Performance measurement as a key development driver in oilfield services companies

Автор: Аникин М.С.

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 6-1 (25), 2016 года.

Бесплатный доступ

Короткий адрес: https://sciup.org/140120462

IDR: 140120462

Текст статьи Performance measurement as a key development driver in oilfield services companies

The combination of experience and motivation of the top management is the most important driver of company’s growth. The board of directors can influence both factors: the first one by hiring or firing employees and the second by establishing the motivation and remuneration schemes which includes factors such as bonuses and salary. Management accounting system and reporting process have a great influence on these factors. Thus, changes in the reporting process affects motivation scheme for company’s employees, especially top management. That is why the accuracy of the reporting and consolidation process is controlled by company’s management. Apart from the management accounting system of the company the combination of the key performance indicators and proportion of the base salary, bonuses and long term incentive plan in the total compensation of the top management are important to set a right motivation scheme. To indicate the most appropriate set of components for the top management of the company in the oilfield services sector the compensation schemes for major players: Schlumberger, Halliburton and Baker Huges is analyzed in the paper

Halliburton. The executive compensation program in the Halliburton is designed to achieve the following objectives:

-

• Provide a clear and direct relationship between executive pay and

Halliburton’s performance on both a short-term and long-term basis;

-

• Emphasize operating performance drivers;

-

• Link executive pay to measures that drive stockholder returns;

-

• Support Halliburton’s business strategies and maximize the return on

Halliburton’s human resource investment.

These objectives serve to assure long-term success and are built on the following compensation principles:

-

• Executive compensation is managed from a total compensation

perspective (i.e., base salary, short- and long-term incentives, and retirement are reviewed altogether);

-

• Each component of the total compensation package is analyzed in order

to determine that compensation opportunities for NEOs are competitive and market-driven.

-

• All elements of compensation are compared to the total compensation

packages of a comparator peer group, which includes both competitors and companies representing general industry that reflect the markets.

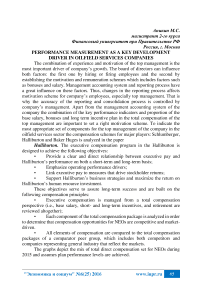

The graphs depict the mix of total direct compensation set for NEOs during 2015 and assumes plan performance levels are achieved.

CEO COMPENSATION MIX

OTHER NEO COMPENSATION MIX

Picture 1. The mix of total direct compensation set for NEOs during 2015

Baker Huges. The purpose of Baker Huges’s compensation program is to motivate exceptional individual and organizational performance that is in the longterm best interests of the stockholders. Baker Huges uses traditional compensation elements of base salary, annual short term incentives, long-term incentives, and employee benefits to deliver attractive and competitive compensation. Baker Huges benchmarks both compensation and Company performance in evaluating the appropriateness of pay. The executive pay decisions are made by an independent Compensation Committee of the Board of Directors, with assistance from its independent consultant. Baker Huges targets the market median for base salary and short-term incentive compensation, while providing the opportunity for executives to earn upper quartile incentive pay based on Company’s performance.

Target pay includes base salary, target bonus, the Black-Scholes grant date value of stock options and the grant date value of restricted stock, and the target value of performance units for the period. Realized pay includes base salary, bonus payout, a recalculated Black-Scholes value of stock options using updated inputs but holding the original exercise price the same, the December 31, 2015 value of restricted stock granted during the period, and the value of cash-based performance units paid out during the period.

