On the role of investment in the socio-economic development of territories

Автор: Uskova Tamara Vitalyevna, Razgulina Ekaterina Dmitrievna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Socio-economic development strategy

Статья в выпуске: 2 (38) т.8, 2015 года.

Бесплатный доступ

The modern stage of Russia’s socio-economic development is characterized by the lack of budgetary resources to finance both strategic and current tasks. The situation is exacerbated by the introduction of political and economic sanctions, the significant fluctuations in oil prices and the ruble exchange rate, the growing mistrust on the part of business, followed by the increase in capital outflow. These circumstances predetermine the search for the ways to solve the socio-economic problems. The studies of leading Russian and foreign scientists prove that investment plays a major role in ensuring sustainable economic growth and solving the problems of territorial development. Moreover, the recently increasing impact of large companies on the country’s development and the low budget lead to the necessity to attract private investment resources for regional development. In this regard, the authors analyze the investment activity in Russia, present the countries’ rankings by the state of investment climate and disclose the successful experience of business’ participation in sociallysignificant regional projects...

Investment, private resources, socio-economic development, economic growth, enterprises, projects, public-private partnership

Короткий адрес: https://sciup.org/147223718

IDR: 147223718 | УДК: 330.322.1(470.12) | DOI: 10.15838/esc/2015.2.38.4

Текст научной статьи On the role of investment in the socio-economic development of territories

In the conditions of slowing economic growth it is very important to find the tools of the integrated solution of socio-economic problems. The studies of leading Russian and foreign scientists (A.G. Granberg, M.A. Gusakov, V.A. Ilyin,V.N. Lazhentsev, V.N. Leksin, V.V. Okrepilov, P.O. Pchelintsev, V.E. Rohchin, V.S. Selin, A.I. Tatarkin, A.N. Shvetsov, J.S. Mill, R. Harrod, R. Solow, R. Campbell, and K. McConnell, J. Galbraith, J. Hobson, W. Eucken, M. Porter, O. Williamson, F. Hayek, O. Hart and others) prove that investment plays the main role in ensuring sustainable economic growth.

In particular, the works of P. Romer, R. Lucas and S. Rebelo present the endogenous models of long-term sustainable growth of the economy depending on the sources of economic growth and investment targets.

The models to accumulate physical capital presuppose that technologies and knowledge embodied in physical capital become public goods and boost labor productivity in the whole economy due to the innovation dissemination.

R. Lucas, assuming that the continuous economic growth is possible due to investment in human capital, creates the model, according to which investment in human capital is more productive than investment in physical capital. The research in the origin of technological progress and the patterns of emergence and implementation of innovation helps elaborate the models, which represent two main sectors involved in the STP formation: the sector (ideas) of production and knowledge accumulation, the sector of goods (things) production – the means of production and the final product. The ideas serve as a tool to produce goods with higher added value and, consequently, they are a more significant factor in economic growth [18].

The most complete definition of economic growth is given by Nobel Prize winner S. Kuznets: “Economic growth is a long-term increase in the economy’s ability to meet increasingly diverse needs of the population by means of more efficient technologies and appropriate institutional and ideological changes”. The study of the theoretical and methodological framework allows us to conclude that the economic growth is the key driving force for the country’s socio-economic development. Hence, the federal authorities should focus on it. In addition, the growth means a distinct vector of growth within certain fluctuations in its rates, having positive values.

The development involves not only the positive values of growth, but its absence or even decline, which, however, should overlap the positive values of growth [13, 19]. So, the concept of economic growth is much narrower than the concept of economic development. The growth is expressed in the quantitative increase in the volume of production and the creation of prerequisites for future growth, when the development involves the social sector (rise in the welfare of the population).

Regional and local budgets are used as the main sources of socio-economic development of territories. They are characterized by the inconsistency between revenues and expenditures. The sustained rapid growth of the economy requires the annual investment in fixed assets in the amount of 30% of GDP instead of the current 22–23% [12].

The RF Minister of Finance A.G. Siluanov stated at the Saint Petersburg International Economic Forum: “At a low growth rate of the economy we are strained to the limit: production is ensured to full capacity, unemployment is at a low level, to accelerate the economic growth private investment is required” [16].

Lack of budgetary resources for comprehensive socio-economic development of territories is exacerbated by the transfer of social infrastructure from major economic structures to municipalities.

However, big business can act as an equal partner of socio-economic development of the territories. Russian corporations, being city-forming enterprises, play an important role in socio-economic development of the territories.

They increase revenues of the regional budgets and incomes of the population, create jobs, influence the environment and develop infrastructure [14]. So, in order to ensure sustainable growth and development of the economy, it is necessary to actively attract investment in physical and human capital.

Let us note that foreign companies pay much attention to private (ethical) investment [21]. Private investment, representing one of the types of capital investment, are forming from the funds of private, corporate companies and organizations, citizens, including both own and borrowed funds.

