Problems of improvement of debitor debt analysis

Автор: Xolmirzaev U.A., Juraev E.S.

Журнал: Мировая наука @science-j

Рубрика: Основной раздел

Статья в выпуске: 1 (34), 2020 года.

Бесплатный доступ

Problems on developing of analysis of turnover of receivables in entities activities have been expounded in this article. Important suggestions on determination tools of circulating period of debtors have been given. Embed of developed tools are increased accuracy of the results of the analysis.

Debtors, analysis of debtors, circulating quantity of debtors, circulating period of debtors, net sales proceeds, net sales revenue

Короткий адрес: https://sciup.org/140289172

IDR: 140289172 | УДК: 338

Текст научной статьи Problems of improvement of debitor debt analysis

The efficiency of business performance in business entities is largely dependent on the rapid implementation of capital turnover. The capital turnover is achieved by the fact that assets and labor costs that are necessary to operate in a given period exceed the costs of supply, production, sales and treatment, which is greater than the profit earned. The faster and more frequent this process is, the better the effect. It should be noted that the role of each stage in the capital turnover is crucial. This is because one of the bases for ensuring sustainable development of business activities is the fact that the final product is the most liquid financial asset. In this regard, “further improvement of monetary policy using instruments used in the best international practice” is an urgent task for each subject[1].

Receivables are also a type of economic activity that occurs when the finished product is converted into cash. It occurs in the order of deferral of payment for the goods sold within the agreed time, not the date of exchange. Consequently, the payment for the goods sold to the manufacturer (in whole or in part) will be paid off in full within the timeframe agreed by the buyer. This is one of the most important types of treatment that often leads to an insufficient cash flow for businesses to maintain the capital flow continuously. For this reason, accounts receivable is a matter that should be widely studied in business.

Literature analysis. The literature on accounting and economic analysis is sufficiently covered to analyze accounts receivable turnover. However, a review of relevant literature shows that they also have different approaches to the analysis of accounts receivable turnover. The views expressed in the literature on the analysis of accounts receivable turnover can be conventionally divided into two major groups.

First. Views of scientists and experts from the CIS.

The second. Approaches to Scientists and Specialists in Developing Countries

-

1. Scientists of the Republic M.Yu.Rahimov, N.N. Kalandarova [4, pp. 455], M.K. Pardaev, J.I. Isroilov, BIIsroilov [5, p. 414], ZA Sagdillaeva, IH Choriev, A. Makhmudov [6, p. 237], Russian scientists L. Dontsova, NA Nikiforova [7, p. 272], M.A. According to Vahrushina, NSPlaskova [8, p. 91] and other experts,

the analysis of accounts receivable in economic entities shows the use of net income from sales of goods for the reporting period and the average of total receivables. In our opinion, net profit from the sale of goods in this manner is expressed in the same way as the volume of sales or profit. However, in practical business, these concepts have significant differences between each other, both in content and in the source of information. The difference between large and medium-sized enterprises is particularly noticeable at the end of the reporting period (except for a few exceptions).

In addition, the use of aggregate debt receivables does not in itself determine the speed and timing of this type of debt by commercial or non-commercial circumstances.

The above circumstances adversely affect the accuracy of all calculations, based on or based on indicators that reflect the accounts receivable turnover.

US scholars Lavrence Revsin, Daniel W. Collins, W. Bruce Johnson [9, p. 335], Donald E. Kieso, J. Weygandt, Terry D. Warfield [10, p. 338] receipts from sales and receivables.

In this case, when calculating the accounts receivable, net income from the sale of the product is ignored. The results of the research show that the volume of sales or profit from sales is not always the same as net sales.

The use of only commercial accounts receivable indices can lead to ignoring the turnover of total receivables and non-commercial receivables.

In this article, we would like to express our views on the specifics of the issue under consideration and their further improvement.

Analysis and Results. In the current economic relations, accounts receivable in the activities of business entities are the result of subjective reality and increasingly become an integral part of business activities. For example, Articles 210 to 310 of the Current Assets section of the current account balance sheet (Form 1) reflect only accounts receivable. Balance Sheet also contains items on accounts receivable from economic entities in developed countries. As can be seen, the changes in accounts receivable, their contents, information about them, and information changes are crucial for understanding the activities of economic entities and making sound business decisions.

