fusion of financial, bank and real capital, which is not implemented at the meso level.

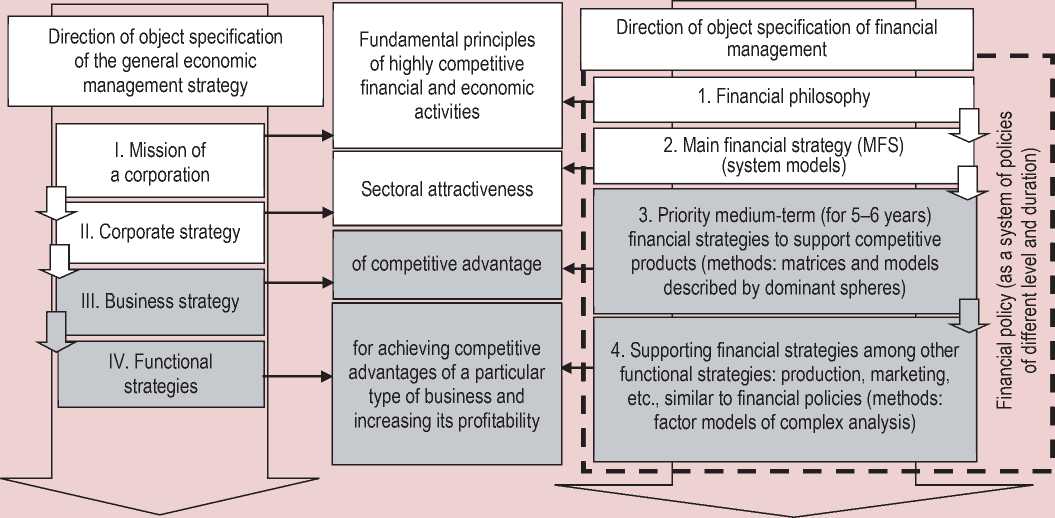

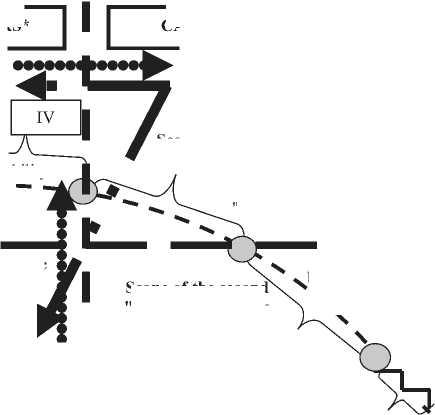

In order to understand the situation of achieving the dominant role of financial management among other economic and management spheres of a corporation, a scheme of management objects connection at separate levels of the general management strategy has been build with objects at hierarchical levels of the financial strategy ( Fig. 1 ). The category “Main financial strategy” is of the greatest interest according to the chosen research subject. It is in the sphere of its interaction between corporate strategy (II) that the main distortions of priority take place and fundamental contradictions arise. The financial mission and philosophy are generalized and do not form clear target programs, or coordinate the priority between the financial and general economic sphere. According to the definition, the main financial strategy (MFS) is a strategy-based systemically streamlined program to manage the process of transformation of enterprise’s strategic financial sustainability carried out in line with the objectives of the general economic strategy which supports sustainable growth and limitations of the financial policy and strategies for achieving their mutual long-term relevance in the developing environment.

Figure 1. Scheme of correlation (correspondence) of different levels of the general management strategy with the levels of financial and strategic management

Source: compiled by the authors.

Table 1. Evolution of strategic management [6, p. 34]

|

Period |

1950 |

1950-s – early 1970-s |

Late 1970-s – mid 1980-s |

Late 1980-s and 1990-s |

2000-s |

|

Prevalent aspect |

Budget planning and control |

Corporate planning |

Positioning |

Competitive advantage |

Strategic and organizational innovation |

|

Main issues |

Financial control |

Growth planning, especially diversification and portfolio planning |

Choosing industries and markets. Positioning of the market leader |

The strategy’s focus on sources of competitive advantage. New business development |

Alignment of company’s size with its flexibility and ability to respond |

|

Main concepts and methods |

Preparation of financial budget. Investment planning. Evaluation of projects |

Long-term and medium-term forecasting. Corporate planning methods. Synergy |

Analysis of the industry. Segmentation. Experience curves. PIMS-analysis. SBUs (strategic business units). Portfolio planning |

Resources and capacities. Share value. Knowledge management. Information technology |

Cooperative strategies. Competition for standards. Complexity and self-organization. Corporate social responsibility |

|

Organizational results |

The system for compiling operational budget and capital estimates become a key coordination and monitoring mechanisms. |

Creation of corporate planning departments and long-term process planning. Merger and acquisition |

Multidivisional and multinational structures. Greater sectoral and market efficiency |

Restructuring and reengineering. Change of direction. Outsourcing. E-business |

Networks and alliances. New models of leadership. Non-formal structures. Less dependence on direction and trends |

Strategic management is moving into the field of innovation management where the obtained advantage works against all competitors (which was a problem in 1980– 1990). It is taking a leading position on the market (the problem in 1970–1980) and subordinates the effectiveness of corporate planning and control over costs (management problems in 1950–1970). [5, p. 147].