In Russia this type of investment is underdeveloped, as evidenced by the results of the countries ranking, according to the degree of ethical economy development ( tab. 1 ) [11].

Table 1. Ranking of the countries according to the degree of ethical economy development

|

Rating |

Country |

Rating level |

|

Very high |

Austria, Denmark, Finland, Germany, Netherlands, Norway, Switzerland, UK, Sweden |

9–11 |

|

High |

France, Spain, Portugal, Brazil, Canada, Italy, Japan, Luxembourg, South Korea |

6–8 |

|

Average |

Australia, Belgium, Czech Republic, Hungary, China, India, Chile, Greece, Indonesia, New Zealand, Slovakia, Slovenia, Taiwan, USA |

3–5 |

|

Low |

Iceland, Ireland, Mexico, Philippines, Romania, Russia, Singapore, Colombia, Malaysia, Peru, Thailand, Turkey, UAE, Argentina, Bulgaria, Costa Rica, Hong Kong, Israel, Pakistan, Poland, Saudi Arabia. |

0–2 |

At the same time, the United States Trade Representative (USTR) estimates Russia’s investment climate as unfavorable. The American experts believe that the measures taken by the Russian authorities are insufficient.

The expert report argues that foreign entrepreneurs are scared of complicated investment legislation, high levels of corruption, distrust in the Russian judicial system and weak protection of the rights of the company shareholders [10].

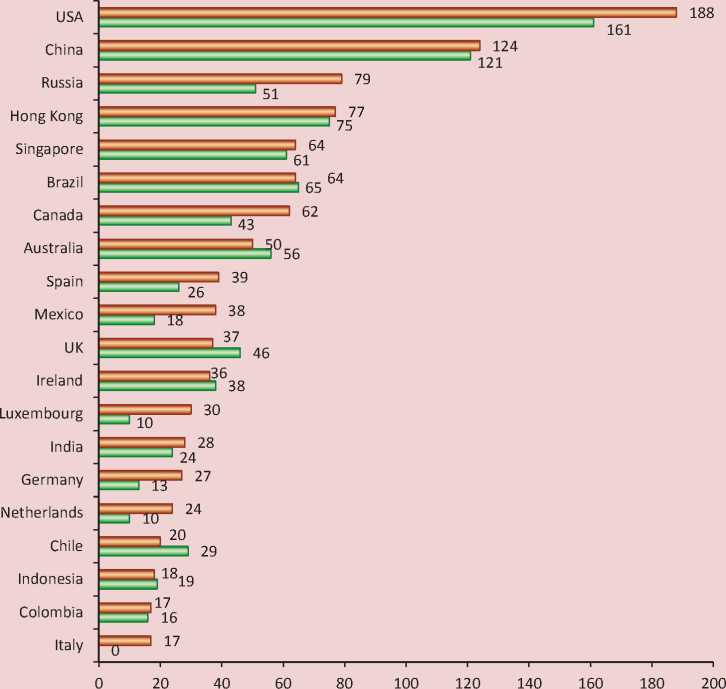

However, in accordance with the 2014 “World Investment Report”, published by UNCTAD (United Nations Confe-rence on Trade and Development), Russia ranges the 3rd by the volume of received foreign investments in 2012 and 2013 (79 and 51 billion U.S. dollars, respectively; fig. 1 ).

Despite the high growth of foreign direct investment in 2013, the year of 2014 was rather ambiguous due to a number of factors negatively affecting the country’s economy.

As a result of the negative impact of these factors the country’s investment attractiveness has declined significantly, as evidenced by the data of international consulting companies. Thus, according to one of them (A.T. Kearney or Kearney Foreign Direct Investment Confidence Index), in 2014 Russia was not included in the group of 25 world countries, most attractive for the investors, although in 2013 it ranked the 11th.

As for the situation inside the country, in 2013 there the positive trend of investment growth, observed in 2010–2012, changed into the negative. At year-end there was a reduction in investment compared to the previous year both in the whole country and in the Northwestern (22.9%), Ural (1.8%), Siberian (9.5) and Far Eastern (19.5%) Federal districts ( tab. 2 ).

Figure 1. Inflow of foreign investment in 20122013, billion U.S. dollars

□ 2012 □ 2013

Source: UNCTAD, World Investment Report 2014.

