Online retail in China and Russia: current state and development prospects

Автор: Dementeva Irina N., Sheng Sheng

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Foreign experience

Статья в выпуске: 4 т.15, 2022 года.

Бесплатный доступ

In recent years, due to the digitalization of the economy, there has been a rapid development of online commerce around the world. China is a global leader in online trade; the country demonstrates the highest volumes of the online sales market. The Russian online sales market is the most dynamic, Russia ranks first in terms of the growth rate of online retail. Within the framework of this study, we analyze the current state of online retail trade in China and Russia over the recent years, assess the contribution of e-commerce to the retail turnover of the two countries, identify factors affecting the active and dynamic development of this sector and promising directions for further development of online consumption in the context of modern socio-economic transformations. In the course of the research, we have found that the successful development of online retail in China is the result of an effective system of political regulation and stimulation of this segment, constant expansion and improvement of Internet coverage, improvement of e-commerce infrastructure and people’s financial situation. In Russia, the widespread use of the Internet, including on mobile devices, the transformation of consumer attitudes, requests and preferences, the increase in sales volumes of the largest marketplaces and online stores reflect large reserves and great potential for further growth and successful development of this sector. The main directions for further development of the e-commerce segment are as follows: improving the standard of living and quality of life, improving the infrastructure of online commerce, mainly in the direction of ensuring the security of online payments and other transactions, expanding the informatization of rural areas and their population, greening online consumption, improving the regulatory framework in the field of e-commerce.

Digitalization of the economy, online retail trade, coronavirus pandemic, retail turnover, marketplaces, e-commerce infrastructure, standard of living, information technology

Короткий адрес: https://sciup.org/147238480

IDR: 147238480 | УДК: 339.13:330.59 | DOI: 10.15838/esc.2022.4.82.15

Текст научной статьи Online retail in China and Russia: current state and development prospects

Currently, in the context of economic globalization and information technology, there have been certain changes in the way of reaching consumers, Internet commerce has become one of the most dynamically developing economic sectors and a new engine of consumption. In the era of the interconnection of the integrated interaction of “human, machine and things”, the space for the development of online commerce is expanding, and its contribution to the national economy and social development is increasing every day. The COVID-19 pandemic and related restrictive measures have led to a fundamental shift in the structure of global demand for online purchases and an increase in the use of digital communication tools and remote consumption, such as social media, Internet telephony, teleconferences, streaming video. The pandemic has transformed consumption patterns and consumer habits, spawned new models and formats of online consumption.

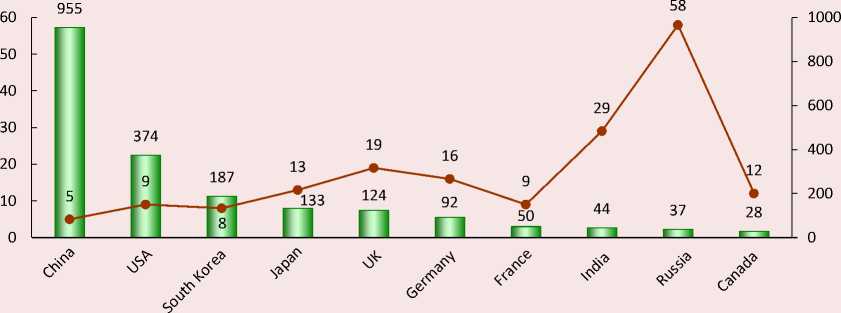

According to research by eMarketer, the global e-commerce market in 2020 amounted to 3.914 trillion U.S. dollars, which is 16.5% more than in 20191. The distribution of sales volumes in the retail segment of e-commerce in ten leading countries of the world shows that China and the United States are unambiguous world leaders in the e-commerce market: they account for about 40% of the market (Fig. 1). The volume of the Russian e-commerce market for 2020 amounted to 37 billion U.S. dollars, which is 26 times less than the volume of the Chinese market and 10 times smaller than the U.S. market. However, in terms of annual growth rates, Russia has been a leader: in 2020, its e-commerce market increased by 58%, which indicates the rapid expansion of this sector of the trade industry.

Analysis of studies and publications on the topic

The problems of digitalization of the economy in general and the development of e-commerce in particular have been reflected in the works of international and national research centers, as well as individual scientists.

The largest consulting agencies like BCG, Deloitte, Euromonitor International, McKinsey, and PWC engage in studying major global trends in the behavior of participants in economic activity, including consumers, as well as the social and economic effects arising in this regard. Indicators of digital economy development are presented in analytical reviews of the information agencies Data Insight, East-West Digital News, the Russian Association for Electronic Communications

Figure 1. Volume and growth of retail e-commerce by country in 2020, billion USD

Volume of retail e-commerce in 2020, USD

Annual growth rate of online retail in 2020, %

Source: E-commerce in Russia 2020. Available at: DI_eCommerce2020 (1).pdf

(RAEC), the Association for Internet Commerce Companies (AKIT). These research centers focus on studying the e-commerce market as a whole and individual segments of online commerce, investigate main features of digital consumers, their media preferences, and study channels for promoting goods and services in the online space (Prokhorov, Karashchuk, 2020).

The works of foreign and Russian authors present a wide range of theoretical, methodological and practical aspects related to the analysis of electronic commerce.

Among foreign authors, the works of R. GlaB and B. Leukert have been widely distributed and recognized; the authors talk about the technological revolution in the economy using the trade sector as an example, they analyze the opportunities and threats of introducing innovation technologies at trading enterprises, consider successful models of digital transformation of well-known German and international trading companies (GlaB, Leukert, 2016). K. Schwab describes large-scale changes in all spheres of society, including the digital transformation of the economy during the Fourth Industrial Revolution (Schwab, 2017). J.B. Long, D. Kosiur, J. Weisman, K. Egneberger describe modern electronic business technologies, consider the possibilities of e-commerce in conducting everyday business operations: invoicing, ordering, money transfers, etc. Other researchers analyze the experience of companies that successfully use e-commerce, and highlight related security issues (Kosiur, 1998). S. Klein, S. Kehli, U. Lutti study e-business from the standpoint of marketing; N. Vulkan carries out a detailed economic analysis of various models of e-commerce, assesses their advantages and disadvantages2; K. Patel and M.P. McCartin address the problems of strategic management of e-business, analyze the fundamental principles on which the process of electronic transformation of the economy is based (Patel,

2001). A fundamental work of D.J. Bowersox and D.J. Closs (Bowersox, Closs, 2008) is devoted to the role and content of logistics in modern electronic business. Ph. Treleaven has created a guide for aspiring entrepreneurs to create their own company in the trading business, which will help solve the issues of introducing advanced technologies and allow the company to remain competitive in the new digital economy (Treleaven, 2000).

