Procurement of hunting resources in the system of fiscal relations (case study of the northern regions of Russia)

Автор: Lazhentsev Vitalii N., Chuzhmarova Svetlana I., Chuzhmarov Andrei I.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Environmental economics

Статья в выпуске: 4 (64) т.12, 2019 года.

Бесплатный доступ

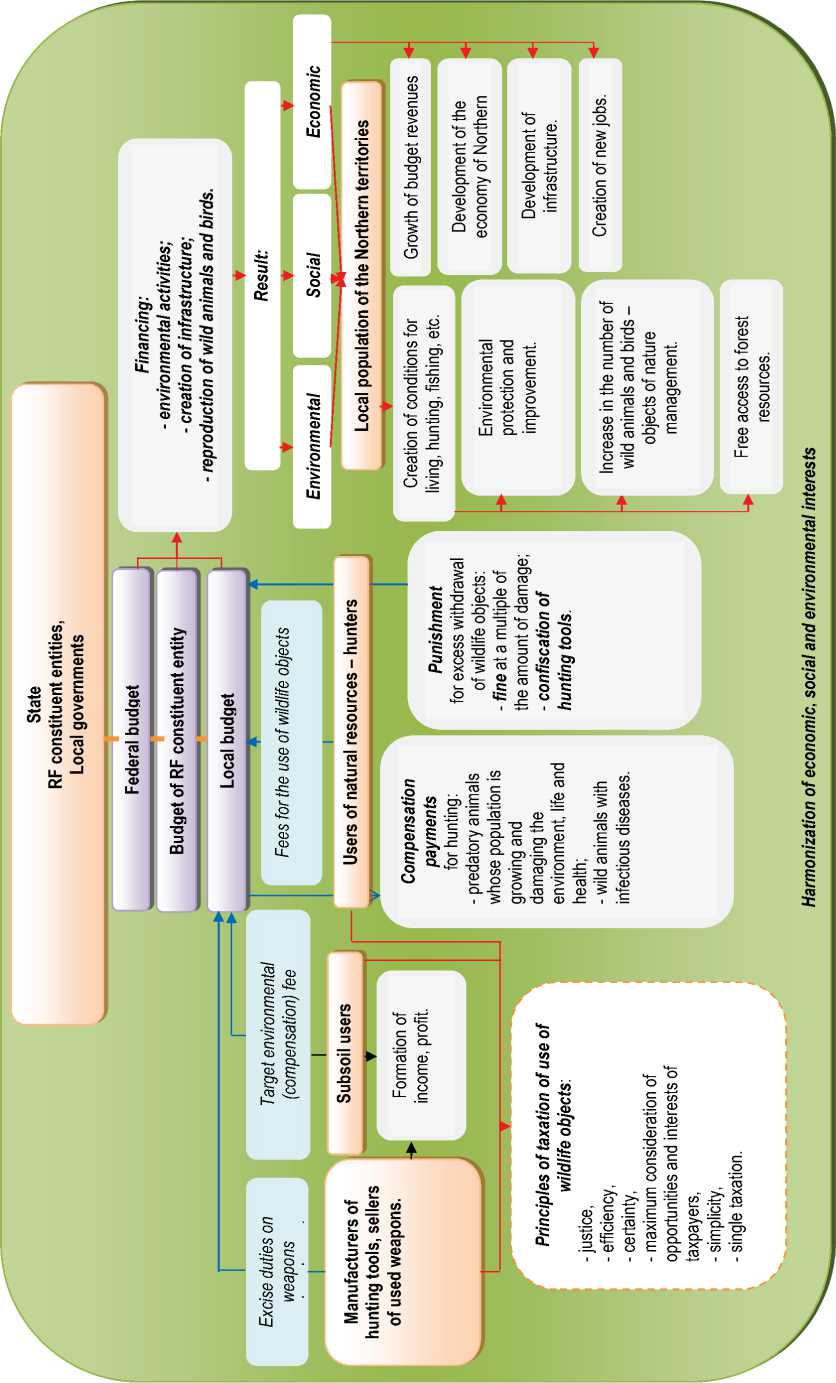

Scientific interest in the topic of hunting and game husbandry is due to the fact that the problems of rational nature management are coming to the fore - it concerns not only land relations, development of minerals and exploitation of forests, but also procurement of hunting resources combined with the protection of wildlife. The latter most clearly shows the problems of greening the modern economic activity and the traditional Northern economy associated with the use of the “gifts of nature”. The paper highlights methodological principles of economic evaluation of wildlife and the analysis of Northern (domestic and foreign) experience of their taxation; we propose a scheme for transition from the disparate approaches to the taxation of this activity (resource, permission, compensation, etc.) to an integrated environmental-economic approach. In addition to the existing norms, this approach includes imposing excise duties on the production of weapons, ammunition and equipment; establishing a targeted environmental fee on the use of subsoil; imposing fines for unlimited or excessive withdrawal of wildlife objects; establishing funds for the protection of wild animals and birds in the system of local budgets. A new approach harmonizes the interests of the state (RF subjects and local government bodies), local population of the Northern territories, nature users (including hunters), subsoil users, and manufacturers of weapons and equipment. We determine the source of formation of tax revenues of local budgets; this measure makes it possible to finance environmental protection measures, reproduction of wild animals and birds, creation of infrastructure in remote Northern territories. The paper proves the necessity of introducing innovative methods for state monitoring of wildlife and correct distribution of functions of federal, regional and local authorities in its reproduction.

