Potential opportunities for the growth of the Russian economy and the monetary policy of the bank of Russia

Автор: Glazyev Sergei Yu.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Socio-economic development strategy

Статья в выпуске: 5 (59) т.11, 2018 года.

Бесплатный доступ

The paper considers the role and place of monetary policy in ensuring the reproduction of modern economy. Monetary policy conducted by the Bank of Russia is based on the IMF’s universal recommendations, which are inconsistent both with the conditions of reproduction of the Russian economy and with specific features of the current period of structural changes in the world economy. The ongoing change of technological and world economic orders is accompanied by fundamental changes in the composition of the industries that determine economic growth, as well as in the system of institutions for managing economic reproduction. The resulting opportunities for a breakthrough in the development of the Russian economy can be implemented only in conditions of an appropriate monetary policy focused on lending to promising areas of economic growth within the existing production factors. The goal of the present paper is to substantiate the mismatch between the monetary policy and the potential opportunities for the growth of the Russian economy in the conditions of changing technological and global economic orders. The paper criticizes the draft major directions of the unified state monetary policy for 2019 and for the period of 2020-2021 and proves that they are inconsistent with modern knowledge about the laws of economic development and growth opportunities of the Russian economy.

Monetary policy, economic policy, economic growth, reproduction of the russian economy, change of technological modes, economic development

Короткий адрес: https://sciup.org/147224099

IDR: 147224099 | УДК: 338.12.017, | DOI: 10.15838/esc.2018.5.59.2

Текст научной статьи Potential opportunities for the growth of the Russian economy and the monetary policy of the bank of Russia

Introduction. Achievement of the goal of “breakthrough scientific, technological and socio-economic development” set out by the President of Russia [1] requires a systemic macroeconomic policy aimed at stimulating investment in promising areas of growth of the new technological mode. Its most important component is monetary policy, which provides the financial component of expanded reproduction of the economy.

Modern economic growth cannot do without constant expansion of credit to finance innovation and investment activity of economic entities. At its core, the credit created by the state is intended to advance production growth; without its consistent expansion, the development of the economy is impossible. At the same time, the interest rate should not exceed the profitability of production. J. Schumpeter called interest rate as a tax on innovation [2]. Otherwise, the credit created by the state will be used to finance speculation to the detriment of real economy sector development. This is what is happening in the Russian economy.

Overestimation of interest rates above the level of profitability of most enterprises in the real sector leads to a reduction in production and investment, and it leads to the flow of money to currency and financial speculation. The outflow of money from the real sector to the banking sector creates the illusion of a liquidity surplus, which is sucked out of the economy by the Central Bank (CB). In contrast to the generally accepted two centuries-long world practice of creating credit resources by national central monetary authorities, the Bank of Russia withdraws money from the economy, thus artificially compressing the lending to the production sector. Thus, it blocks the growth of investment and innovation activity, making it impossible to develop the economy.

In order to assess the policy of the Bank of Russia properly, it is necessary to understand the role and place of monetary policy in promoting the reproduction of modern economy.

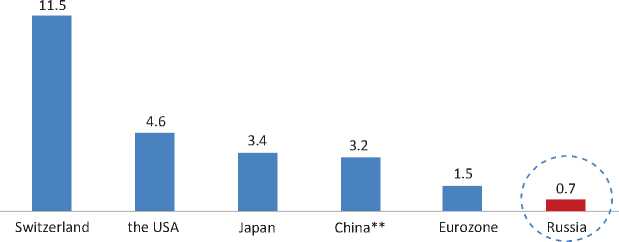

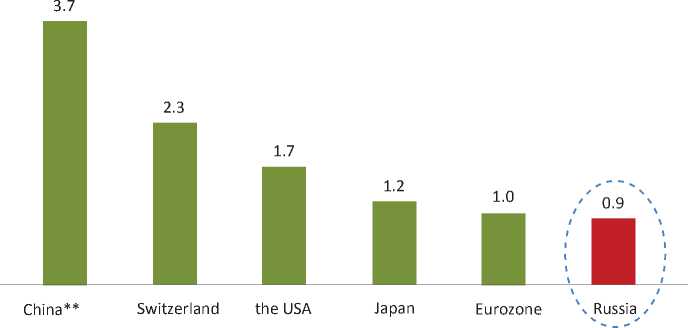

The importance of credit for economic development. Credit expansion is especially important in times of structural changes in the economy, when economic entities do not have the ability to update rapidly aging fixed assets. That is why in 2014–2018 all the leading world countries have been rapidly increasing the volume of money supply (Fig. 1) , providing loans for modernization and growth of production at nominal interest rates (Fig. 2) . Thus, they stimulate investment and innovation activity of their economic entities, making it easier for them to create industries of a new technological mode [3] and ensure its advanced growth.

Money emission is the source of this rapid expansion of credit in advanced and successfully developing countries; this emission is directed to financing the priority directions of social and economic policy established by the state.