The evolution stages of strategic management are presented in Table 1 . The new functions of the MFS are mainly manifested in its new role as the main, rather than as a parity initiator of corporate general economic development goals. Any innovation requires investment, which immediately shifts the main management priority towards finance.

Innovation is quite a convenient tool for gaining competitive advantage. The disadvantage is the need for more frequent strategic de- stabilizing of the entire enterprise when it restarts to a new round curve of the organizational life cycle (OLC) [5, p. 37].

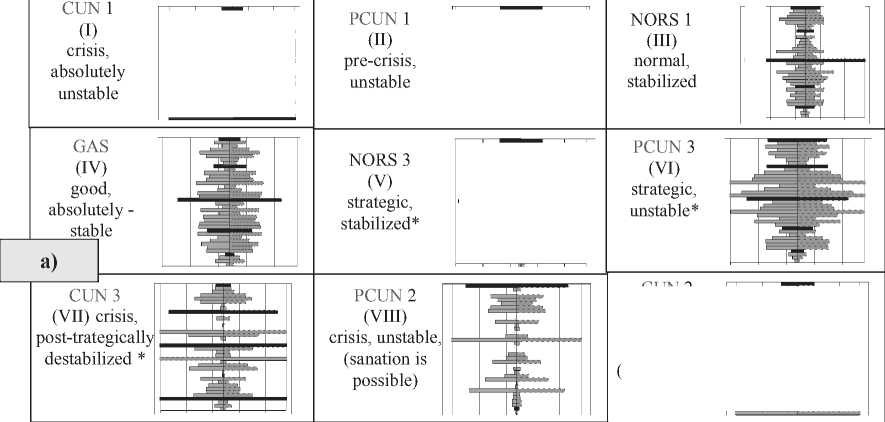

The methods of strategic management have also been developed aiming to provide sufficient supply for new trends in management and analysis. Their complexity has almost been completed with multivariate models of discriminant function analysis by E. Altman Z-score [7, p. 241]. Or the emphasis put on developing the logic of stability analysis procedure. To evaluate objective processes in strategic management methodology one can use the classification of scientific schools of strategic management by Henry Mintzberg ( Fig. 2 ).

The configuration school (lower block), being the most relevant, has not yet entered any of the groups and, most likely, presages the formation of a new class of schools of strategic management. The configuration school

Figure 2. Classification of scientific schools of strategic management by Henry Mintzberg

|

Prescriptive schools |

|||||||

|

1. The design (project development, modeling) school: Ph. Selznick, A . Chandler and C. Andrews, 1950–60s. Strategy as a way to achieve balance of the internal situation organization and the external environment. Schools studying |

2. The planning school: I. Ansoff, J. Steiner and P. L’Orange. The concept of strategic planning of company’s development specific aspects of the real process of strate |

3. The positioning school: M. Porter, Boston Consulting Group (BCG). “Growth-market share” matrix ; M. Porter model of competitive analysis gy formation |

|||||

|

4. T he entrepreneurial school: 0 . Collins and D. Moore, B. Bird, H. Mintzberg, P. Drucker, D. McClelland, J. Schumpeter. The main concept – visionary process, i.e. the visualization of the strategy |

H. Simon, K. Schwenk, P. Corner et al. (since 1980-s). Study of the strategy formation process |

6. The learning school: J. Quinn, G. Sue, R. Paschal, J. March et al. Research object – strategy design technique, rather than its farmulation |

7. The power school: A . Macmillan, H. Mintzberg, G. Pfeffer, and G. Salansik at al. Strategy formation as a negotiation process |

8. The cultural school: A. Pettigrew, J. Johnson, S. Feldman, J. Lorsch, T. Peters, R. Waterman, B. Vernerfeld (sin c e 1980-90-s). Strategy formation as a collective process; “7-C” management model |

9. The environmental school: D. Miller, H. Mintzberg, M. Hannan, J. Freeman (since 1990-s). Strategy as a responsive process, possible role of an organization |

||

|

10. The configuration school: D. Miller, P. Handavall, M. Bier (since 1990-s). Strategy formation as a process of a step-by-step target transformation of a corporation or enterprise |

|||||||

Source: compiled by authors.