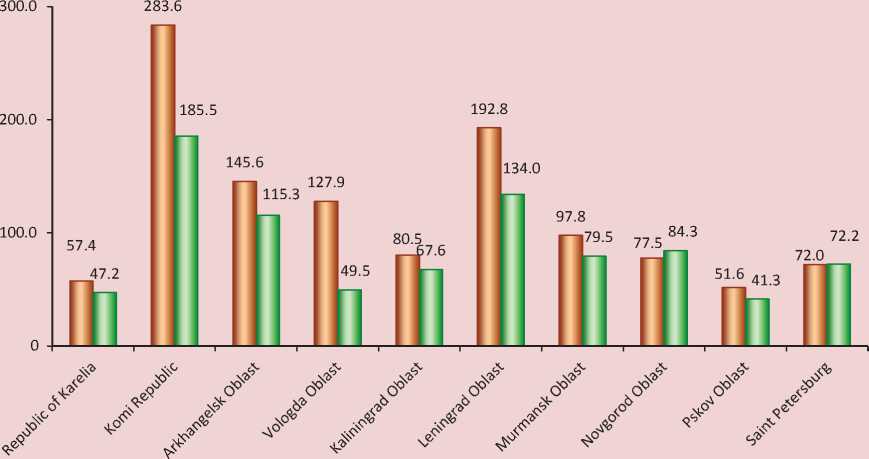

The decline in investment in the NWFD subjects was caused by the completion of the construction of the gas pipeline “Ukhta – Torzhok”. The largest decrease was recorded in 2013 in the Vologda Oblast. where capital investment in economic development was lower by 61.3% (49.5 billion rubles) than in the previous year (fig. 2) .

The decline was related to the launching of the gas turbine power station and the new modern complex of urea production in OJSC “PhosAgro” (Cherepovets).

Undoubtedly, this fact affected the distribution of investment in the region. If before 2012 the maximum amount of investment was allocated to transport and communications, in 2013 the situation

Table 2. Investment in fixed capital, thousand rubles per capita (at 2013 constant prices)

|

Federal district |

2000. |

2005 |

2008 |

2010 |

2011 |

2012 |

2013 |

2013 to 2012, % |

|

|

2000, % |

2012, % |

||||||||

|

Russian Federation |

34.8 |

55.9 |

88.0 |

78.4 |

86.8 |

92.6 |

92.4 |

265.1 |

99.8 |

|

Central Federal district |

34.8 |

53.3 |

79.8 |

66.8 |

71.6 |

80.8 |

84.8 |

243.8 |

105 |

|

Northwestern Federal district |

31.1 |

71.7 |

105.2 |

98.7 |

108.6 |

113.0 |

87.1 |

279.9 |

77.1 |

|

Southern Federal district |

29.3 |

37.7 |

69.7 |

79.6 |

87.8 |

94.3 |

102.5 |

349.9 |

108.7 |

|

North Caucasian Federal district |

21.4 |

37.3 |

34.1 |

37.4 |

38.6 |

43.3 |

44.6 |

208.3 |

102.9 |

|

Volga Federal district |

28.0 |

43.0 |

67.1 |

59.4 |

65.4 |

71.6 |

74.9 |

267.3 |

104.6 |

|

Ural Federal district |

73.4 |

94.9 |

153.5 |

143.7 |

164.1 |

174.6 |

171.4 |

233.5 |

98.2 |

|

Siberian Federal district |

18.5 |

35.7 |

62.5 |

60.8 |

70.6 |

78.9 |

71.4 |

385.3 |

90.5 |

|

Far Eastern Federal district |

28.3 |

77.7 |

105.6 |

145.5 |

184.1 |

162.2 |

130.5 |

460.6 |

80.5 |

Compiled by the authors on the basis of the sources: Investitsii v osnovnoi kapital na dushu naseleniya [Investment in Fixed Capital per Capita.]. Available at.: ; Indeks fizicheskogo ob”ema investitsii v osnovnoi kapital [Index of Physical Volume of Investment in Fixed Capital]. Available at: exe/Stg/d03/

Figure 2. Investment in fixed capital in the Northwestern Federal district, thousand rubles per capita (at 2013 constant prices)

□ 2012 □ 2013

changed markedly: 20.4% of its volume was directed to production and distribution of electricity, gas and water, 18.6% – metallurgical, 10.0% – chemical production and 3.9% – agriculture ( tab. 3 ). The reason is the following: the major investment projects in 2013 were implemented in these industries ( tab. 4 ).

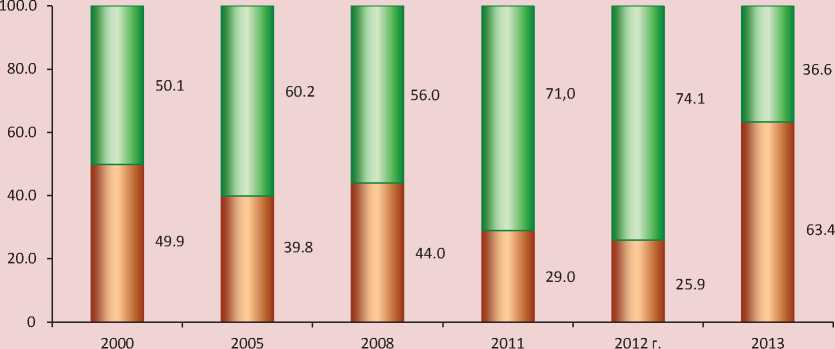

We can but notice that the region continues to carry out other large investment projects [2], which determined the positive growth dynamics in the structure of financing sources in 2013 (fig. 3).

