Modern company management tools: leasing

Автор: Karibaev Askar Amirkhanovich, Afonin Yuri

Статья в выпуске: 2 (17), 2016 года.

Бесплатный доступ

According to p.665 of the Kazakhstan Federation Code of Standards, leasing is the financial renting of property in which the lessor enters into a binding agreement to procure property indicated by the lessee from a selected vendor and to lease the property to the lessee for entrepreneurial purposes. Both movable and real estate assets can be let in such a way.

Leasing, procurement, transfer of equipment, transfer of ownership, development of long-term loan fund capital, maintaining the liquidity, subleasing

Короткий адрес: https://sciup.org/14122316

IDR: 14122316 | УДК: 339.187.62

Текст научной статьи Modern company management tools: leasing

One of the most effective forms of developing an industrial enterprise is via leasing. Leasing is a type of financial transaction which involves means of obtaining fixed-capital assets.

According to p.665 of the Kazakhstan Code of Standards, leasing is the financial renting of property in which the lessor enters into a binding agreement to procure property indicated by the lessee from a selected vendor and to lease the property to the lessee for entrepreneurial purposes. Both movable and real estate assets can be let in such a way.

The central aspects of leasing include the following:

-

- the procurement by the leasing company of the equipment indicated by the lessee

-

- the transfer of the equipment to the lessee

-

- use of the equipment and installment payments made to the lessor

-

- transfer of ownership of the equipment once the cost is entirely paid off

-

- development of long-term loan fund capital

-

- maintaining the liquidity of the company

-

- expedited process of updating production without using circulating capital

There are two main types of leasing: financial and operational.

Financial leasing is characterized by the long duration of the contract (from five to ten years) and the depreciation of all or most of the cost of the equipment. In practice, financial leasing proves to be serve as a type of long-term crediting of a purchase. Once the leasing term expires the lessee can either return the leased object, extend the leasing period or enter into a new contract. The lessee can also purchase the item for the remainder of the cost (typically this is just a nominal amount).

Operational leasing assumes the rent of a multiple-use item for a shorter period of time than the length of its service life. This type of leasing is characterized by a shorter contract duration (from three to five years) and by an incomplete depreciation of equipment during the leasing period. After the contract expires, it can be renewed, or the equipment can be returned to the lessor. Often construction machinery (cranes, excavators, etc.), transportation, computers, etc. are leased under such contracts [1].

Leasing is more advantageous than purchasing for credit for the following reasons:

-

- an enterprise does not weigh down its books with credits (with leasing, debt is reflected only in off-balance accounting)

-

- a decreased tax on profit and property gives the company a chance to regulate the cost value of its products.

Depending on the nature of the relationship between the lessee and the lessor, the lease can be made directly from the manufacturer or owner of the property to the company needing to lease it, or via a third-party intermediary.

The type of financing determines whether it is limited-time leasing contract, in which a onetime rental agreement is entered into, or a renewable leasing contract in which the agreement is renewed once the initial effective term expires.

In practice, other types of leases exist as well, including leaseback, where the manufacturing enterprise sells some of its property to the leasing company at the same time as a leasing contract is signed. This gives the enterprise the opportunity to obtain financial resources by selling manufacturing assets without stopping their operations, and to use them for new capital investments.

Электронное научное издание

Subleasing is when leasing is carried out via an intermediary while the primary lessor retains the rights to receive the lease payments. The contract for a subleasing arrangement also specifies that if the intermediary were to go bankrupt, the primary lesson would continue to receive payments directly.

