Possibilities of Arctic Oil Transportation to the Refineries of the Republic of Bashkortostan

Автор: Ivanova M.V., Fedorova O.A.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 53, 2023 года.

Бесплатный доступ

Communications play an important role in the economic development of states and regions, in the development of new markets by connecting distributed areas of economic activity. The modern sanction economy is characterised by the change of economic partners and, accordingly, communication directions. Thus, the vector of Arctic oil exports is shifting to the Asia-Pacific region, which increases the role of maritime communications for its transport. At the same time, from a practical point of view, it can be assumed that Arctic oil can become one of the resources of domestic refineries. The aim of the study was to consider the possibilities of providing the oldest oil refining complex of the Republic of Bashkortostan with Arctic oil and to build a basic scheme of spatial organisation of communications linking the economic space of Russia. Achievement of the set goal required the solution of the following tasks: to determine the role of Russia in the world oil exports on the basis of “bp Statistical Review of World Energy”; to conduct a comprehensive analysis of studies of domestic scientists on the issues of oil production, sales and refining, as well as promising Arctic offshore projects; and to consider the features of the oil refining industry of Russia and, in particular, the Republic of Bashkortostan. As a result of the research, the conclusions about the prospectivity of Arctic oil production and about the possibilities of its delivery to the refineries of the Republic of Bashkortostan have been obtained; for these purposes, a principal scheme of spatial organisation of communications linking oil deliveries from Arctic offshore fields to refineries in Ufa of the Republic of Bashkortostan has been developed.

Arctic zone, oil, communications, Republic of Bashkortostan, oil refinery

Короткий адрес: https://sciup.org/148329490

IDR: 148329490 | УДК: [332.122+622.276](985)(470.57)(045) | DOI: 10.37482/issn2221-2698.2023.53.62

Текст научной статьи Possibilities of Arctic Oil Transportation to the Refineries of the Republic of Bashkortostan

Economic development of the Arctic is a conditional interaction of resource and infrastructure projects. According to the Ministry of nature and ecology of the Russian Federation, Arctic

∗ © Ivanova M.V., Fedorova O.A., 2023

This work is licensed under a CC BY-SA License

SOCIAL AND ECONOMIC DEVELOPMENT

Medea V. Ivanova, Olga A. Fedorova. Possibilities of Arctic Oil Transportation … hydrocarbon reserves amount to 7.3 billion tons of oil and 55 trillion m3 of gas 1. In the context of the development of the Northern Sea Route and the Arctic shelf, the state actively supports investment projects already underway and expands opportunities to attract new investors (or economic agents). The issues of coordinating interests with the main subsoil users of the Arctic and developing the infrastructure of the Northern Sea Route (NSR) are discussed in more detail in [1, Ivanova M.V., Danilin K.P., Koshkarev M.V., pp. 538–550].

The most important task of the spatial organization of Arctic communications connecting the Arctic region with the intraregional economic space of Russia, along with increasing the efficiency of sea routes, is to expand connectivity with routes of other modes of transport. That is why in the legislative documents forming the long-term transformation of the NSR infrastructure, adopted for the period 2014–2022, much attention is paid to the development of ports: Order of the Government of the Russian Federation dated September 30, 2018 N 2101-r (as amended on April 13, 2022) “On approval of a comprehensive plan for the modernization and expansion of the main infrastructure for the period up to 2024” 2; Order of the Government of the Russian Federation dated November 27, 2021 N 3363-r “On the transport strategy of the Russian Federation until 2030 with a forecast for the period up to 2035” 3; Order of the Government of the Russian Federation dated 01.08.2022 N 2115-r “On approval of the Development Plan of the Northern Sea Route for the period up to 2035” 4; Decree of the President of the Russian Federation dated July 31, 2022 N 512 “On approval of the Maritime Doctrine of the Russian Federation” 5. Due to the fact that the main ports were formed in the process of natural development on the coast of all Arctic seas and along the flow of large rivers, they are in fact a link between sea and land transport.

Since the development and production of oil and gas reserves is strictly tied to the areas where they are found, the NSR is the most important communication and link between the production and the potential consumer. In 2013, Russia began implementing a unique project for oil production on the Arctic shelf, Prirazlomnoe, and already in 2014, a new type of oil entered the world market — arctic oil (ARCO). In fact, this was a new stage in the development of the Russian oil industry. Most of the oil production in the Arctic is concentrated in the continental part and on the shelf of the Barents and Kara seas. The main consumers of Russian crude oil are Europe (until 2022) and China. Thus, according to the “bp Statistical Review of World Energy–2022”, in 2021, Russian oil imports in Europe amounted to 25% of all EU oil imports. Also in 2019–2021 Russia was among the top three leaders in global crude oil exports (Fig. 1). One of the features of the distribution of oil in the world is the heterogeneity of the relationship between reserves and production volumes [2, Filimonova I.V., Nemov V.Yu., Provornaya I.V. et al., pp. 69–77]; this is due to both the qualitative characteristics of reserves and political and economic factors, which largely determine the nature of the global oil market.