The experience of business organizations participation in solving social and economic problems in the Vologda Oblast can be applicable in other regions. It is critical to develop public-private partnership as an effective mechanism to attract private investment resources for the implementation of socially significant regional projects [15].

Table 3. Distribution of investment by kinds of economic activity in the Vologda Oblast (% to the total)

|

Structure |

2000 |

2008 |

2011 |

2012 |

2013 |

|

Total |

100 |

100 |

100 |

100 |

100 |

|

Agriculture, hunting and forestry |

5.9 |

4.4 |

2.8 |

1.7 |

3.9 |

|

Manufacturing: |

40.3 |

30.0 |

21.1 |

16.8 |

36.6 |

|

manufacture of other non-metal mineral products |

- |

1.3 |

0.6 |

0.7 |

1.2 |

|

metallurgical production and production of finished metal products |

18.5 |

16.6 |

3.6 |

18.6 |

|

|

production of machinery and equipment |

1.7 |

0.5 |

0.3 |

0.2 |

0.6 |

|

chemical production |

4.0 |

6.5 |

8.8 |

6.6 |

10.0 |

|

Production and distribution of electricity. gas and water |

4.9 |

7.1 |

9.4 |

6.7 |

20.4 |

|

Construction |

1.5 |

1.3 |

0.2 |

0.4 |

0.6 |

|

Wholesale and retail trade; repair of motor vehicles |

1.6 |

1.2 |

0.5 |

0.8 |

2.4 |

|

Hotels and restaurants |

- |

0.9 |

0.2 |

0.1 |

0.2 |

|

Transport and communications |

30.1 |

39.9 |

60.3 |

68.0 |

22.9 |

|

Financial activities |

0.7 |

0.6 |

0.5 |

0.4 |

1.1 |

|

Operations with real estate, rent and provision of services |

0.3 |

9.3 |

2.3 |

2.4 |

6.1 |

|

Public administration and defense security; social insurance |

0.7 |

0.9 |

0.2 |

0.3 |

0.4 |

|

Education |

2.1 |

1.0 |

0.4 |

0.3 |

1.4 |

|

Healthcare and social services |

3.3 |

1.5 |

0.5 |

1.2 |

2.4 |

|

Other public utilities, social and personal services |

3.5 |

1.9 |

1.6 |

0.7 |

1.2 |

Sources: Investitsionnye protsessy v Vologodskoi oblasti: statisticheskii sbornik [Investment Processes in the Vologda Oblast: Statistics Digest]. Goskomstat [Federal State Statistics Service]. 2003, p. 40.; Investitsionnye protsessy v Vologodskoi oblasti: statisticheskii sbornik [Investment Processes in the Vologda Oblast: Statistics Digest]. Territorial’nyi organ Federal’noi sluzhby gosudarstvennoi statistiki po Vologodskoi oblasti [Territorial Body of Federal State Statistics Service of the Vologda Oblast]. 2010, pp. 33-34; Ibidem . Pp. 37-39.

Table 4. Largest and most significant investment projects in the Vologda Oblast in 2013 [3]

|

Project |

Volume of investment, billion rubles |

Number of jobs created, people |

|

Construction of Gazprom Neft filling stations (29 stations) in the region (2013–2017) |

2.4 |

550 |

|

Upgrade of 200 boiler plants in the region with the participation of OAO “Gazprom” |

5.0 |

No data |

|

Modernization of the Vologda CHPP (OAO “TGC-2”) |

6.0 |

46 |

|

Construction of electric grid complex objects of OAO “FGC UES” |

5.4 |

No data |

|

Reconstruction of existing paper production in LLC “Sukhonsky PPM” (2011–2019) |

4.1 |

300 |

|

Construction of two plants for processing of wild berries, vegetables, fruits and mushrooms (LLC “Vologodskaya yagoda”) |

6.0 |

619 permanent + 3000 seasonal |

|

Construction of a new energy efficient ammonia production facility with the capacity of 220 tons/day (760 thousand tons a year) at OJSC “PhosAgro” (2013–2017) |

30.0 |

300 |

Figure 3. Distribution of investment in fixed capital by financing sources in the Vologda Oblast, %

Own funds Attracted funds

Compiled by: Investitsionnye protsessy v Vologodskoi oblasti: statisticheskii sbornik. [Investment Processes in the Vologda Oblast: Statistics Digest]. Territorial’nyi organ Federal’noi sluzhby gosudarstvennoi statistiki po Vologodskoi oblasti [Territorial Body of Federal State Statistics Service of the Vologda Oblast]. 2014, p. 32; Ibidem p. 28.

In particular, the Cherepovets Steel Mill OAO Severstal has completed the investment project to reconstruct No.7 Coke Oven Battery which will reduce the environmental load due to the construction of the ecological objects complex.