describes a step-by-step implementation of the strategy as a transformation or adaptation of an enterprise to new conditions [8, p. 27]. It analyzes the interposition of various states of an organization in certain conditions, which helps define its “structures”, “models”, and “ideal types”. The school also considers the temporal sequence of change in different states in order to determine the “stage”, “period” or the whole life cycle of an organization [9]. The development of the strategy seems to be a peculiar process of imbalance in the existing schemes (sustainable elements) so that the organization can move into a new state. The configuration school considers this process as a dramatic transformation such as, for example, revitalization (regeneration), “a turn around”. The main disadvantages of the configuration school approach first of all lie in considering quantum leaps in the development of an organization. Under real life conditions, most organizations follow the model of incremental change (incrementalism). Second, generalizations of the configuration approach are somewhat arbitrary [10]. The disadvantages are more compensated by using system models (which, for example, include the author’s “Frigate”-model which will be described below), with can help skip several stages having a certain idea of the state of the system of financial stability (total risks) at a particular stage of enterprise development (for example, by stage of the life cycle of an organization). Profile management (configuration of a sequence of combinations of internal and external states) is an approach of system modeling, which has become a necessity due to the constant demand for innovative reboot (leap) of target strategic type. Strategic transformations of the market leader (potential or current) change the external environment of the entire competitive environment for sanatorium enterprises, usually within the region. This situation goes beyond the traditional understanding of the isolation of the enterprise external and internal environment and prepares the emergence of methods describing the “universum system” (a uniform category of interaction between the environment and the system).

Modelling financial stability on the threshold of “superfinance” era as the primary variant of the method for permanent delay of its occurrence for an indefinite period.

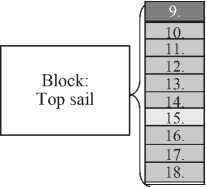

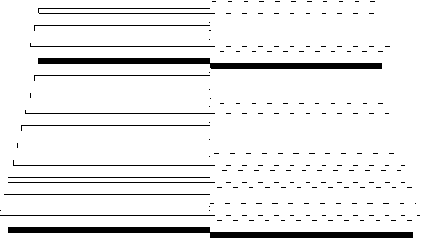

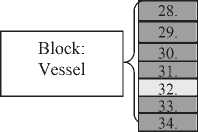

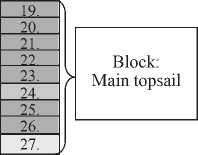

It is necessary to specify that it is impossible to indefinitely delay the objective process of global scale including in the field of finance – there will inevitably be an overflow of quantitative changes and a qualitative leap will take place. However, system analysis uses concepts such as crisis and bifurcation point, which exclude uncertainty in further development of the system and at the same time substantiate the existence of duality of its outcomes. The purpose for modeling presented below is to obtain a second alternative to crisis resolution by gradually correcting the situation and developing the global economy in direction opposite to “superfinance” at the level of main player-elements of the crisis economy, namely, corporate associations. Complex modeling of corporate stability indicated in the title of the paper implies the use of the model in two interrelated variants of application. The first option at the level of enterprise financial management (microeconomics), the second option involves the construction of a system of strategic management of stability of corporate associations of enterprises of the industry, a separate state, a region or resort destination (taking into account the peculiarity of the chosen framework of empirical research) [11], that is, highly complex systems that require administrative framework regulating modeling regulatory support. Before the fundamental change (cancellation) in traditional forms of financial statements, the “Frigate”-model is based on the generally accepted forms of reporting (balance sheet and statement of financial results as a source of information on costs and financial results in the context of core activities). The model helps identify the approaching of the bifurcation moment (in the definitions of the configuration school – the so-called “quantum leap”) in the overall sequence of the life cycle of an organization and prepare for the necessary transformation. Or choose the path of passively following the cycle stages and set the time of the most effective disinvestment (enterprise rehabilitation or dissolution). The practical part of the research is carried out based on enterprises located in Bolshaya Yalta municipal district. At the beginning of period under study (2004), 144 enterprises of sanatorium-resort complex were registered. Most of the enterprises in the sample were part of Ukrprofzdravnitsa corporate association [12]. As a result of experiments with various types of visual modeling, a comprehensive visual model (“Frigate”-model) for assessing the financial sustainability of the enterprise was developed. It has the form presented in Figure 3.

indicators of cluster “predominantly financial sustainability”

1-8, 15*, 27*, 32*

indicators of cluster “mainly solvency”

Figure 3. Structure of internal profile of visual model-system (“Frigate”-model) of financial assessment for strategic purposes

indicators of cluster “mainly profitability”

19-23, 25-26

35-38, 9*

indicators of cluster “flow generation”

10-14, 16-18, 24*

indicators of cluster “mainly turnover”

28-31, 33-34

Block: Keel

* Diffusion indicators of some blocks in others (non-typical)

(End of phase profile – “Youth”, i.e. criteria boundaries at minimum risks and sustained high income).

