Modeling the Impact of Bank Investments Attracted by Institutional Sectors on the Socio-Economic Development of Russian Regions

Автор: Naumov I.V., Nikulina N.L.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Regional economy

Статья в выпуске: 5 т.14, 2021 года.

Бесплатный доступ

Banking capital plays a significant role in providing the financial foundations for the development of institutional sectors in regional systems, which include financial and non-financial corporations, households, public administration sector and foreign institutions. However, a study of the processes of banking capital flows between them shows that the banking sector currently does not perform its traditional functions of saving institutional sectors’ capital and providing them with loans, but carries out a speculative policy, contributing to a significant outflow of financial resources abroad and causing serious harm to the Russian economy. In this regard, the purpose of the work is to study the imbalances in the processes of banking capital flows between institutional sectors and to model the impact of bank investments attracted by institutional sectors on the socio-economic development of constituent entities of the Russian Federation. We have developed a methodological approach based on the methodology of forming balanced matrices of financial flows between institutional sectors using data from the primary accounting statements of loan institutions, the methodological principle of double entry bookkeeping of the System of National Accounts and methods of regression analysis using panel data. We built matrices of financial flows in the regions, characterizing the processes of bank capital flows between the sector of financial and non-financial corporations, public administration, households and foreign institutions, regression models characterizing the impact of bank investments attracted by each institutional sector on the indicators of socio-economic development of regional systems. The study has found that the capital raised by banks in the sector of non-financial corporations has a positive impact on the dynamics of the gross regional product of Russia’s constituent entities, leads to a decrease in unemployment in the regions, the number of people with incomes below the subsistence level, the degree of capital consumption, as well as an increase in the balanced financial performance of enterprises and the average monthly nominal wage.

Bank investments, financial flows, institutional sector, regression analysis, panel data

Короткий адрес: https://sciup.org/147234807

IDR: 147234807 | УДК: 336.7:332.1, LBC 65.26 | DOI: 10.15838/esc.2021.5.77.3

Текст научной статьи Modeling the Impact of Bank Investments Attracted by Institutional Sectors on the Socio-Economic Development of Russian Regions

The banking sector plays a key role in the economic development of regional systems of various levels. It provides the real sector of the economy with financial resources to implement investment projects aimed at modernization and technological renewal of production processes, introduction of technical-technological, organizational and social innovations, to diversify production and increase competitiveness of manufactured products. Studies carried out by A. Aganbegyan, I. Rudenskii [1], A. Milyukov [2], P.V. Akinin, V.P. Akinina [3], E.A. Goncharuk1, V.V. Trubnikova, A.V. Savenkova [4], A. Danilov-Danil’yan [5], N.P. Kazarenkova [6], V.A. Ilyin et al. [7], M.A. Pechenskaya [8], B. Urosevic, B. Zivkovic, M. Bozovic [9], S. Gilchrist, E. Zak-rajsek [10] showed the importance of attracting bank investments in the real economy, lending to enterprises of various types of economic activity. Along with providing the non-financial corporate sector with credit resources, banks and loan institutions perform another important function: they provide settlement and cash services to enterprises and ensure the safety of their financial resources.

The banking sector forms the financial foundation for the implementation of infrastructure projects, strategic programs and projects of regional systems through investments in debt securities (government agencies, Russian Federation constituent entities, municipalities) and lending their public debt. Studies by D. Monacelli, M.G. Pazienza, C. Rapallini [11], W. Jeong [12], I.V. Naumov [13] testify that the capital attracted by banks contributes to an increase in the budgetary security of territories, and its use helps address acute socio-economic problems of their development.

Providing households with consumer and mortgage loans, carrying out activities for the preservation of money savings, the banking sector forms the financial foundation for the development of this institutional sector of the economy. Studies conducted by E.I. Strogonova [14], L.M. Yusupova, T.V. Nikonova, M.E. Ivanov [15], L.F. Orlov [16], K. Ellis, A. Lemma, J.-P. Rud [17], S. Bouyon [18], O.G.F. Mwalughali [19], confirm the importance of attracted banking resources for the development of the household sector. By investing in equity and debt securities of other financial institutions, providing credit resources to insurance organizations, investment companies, pension funds, the banking sector contributes to the development of the financial corporation sector in regional systems, which performs important functions for households and the real sector of the economy.

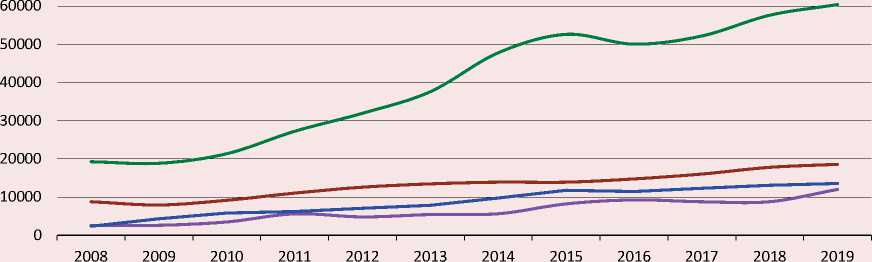

Thus, we can note that the banking sector is a link in the development of the institutional sectors of the economy, which, according to the methodology of the System of National Accounts, include sectors of financial, non-financial corporations, public administration, households and foreign institutions. The dynamics of changes in the volume of investments attracted by banks in government and corporate debt securities, shares, as well as the volume of lending to various institutional sectors shows that the banking sector has a truly powerful investment potential for progressive socio-economic development of regions (Fig. 1).

Based on the data presented in Figure 1, we can conclude that the investment opportunities of the banking sector exceed many times the investment resources of enterprises of various types of economic activity, as well as direct foreign investments coming into the economy. However, as our earlier studies have shown [20], in the periods of increasing crisis phenomena in the economy the banking capital is not used to solve the financial problems of the development of the real sector of the economy and the public administration sector, it is increasingly used for speculative purposes. Loan institutions carry out speculative operations

Figure 1. Dynamics of changes in the volume of investment resources of enterprises, banking institutions, foreign institutions in Russia for the period 2008-2019, bil. rub.