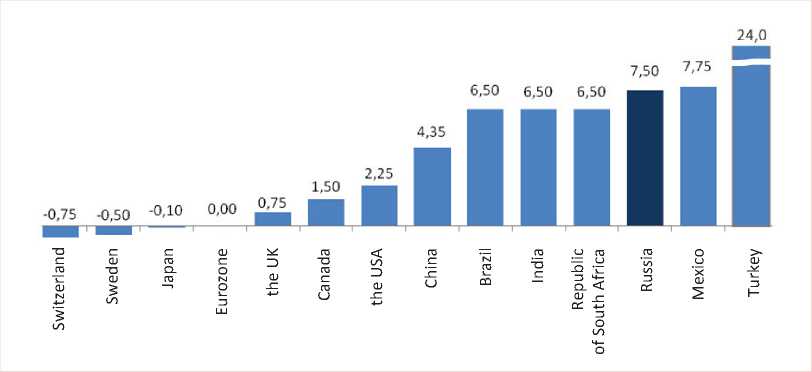

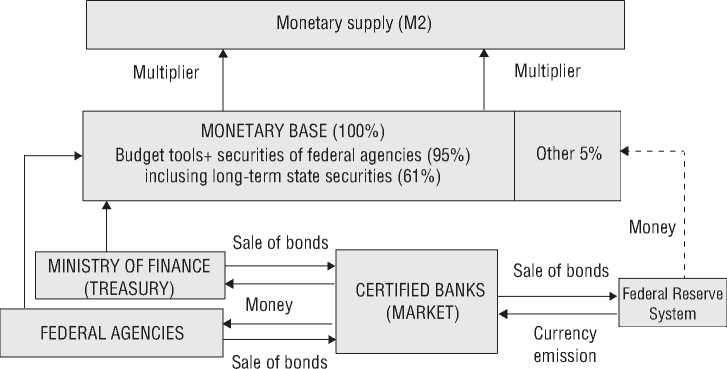

Monetary authorities of the leading countries have learned to create money for debt obligations of the state and business to finance expanded reproduction of the economy. Today, in the context of the structural crisis, they use significant issue of money to stimulate investment in the development of a new technological structure. Its main channel is the purchase of low-income debt obligations of the state by the Central Bank in order to finance budget deficit. As part of “quantitative easing”, the U.S. Federal Reserve System and the European Central Bank also issue money to purchase obligations of large banks and corporations. China and other successfully developing countries issue money taking into consideration the investment plans of economic agents in accordance with centrally established priorities (Fig. 3–6) [4, 5].

Figure 1. Growth of money supply in different countries

A. Growth of the monetary base for certain currencies, 2007–2015, times*

B. Growth of money supply (M2), 2007–2015, times*

* Calculated in US dollars at the appropriate exchange rate.

** Data as of 2017.

Source: Central banks of the countries under consideration.

Figure 2. Real level of the key rates of central banks in several countries (as of September 27, 2018, %)

-

Figure 3. Money emission in the U.S.

2015: dollar emission (monetary base generation) based on purchase of state securities Similar mechanisms are applied in many developed countries

Source: Ershov M. according to the U.S. Federal Reserve System.

-

Figure 4. Mechanism of formation of money supply, European Central Bank

Monetary supply

Monetary base

Multiplier Multiplier

|

European Central Bank |

Securies for monetary policy 53% |

Re-financing of commerical banks 30% |

Other tools 17% |

Source: Ershov M. according to the ECB.

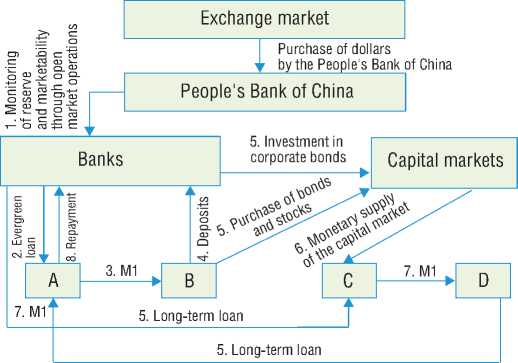

Figure 5. Organization of money supply in China

Source: Yu Yonging, 2017.

Figure 6. Formation of money supply by the Bank of Japan

Monetary supply

Monetary base

Multiplier Multiplier

|

Bank |

Bonds of the Japanese |

Lending support |

Other tools |

|

of Japan |

governmnet 85% |

program 10% |

5% |

Source: Ershov M. according to the Bank of Japan.

Unlike the Bank of Russia, central banks that issue reserve currencies provide a wide range of cheap credit resources at quasi-zero interest rates. This does not lead to inflation because the loans are directed to finance investment in modernization and production growth; as a result, costs are reduced and supply of goods is increased, and therefore, the purchasing power of money grows, as well.

China’s experience demonstrates the possibility of using money emission for issuing loans aimed at the growth of investment and production without inflationary consequences. For instance, the 10-fold GDP growth in China from 1993 to 2016 was accompanied by the 28fold increase in investment, 19-fold increase in the money supply and 15-fold increase in bank loans to the manufacturing sector. The unit of GDP growth accounts for almost three units of investment growth and about two units of growth of the money supply and the volume of credit. This illustrates the mechanism of growth of the Chinese economy: the increase in economic activity measured by GDP is provided by a rapid increase in investment, most of which is financed by expanding the credit of the governmental banking system. Despite the fact that the increase in money supply exceeds manifold production growth, inflation in China remained in the range of 4–7% for the entire period of rapid economy monetization.

Low inflation was ensured by a continuous increase in the efficiency and volume of production of goods due to the retention of cash flows in the following circuit: credit issue – growth of investment – increase in the volume and efficiency of production – growth of the mass of goods with a decrease in unit costs of their production and the unit price of consumer value – increase in income – expansion of savings – growth of investment. This was achieved by linking the credit of state-owned banks to investment projects of production development and by complying with foreign exchange restrictions on capital transactions, “end-to-end” responsibility of public authorities for the achievement of the indicators of production and investment growth, and by implementing anti-corruption measures.

Similar methods of using the issue of fiat money to credit the investment growth are successfully used in Japan, India, Vietnam, Korea, Malaysia, Singapore and other successfully developing countries. Their characteristic feature is the outstripping increase in the targeted credit issue for financing investments in accordance with the priorities determined by the state. Due to this, a sharp increase in the rate of accumulation was achieved with low incomes and savings of the population. Targeted credit issue has been and still remains the major source of financing for capital investments in the development of all countries that have performed an economic “miracle”.

Invalidity of the basic assumptions of the main directions of the unified state monetary policy . Judging by the published draft of the main directions of the unified state monetary policy (hereinafter “the Directions”) [6] until 2021, the management of the Bank of Russia is unfamiliar with the laws of long-term economic development and modern practice of advanced and successfully developing countries in the use of monetary policy tools to ensure economic growth. It also does not have a clear picture of the actual opportunities for development of the Russian economy and reduces its potential to the current volume of production. This is due to very popular, but superficial and unrealistic ideas about the development of the economy and the interdependence of money supply, inflation and production growth. Based on these views, the Directions will hinder development of the Russian economy and condemn it to growing technological backwardness and degradation.

The logic of the Directions is based on the “Concept of the equilibrium state of the economy and the deviations of the main macroeconomic variables (gaps) from it” in which “the economy can remain indefinitely in the absence of various shocks that lead to short-term deviations of the economy from it” (p. 25; hereinafter we provide a reference to the relevant page of the draft Directions for the 2019–2021 period). According to this concept, “in the long-term equilibrium, all key indicators in the economy are growing at a constant pace, which is determined by fundamental factors. That is, long-term equilibrium is not a specific point, but a stable trajectory along which the economy is moving. When conducting monetary policy within the framework of the inflation targeting regime in the long-term equilibrium, consumer prices grow at a rate corresponding to the target level of inflation, and the growth rate of the economy is equal to the potential growth rate and is determined by the growth rate of productivity of the factors of production, as well as the speed of technological development” (p. 25).