Fig. 1. The main countries of world oil exports as of 2021. 6

The new “sanctions” era is creating new economic development horizons, including for Arctic projects. Will Russia remain the leader in oil exports, which countries will replace lost consumers, is it possible to use Arctic oil by domestic oil refineries (ORs)?

Literature review, materials and methods

The results of studying various scientific and information sources, as well as expert assessments, generally indicate positive dynamics in the implementation of Arctic oil and gas projects. The expert community foresaw a reversal of long-term priorities of export policy in the oil sector towards the countries of the Asia-Pacific region, mainly to India and China.

The main patterns of development of the world oil market, features of the distribution of oil reserves, analysis of the dynamics of reserve growth and the reproduction rate of the Russian oil resource base are presented in [2, pp. 69–77]. According to experts, the share of export volumes of oil and petroleum products over the past 20 years has consistently exceeded domestic consumption by 3 times. Scientists rightly note the strengthening of the Pacific direction of sup- plies, which is updated not only by the “sanctions” policy, but also by the intensive development of subsoil use in the east of Russia, the construction of the main pipeline infrastructure [3, Filimonova I.V., Nemov V.Yu., Provornaya I.V. et al., pp. 65–74]. In 2023, specialists from the industry analytical company Vortexa noted that in March of this year, 91% of oil and petroleum products exports went to India and China 7. A number of authors justify the need to maintain the economic turnover of the development of oil resources in the Arctic, since this particular resource is the most important financial source of replenishment of the federal budget and the strategic objectives of the state [4, Kozmenko S.Yu., Kozmenko A.S., pp. 38–54].

The works of scientists from the Kola Science Center analyze in detail the state of the oil and gas complex of the Arctic zone of the Russian Federation (AZRF), the prospects of Russian producers in the global liquefied natural gas market from the perspective of diversification and modernization of oil and gas transport infrastructure, the organization of transport support for large energy projects in the aspect of maritime transportation of oil, coal and natural gas; directions for the development of domestic shipbuilding for the modernization of Arctic communications have been identified [5, Organization of infrastructure support...], [6, Global development trends...].

Modern forms of organizing the production and transportation of Arctic hydrocarbons are considered in works devoted to the organization of mineral resource centers in the Russian Arctic. Issues of arranging the production and transportation of Arctic hydrocarbons and other minerals are acquiring great significance within the framework of the implementation of the Strategy for the spatial development of the Russian Federation for the period up to 2025 8 and the Strategy for the development of the Arctic Zone of the Russian Federation and ensuring national security for the period up to 2035 9, which define new “economic localities”: “geostrategic territories”, such as the AZRF, and priority “mineral resource centers” (MRC). The research [7, Ivanova M.V., Kozmenko A.S., p. 92–104] notes that the definition of new localities is associated with new trends in the spatial organization of the country’s economy and the shift of production of hydrocarbon raw materials to the underdeveloped territories of Eastern Siberia, the Far East and the shelf waters of the Far Eastern and Arctic basins. Features of the formation and prospects for the development of

MRC are considered in the following works: 10, [8, Lipina S.A., Cherepovitsyn A.E., Bocharova L.K., pp. 29–39], [9, Filimonova I.V., Ivanova M.V., Kuznetsova E.A. et al., pp. 66–88; 10, Rozhdestvenskaya I.A., Rostanets V.G., pp. 83–87]. As a result, the study [9, pp. 66–88] indicates that the effectiveness of the MRC is determined by the development of the communications system and the interaction of national and corporate interests, generating a multiplier effect from the organization of mineral resource centers on the economy of the region and the country as a whole.

The works of Novosibirsk scientists are devoted to the issues of the characteristics of the raw material base of hydrocarbons, their influence on regional innovative development, as well as the peculiarities of the functioning of modern oil refineries in Russia [11, Filimonova I.V., Komarova A.V., Nemov V.Yu. et al., pp. 13–20; 12, Nemov V.Yu., Filimonova I.V., Provornaya I.V., Kartashevich A.A., pp. 149–161]. A large corpus of works by domestic scientists is devoted to the study of the prospects and features of the development of refineries in Russia in general and in the context of regions. The territorial distribution of production forces in individual regions of Russia and their features are discussed in the works of A.A. Biev [13, pp. 82–95], who suggests that expanding the network of small and modular refineries will become the most possible direction for further modernization of the fuel and energy sector.

Assessment of the long-term prospects for the development of the global and Russian oil refining industry is covered in the works of A.P. Solomonov [14, pp. 53–56], N.A. Budarina [15, pp. 110–114]. The authors forecast an increase in diesel fuel demand relative to other petroleum products in global consumption by 2025 (the share of diesel fuel consumption will increase from 32 to 37%). Such changes, in turn, will require modification of the structure of energy consumption for refining.