Source: compiled by authors.

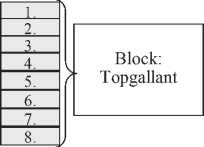

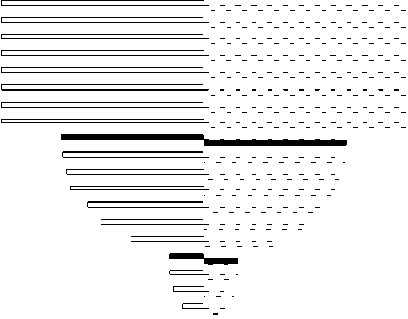

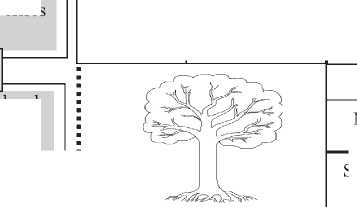

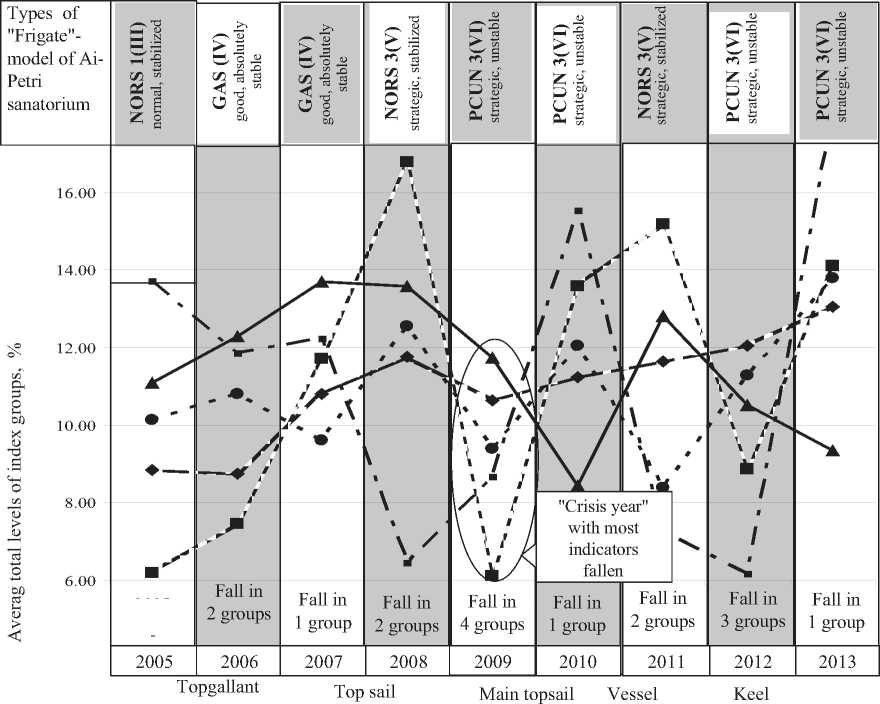

The model is based on relative indicators with the criteria boundaries normalized by a visual profile, which ensures relative comparability of enterprises [15]. The performance of model indicators is correlated with changes in international macroeconomic indicators (2004–2013). Groups of indicators represent areas, for example, the “Topgallant” block (indices of financial stability, B zone), they offer three block widths: narrow, between 0.2–0.4 base unit; “normal”: 0.4–1.0, etc. Taking into account this format and based on statistical data of sanatorium enterprises, typical visual profiles of the “Frigate”-model internal environment are constructed. They are presented in Figure 4 (a) and Figure 4 (b) .

The first part is related to individual enterprises, the second – to a corporation as a whole – “The tree of strategic diversification of corporate capital” (hereinafter TSDC). The response rate of individual indicators to global and individual crises form the framework for their gradation within a visual model. An additional criterion is the degree of stability in time, which is recognized by individual scientists [13]. At the top of the profile indicators most responsive indicators are places; any crisis begins from the “top”, however, the depth of passage through individual levels and the time of returning to the normal state indicates the degree of internal crisis.

The description of visual model profiles corresponding to each new type of financial sustainability of the internal environment is made in Table 2 .

To establish the correlation between the company’s external and internal environment each indicator in five groups was converted in percentage relative to their sum in 2005– 2013. The results are graphically presented in Figure 5 . Macro-economic analysis data are used for analysis [14].

Against the background of the overall performance of group of companies, success or failure in strategic development of a particular enterprise can identify its specific individual profile formed under the influence of both general crisis (in the external environment) and its internal crisis trends.