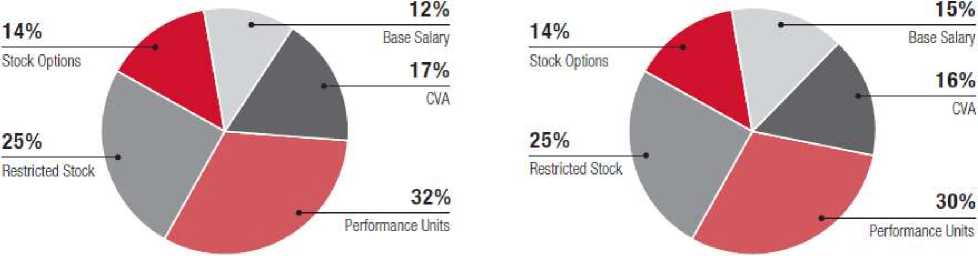

The charts below (pic.2) show the fiscal year 2015 mix of compensation elements for the executive officers as compared to that of the Reference Group market median. This comparison demonstrates that the allocation of the compensation elements is similar to the compensation practices of the Reference Group, but with more weight to long-term incentives. This allocation is aligned with one of the compensation objectives to provide a significant percentage of total compensation that is variable and at risk.

Picture 2. The fiscal year 2015 mix of compensation elements for the NEOs as compared to that of the Reference Group market median

Schlumberger

Schlumberger success in delivering strong long-term stockholder returns and financial and operational results is a result of attracting, developing and retaining the best talent globally. A highly competitive compensation package is critical to this objective and, to this end, the Compensation Committee seeks to target total direct compensation (i.e., base salary plus annual cash incentives plus LTI awards) for company’s NEOs and other executive officers at or very close to the 75th percentile of the Company’s two main executive compensation comparator groups.

Accordingly, company’s named executive officers receive a greater percentage of their compensation through at-risk pay tied to Company performance than our other executives. Schlumberger’s executive compensation program consists of three primary elements, comprising our executives’ total direct compensation: long-term equity incentives; annual cash incentives, based upon Company and individual performance; base salary.

These elements allow the Company to remain competitive and attract, retain and motivate top executive talent with current and potential future financial rewards. At the same time, this relatively simple compensation program is applied and communicated consistently to company’s exempt employees of more than 140 nationalities operating in approximately 85 countries.

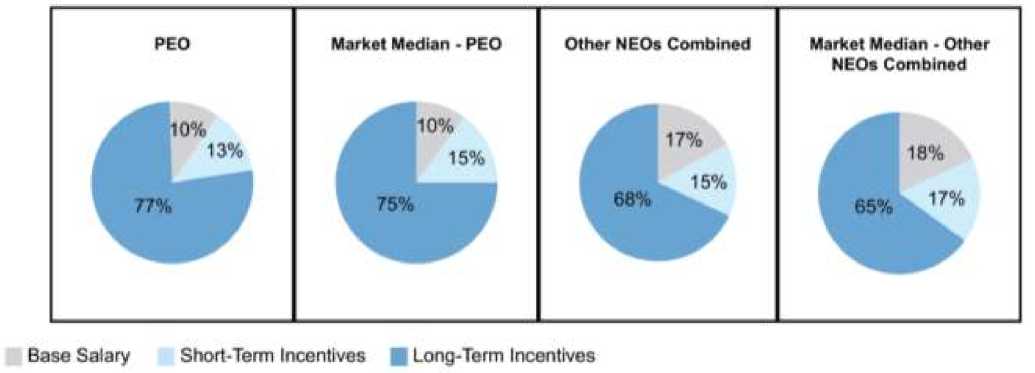

Based on market data provided by Pay Governance, the charts below (pic. 3) show the average percentage of 2015 base salary, target cash incentive and 2015 LTI compensation established by the Compensation Committee in January 2015 for the NEOs who served throughout 2015, in comparison to the Company’s two main comparator groups. The charts demonstrate that Schlumberger’s pay mix generally aligns with that of both peer groups, though Schlumberger provides a slightly higher proportion of at-risk LTI compensation.

RiV S4l«ft

Average

Picture 3. The average percentage of 2015 base salary, target cash incentive and 2015 LTI compensation for NEOs in 2015 compared to comparator groups

■fUw SataQ

■Uobm Ькеяаге

"Экономика и социум" №6(25) 2016