In addition to the above-mentioned authors, other scientists have studied the problems of the oil refining industry in Russia and the world: [16, Bashkirtseva N.Yu., pp. 63–68], [17, Braginskiy O.B.; 18, Braginsky O.B., pp. 232–237].

Scientific research is based on a general scientific approach. The theoretical constructions are based on the results of the analysis of expert assessments, strategies and other regulatory government documents addressing the development of the oil production and oil refining complex. Information sources were systematic research in the field of economic development of the Arctic, the oil industry and the Northern Sea Route; materials from specialized news agencies and legal reference systems; information and analytical materials from foreign analytical centers and government bodies of the Russian Federation.

Arctic oil resource base

The raw material base of liquid hydrocarbons in Russia, due to its significant volume and quality characteristics, provides domestic consumers with oil and petroleum products, and, de- spite the sanctions policy, allows the country to maintain a leading position in the world ranking of exporters (Fig. 1). The main subsoil users of the Russian Arctic are the country’s leading companies [19, Ivanova M.V., Danilin K.P., Koshkarev M.V., pp. 538–550]: PJSC Gazprom, PJSC Gazprom Neft, PJSC NK Rosneft, PJSC NOVATEK, PJSC Lukoil. In Russia, the most famous types of oil are: Urals, Siberian Light, ESPO, Sokolov, Vityaz, ARCO, Sakhalin Blend. According to news agencies, in 2023

China began purchasing “Arctic” brands of oil, such as ARCO, Varandey, Novy Port.

The top three Russian oil companies in terms of volumes and oil refining operating in the

Arctic include Gazprom Neft (GPN). This company was the first to start oil production on the Rus- sian Arctic shelf (Fig. 2).

Fig. 2. Gazpromneft’s Arctic program 11.

Since 2008, LUKOIL has been operating a stationary ice-resistant loading berth with a capacity of 12 million tons of oil per year, 21 km from the coastline in the area of Varandey Island (Nenets Autonomous Okrug) in the Barents Sea 12.

The share of Arctic oil in the total gas production volume in 2020 exceeded 30%. Oil from the Prirazlomnoe and Novoportovskoe fields is supplied via the Northern Sea Route throughout the year. Since 2016, Novoportovskoe oil has been shipped through the Gates of the Arctic terminal with a capacity of 8.5 million tons per year (built in the Gulf of Ob, 3.5 km from the coastline) (Table 1).

Table 1

Basic characteristics of the projects 13

|

No. |

Field |

Location |

Characteristics |

Oil |

Transport infrastructure |

|

1. |

Prirazlomnoye |

Pechora Sea, 60 km from the coast (depth up to 20 m) |

The only operating offshore iceresistant stationary platform in the Russian Arctic |

ARCO (Arctic Oil) |

Loading to tankers from the oil storage facility at the bottom of the platform, then along the NSR |

|

2. |

Novoportovskoye |

Yamal Peninsula in the Yamal-Nenets AO, 250 km north of Nadym |

The Gate of Arctic terminal, 3.5 km from the coast for safe loading of large-tonnage tankers |

Novy Port |

Pipeline to the Gate of Arctic terminal, loading into tankers, then along the NSR |

|

3. |

Vostochno-Messoyakhskoe |

Gydan Peninsula of the Yamal-Nenets AO, 340 km north of the city of Novy Urengoy |

The northernmost continental region of Russia. Horizontal and fishbone wells |

no data |

Pipeline to the Zapolyarye-Purpe main oil pipeline, then along the ESPO |

The company has its own Arctic fleet, which includes two reinforced ice-class icebreakers of the Aker ARC 130A (IBSV01) project “Alexander Sannikov” and “Andrey Vilkitskiy” to support the operation of the Arctic Gate terminal and 6 Arc7 ice-class tankers. Passage along the NSR is ensured by the nuclear-powered icebreaker “50 Let Pobedy”.

Another largest oil and gas company in Russia is PJSC NK Rosneft. The company’s main activities are exploration and development of hydrocarbon deposits, including offshore ones, oil and gas production, processing of raw materials, sales of oil and gas, as well as their processed products in the Russian Federation and abroad. Rosneft owns 28 license areas on the Arctic shelf with total resources of 34.6 billion tons of oil equivalent, where the company continues to conduct geological exploration (Table 2) 14.