The second part of the model is determined by matrix positioning to conditions of the external environment (the form is a simple matrix for the distribution of types of environment and conditions of an enterprises, see in detail in [15]). When forming a system of complex profile types, the second part (taking into account the external environment) is modeled as a set of types according to the nature of the impact on the financial state of an enterprise: aggravating, neutral, improving [16; 17, p. 39]. Positioning to the type of the external environment helps localize the causes of crisis (external, internal) and forecast the

Table 2. Characteristics of types of visual profiles for assessing internal financial environment of “Frigate”-model of sanatorium enterprises

|

No |

Type |

Conditional characteristic of the state of “Frigate”-model and brief code breaking of its description based on scaling values of blocks with fixing their typical manifestations at enlarged stages of the life cycle |

|

1. |

CUN (I), crisis, absolutely unstable |

The state of the “vessel”: “the hull is almost built, sails tremble on the upper yards” (“Birth” “Death in infancy”). “B3—“ – “wide” block – “breakdowns” take place (beyond a scale value of 1.2), due to underdeveloped capital the amount of working capital can be negative; “M3” – “negative wide” block, certain types of profitability are unstable (negative “breakdowns”); “G1-” – “narrow” block – with almost no breakdowns, non-uniform; “C2+” – the block is basically close to the normal state but at the same time is unstable, a lot of “breakdowns” are possible; “K1-” –“narrow” block – the increase in the flow is restrained or absent (with breakdowns), etc. |

Figure 4 (a). “Frigate”-model internal profiles by type of strategic financial state of sanatorium enterprises in Bolshaya Yalta municipal district;

(b). “Tree of strategic diversification of corporate capital” (zoning of corporate capital investment, (case study of Yaltakurort)

- states which take place at enterprise’s strategic “overload” (secondary life cycle)

Areas of significant impact of crisis factors

|

1122593715 |

Zones of capital aggregation concentration

b)

of global and sectoral (innovation) crises

of global economic (system) crises

|

Ai-Petri sanatorium |

Miskhor sanatorium |

|||||

|

PCUN 3 (VI) |

PCUN 2 (VIII) |

2393 |

||||

|

Share: - 25% |

- 25% |

193 |

||||

Kurpaty sanatorium

NORS (V)

Share: - 15%

Leaders of the regional market and large (by share (over 20%, average of 3 years) of total assets in corporate capital), “Leafage”

Notable and average (by share (over 15%, average of 3 years) of total assets in corporate capital), “Trunk”

of all types of crises and longterm stagnation

Yasnaya polyana sanatorium

Orlinoe gnezdo sanatorium

Ukraine sanatorium

Livadia sanatorium

|

— |

1 15 93 CUN 2(IX) |

15 171921 11 13 PCUN 2(VIII)) |

579111315 17 CUN 3 (VII) |

193 PCUN 2(VIII) |

|

|

Share: 8–10% |

Share: 8–10% |

Share: 8–10% |

Share: 8– 10% |

||

Below average (by share (over 8%, average of 3 years) of total assets in corporate capital), “Roots – sprouts”

System of capital aggregation distribution in “Tree” groups by “Frigate”-model

- 0. horizontal type, - 1. merger-acquisition type, (2. liquidation-desintegration type)

- 1. pyramid, primary type, - 1. developing type, (2. “frozen” type)

- 2. rectangular type, - 3. trapezoidal type,

1. mature, balanced 1.deteriorating, leadership type (2. Stagnant type) type, (2.double trapezoid, - “post-leadership”)

Source: compiled by the authors.

Figure 5. Average values of five individual blocks of the internal environment of enterprise of the “Frigate”-model for the enterprises of Yaltakurort corporation in 2005–2013, in % to the sum of years [15]

development of company’s sustainability in the form of a sequence of changing model types taking into account the trends of economic development at the macro level.

The result of applying visual modeling when finding ways to return the main financial strategy of parity role in substantiating the necessity of strategic transformations of a corporation

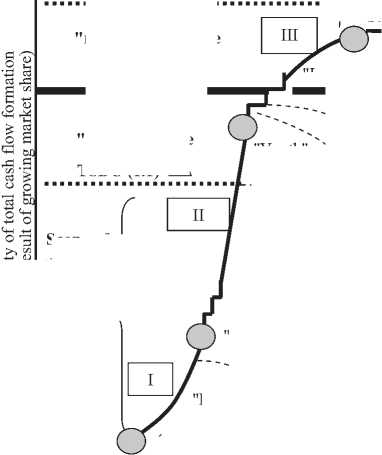

Diversification as the main system tool for resisting negative combinations of internal and external environment can be built according to three possible main financial corporate strategies: aggressive (expanded growth), balanced (with a focus on even distribution of capital and representation of a full range of types of complex stability, providing the ability to support low-risk competitive status or its return); of the strategy of anti-crisis mobilization (gradual withdrawal of separate enterprises from the zone of catastrophic risk, holding back crisis development among the others). The presented system of strategy types and the tree of strategic capital diversification makes it possible to substantiate the concept of the whole life cycle of a corporate association of enterprises (LCCAE) as diversification of risk of capital aggregation in enterprises of a particular financial state, market position and strategic objectives (scheme is presented in Figure 6). The initial conditions for the newly formed enterprise associations are very different, which affects the induction type of TSDC.