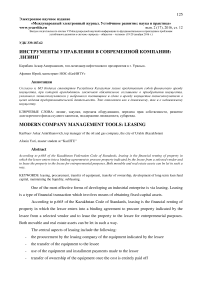

Fig. 1. Classification of Leasing Transactions

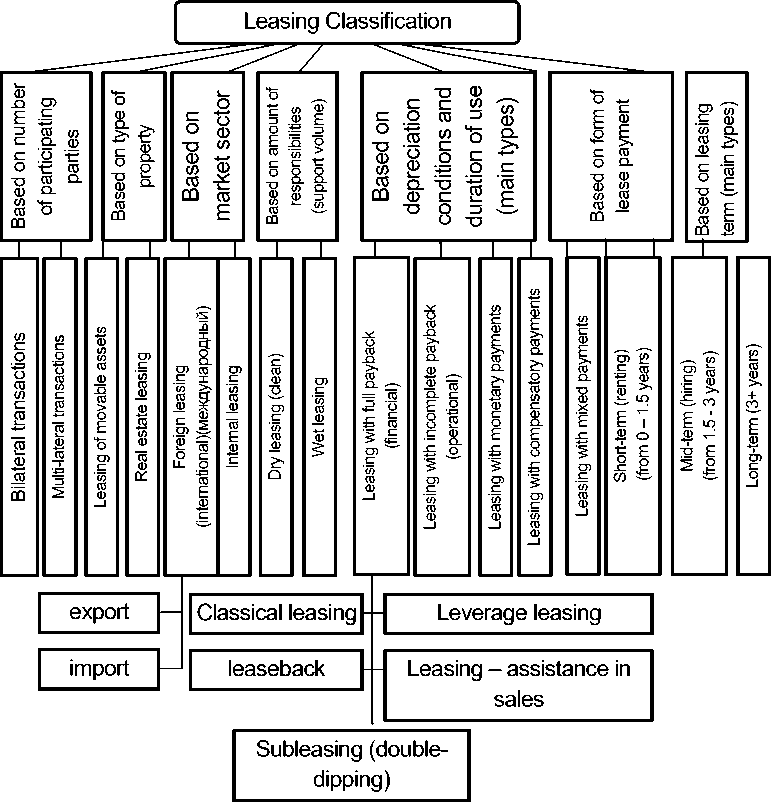

Leasing transactions are performed according to different schemes. The simplest of these is when the lease buyer, who needs a certain property, turns to the lessor and the lessor makes the purchase and transfers it to the lessee under the agreed-upon conditions [2].

Fig. 2. Simplest Leasing Scheme

The use of leasing practices in Russian conditions provides several advantages:

-

- a relatively more affordable way of financing capital expenses, in which the taxable income and taxable property is decreased

-

- relative flexibility for mid-term and long-term financing, in which the leasing company requests one or more forms of financing from its clients: advance (typically 15-30% from the total cost of the equipment to be leased), deposit, or other additional financing.

Contrary to the situation in the West, Russian leasing companies require a guarantee of payment (co-signed by a third party), a security deposit of assets, or additional insurance. The use of leasing services is especially relevant in the critical economic situation in Russia today. As a result of major structural shifts and a drastically decreased demand, many major Russian companies (first and foremost in the military and industrial sector) do not use a significant portion of their production facilities. Based on data from the National Committee of the Russian Federation on Development and Small Business, the total cost of unused, but functional equipment totals 4,000 billion rubles. At the same time the vast majority of small businesses do not have a sufficient cash flow to be able to purchase the necessary machinery and hardware. The use of a mere 20% of the unused technology today would allow the small business sector to produce goods worth 500 billion rubles. However, despite measures taken by the government, the full-force implementation of leasing practices as effective tools for expediting the scientific and technological process is only possible with the “healing” of the entire economic organism. [3]

It should be noted that leasing has some drawbacks as well. These include the relatively inflexible leasing conditions in which floating rates and variable payment schedules dictated by the cash-flow of the lessee. The lessor can also introduce additional limiting conditions (the lease duration, rules of use, etc.) The leasing process itself is a complex transaction which demands the balancing of interests of its many participants. It is important to remember that in some sectors the equipment can become outdated before the duration of the lease is up, and even then the leasing company will come to own the equipment only after all of the terms of the leasing contract have been fulfilled.

Электронное научное издание

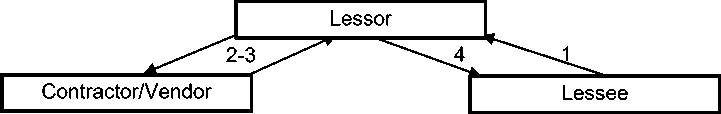

Fig. 3. Classical Leasing Scheme

According to research performed by the International Financial Corporation, there are several main reasons why businesses based in the Russian Federation turn to leasing companies. These include the following:

-

- extensive flexibility provided by leasing

-

- less stringent requirements for additional support and guarantees

-

- less bureaucratic hurdles

-

- taxation advantages

-

- significant support provided by the vendors

The most notable reason for the popularity of leasing in Russia is the inaccessibility of bank credit to many lessees. This highlights one important quality inherent to leasing: in many cases leasing provides an alternative source of financing which does not compete directly with bankbased loans.

Список литературы Modern company management tools: leasing

- Michaels E., Handfield-Jones H., Axelrod B. The War for Talent. Mann, Ivanov and Ferber pub. 2009. P. 251.

- Vision 2010 Designing Tomorrow's Organization / Economist Intelligence Unit Ltd. London (United Kingdom), 1997. P. 198.

- Dubie D. Down Economy Fuels IT Outsourcing. Network World. 2009. 13 Feb. P. 65.