In 2013 the first phase of sawmill LLC “Harovsklesprom” was launched; the amount of investment amounted to more than 1.2 billion rubles. Its social orientation and environmental friendliness are distinctive features of the project, since the complete processing of bark and sawdust helps supply heat to one of the districts in Kharovsk [2. 3].

The FosAgro nitrogen and phosphorus complexes are characterized by gradual investment in the construction of new chemical plants and the increase in output of products with high added value. The realization of these and other projects together with the use of capacities of the gas transmission system will facilitate the creation of the gas chemical complex, improve the use of natural resources and reduce the industry’s dependence on import of polymeric materials.

The successful implementation of investment projects depends on the effective activity of regional authorities and local administrations. They should be interested in attracting private investment, because in the conditions of competition for limited resources investment is a tool to create new jobs, broaden the revenue base of regional and local budgets and, ultimately, enhance the quality of life.

The Vologda Oblast has the following conditions to maintain favorable investment climate:

– there is the Investment Council under the Governor of the Oblast and JSC “The Vologda Region Development Corporation”;

– there is the law “On state regulation of investment activity in the form of capital investment on the territory of the Vologda Oblast and on amending certain laws of the oblast” of May 8. 2013. no. 3046-OZ (edition of June 4. 2014);

– the separate section “Strategy of investment policy” was added to the “Strategy for socio-economic development of the Vologda Oblast for the period up to 2020” (approved by the Vologda Oblast Government decree of June 28. 2010. no. 739).

However, these tools are not sufficient to enhance the measures maintaining favorable investment climate. The fact is that in accordance with the Decree of the RF Government “On approval of the lists of indicators to measure the effectiveness of activities and methods for determining the target values of indicators of the assessment of efficiency of Executive authorities activities to create favorable conditions for entrepreneurial activity (up to 2018)” of April 10. 2014. no. 570-p, the target values of the indicator “investment in fixed capital” in 2014–2018 are set for each RF subject as a target value for the previous period, increased by 0.5 percentage points

This indicator decreased in 2013. A similar situation is observed in Russia as a whole: at the end of 2013 investment in fixed capital decreased by 0.2%.

So, according to the RF socio-economic development scenario presented by the Ministry of Economic Development, the decline in investment attraction is caused by the structural factors (reduction in Gazprom’s investment) and the growing mistrust on the part of business, followed by the increase in capital outflow.

The increasing decline of investment in fixed capital reached 4.8% in the first quarter of 2014 [17]. Investor sentiment is aggravated by the growing uncertainty concerning future events and the ruble exchange rate dynamics.

The changed foreign policy hinders enterprises to raise funds on external markets. The lack of resources to finance investment projects and the reduction in demand for investment due to rising uncertainty and deteriorating expectations are among the main negative factors that determined economic performance in 2014.

The positive growth of investment (by 2.4% as average) is expected to be achieved in 2015 at the expense of sectors, such as transport, trade, financial activity, operations with real estate. etc. [17] However, it will be difficult to attain the goal due to the rising economic uncertainty.

Vologda Oblast Governor Oleg Kuvshinnikov claims in the report “Investment climate and investment policy of the Vologda Oblast for 2015” that in the current year investment is to increase by 2% due to the launch of the following major investment projects.

-

1. The project to open a pig farm CJSC “Shuvalovo” (25 thousand heads of cattle) in Gryazovetsky Dustrict. The total investment amounts to 500 million rubles, of which almost 400 million rubles are borrowed funds. In 2015 the volume of investment is to increase by 7–8%, in 2016 – by approximately 20%.

-

2. To upgrade the production of JSC “Sokol” 120 million rubles will be invested in 2015 and 125 million rubles in 2016.

-

3. About 110 million rubles will be spent on the reconstruction of existing LLC “Sukhonsky PPM” and about 80 million rubles – reconstruction of LLC “Harovsk-lesprom”.

-

4. OJSC “PhosAgro” launches the construction of a new energy efficient ammonia production facility. The enterprise’s total investment in the project implementation (2014–2017), including the construction of infrastructure, will exceed 25 billion rubles [2].

The economic development will be boosted by the implementation of investment projects, the development of new sites and territories, the formation of territorial industrial clusters on the basis of large projects and the maximum involvement of local suppliers and contractors in the projects implementation.

At the same time, it is necessary to continue promoting the activities of JSC “The Vologda Region Development Corporation” in areas, such as:

-

• organization and holding conferences, forums, round tables, business visits, seminars and other PR events;

-

• region’ representation at business events in Russia and abroad;

-

• partnership with international, federal and regional mass media;

-

• filling the information space with relevant information about socio-economic development of the region and key investment offers;

-

• informational and organizational support of various events held in the region and beyond;

-

• provision of advisory services;

-

• signing of framework agreements with consulting companies to attract investment to the region.

