On the issue of the efficiency of taxation of joint stock companies

Автор: Shernaev A.A.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 9-2 (67), 2020 года.

Бесплатный доступ

The article outlines topical problems of the efficiency of taxation of joint-stock companies in the Republic of Uzbekistan. Methods for analyzing the efficiency of taxation of joint-stock companies are considered. Based on the characteristics of the object under study and the goal set, the principles and methods of analyzing the efficiency of taxation systems of joint-stock companies were put forward.

Tax, taxation, taxation of joint stock companies, analysis, efficiency of taxation, management system

Короткий адрес: https://sciup.org/170182982

IDR: 170182982 | DOI: 10.24411/2411-0450-2020-10747

Текст научной статьи On the issue of the efficiency of taxation of joint stock companies

With the help of taxes, the foreign economic activity of joint-stock companies is regulated, including the attraction of foreign investment, the income and profit of the enterprise is formed. Therefore, an analysis of the efficiency of taxation and its timely optimization will help the company to ensure financial security, increase the profitability of the business and stimulate it for further development.

The adoption of effective management decisions by the management of joint stock companies at the present stage of development of market relations in Uzbekistan predetermines the need for appropriate analytical tools. A striking example is the costly mechanism of a joint stock company, one of the main elements of which is the tax component. Reducing the tax burden can have a significant impact on the financial result of the enterprise, which, however, is not possible without information and analytical support, the basis of which is a system of accounting and off-accounting data converted using analytical methods and techniques. This requires a systematic collection, processing and analysis of information in the tax field of the enterprise for the management of the joint-stock company to make informed management decisions in the field of tax planning and to minimize the impact of the tax factor on the financial result.

In accordance with the current tax legislation, the company has a real opportunity to use a number of benefits in the calculation and payment of individual taxes, which can significantly reduce the total tax burden of the company. This is achieved, first of all, due to the fact that tax legislation often uses reference norms containing references to regulations of other branches of law, which are dispositive in nature and provide the taxpayer with the freedom of choice in a particular issue.

However, before deciding on the use of one or another tax break, you should conduct a thorough analysis of the feasibility and economic justification of such an action. In addition to this, it is necessary to consider the interests of shareholders to maximize their income. In our opinion, an analysis of the efficiency of the taxation systems of joint-stock companies is a necessary tool to simulate the tax consequences of managerial decisions and to reveal the influence of methods for optimizing the tax burden of a joint-stock company on its financial condition and financial results.

The lack of a fully formed conceptual apparatus, theoretical and methodological base, allowing to distinguish between the concepts of the tax system and the taxation system, the lack of development of the methodological foundations of the concept of analyzing the efficiency of taxation systems of joint-stock companies and tools for assessing the impact of tax optimization methods on the total tax burden of a joint-stock company and its financial condition as the basis for management decisions, predetermined the choice of the research topic.

The problem of analyzing and optimizing the tax burden of a joint-stock company has long attracted the attention of economists. However, the overwhelming majority of works are devoted to the optimization of individual tax payments in specific business situations in the absence of a systematic comprehensive analysis of the tax burden of an enterprise and the impact of individual optimization methods on the overall financial condition of the enterprise.

In a broad sense, the tax system is the entire sphere of activity of the state in the field of taxation; in a narrow sense, it is a system or a set of all taxes, i.e. system of taxation. Thus, as a subsystem of taxation of an enterprise, we understand an integral, complete and closed tax field formed at a particular enterprise under the influence on the one hand of external factors (statutory tax payments, their rates, payment deadlines, etc.) and, on the other hand, internal ( local) features of the enterprise in question (organizational and legal form, type of activity, location, etc.). Proceeding from this, the analysis of the efficiency of the taxation systems of joint-stock companies will be a scientific way of understanding the essence of economic and legal phenomena and processes in the tax field formed at a particular enterprise under the influence of external and internal factors.

In this case, the subject of analysis of the efficiency of taxation systems of joint-stock companies can be defined as causal relationships of economic and legal phenomena and processes of the enterprise taxation system in their statics and dynamics, taking into account internal and external factors affecting the system.

The object of the analysis of the efficiency of the taxation systems of joint stock companies is the specific economic results reflected in the accounting (financial) statements of a particular joint stock company. It is on their basis that the analysis is carried out, and the changes obtained when using (or not using) the results of the analysis are compared with them.

The content of the analysis of the efficiency of taxation systems for enterprises is a deep and comprehensive study of economic and legal information on the functioning of the taxation system of the analyzed business entity in order to make optimal management decisions not only in the field of the taxation system of the entity, but also in other interrelated and interdependent areas.