^^^^^^^^^^^ Company’s investments in fixed assets

^^^^^^^^^^^ Foreign direct investment inflows

: Banks’ investments in government and corporate debt securities, shares, and discounted bills

^^^^^^^^^ Volume of bank lending to financial institutions, enterprises of various types of economic activity, and individuals

Source: own compilation according to the Regional Section of the Central Bank of the Russian Federation and the Federal State Statistics Service.

with foreign currency, derivatives (futures and options), invest in equity and debt securities of foreign issuers, place funds on settlement accounts of foreign financial institutions, contributing to the outflow of a large part of capital abroad and reducing the volume of lending to financial, nonfinancial corporations, the household sector and public administration. The banking sector in times of economic and financial crises ceases to perform its traditional functions of accumulation, saving and reproduction of financial resources of institutional sectors of the economy. Speculative operations carried out by it lead to growing imbalances in the distribution of financial resources between institutional sectors, negatively affect the financial sustainability of institutional sectors, reduce their investment opportunities to solve the most important problems of socioeconomic development. That is why the main purpose of the work is to study the imbalances in the processes of banking capital flows between institutional sectors and to model the impact of banking investments attracted by institutional sectors on the socio-economic development of the Russian Federation constituent entities.

Review of research on assessing the impact of bank investments attracted by the institutional sectors on the socio-economic development of territories

Theoretical review of the works shows that to assess the impact of bank investments on the dynamics of socio-economic development of regional systems, researchers usually use statistical methods of data analysis (relative indicators, averages and dynamics indicators) and regression modeling methods. The simplest statistical methods for studying the role of bank capital in the socioeconomic development of territories were applied by N.P. Kazarenkova [6], L.N. Sotnikova, M.V. Tkacheva [21], V.I. Terekhin, O.P. Sukovatova [22],

T. Beck, R. Dottling, T. Lambert, M. van Dijk2, P.V. Akinin, V.P. Akinina [3] and others. These methods allowed researchers to estimate only superficially the impact of investments attracted by banks on the socio-economic development of enterprises of the real sector of the economy, households and the public administration sector, to form initial assumptions about this impact. Regression analysis methods were most often used to justify the assumptions. For example, in order to assess the short- and long-term effects of public investment on economic growth and private investment, C.T. Nguyen, L.T. Trinh projected autoregressive distributed lags models, given the macroeconomic data of Vietnam for the period 1990–2016. [23]. T.I. Solodkaya, M.M.T. Tali, and M.A. Industriev established cointegration of non-stationary time series: gross domestic product, total capitalization volume of the Moscow Exchange, and bank lending to individuals and legal entities. The Engle Granger test found a cointegrating relationship confirming the long-term equilibrium relationship of the variables and the genuineness of their correlation. It showed that economic growth depends more on the volume of bank lending and less on the growth of market capitalization of stocks [24]. T.V. Pogodaeva, N.A. Baburina, E.P. Druz’, M.P. Sheremet’eva used methods of economic-statistical and econometric analysis to identify the impact of banking sector development indicators on the socio-economic development of states [25]. P.V. Porubova identified a differential economic and mathematical model of multiplication and acceleration according to the economic development of Russia and the Republic of Kazakhstan, reflecting the dependence of GDP growth rates on such factors as the volume of investment and the value of the investment multiplier. This model allowed P.V. Porubova to determine the values of factors necessary to accelerate the dynamics of economic development3.

Md.S. Alam, M.R. Rabbani, M.R. Tausif, J. Abey formed a dynamic vector error correction model (VECM) based on panel data of 20 public sector banks from 2009 to 2019, and a fully modified least squares panel OLS (FMOLS) and dynamic OLS (DOLS) to estimate the relationship between return on interest margin on assets and bank investment and credit capacity with GDP [26]. Using quarterly GDP data, as well as various commercial bank indicators covering the period from March 2005 to December 2016, E. Paavo examined the impact of commercial bank dynamics on economic growth in Namibia. The study used the autoregressive distributed lag (ARDL) approach to determine the presence of short-term and long-term relationships, as well as the Engle Granger test to determine the cause and effect relationship between the development of the banking sector and economic growth [27]. M. Prochniak, K. Wasiak analyzed the impact of the financial sector on the economic growth of 28 EU countries and 34 OECD countries in the period 1993–2013 by applying extended econometric modeling, including testing of nonlinear relationships. Regression equations were estimated using Blundell and Bond’s GMM estimation system [28].

At the regional level, regression analysis was used, for example, by P.A. Ivanov and T.I. Tyutyunnikova, who justified the impact of bank lending to households on the gross regional product by the example of the Republic of Bashkortostan [29]. A review of the current state of scientific works in this area shows that regression analysis is the most frequently used method for assessing the impact of bank investments on the socio-economic development of territories. This very set of tools that will be the basis of the methodological approach in our study.