In those RF subjects, which have not adopted a regional law on investment activity yet, it is advisable to introduce a legal act, stipulating:

-

– the main ways to protect investors’ rights;

-

– guarantees that the state of investors will nor worsen for the period of the investment strategy implementation;

-

– guarantee of non-abuse on the part of the executive authorities in the RF subject;

-

– procedure for investors to seek for protection and assistance;

-

– state support measures and mechanisms of its provision.

To implement investment projects and investment policy strategies not only in the Vologda Oblast, but also in other RF subjects it is advisable to carry out activities, such as:

-

1) organization of work with the federal government to attract federal funds in the region for the social infrastructure development;

-

2) work with the state monopolies to develop infrastructure potential of the region;

-

3) development of cooperation on the basis of public-private partnership;

-

4) creation of a direct communication channel between investors and regional authorities to solve urgent tasks arising in the course of investment activity;

-

5) adoption of a system of measures for the state support of the organizations implementing priority investment projects;

-

6) establishment of regional development institutions;

-

7) simplification of a procedure for state duty payment and introduction of online registration;

-

8) implementation of measures to improve tax literacy of taxpayers;

-

9) development of model administrative regulation of the procedure for building permit issuance, simplification of a procedure for the applicant, its standardization in municipalities;

-

10) creation of an online portal that will host an interactive map of investment sites.

However, only the regional authorities’ activities are not enough; the action is required at the federal level. Russian President Vladimir Putin signed the Industrial Policy Law Amendments concerning tax incentives to industrialists December 31. 2014.

This package includes four types of benefits:

-

• investment in fixed assets (not less than 20 million rubles a year, 50 million rubles for 3 years and 200 million rubles for 5 years) is reckoned toward reduction of profit tax;

-

• tax holidays on profit and property taxes for new businesses;

-

• accelerated depreciation of fixed assets;

-

• reduced rate of insurance premiums for the enterprises engaged in engineering and industrial design.

According to the developers, subsidies will encourage investment in production and, consequently, tax revenues in the budget. Thus, if the costs of the measures implementation amount to 159 billion rubles, the final effect will be 2.156 trillion rubles of additional yield.

It is important to note that the tax incentives offered by the Ministry of Industry and Trade will work for a very limited range of companies.

First, they set a high barrier for participation. The industrial enterprise must be new and the amount of the minimum investment – 20 million rubles a year.

As a result, the average business, which theoretically reacts to opportunities faster than others, stands aside.

Second, these measures are limited to profit and property taxes. But it is well-known that there is no property tax for new equipment in the Russian Federation and no one will agree to lower real estate tax. In

2015 local authorities are to transfer to the assessment of real estate, according to the cadastral value, and in the future this tax will become one of the basic. As for profit tax privilege, new businesses, interested in benefits, have no profit, that is why tax is not imposed.

Third, the situation is unclear with reduced insurance rates for the enterprises operating in the field of engineering and industrial design. After all, the goal is to promote the whole industry, but not any particular sector [9]. It is necessary to cut social contributions and calculate the rates beneficial for business. Nowadays social contributions are, in fact, the biggest tax for businesses, labor tax.

The public organization “Business Russia”, including entrepreneurs from 77 regions, has the following alternative proposals:

-

1. It is necessary to reduce the VAT rate from the current 18% to 12%. First, the same VAT rate is observed in Kazakhstan, and all the production that could “be transferred” to Kazakhstan (especially from neighboring Russian regions), was transferred due to lower social contributions and VAT rates and a package of tax incentives for new businesses. Second, gray schemes are used to sidestep the VAT payment. According to the various estimates, 30–50% of the total funds will be “white”.

-

2. It is required to give preferences to reinvested profit into production, that is, to tax the profit that the company reinvests at 10 or 5%.

-

3. It is necessary to diversify the insurance premiums depending on the age of a worker and the labor productivity in order to encourage the creation of new productive jobs. If a person works at a high-performance workplace, produces a lot and gets a high salary, he/she should be imposed tax not by a progressive, but regressive scale. As for age, it is necessary to encourage businesses to employ young people (for example, aged under 30 to pay social security contributions at a reduced rate). According to the “Business Russia” Tax Committee Chairman, it is necessary to introduce a monthly social deduction, taxed at 0%, equal to subsistence minimum for an adult person plus subsistence minimum for each dependent who is under care of an employee. The poor will not have to pay contributions.

-

4. It is advisable to follow the recommendations of the Ministry of Industry and Trade regarding the accelerated depreciation of fixed assets. Allowance for depreciation gives enterprises the right to regulate first profit. The equipment acquisition represents the real costs of fixed assets renewal [9].

Probably, the implementation of these measures and the amendment of the federal legislation will encourage the implementation of the Presidential decrees, aimed at creating a favorable investment climate, increasing the paces and sustainability of socio-economic development.

The compliance of the Russian norms to regulate economic activity with global norms is one of the most important tasks to improve the country’s investment climate and boost its investment attractiveness. It is necessary to adjust Russian accounting in accordance with the international standards. Potential investors will assess the performance and the balance sheet figures of Russian enterprises more accurately when cooperating with them.