Among Russian scientists, we can point out the works on the formation of a “new electronic economy” (N.I. Ivanova, V.V. Malyanov, D.A. Chash-kin, V.Yu. Shishkov, A.S. Zuev, S.M. Tsirel); research on the role of the Internet in the development of electronic commer ce (V.N. Popov, R.N. Kostyaev, E.N. Kostomarov, I.K. Uspensky, N.P. Ivanov); studies on the world experience in the field of electronic commerce (A.A. Sokolova, N.D. Gerashchenko, A.K. Dvoretsky, M.S. Zelenfroyd, D.A. Kochegarin); legal support for the development of electronic commerce in Russia (N.I. Solovyanenko, A.M. Kastelskaya, G.K. Ekaterinina); problems of electronic business security (V.V. Bykov, V.K. Tsarev, A.K. Dvoretsky); the state of the e-commerce market in Russia (V.K. Ryabtsun, K. Liukhto, V.A. Medvedev)3.

In general, despite the wide range of problems raised in the works of foreign and domestic researchers, the issues such as assessing the state and prospects for the development of online commerce in the context of the transformation of national socio-economic systems, including under the influence of the global epidemiological crisis, require further research; this served as the basis for our present study.

The purpose of the study is a comprehensive analysis of the state and prospects for the deve- lopment of online retail in Russia and China. To achieve this goal, it is necessary to implement the following tasks:

– conduct a comparative analysis of the current state of online retail trade in China and Russia over the recent years;

– identify factors affecting the active and dynamic development of this sector;

– identify promising directions for further development of online consumption in the context of modern socio-economic transformations.

The information and empirical base of the study includes official data provided by the Federal State Statistics Service (Rosstat), sociological research of the International Institute for Marketing and Social Research GfK Rus, the research agency in the field of e-commerce Data Insight, information and analytical materials of the National Research University “Higher School of Economics” (NRU HSE), China Commercial Industry Research Institute, the National Bureau of Statistics of China, the Municipal Bureau of Commerce of China.

The research tasks were solved with the help of general scientific methods and techniques (dialectical method, statistical analysis method, generalization, systematization, comparison).

Research findings

Major online retail trading platforms in China and Russia

According to experts, the modern structure of online retail includes two main forms in which Internet platforms are arranged. These include marketplaces – aggregator sites or specialized intermediaries that automatically collect and process information from various suppliers for different product groups; online stores – websites where you can view information about a product or service of interest and place an order on the Internet (Trofimova, 2018).

The structure of online retail in China is represented by such platforms as Taobao Mall established in May 2003, JD Mall established in January 2004, Pinduoduo established in April 2015, etc. The consistent creation and rapid development of e-commerce platforms reflect huge demand for the development of online retail. In the process of developing online sales in China, various online platforms have promoted the creation of a number of iconic consumer cultural symbols, such as Taobao Mall’s “Double Eleventh Day” starting in 2009, and

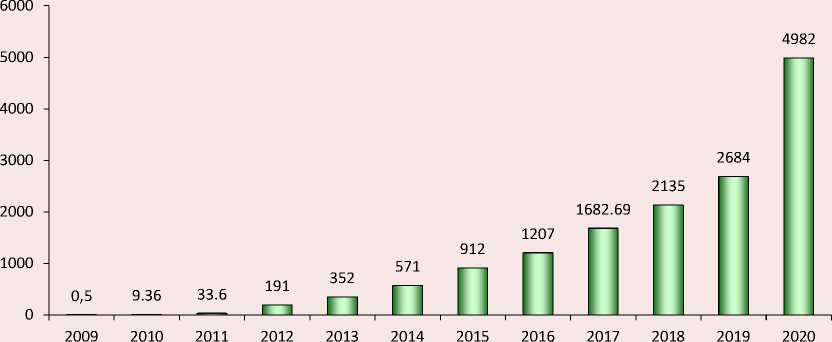

Figure 2. Taobao Mall “Double Eleventh Day” transaction volume data from 2009 to 2020, 100 million yuan

Source: China Commercial Industry Research Institute.

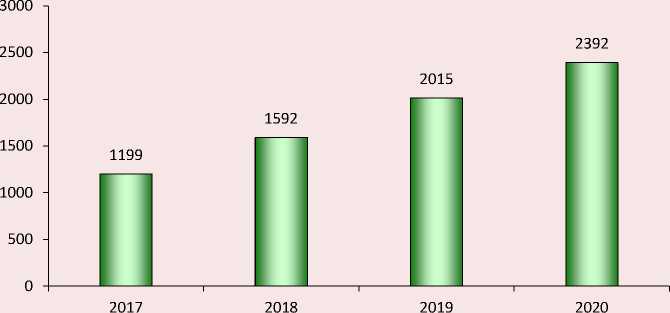

Figure 3. Total amount of orders of JD Mall during the “6.18” shopping festival from 2017 to 2020, 100 million yuan)

Note: The data for 2020 represents the cumulative order amount from 0:00 on June 1 to 14:00 on June 18.

Source: China Commercial Industry Research Institute.