Table 2

Geography of licensed areas

|

Region |

Number of projects |

Shelves of the seas |

Licensed areas |

Total reserves |

|

Western Arctic |

19 |

Barents sea |

Fedynskiy, Central Barents, Perseevskiy, Albanovskiy, Varnekskiy, West-Prinovozemelskiy, Gusinozemelskiy |

16.3 bln TOE |

|

Pechora Sea |

Russkiy, South-Russkiy, South-Prinovozemelskiy, West-Matveevskiy, North-Pomorskiy-1,2, Po-morskiy and Medynsko-Varandeyskiy, Dolginskoe |

|||

|

Kara Sea |

East-Prinovozemelskiy-1, 2, 3, Severo-Karskiy |

|||

|

Eastern Arctic |

9 |

Laptev sea |

Ust-Olginskiy, Ust-Lenskiy, Anisinsko-Novosibirskiy, Khatangskiy, Pritaymyrskiy |

18.3 bln TOE |

|

East-Siberian Sea |

East-Sibirskiy-1 |

|||

|

Chukchi Sea |

North-Vrangelevskiy-1,2, South-Chukotskiy |

Features of the oil refining industry in Russia

The oil refining industry is an important element of the energy supply system of the country’s economy and the main direction of oil use on the domestic market in the motor and petrochemical sectors. Currently, there are more than 30 oil refineries located on the territory of the Russian Federation with an oil processing volume of more than 1 million tons per year [12, Nemov V.Yu., Filimonova I.V., Provornaya I.V. et al., pp. 149–161]. The largest refineries are mainly concentrated in the European part of Russia (Fig. 3).

Under construction

Fig. 3. Geographical distribution of the largest oil refineries in Russia 15.

-

15 S 2016 g. AFK «Sistema» ne yavlyaetsya kontroliruyushchem organom, zavody prinadlezhat «Rosneft'» [Since 2016, AFK Sistema is not a controlling body; the plants belong to Rosneft]. URL: http://expert.ru/data/public/425663/425688/029_expert_20.jpg (accessed 10 April 2023).

The uneven distribution of refineries is explained by the USSR policy of locating refineries in the places of highest consumption 16 and in the areas of oil deposits 17. This unevenness led to the fact that the Samara region and Bashkiria, for example, have three oil refineries each, while most regions have none.

Another feature of Russian refineries is the depth of oil refining, which is currently 82.5% (in Europe —85%, and in the USA — 96%). The high share of output of dark petroleum products is due to both domestic and foreign market demand and technological equipment.

According to experts, there is an urgent need to modernize oil refineries in Russia to increase the output of products with high added value and meeting environmental standards. The paper [11, Filimonova I.V., Komarova A.V., Nemov V.Yu. et al., pp. 13–20] considers trends towards deterioration in the structure and quality of the raw material base of the oil-producing regions of Russia. According to the results of the analysis, a quarter of the regions (out of 26 studied) fell into the group with a high degree of exploration (73%), with a high proportion of sulfurous (83.7%) and dense (59.4%) oil. One of these regions is the Republic of Bashkortostan, and its oil fields are among the oldest in Russia.

Why does the Republic of Bashkortostan need Arctic oil?

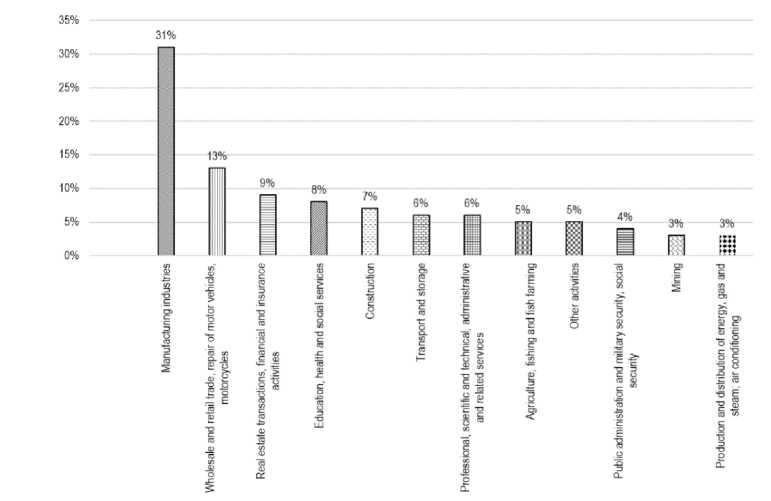

The Republic of Bashkortostan has a fairly diversified economy, with a 3% share of mineral production. The dominant activities, which determine the economic specialization of the region, are: oil refining, chemistry and petro-chemistry, which accounts for more than 30% of GRP (Fig. 4).