Methodological approach to assessing the impact of bank investments attracted by the institutional sectors on the socio-economic development of Russian regions

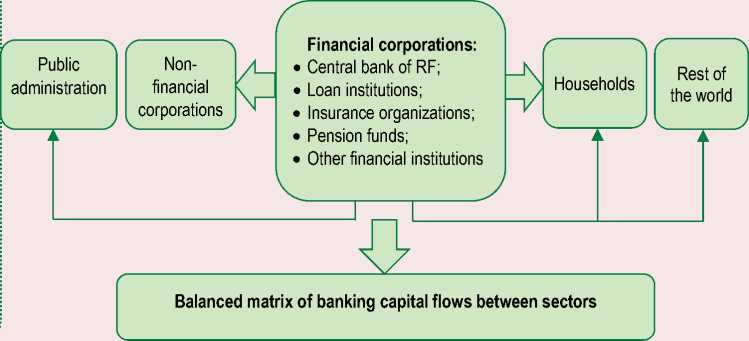

Theoretical review of the works shows that the main obstacle to the study of the role of banking capital in the socio-economic development of Russian regions is a fragmented and underdeveloped statistical database formed by the state statistics authorities, the Central Bank and the Ministry of Finance of the Russian Federation. Official statistics provide information on regional specifics of banks’ lending to individuals and legal entities, public debt of the RF constituent entities, banks’ investments in debt and equity securities of enterprises in various spheres of economic activity, debt securities of the RF constituent entities and municipalities. At the same time, official statistics do not allow assessing the impact of investment by banks and other loan institutions in monetary gold, foreign currency and financial derivatives on the socio-economic development of regional systems. In order to solve this problem and to analyze in a more systematic way the capital attracted by banks to the economy, we developed a methodological approach (Fig. 2) based on the methodology of forming balanced models of financial resources flow between institutional sectors within the regional system, which, in accordance with the System of National Accounts, include the financial corporations sector (the Central Bank, banks and other loan institutions, investment companies),

Figure 2. Methodological approach to assessing the impact of bank investments on socio-economic development of regions

Formation of balanced matrices of banking capital flows between institutional sectors in the regions of Russia

Finding patterns of banking capital flows between institutional sectors in periods of economic recession and recovery

Assessment of the volume of banking capital raised by institutional sectors in different periods of economic development

Regression modeling of the dependence of the dynamics of regional economic development indicators on the banking investments attracted by the institutional sectors

Source: own compilation.

non-financial corporations sector (enterprises of various types of economic activity), the public administration sector (state-owned enterprises and budgetary institutions), the households sector and foreign institutions.

The initial stage of the study, according to the presented approach, is the formation of balanced matrices of bank investment flows between financial and non-financial corporations, the household sector, public administration and foreign institutions. For the most complete and accurate reflection of the processes of bank capital flow we propose to use the primary data of the turnover statement on the accounting records (form no. 101) of banks and other loan institutions registered in the territory of the region under consideration. This reporting form contains detailed information about the banks’ financial resources flows not only on traditional investment instruments, which are reflected in the official statistics (lending to individuals and legal entities, public debt of the Russian Federation constituent entities, operations with deposits, debt and equity securities of various institutional sectors), but also on such instruments as investments in monetary gold, foreign currency, derivatives.

For the formation of balanced matrices of financial flows between sectors we applied the basic principles of the formation methodology of the System of National Accounts: the double-entry bookkeeping, the list of institutional sectors of the national economy and the structure of their financial account (Fig. 3) .

The principle of double-entry bookkeeping used in the matrices of the bank financial resources flows between sectors allows studying the specifics of potential formation by some sectors and use by other sectors. In the matrices, investments in various financial instruments are shown with a negative sign for the sector that carries them out and with a positive sign for the sector that receives funds as a result of asset sales. Lending transactions to institutional sectors by banking institutions, according to this approach, are shown on the asset side of the balance sheet with a negative sign for

-

• Investments in monetary gold

-

• Investments in foreign currencies

-

• Deposits

-

• Investments in debt securities

-

• Outstanding loans and borrowings

-

• Investments in derivatives

-

• Investments in stocks

-

• Generation of accounts receivable / payable

-

• Payment of taxes and duties

-

• Wage settlements

-

• Settlements with suppliers

-

• Investments in fixed assets

Figure 3. Algorithm of forming a balanced matrix of banking capital flows between institutional sectors in the region

Passive part of the balance sheet of the matrix of banking capital flows between sectors

Public administration

Financial corporations:

Central bank of RF;

Loan institutions;

Insurance organizations;

Pension funds;

Other financial institutions

Households

Rest of the world

Active part of the balance sheet of the matrix of banking capital flows between sectors

Source: own compilation.

the loan institution sector and a plus sign for the borrowing sector. The reverse situation arising from the repayment of taken loans is shown in this matrix with opposite signs. As a result, the model balances the financial flows between institutional sectors. Formed accordingly, the passive part of the balance sheet of the financial flows matrix reflects the processes of formation of the banking sector investment potential of the economy and its use by other institutional sectors, the active part, by contrast, reveals the features of attracting banking capital by sectors of financial and non-financial corporations, public administration, households and foreign institutions. The negative sign for the sectors in the balanced matrix allows concluding that the volume of investments they attract is reducing and their investment opportunities become less favorable. The negative balance sign also reflects the amount of funds invested by institutional sectors, which helps determine the financial instruments for using the investment potential of institutional sectors. The positive final value of the balance in the balanced matrix allows assessing the investment opportunities for the development of institutional sectors, and the volume of bank investment they have attracted.

The formed matrices of the banking capital flows for all regions of Russia in dynamics for the period from 1998 to 2019 will make it possible in the second stage to establish patterns of banking capital flows between institutional sectors during periods of economic recession and recovery and in the third stage – to estimate the amount of attracted banking capital by institutional sectors in different periods of economic development. The comparison of the identified patterns in the processes of attracting banking capital by institutional sectors and indicators of socioeconomic development of regions using regression modeling on panel data, carried out at the final stage of the study, will allow us to make objective assessment concerning the role of the banking sector in the development of the economy. In the course of modeling it is planned to study the impact of the dynamics of bank investments attracted by the public sector of the economy on the dynamics of gross regional product, consumer price index, unemployment rate, the number of population with incomes below the subsistence level, the amount of average per capita cash income and income of consolidated budgets of the RF constituent entities.

In order to assess the impact of banking resources attracted by the household sector, we propose to form regression models in which the dependent variables are unemployment rate, average monthly nominal accrued wages per employee, the proportion of the population with incomes below the subsistence level. The formation of these models will allow assessing the impact of bank resources attracted by households on the indicators of their financial security. In addition, the study assumes the construction and regression models of the impact of the dynamics of banking capital attracted by the non-financial corporations on the dynamics of GRP, industrial production index, the degree of depreciation of fixed production assets, exports of manufactured products, balancing of financial performance of organizations, the amount of their overdue accounts payable, unemployment rate, the share of the population with incomes below the subsistence level, the average monthly nominal wage per employee.

