Направление развития местного налогово-бюджетного потенциала в регионах

Автор: Юлдашев А.А., Джураев Э.С.

Журнал: Теория и практика современной науки @modern-j

Рубрика: Основной раздел

Статья в выпуске: 3 (33), 2018 года.

Бесплатный доступ

В статье проанализировал механизм укрепления местного налога бюджетного потенциала и формирования бюджетных ресурсов в регионах.

Финансовые ресурсы, бюджетные ресурсы, местный бюджет, стабильность финансовых ресурсов, региональный потенциал

Короткий адрес: https://sciup.org/140289469

IDR: 140289469

Текст научной статьи Направление развития местного налогово-бюджетного потенциала в регионах

The formation of budgetary resources in the country is the result of the distribution and redistribution of GDP. Due to the flow of financial resources and financial relations that occur in this process, the revenue and budget resources of the budget are formed. Similar processes are also occurring in the regions and, to a greater extent, cover the inner product of the region. It should be noted that in the initial formation of budgetary resources in the region is based on the financial potential or financial potential of the region.

In the Strategy for Action for the Development of the Republic of Uzbekistan for 2017-2021 in further strengthening of macroeconomic stability, "maintaining macroeconomic balance and ensuring sustainable growth rates of gross domestic product through deepening structural and institutional changes based on the medium-term programs;

improving the intergovernmental fiscal relations aimed at ensuring proportionality at all levels of the State Budget, strengthening the revenue part of the local budgets while maintaining social orientation of expenditures;

continue the policy of reducing the tax burden and simplifying the taxation system, improving tax administration and expanding appropriate stimulus measures"[1].

The assessment of the financial potential of the regions is also important for the formation of an effective national inter-budgetary system, as well as for the policy of equality of resources of local budgets by strengthening the financial capacity of the regions. At the same time, it is inevitable to ignore the financial resources of the regions only through sources of taxation. Especially for a long term, this is not a wise approach.

Of course, financial constraints (financial potential, financial capacity) and financial resources are closer to one another, but they must be distinguished from their content. Financial resources are the funds allocated to achieve socioeconomic goals accumulated in monetary funds as a result of distribution of GDP generated on the territory. These funds can be assimilated at various economic entities. These resources, collected at the expense of the local budget, are the resources of the local budget. The financial capacity is the real possibility of mobilizing the relevant portion of the domestic product, which is created in the region, for financial purposes. Budgetary resources cannot be higher than financial resources. Transforming much of the financial resources of the region into domestic resources can make the economy more difficult. An example of a business economy can be illustrated by this. The enterprise funds are funded mainly by production funds, treasury funds. However, a large portion of the money will be spent on reducing production. In the region, budgetary resources can also be considered to be a function similar to that of monetary funds in the enterprise (conditional). As you can see, the financial possibility is valueless.

In our country, the generally accepted methodology for evaluating the financial capacity of regions is not developed. However, the relevant government agencies, in particular the Ministry of Finance, need to be evaluated financially in their responsibilities.

Economic editions are not sufficient to limit the financial ability of the regions to cover the revenue base of the local budget, which should include the possibility of financing the state-run measures that take into account the growing budgetary responsibilities in the region[2].

At the same time, it should be noted that some economists take the notion of "local financial opportunity" with the notion of "local financial opportunity" as well as the concept of "financial resources" in the same sense as "financial opportunities"[3]. In the economic interpretation, if the concept of the region applies to more regions or groups, the concept of local economies is also applied to the top economics.

The most important link between the financial opportunity and the budget is the tax potential. It describes the total taxable resources of the region, taking into account the maritime indicators of the region's development, the possibility of levying taxes and fees, and the tax burden. In other words, it is part of the budget revenues of the region in line with the current legislation.

In order to determine the tax potential of the region, it is necessary to sort the business entities accordingly. Sort by indicators. They provide an opportunity to disclose the trends in the tax base's description of specific tax types.

Taxpayer identification approaches can be grouped as follows:

-

1. Approaches to economic income as a source of budget revenues;

-

2. Approaches when the tax system aims to adapt to economic development needs;

-

3. Approaches based on the processing of the official forms of tax reports;

-

4. Approaches envisaging adjustments to the budget actually received amounts.

Taxpecial management of the area should facilitate the receipt of satisfactory and incremental revenues to the region, and sufficient funds to meet the budget commitments to various economic entities and population.

Territorial taxation policy is a combination of economic and legal measures aimed at improving the taxation system by meeting financial needs at the territorial level, redistribution of financial resources for the implementation of planned socioeconomic programs, and changing the fiscal aspects.

The aim of planning and predicting tax potential of the regions is to assess the tax potential of the regions by comparing actual tax revenues, and the objective of tax forecasting is to determine the future taxable volumes.

The tax potential of the region is defined as the ability to provide tax revenues to the budget under existing taxation conditions under taxation that operates within a particular area of taxation within the framework of the finalized approach to restructuring the economy. Taxable bases are the basis for determining tax potential on resources. A thorough analysis of these approaches indicates that they are unilaterally integrated into the tax potential. Therefore, the most important feature of taxpayers is that these approaches are neglected.