Fig. 4. GRP structure of the Republic of Bashkortostan for 2019

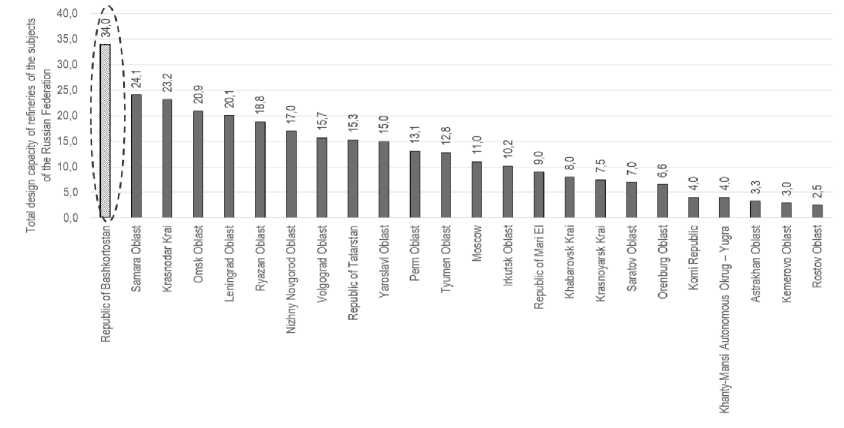

The Republic is a leader in the total design capacity of oil refineries among other constituent entities of the Russian Federation of similar profiles (Fig. 5). Considering the depletion of its own resource base, it is possible to assume the probability of insufficient supply of the republic’s oil refining complex in the long term.

Fig. 5. Distribution of the total design capacity of oil refineries by regions of the Russian Federation 19.

As of 2020, the volume of crude oil refining exceeds the volume produced in the region by 55.76%, which means that oil is imported from other subjects of the Russian Federation to maintain the functioning of production specialization. Oil refineries in Bashkortostan process not only local oil, but also part of the Tyumen, Udmurt and Perm oil.

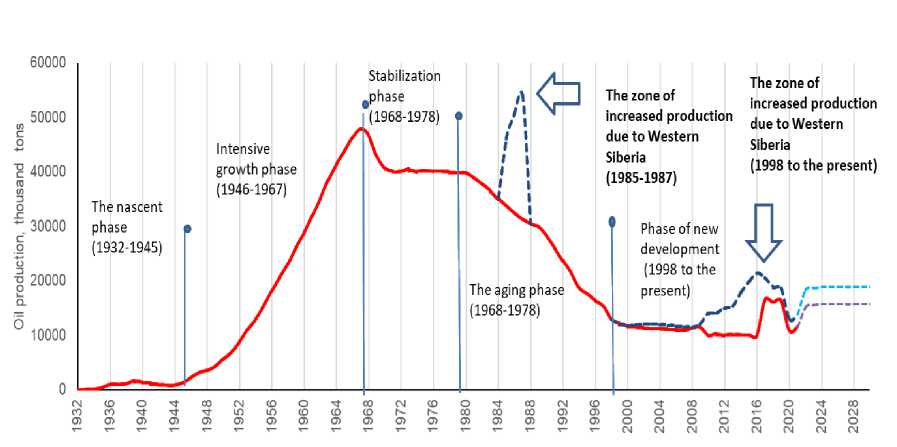

Identification of the characteristic phases of the “life cycle”: origin, development, aging and new development (due to oil production in Western Siberia of the Russian Federation) confirms the probability of insufficient supply of the oil refining complex of the Republic (Fig. 6).

Fig. 6. Schedule of oil production in the Republic of Bashkortostan and adjacent territories

-

19 Source: Compiled by authors by URL: https://energybase.ru/processing-plant?ysclid=lhdm0pc5je367599669 (accessed 15 March 2023).

At the same time, according to the estimates of the Federal Agency, the volume of oil produced in the Republic in 2021 was 7.7% higher than in 2020, due to an increase of 39.8% in the number of wells drilled and by 33.3% of wells put into operation 21. Thus, the low quality of the raw material base stimulates the use of new technological processes in the development of new fields; for example, the development of wells using hydraulic fracturing allows the use of new and poorly draining areas of the formation. Indeed, this confirms the opinion of experts that this region is distinguished by a high level of innovation and a high degree of hard-to-recover reserves [11, Filimonova I.V., Komarova A.V., Nemov V.Yu. et al., pp. 13–20]. At the same time, new mining methods are unsafe for the environment. Thus, the search for new sources of raw materials for the refineries of the Republic of Bashkortostan is a promising and urgent problem.

Spatial organization of communications to supply ORs of the Republic of Bashkortostan