JD Mall’s “6·18” starting in 2010, etc., having become a carnival for Chinese residents’ online consumption. According to the data, during the Double Eleventh Day period in 2020 (1 1.1– 11.11), Taobao Mall’s transaction volume was 498.2 billion yuan, JD Mall’s cumulative order amount was 239.2 billion yuan; we should also note the transaction volume of e-commerce platforms such as Pinduoduo ( Fig. 2, 3 ) . The total transaction volume of Chinese consumers during the Double Eleventh Day period may approach one trillion yuan.

In Russia, major marketplaces where most product categories are represented include Wildberries, Ozon, Aliexpress Russia and Yandex. Market. In 2020, the volume of this market niche increased by 108%, up to 721 billion rubles. In total, Russians ordered 405 million goods from these sites with an average sum of one order amounting to 1,780 rubles4.

According to Data Insight research agency, the rating of the largest online stores in Russia by the end of 2020 is headed by Wildberries with the revenue of 413.2 billion rubles, which is 96% more than a year ago ( Tab. 1 ). The second place in the list is occupied by Ozon whose revenue is 197 billion rubles; compared to 2019 it has increased by 144%. Citilink’s revenues rose by 47% to 132.7 billion rubles. In 2020, DNS increased online sales by 117%, to 116.7 billion rubles (12 million orders), and M.Video showed a twofold growth, up to 113.2 billion rubles (8.9 million orders). The most popular goods in 2020 on the local market are electronics and household appliances, clothing and footwear, food, furniture and household goods, beauty and health products (Merzlyakova, Bridskii, 2021).

In general, in recent years, both Chinese and Russian online platforms have been rapidly developing and actively increasing sales volumes and the amount of orders.

Table 1. Top 10 most visited Russian e-commerce websites in 2020

|

# |

Store |

Category |

E-commerce |

Orders |

Average receipt |

|||

|

Million rub. |

Increase, in % to 2019 |

Thousand units |

Increase, in % to 2019 |

Rubles |

In % to 2019 |

|||

|

1 |

Wildberries.ru |

General stores |

413 200 |

96 |

305 000 |

100 |

1 350 |

-2 |

|

2 |

Ozon.ru |

General stores |

197 000 |

144 |

73 800 |

133 |

2 670 |

5 |

|

3 |

Citilink.ru |

Elelctronics and appliances |

132 730 |

47 |

12 390 |

23 |

10 710 |

19 |

|

4 |

Dns-shop.ru |

Elelctronics and appliances |

116 760 |

117 |

12 370 |

82 |

9 440 |

20 |

|

5 |

Mvideo.ru |

Elelctronics and appliances |

113 200 |

100 |

8 900 |

71 |

12 720 |

17 |

|

6 |

Eldorado.ru |

Elelctronics and appliances |

53 760 |

95 |

6 400 |

80 |

8 400 |

8 |

|

7 |

Lamoda.ru |

Clothing, footwear and accessories |

52 970 |

32 |

14 550 |

28 |

3 640 |

4 |

|

8 |

Apteka.ru |

Health |

50 070 |

46 |

32 240 |

48 |

1 550 |

-2 |

|

9 |

Aliexpress.ru |

General stores |

49 000 |

171 |

19 060 |

218 |

2 570 |

-15 |

|

10 |

Pokupki.market. yandex.ru |

General stores |

44 090 |

136 |

15 490 |

159 |

2 850 |

-9 |

Source: Top-100 largest online stores in Russia. Available at:

The basic status of online retail in China and Russia

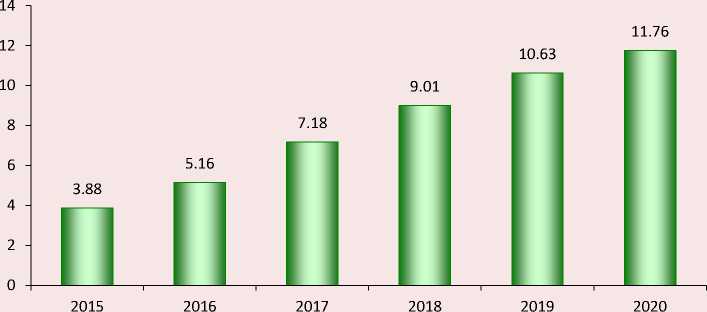

In recent years, online retail in China has demonstrated a rapid expanding trend, it continued its steady growth and increased contribution to the overall retail turnover. The scale of online retail in China is rapidly expanding. In 2020, the volume of online sales in China amounted to 11.76 trillion yuan, which is 3.03 times more than in 2015 (3.88 trillion yuan); the growth of these indicators shows an increase in the scale of this sector ( Fig. 4 ). The volume of online commerce in China has increased by one trillion yuan, largely due to the pandemic in 2020.

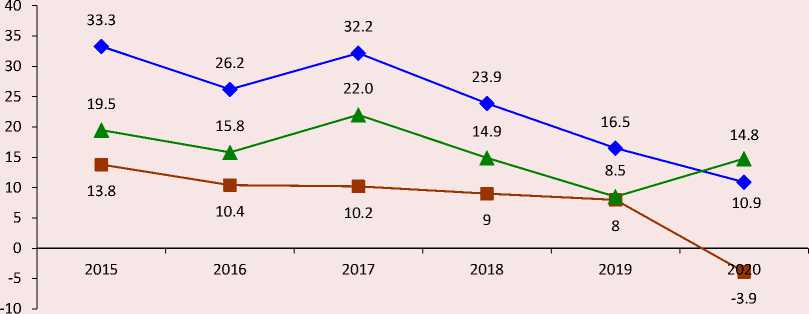

China’s online retail also demonstrates high growth rates. From 2015 to 2020, the average growth rate of China’s online retail sales was 23.8%, which is 15.9% higher than the 7.9% average growth rate of total retail sales of consumer goods in China for the same period. In particular, due to the impact of the pandemic in 2020, the growth rate of China’s total retail sales of consumer goods decreased by 3.9%, while online retail sales in China, on the contrary, increased by 10.9%, showing high growth rates ( Fig. 5 ).