During the construction of regression models, the analysis of data for stationarity using the Dickey-Fuller test, the formation of regressions with fixed and random effects and the selection of the most adequate models using the Hausman and Breusch-Pagan tests, as well as the Schwartz, Akaike and Hannan-Quinn information criteria, the analysis of statistical significance of regression parameters and the implementation of the basic assumptions of Gauss-Markov. The models built allow justifying or disproving the impact of attracted by the institutional sectors bank investments on the dynamics of socio-economic development in the regions of Russia.

The patterns of banking capital flows between institutional sectors in the regions of Russia

The systematization of data from the accounting turnover balance sheet according to Form no. 101 of regional banks for the period from 1999 to 2019 allowed forming matrices of banking capital flows between institutional sectors in each region according to different investment instruments. An example of such a matrix, characterizing the processes of banking capital flows between sectors in Russia as a whole, is presented in Table 1 . The data show that bank capital in 2018 was actively raised by the Central Bank of Russia (6,008 bil. rub.), the non-financial corporation sector (1,913 bil. rub.), and households (712 bil. rub.). A significant part of the banking capital was raised by the sector of foreign institutions (3,784 bil. rub.) in the form of lending (1,075 bil. rub.) and investment in foreign currency (4,722 bil. rub.).

Table 1. Balanced matrix of banking capital flows between institutional sectors in Russia in 2018, bil. rub.

|

Investments |

Financial corporations |

Public administration |

Non-finan-cial corporations |

Households |

Rest of the world |

||

|

CBR |

Banks |

Other institutions |

|||||

|

1. Investments in gold |

28 |

131 |

-29 |

6 |

6 |

-49 |

-93 |

|

2. Cash currency |

4,664 |

-5,260 |

-4,700 |

13 |

9 |

552 |

4,722 |

|

3. Deposits |

1,150 |

7,153 |

-651 |

-2,589 |

-1,974 |

-2,783 |

-306 |

|

time deposits (up to 30 days) |

144 |

594 |

-223 |

129 |

-337 |

-277 |

-31 |

|

short-term deposits (from 30 days to 1 year) |

462 |

3,368 |

-268 |

-1,580 |

-996 |

-1,068 |

82 |

|

medium-term deposits (from 1 to 3 years) |

0 |

116 |

96 |

-396 |

130 |

88 |

-34 |

|

long-term deposits (over 3 years) |

0 |

466 |

27 |

-65 |

-644 |

-214 |

430 |

|

demand deposit |

542 |

2,445 |

-119 |

-677 |

-128 |

-1,312 |

-752 |

|

4. Investments in debt securities |

453 |

3,079 |

-853 |

-962 |

-771 |

273 |

-1,218 |

|

available for sale |

779 |

-509 |

-43 |

27 |

-4 |

-3 |

-246 |

|

maturity up to 1 year |

1 |

-241 |

36 |

0 |

1 |

204 |

0 |

|

maturity from 1 to 3 years |

-5 |

-76 |

40 |

0 |

-5 |

46 |

0 |

|

on demand |

-322 |

3,905 |

-886 |

-989 |

-763 |

26 |

-972 |

|

5. Loans provided |

-231 |

-6,256 |

-606 |

-75 |

2,758 |

3,335 |

1,075 |

|

short-term loans (up to 1 year) |

607 |

-634 |

42 |

-38 |

373 |

-9 |

-340 |

|

medium-term loans (from 1 to 3 years) |

495 |

-1,067 |

-28 |

52 |

223 |

126 |

199 |

|

long-term loans (up to 3 years) |

-1,332 |

-4,591 |

-413 |

-87 |

2,133 |

3,032 |

1,259 |

|

on demand |

0 |

35 |

-206 |

-2 |

30 |

186 |

-43 |

|

6. Investments in deprivatives |

0 |

-377 |

377 |

0 |

0 |

0 |

0 |

|

7. Investments in stocks |

-49 |

4,321 |

-1,866 |

-555 |

-879 |

-511 |

-461 |

|

8. Overdraft |

-8 |

-18 |

-79 |

1 |

89 |

-64 |

79 |

|

9. Tax payments |

0 |

-63 |

0 |

63 |

0 |

0 |

0 |

|

10. Wage payment settlement |

0 |

14 |

0 |

-3 |

0 |

-11 |

0 |

|

11. Settlements with suppliers |

0 |

-2,607 |

-1 |

0 |

2,624 |

0 |

-15 |

|

12. Investments in fixed assets |

0 |

-117 |

1 |

93 |

53 |

-30 |

0 |

|

BALANCE |

6,008 |

0 |

-8,408 |

-4,009 |

1,913 |

712 |

3,784 |

|

Source: own compilation on the basis of the turnover statement no. 101 of loan institutions. |

|||||||

By forming matrices for each region for the period from 1999 to 2019, the following patterns have been established. During the periods of economic recession (1998–1999, 2003–2004, 2008–2009, 2014–2015, 2018) there was a significant outflow of banking capital abroad, caused by the speculative investment policy implemented by banks with foreign currency, equity and debt securities of foreign issuers.

The volume of lending to the real sector, the public administration sector and households sharply declined during these periods, while lending to foreign institutions increased. Instead of active financial support of the real economy during recessions and crises, banks actively transferred their capital abroad (Tab. 2).

During the periods of worsening economic situation, the volume of bank investments attracted by the sector of non-financial corporations, which includes enterprises of various types of economic activity, also declined. The capital accumulated by banks was used for speculative purposes, namely for investments in high-risk derivatives (futures and options).

