Problems of application of IFRS in Russia

Автор: Esenova Alana

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 1 (20), 2016 года.

Бесплатный доступ

Application of IFRS in Russia contribute improving accounting information system in order to manage economic activity with using specific methods forming data predictable character in financial statement. Meanwhile problems of application IFRS in Russia quite substantial, that represented and considered in this article.

Ifrs, problems, financial statement, changes

Короткий адрес: https://sciup.org/140115741

IDR: 140115741

Текст научной статьи Problems of application of IFRS in Russia

Reforming of accounting and financial statement in the Russian Federation connected with changes in economic relationship. International Financial Reporting Standards (IFRS) is the core of this reforming [2, p. 3].

In the 5 of December 2011 was singed order of the Ministry of the Russian Federation, registration number 160N “Impose in action International Financial Reporting Standards and interpretation International Financial Reporting Standards on the Russian Federation’s territory” dated by the 25th November 2011 [1].

The order was published in accounting journal. It consolidates standards and gives explanations of IFRS, which adopted in the Russian Federation. However, not all companies have positive relation to transition on IFRS. Most of companies are not prepared to this transition.

One of the most major problems for adaptation IFRS in the mass – is the human resources problem. IFRS is more complicated than Russian Accounting Standards, that’s why it required more professional knowledge. Despite many universities providing IFRS preparation programs, but there is no systemized approach to education in this area. Also, the number of qualified specialists, which can consult companies, is not enough in Russia. Additionally these specialists are cost expensive, and not every organization can hire them (Pic. 1).

IFRS with IFRS IFRS IFRS

Picture 1 – Average wages of specialists with IFRS (data of investigation of Moscow human resources market dated by the 1th April 2014) [6, p. 129]

Another reason is the undeveloped legal base for adopting IFRS. Certification of IFRS auditors does not exist in Russia, that’s why this problem must be decided too.

One of the requirements, which are made to financial statement, is operational efficiency of providing information. Unfortunately, preparation of financial statement according International Financial Reporting Strands is a very long process for most of Russian companies, because of that accounting information loses actuality. This problem can be solving by automatization accounting operations. Most of companies prepare financial statement using, for instance, MS Excel. They import data in MS Excel and adjust financial information according IFRS there. Implementation system of parallel accounting in companies solve problem of laboriousness.

Necessity of IFRS has objective reasons. One of the main reasons of transition on IFRS is possibility of the access to world markets. Nevertheless, this is more suitable for huge companies, while interest of other companies different. Application of IFRS can provide information to management of companies, which gives opportunity to increase efficiency of management, and help connected with shareholders more competently.