An upward trend in the development of e-commerce is observed in Russia as well. A local online retail system is being formed in the country; the system is being integrated into the global e-commerce system under the influence of globalization processes. According to Data Insight, over the period from 2015 to 2020, the turnover of Russian online commerce increased almost 4.5-fold, amounting to 3.2 trillion rubles ( Fig. 6 ). Despite the weak macroeconomic dynamics and the long-term stagnation of people’s real incomes, online sales grew rapidly due to the growth of Internet penetration, the arrival of new major players on the market, improved logistics and growing competition. Stagnation of real incomes has become, in a certain sense, one of the main catalysts for the growth of online commerce – due to lower (than traditional retailers) operating costs, online stores were able to offer consumers low prices and more favorable conditions for purchases (delivery, exchange and return of goods, etc.) (Magomedov, 2020). The maximum growth rate (almost 60%) was recorded in 2020 and was due to the impact of the COVID-19 pandemic, which forced people to

Figure 4. China’s online retail sales from 2015 to 2020, trillion yuan

Source: National Bureau of Statistics of China.

Figure 5. Growth of China’s online retail sales and retail sales of consumer goods from 2015 to 2020, %

— ♦ — Increase in online retail sales

— ■ — Increase in total retail sales of consumer goods

—*— Comparison of retail sales dynamics and online retail sales dynamics

Source: National Bureau of Statistics of China.

Figure 6. Dynamics of the volume of the Russian e-commerce market

■ ■ Volume of sales, billion rubles — ♦ — Growth rate, %

Source: Federal State Statistics Service. Available at:

Figure 7. Proportion of China’s online retail sales in the total volume of retail sales of consumer goods in the period from 2015 to 2020, %

|

35.00 30.00 25.00 20.00 15.00 10.00 5.00 |

30.00 25.83 23.65 19.60 15.53 12.89 |

|

2015 2016 2017 2018 2019 2020 |

Source: National Bureau of Statistics of China.

spend more time at home and order goods online. This has led to the emergence of new opportunities and additional areas of growth for the e-commerce sector as a whole5.

Contribution of online retail to consumption in China and Russia.

Rapid expansion of online consumption in China and the strong impetus to the development have made online commerce an important engine of national public consumption. In 2020, online retail sales in China accounted for 30% of the total retail sales of consumer goods in the country, an increase of 17% compared to 2015 (13%; Fig. 7 ). In addition, according to China’s 14th Five-Year Plan for business development, the volume of retail online sales in the country will reach 17 trillion in 2025, and the share in the total volume of retail sales of consumer goods in the country will increased to 34%.

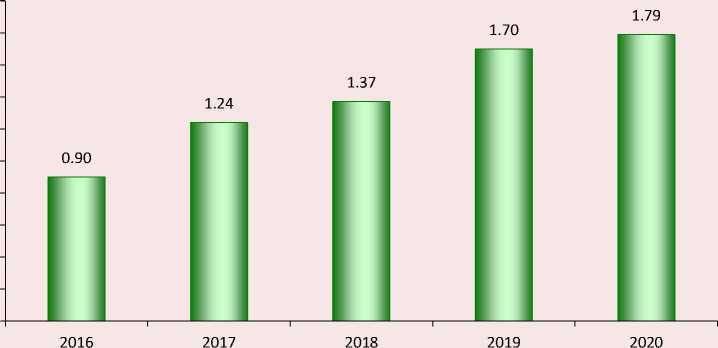

Particular attention should be paid to the rapid development of online commerce in rural China. By the end of 2020, a comprehensive demonstration of e-commerce in rural areas in China supported 1,338 counties and provided full coverage to 832 national poverty-stricken counties. In 2020, China’s rural online retail sales reached 1.79 trillion yuan, which is almost ten times more than in 2014 (180 billion yuan; Fig. 8 ).

Thus, in Xunwu County, Ganzhou City, Jiangxi Province, at the end of 2020, 797 e-commerce companies were registered and more than 3,000 online stores (including mobile phone and computer users) were created, in which almost 40,000 people are engaged in e-commerce and related industries, with the volume of e-commerce transactions reaching 1.028 billion yuan. It is worth noting that in a relatively remote county with a lagging level of economic development, the number of express deliveries to the county amounted to 8236.5 thousand, and from the county – 8297 thousand, while the number of outgoing deliveries

1.8

1.6

1.4

1.2

0.8

0.6

0.4

0.2

Figure 8. China’s rural online retail sales from 2016 to 2020, trillion yuan

Source: Ministry of Commerce of China.

rarely exceeds the number of incoming ones. The development of online retail business has driven the online sales of the county’s characteristic and advantageous agricultural products, which has led to an increase in the income of local residents.

Describing the contribution of online retail trade to consumption in Russia, we should note that according to Rosstat, in the period from 2015 to 2020, the share of online sales in retail turnover increased fourfold (from 0.9 to 3.9%), in the period from 2019 to 2020, the share of e-commerce has almost doubled (from 2 to 3.9%), which was largely facilitated by the coronavirus pandemic (Tab. 2). At the same time, experts point out that despite the significant growth, online commerce does not play a decisive role in the country’s retail turnover, this indicator is several times less than the global average (15.7% in 2020). In a number of large countries, the penetration rate of online commerce already exceeds 20%. Among European countries,

Table 2. Dynamics of the share of Internet sales in the total retail turnover in RF federal districts (in actual prices, in %)

Federal district 2015 2016 2017 2018 2019 2020 Russian Federation 0.9 1.2 1.3 1.7 2.0 3.9 Central Federal District 1.2 2.0 2.1 2.7 3.2 6.1 Northwestern Federal District 0.9 1.0 1.2 2.5 2.7 4.4 Southern Federal District 0.5 0.6 0.6 0.6 0.9 4.3 North Caucasian Federal District 0.1 0.1 0.2 0.3 0.3 0.8 Volga Federal District 0.6 0.6 0.7 0.8 1.1 3.0 Ural Federal District 1.0 1.1 1.1 1.3 1.3 4.2 Siberian Federal District 1.4 1.4 1.4 1.7 1.9 3.8 Far Eastern Federal District 0.5 0.6 0.6 0.4 0.4 1.5 Source: Federal State Statistics Service. Available at: the leaders in the development of e-commerce in retail are the United Kingdom, Germany, Denmark, the Netherlands (15–20%)6. As mentioned above, in China, the share of the online segment in retail trade is 30%.