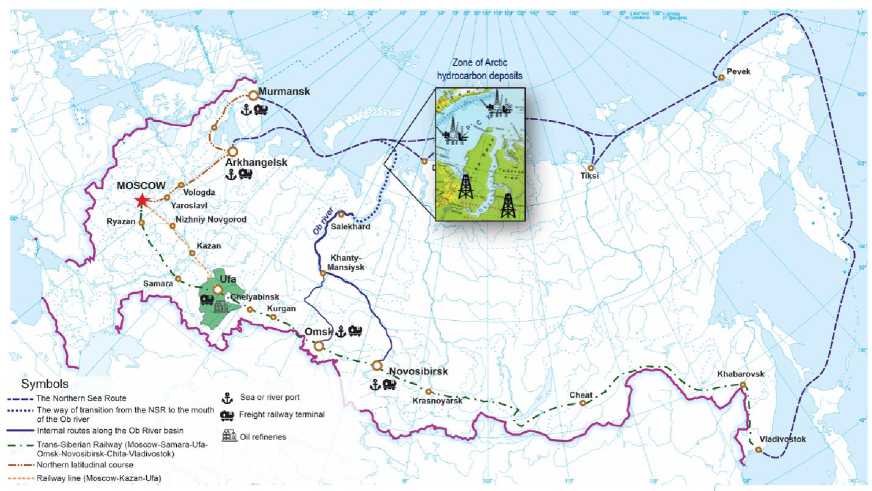

Most of the major oil production projects in the Russian Federation are being commissioned in the Arctic, primarily in the Yamalo-Nenets Autonomous Okrug, Nenets Autonomous Okrug, on the left bank of the Yenisey River in the Krasnoyarsk Krai and within the Vankor-Suzun zone, as well as on the shelf of the Arctic seas [20, Oil and gas complex of Russia]. Figure 7 presents a schematic diagram of the spatial organization of communications connecting oil supplies from Arctic fields on the shelf to oil refineries in the city of Ufa of the Republic of Bashkortostan.

Fig. 7. Scheme of spatial organization of communications for oil supplies from Arctic offshore fields to oil refineries in

Ufa, Republic of Bashkortostan 22.

It can be concluded that the main oil fields are located in the North-West of the Arctic zone. Possible options for delivering Arctic oil to the Republic of Bashkortostan may be combined routes: sea, river, rail and road.

The cost of river transportation is significantly lower than overland transportation. So, according to Fig. 7, the closest river artery to the deposits is the Ob River. Research [21, Khorokhina Ya.V., pp. 422–424] showed: firstly, the transport fleet of Siberia is outdated, its wear and tear is 70%; secondly, the industry does not have vehicles capable of operating in extremely shallow river conditions (0.5–0.8 m). In addition, it is well known that ice cover near the Ob River is approximately 150 days at the source and about 220 days at the mouth, and this is from 40 to 60% per year. However, the interaction of river transport with land transport (road and rail) is carried out through transport hubs operating on the basis of river ports. On the banks of the Ob, these are: Barnaulskiy, Novosibirskiy, Surgutskiy, Sergino, Salekhardskiy and Tomskiy, the service boundaries of which reach the coast of the Ob. Their role in transport provision of the West Siberian region is great. On the basis of these conclusions it is possible to propose a model of advanced hydrocarbon importation for local consumers while renewing the transport river fleet. In addition, a promising topology for the development of the railway network has been developed in the Russian Federation, which indicates plans for the construction of strategic, cargo-generating, technological and socially significant railway lines oriented towards the Arctic coast. It is possible that in the future the supply of raw materials for the functioning of the production specialization of petrochemical and oil refining will be carried out by rail, although this will significantly increase the cost of final products compared to river transport.

Conclusion

For both the state and resource-extracting companies, the Arctic, despite the harsh climate, underdeveloped infrastructure, and remoteness from domestic and foreign markets, remains a region of promising development. Under the new sanctions policy, the rich resource base of Arctic oil opens up new opportunities in new foreign markets, and can also be in demand in the domestic market, supplying Russian refineries. Obviously, there are certain difficulties in dealing with the domestic market: complex transport logistics and the need to modernize refineries. However, the directions stated in the country’s development strategies allow making long-term plans in this direction.

As already noted, despite the sanctions 23, oil production in the Russian Federation in 2021 amounted to 524 million tons, while exports amounted to 230 million tons (43.8%), 56.2% of oil was sent to the domestic market. According to the research [22, Fedorova O.A., p. 49], oil produc- tion in 2015 amounted to 533.5 million tons, exports — 241.3 million tons (45.2%). The production reduction in 2021 relative to 2015 was 1.8%.

The focus on export of finished products contributes to the development of production specialization of the region’s petrochemical and refining profile, but currently finished products are mainly sent to the domestic market and Asia-Pacific countries.

In the long term, interregional communications with the lowest costs are necessary to ensure the specialization of the petrochemical and oil refining profile of the Republic of Bashkortostan with mineral raw materials — oil. On the one hand, the question of whether the refineries of the Republic of Bashkortostan will be supplied with Arctic hydrocarbon raw materials remains open and requires further research; on the other hand, the development of pipeline transport by PJSC Transneft may involve the supply of oil to the region in the future. Currently, the growth pole is the Arctic zone, where oil and gas companies are involved [23, Yakusheva U.E.]. Focusing on the long-term development of these companies and the development of the territories of Eastern Siberia and the Far East will contribute to the development of various water and land communications, which will certainly have a positive effect in the future.