Table 2. Dynamics of banking capital flows between institutional sectors in Russia over the period 1998-2019, bil. rub.

|

Year |

Financial corporations |

Public administration |

Non-financial corporations |

Households |

Rest of the world |

|

|

CBR |

Banks |

|||||

|

1998 |

20 |

-32 |

-25 |

45 |

-20 |

12 |

|

1999 |

-7 |

11 |

7 |

4 |

-1 |

-14 |

|

2000 |

40 |

-41 |

-1 |

-2 |

-13 |

18 |

|

2001 |

14 |

-32 |

-29 |

64 |

-16 |

-2 |

|

2002 |

122 |

-271 |

276 |

882 |

-941 |

-69 |

|

2003 |

174 |

-49 |

8 |

137 |

-178 |

-91 |

|

2004 |

-149 |

123 |

-229 |

478 |

-120 |

-102 |

|

2005 |

-296 |

216 |

-129 |

612 |

-202 |

-201 |

|

2006 |

-182 |

74 |

-466 |

1,080 |

-50 |

-456 |

|

2007 |

-400 |

-77 |

-799 |

1,883 |

-138 |

-470 |

|

2008 |

-1,768 |

-1,816 |

-3,051 |

7,868 |

-772 |

-461 |

|

2009 |

951 |

-1,714 |

-1,191 |

2,281 |

-2,757 |

2,429 |

|

2010 |

1,557 |

925 |

492 |

-1,567 |

-1,182 |

-225 |

|

2011 |

-1,875 |

706 |

-1,618 |

2,791 |

-703 |

700 |

|

2012 |

-1,460 |

-932 |

-827 |

2,629 |

315 |

275 |

|

2013 |

-3,193 |

1,893 |

-1,459 |

3,580 |

-397 |

-424 |

|

2014 |

-4,050 |

2,182 |

-4,084 |

4,832 |

-1,870 |

2,991 |

|

2015 |

-2,861 |

-4,437 |

-4,735 |

4,044 |

-4,596 |

12,586 |

|

2016 |

179 |

5,476 |

1,667 |

-1,555 |

-1,317 |

-4,449 |

|

2017 |

-3,847 |

10,940 |

1,060 |

-1,819 |

-1,235 |

-5,099 |

|

2018 |

6,008 |

-8,408 |

-4,009 |

1,913 |

712 |

3,784 |

|

2019 |

4,637 |

-1,096 |

-2,092 |

799 |

454 |

-2,701 |

Source: own compilations on the basis of the turnover statement no. 101 of loan institutions.

During the periods of economic recovery (2000–2002, 2005–2007, 2010–2013, 2016–2017), there were opposite patterns in the processes of bank investment flows between sectors. Banking capital returned from abroad and was actively used for lending to non-financial corporations, the public administration sector and households, for investments in equity and debt securities of the real sector of the economy and constituent entities of the Russian Federation and federal loan bonds. During the periods of economic recovery, banking capital was actively attracted by institutional sectors, the interest of banks in high-risk derivatives decreased (see Tab. 2). The formation of the balancing matrix of the banking investment flows between sectors with the increase since 1998 allowed establishing that at present (as of January 1, 2020) a significant share of financial resources accumulated by banks of institutional sectors still remains abroad. This poses threats to the financial development of Russian regions.

Results of regression modeling of the dependence of regional economic development on bank investments

As a result of the study, using 1,716 observations, the dependence of the dynamics of gross regional product of the Russian Federation constituent entities on bank investments attracted to the sector of non-financial corporations was established:

Y = 452123 + 0.289 • X, (1)

where Y – the volume of GRP of the Russian Federation constituent entities, in current prices, mil. rub.;

X – the volume of bank investments attracted in the sector of non-financial corporations, mil. rub.

According to the results of the Hausman and Breusch-Pagan tests, as well as the comparison of Schwartz, Akaike and Hannan-Quinn information criteria, we found that the optimal model of the relationship of these indicators is a regression model with fixed effects. Its reliability is confirmed by low values of standard errors and p -values in regression parameters, high value of coefficient of determination and its statistical significance (Tab. 3) .

The model showed that the inflow of additional bank investments in the sector of non-financial corporations in the amount of 1 mil. rub. contributes to the growth of GRP by 0.289 mil. rub.

A generalized least squares regression model shows that the inflow of bank investment in the sector of non-financial corporations contributes to the reduction of unemployment in the regions:

Y = 8.685 - 0.000000134 • X, (2)

where Y – the unemployment rate of the Russian Federation constituent entities, %;

X – the amount of bank investments attracted to the sector of non-financial corporations, mil. rub.

The banking resources attracted to the sector of non-financial corporations in the form of lending and investment in equity and debt securities form the financial basis for enterprises to carry out modernization and technological renewal, increase production capacity and diversify production, which helps create new jobs and reduce the unemployment rate in the regions. The parameters of the regression model presented in Table 4 confirm its reliability.

Table 3. Model of the impact of bank investments attracted by the non-financial corporations sector on the dynamics of GRP of the constituent entities of the Russian Federation

|

Coefficient |

Standard error |

t -statistics |

P -value |

|

|

const |

452,123 |

19 674.8 |

22.98 |

1.64e-101*** |

|

X |

0.289 |

0.07 |

4.118 |

4.02e-05*** |

|

R-squared = 0.608 |

F (78, 1637) = 32.53 |

Р -value ( F ) |

2.5e-275*** |

|

|

Schwartz criterion |

52 082.99 |

Akaike criterion |

51 652.62 |

|

|

Hannan-Quinn criterion |

-25 747.31 |

|||

|

Distribution free Wald test for heteroskedasticity |

Chi-square (78) = 1.79e+008 |

0.000*** |

||

|

Wooldridge test for autocorrelation |

Test statistics: T (1.77) = 338.679 |

6.43e-030*** |

||

|

The null hypothesis – the absence of a normal distribution |

Chi-square (2) = 9097.65 |

0.000*** |

||

|

Pesaran CD test for cross-sectional dependence Average absolute correlation = 0.981 |