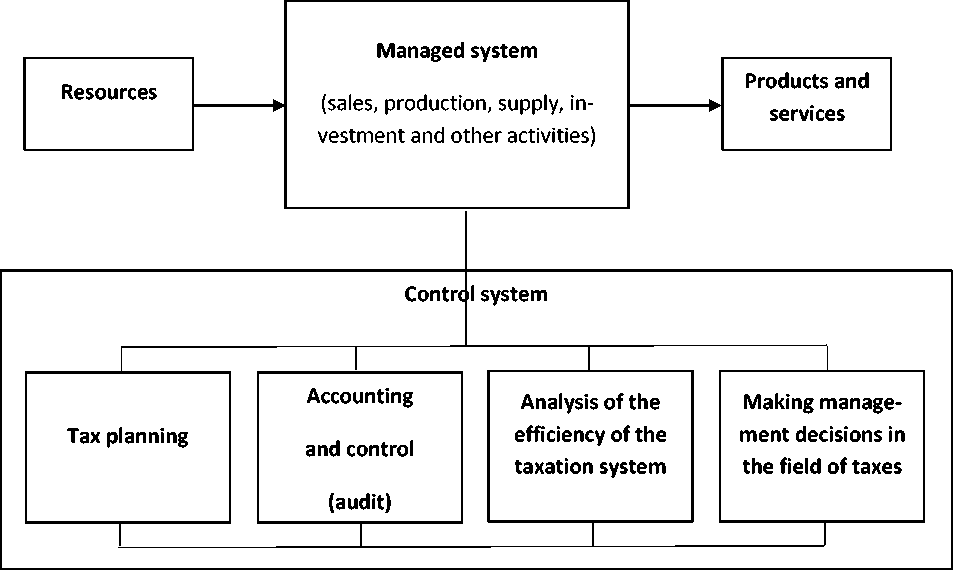

The content of the analysis of the efficiency of the taxation system is determined by the functions that it performs in the enterprise management system (fig. 1).

Figure 1. Analysis of the efficiency of the taxation system of a joint-stock company in the enterprise management system

Based on the characteristics of the object under study and the goal set, the principles and methods of analyzing the efficiency of taxation systems of joint-stock companies were put forward. We offer the concept of a methodology for analyzing the effectiveness of taxation systems for enterprises. The following main elements of the analysis are proposed as a methodological basis:

-

1. Analysis of the financial condition and financial results of the joint stock company. The analysis is based on the calculation and use in the spatial-temporal analysis of a system of coefficients calculated on the basis of the financial statements of the joint-stock company, as well as the data of accounting and management accounting.

-

2. Analysis of the aggregate tax burden of a joint stock company. Within the framework of this element, the main methods for determining the total tax burden that are currently proposed were considered and the approach most acceptable for the purposes of this analysis was developed.

-

3. Analysis of the accounting policy of the joint stock company. Within the framework of this element, the main points of the accounting policy of the joint-stock company are analyzed for both accounting and tax purposes, and the main possibilities for changing the accounting policy in order to reduce the tax burden are considered.

-

4. Analysis of the contractual policy of the joint stock company. The significance of the agreement from the point of view of taxation is that the object of taxation arises from the transactions of the taxpayer, made on the basis of the agreement. Most of the provisions of civil law are dispositive, that is, they allow the parties to the contract to resolve certain issues solely at their own discretion, without adhering to the strictly recommended forms and structures established in the law. This element of the analysis of the taxation system is devoted to the analysis of the possibilities of obtaining tax savings by changing the clauses of the contracts used by the enterprise.

-

5. Analysis of the calculation and payment of individual taxes at the enterprise. This element of the analysis allows you to take into account the specifics of the calculation and payment of individual taxes associated with sectoral, legal, territorial and other features of the analyzed enterprise.

It should also be noted that the 1st and 2nd elements of the methodology for analyzing the taxation system of a joint-stock company are both the initial and the final stage of the entire analysis, which makes it possible to compare the initial data and the result obtained during the analysis and optimization, as well as to conduct a comparative assessment key indicators (financial ratios and an indicator of the total tax burden).

At the end of the analysis, a re-analysis of the financial condition, financial results and the total tax burden of the joint-stock company is carried out for the purpose of a comparative analysis of the results obtained.

Список литературы On the issue of the efficiency of taxation of joint stock companies

- Tax Code of the Republic of Uzbekistan // National database of legislation, 03/21/2019, №03/19/531/2799

- Decree of the President of the Republic of Uzbekistan No.UP-5468 dated June 29, 2018 "On the Concept of Improving the Tax Policy of the Republic of Uzbekistan".

- Буторин В.К. Основы финансовой безопасности: в 3 т. Т. 1. Системные концепции финансовой безопасности / В.К. Буторин, А.Н. Ткаченко, С.А. Шипилов. - М.: КНОРУС, 2017. - 220 с.

- Возжеников А.В. Финансовая безопасность: теория, политика, стратегия. - М.: НПО "Модуль", 2017. - 240 с.

- Некоторые подходы к разработке системы индикаторов мониторинга финансовой стабильности / С.М. Дробышевский (рук. авт. коллектива) и др. - М.: ИЭПП, 2016. - 305 с.

- Shernaev A. General methodological bases of tax planning in enterprises / International Journal of Economics, Commerce and Management. - 2020. -Vol. VIII, Issue 4. - P. 357.

- Жалилов Ш.К., Кабулов Х.А. Система налогообложения топливно-энергетических предприятий в Узбекистане: проблемы и пути их решения // Интернаука. - 2020. - №17 (146). Ч. 2. - С. 46-48.