This view is as far from reality as the political economy of socialism that was popular in the USSR, or the theory of optimal functioning of the economy. The authors of the Directions accept this view as an absolute truth that requires no proof. In reality, the state of long-run equilibrium does not exist. Economic development is non-linear, non-equilibrium and often uncertain. Under the influence of science and technology progress new technological opportunities are constantly opening up, pushing the previous restrictions on economic growth. The suitable way to describe the long-term development of the economy is not a stable trajectory, but a wave-like movement in which the stages of rapid growth in ascending phases of the long Kondratiev waves are interspersed with structural crises that mediate the change of technological structures.

Business, investment, research and production cycles are studied thoroughly in economics; the key role of science and technology progress and innovations in ensuring economic development is proved [7]; their introduction causes deviations from the hypothetical state of equilibrium and creates new attractors of economic movement. The economy moves from one attractor to another, never reaching equilibrium under the influence of innovations continuously generated by economic entities. In the modern view of the innovative economic development, the equilibrium state looks like a ridiculous speculative abstraction, theoretically possible in the static economy of the Middle Ages, in which there was no credit and the innovators were persecuted by the Inquisition.

For more than 50 years, the concept of the equilibrium state of economy has been rejected by academic science because it was looked upon as failing to reflecting reality and misleading decision-makers. None of the developed and successfully developing countries applies this concept in practice and uses it for ideological purposes to justify the necessary large-scale capital policy of deregulation of the economy [8]. Proving the harmfulness of government intervention, which allegedly interferes with the equilibrium economic growth, financial capital brings under its control the factors of production in order to maximize profit and does so, among other things, by establishing monopolies contrary to the concept of equilibrium.

The concept of equilibrium is laid down in the mainstream of economic thought, which imposes a scientific idea of the reasonableness and consistency of liberal globalization on the public consciousness. This approach is characteristic of religious thinking, which in this case has its carriers of “absolute knowledge” represented by the IMF and other international organizations and regulators that implement global interests of the financial capital of the U.S. and other countries that issue world currencies in limitless expansion by limiting national credit in other countries. The practical application of this approach in Russia and other post-socialist countries, as in many countries in Africa and Latin America, has invariably led to the degradation of the economy and subordination of its reproduction to the interests of transnational corporations refinanced by issuers of the US dollar and other world currencies.

Misinterpretation of economic growth opportunities. The inadequacy of theoretical ideas about the development of the economy entails erroneous assessments of its actual state and development opportunities. The authors of the Directions believe that “in an open economy, temporary deviations from the equilibrium can be associated with the changes in domestic economic conditions and the changes in the external economic situation. The reaction of macroeconomic policy and monetary policy to the implementation of the shocks makes it possible to minimize their impact on the economy and facilitate its speedy return to its long-term equilibrium” (p. 25). However, since it exists only in the imagination of the authors, the measures planned in the Directions do not return the economy to a state of equilibrium, but are aimed at maintaining its current state, which is interpreted by the authors as equilibrium. Thus, the authors of the document believe that “the increase in domestic and external demand provided economic growth at a level corresponding to the longterm potential, taking into account its current structure. According to the Bank of Russia, the annual GDP growth rate in 2018 will be 1.5–2%” (p. 42). They also conclude that “the growth of the Russian economy has continued at a pace that is estimated by the Bank of Russia as corresponding to its long-term potential” (p. 36). And then, moving on to the forecast, the authors write: “Under the influence of all these factors, the growth rate of the economy at the end of 2019 will be 1.2% and 1.7%, remaining close to the potential growth rate” (p. 52).

The hypothetical equilibrium growth of the economy, imagined by the authors, is included in the target forecast under which monetary policy measures are planned and which thus becomes self-fulfilling. Evaluating the effectiveness of the current policy, the authors of the Directions argue that “...economic growth occurred without excessive buildup of inflationary pressures; such a growth was promoted by monetary policy. Changes in the key rate ensured the continued attractiveness of ruble savings and the growth of lending to the economy in accordance with the increase in income. The resulting increase in the consumer and investment demand did not get ahead of the opportunities to expand the supply” (p. 36).

In fact, the growth of the economy, which was within the statistical error, was visible only to the authors of the Directions. Due to the sharp rise in the cost of credit and the preservation of credit conditions unaffordable for most industrial enterprises, there was a fall in investment and income of the population; all this led to a decline in production much below the potential level [9]. Contrary to the opinion of the authors of the Directions, the possibilities of expanding the supply of goods and services are very significant, amounting to at least 25% of GDP growth given the current state of the factors of production.

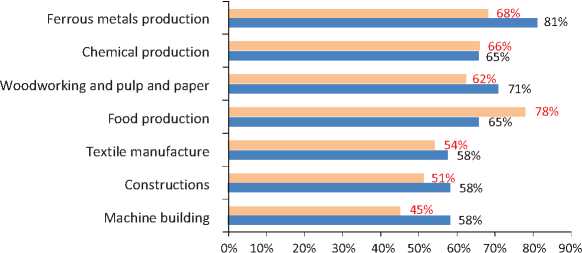

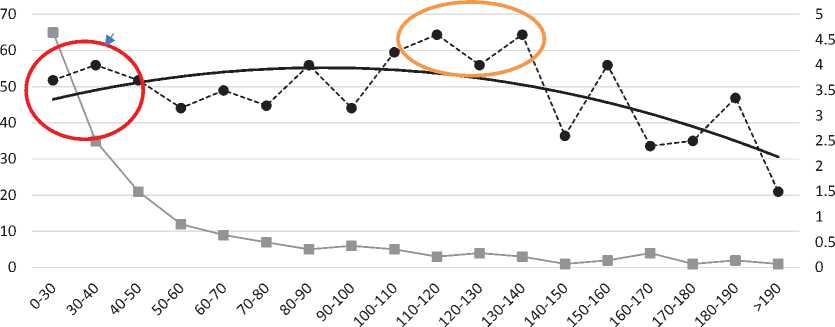

According to statistics, the load of fixed assets in the industry does not exceed 60%, including new capacity introduced in the last five years (Fig. 7) .