Test statistics: z = 252.24 |

0.000*** |

||

|

Source: own compilation. *** Statistical significance at the level of 1%. |

||||

Table 4: Model of the impact of bank investments attracted by the sector of non-financial corporations on the unemployment rate in the RF constituent entities

|

Coefficient |

Standard error |

t -statistics |

P -value |

|

|

const |

8.685 |

8.685 |

59.8 |

0.000 *** |

|

X |

-1.34574e-06 |

4.73203e-07 |

-2.844 |

0.0045 *** |

|

R-squared = 0,0047 |

F (1.1714) = 8.0876 |

Р -value ( F ) |

0.00451 |

|

|

Schwartz criterion |

11035.66 |

Akaike criterion |

11024,77 |

|

|

Hannan-Quinn criterion |

11028.80 |

|||

|

The White test for heteroscedasticity |

Test statistics: LM = 0.76353 |

0.068* |

||

|

Wooldridge test for autocorrelation |

Test statistics: T (77) = 34.992 |

4.951e-049 *** |

||

|

The null hypothesis – the absence of a normal distribution |

Chi-square (2) = 3844.43 |

0.000 *** |

||

|

Pesaran CD test for cross-sectional dependence Average absolute correlation = 0.743 |

Test statistics: z = 179.97 |

0.000 *** |

||

|

Source: own compilations. ***, * Statistical significance at the level of 1 and 10%, respectively. |

||||

The study found a correlation between the proportion of the population with incomes below the subsistence level and the inflow of bank investments into the sector of non-financial corporations:

Y = 21.701 - 0.000000207 • X , (3)

where Y – the proportion of the population with incomes below the subsistence level, %;

X – the volume of bank investments attracted in the sector of non-financial corporations, mil. rub.

The main parameters of the constructed model and the results of testing its validity are presented in Table 5 . There is no autocorrelation between the errors in the model, and the errors in the model are normally distributed. Standard errors and p-values of the main regression parameters, as well as the Akaike, Schwartz and Hannan-Quinn information criteria confirm the statistical significance of the regression coefficients found. The model shows that the inflow of additional investment in the sector of non-financial corporations contributes to the reduction in the share of the population with incomes below the subsistence level in Russian regions.

The relationship established in the regression model is obvious, since the inflow of banking capital into enterprises of various spheres of economic activity in the form of lending and investment in equity and debt securities forms additional financial opportunities for their development, increasing production capacity. This positively affects not only the level of unemployment in the regions, but also the incomes of the population. The impact of bank investments attracted by non-financial corporations on the average monthly nominal accrued wages of employees is substantiated in the regression model with random effects that we constructed:

Y = 16389.9 + 0.00227 • X , (4)

where Y – the average monthly nominal accrued wages per employee, rub.;

X – the volume of bank investments attracted in the sector of non-financial corporations, mil. rub.

The model allowed establishing a direct correlation between the rate of wages of employees of enterprises and the volume of bank investments attracted to the sector of non-financial corporations. The inflow of banking capital in this sector of the

Table 5. Model of the impact of bank investments attracted by the non-financial corporation sector on the share of the population with incomes below the subsistence level in the RF constituent entities

|

Coefficient |

Standard error |

t -statistics |

P -value |

|

|

const |

21.701 |

0.317 |

68.33 |

0.000 *** |

|

X |

-2.07685e-06 |

1.03477e-06 |

-2.007 |

0.044 ** |

|

R-squared = 0,45 |

F (1, 1714) = 4.028 |

Р -value ( F ) |

0.0449 ** |

|

|

Schwartz criterion |

13720.91 |

Akaike criterion |

13710.01 |

|

|

Hannan-Quinn criterion |

13714.04 |

|||

|

Distribution free Wald test for heteroskedasticity: |

Chi-square (78) = 14290.7 |

14290.7 |

||

|

Wooldridge test for autocorrelation |

Test statistics: T (77) = 135.441 |

2.362e-093 *** |

||

|

The null hypothesis – the absence of a normal distribution |

Chi-square (2) = 1193,87 |

5.67e-260 *** |

||

|

Pesaran CD test for cross-sectional dependence Average absolute correlation = 0.863 |

Test statistics: z = 212.087 |

0.000 *** |

||

|

Source: own compilation. ***, ** Statistical significance at the level of 1 and 5%, respectively. |

||||

economy also has a positive impact on the balanced financial performance of enterprises in the regions of Russia:

7 = 63835.5 + 0.215- X, (5)

where Y – the balanced financial result of enterprises, mil. rub.;

X – the volume of bank investments attracted in the sector of non-financial corporations, mil. rub.

According to the model built, the negative financial result of enterprises may be a consequence of the reduction of financial resources attracted by banks and loan institutions for enterprises of various types of economic activity, i.e. with the reduction of lending and investment in corporate debt and equity securities, which was observed during the periods of economic recessions and the increase of crisis phenomena in the economy. Bank capital, attracted by the public administration sector, as shown by the panel regression model with fixed effects (Tab. 6), contributes to the reduction of the consumer price index in the regions of Russia:

Y = - 3.03843 - 0.000000373 • X, (6)

where Y – consumer price index (December of the current year to December of the previous year), %;

X – amount of bank investments attracted in the public administration sector, mil. rub.