Список литературы Possibilities of Arctic Oil Transportation to the Refineries of the Republic of Bashkortostan

- Ivanova M.V., Danilin K.P., Koshkarev M.V. Severnyy morskoy put' kak prostranstvo soglasovaniya in-teresov dlya ustoychivogo sotsial'no-ekonomicheskogo razvitiya Arktiki [The Northern Sea Route as a Co-ordination of Interests’ Medium for Sustainable Socio-Economic Development of the Arctic]. Arktika: ekologiya i ekonomika [Arctic: Ecology and Economy], 2022, vol. 12, no. 4, pp. 538–550. DOI: 10.25283/2223-4594-2022-4-538-550

- Filimonova I.V., Nemov V.Yu., Provornaya I.V., Mishenin M.V. Sovremennye tempy i proportsii razvitiya mi-rovogo rynka nefti [Current Rates and Proportions of World Oil Market Development]. Mineral'nye resursy Rossii. Ekonomika i upravlenie [Mineral Recourses of Russia. Economics and Management], 2022, no. 1 (176), pp. 69–77.

- Filimonova I.V., Nemov V.Yu., Provornaya I.V., Kartashevich A.A. Ekonomika i prioritety eksportnoy politiki Rossii v neftyanoy sfere [Economy and Russia's Oil Export Policy Priorities]. Mineral'nye resursy Rossii. Ekonomika i upravlenie [Mineral Recourses of Russia. Economics and Management], 2022, no. 3–4 (178), pp. 65–74.

- Kozmenko S.Yu., Kozmenko A.S. The Arctic Geo-Economy: Mobility of Strategic Oil Resources at the End of Globalization. Arktika i Sever [Arctic and North], 2022, no. 49, pp. 38–54. DOI: 10.37482/issn2221-2698.2022.49.38

- Bogachev V.F., Veretennikov N.P. et al, eds. Organizatsiya infrastrukturnoy podderzhki arkticheskoy nefte-gazovoy otrasli: monografiya [Organization of Infrastructure Support for the Arctic Oil and Gas Industry]. Apatity, FRC KSC RAS Publ., 2020, 159 p. (In Russ.). DOI: 10.37614/978.5.91137.445.7

- Agarkov S.A., Bogoyavlenskiy V.I., Koz'menko S.Yu., Masloboev V.A., Ul'chenko M.V., eds. Global'nye ten-dentsii osvoeniya energeticheskikh resursov Rossiyskoy Arktiki. Chast'. I. Tendentsii ekonomicheskogo razvitiya Rossiyskoy Arktiki: monografiya [Global Trends in the Development of Energy Resources of the Russian Arctic. Part I. Trends in the Economic Development of the Russian Arctic]. Apatity, KSC RAS Publ., 2019, 170 p. (In Russ.). DOI: 10.25702/KSC.978.5.91137.397.9-1

- Ivanova M.V., Koz'menko A.S. Prostranstvennaya organizatsiya morskikh kommunikatsiy Rossiyskoy Arktiki [Spatial Management of the Shipping Routes in the Russian Arctic]. Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz [Economic and Social Changes: Facts, Trends, Forecast], 2021, vol. 14, no. 2, pp. 92–104. DOI: 10.15838/esc.2021.2.74.6

- Lipina S.A., Cherepovitsyn A.E., Bocharova L.K. The Preconditions for the Formation of Mineral and Raw Materials Centers in the Support Zones of the Arctic Zone of the Russian Federation. Arktika i Sever [Arctic and North], 2018, no. 33, pp. 24–32. DOI: 10.17238/issn2221-2698.2018.33.29

- Filimonova I.V., Ivanova M.V., Kuznetsova E.A., Kozmenko A.S. Assessment of Effectiveness of New Eco-nomic Growth Centers in the Arctic. Arktika i Sever [Arctic and North], 2023, no. 50, pp. 66–88. DOI: 10.37482/issn2221-2698.2023.50.66

- Rozhdestvenskaya I.A., Rostanets V.G. Mineral'no-syr'evye tsentry kak novye ob"ekty upravleniya i strate-gicheskogo planirovaniya na makroregional'nom urovne [Mineral Resource Centers as New Objects of Management and Strategic Planning at the Macro-Regional Level]. Vestnik RAEN [Herald of Education and Science Development of the Russian Academy of Natural Sciences], 2021, vol. 21, no. 2, pp. 83–87. DOI: 10.52531/1682-1696-2021-21-8-83-87

- Filimonova I.V., Komarova A.V., Nemov V.Yu., Dzyuba Yu.A., Chebotareva A.V. Vliyanie syr'evoy bazy na in-novatsionnoe razvitie neftedobyvayushchikh regionov Rossii [The Influence of the Resource Base on Inno-vation Development of Oil-producing Regions of Russia]. Geografiya i prirodnye resursy [Geography and Natural Resources], 2022, vol. 43, no. 1, pp. 13–20. DOI: 10.15372/GIPR20220102

