Problems related to regional budgeting amid fiscal consolidation

Автор: Povarova Anna I.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 2 (56) т.11, 2018 года.

Бесплатный доступ

The development of the major financial plan of the Vologda Oblast for 2018-2020 was carried out amid stagnating GRP growth rates, a sharp decline in investment activity, further decrease in population's real money incomes. In this regard, conceptual approaches to budgeting, which should be determined in view of its orientation on providing conditions for future sustainable development, is becoming more relevant. However, according to the study, the concept of a new financial cycle is based on fiscal consolidation, which is reflected in extremely low average annual growth rates of own revenues and budget expenditure which do not compensate for inflation. Such approaches to regional budgeting are predetermined by federal guidelines, which absolutize the principle of achieving surplus at the cost of reducing the funding of the territory's future development. Year after year, the opportunities of using budget as a tool for triggering the investment policy are being missed...

Budget planning, regional budget, fiscal consolidation, budget surplus, own revenues, expenditure, debt load, inter-budget policy

Короткий адрес: https://sciup.org/147224031

IDR: 147224031 | УДК: 336.143(470.12) | DOI: 10.15838/esc.2018.2.56.7

Текст научной статьи Problems related to regional budgeting amid fiscal consolidation

Regional budgets are an important tool of the state’s economic policy. During market reforms carried out in Russia since 1991, a significant part of regulatory functions for socio-economic processes has been incorporated from federal into sub-federal government bodies, thereby increasing the role of regional budgets. From 2000 to 2016, their level increased thirteen times – from 0.7 trillion to 9.4 trillion rubles. The share of regional budgets accounts for about 40% of the country’s budget resources. These budgets fund 70% of housing, utilities and healthcare, 60% of education and agriculture, and 50% of road maintenance costs.

Drafting the regional budget is the first stage of the budget process; its quality determines the stability of its implementation. The importance of proper preparation of draft budgets is demonstrated by the principle of budget reliability enshrined in the budget legislation, which provides for the reliability of indicators of territory’s socio-economic development and realistic calculation of budget revenues and expenditure1.

It is important to recognize that, despite the existing fundamental works in the research of the budget system, the issues of budgeting, especially at the regional level, in the domestic economic literature are only partly covered. The authors mainly consider the problems related to the functioning of the federal budget and inter-budgetary relations between the federation and its constituent entities.

At the same time, the issue of the primacy of budgeting revenues or expenditure is quite debatable. Thus, for example, the founder of financial law, a French scientist P.M. Gaude-met, noted that “the dependence of public expenditure on opportunities determined by available resources is, in fact, the principle of sheer prudence” [1].

The Russian classical economist I.T. Tarasov expressed another opinion: “The state economy is dominated by needs which must necessarily be satisfied, therefore it is more correct to first identify these needs and then specify the means to satisfy them” [2].

When assessing the draft federal budget for 2018–2020, scholars at the Institute of Economics of the Russian Academy of Sciences conclude that a significant difference between growing budget revenues and expenditure in favor of the former is the main concept of the state budget policy – using both income growth and saving to reduce budget deficit rather than ensure development [3].

The researchers of the Vologda Research Center of the Russian academy of Sciences (VolRC RAS) have the same opinion. In our opinion, one of the system errors of the budget policy currently pursued by the Russian government is the prevalence of budget revenues over expenditure, which determines the limitation of public expenditures to the amount of income generated regardless of the economic level. This approach does not ensure proper use of expenditure as a tool to address development objectives and influences them [4].

The issues of regional budgeting, particularly the budget of the Vologda Oblast, are the research subject of scholars at VolRC RAS. Since 2009, annual expert examinations of draft regional budgets are held, which sets the framework for a series of research publications. Works prepared by the staff of the Center note the following flaws in the budgeting process:

V absence of a system of indicative planning reducing the quality of budget administration management (in 2014–2016, annual average amount of undeveloped funds in the regional budget amounted to about 2 billion rubles);

V untimely distribution and transfer of grant aids to the regions from the federal budget, entailing a significant underdeclaration of revenues at the stage of regional budgeting and complicating the solution of the main objective of the budget policy – ensuring macroeconomic stability (in 2014– 2016, the regional budget revenues forecast error in the Vologda Oblast was on average more than 4 billion rubles, or 10%);

V absence of mechanisms for influencing the relations with major corporate taxpayers, whose tax administration is located within remote interregional offices, leaving financial results of large companies beyond the reach of regional authorities, which is reflected in full involvement in budget revenues planning (for example, the Government of the Vologda Oblast does not consider the budget revenuegenerating enterprise Severstal as a major catalyst for financial resources of the region’s economy and does not include its returns in the socio-economic development forecast, and the draft budget is based on Severstal revenues not supported by any economic justification).

Thus, one of the urgent objectives of the budget policy is the development of a budgeting mechanism for the Russian Federation that would provide regional authorities with legislative initiatives and greater budgeting transparency. Nevertheless, the basic elements of income and expenditure of Russia’s constituent entities are determined by federal legislation, leaving regions in a narrow space for maneuvers [5].

This article continues the series of VolRC RAS publications devoted to regional budgeting of the Vologda Oblast. In this paper, we do not claim to develop the theoretical and methodological framework for regional budgeting. The main purpose for the study is to consider the scientific and practical aspects and analyze budget parameters, as well as assess its role in the socio-economic development of the region in 2018–2020.

The theoretical framework of the research consists of works of domestic and foreign economists in public finance. The research uses legislative acts of the Russian Federation, Presidential decrees, legislative and subordinate normative acts of the Vologda Oblast and the constituent entities of the North-Western Federal District of the Russian Federation (NWFD), as well as periodical publications.

The information and statistical framework of the research includes reporting data of Rosstat, the Ministry of Finance of the Russian Federation, the Ministry of Economic Development of the Russian Federation, the Federal Tax Service, the Federal Treasury, the Department of Strategic Planning and the Department of Finance of the Vologda Oblast.