Table 6. Model of the impact of bank investments attracted by the public administration sector on the dynamics of the consumer price index

|

Coefficient |

Standard error |

t -statistics |

P -value |

|

|

const |

-3.038 |

0.247 |

-12.32 |

2.15e-033 *** |

|

X |

-3.73603e-06 |

1.74912e-06 |

-2.136 |

0.0328 ** |

|

R-squared = 0.49 |

F (78, 1637) = 4.25 |

Р -value ( F ) |

1.03e-08 *** |

|

|

Schwartz criterion |

13341.29 |

Akaike criterion |

12910.92 |

|

|

Hannan-Quinn criterion |

13070.17 |

|||

|

Distribution free Wald test for heteroskedasticity |

Chi-square (78) = 146.938 |

3.897e-006 *** |

||

|

Wooldridge test for autocorrelation |

Test statistics: F (1, 77) = 24.574 |

4.153e-006*** |

||

|

The null hypothesis – the absence of a normal distribution |

Chi-square (2) = 8750.91 |

0.000 *** |

||

|

Pesaran CD test for cross-sectional dependence Average absolute correlation = 0.844 |

Test statistics: z = 216.866 |

0.000 *** |

||

|

Source: own compilation. ***, ** Statistical significance at the level of 1 and 5%, respectively. |

||||

The reduction in the volume of bank investments in stocks of state-owned companies and debt securities of RF constituent entities and the volume of their lending cause the growth of the consumer price index in the regions. The consumer price index is a key indicator of inflation, in order to reduce it bank capital should be attracted to the public sector of the economy. This will increase the budgetary provision of the regions and form additional financial opportunities for the implementation of strategic initiatives and more effective solutions to acute problems of socio-economic development. However, on the other hand, the excessive inflow of bank investments in debt securities of the RF constituent entities and the high volume of bank lending of their public debt have a negative impact on the budget security of the regions.

At present, the consolidated budget revenues of the majority of the RF constituent entities depend on bank loans and investments in regional debt securities, which form the public debt of the RF constituent entities. The regression model with fixed effects allowed identifying a high level of indebtedness of the regions:

7 = 61244,8 - 0,4387 • %, (7)

where Y – revenues of the consolidated budgets of the subjects of the Russian Federation, mil. rub.;

X – amount of bank investments attracted in the public administration sector, mil. rub.

The model shows that in order to increase the revenues of the consolidated budgets of most regions, it is necessary to reduce the volume of bank resources coming into the budget of the subjects. As shown by our earlier research, in order to increase the budgetary security of the regions, the optimal solution is to reduce the volume of loans allocated by banks and loan institutions. Thus, the matrices of the movement of banking capital between institutional sectors and regression modeling with the use of panel data built in the dynamics allowed assessing the impact of banking resources attracted by institutional sectors on the indicators of socio-economic development of Russian regions.

Conclusion

As a result of a review of the scientific literature, we found that the current statistical information does not provide an opportunity to accurately and objectively assess the impact of banking capital on the socio-economic development of territories. To solve this problem, we developed a methodological approach based on the methodology of forming balanced matrices of financial flows between institutional sectors using data from the primary accounting statements of loan institutions, the methodological principle of double-entry bookkeeping of the System of National Accounts and the methods of regression analysis using panel data. As a result of approbation of the methodological approach, we built matrices of financial flows in the regions, characterizing the processes of banking capital flows between the sector of financial and non-financial corporations, public administration, households and foreign institutions, as well as regression models characterizing the impact of bank investments attracted by each institutional sector on the indicators of socio-economic development of regional systems. The matrices of financial flows between the banking and other institutional sectors in Russian regions for the period from 1998 to 2019 show that the banking sector currently does not perform its traditional functions of saving capital and providing loans to the real sector of the economy, public administration and households, but carries out speculative policies, which contribute to a significant outflow of financial resources of these sectors abroad and harm the Russian economy.

Regression modeling revealed that the capital raised by banks in the sector of non-financial corporations has an impact on the dynamics of the gross regional product of the RF constituent entities, leads to a decrease in the unemployment rate in the regions, the number of population with incomes below the subsistence level, the degree of depreciation of fixed production assets, the increase in the balanced financial result of the activity of enterprises and the average monthly nominal wage of employees. The system of regression models and matrices of financial flows between the banking and other institutional sectors is, in our opinion, an effective tool for forming forecast scenarios of changes in the dynamics of socio-economic development of Russian regions in the medium term.

Список литературы Modeling the Impact of Bank Investments Attracted by Institutional Sectors on the Socio-Economic Development of Russian Regions

- Aganbegyan A., Rudenskii I. On the role of the Russian banking system in overcoming the recession and resuming social and economic growth. Problemy teorii i praktiki upravleniya=International Journal of Management Theory and Practice, 2016, no. 8, pp. 8–19 (in Russian).

- Milyukov A. The role of banks in overcoming the crisis and reviving the Russian economy. Problemy teorii i praktiki upravleniya=International Journal of Management Theory and Practice, 2016, no. 8, pp. 64–72 (in Russian).

- Akinin P.V., Akinina V.P. Pairing mechanisms and tools of financial and real sectors of the economy. Finansy i kredit=Finance and Credit, 2014, no. 16(592), pp. 2–8 (in Russian).

- Trubnikova V.V., Savenkova A.V. The organization of interaction of real and bank sectors of economy of territories. Regional’naya ekonomika: teoriya i praktika=Regional Economics: Theory and Practice, 2011, no. 20(203), pp. 34–39 (in Russian).

- Danilov-Danil’yan A. Problems of managing the Russian banking system as a source of investment to overcome the current economic crisis. Problemy teorii i praktiki upravleniya=International Journal of Management Theory and Practice, 2016, no, 8, pp. 73–79 (in Russian).

- Kazarenkova N.P. Analyzing and assessing the results of interaction between the banking and real sectors of the Russian economy. Finansy i kredit=Finance and Credit, 2015, no. 47, pp. 44–56 (in Russian).

- Ilyin V.A., Chekavinskii A.N., Uskova T.V. et al. Natsional’naya bezopasnost’ Rossii: problemy obespecheniya ekonomicheskogo rosta: monografiya [National Security of Russia: Problems of Economic Growth: Monograph]. Vologda: ISERT RAN, 2016. 300 p.

- Pechenskaya M.A. Regional development: goals and opportunities. Finansy=Finance, 2014, no. 10, pp. 135–145 (in Russian).