To stimulate the inflow of private investment it is required to introduce special financial incentives, including government co-financing of basic infrastructure, provision of loan guarantees, extension of the territories having the special economic regime, backing interest rates for their development, equipment acquisition and provision of lease incentives.

In addition to the financial incentives, to attract investment to the Russian Federation the state should focus on the improvement of the processes of interaction with investors and support the active promotion of products on domestic and foreign markets.

The elements of the system to improve investment climate in Russia should be the following: first, the national rating of investment climate in the regions; second, the tools to motivate regional authorities and the development of these tools; third, the mechanism to exchange best practices based on dialogue between business and authorities [8].

Thus, taking into account the stated above, we can propose the measures to improve conditions for investment activities in the Russian regions ( tab. 5 ).

Table 5. Measures to improve conditions of investment activity in the RF regions

|

Factors of investment climate |

Indicators |

Suggestions for investment climate improvement |

|

Legislative support of investment activity |

Taxation level. Tax benefits. Government guarantees. Investment tax credit. Guarantee of legal equality for all investors. |

It is necessary to legally recognize tax exemptions for profit tax for enterprises and organizations, engaged in real investment, including those participating in PPP projects. The cost of debt servicing, including the repayment of the primary loan, should be taken into account in order to reduce a taxable base of profit tax. |

|

Development of market infrastructure |

Availability of banking services; insurance of investment risks; insurance of construction and installation; leasing; consulting services. |

It is necessary to develop a system of long-term credit provision and investment risks insurance. In the framework of investment and industrial policy one should provide for a mechanism to compensate the investment component of interest credit rates on loans, aimed at the implementation of real projects, including PPP. |

|

Availability of real estate |

Transparency of tenders. Order of land title registration. Availability and adequacy of office space. Possibility of obtaining land titles. |

It is necessary to form a unified information system of available real estate, simplify and make transparent the system to distribute land for the implementation of real projects in industry and infrastructure. |

|

Development of engineer infrastructure |

Transport. Road. Electricity. Water supply and Sewerage. Connection. Availability of the construction of new infrastructure facilities; engineering, approval, operation permit. |

It is necessary to simplify the procedure to approve the design, construct and obtain the permit for new infrastructure facilities operation, primarily in the field of energy supply. |

|

Availability of skilled personnel |

Adequacy of administrative and economic personnel, engineering staff and skilled workforce. |

It is necessary to provide a comprehensive program of staff training for the implementation of real projects at all levels of the RF educational system: – at the level of secondary education– encourage careerguidance, actively develop technical schools and technical high schools, focused on training highly qualified workers, including builders, introduce mandatory certification of construction laborers. – at the level of secondary professional and higher professional education – promote interaction with enterprises and organizations of the real sector, increase the number and duration of mandatory production practices, open branches organizing production practices of students of secondary and higher vocational institutions. |

|

Information infrastructure |

Availability of relevant information. Accuracy of the information significant for investors. |

To create an information portal, providing reliable, relevant and adequate information to all users, interested in the realization of investment projects, including PPP; provide a broad PR, according to new laws and regulations, determining the conditions of investment activity implementation. |

|

Administrative factor |

Speed required for obtaining permits and approvals. Level of corruption. |

To take measures to reduce the corruption impact of on investment, maximize control over compliance with the deadlines and the procedure to obtain permits. |

|

Compiled by: [20]. |

||

It should be noted that in the modern conditions, when the budget funds are insufficient and the additional sources of funding are required, private investment serves as one of the types of extra-budgetary investment in infrastructure development, addresses specific socio-economic problems, expands the range and improves the quality of services, forms new points of growth, contributes to the increase in the level of socio-economic development of the region.

However, this is not possible without transparent, mutually beneficial mechanisms of government-business cooperation, reviewing existing stereotypes of business structures’ conduct and methods of their participation in the territorial development.

The authorities should show political will and business should elaborate a new approach to understanding of its role in social investment and become more interested in the territorial development. Only in this case we can speak about a new stage of development of the Russian model of investment, which will create comfortable conditions for business operation and will improve the efficiency of budget funds, used to ensure sustainable development of the regions.

