Modeling the results of factor analysis in the corporate financial management system

Автор: Nevmerzhitsky A.L.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 7 (113), 2024 года.

Бесплатный доступ

In this study, the author makes an attempt to model the impact of key factors for the construction industry on the profitability and prospects for the development of a corporate entity in general. Factor decomposition, as a method of modeling, was chosen by the author due to the universality of the analysis of factors of the external conjuncture and for subsequent ranking. The result of the study was a model representation of the influence of factors on the volume of financing of a construction project based on the forecasting of incoming and outgoing transactions in the context of the financial management system.

Factor analysis, financial management, modeling, forecasting

Короткий адрес: https://sciup.org/170205917

IDR: 170205917 | DOI: 10.24412/2411-0450-2024-7-168-172

Текст научной статьи Modeling the results of factor analysis in the corporate financial management system

All these factors have a different impact on the prospects for the development of a corporate entity (Figure 1).

Degree of i к influence of factors

Changing corporate strategy

Dynamics of the cost per square meter in the region

Developing partnerships with local companies

Changes in the

competitive environm

Changes in legislation

Innovative potential of the region

Curtailment of state mortgage support programs

Changes in the geopolitical situation

Changes in lending terms

Interaction with regional authorities

—►

Prospects for the development of a corporate entity

Fig. 1. Modeling the results of factor analysis

The figure presents the results of factor analysis in the format of a model, which shows the distribution of risks on a conditional scale and the assessment of the degree of their impact on the prospects that are significant for the subject.

The most significant factor for any positive prospects of a corporate entity has been and remains the conditions for attracting financing. Developers traditionally attract funds from real estate buyers to invest in construction, which, since 2019, in accordance with Article 15 of the Federal Law of 30.12.2004 № 214-FL (as amended on 14.02.2024) "On participation in shared construction of apartment buildings and other real estate objects and on amendments to certain legislative acts of the Russian Federation" have been accumulated in escrow accounts and provide guarantees for the fulfillment of obligations by the parties. Actually, financial management is carried out taking into account the specifics of attracting credit resources - it is important to maintain a balance between the volume of funds in escrow accounts and the volumes involved in construction. If this balance is in favor of escrow accounts, then the cost of credit resources used is significantly lower than the market [3].

Moving on to the legal to scientific aspects of the organization of the financial management system, the author notes that modeling the financing of construction and all activities of the developer should be considered in the context of macroeconomic volatility and the use of state support instruments, which make credit resources much more attractive for real estate buyers compared to market conditions.

Investors and creditors involved in the financing of capital-intensive projects are also interested in state aid programs, since they consider it as additional guarantees, and therefore an advantage that is not available to all sectors of the national economy [5].

Modeling of a truly adequate financial management system that meets the real tasks takes place on the basis of theoretical and methodological provisions of financial science [6]. This is possible through the substantiation of key indicators of calculations of all factors accompanying both independent and state financing of construction, which can be implemented in several forms:

-

- repayment of part of the interest on the loan;

-

- provision of subsidies, subventions or grants;

-

- loan guarantee;

-

- concession agreement within the framework of the PPP mechanism.

The provision of direct state financing is fundamentally different from all other forms of support, since it provides for the return of interest on attracted credit resources, so the calculation can be carried out according to the formula:

TI^ = Qinv+ Qgv+lLltr (1)

where: Tl^ - the total amount of investments with state support; - the volume of attracted private investment; - the amount of public funds attracted to the project; - the amount of repaid interest on attracted credit resources. QinvQ5v E [=i 4 cr

Next, we form the total amount of funds raised by the developer to finance the facility under construction:

Tinv = TiC r + TCiv

where: TInv is the amount of total financing; = , that is, total credit investments are the amount of the developer's costs for credit resources; - the volume of attracted private in- vestment.TIcrTCcrTI ?V iV

As noted above, one of the forms of state participation may be the reimbursement of interest on loans, in which case debt service is not taken into account:

Tier = [‘-^^ X П1=1 Uc] X (1 -tax) (3)

In this case, we will rewrite the total investment:

Tl„v = [?-^H; X П1=1 Uc] X (1 - tax) + Qinv + Qgv (4)

To calculate the relative efficiency indicator, such as the profitability of credit resources attracted by the developer, the author considers the use of the following expression to be justified:

Rerr =

Cr NPr

| Q ^t=l^er xn T =i Ht+Z r=1 ^ cr ] x(1-tax) 100%(5)

where: Recr - profitability of the use of credit resources.

Thus, the justification for calculating the profitability of construction financing is obtained, taking into account the cost of credit resources and reducing the tax burden.

It is logical that to calculate the profitability of the entire volume of investments attracted by the developer (taking into account credit funds) within the framework of the construction financing mechanism, we use the following construction:

NPr

[ ^^-^H^ xn^ i H t j

x(1 tax)+ Q tnv + Q gv

Re total

- x 100%

Thus, the author proposes to assess the profitability of financing by calculating profitability, the economic meaning of which is as follows: the profitability of the funds raised by the developer shows what profit they gen- erate, that is, how efficiently the component investment capital is used.

