Position of non-state pension funds in the market of pension services in Russia

Автор: Lavrenova E.S.

Журнал: Теория и практика современной науки @modern-j

Статья в выпуске: 6-1 (12), 2016 года.

Бесплатный доступ

In this paper the role of non-state pension funds and state of pension system of Russia in general are described. Pension reform, its consequences, and the current state pension policy are analyzed. The author examine the current state of the Russian pension market. The conclusion about further directions and tendencies of development of funds in Russia is supposed.

Non-state pension funds, pension reform, pension policy, pension market, pension accruals, pension reserves, pension system

Короткий адрес: https://sciup.org/140289334

IDR: 140289334

Текст научной статьи Position of non-state pension funds in the market of pension services in Russia

Review of the pension system in Russia and role of non-state pension funds

The pension system of the Russian Federation has a lot of disadvantages and unresolved problems, besides Russian pension system ranks low position in the international qualitative pension ratings. Visually the position of Russia is presented in the global ranking table – Global Age Watch Index (look at the table 1) according to the social and economic wellbeing and a state of health of pensioners, and an extent of development of the social environment. It is curious, that such countries as Tajikistan, Brazil, Thailand, Bangladesh, Guatemala and others take higher positions, than Russia.

Table 1

Global AgeWatch Index [1]

|

2013 |

2014 |

2015 |

|||

|

1 position |

Sweden |

1 position |

Norway |

1 position |

Switzerland |

|

45 position |

Latvia |

48 position |

China |

48 position |

Peru |

|

91 position |

Afghanistan |

96 position |

Afghanistan |

80 position |

Cambodia |

|

78 position |

Russia |

65 position |

Russia |

65 position |

Russia |

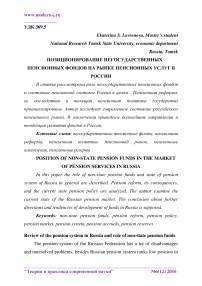

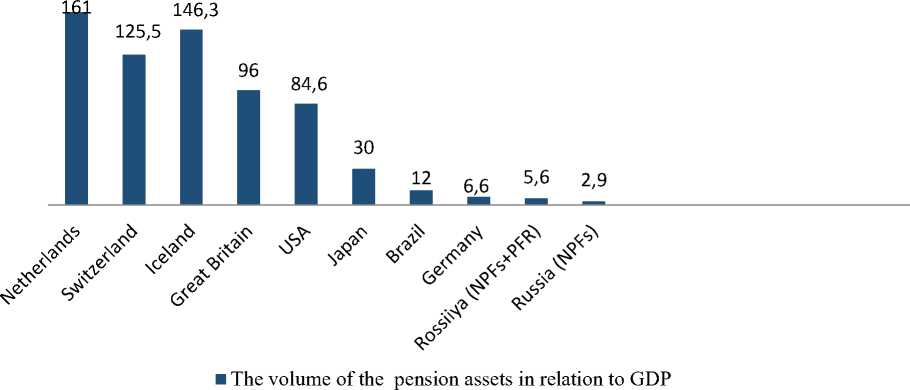

The non-state pension system is rather developed and diverse in the world. Non-state pension funds (in abbreviated form are NPFs) in Russia have later development and have the smaller importance and distribution in comparison with foreign experience. There is the share of pension assets in Gross Domestic Product (in abbreviated form is GPB) of various countries in the figure 1, the share of the Russian NPFs in the financial market Russian Federation in the figure 2. Thus, the major characteristics of Russia are the low share of pension assets in GDP of the country (in comparison with foreign countries), and the high role of banks in investment market (their share takes about 94%), whereas NPFs, mutual funds, insurance and management companies present only 6% of the market in total.

Figure 1. The relation of the pension assets to GDP over the countries in 2014, % [2]

■ Banks 94%

■ NPFs 2%

■ Insurance companies 2%

■ Mutual funds 1%

■ Management companies 1%

Figure 2. Structure of the Russian financial market according to the assets of participants by the end of 2014, % [3]

About pension reform

In 2013 the new concept of pension reform was created in Russia, which has significantly influence on activity development of NPFs. The positive effect, that it is possible to reach high level of guaranty insured system of pensioners and obligation of NPFs to come into it. According to data of the Central Bank of the Russian Federation at the date of 01.07.2015 already 28 NPFs had conformed to requirements of participation in the guaranty insured system of pensioners, that controls 1532.06 billion rubles of pension accruals that makes 91.49% of the market of pension accruals of NPFs [4]. As for the new pension formula, it represents the difficult and confused calculation mechanism, moreover, it creates incentives to later retirement. Calculation of future pension also includes coefficients, which are much higher if future pensioner forms insurance pension on a full scale and doesn't create the nongovernmental pension in NPFs or private management companies. Actually, this reform is directed to return to distributive pension system. Reforming also was followed by compulsory procedure of incorporating Russian NPFs and "freezing" of pension accruals of funds during this period. In general, it is positive, because it raises transparency of pension market, but at the same time, in 2016 the new “freezing” was declared again, it is an act of impairment of a right of citizens.

Thus, in 2015 the role of NPFs the major indices of their activities increased, despite a financial crisis in Russia economy and in pension system, in particular. Pension reform does not completed, because today many questions according to it are discussing. The pension accruals are a basic element and a factor of development of non-state pension system in Russia. Therefore, it is important to save system of mandatory funded pension, and also to save a possibility of citizens to choose NPFs.

Список литературы Position of non-state pension funds in the market of pension services in Russia

- Global AgeWatch Index 2015 //Global AgeWatch Index. -Electronic data. -URL: http://www.helpage.org/global-agewatch (access date: 25.04.2016).

- Pension Funds in Figures //OECD. -Electronic data. -URL: http://www.oecd.org/finance/Pension-funds-pre-data-2015.pdf (access date: 01.15.2016).

- The Central Bank of the Russian Federation //Bank of Russia. -Electronic data. -URL: http://www.cbr.ru/sbrfr/?PrtId=polled_ investment (access date: 10.05.2016).

- News of the market of non-state pension funds //National association of non-state pension funds. -Electronic data. -URL: http://www.napf.ru/(access date: 09.05.2016).

- Lavrenova E. Review of the market of non-state pension funds in the Russian Federation/Е. Lavrenova, О. Belomyttseva//Problems of Accounting and Finance. -2015. -№ 2. -P. 39-44.

- The Pension Fund of the Russian Federation //PFR. -Electronic data. -URL: http://www.pfrf.ru/(access date: 29.04.2016).

- The PFR approves funded pension in a voluntary basis employees //Accounting, taxation, audit. -Electronic data. -URL: http://www.audit-it.ru/news/personnel/859987.html (access date: 05.05.2016).

- Non-state pension funds //InvestFunds. -Electronic data. -URL: http://npf.investfunds.ru/(access date: 11.05.2016).