Thus, judging by the load of the main factors of production, the growth potential of the

Figure 7. Level of capacity utilization, in %

■ Capacity utilization rate in 2017

■ Capacity utilization rate in 2013

Source: RAS Institute of Economic Forecasting.

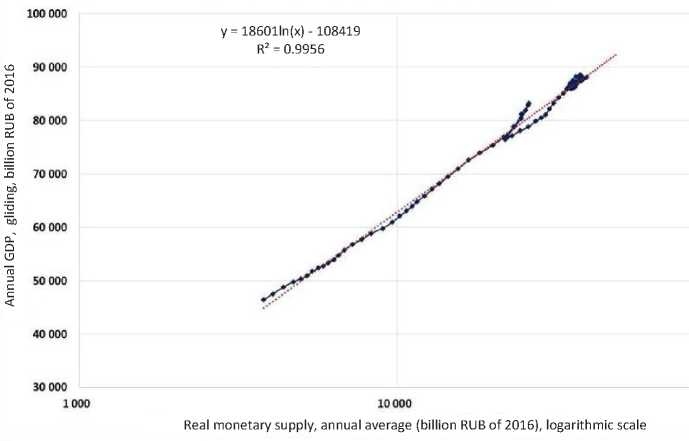

Russian economy at the expense of extensive expansion is as follows: increase in industrial production by 40%, increase in the production of engineering and chemical products by more than 50%; increase in agricultural production by at least 20%; increase in the provision of transport and construction services by 15%. With the intensification of the use of production resources at the expense of science and technology progress, GDP could be doubled within a decade. In other words, the Russian economy can grow at a rate of at least 7% of annual GDP growth in the short term, and if the increase in investment is 15%, then the economy can grow in the long term. The main limiting factor is the artificially created shortage of credit resources, which does not contribute to linking unused factors of production in the production process. This is evidenced by the linear statistically significant correlation that has developed in the Russian economy between the growth of GDP and the growth of the money supply (Fig. 8) .

If the volume of credit were not the factor that limits growth, then the dynamics of the money supply would not correlate with such a high statistical significance with GDP growth and would not form a liquidity surplus with the increase in interest rates.

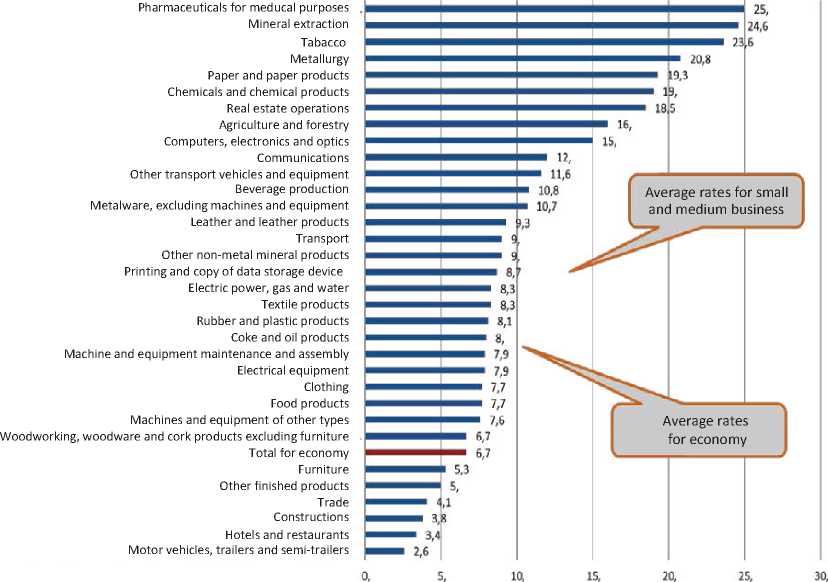

An imaginary liquidity surplus. As a result of unacceptably high interest rates that exceed the level of profitability for most manufacturing industries (Fig. 9) , capacity utilization falls as enterprises repay loans and reduce their working capital.

Focusing on the key rate, banks do not reduce interest rates and reduce lending to manufacturing enterprises. As a result, they have excess funds that are perceived by the authors of the Directions as structural liquidity surplus, which the Central Bank is going to withdraw: “In terms of the liquidity surplus of the banking sector, the Bank of Russia used deposit auctions for a period of one week as the main instrument of monetary policy. In 2018, the volume of funds raised for them

Figure 8. Correlation between Russia’s GDP and the real money supply

Source: Central Bank, Rosstat, S. Blinov’s calculations [11]

Figure 9. Level of return on sales by type of activity and interest rates on loans (as of the end of 2017)

Source: RAS Institute of Economic Forecasting.

increased significantly. Thus, in 2017, the average volume of funds raised at weekly deposit auctions amounted to 0.8 trillion rubles, and in January–August of the current year – about 2.5 trillion rubles. The volume of placement of coupon bonds of the Bank of Russia for a period of three months also increased... At the beginning of 2018, the volume of the coupon bonds in circulation was 0.4 trillion rubles, and as of September 1, 2018 – already 1.4 trillion rubles” (p. 14).

Thus, the Bank of Russia withdrew about four trillion rubles from the economy, and it is planning to continue this practice in the next three years. In total, since 2014, as we have shown above, the Central Bank has withdrawn more than 10 trillion rubles from the economy and actually ceased to refinance commercial banks. Accordingly, there was a reduction in the working capital and investments of enterprises, which were financed via bank loans. This policy led to the reduction of production and the cessation of economic growth [12, 13]. At the same time, the authors of the Directions do not see an obvious link between the increase in the interest rate above the level of the average profitability of the real sector of the economy and the liquidity surplus. Contrary to common sense they do not see the “...evidence of the impact of bank liquidity on the transactions of banks at the credit and deposit markets” (p. 87). This is like ignoring the signs of hunger amid large-scale malnutrition of the population and explaining such an ignorance with the fact that on the shelves there is a surplus of excessively expensive goods.