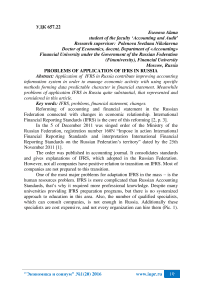

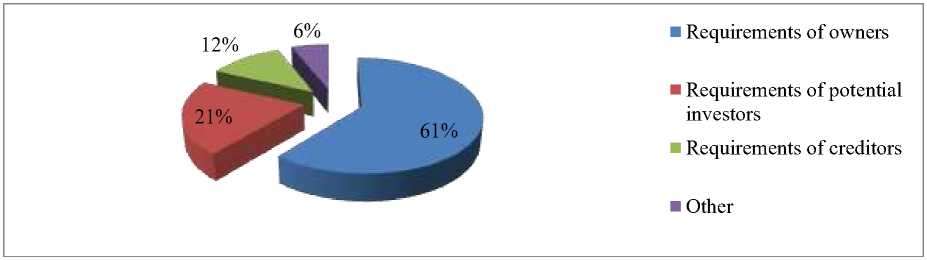

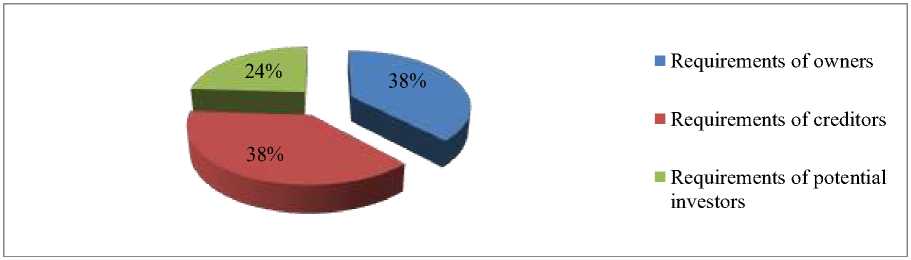

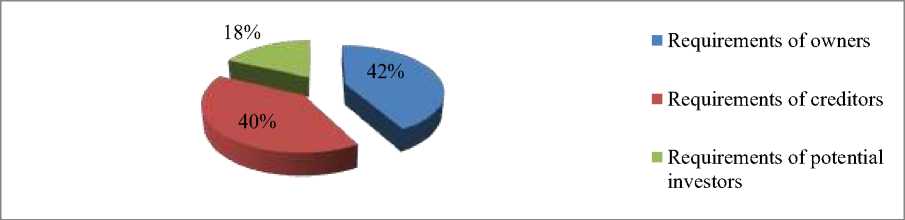

To represent reasons of application IFRS by Russian companies (depending on revenue), show series of pie chart below (Pic. 2-5, p. 4-5) [3, p. 68]. Analysis of this charts allow to make a conclusion that the most often causes to application of IFRS is requirement of owners of organization.

Preparation and transformation of financial statement according IFRS are necessary for companies, which shares are traded in American or European stock markets or for companies which have foreign organizations among their founders.

Picture 2 – Causes application of IFRS in companies with revenue up to the 3 bl. Rub.

This way, transformation of financial statement according IFRS is necessary condition for existing of profitable international activity. Also, it contributes for integration of Russian companies in world economic society.

Financial statement, prepared according IFRS, gives investors and other stakeholder’s reliable and understandable information about the company. This is decrease indeterminacy and risk, that’s why company became more competitive in certain market segment. Moreover, IFRS financial statement is free from convention and limitation, like legal, which have Russian Accounting Standards [7, p. 67]. Importance of preparation and publication of financial statement according IFRS become more actually in conditional of economic crisis. Operation a preparation of financial statement allows valuing real

Picture 3 – Causes application of IFRS in companies with revenue between 3 and 6 bl. Rub.

Picture 4 – Causes application of IFRS in companies with revenue between 6 and 15 bl. Rub.

Picture 5 – Causes application of IFRS in companies with revenue over 15 bl. Rub.

situation in company and taking correct anti-crisis actions. Players of market, which don’t do this, can be considered as companies that have financial difficulties.

Nowadays there are favorable conditions for further development of accounting in the Russian Federation. Society understands necessity of adopting IFRS more quickly. Therefore, the establishment of IFRS is economic necessity, because for developing of financial markets require financial statement.

Список литературы Problems of application of IFRS in Russia

- Приказ Минфина России от 25.11.2011 N 160н (в ред. от 21.01.2015 №9н) "О введении в действие Международных стандартов финансовой отчетности и Разъяснений Международных стандартов финансовой отчетности на территории Российской Федерации" //http://www.consultant.ru/document/cons_doc_LAW_122870.

- Агеева О.А. Международные стандарты финансовой отчетности: Учебное пособие. М.: Бухгалтерский учет, 2013. -447 c.

- Дмитриева И.А., Горлова Н.А. Перспективы развития бухгалтерской (финансовой) отчетности по МСФО//Актуальные вопросы экономических наук. 2014. № 37. С. 168 -172.

- Миславская Н.А., Поленова С.Н. Международные стандарты учета и финансовой отчетности: учебник. М.: Дашков и К, 2012. 372 с.

- Поленова С.Н. Проблемы перехода российских организаций на МСФО//Международный бухгалтерский учет. 2008. № 9. С. 9 -17.

- Сулейманов З.З. Некоторые проблемы перехода предприятий на международные стандарты финансовой отчетности//Вестник Башкирского государственного аграрного университета. 2014. № 3. С. 129 -132.

- Шишова Л.И. Трансформация финансовой отчетности в соответствии с требования МСФО//Вестник Волжского университета им. В.Н. Татищева. 2014. № 1 (30). С. 67 -74.