- Nemov V.Yu., Filimonova I.V., Provornaya I.V., Kartashevich A.A. Issledovanie innovatsionno-tekhnologicheskogo potentsiala neftepererabatyvayushchikh zavodov s primeneniem metoda klasterizatsii [Study of Innovative and Technological Potential of Oil Refinery Using the Clusterization Method]. Nefte-gazovoe delo [Petroleum Engineering], 2022, vol. 20, no. 5, pp. 149–161. DOI: 10.17122/ngdelo-2022-5-149-161

- Biev A.A., Shpak A.V. Vozmozhnosti i perspektivy poyavleniya novykh neftepererabatyvayushchikh predpriyatiy v severnykh regionakh Rossii [Opportunities and Prospects for the Emergence of New Refiner-ies in Russia's Northern Regions]. Ekonomicheskie sotsial'nye peremeny: fakty, tendentsii, prognoz [Eco-nomic and Social Changes: Facts, Trends, Forecast], 2014, no. 1 (31), pp. 67–77. DOI: 10.15838/esc/2014.1.31.8

- Solomonov A.P. Osnovnye regional'nye tendentsii razvitiya mirovoy neftepererabatyvayushchey promysh-lennosti [Main Regional Tendencies of Development of World Oil-processing Industry]. Vestnik universi-teta, 2014, no. 21, pp. 53–56.

- Budarina N.A., Prokopovich R.S. Perspektivy neftepererabatyvayushchey promyshlennosti Rossii [Prospects of Oil Refining Industry of Russia]. Mezhdunarodnyy zhurnal gumanitarnykh i estestvennykh nauk [Interna-tional Journal of Humanities and Natural Sciences], 2019, no. 6–1, pp. 110–114. DOI: 10.24411/2500-1000-2019-11260

- Bashkirtseva N.Yu. Neftepererabatyvayushchiy kompleks mira [Oil Refining Complex of the World]. Vestnik Kazanskogo tekhnologicheskogo universiteta [Herald of Technological University], 2015, vol. 18, no. 6, pp. 63–68.

- Braginsky O.B. Neftegazovyy kompleks mira [Oil and Gas Complex of the World]. Moscow, Izdatel'stvo «Neft' i gaz» Publ., 2006, 640 p. (In Russ.)

- Braginskiy O.B. Neftekhimicheskaya promyshlennost' (obzor) [Petrochemical Industry (Review)]. Zhurnal novoy ekonomicheskoy assotsiatsii [Journal of the New Economic Association], 2009, no. 3–4, pp. 232–236.

- Ivanova M.V., Danilin K.P., Koshkarev M.V. Severnyy morskoy put' kak prostranstvo soglasovaniya in-teresov dlya ustoychivogo sotsial'no-ekonomicheskogo razvitiya Arktiki [The Northern Sea Route as a Co-ordination of Interests’ Medium for Sustainable Socio-economic Development of the Arctic]. Arktika: ekologiya i ekonomika [Arctic: Ecology and Economy], 2022, vol. 12, no. 4, pp. 538–550. DOI: 10.25283/2223-4594-2022-4-538-550

- Kontorovich A.E., ed. Neftegazovyy kompleks Rossii — 2017. Chast' 1. Neftyanaya promyshlennost' — 2017: dolgosrochnye tendentsii i sovremennoe sostoyanie: monografiya [The Oil and Gas Complex of Rus-sia — 2017. Part 1. The Oil Industry — 2017: Long-term Trends and Current State]. Novosibirsk, INGG SB RAS Publ., 2018, 86 p. (In Russ.)

- Khorokhina Ya.V. Otsenka transportnogo ispol'zovaniya reki Obi [Assessment of the Transport Use of the Ob River]. Molodoy uchenyy [Young Scientist], 2018, no. 50 (236), pp. 422–424.

- Fedorova O.A. Sravnitel'nyy analiz sostoyaniya resursnoy bazy predpriyatiy neftekhimicheskoy i neftepere-rabatyvayushchey otrasley [Comparative Analysis of Resources for Petrochemical and Refining Industries]. Nauka vchera, segodnya, zavtra: sb. st. po mater. XXXVIII mezhdunar. nauch.-prakt. konf. [Science Yesterday, Today, Tomorrow: A Collection of Articles Based on the Materials of the 38th Intern. Sci. and Pract. Conf.], 2016, no. 9 (31), pp. 139–151.

- Yakusheva U.E. Sotsial'no-ekonomicheskaya politika Arkticheskogo regiona: dis. dok. ekon. nauk [Socio-economic Policy of the Arctic Region: Dr. Econ. Sci. Diss.]. FRC KSC RAS, 2020, 173 p.