According to the standards of the budget legislation, the socio-economic development forecast of the region for 2018–2020 prepared on the basis of scenario conditions and forecast of socio-economic development of the Russian Federation, served as a framework for regional budget planning in the Vologda Oblast. The regional budget was designed according to the basic version of forecast parameters ( Tab. 1 ).

Table 1. Main indicators of socio-economic development forecast in the Vologda Oblast in 2018–2020, in comparable prices, % to the previous year

Indicators Fact Forecast Average for 2018–2020 Average for 2018– 2020 in Russia 2016 2017 2018 2019 2020 GRP 100.1 100.1 102.1 100.9 100.7 101.2 (GDP) 102.2 Industrial production 99.8 101.0 101.8 101.2 100.9 101.3 102.5 Fixed investment 128.4 108.3 100.2 100.0 100.1 100.1 105.3 Retail turnover 95.6 104.5 101.4 100.7 100.5 100.9 102.7 Real wages 99.8 103.0 101.6 100.4 100.1 100.7 102.3 Real monetary income of the population 100.9 98.3 101.2 100.2 100.2 100.5 101.5 Sources: Rosstat data; Socio-economic development forecast of the Russian Federation for 2018 and for the planning period of 2019 and 2020. Available at: ; On the socio-economic development forecast of the Vologda Oblast for a mediumterm period 2018–2020: Vologda Oblast Government Decree no. 961, dated 30.10.2017; author’s calculations.

The Government of the Vologda Oblast states that this option is based on progressive rates of economic growth and preservation of favorable investment climate, which is clearly overestimated.

First, the annual GRP growth rate constituting 1.2% give grounds to recognize the stagnating economic growth.

Second, the baseline forecast scenario does not contain investment development impulses: virtually zero average annual investment growth rates reflect the unsatisfactory state of the business environment and the ability of authorities and the corporate sector to fund investments.

Thirdly, tense retail turnover performance, real monetary incomes of the population and real wages do not give reason to expect a rapid recovery of domestic consumer demand and increase its contribution to the rise of the regional economy.

The fact that all macroeconomic indicators included in the socio-economic development forecast in the Vologda Oblast are several times lower than the national average is noteworthy.

Sluggish economic growth amid investment deficit inevitably affected the performance of regional budget revenues ( Tab. 2 ).

In the planned period, the total budget revenues will demonstrate a downward trend, while in real terms they will be reduced by 7.5 billion rubles, or 11% to the level of 2017.

The forecast of non-repayable financial aid in the form of transfers from the federal budget demonstrates the overall unfavorable trends in Russia2: its amount in both nominal and real terms will have decreased by a third. This situation only in the case of one territory means nothing more than shifting of financing federal budget deficit to the regional level.

With limited support from the federal center, regional budget will need to significantly increase its own budget revenues. It is planned that absolute tax and non-tax (hereinafter – own) budget revenues will increase by 3%, but inflationary depreciation will be 7%, which does not give reason to expect a significant replenishment of its own resources.

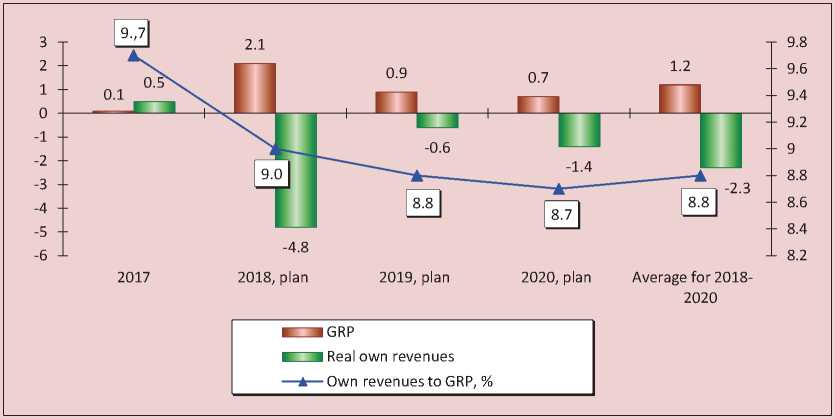

In the planned period, the average annual growth of own revenues will lag behind GRP growth rates. Moreover, a reduction in own budget sources against GRP is expected from 9.7% in 2017 to 8.7% in 2020 ( Fig. 1 ). Such performance demonstrates low efficiency of the economic and budgetary policy and lack of growth points in the future.

Table 2. Regional budget revenues in the Vologda Oblast in 2017–2020

|

Revenues |

2017, actual |

2018, plan |

2019, plan |

2020, plan |

2020 to 2017, % |

|||

|

Mln RUB |

To 2017, % |

Mln RUB |

To 2018, % |

Mln RUB |

To 2019, % |

|||

|

Total |

60134 |

57946 |

96.4 |

57442 |

99.1 |

58849 |

102.4 |

97.9 |

|

In real terms* |

66268 |

62582 |

94.4 |

59740 |

95.5 |

58849 |

98.5 |

88.7 |

|

Tax and non-tax |

50598 |

49168 |

97.2 |

50750 |

103.2 |

52050 |

102.6 |

102.9 |

|

In real terms* |

55759 |

53101 |

95.2 |

52780 |

99.4 |

52050 |

98.6 |

93.3 |

|

Inter-budget transfers |

9536 |

8778 |

92.1 |

6692 |

76.2 |

6798 |

101.6 |

71.3 |

|

In real terms* |

10509 |

9480 |

90.2 |

6960 |

73.4 |

6798 |

97.7 |

64.7 |

* In this article, all real budget indices are calculated in the prices of 2020.

Sources: hereinafter, the actual data on budget performance are given from the reporting of the Federal Treasury, planned data – from the Law of the Vologda Oblast no. 4261-OZ “On the regional budget for 2018 and the planning period of 2019 and 2020”, dated 15.12.2017.