In order to analyze accounts receivable in the accounting system, it is first necessary to determine its structure correctly. At the same time, it is necessary to have a sound system of accounts receivable analysis. If you look at their foreign experience, they have a system that is in line with international standards and is working well.

Taking into account the transition to financial reporting in the country in the near future, there are, of course, foreign methods that have been tested, accumulated and practiced for the national accounting system. The current international experience can be effectively used in the national accounting system.

However, in order to use or be prepared for similar methods, we need to study existing international practices in more detail. This requires the following tasks:

-

1. Formation and submission of financial statements in the national

-

2. Adjustment of methods used by business entities in developed

accounting system to international financial reporting standards.

countries to our own accounting system, taking into account the specifics of existing relations in the national economy.

Publication of financial information in the form of international requirements is essential for facilitating and facilitating the process of thinking, understanding and communicating with each other based on the same concepts as foreign partners.

There are also some issues that need to be addressed in the analysis of accounts receivable, and the timely resolution of these issues will help ensure that the information and information obtained from the accounting system is objective. It also provides valid information that is critical to business decision making. For this reason, it is advisable to revise accounts receivable and the indices that reflect the period, as well as the information used to meet them.

It is well known that in many CIS and domestic literature, it is recommended to determine the number of accounts receivables:

Д қа = С ст / Д қў (1)

Here it is: Д қа – number of accounts receivable turnover;

С ст - net proceeds from the sale;

Д қў – average of accounts receivable.

Determining the period of debt receivables is as follows:

Д қад = (Д қў * 360) / С ст (2)

Бу ерда: Д қад – accounts payable period, daily.

The data in the formulas contained in Formulas 2 in this Form 1 are obtained from the current Financial Statements Form 1, “Balance Sheet” and Form 2 “Financial Results Report”.

At first glance, these two formulas seem to have no flaws. However, when we look at the actual content of each used data, we can see a serious problem. The fact that these problems are not resolved means that there are significant shortcomings in this calculation procedure.

Note that both of the above formulas use net sales (С ст ) data. This information is obtained from line 010 of the current Financial Statement Form 2 of the Report on Financial Results: "Net Profit from Sales of Products (Goods, Works and Services)". Now we will focus on the instructions in the official sources for this line.

The first official source is the “Net proceeds from the sale of goods (goods, works and services)” (line 010) with the proceeds from the sale of goods, goods, works and services, including taxes (value-added tax, excise tax) and returned goods. discount of the finished product, discount of the buyer.

Line 010 is filled with information from the main activities (9000).

Enterprises whose primary activity is to lease property under line 010, reflect the amount of revenue attributable to the current reporting period.

Line 010 instructs that the intermediaries reflect the amount of commissions.[2]

In the second official source, "Accounting for Income" (9000) - summarizing information on sales of finished goods, goods, works and services, as well as returns, sales and price discounts:

9010 “ Income from sale of finished products”;

9020 “ Income from sale of goods”;

9030 “ Income from work and service provision”;

9040 “ Return of goods sold”;

9050 “ Discounts to buyers and customers”, The instruction is written.[3]

It is worth noting that the revenue from the sale of the product with the net proceeds from the sale of the two official sources is the same. Is it really so?

From the practical experience we can say that if the money payable for the goods sold goes to the economic accounts of the business entity and is certified by the relevant documents, then the proceeds are referred to as gross sales. Taxes on gross sales proceeds (value-added tax, excise tax), as well as the value of returned goods and finished goods, after deduction (if any) of the buyer, are called net sales.

Revenue from the sale of finished goods is the value of the sale of goods, which is considered to be realized on the basis of the principle of accounting in an economic entity, in the presence of the relevant documents. Sales revenue does not include sales taxes (value-added tax, excise tax), and the value of returned goods and finished goods, with no discounts on the sale price of the buyer. Recognition or recognition of this indicator does not depend on when and in what order the cash flows are to be paid for the goods sold.

From the above it is clear that the concept of net proceeds from the sale of the product and the income from the sale of the finished product does not have the same meaning (except for some cases).

It is worth noting that the economic transactions that are considered are quite complex. If the entity sells goods for the amount of 100 million sums in the reporting period, or the payment for the goods is made in advance or in time, then the net proceeds from the sale of the product and the revenue from the sale of the finished product are in line with each other. Both concepts can be used to address different issues in the same context.