Official statistics data in the context of RF federal districts also confirm that regional e-com-merce is insufficiently developed and has large reserves for further growth (see Tab. 2). The leaders among the macro-regions of the Russian Federation are the Central and Northwestern federal districts (6.1 and 4.4%, respectively). Moreover, in these regions, the development of online commerce is determined by the influence of large cities such as Moscow and Saint Petersburg. These regions are currently the drivers of the development of e-commerce in Russia (Li Zhimeng, 2020; Krasil’nikova, 2019). In general, there is a significant potential for the growth of e-commerce in the coming years, including by increasing the level of penetration and replacing traditional retail formats.

Factors determining the development of online retail in China and Russia

Based on numerous studies and expert opinions, we can highlight several reasons for the rapid development of online retail in China.

First, creating an integral system for governmental regulation of electronic commerce. The emergence and development of new types of business is the result of the internal drive of the market, which, in turn, requires policy guidance, encouragement and regulation. China has successively introduced a series of related policies, such as the “Opinions of the State Council on Vigorously Developing E-commerce and Accelerating the Cultivation of New Economic Impetus” “Guiding Opinions on Promoting the

Healthy and Rapid Development of Cross-border E-commerce”, “Guiding Opinions of the State Council on Actively Promoting the “Internet +” Action”, “Action Outline for Promoting the Development of Big Data”, “Opinions of the General Office of the State Council on Promoting Online and Offline Interactions and Accelerating the Innovative Development, Transformation and Upgrading of Commercial Circulation”, “Guiding Opinions of the General Office of the State Council on Promoting the Accelerated Development of Rural E-commerce”, “Opinions of the General Office of the State Council on the Deep Implementation of the ‘Internet + Circulation’ Action Plan”, etc., especially after the outbreak of the pandemic, in order to stimulate consumption, China promulgated the “Opinions of the General Office of the State Council on Guiding the Accelerated Development of New Types of Consumption with New Business Types and Models” (G.B.F.(2020) No. 32) and the “Implementation Opinions on Promoting Expansion and Quality Improvement of Consumption and Accelerating the Formation of a Strong Domestic Market” (F.G.J.Y.(2020) No. 293), etc., having provided strong policy support for the recovery and development of China’s online retail industry.

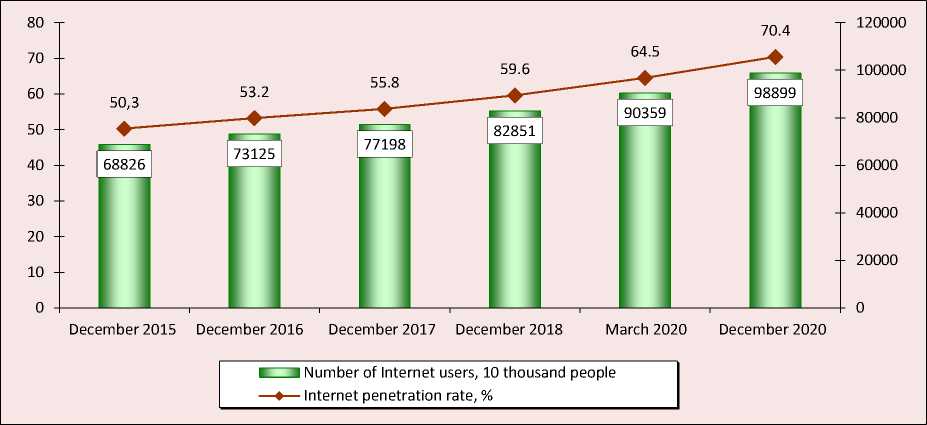

Second, continuous increase in the rate of Internet penetration. The number of Chinese netizens increased from 688 million at the end of 2015 to 989 million at the end of 2020. In general, China’s Internet users account for about a fifth of global network users; the Internet penetration rate increased from 50.3% to 70.4% ( Fig. 9 ). In December 2020, there were 986 million mobile Internet users in China, of which 99.7% used mobile phones ( Fig. 10 ). These large amounts of Internet users and mobile Internet users have provided a huge source of power for online shopping.

Figure 9. Scale of Chinese netizens and the Internet penetration rate from 2015 to 2020

Source: Statistical survey on the development of the Internet in China.

Figure 10. Number of mobile Internet users in China and their share among all Internet users in the period from 2016 to 2020

Number of mobile Internet users, 10 thousand people

— ♦ — Proportion of mobile Internet users among all network users, %

Source: Statistical survey on the development of the Internet in China.

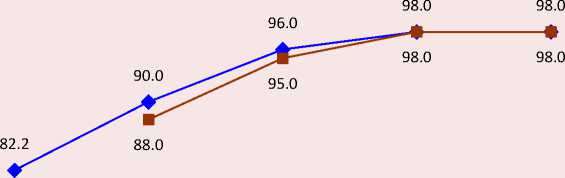

Figure 11. Growth of optical fiber and 4G access in China’s administrative villages from 2016 to 2020

2016 2017 2018 2019 2020

♦ Proportion of optical fiber access ■ Proportion of 4G access

Source: Digital China Development Report (2020).

Third, infrastructure improvement. A complete network and modern transportation infrastructure are important prerequisites for supporting online retail. By the end of 2020, the access to optical fiber and 4G in China’s administrative villages has reached 98%, which is 8% and 10% respectively higher than in 2017 ( Fig. 11 ). By the end of 2020, there were more than 2,000 e-commerce and logistics distribution centers at the county level and more than 130,000 online retail service stations at the village level across the country. Also, express delivery outlets covered more than 30,000 townships/towns across the country, with a coverage rate of 97.6%, and 27 provinces (districts, cities) achieved full coverage of express delivery outlets in towns and villages.