Figure 1. GRP and regional budget own revenue growth rates in the Vologda Oblast in 2017–2020, %

The structure of tax revenues of the regional budget will undergo some changes related to the transformation of profile taxes: income tax will move from the first to the third position, and the role of property taxes will increase. In total, property payments and personal income tax (PIT) will generate about 60% of tax revenues ( Tab. 3 ). Thus, the structure of the taxable base of the regional budget is becoming more flexible, which is important because compared with income tax, property taxes and personal income tax have a higher cycle resistance.

Particular attention should be paid to the planning of income tax revenues. Again, we have to make a claim due to lack of justification for why the income forecast does not include the indices of two major taxpayers of the Vologda Oblast – PAO Severstal and AO Apatit3, and income tax revenues are projected

Table 3. Structure of tax revenues of the regional budget of the Vologda Oblast in 2017–2020

|

Tax revenues |

2017, fact |

2018, plan |

2019, plan |

2020, plan |

||||

|

Mln RUB |

% |

Mln RUB |

% |

Mln RUB |

% |

Mln RUB |

% |

|

|

Total |

48731 |

100.0 |

47546 |

100.0 |

49107 |

100.0 |

50410 |

100.0 |

|

- PIT |

13722 |

28.2 |

13523 |

28.4 |

14140 |

28.8 |

14762 |

29.3 |

|

- property taxes |

11447 |

23.5 |

12432 |

26.1 |

13554 |

27.6 |

14153 |

28.1 |

|

- income tax |

15453 |

31.7 |

13063 |

27.5 |

13005 |

26.5 |

13445 |

26.7 |

|

- excise duties |

6335 |

13.0 |

6700 |

14.1 |

6496 |

13.2 |

6071 |

12.0 |

|

- other taxes |

1774 |

3.6 |

1729 |

3.9 |

1912 |

3.9 |

1979 |

3.9 |

Table 4. Income tax revenues to the regional budget of the Vologda Oblast in 2017–2020, mln rubles

|

Indicators |

2017, fact |

2018, plan |

2019, plan |

2020, plan |

2020 to 2017, % |

|

Income before income tax |

16041 |

16782 |

17846 |

19067.5 |

118.9 |

|

Income tax payments |

15452.5 |

13063 |

13005 |

13444.5 |

87.0 |

|

Including from PAO Severstal and AO Apatit |

7299 |

5939.5 |

5420 |

5383 |

73.7 |

|

Share in total income tax payments, % |

47.2 |

45.5 |

41.7 |

40.0 |

-7.2 p.p. |

Figure 2. Income tax revenues to the regional budget of the Vologda Oblast from PAO Severstal in 2015–2020, mln rubles

□ Plan □ Actual

Source: Federal Tax Service (FTS) reporting data. Available at: taking into account these companies. In 2020, with the growth of the taxable base by 19%, income tax collection will be reduced by 13% to the level of 2017. Judging by forecast figures, the reduction in tax payments will be due to a decrease in contributions of revenue-generating enterprises by 26% (Tab. 4).

A reduction in the share of payments from key suppliers of the income tax from 47 to 40% could be a positive aspect. But this cannot yet significantly change budget dependence on two major taxpayers and requires significant changes in the structure of industry.

In addition, in our opinion, expectations of income tax mobilization, in particular from PAO Severstal, may be underestimated as indicated by the performance of planned and actual indices: in 2015–2017 actual tax payments were 1.2–1.8 higher than planned ( Fig. 2 ).

According to the forecast of the Ministry of Economic Development of the Russian Federation, in 2018–2020, ferrous metallurgy will maintain stable positions: average annual production growth rates will be 101.3% against 97.8% on average for 2015–2017. The World Steel Association predicts a 1.6% growth in global consumption. The expectations of PAO Severstal in terms of increasing demand for metal in Russia at the level of 3% are no less optimistic.

Personal income tax collections are planned to increase by 7.6% to the level of 2017, which is lower than the expected growth of average wages in the region’s economy. At the same time, personal income tax revenues in real terms will be falling, which is caused by an outstripping increase in inflation compared to real wages ( Tab. 5 ).

Unlike taxes and income taxes, another major source of income of the regional budget – corporate property tax – will dynamically increase not only in current but also in comparable prices, providing the main increase in their own revenues. However, a slight increase in residual value of fixed assets indicates that its growth in the budget is due not so much to factors in economic growth (capital investment, modernization of fixed assets, etc.), but rather to changes in the fiscal administration of property tax in respect of natural monopolies (Tab. 6).

In the next three years, the fiscal capacity of Vologda citizens will be lower than the national average by an average of 20 thousand rubles, or by one quarter, that is why the region will continue to receive equalizing subsidies4. Moreover, in three years the amount of per capita fiscal capacity will increase by less than 1%, and allocation of region’s grants will reduce by 53% ( Tab. 7 ).

Completing the analysis of budget revenues we note that amid slower performance of the regional economy we should carefully plan own budget revenues. However, the fact that following the example of 2015–2017 the excess of actual revenues over planned revenues will be withdrawn from economic circulation and used to achieve budget surplus is of a great concern.