Список литературы On the role of investment in the socio-economic development of territories

- Investitsii v osnovnoi kapital na dushu naseleniya . Available at.: http://www.gks.ru/bgd/regl/b14_14p/IssWWW.exe/Stg/d03/23-02.htm

- Indeks fizicheskogo ob”ema investitsii v osnovnoi kapital . Available at: http://www.gks.ru/bgd/regl/b14_14p/IssWWW.exe/Stg/d03/23-03.htm

- Investitsionnye protsessy v Vologodskoi oblasti: statisticheskii sbornik . Territorial’nyi organ Federal’noi sluzhby gosudarstvennoi statistiki po Vologodskoi oblasti . 2010, pp. 37-39

- Byrkova E. Kak izmenilas’ investitsionnaya privlekatel’nost’ Rossii . Informatsionno-analiticheskoe izdanie PROVED . Available at: http://proved.rf/analytics/research/19533-kak-izmenilasy-investitsionnaya-ppivlekatelynosty-possii.html

- Doklad gubernatora oblasti “Investitsionnyi klimat i investitsionnaya politika Vologodskoi oblasti na 2015 god” . Available at: http://yandex.ru/clck/jsredir?from=yandex.ru

- Doklad gubernatora oblasti “Ob investitsionnom climate” . Available at: http://vologda-oblast.ru/gubernator/vystupleniya_intervyu/doklad_gubernatora_oblasti_ob_investitsionnom_klimate/?sphrase_id=319434

- Ilyin V.A. Natsional’naya i regional’naya bezopasnost’: vzglyad iz regiona . Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz , 2013, no. 3 (27), pp. 9-20.

- Investitsionnye protsessy v Vologodskoi oblasti: statisticheskii sbornik . Goskomstat . 2003, p. 40.

- Investitsionnye protsessy v Vologodskoi oblasti: statisticheskii sbornik . Territorial’nyi organ Federal’noi sluzhby gosudarstvennoi statistiki po Vologodskoi oblasti . 2010, pp. 33-34.

- Investitsionnye protsessy v Vologodskoi oblasti: statisticheskii sbornik. . Territorial’nyi organ Federal’noi sluzhby gosudarstvennoi statistiki po Vologodskoi oblasti . 2014, pp. 37-39.

- Itogi pilotnogo aprobirovaniya Natsional’nogo reitinga sostoyaniya investitsionnogo klimata v sub”ektakh Rossiiskoi Federatsii . Agentstvo strategicheskikh initsiativ . Moscow, 2014. 178 p.

- Krasnova V. Lukavaya politika . Ekspert , 2015, no. 7. Available at: http://expert.ru/expert/2015/07/lukavaya-politika/

- Mantashyan G.G. Delovoi i investitsionnyi klimat v Rossii . Gorizonty ekonomiki , 2013, no.6 (11), pp. 47-50.

- Milevskaya M.A. Mezhdunarodnoe sostoyanie eticheskikh investitsii i otvetstvennykh predpriyatii . Vestnik ekonomicheskoi integratsii , 2014, no. 3, pp. 57-65.

- Mindich D. Granitsy gosudarstva . Ekspert , 2014, no. 43. Available at: http://expert.ru/expert/2014/43/granitsyi-gosudarstva/

- Uskova T.V., Lukin E.V., Vorontsova T.V., Smirnova T.G. Problemy ekonomicheskogo rosta territorii: monografiya . Under editorship of T.V. Uskova. Vologda: In-t sotsial’no-ekonomicheskogo razvitiya territorii RAN, 2013. 170 p.

- Razgulina E.D. K voprosu ob investirovanii kompaniyami regional’nogo razvitiya . Vestnik ChGU , 2013, no. 4 (51), vol. 1, pp. 59-64.

- Razgulina E.D. Partnerstvo organov vlasti i biznes-struktur kak neobkhodimoe uslovie privlecheniya chastnykh investitsionnykh resursov . Problemy razvitiya territorii , 2014, no. 5 (73), pp. 78-90.

- Siluanov A.G. Usloviya rosta . Expert Online , 2013. Available at: http://expert.ru/2013/06/21/usloviya-rosta/

- Stsenarnye usloviya, osnovnye parametry prognoza sotsial’no-ekonomicheskogo razvitiya Rossiiskoi Federatsii i predel’nye urovni tsen (tarifov) na uslugi kompanii infrastrukturnogo sektora na 2015 god i na planovyi period 2016 i 2017 godov . Ministerstvo ekonomicheskogo razvitiya Rossiiskoi Federatsii . Mai 2014. 69 p. Available at: http://de.gov.yanao.ru/doc/soc_eco/scen_usl/scen_y_2015-2017.pdf.

- Uskova T.V. O roli investitsii v obespechenii ustoichivogo ekonomicheskogo rosta . Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz , 2013, no. 6 (30). pp. 223-234.

- Uskova T. V. Upravlenie ustoichivym razvitiem regiona: monografiya . Vologda: ISERT RAN, 2009. 355 p.

- Khazuev A.I. Teoretiko-metodologicheskie aspekty upravleniya investitsionnymi protsessami v depressivnykh regionakh (na materialakh Chechenskoi Respubliki) . Terra Economicus , 2012, part 3, no. 3, pp. 127-131.

- Beal D.J., Goyen M., Phillips P. Why do We Invest Ethically? Journal of Investing, 2005, vol. 14, no. 3, pp. 66-77.

- Doing Business 2014: Understanding Regulations for Small and Medium-Size Enterprises. Available at: http://www.doingbusiness.org/reports/global-reports/doing-business-2014.