For example, by the end of 2020, Jiangxi Province has achieved full coverage of high-speed railways in 11 district-divided cities, expressways in 84 counties (cities), power and electricity in 16 thousand administrative villages, and cement (asphalt) roads in 169 thousand natural village groups; the narrowband Internet of Things has reached full coverage in Jiangxi Province and 5G base stations have achieved full coverage of major urban areas in 11 district-divided cities.

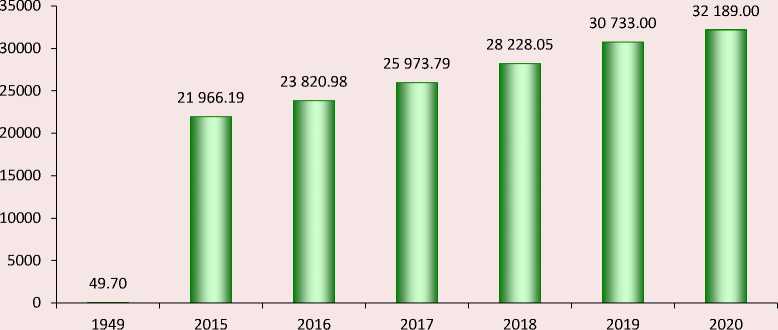

Fourth, an increase in the income level of urban and rural residents. Income is a prerequisite for consumption. The Chinese Government attaches great importance to improving people’s living standards, considers raising people’s living standards as a starting point and basis for all the relevant efforts, and adheres to the orientation of economic development toward employment. Since the founding of the People’s Republic of China, especially the reform and opening up, the income of the urban and rural population has grown significantly, and the consumer opportunities of residents have also increased: from the lack of basic necessities to a comprehensively prosperous society. Thus, the country defeated poverty with integrated measures. In 2020, the per capita disposable income of Chinese residents reached 32,189 yuan, which is 648 times more than in 1949. The increase in people’s income level provides a source for online consumption ( Fig. 12 ). According

Figure 12. Changes in per capita disposable income of Chinese residents

Source: National Bureau of Statistics of China.

to the UN standard, China is a prosperous and rich country, since the Engel coefficient (the share of total food expenses in personal consumption expenditures) in 2020 among Chinese residents was 30.2%, in urban areas – 29.2%, and in rural areas – 32.7%.

In general, the development of online retail in China is the result of an effective system of political regulation and stimulation of this segment, continuous expansion and improvement of Internet coverage in China, improvement of infrastructure and the financial situation, and increase in people’s incomes.

Using the data of scientific and statistical sources, we can identify a number of factors affecting the development of online commerce in Russia.

First of all, we should note that in recent years the Russian state has been taking serious measures to regulate and improve online commerce. In 2017, the Program “Digital economy of the Russian Federation” was adopted. It sets out the goals, objectives, and directions of state policy for development of the digital economy in Russia, and sets deadlines for their implementation. According to the Program, by 2024, it was planned to provide 97% of households in the Russian Federation with broadband Internet access (100 Mbit/s). In all major cities with a population of 1 million or more, it was planned to provide stable coverage of the 5G network and above. In Russia, it was planned to create ten enterprises that occupy leading positions in the field of high technology, as well as ten digital platforms for servicing the main sectors of the economy, including the trade sector7.

The most important document for the e-commerce sector is the “Strategy for development of e-commerce in the Russian Federation for the period up to 2025” elaborated by the RF Ministry of Industry and Trade; the Strategy defines conceptual vectors for development of the Russian e-commerce market for the next decade. According to the Strategy, the share of electronic commerce in the total volume of Russian trade in 2025 will

Table 3. RF households that have Internet access, % of the total number of households

Indicator 2015 2016 2017 2018 2019 2020 Proportion of households with Internet access in the total number of households 72.1 74.8 76.3 76.6 76.9 80.0 Proportion of households with broadband Internet access in the total number of households 66.8 70.7 72.6 73.2 73.6 77.0 Proportion of the population with access to the Internet using mobile devices (mobile phones or smartphones, e-book readers, PDAs) 41.4 48.9 56.0 61.9 65.9 70.7 Proportion of the population who used the Internet to order goods and (or) services in the total population 19.6 23.1 29.1 34.7 35.7 40.3 including urban areas 22.5 26.5 32.6 38.3 39.6 45.1 rural areas 10.6 12.9 18.4 23.7 23.8 25.8 Source: Federal State Statistics Service. Available at:

reach 20%. It is assumed that 70% of retail stores (mainly small and medium-sized entrepreneurs) will use Internet channels. At the same time, the share of the Russian Federation in the global e-commerce market will be at least 10% (Minakova et al., 2020). These regulations allow us to point out that in Russia the need to create a set of favorable regulatory, organizational and technical conditions for the development of the online trade sector, stimulating the business activity of e-commerce participants, creating a competitive environment and creating a comfortable consumer climate for the population is defined at the highest legislative level (Zhilina, 2018).

As mentioned above, the most important factor in the dynamic development of e-commerce around the world, including Russia, is the active introduction of information technology. Special surveys of the Russian Internet audience show that in the period from 2015 to 2020, the share of households with Internet access increased by 8 percentage points, from 72 to 80%, broadband access – by 10 percentage points, from 67 to 77% (Tab. 3). The most significant leap forward is observed in the segment of mobile device usage: the audience of Internet users on mobile phones, smartphones, etc. increased by 30 percentage points, from 41 to 71%, respectively. In the regional context, Moscow and Saint Petersburg remain leaders in terms of Internet penetration, but gradually the differences between the regions in this indicator are being smoothed out8.

The wide and dynamic spread of the Internet has great potential for involving people in online shopping. In 2020, with the share of Russian households with Internet access at 80%, the proportion of the population using this channel for online shopping was only 40%. During the period under consideration from 2015 to 2020, there was an uneven increase in the involvement of residents in online purchases, depending on the territory of residence: the difference in the growth of this indicator in urban and rural areas was about 10% in favor of the city (Sovetova, 2021). This reflects the large reserves available for the further development of online commerce in Russia: expansion of the audience of online buyers, involvement of people already connected to the Internet to make purchases online, including in rural areas.