Table 5. Taxable base and personal income tax revenues to the regional budget the Vologda Oblast in 2017–2020

|

Indicators |

2017, fact |

2018, plan |

2019, plan |

2020, plan |

2020 to 2017, % |

|

Average monthly nominal wage, RUB |

31636 |

32935 |

34380 |

35808 |

113.2 |

|

Nominal PIT payments, mln RUB |

13722 |

13523 |

14140 |

14762 |

107.6 |

|

Real wages, % to the previous year |

103.0 |

101.6 |

100.4 |

100.1 |

102.1 |

|

Real PIT payments |

15122 |

14605 |

14705 |

14762 |

97.6 |

|

Consumer Price Index, % |

102.2 |

104.0 |

104.0 |

104.0 |

112.5 |

Table 6. Corporate property tax payments to the regional budget of the Vologda Oblast in 2017–2020, mln RUB

|

Indicators |

2017, fact |

2018, plan |

2019, plan |

2020, plan |

2020 to 2017, % |

|

Total - in current prices |

10083 |

11055 |

12105 |

12666 |

125.6 |

|

- in comparable prices |

11111 |

11939 |

12589 |

12666 |

114.0 |

|

Net fixed assets, bln RUB |

582 |

588 |

593 |

595 |

102.2 |

|

Rates for pipelines, % |

1.6 |

1.9 |

2.2 |

2.2 |

+0.6 p.p. |

|

Rates for railway lines, % |

1.0 |

1.3 |

1.3 |

1.6 |

+0.6 p.p. |

4 In 2000–2010, the Vologda Oblast had the status of a donor region and did not receive subsidies from the federal budget for equalization of budgetary security.

Table 7. Population’s fiscal capacity, rubles per person

|

Indicators |

2017, fact |

2018, plan |

2019, plan |

2020, plan |

2020 to 2017, % |

|

Vologda Oblast |

61095 |

59577 |

59886 |

61671 |

100.9 |

|

Russia |

73264 |

76439 |

79603 |

83936 |

114.6 |

|

Gap between Oblast’s and country’s fiscal capacity |

|||||

|

thousand rubles |

-12169 |

-16862 |

-19717 |

-22265 |

183.0 |

|

% |

-16.6 |

-22.1 |

-24.8 |

-26.5 |

+9.9 p.p. |

|

Grants to equalize fiscal capacity, mln rubles |

2884 |

2734 |

1345 |

1370 |

47.5 |

One of the main objectives of the budget policy is to limit the increase in expenditure. However, it follows from the information content of the budget law that the objective is not to limit but to consolidate the budget. This clearly shows a decrease in expenditure as a share of GRP to 9.2% in 2020 compared to 10.1% in 2017. Over a three-year period, the increase in nominal expenditure will comprise 4.8%, which does not compensate for inflation; and real expenditure will decrease by 5% ( Tab. 8 ).

Fiscal austerity is evidenced by the performance of main types of expenditure (Tab. 9). In real terms, all types of expenditure will be reduced, with the exception of operating expenses involved in public debt service and management. Increased public spending on healthcare will be mainly due to wage increase according to President’s May 2012 decrees, rather than sectoral modernization.

The strongest sequestration will affect important spheres of population’s life support such as housing, sports, and agriculture. The situation with financing housing and communal services is especially alarming because in the context of population income stagnation regional authorities shift the content of this industry to the citizens.

Table 8. Regional budget expenditure of the Vologda Oblast in 2017–2020

|

Expenditure |

2017, fact |

2018, plan |

2019, plan* |

2020, plan* |

2020 to 2017, % |

|

Nominal |

52679 |

57111 |

55325 |

55208 |

104.8 |

|

To GRP, % |

10.1 |

10.4 |

9.6 |

9.2 |

-0.9 p.p. |

|

Real |

58052 |

61680 |

57538 |

55208 |

95.1 |

|

Consumer Price Index, % |

102.2 |

104.0 |

104.0 |

104.0 |

112.5 |

|

* For comparability purposes expenditure for 2019–2020 are given excluding conventionally approved expenditure, which is included in the budget without allocation by funding streams. |

|||||

Table 9. The performance of main types of regional budget expenditure of the Vologda Oblast in 2017–2020, mln RUB

|

Expenditure |

2017 |

2020 |

2020 to 2017, % |

||

|

Nominal |

Real |

Nominal |

Real |

||

|

Public debt service |

692 |

763 |

993 |

+43.5 |

+30.1 |

|

Healthcare |

3771 |

4156 |

4985 |

+32.2 |

+19.9 |

|

National issues |

2440 |

2689 |

2744 |

+12.5 |

+2.0 |

|

Education |

11776 |

12977 |

12759 |

+8.3 |

-1.7 |

|

Road management |

5700 |

6281 |

5990 |

+5.1 |

-4.6 |

|

Social policy |

18422 |

20301 |

19143 |

+3.9 |

-5.7 |

|

Culture |

667 |

735 |

680 |

+1.9 |

-7.5 |

|

Agriculture |

1900 |

2094 |

1692 |

-10.9 |

-19.2 |

|

Physical education and sport |

196 |

216 |

167 |

-14.8 |

-22.7 |

|

Housing and public utilities |

2155 |

2375 |

566 |

-73.7 |

-76.2 |

The attitude of the budget to addressing the issues of creating conditions for regional economic growth and improving the quality of life in the Vologda Oblast is largely determined by the distribution of allocations for state programs (SP).

The structure of state programs in the long term will maintain the social focus of the budget: more than 75% of program funding ( Tab. 10 ) will be used for the implementation of social obligations, which actually meets the goal to accumulate human capital set in the Strategy for socio-economic development of the Vologda Oblast for the period up to 20305.

However, the implementation of the policy of population safety is impossible without creating conditions for the development of human capital, which predetermines sustainable economic growth. However, the share of public expenditure to support economic sectors will decrease from 19% in 2017 to 17.5% in 2020. For example, the already insufficient financial support for Economic Development state program has reduced two times. The expenditure on the Small and medium business support and development state program is cut more than twice, which contradicts the priorities of economic policy stated in the Strategy. It should be added that only in 2018 a quarter (2.5 billion rubles) of 9.5 billion rubles of the total amount of allocations for the implementation of economic recovery programs is intended for financial support of activities of state institutions and administrative functions in the sectors of the national economy.