Figure 6. Conceptual scheme of corporate life cycle of business associations in designations of TSDC when applying the classification of types of strategic business units (BCG matrix)

STARS*

Scope of the first 'trapezoidal" type TSDC (3.1) 1

TSDC, (2.1)

Scope of the first rectangiular" type

Scope of the 'pyramid" type TSDC (1.1) A

' Prosperity'

A failed

—W'""> entrepreneur Founder's trap or nepotism trap

"Youth'

"Come on-Come on'

(0.1)

Infancy'

Giving care

Death in infancy

TSDC

Scope of the first 'horizontal type

CASH COWS*

"Aristocraticism'

."Bureaucratization1

"Earlier bureaucratization"

- Premature (_2 ageing

TSDC, (2.2) D

Scope of the second "rectangiular" type

Scope of the second "horizantal" type

TSDC (0.2) О

Stability

Scope of the second "trapezoidal type TSDC (3.2)

on

о

> a

QUESTION MARKS*

"Death"

DOGS*

Time

£

OD 6

<

Growth

Ageing

The starting points of the life cycle of corporate enterprise associations with different starting configurations:

OOOO - association of WOVAV enterprises

I

with relatively equal capital;

II

- acquisition of a relatively smaller

enterprise by a larger enterprise;

Main directions of efficient financial flows in BCG matrix

III

equal enterprises

- merger of relatively

IV

- merger of enterprises of different size and competitive status;

Typical way of product development in BCG matrix

* The connecting areas of the external environment of market growth (crisis) of demand for the product (feature I of BCG matrix) favoring the competitive status of an enterprise and the onset of a particular type of strategic financial stability according to the internal profile ofteh "Frigate"-model of corporate enterprise associations as the achieved market share (feature II of BCG matrix).

Source: compiled by the authors.

The new sustainability management system rules are as follows:

-

1. Required support for mobility of the middle group of enterprises for TSDC (“Trunk”), the association of enterprises must ensure continued capital aggregation in the middle group of potential business leaders (at the level of 25% or higher), which helps diversify the corporate profile and quickly replace former leading companies which have passed their life cycle with new leaders of the middle group, types, 2.1; 3.1;

-

2. Support for active and flexible (adaptive) process of capital flows between participants of corporate associations to ensure that strategic diversification as a managed activity for nomination of leading enterprises among the number of enterprises participating in associations (protection from competition, increasing resistance to adverse conditions, etc.).

Discussion

The proposed visual model of a new type as a financial and analytical tool helps apply financial and managerial impact to the object “enterprise development sustainability” both at the corporate and macroeconomic level.

In the first case, we understand the possibility of programming the model profile as both an individual enterprise and groups (levels) of enterprises in a corporate association.

It is also possible to calculate the change of model profiles across the corporation:

-

– in general by consolidated equity and financial results;

– by means of averaging the types of sustainability models of individual enterprises.

On the basis of remoteness (approximation) of intra-corporate consolidated and averaged types it is possible to establish the degree of integration efficiency of a corporation. With greater isolation (financial, organizational, market) of enterprises within the corporation these types will be significantly different. That is, both the success and the crisis of an individual enterprise is an individual result.

In the second case, we are talking about the macroeconomic application of the model as a tool for coordinating a certain number of enterprises united under a certain feature, for example, a specific territory-limited economic level such as resort destination, economic sector, territory of the state, and even global economy.

The main advantage of the model is that it returns the main financial strategy to the sphere of financial support of the most effective real capital application with justified target risk by linking the sequence of enterprise’s financial capacity development at the stages of the life cycle of an organization and its strategic market position (in the definitions of BCG matrix ). At the same time, the main financial strategy establishes the parity (rather than main) role in initiating the economic transformation of a corporation. In this case, the influence of the principle of total capital increment, return on total capital and the impact of the stock market is limited [18; 19]. Even areas that are directly related to them are of equal importance in the “Frigate”-model among all other areas of comprehensive financial sustainability, in contrast to the most popular approaches to constructing a system of strategic controlling (in which the profitability model of DuPont system indicators center).

The model quite clearly shows that in anticipation of the implementation of a large-scale strategic project, the entire system of complex financial sustainability is in a state of destabilization and with financing such external changes (through additional issue of shares, long-term loans), the risks will only be aggravated, since production facilities, at best, remain at the same level. It is also necessary to take into account the fact that the imperfection of the system of stock market regulation in countries with developing economies makes it possible to use this system to gain monopoly and windfall revenues [20]. In this case, the advantage of Crimea sanatorium enterprises (research framework) is that they almost do not use stock issue of enterprise lending (historically) and implement strategic projects at their own expense (which has ensured the purity of model responses).