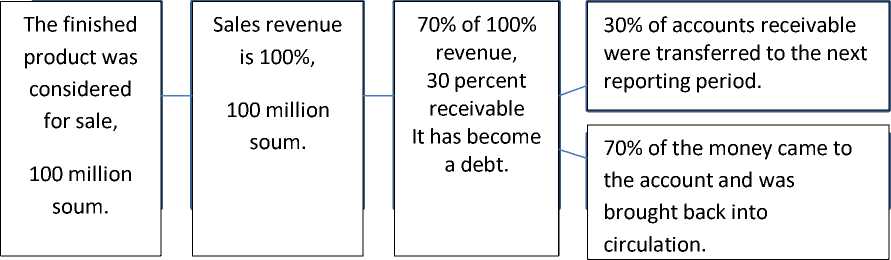

However, if the entity sells goods worth 100 million soums in the reporting period, 70 million soums paid for the sale and 30 million soums as receivables in the reporting period, then the net proceeds from the sale of the finished product and the proceeds from the sale of the finished product are consistent. does not come. Because both concepts differ in quantity. The reporting period alone is not enough to make them equal. Both concepts cannot be used to solve different problems in the same context. Even if this happens, the results of the calculations or analysis will not be correct.

The solution to this problem can be seen in the picture below.

Figure 1. In the reporting period, the profitability index of the finished product and the cash flow of the product.

As you can see from the figure, although the profitability index of the finished product is 100% sold, in fact, 70% of it has actually become cash during the reporting period and will be resumed at the beginning of the next reporting period. It is well-known that the availability of sufficient funds in the business of a business is one of the main conditions for a continuous and consistent capital turnover, solvency and financial stability. You can see that 30% of debtor's debt is being repaid over 360 days, but not more.

If we consider this with the above data, the following will not occur.

-

1. Case in which an indicator of sales of finished goods is used.

-

2. The situation with the use of the sales revenue for the reporting period.

-

3. In our opinion, the situation with the use of the sales revenue for the reporting period is a positive result. This account is based on the receipt of the book. An important consideration in the analysis is the reduction of the difference of 1 (3,3-2,3). The purpose of the analysis is to identify each factor that makes a difference, calculate its effect on the difference value, and develop specific proposals.

100 / 30 = 3,3

Thus, in the reporting period accounts receivable became 3.3 times. (The average amount of accounts receivable would have to be deducted from this account. However, the average amount of accounts receivable would be close to that amount. Therefore, 30 million sums were contingent).

70 / 30 = 2,3

In the reporting period, accounts receivable became 2.3 times.

Conclusion.

Based on the foregoing considerations, we summarize the following conclusions on improving the analysis of accounts receivable and make our recommendations in this regard.

Debtors' items that are included in the Current Assets section in the Balance Sheet form should be developed in accordance with international financial reporting standards and best practices in developed countries.

Revision of the information presented in the financial statements on the basis of new approaches in the national economy and international accounting practices will serve as an important step in addressing these issues on a timely basis.

Attachment No.1 to the Order of the Ministry of Finance of the Republic of Uzbekistan dated December 27, 2002 No. 140: Form 2 of the Financial Statement Revenue ” This will ensure the integrity of the form and content of the information and increase transparency. The analysis of accounts receivable turnover in the national accounting system increases the accuracy of the results.

The implementation of the proposed procedure will be another important step in integrating national accounting systems with international methods.

Список литературы Problems of improvement of debitor debt analysis

- Ўзбекистон Республикаси Президентининг 2017 йил 7 февралдаги ПФ-4947-сонли Фармонига 1-ИЛОВА "2017-2021 йилларда Ўзбекистон Республикасини ривожлантиришнинг бешта устувор йўналиши бўйича ҳаракатлар стратегияси"

- Ўзбекистон Республикаси Молия вазирлигининг 2002 йил 27 декабрдаги 140-сонли буйруғига 1-сонли илова: "Молиявий ҳисобот шаклларини тўлдириш бўйича қоидалар"

- 21-Бухгалтерия Ҳисобининг Миллий Стандарти.

- Рахимов М.Ю., Қаландарова Н.Н. Молиявий таҳлил. Дарслик.-T.; "Iqtisod-Moliya", 2019. -736 б.

- Пардаев М.К.,Исроилов Ж.И., Исроилов Б.И. Ўқув қўлланма.-Т.; 2017.534 б.