With the general 9% increase in program funding the cost of implementing the programs in public administration will increase by almost

Table 10. Regional budget expenditure of the Vologda Oblast on the implementation of state programs in 2017–2020, mln RUB

|

Program name |

2017, fact |

2018, plan |

2019, plan |

2020, plan |

2020 to 2017, % |

|

Program expenditure, total |

49189.5 |

54917 |

53422 |

53481 |

108,7 |

|

Human potential development and improving population’s quality of life |

|||||

|

Social support for the citizens |

11548 |

11867 |

11600 |

11650 |

100.9 |

|

Development of education |

11056 |

11849 |

11933 |

11933.5 |

107.9 |

|

Development of healthcare system |

8782 |

10463.5 |

10292.5 |

10572 |

120.4 |

|

Provision of affordable housing |

2452 |

1855 |

1745 |

2098 |

85.6 |

|

Total |

36977 |

41568.5 |

40902.5 |

40406.5 |

109.3 |

|

Share in program expenditure, % |

75.2 |

75.7 |

76.6 |

75.6 |

+0.4 p.p. |

|

Improving sustainability and modernization of priority economic sectors |

|||||

|

Transport system development |

5652 |

5737 |

5477 |

5737 |

101.5 |

|

Development of agro-industrial sector and consumer market |

2161 |

2153 |

2215 |

2365 |

109.4 |

|

Economic development |

362.5 |

272 |

176 |

176 |

48.6 |

|

Small and medium business support and development |

156 |

75 |

56.5 |

68.5 |

43.9 |

|

Total |

9326.5 |

9472 |

8944.5 |

9367.5 |

100.4 |

|

Share in program expenditure, % |

19.0 |

17.2 |

16.7 |

17.5 |

-1.5 p.p. |

|

Improving the system of public administration |

|||||

|

Improving public administration |

208 |

281 |

237 |

237 |

113.9 |

|

Regional finance management |

2676.5 |

3595 |

3337 |

3470 |

129.6 |

|

Total |

2884.5 |

3876 |

3574 |

3707 |

128.5 |

|

Share in program expenditure, % |

5.8 |

7.1 |

6.7 |

6.9 |

+1.1 p.p. |

|

Source: compiled by the author according to data from the Department of Finance of the Vologda region. |

|||||

5 Decree of the Government of the Vologda Oblast no. 920 “On the Strategy for socio-economic development of the Vologda Oblast up to 2030”, dated 17.10.2016.

30%. Funds for Management of regional finance of the Vologda Oblast state program will amount to the annual average of 3.5 billion rubles, and funds for three combined programs in economy (development of the agro-industrial complex, economic development and support for small and medium business) – 2.5 billion rubles.

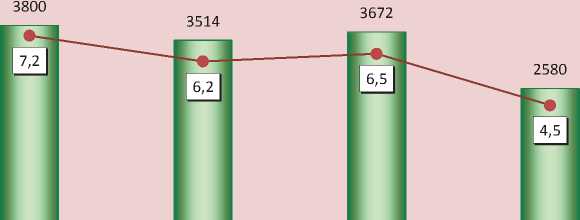

Increasing the share of investment budget expenditure is one of the main objectives in the new cycle of budget policy. However, with limited financial resources, the level of social expenditure will have to be maintained, so capital investment will retain the status of an equilibrating source: its share in regional budget expenditure will decrease from 7.2 to 4.5% in three years ( Fig. 3 ), which will be one of the factors in the overall slowdown in investment activity in the region and will not help solve the above mentioned problem.

According to some scholars, it is public investment in the context of declining business activity that can assume the anticyclical role, maintaining the level of employment and aggregate demand [6; 7].

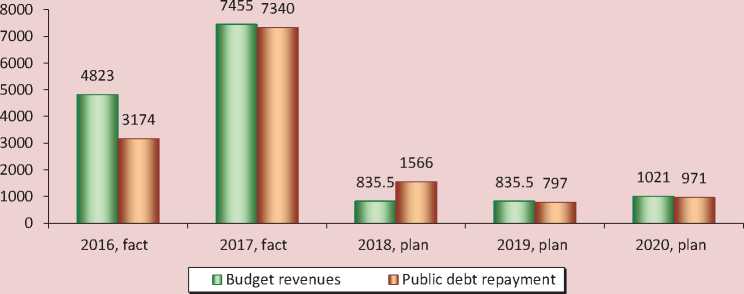

The result of budget consolidation will be surplus regional budget administration. Surplus budgeting and budget administration is one of the main conditions in budget loan agreements6 concluded by the government of the Vologda Oblast with the Ministry of Finance in 2014– 2017.

According to the terms of agreements, the largest share of budget surplus in 2016–2017 was allocated to the region’s public debt repayment rather than to additional funding for economic and social spheres. Unfortunately, this approach dictated by the central financial institution is prolonged in the next three years, as evidenced by the performance of expected budget surplus and debenture bond repayment ( Fig. 4 ).

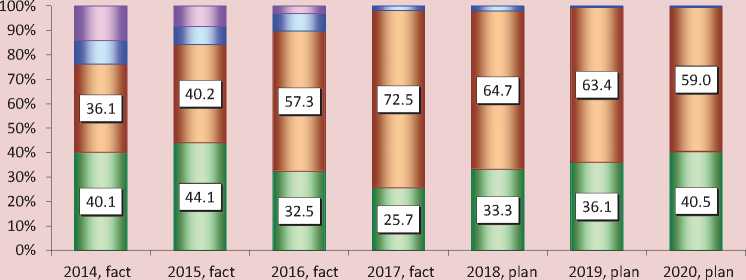

The substitution of commercial debt with federal budget loans and the use of budget surplus for debt retirement significantly reduced the region’s debt load – from 100% in 2014 to 47% in 2017. However, it is not expected to noticeably reduce in the upcoming financial cycle, on the contrary, in the first two years, the debt load is expected to increase slightly ( Fig. 5 ).