While being immersed in their own ideas about the alleged equilibrium development of the economy near its long-term potential level, the authors of the Directions deny the possibility of the Central Bank “to influence the productivity of production factors and the adoption of technologies with the help of monetary policy tools” (p. 6). The authors write that “attempts to stimulate economic growth by monetary policy measures in the current conditions through an unreasonable reduction in the key rate can entail large-scale negative consequences. In the short term, the reduction in the key rate will create incentives for the growth of lending and increase investment and consumer demand. This growth should not be ahead of the possibility of expanding production, otherwise it will have inflationary consequences. It is currently impossible to increase production significantly at the expense of existing capacities, as the economy operates at a level close to its potential level [14]. Faced with increasing demand, companies will compete for labor and will raise wages. This will also contribute to the expansion of consumer demand. In this case it will take time to increase fixed assets in many industries through the implementation of investment projects. As a result, an increase in domestic demand in the absence of domestic opportunities to meet it will lead to a significant acceleration of inflation...” (p. 6).

In fact, as shown above, the economy is operating well below its potential level, and there are huge opportunities to increase production without going beyond the existing resource constraints. In this situation, economic science recommends increasing the money supply, which results in an increase in output and a decrease in inflation. Conversely, adherence to the Directions leads to higher costs due to lower capacity utilization, which leads to higher prices with falling output of goods, as well as a decline in the competitiveness of the national economy, which results in the devaluation of the ruble.

Unfortunately, the authors of the Directions are guided by superficial ideas about the relationship between the dynamics of the money supply, inflation and production, which result in incorrect judgments about the causal mechanisms of monetary policy.

Misinterpretation of the interdependence of macroeconomic parameters. The authors of the Directions proceed from a superficial understanding of a linear and direct proportional relationship between the money supply and inflation. This dependence occurs only for a hypothetical equilibrium state of the economy, in which “...in the conditions of increasing demand (due to wages and loans) amid a lack of supply of domestic goods, the prices for them will increase” (p. 6). The authors believe that “monetary policy affects the deviation of the growth rate of the economy from its potential growth rate, and does not affect the economic potential itself” (p. 6). However, as mentioned above, the economy is never in a state of equilibrium, and in reality the relationship between the money supply and inflation can be the exact opposite and can change depending on the management of cash flows. And when the money issue is used to lend money to productive investments, then monetary policy has a direct impact on the increase in productive capacity.

If we exclude from the previously quoted fragment of the Directions the erroneous statement that “it is impossible to increase production at the expense of available capacities”, then the logic of reasoning about the inflationary consequences of credit expansion changes to the opposite. If credit is directed toward replenishing working capital related to the existing demand for manufactured products, then the result will be the expansion of production of goods and the reduction in fixed costs of their production; due to this fact, ceteris paribus, there will be a decrease in prices. A similar effect will be achieved with the use of credit to finance investment for the expansion and modernization of production. These are the consequences that have taken place in recent years in the agricultural market as a result of the expansion of lending to its production at a reasonable interest rate that did not exceed its profitability.

International experience of successful economic development demonstrates the key importance of expanding credit for financing productive investment. All the countries that made a breakthrough in their development started it with large-scale lending of investments in the development of advanced technologies in promising areas of economic growth. Tables 1 and 2 illustrate the positive feedback between credit expansion and investment growth in the countries that have performed an economic miracle in recent decades. Having correctly determined the priority directions of development of the national economy, monetary authorities of these countries provided targeted low-interest long-term loans to their economic entities

Table 1. Scale of lending to the economic breakthrough in the world

|

Year |

South Korea |

Singapore |

China |

Hong Kong |

India |

|

1950 |

х |

х |

х |

х |

15.6 |

|

1955 |

х |

х |

х |

х |

18.9 |

|

1960 |

9.1 |

х |

х |

х |

24.9 |

|

1963 |

16.6 |

7.2 |

х |

х |

25.8 |

|

1970 |

35.3 |

20 |

х |

х |

24.8 |

|

1978 |

38.4 |

30.7 |

38.5 |

х |

36.4 |

|

1980 |

46.9 |

42.4 |

52.8 |

х |

40.7 |

|

1990 |

57.2 |

61.7 |

86.3 |

х |

51.5 |

|

1991 |

57.8 |

63.1 |

88.7 |

130.4 |

51.3 |

|

2000 |

79.5 |

79.2 |

119.7 |

136 |

53 |

|

2009 |

109.4 |

93.9 |

147.5 |

166.8 |

72.9 |

|

2010 |

103.2 |

83.9 |

172.3 |

199 |

76.2 |

|

Source: Ya. Mirkin [15]. |

|||||

Table 2. Increase in the rate of accumulation during periods of economic leap

|

Year |

Japan |

South Korea |

Singapore |

Malaysia |

China |

India |

|

1950 |

х |

х |

х |

х |

х |

10.4 |

|

1955 |

19.4 |

10.6 |

х |

9.2 |

х |

12.5 |

|

1960 |

29 |

11.1 |

6.5 |

11 |

х |

13.3 |

|

1965 |

29.8 |

14.9 |

21.3 |

18.3 |

х |

15.8 |

|

1970 |

35.5 |

25.5 |

32.6 |

14.9 |

х |

14.6 |

|

1975 |

32.5 |

26.8 |

35.1 |

25.1 |

х |

16.9 |

|

1980 |

31.7 |

32.4 |

40.6 |

31.1 |

28.8 |

19.3 |

|

1985 |

27.7 |

28.8 |

42.2 |

29.8 |

29.4 |

20.7 |

|

1990 |

32.1 |

37.3 |

32.3 |

33 |

25 |

22.9 |

|

1995 |

27.9 |

37.3 |

33.4 |

43.6 |

33 |

24.4 |

|

2000 |

25.2 |

30 |

30.6 |

25.3 |

34.1 |

22.7 |

|

2005 |

23.3 |

28.9 |

21.3 |

20.5 |

42.2 |

30.4 |

|

2009 |

20.6 |

29.3 |

27.9 |

20.4 |

46.7 |

30.8 |

|

2010 |

20.5 |

28.6 |

25 |

20.3 |

46.1 |

29.5 |

|

Source: Ya. Mirkin [15]. |

||||||

for investment in advanced technologies. The subsequent expansion in the production of world marketable goods has led to an increase in income and savings, which have provided the basis for further investment. At the same time, inflation in these countries remained moderate, and in some periods prices even declined, despite the rapid growth of the money supply. Thus, during the period of particularly rapid growth in China (up to 10% of annual GDP growth), the money supply grew to 40% per year with falling prices for household appliances and other industrial goods.