Another important driver of online retail development in Russia is the new consumer attitudes and preferences that have been emerging in recent years. Among modern global consumer trends, experts name “the desire to consume high-quality and safe goods and services; conscious choice and orientation toward the conformity of goods with consumer values; strengthening consumer interaction, sharing consumer experience through social media”9. Of no small importance is the fact that the preferences of modern consumers have changed toward individualization of consumption (Belyakov et al., 2020). Consumers are increasingly demanding only products and services that meet their specific needs, trying to make them the subject of self-expression, personal identification (individualization of the need), as well as the most appropriate way to meet the need (individualization of service) and time (delivered only when the consumer wants them – individualization of the time of satisfaction of the need) (Vorobyev, 2015). According to a KPMG study, 56% of online store visitors expect retailers to take an individual approach to the customer and consider excellent service to be the most important factor in increasing customer loyalty. When deciding which brand to choose and which retailer to purchase from, Russians take into account the possibility of making purchases around the clock (59%), convenience and ease of use (53%), availability of real-time delivery information (49%)10. Such a transformation of consumer needs and preferences encourages entrepreneurs to make significant changes in the way they engage in trade, including digitalization of many of their services, expansion and improvement of online trading.

In general, the main obstacle to the development of e-commerce in Russia is the lack of Internet coverage in various localities and regions, lack of technical means and opportunities to use the Internet in remote areas, including rural areas, which creates imbalances in the development of this economic sector. In addition, despite the formation of new consumer attitudes, certain restrictions on online consumption are associated with Russians’ mentality: many buyers are still not ready to abandon making purchases in traditional stores and completely shift to online shopping, physical contact is still important to strengthen confidence in the product and the manufacturer (Dement’eva, 2021).

Major directions for further development of online commerce in China and Russia

Despite the different current level and pace of development of national markets, it is possible to identify areas of further development of online retail trade that are relevant for China and Russia.

First, the most important direction that promotes the development of domestic demand and the growth of online consumption is to create conditions for the growth of people’ incomes and to meet their basic socio-economic needs as a foundation for ensuring purchasing activity and expanding the material possibilities of using e-commerce technology. Income is a prerequisite for consumption, and stable and predictable income growth is an important basis for ensuring the effective use of consumer potential. The increase in the purchasing power of the population’s income is directly related to the stabilization of the situation on the labor market, the solution of employment problems. An important role belongs to the increase in residents’ property income, especially for rural residents through the implementation of the rural revitalization strategy. The improvement of the social security system is also essential. The expansion of consumer activity of the population is based on a sense of stability and confidence in the future, which requires a reliable social security system, namely, improving housing conditions, medical care, pensions, etc.

Second, it is necessary to optimize the infrastructure and the online consumption environment. Online consumption is a system-wide project that includes creating a network infrastructure, modern logistics infrastructure, and a safe consumption environment. This requires an integrated approach to optimize and improve the entire chain and the whole consumption process. The necessary steps in this direction may be as follows: to develop mobile retail further by creating and significantly improving Internet applications for mobile devices, to increase the volume of development of such software products by trade enterprises; to carry out timely restructuring of online store sites for convenience and ease of use for customers (Matuzenko et al., 2021); to optimize the goods delivery system; to improve payment forms by increasing the construction of intelligent service terminals and to develop contactless transaction services in order to ensure the security of online payments, including the safety of personal data.

All of the above will contribute to expanding the offer of online services in the retail sector and increasing involvement in online consumption.

Third, reducing the gap in online consumption between urban and rural areas. As mentioned above, in China and in Russia, there is insufficient coverage of rural areas by Internet connection; this fact limits the ability of rural residents to make purchases using e-commerce channels. In this regard, the experience of China is noteworthy: on the one hand, the level of Internet penetration in China is constantly expanding, and on the other hand, the infrastructure of online commerce in rural areas is being improved. Logistics sorting centers created at the county level focus on warehousing, LTL transportation, express delivery, e-commerce, postal services, deliveries, marketing and other business formats. With the support of postal express delivery and supply and marketing points, the “Internet + four party logistics” supply and marketing collection and distribution model is being promoted, it is aimed at facilitating the construction of comprehensive service outlets in remote settlements, rural areas, as well as the creation and improvement of a two-way unimpeded logistics distribution network between urban and rural areas, in order to stimulate the potential of consumption in rural areas.

Fourth, promoting the eco-friendly development of online retail. In the process of online retail, a large amount of packaging material is used, therefore it is especially important to implement green recycling of express parcels. It is necessary to research, develop and use environmentally friendly packaging materials, increase the intensity of recycling, and minimize the amount of waste.

Fifth, we should mention that the need to improve the legal framework for regulating this segment is a long-term direction for the formation of upward trends in the development of Internet sales in Russia. According to experts, the regulatory framework of online commerce in Russia is in the process of formation and requires significant improvement. First of all, this concerns reducing the risks accompanying transactions and ensuring cybersecurity. The state should pay close attention to improving the identification and authentication of interacting agents, protection against unauthorized access, falsification of documents, etc. A unified concept of e-commerce infrastructure formation should be created with clearly defined goals, objectives, and tools used (Minakova et al., 2020).

Conclusions

In recent decades, under the influence of globalization and digitalization of the economy, the world e-commerce system has been actively developing. China is the absolute leader in online commerce in the world; the country demonstrates the most significant volumes of the Internet sales market: in 2020 it amounted to 955 billion U.S. dollars, which corresponds to 6.7% of China’s GDP. As of 2020, Russia is among the top 10 largest markets and ranks 9th with the volume of its e-commerce market amounting to 37 billion U.S. dollars, which is 2.5% of its GDP. At the same time, considering the dynamic changes, we can say that the Russian Internet sales market is the most actively developing and rapidly growing. In 2020, Russia ranked first the world in terms of the growth rate of online retail: this figure was 58% (in China – 5%).