Figure 3. Regional budget expenditure on capital construction in the Vologda Oblast in 2017–2020

2017, fact

2018, plan

2019, plan

2020, plan

■ ■ Mln rub. • share in budget expenditure,%

Figure 4. Regional budget surplus and public debt repayment in the Vologda Oblast in 2016–2020, mln RUB

Figure 5. Public debt of the Vologda Oblast in 2014–2020

Mln rub. Debt load, %*

* Debt load is calculated as the ratio of public debt to own budget revenues.

The reason for the actual public debt stagnation, both in absolute and comparable terms, will be a gradual increase in loans from commercial banks: in 2020, their share in the debt structure will be comparable to that of 2014 ( Fig. 6 ). In the absence of loans from the federal budget which are not provided for at the stage of regional budget planning and approval, there may be risks of resuming the role of market loans as the main tool of the region’s debt policy.

It is necessary to recognize that after 2012, due to the need to execute the decrees of the President of the Russian Federation, the debt crisis of the majority of Russian regions entered an acute stage, creating immediate threats to financing priority expenditure needs. From 2012 to 2017, public debt doubled, as well as the number of regions whose budget debt exceeded half of their own revenues. In 2013– 2015, expensive commercial loans began to prevail in the structure of public debt of Russia’s

Figure 6. The structure of public debt of the Vologda Oblast in 2014-2020, %

□ Bank loans О Budget loans DGuarantees Insecurities

constituent entities, and only in 2016 this trend was reversed by replacing market loans with loans from the federal budget. At the end of 2017, the share of bank loans did not manage to comprise 30% against 40% as the average for 2013–2015 ( Tab. 11 ). Nevertheless, sub-federal debt remains significant: more than 30% of the regions’ own resources have to be used for debt repayment.

Another innovation in the debt policy at the regional level, the need for which has long been discussed by the experts and the scientific community [8; 9; 10], is associated with the restructuring of budget loans7 received in 2015– 2017. It is expected that within 7–12 years the restructuring will affect all Russian regions and will in the first two years save about 438 billion rubles. According to the Department of Finance of the Vologda Oblast, in 2018–2020 it is expected to release more than 4 billion rubles and allocate additional funds to address significant issues of social and economic development.

Summing up the analysis results, we conclude that the regional budget of the

Vologda Oblast for 2018–2020 is focused on

Table 11. Main indicators of public debt of the Russian Federation in 2011–2017

|

Indicator |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2017 to 2011, % |

|

Public debt, bln RUB |

1154.0 |

1334.3 |

1719.2 |

2061.2 |

2285.7 |

2352.9 |

2315.1 |

200.6 |

|

Debt load, % |

24.7 |

25.7 |

32.6 |

34.9 |

36.2 |

33.8 |

30.5 |

+5.8 p.p. |

|

Number of regions with debt load over 50% |

23 |

33 |

46 |

55 |

57 |

55 |

48 |

208.7 |

|

Budget loans, %* |

36.3 |

31.9 |

27.4 |

31.4 |

35.4 |

42.1 |

43.6 |

+7.3 p.p. |

|

Bank loans, %* |

24.5 |

31.1 |

39.2 |

41.7 |

40.8 |

34.4 |

28.9 |

+4.4 p.p. |

|

* Share in the structure of public debt. Source: author’s calculations according to data from the Ministry of Finance and the Federal Treasury. |

||||||||

7 This decision was initiated by V. Putin at a meeting of the Presidium of the State Council of the Russian Federation, 22.09.2017.

consolidation of budget surplus achieved in 2016–2017, which in general will contribute to economic stability. However, it is important to understand that the surplus is based on insufficient economic stimulus, which is planned to be supported by an average of 20% of budget resources8. The consequence of limiting the opportunities for stimulating measures will be a slowdown in the region’s economic growth to 0.7% in 2020 against 2.1% in 2018.

The implications of fiscal consolidation will be losses resulting in a decrease in both economic growth and personal income. The declared increase in labor costs will not improve people’s financial situation: the growth rates of real money income over three years will drop from 1.2 to 0.2%, and by 2021, the number of Vologda citizens with incomes below living wage will be about 150 thousand people, or 12.6% of the total region’s population with the national average of 11.2%.

The focus of the fiscal policy on budget surplus forces a cautious approach to expenditure planning. At the same time, significant fluctuations in the expenditure growth rates also draw attention. Thus, in 2018 they are set at the level of 108.4%, while in 2019 and 2020 – at the level of 99.1 and 102.2% respectively. Thus the average annual expenditure growth in 2019–2020 will comprise 100.6%, which does not compensate for inflation, which means that it will not sufficiently use budget as a development tool.

In our view, budget expenditure should be increased taking into account inflation by at least 4% per year, even at the expense of increasing budget deficit. Consequently, the projected expenditure in 2019 would be: 59 billion rubles; in 2020 – 62 billion rubles. This would allocate 7 billion rubles for socioeconomic needs. Budget deficit would be at an economically safe level of 3–6% regarding own revenues9.

Nevertheless, the budget policy pursued by financial and economic bloc of the Russian government regards budget deficit extremely negatively, hence the conservative approach to budgeting of all levels based on the principle of balance, which, according to academician V.V. Ivanter, “should not be absolutized... If the state increases pensions and wages for public sector employees, there is an additional demand in the economy, and this is another signal for businesses to invest in production…” [11].

American economists K.R. McConnell and S.L. Brue noted that “a balanced budget is incompatible with the active fiscal policy as an anti-cyclical stabilization tool. To achieve a balanced budget, the government must either raise tax rates or cut expenditure. Each of these measures is even more overwhelming, rather than stimulating for aggregate demand. The annual approval of a balanced budget is the procyclical, rather than counter-cyclical policy.” [12]

The practical experience of developed countries confirms the scholars’ conclusions regarding the role of budget deficit in the system of state regulation of demand. The deficit helped to overcome the negative consequences of the 2008–2009 crisis. Public expenditure of most world countries are currently based on deficit financing: in 2016, only 30 of the 220 countries had balanced budgets10.