Results and conclusions. Monetary policy creates conditions for economic growth and increases economic potential through credit expansion. Naturally, to implement it, the economy must have free resources; in order to get them in the production process, entrepreneurs attract loans. In the Russian economy, all the resources needed to expand production are abundant. Judging by the scale of refinancing compression by the Bank of Russia and the decline in production and investment that happened after the sharp increase in interest rates, the deficit of credit resources for expanding production to a potential level is about 14 trillion rubles. If this money will be used for lending to production growth, we can expect an increase in GDP growth to 10% in 2019–2021, while keeping inflation close to the target level of 4%.

In response to the global crisis that began in 2008, all developed and successfully developing countries started to pursue a policy of quantitative easing in order to maintain economic and investment activity; the policy was accompanied by a sharp increase in the monetary base with interest rates falling to zero. This allowed them to avoid the depression typical for such periods of structural crises of the economy that mediate the change of technological structures. At the same time, inflation remained low.

Among the top 20 countries Russia was the only country that responded to the crisis by tightening its monetary policy, which resulted in a stagflationary trap. The increase in interest rates and the contraction of credit led to a decline in output and an increase in production costs, as well as a sharp decline in investment, resulting in a decline in the competitiveness of the economy and the devaluation of the ruble; this was exacerbated by the manipulations of speculators after the exchange rate of the ruble moved to a free-float regime. As a result, an inflationary wave was formed, which could be extinguished only three years later by artificially compressing the demand at the cost of terminating the development of the economy and reducing people’s incomes. Some time after the crisis, Brazilian monetary authorities adopted such a policy with the same consequences; it resulted in an acute

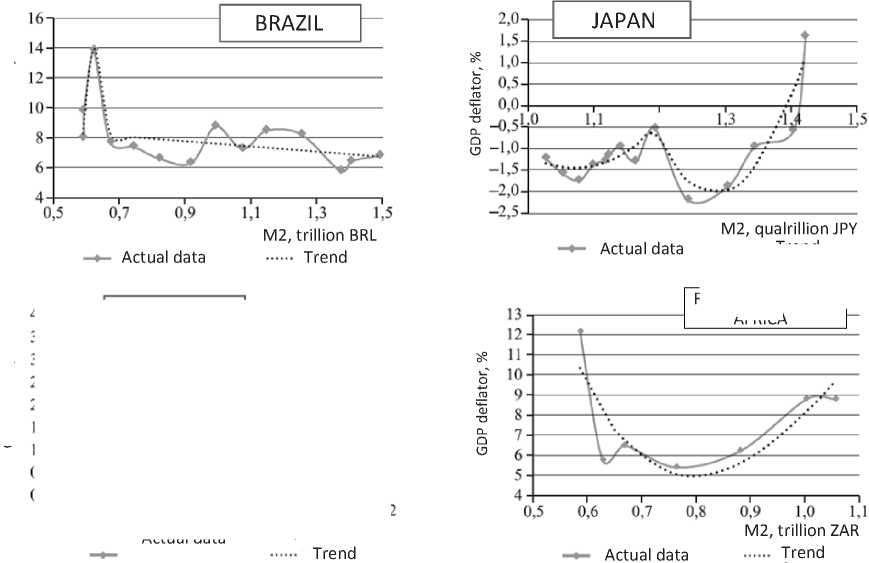

Figure 10. Dependence of GDP growth and inflation on monetization of the economy (averaging over 203 countries, 1992–2012)

Inflation, % GDP growth rate, %

Source: IMF [16, 17].

socio-political crisis accompanied by the impeachment of the head of state.

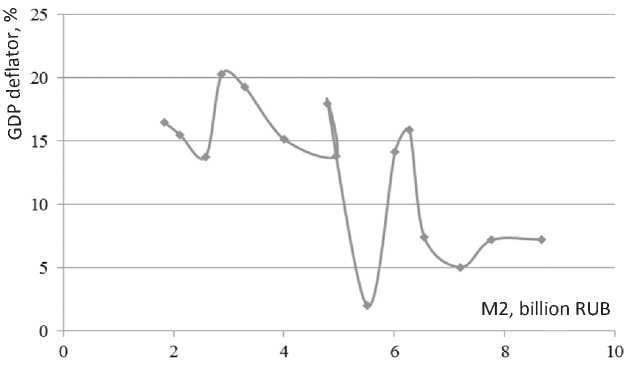

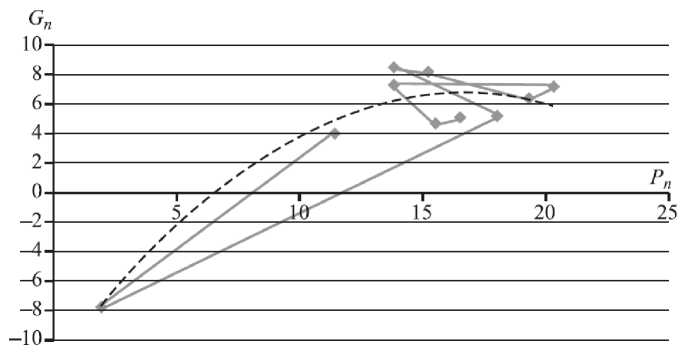

The authors of the Directions do not understand that inflation can grow not only with an increase in the money supply in the conditions of the full use of economic potential, but also with a decrease in the money supply in the real economic conditions. This happens when the costs increase and capacity utilization declines; it is followed by the devaluation of the national currency due to the decline in the competitiveness of the national economy caused by the reduction in the investment in its development. Statistical research on the relationship between the dynamics of the money supply and inflation [18] conducted in a large number of countries show that inflation can grow both with an increase and a decrease in the volume of the money supply (Fig. 11). This suggests that for each state of the economy there is an optimal level of monetization at which minimum inflation is achieved. It corresponds to the needs of the economy in lending for the purposes of its expanded reproduction within the existing resource constraints.

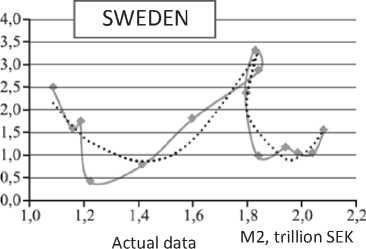

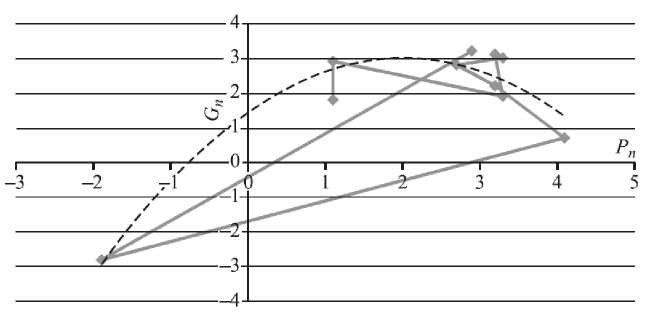

Contrary to the opinion of the authors of the Directions who think that reducing inflation to the target level automatically creates conditions for sustainable economic development, in fact, for each economic system there is a level of inflation at which the maximum rate of economic growth is achieved (Fig.12) .

