Money market function of macroeconomic model of the former soviet union countries: Armenia, Azerbaijan, Belarus, Georgia and Ukraine. From 2000 to 2013

Автор: Sharapov M.M.

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 4-1 (13), 2014 года.

Бесплатный доступ

This article provides an econometric analysis of the money market function for the Armenia, Azerbaijan, Belarus, Georgia, Ukraine. The analysis of the information obtained. Given the assumptions of the author about the adequacy and fairness of these models.

Econometrics, money market model, ussr, armenia, azerbaijan, belarus, georgia, ukraine, gdp, interst rate, money supply

Короткий адрес: https://sciup.org/140124527

IDR: 140124527

Текст научной статьи Money market function of macroeconomic model of the former soviet union countries: Armenia, Azerbaijan, Belarus, Georgia and Ukraine. From 2000 to 2013

This economic system studies the money market function of Macroeconomic model of the former Soviet Union Countries: Armenia, Azerbaijan, Belarus, Georgia, and Ukraine. In this study we have three variables: interest rate, measured in percentages, GDP and money supply which are measured in US dollars.

In this study, we consider a short period of time. Each of these countries has created its own economy after the collapse of the USSR. Obviously, this is a complex process and incident rare in the world. Formally, the country began construction of its own economic mechanisms since 1991. In reality, it took years, to the economy of these countries began to work and share their statistical information. Unfortunately, we have to miss the time period up to 2000, due to the lack of sufficient information required.

However, this study is important from the point of view of the analysis of recently established economies. As mentioned earlier - the creation of a new country, as well as a complex economy, and rare in the world process. It is particularly interesting to analyze several countries began their formation in one and the same time.

In this paper we study the following countries: Armenia, Azerbaijan, Belarus, Georgia and Ukraine. The main methods of research are methods of analysis of econometric models and simulation methods.[1]

As a result of research we find out about, as far as are adequate econometric models, and suggests the possibility of money market function.

The necessity of this study caused the need for a detailed analysis of the newly created economics that are developing at the moment, as well are also important economic partners of Russia.

An important step in this research is to collect relevant data on the three variables. The World Bank has long been leading a detailed and reliable statistics, it is this resource is the data source. [2]

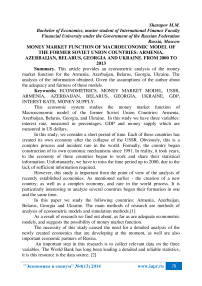

Based on the results of research we have found out following (Figure 1):

|

Armenia |

Azerbaijan |

Belarus |

Georgia |

Ukraine |

|

|

R2 |

0,83 |

0,33 |

0,60 |

0,50 |

0,81 |

|

F-test |

|F|> Fcrit |

|F|< Fcrit |

|F|< Fcrit |

|F|< Fcrit |

|F|> Fcrit |

|

t-test |

|t b1 |< t crit |

|t b1 |< t crit |

|t b1 |< t crit |

|t b1 |< t crit |

|t b1 |< t crit |

|

E(u) |

0 |

0 |

0 |

0 |

0 |

|

GQ-test |

- |

- |

- |

- |

+ |

|

DW-test |

- |

+ |

+ |

+ |

+ |

|

adequacy |

+ |

+ |

+ |

+ |

+ |

Figure 1. Results of the research

Economic problems of the new countries are particularly important for the study of the present time. On the one hand we are faced with the growth of new economies today. On the other hand it is important to analyze the data on the background of the economy as a developing stages - from 2000 to 2008, and during the subsequent crisis.

This study we used an econometric model money market function. The variable is the basic of this model are: interest rates, Gross Domestic Product and money supply. It is also important to factor in inflation. In the economic literature, inflation is defined as a process of long-term and sustained depreciation of money, caused by the decline in their relative rarity compared to the mass of commodities.[3] Obviously, for greater accuracy, we need to use the data over a long period of time - at least 20-25 years. Unfortunately, due to the fact that the economy was only formed in 1991, just after 9 years the World Bank has become siting of sufficient information. From this we can conclude that the exact model we can make no earlier than 10 years. The sharpness of outline briefly the problem of discontinuity theory and practice in the educational process dramatically increases the power taken by our country's international obligations. [4]

The first step of our work was to search for data. As mentioned earlier, the World Bank gathers all the necessary indicators and places them on the official website.

The next step was the creation of the creation of correlation for each individual economy. A correlation spending indicators was obvious that they are poorly correlates with each other. This is due to the fact that this model was originally developed for the US economy.

In order to predict the growth rate of money supply and the interest rate, you can use a probabilistic approach, since the values of these variables (growth of the money supply and interest rate) does not contain a time trend, and fluctuate around nekotoro- of values. [5]

Afterwards I’ve done coefficients’ estimation in Excel, and made all models tests such as R2 test, F-test, T-test, Goldfeld–Quandt test, Durbin–Watson test. These tests were analyzed and the results are presented in the work.

Summing up the results, I think it is important to note a few things. As mentioned earlier, unfortunately at the moment we do not have sufficient data to conduct full investigations and reduce the likelihood of errors. Nevertheless, we may draw some conclusions.

Firstly it is evident that the high interest rates in the country due to the rather low GDP, over time, with an increase in GDP, and the development of the banking system will be able to decrease the rate. Conversely, if in the future the country's GDP will decline, bank rate again begins to grow. A further conclusion is that at high GDP availability of money in the country falls. It is obvious that people find it difficult to take and service the loans issued at high interest rates. Respectively, the lower the interest rate, the greater the supply of money.

Therefore, there is a direct correlation between the growth of production in the country, or GDP growth and lower interest rates. By reducing interest rates, increasing the money supply.

It is obvious that the studied countries have the geographical as well as others potential to increase GDP. From this, we would like to think that in the future, these countries have good prospects.