Conclusion

At first glance, the presented variant of substantiating system transformations of a corporate association of enterprises on the basis of the “Frigate”-model does not look strong enough compared to the motives of global corporations in setting the goals of their activities. However, its role is to present a variant of gradual restructuring of the system of ideological values of corporate management, which significantly deviated from a correct understanding of a corporate mission, consisting in the system of goals in addition to earning money. To do this, in most cases, the growth of the company (growth of capital) is enough, if we put such an approach at the forefront, all life cycle management will be aimed at increasing financial capacity by extensive and intensive methods. Returning to the provisions of Joseph Schumpeter, – the company’s growth should not become iots main development goal, otherwise all changes will be made dependent on the GROWTH goals (capital letters – as a philosophy). The easiest way to achieve GROWTH is by applying financial methods. This property of finance has served as a framework for finance gaining exceptional importance throughout global economy. GROWTH must be the servant of DEVELOPMENT, and not vice versa. Dialectically, any development occurs abruptly, on the basis of accumulation of extensive results of GROWTH (which is methodically supported by the configuration school as the most relevant school of strategic management). Avoiding “slow” preparation for the implementation of strategic projects is possible by raising funds from beyond financial markets. That is, lending and emissions, which themselves include specific risk factors acting as a price of benefits over time. Otherwise the development will be assessed in terms of stock market indices which in turn are based on the real growth of capital and demand for its tools, whose cost and effectiveness are dependent on the tools of the same stock market (for example, the average capital cost is calculated in the breakdown of groups of capital taking into account the cost of its attraction). However, the society has long ago understood that the only way to achieve global development is to strive for sustainable development, having developed the whole concept in related areas in detail.

When choosing the type of financial management for global corporations, priority should be given to gaining financial power and reducing the risks of social or environmental problems, whose history has shown to be of little importance, rather than addressing these problems themselves. The “Frigate”-model with global (meaning a sufficient level of transnational corporations) application does not limit competition, although it changes the environment, shifting the innovation focus towards competition for ensuring asset turnover and cash flow efficiency (the last two levels in the model structure – their transformations are associated with truly strategic transformations).

Their values cannot be “dispersed” by stock market tools (in which income is correlated with current assets), which creates a pledge and an incentive to establish a stable framework of development in the future with significant complications for the effects from stock market tools. Having the DEVELOPMENT framework at their disposal, the company can situationally gain GROWTH in a fairly short period of time, which in the opposite direction (gaining capital for development) can take a much longer period of time, despite accelerated scientific progress. Understanding this process is largely due to the “Frigate”-model and the features of its integrated application in assessing sustainability. The model clearly separates intermediate and bifurcation stages of enterprise development, using a simple mechanism of ranking complex financial stability, and operates, respectively, financial indicators. This, in turn, justifies a system of criteria for separating GROWTH from DEVELOPMENT. The peculiarity of sanatorium and resort enterprises is their dependence (proximity) of the goods life cycle and the organization (which helps apply the BCG matrix to the OLS curve), and the increase in the size and almost accordingly market share reduces dependence on crises.

Investment in strategic innovation as the main driver of economic growth should acquire the role of financing the tool achieve DEVELOPMENT; individual innovation, even successfully implemented, does not always lead to strategic results (transition to a new qualitative level) and true strategic, high-risk mobilization of all enterprise resources. Such transitions clearly identify the model.

The most important feature of the new model is also exclusion of the situation where market leaders plan to prepare all enterprises of a corporate association at the same time, which is impossible without an extreme increase in the risk of underfunding, especially amid low integration efficiency of sanatorium enterprises in the association. However, in real life the risk is compensated by tools of financial service markets (lending, emission, etc.) by removing risk from the corporate system to the global financial system where it can not be fully distributed and repaid by bankruptcy of other market players, which leads to accumulation of force of risk factors. They are returned to the corporation in the form of global and system crises, being transformed from crises able to be diversified (based on model) into crises of the external environment that the company can only take up and survive (or not).