It can depend on the efficiency of economic regulation, its technical level, competitiveness, and inflation expectations. Low inflation really makes it easier for business entities to plan investments and contributes to the accumulation of savings. However, if their volume is insufficient for expanded reproduction of the economy, there can be no economic growth.

There are many examples of countries with low inflation and low economic growth and, vice versa, there are many examples of countries with double digit inflation and high economic growth. At the same time, there is a fairly high inflationary background, which cannot be suppressed by monetary policy

-

Figure 11. Relationship between the rate of inflation and the volume of money supply in Russia and the world

A. Relationship between the rate of inflation and the volume of money supply in Russia, 2001–2015

B

between the rate of inflation and the volume of money supply in the world, 2001–2014

GDP deflator, % GDP deflator, %

Source: R. Nizhegorodtsev, N. Goridko [19].

Trend

Repiblic of SOUTH AFRICA

-

Figure 12. Quadratic dependency of the GDP growth rate on the inflation level in Russia and Canada

-

A. Quadratic dependency of the GDP growth rate on the inflation level in Russia, 2001–2010

-

B. Quadratic dependency of the GDP growth rate on the inflation level in Canada, 2001–2010

Source: R. Nizhegorodtsev, N. Goridko [20].

measures. Thus, high corruption in public administration is usually accompanied with high inflation. Increased credit emissions in the context of a corrupt public sector and weak currency control can lead to grown currency speculation and capital outflows. In this case, as Russian experience of the 2008 credit issue expansion shows, in order to save large banks that bought foreign currency at the expense of received loans from the Central Bank, the rise in money supply promotes inflation and does not boost investment and production. To achieve

-

transformation of loans into investment, it is necessary to monitor their use in terms of compliance with lending objectives and investment effectiveness.

Although the Directions authors argue that “to work out the forecast, the Bank of Russia uses a modern macroeconomic model” (p. 8), there are no references to the description of these models. It seems that these are standard econometric general equilibrium models that have long been rejected by the scientific community as inadequate to real economic dynamics and unsuitable for reliable forecasting. As the Directions authors are persistent in ignoring the fact of low production capacity utilization, most likely, they use models interpreting unemployment as an indicator of economy proximity to a hypothetical equilibrium level. Thus, all assessments of operational objectives and monetary policy tools can not be considered valid. They only reflect the authors’ subjective assessment, supported by the calculated primitive models that do not reflect a real situation, adjusting calculations to the desired results in order to give a scientific character of the argument.

Inadequacy of operational objectives and tools to advanced economic development goals. The targets economic growth laid out in the Directions are clearly not consistent with the RF President’s instruction to encourage breakthrough development of the country’s economy. Even under the optimistic scenario “the GDP growth rate in 2019 will be slightly higher than baseline scenario rates and amount to 1.5–2%” (p. 59). This is significantly lower than a projected 3.9% of the global average economic growth rate and more than threefold lower than in China and other Southeast Asian countries that become the world economy center.

As shown above, the fixed assets of Russian economy are loaded by 60%, and it has no growth restrictions on any production factor. The negative output gap is not less than 25%, and the potential economic growth rate is from 7 to 10% of the annual GDP growth for the period up to 2021, depending on the choice of a reproduction model – extensive or intensive.

The restrictive monetary policy, pursued by the Board of Directors of the Bank of Russia due to the subjective views on the Russian economy growth possibilities, hinders the fulfilment of the RF President’s objective to promote advanced development. It primarily caused the recession, followed by prolonged stagnation of the economy and growing decline of investment in fixed capital on the background of significantly increased production of investment goods since 2014. The annually observed 50% difference in growth rates of these indicators (p. 42) reveals that it is not objective restrictions on production factors enlargement, but restrictions on credit emissions artificially created by the Bank of Russia that became a key reason for hindering economical growth in Russia.

Unfortunately, the Directions do not include scientifically sound approaches to monetary policy implementation, though different from subjective perceptions of the Bank of Russia authorities, “The Bank of Russia considers two main scenarios of the medium-term economy development forecast: the baseline and the one with unchanged oil prices” (p.46).

According to the Directions, “growth in loans in the economy and then in money supply will correspond to the baseline scenario estimates, amounting to 8–12% in 2019 and 7–12% in the medium term” (p. 59); “in 2019–2021 the requirements to the economy and money supply will increase at the annual rate of 7–12%” (p. 54); “the growth rate of requirements to organizations in 2019–2021 will be 6–10%” (p. 55); “...the annual growth rate of gross fixed capital formation will amount to 3–3.5% in 2020 and 3.5–4.5% in 2021” (p.53).

This increase is to be achieved without a rise in loans from the Bank of Russia. The latter will remain a net borrower of the banking system, extorting 3–5 trillion rubles from it: “The Bank of Russia will continue to absorb excess funds through deposit auctions and coupon bonds” (p.17). Taking into account the Government stabilization funds, the monetary authorities withdraw 16–26 trillion rubles from the economy in different years of the forecast period. At the same time, we observe termination of commercial banks refinancing and special refinancing tools that finance loans to small and medium-sized businesses, preferential loans for non-resource export expansion and investment projects guaranteed by the Government, “As the availability of market funding increases, the Bank of Russia plans to continue implementing its exit strategy from the use of specialized refinancing tools” (p.49).