Contrary to the international practice, Russia’s budget policy for the next three years does not imply any major changes; its main concept is financial consolidation maintaining low rates of economic growth.

In our opinion, despite uncertain objectives of spatial regulation, there is a residual mobilization potential of internal reserves of regional budgets including the budget of the Vologda Oblast.

First , the issue of raising tax collection remains on the agenda. According to the Department of Finance, regional budget liabilities at the beginning of 2018 amounted to 1,323 million rubles, having decreased by only 5% compared to the same period of 2017. Debt repayment would help replenish own revenues of the regional treasury by 3%.

Second , accumulation of receivables from major budget owners is gaining apace: during 9 months in 2017, it has grown almost five times and reached 1.2 billion rubles – amount sufficient to re-finance expenses in the case of existing debts recovery.

Third , shadow economy continues to impoverish the budget. According to the Department of Strategic Planning, by 01.04.2017, the number of people paid off-the-books in the Vologda Oblast comprised 99.8 thousand people, or 15% of the workingage population. Rough estimates indicate that PIT budget loss due to “off-the-book” salaries comprise about 5 billion rubles a year.

Thus, fighting illegal wages, elimination of budget debts is still relevant in the short term.

Fourth, we must not forget the quality of budget expenditure management. According to the Department of Finance, in 2013–2017, the average annual amount of violations in the course of monitoring activities for regional budget execution amounted to 1.7 billion rubles. Our calculations show that in the context of the ongoing budget consolidation, the annual amount of 1.5 billion rubles of allocated funds is not being drawn. All these facts indicate low responsibility of budget holders regarding effective use of budget funds.

Fifth , it should be repeated that the most important reserve for strengthening fiscal capacity of regional budgets should be the abolition of corporate property tax benefits provided by federal legislation without adequate compensation for shortfall in income sources. In 2016, 50% of corporate property tax payers among Russia’s constituent entities used tax preferences (in the Northwestern Federal District – 55.5%, in the Vologda Oblast – 35.6%), 82.4% of them were receiving benefits under federal law. In the Vologda, Arkhangelsk, and Novgorod oblasts and in Komi Republic almost the entire volume of tax advantages was established by the federation. As a result of operating preferential tax regimes, the amount of corporate property taxes for regional budgets was one third less ( Tab. 12 ). In the Vologda Oblast, the loss was twice less, because due to efforts of regional authorities it was possible to achieve the abolition of a number of benefits for natural monopolies.

It is obvious that it is necessary to take inventory of the existing tax benefits. Unfortunately, there is no public information on the amount of benefits, the number of benefit holders in the context of economic entities, there is no methodological support to assess the effectiveness of benefits in terms of impact on industry performance.

Sixth , the results of long-term VolRC RAS studies of activities of major taxpayers [13; 14; 15] prove that budgets of regions with mono-structural tax systems are greatly damaged by an extremely opaque mechanism of revcenue

Table 12. Corporate property tax preferences provided according to the federal legislation in constituent entities of the Northwestern Federal District in 2016

|

Constituent entity |

Number of tax payers |

Including those using benefits |

Including federal |

To the total number of benefit holders, % |

Amount of benefits, mln RUB |

To assessed taxes, % |

|

Komi Republic |

3790 |

1705 |

1665 |

97.7 |

1848 |

12.8 |

|

Leningrad Oblast |

7827 |

4772 |

2396 |

50.2 |

2197 |

14.2 |

|

Vologda Oblast |

6740 |

2397 |

2286 |

95.4 |

1397 |

14.3 |

|

Pskov Oblast |

2819 |

1327 |

1180 |

88.9 |

346 |

24.8 |

|

Arkhangelsk Oblast |

3793 |

1814 |

1789 |

98.6 |

1542 |

26.2 |

|

Novgorod Oblast |

2949 |

1203 |

1147 |

95.3 |

830 |

27.2 |

|

Murmansk Oblast |

2851 |

2031 |

912 |

44.9 |

1162 |

28.4 |

|

Republic of Karelia |

2726 |

1750 |

977 |

55.8 |

844 |

43.2 |

|

Saint Petersburg |

32215 |

19889 |

16597 |

83.4 |

15822 |

50.6 |

|

Kaliningrad Oblast |

3935 |

1772 |

1608 |

90.7 |

2273 |

64.1 |

|

Northwestern FD |

69645 |

38660 |

30557 |

79.0 |

28261 |

31.1 |

|

Russia |

605932 |

303374 |

255573 |

84.2 |

225318 |

28.7 |

|

Source: author’s calculations based on data from the Federal Tax Service. |

||||||

Table 13. PAO Severstal income tax payments to the regional budget of the Vologda Oblast in 2015–2017, billion rubles

|

Indicators |

2015 |

2016 |

2017 |

Average for 2015–2017 |

|

Income before income tax |

44.3 |

106.5 |

146.0 |

98.9 |

|

Estimated income tax* |

8.0 |

19.2 |

24.8 |

17.3 |

|

Actually paid income tax |

0.4 |

2.6 |

5.5 |

2.8 |

|

Differential |

-7.6 |

-16.6 |

-19.3 |

-14.5 |

|

PAO Severstal owner dividends |

39.1 |

53.5 |

54.6** |

49.1 |

|

To the paid income tax, times |

97.7 |

20.6 |

9.9 |

17.5 |

|

* In 2015–2016 – a 18% rate, in 2017 – 17%. ** For 9 months in 2017 Sources: data from the Federal tax Service; financial statements of PAO Severstal; author’s calculations. |

||||

administration of large corporations. The use of various methods of tax minimization is described in detail in a number of VolRC RAS publications. TO continue the discussion we present the recently published data of financial statements for 2017 of the key supplier of income tax to the budget of the Vologda Oblast – PAO Severstal ( Tab. 13 ).