Achieving the research goal is determined by obtaining a new financial analytical tool (model) to identify the type of financial sustainability as a system sequence of complex profile changes (when assessing the internal and external environment) of individual enterprises and their corporate associations. At the level of corporate financial management the model coordinates the process of capital aggregation according to the objectives of type of strategic development (preparation of the financial framework for the chosen main financial strategy), taking into account the required and achieved type of financial state of each enterprise and the corporation as a whole (the remoteness of which is the financial risk of strategic activity). Practically this means that capital value is possible to be structured by system of TSDC and the process is possible to subordinate to the objective of supporting the strategic competitiveness of the main product (service) on the market, that is not provided by any of the known methods. As a result of applying the proposed approach, the basic conditions of sustainable development are achieved – saving resources and reducing the overall risk of operating a single economic system by reducing the risk of activities of each of its participants, forming a single low-risk external activity environment. Amid difficulties in attracting resources of the stock market (due to its weak development and sanctions imposed on Crimea), regional enterprises financing the introduction of innovative products and services can to a greater extent rely on their own capacities, which in turn creates a specific version of self-sufficient and successful existence of an enterprise amid global economic crises.

Список литературы Modeling complex financial sustainability of a corporation in the age of global economic crises

- Schumpeter J.A. A theorist’s comment on the current business cycle. Journal of the American Statistical Association, 1935, vol. 30 (189), pp. 167-168 DOI: 10.2307/2278223

- Kondratieff Waves: Dimensions and Prospects at the Dawn of the 21st Century. Volgograd: Uchitel’ Publishing House, 2012. 224 p.

- Reynolds A. No Housing Bubble Trouble. Washington Times, 2005, January 9.

- Maslov O.Yu. 23 reasons for the global crisis (the chronicle of the current global crisis -36). Ezhenedel’noe nezavisimoe analiticheskoe obozrenie=Weekly independent analytical review, 2009, issue 36. Available at: http://www.polit.nnov.ru/2009/10/13/crisisology23cause36/..

- Ansoff I. Strategicheskoe upravlenie . Translated from English. Moscow: Ekonomika, 1989. 358 p.

- Grant R.M. Sovremennyi strategicheskii analiz . Saint Petersburg: Piter, 2008. 560 p.

- Altman E. Corporate Financial Distress and Bankruptcy. 3rd edition. John Wiley and Sons, 2005. 354 p.

- Mintzberg H., Lampel L., Quinn, J., Ghoshal S. The Strategic Process, 4th edition. New Jersey: Prentice Hall publishing, 2003. 489 p.

- Black E.L. Life-Cycle Impacts on the Incremental Value-relevance of Earnings and Cash Flow Measurers. Journal of Financial Statement Analysis, 1998, vol. 4, no. 1, pp. 40-56.

- Chambers A.D. New guidance on internal audit -an analysis and appraisal of recent developments. Managerial Auditing Journal, 2014, vol. 29, pp. 196-218 DOI: 10.1108/MAJ-08-2013-0927

- Butler R.W. The concept of a tourist area cycle of evolution: implications for management of resources. Canadian Geographer, 1980, vol. 24, pp. 5-12 DOI: 10.1111/j.1541-0064.1980.tb00970.x

- Malyshenko V.A. Authorship certificate 2016620078 Russia, Baza finansovykh koeffitsientov strategicheskogo finansovogo analiza predpriyatii sanatorno-kurortnogo kompleksa YuBK (Yuzhnogo berega Kryma) . Declared 6.10.2015; State registration date in the database list 19.01.2016.

- Kopacheva E.I. Basic processes of strategic management of financial sustainability of tourism enterprises. Uchenye zapiski Tavricheskogo natsional’nogo universiteta im. V.I. Vernadskogo. Seriya: Ekonomika i upravlenie=Bulletin of Tavrida National V.I. Vernadsky University: Series Economics and Management, 2011, no. 2, pp. 86-97..

- Robert J. S. Stock Market Data Used in "Irrational Exuberance". Princeton University Press, 2000, 2005, updated. 296 p.

- Malyshenko V.A. The model of system-strategic financial analysis of Crimea sanatorium-and-health-resort enterprises. Ekonomika regiona=Region’s economy, 2016, vol. 12, no. 2, pp. 510-525. DOI: 10.17059/2016-2-16

- Geniberg T.V., Ivanova N.A., Polyakova O.V. The nature and methodological framework of developing a company’s financial strategy. Nauchnye zapiski NGUEU=Bulleting of Novosibirsk State University of Economics and Management, 2009, no. 4, pp. 68-88..

- Bender R., Ward K. Corporate financial strategy. Butterworth Heinemann, 2010. 395 p.

- Fama E.F. Efficient Capital Markets: A Review of Theory and Empirical Work. Journal of Finance, 1970, May, pp. 383-417 DOI: 10.1111/j.1540-6261.1970.tb00518.x

- Nance J.P., Roemmich R.A. Are Financial Statements Meaningful under Exchange Rate Fluctuations. Journal of financial management and analysis, 2008, vol. 2. pp. 65-74.

- Malyshenko K.A. Studying the stock market of Ukraine with the use of the event analysis. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and social changes: facts, trends, forecast, 2017, no. 1, pp. 235-253. DOI: 10.15838/esc.2017.1.49.13