The monetary authorities’ net contribution to the Russian economy development corresponds to the amount of withdrawn money and is about 20 trillion rubles of the artificially reduced economic activity. We get a similar assessment by calculating the output gap between potential and actual GDP based on the load of key production factors. Compared to potential GDP growth, the Directions implementation will cause a 5% artificial slowdown of economic growth, which corresponds to 5 trillion rubles of nonproduced goods in the coming year and 18 trillion rubles in the next three years. At the same time, during the entire forecast period, investment in fixed assets remains below the level of 2014, when the Bank of Russia switched to the credit contraction policy. A steady 7-year decline in investment, with its volume remaining half of the 1990 level and clearly insufficient even for simple economic reproduction, will have disastrous consequences for Russia. A growing technological gap not only from the advanced, but also developing Asian countries will soon entail another round of ruble devaluation and a new inflationary wave [21]. Within the framework of the principles laid down by the Directions, the monetary authorities will respond to this with a new cycle of tightening monetary policy with the same negative consequences: a fall in economic activity and population’s income. The Directions doom Russia to slide down a spiral tapering of reproduction due to a built-in negative feedback: raised interest rates – credit contraction – fall in investment – technological degradation of the economy – reduction in its competitiveness – ruble devaluation – inflation – raised interest rates... Along with that longterm negative feedback between monetary policy and economic development there is a short-term negative relationship: rise in interest rates – credit contraction – reduction in working capital of enterprises – decline in production – decrease in revenues – reduction in demand – fall in production – rise in costs – increase in inflation – increase in interest rates.

Adjustment of the Directions in accordance with the rapid economical development objectives. The transition to a monetary policy focused on investment growth and advanced economic development is necessary to break the vicious circle of shrinking reproduction and Russian economy degradation. According to scientifically proved recommendations, based on knowledge of economic development laws and real opportunities for production growth in Russia, it should provide for a targeted increase in loans to finance investment in promising development areas of the Russian economy in the amount of at least 10 trillion rubles a year. The provision of these funds to economic entities should be carried out in the format of private-public partnership through special investment contracts in accordance with strategic and indicative plans for social and economic development stipulated by the Federal law “On strategic planning in the Russian Federation” (June 28, 2014, No. 172-FZ). The intended use of this money can be monitored with the help of modern digital technologies that control its circulation through cryptographic means and blockchain.

Список литературы Potential opportunities for the growth of the Russian economy and the monetary policy of the bank of Russia

- On national goals and strategic objectives of Russia’s development up to 2024. Presidential Decree no. 204, dated 07.05.2018.

- Schumpeter J. Teoriya ekonomicheskogo razvitiya . Moscow: Progress, 1982.

- Glaz’ev S.Yu. The discovery of regularities of change of technological orders in Central Economics and Mathematics Institute of the Soviet Academy of Sciences. Ekonomika i matematicheskie metody=Economics and the Mathematical Methods, 2018, no. 3, pp. 17-30..

- Ershov M.V. Growth opportunities amid monetary failures in Russia and economic bubbles in the world. Voprosy ekonomiki=Voprosy Ekonomiki, 2015, no. 12, pp. 32-50..

- Ershov M.V. Russia and the world: How sustainable is economic growth? Risks and barriers. Voprosy ekonomiki=Voprosy Ekonomiki, 2017, no. 12, pp. 63-80..

- Basic areas of single state monetary policy for 2019 and 2020-2021. Project dated 01.10.18. Central Bank of Russia. Moscow, 2018. Available at: http://www.cbr.ru/Content/Document/File/48125/on_2019(2020-2021).pdf

- Sukharev O.S. Economic growth of the rapidly changing economy: theoretical aspect. Ekonomika regiona=Region’s Economy, 2016, vol. 12, no. 2, pp. 359-370..

- Glaz’ev S.Yu. On a new paradigm in the political economy. Ekonomicheskaya nauka sovremennoi Rossii=Economics of Contemporary Russia, 2016, no. 3, pp. 7-17, no. 4, pp. 10-22.

- Glaz’ev S.Yu., Gorid’ko N.P., Nizhegorodtsev R.M. The critics of Irving Fisher’s formula and some illusions about contemporary monetary policy. Ekonomika i matematicheskie metody=Economics and Mathematical Methods, 2016, vol. 52, no. 4, pp. 3-23..

- Strukturno-investitsionnaya politika v tselyakh obespecheniya ekonomicheskogo rosta v Rossii . Moscow: Nauchnyi konsul’tant, 2017. 195 p.

- Blinov S. Real’nye den’gi i ekonomicheskii rost . Available at: https://mpra.ub.uni-muenchen.de/67256/1/MPRA_paper_67256.pdf..

- Russian Federation: 2015. Article 4. Consultation IMF Staff Country Report no. 15/211.

- Crozet M., Hinz J. Collateral Damage: The impact of the Russia Sanctions on Sanctioning Countries` Exports. Research and Expertise on the World Economy. CEPII Working Paper. 2016-16-June.

- Obstfeld M., Shambaugh J., Taylor A. Monetary Sovereignty, Exchange Rates, and Capital Controls: The Trilemma in the Interwar Period. IMF Staff Papers, 2004, special issue, vol. 51.

- Ya.M. Mirkin (Ed.). Finansovye rynki Evrazii: ustroistvo, dinamika, budushchee . Moscow: Magistr, 2017.

- Global Financial Stability Report, April 2018: A Bumpy Road Ahead. USA: International Monetary Fund. DOI: https://doi.org/10.5089/9781484338292.082. Available at: https://www.elibrary.imf.org/view/IMF082/24893-9781484338292/24893-9781484338292/24893-9781484338292.xml

- Adrian T., Laxton D., Obstfeld M. Advancing the Frontiers of Monetary Policy. USA: International Monetary Fund, 2018. DOI: https://doi.org/10.5089/9781484325940.071. Available at: https://www.elibrary.imf.org/view/IMF071/24708-9781484325940/24708-9781484325940/24708-9781484325940.xml

- Ilyin V.A., Morev M.V. The disturbing future of 2024. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2018, vol. 11, no. 3, pp. 3-24. DOI: 10.15838/esc.2018.3.57.1.

- Goridko N.P., Nizhegorodtsev R.M. Elaborating of long-run lag regressional models of Cobb-Douglas type. Problemy upravleniya=Control Sciences, 2012, no. 3, pp. 55-63..

- Goridko N.P., Nizhegorodtsev R.M. Sovremennyy ekonomicheskiy rost. Teoriya i regressionnyy analiz . Moscow: Infra-M Publ., 2016. 343 p. DOI: 10.1237/7711..

- Dementyev V.E. Structural factors of technological development. Ekonomika i matematicheskie metody=Economics and Mathematical Methods, 2013, no. 49 (4), pp. 33-46.