As can be seen, having a 146 billion ruble income before income tax at the end of 2017 the corporation was expected to have paid 25 billion rubles to the regional budget. In fact, the budget received 5.5 billion rubles, which is 4.5 times less. It should be noted that this is the most significant discrepancy between tax base and income tax for the past three years. The causes of such imbalances are to be reviewed in the course of studying the process of generating financial results and the tax base. However, the practical experience of previous studies suggests that the key factors lie in the legal framework allowing for maximum consideration of taxpayers’ costs and excluding a number of income sources, and deriving the optimized income from economic turnover in the form of huge dividends. J. Galbraith, a classical economic theorist, rightly believed that “it is possible to reduce the high level of oligarchs’ income through abolition of tax benefits and elimination of “loopholes” in tax legislation” [16].

Identifying certain flaws of the new budget of the Vologda Oblast we proceed from the understanding that the opportunities of selfgovernment of regional authorities are currently limited by the centralized model of the budget system, which has already led to the degradation of the tax base of most territories. Instead of forming an economically motivated system of power differentiation between the levels of governance, the federal center undertakes underdeveloped and sometimes paradoxical decisions on income redistribution11, leading to loss of self-sufficiency of regional budgets. According to estimates of the Department of Finance of the Vologda Oblast, in 2018–2020 as a result of changes in federal legislation, annual tax losses of the regional budget will exceed 4 billion rubles.

The need to develop an alternative interbudget policy is more and more multidimensional. Experts and representatives of the scientific community have repeatedly made specific proposals in this area, in particular:

V inventory of revenue and expenditure powers of constituent entities of the Russian Federation: in 2000, there was no case of federation’s delegation of powers to regions with complete financial security [17];

V the transfer of income tax payments, rather than its decrease in the share in regional budgets [18], especially since the share of this payment does bot exceed 3% in federal budget revenues;

V introduction of a progressive PIT scale, which operates in all BRICS countries except Russia, not to mention the developed countries. According to RAS academician B.S. Kashin, the main reason preventing the introduction of this measure in our country is excessive oligarchs’ greed and their strict control over government authorities [19].

In short, budget administration in the system of government regulation needs significant adjustment and regional re-focus. Continuing the policy of fiscal consolidation will inevitably lead to a protracted debt crisis and destabilization of territories’ economy [20].

Список литературы Problems related to regional budgeting amid fiscal consolidation

- Gaudemet P.M. Finansovoe pravo . Moscow: Progress, 1978. 428 p.

- Tarasov I.T. A sketch on financial law. Finansy i nalogi: ocherki teorii i politiki . Moscow: Statut, 2004. P. 211.

- Expert opinion of Institute of Economics of the Russian Academy of Sciences on the draft federal budget for 2018-2020. Official website of Institute of Economics of the Russian Academy of Sciences. Available at: https://inecon.org/demo/ekspertno-analiticheskaya-deyatelnost/.

- Ilyin V.A., Povarova A.I. Effektivnost' gosudarstvennogo upravleniya 2000-2015. Protivorechivye itogi -zakonomernyi rezul'tat . Vologda: ISERT RAN, 2016. 304 p.

- Valentei S.D. (Ed.).Rossiiskii federalizm. Ekonomiko-pravovye problemy . Institute of Economics of the Russian Academy of Sciences; Center for Economics of Federal Relations. Saint Petersburg: Aleteiya, 2008. 320 p.

- Dequech D. Post Keynesianism, Heterodoxy and Mainstream Economics. Review of Political Economy, 2012, April, vol. 24, no. 2, pp. 353-368.

- Lerner A.P. Functional Finance and the Federal Debt. Social Research, 1943, vol. 10, pp. 38-51.

- Biryukov A.G. The practice of granting budget loans for budgets of Russia's constituent entities. Vlast'=The Power, 2012, no. 1, pp. 12-21..

- "The regions send a debt "SOS!" Interview with Doctor of Economics O.G. Dmitrieva. Mir novostei=World of news, 2013, no. 2092. Available at: https://mirnov.ru/ekonomika/..

- They will waive the debt for seven years: interview with Doctor of Economics V.V. Klimanov. Rossiiskaya Gazeta, 2018, no. 7464. Available at: https://rg.ru/2018/01/08/..

- Ivanter V.V. What the will tell. Rossiiskaya Gazeta, 2017, no. 7394. Available at: https://rg.ru/2017/10/09/..

- McConnell C.R., Brue S.L. Ekonomika: printsipy, problemy, politika . Moscow: IN-FRA-M, 1999. 974 p.

- Povarova A.I. Relationship between metallurgical works and the budget: debt increases, taxes decline. Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz= Economic and Social Changes: Facts, Trends, Forecast, 2014, no. 6, pp. 159-182..

- Povarova A.I. The influence of the metallurgical corporation owners' interests on the financial performances of the parent enterprise (in case of OJSC "Severstal"). Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2011, no. 5, pp. 36-51..

- Povarova A.I. Reduction of the fiscal function of corporate tax: the factors and ways of increase. Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2014, no. 3, pp. 180-195..

- Galbraith J. The New Industrial State. Boston, 1967. P. 227.

- Tatarkin A.I. Dialectic of public and market management of the socio-economic development of regions and municipal units. Ekonomika regiona=Region's economy, 2014, no. 1, pp. 9-30..

- Zubarevich N.V. Center and regions inter-budgetary relations: economic and institutional aspects. Zhurnal novoi ekonomicheskoi assotsiatsii=Journal of the New Economic Association, 2014, no. 3, pp. 158-161..

- Kashin B.S. Vystupleniya v Dume . Moscow, 2016. 192 p.

- Ilyin V.A., Povarova A.I. The issues of regional development as a result of public administration efficiency. Ekonomika regiona=Region's economy, 2014, no. 3, pp. 48-63..