E-commerce in China and Russia is developing under the influence of global trends facilitated by such important factors as the spread of information technology and the Covid-19 pandemic. In recent years, of key importance for the development of e-business in the retail sector has been the spread of broadband Internet, providing high-speed data transmission and the formation of global networks based on ICT. The Internet has become a platform for making transactions for the purchase and sale of electronic content and tangible goods, opening up new opportunities for both sellers and buyers. In the period from 2015 to 2020, the number of Internet users in China increased by 40% (from 688 to 989 million people), in Russia – by 15% (from 114 to 131 million people).

The coronavirus pandemic acted as a catalyst for the development of distance trading. The economic downturn against the background of coronavirus, quarantine restrictions and the transformation of lifestyle and consumer behavior contributed to a sharp and thorough transition to the use of the latest technology in retail (Belyakov, 2020). Thus, in 2020, the largest Chinese platforms Taobao Mall, JD Mall, and Pinduoduo increased the volume of transactions and the number of orders several times. There is a rapid growth of online commerce in rural areas of China. Universal Russian marketplaces Wildberries, Ozon, Aliexpress Russia and Yandex.Market are also rapidly increasing their sales volumes.

The reasons for the differences in the current state of the national e-commerce markets in China and Russia are as follows: uneven Internet coverage in various regions and localities of the Russian Federation, insufficient quality of Internet communication in remote territories of Russia, Russians’ mentality associated with adherence to traditional formats of purchasing goods and services. Certain risks associated with the development of electronic commerce are high dependence on IT technology, the risk of fraud and the need to ensure information security, the need for significant investments in logistics infrastructure, changes in the structure of employment and qualification requirements for the workforce in the trade sector, potential risks of reducing the competitiveness of small and mediumsized trade business.

Promising areas of increasing consumer demand in the e–commerce segment, contributing to its further development, include:

– improving people’s living standards, quality of life and the purchasing power of income;

– improving infrastructure, mainly in the direction of ensuring the security of online payments and other transactions, including personal information;

– increased Internet coverage of various localities and regions;

– informatization of rural areas and their population, reducing the gap in online consumption between urban and rural areas;

– making online consumption eco-friendly;

– implementing organizational, informational, technical support from the state, improving the regulatory framework in the interests of enterprises involved in the field of e-commerce, as well as consumers.

The long-term trends in the development of e-commerce in China and Russia will largely depend on the global economic situation, the epidemiological situation, the state of national economies, and the effective social policy of the state.

Список литературы Online retail in China and Russia: current state and development prospects

- Belyakov S.A., Eirikh V.E., Stepina I.O. (2020). Changing consumer behavior and marketing trends, changes after the COVID-19 pandemic. CITISE, 3(25), 363–373 (in Russian).

- Bowersox D.J., Closs D.J. (2008). Logistical Management: The Integrated Supply Chain Process. McGraw-Hill College.

- Dement'eva I.N. (2021). Internetization of consumption in the region in the context of socio-economic uncertainty. Aktual'nye problemy ekonomiki i menedzhmenta, 3(31), 34–47 (in Russian).

- Gläß R., Leukert B. (2016). Handel 4.0: Die Digitalisierung des Handels - Strategien, technologien, Transformation. Berlin.

- Kosiur D. (1998). Understanding Electronic Commerce. Microsoft Corporation.

- Krasil'nikova E.A. (2019). Regions driving e-commerce development in the Russian Federation Problemy teorii i praktiki upravleniya=International Journal of Management Theory and Practice, 11, 22–34 (in Russian).

- Li Zhimeng, Lukin E.V., Sheng Fangfu, Zeng Wenkai (2021). Assessing the impact of the COVID-19 pandemic on the economies of China and Russia Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 14(5), 277–299 (in Russian).

- Magomedov A.M. (2020). Pandemia, online trade and online store promotion. Marketing v Rossii i za rubezhom=Journal of Marketing in Russia and Abroad, 5, 35–43 (in Russian).

- Matuzenko E.V., Glazunova O.A., Izvarin A.A. (2021). Trends, problems and prospects for the development of electronic commerce in the sphere of Internet trade. Vestnik Belgorodskogo universiteta kooperatsii, ekonomiki i prava= Herald of the Belgorod University of Cooperation, Economics and Law, 1, 197–206 (in Russian).

- Merzlyakova E.A., Bridskii E.V. (2021). The main trends and promising directions of e-commerce development in Russia. CITISE, 2(28), 510–522 (in Russian).

- Minakova I.V., Raspopin D.I., Bykovskaya E.I. (2020). Opportunities and limitations of development of internet trade in Russia. Fundamental'nye issledovaniya=Fundamental Research, 5, 136–142 (in Russian).

- Patel K. (2001). Secrets of Success in Electronic Business. New York.

- Prokhorov Yu.N., Karashchuk O.S. (2020). Retail internet trade in Russia: Standing, trends and further development. Vestnik REU im. G.V. Plekhanova=Vestnik of the Plekhanov Russian University of Economics, 5(113), 196–206 (in Russian).

- Schwab K. (2017). The Fourth Industrial Revolution. New York: Crown Business.

- Sovetova N.P. (2021). Rural territories’ digitalization: From theory to practice. Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 14(2), 105–124 (in Russian).

- Treleaven Ph. (2000). E-Business Start-Up. The Complete Guide to Launching Your Internet and Digital Enterprise. London: Kogan Page.

- Trofimova V.V. (2018). Developing internet trading in Russia and in the world. Biznes-obrazovanie v ekonomike znanii, 2, 73–76 (in Russian).

- Uskova T.V. et al. (2013). Problemy ekonomicheskogo rosta territorii [Problems of Economic Growth of the Territory]. Vologda: ISERT RAN.

- Vorobyev K.Yu. (2015). Essence of e-commerce in the system of international trade relationships. Rossiiskii vneshneekonomicheskii vestnik=Russian Foreign Economic Journal, 3, 106–114 (in Russian).

- Zhilina I.Yu. (2018). Electronic retail in Russia: Status and prospects. Ekonomicheskie i sotsial'nye problemy Rossii, 1, 39–70 (in Russian).