Using the term "component", the author proceeds from the structure of attracted financing – at least three-component: escrow lending, state participation and private investment.

The indicator proposed by the author is fundamentally different from other types of profitability, it can be used only for such cases when investments are complexly structured in terms of conditions and sources, that is, they have a component structure.

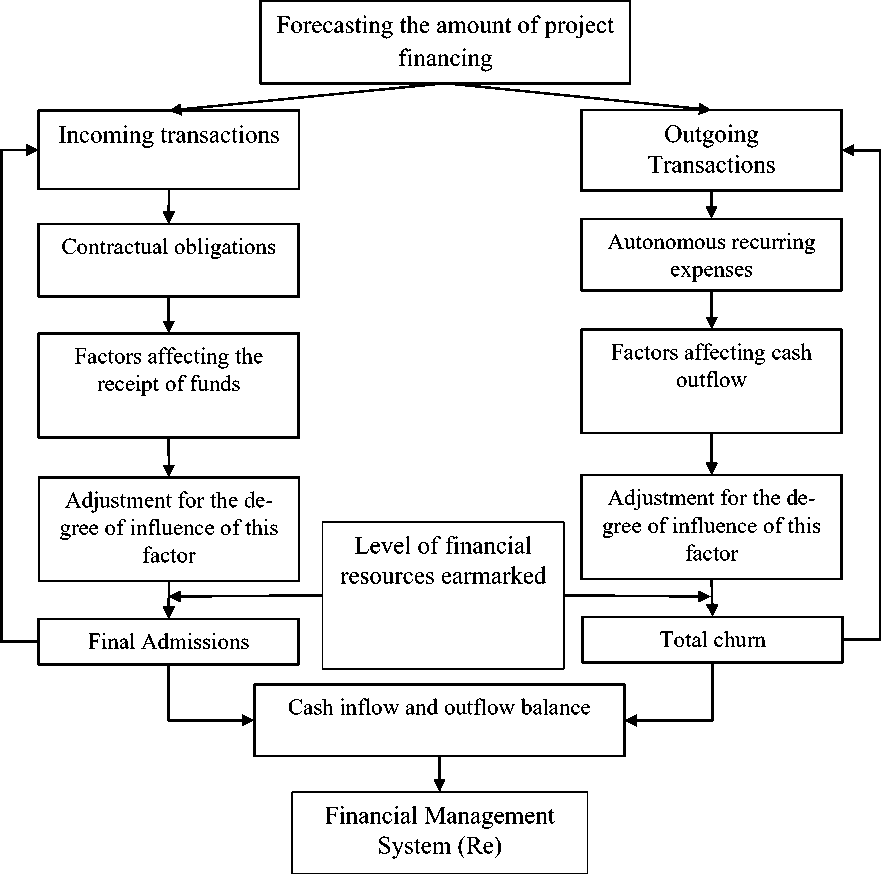

In conclusion, we present a model of factor analysis, potentially integrated into the financial management system and therefore being a universal methodological apparatus for managing cash flows of any corporate entity.

It should be noted that the proposed model makes it possible to predict cash flows taking into account the factors of cash inflow and outflow. The model is schematically presented in Figure 2.

The use of modeling makes it possible to neglect operational processes in the aspect of simplification and focus research attention on the final result – cash flows [4].

One way or another, simplification highlights the main thing that interests the subject of financial management – the key parameter for assessing the state of a corporate entity – profitability.

Fig. 2. Modeling of factor analysis through forecasting the amount of project financing

As can be seen from the model scheme, the main issue to be solved in the process of the company's activities is the balance of cash flows in such a way as to ensure the achieve- ment of a sufficient level of profitability -through the assessment of the balance in the corporate financial management system.

Список литературы Modeling the results of factor analysis in the corporate financial management system

- Kaledin S.V., Motorina M.S. Financial management of the corporation. - London: Glasstree Academic Publishing, 2020. - 90 p. DOI: 10.20850/9781534299085

- Nevmerzhitsky A.L. Development of smart contracts in construction based on digital fintech // Industrial Economy. - 2022. - № 1, Vol. 4. - P. 357-361. DOI: 10.47576/2712-7559_2022_1_4_357 EDN: HEGNSN

- Razumovskaya E.A., Nevmerzhitsky A.L. Formation of the Financial Management System in Construction on the Basis of Digital Financial Technologies // Finance and Credit. - 2024. - Vol. 30, Iss. 6 (846). - P. 1290-1309. DOI: 10.24891/fc.30.6.1290 EDN: ARNGBQ

- Stashkova K.R., Polyakov V.A., Fomicheva I.V. Essence of financial strategy in the system of strategic management of the enterprise. - 2019. - № 1-2. - Pp. 249-251.

- Amanullaeva Yu., Usmonova S., Nўmonjonova G. Financial Management in the Corporate Sector of the Economy // Capital of Science. - 2020. - № 11 (28). - Pp. 136-141.

- Suranov M.V., Firsov V.L., Kislyakov M.S. The Content and Role of Financial and Non-Financial Asset Management as a Key Activity of the Company's Management. - 2023. - № 1 (150). - Pp. 1301-1304.