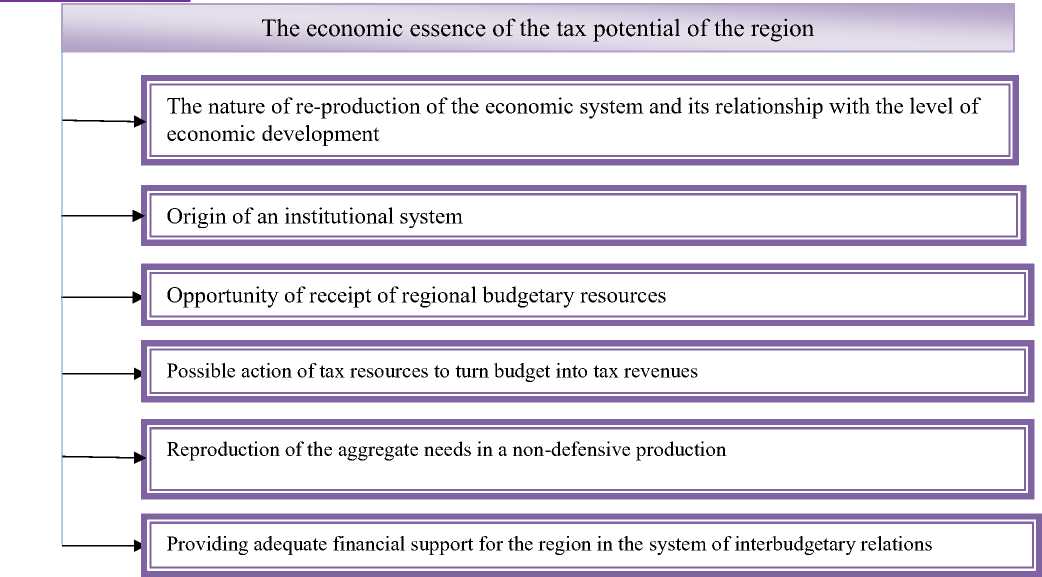

Significant signs of tax potential as an economic category are reflected in the nature of the reproduction, the potential characteristic (which is expressed by the fact that the tax potential is not the actual size of tax revenues, but the institutional organization of the economic system). Studying the economic nature of the tax potential of the region will enable it to cover its functional elements (Figure 1).

Areas of the tax potential growth of the region are as follows:

-

1. Increasing the economic potential directly affecting the growth of the tax base and taxable resources;

-

2. Reduction of dependency on taxpayers through the voluntary repayment and redemption of taxpayer liquidity, in particular through the declaration and registration of previously existing taxable items and objects of taxation;

-

3. Universal measures to promote simultaneous growth of tax base and its improvement.

The tax potential of the region is achieved through the reduction of volumes of liquidity, minimizing the scale of misbalance and reducing the debts of business entities through actual payments. This will also help to increase the quality and effectiveness of control measures to disclose and dispose of damages, to exploit the pawnbroker, to obviate the illegal income and taxation of this category of business entities.

Usually a practical approach, on the one hand, has to determine the amount of objective funding required, depending on the socio-economic development needs of the region and its effective management capabilities. On the other hand, territorial administrations will have to develop measures to replenish their income budget. These two processes are run parallel to each other. The issues of formulating and effective use of local budget resources are solved in the same way. "Democratization will also be provided at the same time as the formation and use of budgetary resources. Because all the authorities of the state have their own budgetary funds and use their respective budgetary rights "[4].

Financial resources of the region can be mobilized at the expense of the region budget. In addition, the resources of the local budget can be formulated at the expense of funds received from the higher budgets or from the outside of the region, except for the internal product of the region.

Local authorities are interested in consolidating the revenue base of their local budgets. This will be achieved through socio-economic development and economic growth. Because the final source of budgetary resources is the domestic product. At the same time, focusing on the tax potential of the region and limiting tax burden can significantly reduce the impact of fiscal policy while elaborating public policy measures on resource allocation and resource utilization of local budgets. The local budget covers some of the financial resources of the region, and the corresponding part of the regional financial resources becomes budgetary resources.

It is noted that part of the financial resources will become financial resources because additional conditions will be required for that. In order for the financial resources available to separate categories and groups of economic entities in the region, they need special conditions and the appropriate financial infrastructure. In turn, this infrastructure will be formed based on the relevance of the socioeconomic needs of the region within the boundaries of the budget and beyond. Accordingly, in our opinion, the concept of financial opportunity of the local budget should be interpreted as the base of income, allowing to satisfy the socioeconomic needs of the region in accordance with the level of progress achieved.

In summary, the development of financial potential of the regions serves as the most robust and reliable financial base for the full, timely and secure provision of the obligations related to the socio-economic tasks and guarantees of local budgets' capacities. In the regions, socio-economic development is based on the availability of strong financial resources at the disposal of local authorities.

Thus, the financial resources of the region, the financial resources of the region, the local budget's revenue base should be investigated in terms of the distribution and redistribution of inland products.

Список литературы Направление развития местного налогово-бюджетного потенциала в регионах

- Ўзбекистон Республикаси Президентининг 2017 йил 7-февралдаги ПФ-4947-сонли Фармонига 1-илова 2017-2021 йилларда Ўзбекистон Республикасини ривожлантиришнинг бешта устувор йўналиши бўйича Ҳаракатлар Стратегияси.

- Сабитова Н.М. О понятии финансового патенциала региона и методологии его оценки. "Финансы", 2003, №2, с-63-65.

- Зарипова И.Р., Хафизова В.Р. Баланс финансовых ресурсов территорий. 2-изд. Уфа: ГП Принт, 2001, с.86-90; Верхолаз М.А. Влияние степени исползования экономического патенциала на состояние местных бюджетов, 2-изд. Белгарад: Искра, 2000, с-24-26; Сабитова Н.М. О понятии финансового патенциала региона и методологии его оценки. Финансы, 2003, №2, 63-65-б.

- А.В.Ваҳобов, Т.С.Маликов. Молия. "Ношир" Тошкент, -2012. 285 б.