- Urosevic B., Zivkovic B., Bozovic M. The influence of financial on real sector of economy. Ekonomika Preduzeca, 2011, no. 59(1–2), pp. 34–44. DOI: 10.5937/ekopre1102034U

- Gilchrist S., Zakrajsek E. Linkages between the financial and real sectors: an overview. 2008. Available at: https:// www.researchgate.net/publication/228902565_Linkages_Between_the_Financial_and_Real_Sectors_An_Overview (accessed: June 25, 2021).

- Monacelli D., Pazienza M.G., Rapallini C. Municipality Budget Rules and Debt: is the Italian regulation effective? In: Conference: working paper DISEI, 2014. 34 p. Available at: https://www.researchgate.net/publication/282033160_Municipality_Budget_Rules_and_Debt_is_the_Italian_regulation_effective (accessed: June 21, 2021).

- Jeong W. Three Essays on the Relationship Between the Banking Sector, the Real Sector, and the Political Environment. Morgantown, West Virginia, 1999. 90 p. Available at: https://www.proquest.com/openview/fa823d149ca5b1cebe7221fccd874d38 /1.pdf?pq-origsite=gscholar&cbl=18750&diss=y (accessed: June 21, 2021).

- Naumov I.V. Role of financial resources of the economy’s banking sector in Russian regions’ socio-economic development. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2020, vol. 13. no. 6, pp. 152–168. DOI: 10.15838/esc.2020.6.72.9 (in Russian).

- Strogonova E.I. Financial assets of household establishments as a source of formation of investment resources of commercial banks. Nauchnyi vestnik YuIM=Scientific Bulletin of the Southern Institute of Management, 2017, no. 1, pp. 28–32 (in Russian).

- Yusupova L.M., Nikonova T.V., Ivanov M.E. Factors determining the investment of household savings in the Russian banking sector: the current state. Servis v Rossii i za rubezhom=Services in Russia and Abroad, 2017, vol. 11, issue 5, pp. 93–101. DOI: 10.22412/1995-042X-11-5-8 (in Russian).

- Orlov L.F Theoretical bases of formation financial potential of households. Vestnik MGOU. Seriya Ekonomika=Bulletin MSRU. Series: Economics, 2010, no. 3, pp. 36–41 (in Russian).

- Ellis K., Lemma A., Rud J.-P. Financial inclusion, household investment and growth in Kenya and Tanzania. Project Briefing, 2010, 43, 4 p.

- Bouyon S. The impact of banking structural reform on household retail finance, 2014. Available at: https://www.ceps.eu/ceps-publications/impact-banking-structural-reform-household-retail-finance (accessed: June 21, 2021).

- Mwalughali O.G.F. The impact of community savings and investment promotion program on household income and credit market participation in Kasungu district, Central Malawi. University of Malawi Bunda College of agriculture, 2013. 128 p. Available at: https://ageconsearch.umn.edu/record/157595/ (accessed: June 21, 2021).

- Naumov I.V. Theoretical and methodological foundations of designing a balance model for reproducing investment potential of institutional sectors in the regional system. Finansy: teoriya i praktika=Finance: Theory and Practice, 2019, vol. 23, no. 5, pp. 101–114 (in Russian).

- Sotnikova L.N., Tkacheva M.V. The banking system of the Russian Federation: status and prospects. Vestnik VGUIT=Proceedings of the Voronezh State University of Engineering Technologies, 2015, no. 2, pp. 260–266 (in Russian).

- Terekhin V.I., Sukovatova O.P. Efficiency of investment activity in the region: evaluation and planning. Sotsial’noekonomicheskie yavleniya i protsessy=Social-Economic Phenomena and Processes, 2009, no. 1(013), pp. 86–89 (in Russian).

- Nguyen C.T., Trinh L.T. The impacts of public investment on private investment and economic growth. Evidence from Vietnam. Journal of Asian Business and Economic Studies, 2018, vol. 25, no. 1, pp. 15–32. DOI: 10.1108/JABES-04-2018-0003.

- Solodkaya T.I., Tali M.M.T., Industriev M.A. Econometric analysis of the financial market structure’s influence on the Russian Federation’s economic growth. Izv. Sarat. un-ta. Nov. ser. Ser. Ekonomika. Upravlenie. Pravo=Izv. Saratov Univ. (N. S.). Ser. Economics. Management. Law, 2019, vol. 19, issue 1, pp. 28–35. DOI: https://doi.org/10.18500/1994-2540-2019-19-1-28-35 (in Russian).

- Pogodaeva T.V., Baburina N.A., Druz’ E.P., Sheremet’eva M.P. A role of the banking sector in the social and economic development: the developed and developing countries case. Finansy i kredit=Finance and Credit, 2016, no. 10, pp. 2–13 (in Russian).

- Alam Md.S., Rabbani M.R., Tausif M.R., Abey J. Banks’ Performance and economic growth in India: A panel cointegration analysis. Economies, 2021, 9(1), pp. 38. DOI: https://doi.org/10.3390/economies9010038.

- Paavo E. The Impact of Commercial Banks Development on Economic Growth in Namibia: Dissertation of Master of Commerce in Development Finance Degree, 2017. 59 p. Available at: https://open.uct.ac.za/bitstream/handle/11427/28116/thesis_com_2018_paavo_elia.pdf?sequence=1&isAllowed=y (accessed: June 15, 2021).

- Prochniak M., Wasiak K. The impact of the financial system on economic growth in the context of the global crisis: empirical evidence for the EU and OECD countries. Empirica, 2017, no. 44, pp. 295–337. DOI: https://doi.org/10.1007/s10663-016-9323-9.

- Ivanov P.A., Tyutyunnikova T.I. The financial resources of the households as a reserve economic growth regions of Russia. Sovremennye problemy nauki i obrazovaniya=Modern Problems of Science and Education, 2015, no. 1–1. Available at: http://www.science-education.ru/ru/article/view?id=18264 (accessed: June 29, 2021; in Russian).