Nature management, fauna, ecology, procurement of hunting resources, environmental protection, taxes, fees, excise taxes, experience of northern countries

Короткий адрес: https://sciup.org/147224191

IDR: 147224191 | УДК: 336.221; | DOI: 10.15838/esc.2019.4.64.8

Текст научной статьи Procurement of hunting resources in the system of fiscal relations (case study of the northern regions of Russia)

In our review of fiscal relations in the system of environmental management in the North [1] we note that the methodologically accurate account of resource taxes and payments can have a significant impact on the condition of the entire natural resource economy. We point out that renewable natural resources play a leading role in the organization of life in the Arctic and Northern regions; however, these resources are in the background of mineral and fuel resources in the system of financial and budgetary relations. We make a conclusion about a need for a partial flow of capital from the mining industries in agriculture, forestry and water management, and in the traditional activities of the northerners such as hunting and other trades. In this article, the financial and budgetary topic is considered in relation to the extraction of hunting resources, which is not very significant in the structure of the gross domestic product, but very indicative in identifying the features of the Northern life.

The goal of the study is to assess theoretical views on taxation of hunting resources in the system of fiscal relations, to analyse Northern (domestic and foreign) experience in this field of economic activity, to search for a new way to combine commodity-money relations in hunting and hunting farms and the problems of nature protection.

The objectives of the study are as follows: to determine the position of the taxation of hunting in the system of environmental management; to show the socio-economic value of wildlife and its use by an individual; to formulate methodological principles of economic evaluation of the objects of fauna; to undertake an analysis of hunting taxation; to reflect the international experience in this area and identify opportunities for its use; to draw conclusions on the comprehensive approach to the taxation.

Relevance of the research topic. More than 350 species of various animals and birds inhabit the Northern territories of Russia; 84 species of wildlife are classified as hunting resources, including 51 species of mammals and 33 species of birds. In the scientific literature and in the media, the issues of preservation of the unique Arctic and Northern fauna are considered with great concern, the search for harmonization of interests in various aspects of hunting and fishing is being conducted.

The key problem of the Northern regions of Russia, which have a huge natural and resource potential and a biologically diverse wildlife that differs significantly across territories, is the lack of financial resources to address these issues, to ensure sustainable development, and to finance public goods. Hunters not always understand and comply with a significant array of regulations on hunting and taxation of this type of activity (more than 10 at the federal level and more than 10 in each constituent entity of the Russian Federation). So, hunters in Russia pay llicence fees, fees for the use of wildlife objects, legal costs, membership fees in social organizations for hunting; the amounts of their (fees) are differentiated by type of production, territories, terms, etc.

We agree with domestic and foreign authors who believe that, along with the organization of hunting, as a sector of national economy with its own special technology and economy, it is necessary to establish proper tax regulation, and also understand the benefits of public-private partnership in the sphere of nature management [2,3,4], to determine the set of measures on economic and ecological behavior of people [5].

The scientific novelty of our research lies in the formation of a new integrated ecological and economic approach to the taxation of hunting resources in the Northern regions of Russia, based on the relationship of the theory of taxation of natural resources with the practical tasks of organization of hunting and wildlife protection.

Theoretical and practical significance of the research lies in defining topical issues of harmonizing fiscal, social and environmental relations in the field of use of wildlife objects, in studying the best international practices of taxation, in the development of a new integrated ecological-economic approach to the taxation of hunting.

The research methodology is based on the theories of taxation, environmental economics, regional economics, and organization of hunting. We use such methods as dynamic and static analysis of budget revenues fro the fees for the use of wildlife in the Northern regions of Russia, and we conduct a comparative analysis of tax systems in the field of hunting resources.

The results of the study present an assessment of the socio-economic value of the animal world and address the problems of ecological taxation; we also present the results of the analysis of taxes and fees in the system of procurement of hunting resources.

Socio-economic value of wildlife

Game animals in our country are considered as an important part of natural capital, which provides the formation of consumer and environmental ecosystem services. Hunting grounds in the Russian Federation occupy an area of about 1.5 billion hectares; more than half are legally used by 4,450 legal entities and individual entrepreneurs that carry out activities in 6,050 hunting grounds; valuation of game animals on the territory of the Russian Federation exceeds 87 billion rubles, the total annual turnover in the field of hunting is estimated at 80–100 billion rubles; more than 80 thousand workers are permanently or temporarily employed in the field of hunting. There are about 2.7 million hunters in Russia, taking into account game and tourist hunting. The annual expenditures that the federal budget allocates to Russia’s constituen entities for the implementation of powers in the field of protection and use of game animals related to the control, supervision, issuance of permissions for hunting game animals and the conclusion of hunting and economic agreements are estimated at 1.3–1.5 billion rubles; budgets of constituent entities of the Russian Federation annually allocate additional funding for these purposes (in 2012, for example, in the amount of 2.4 billion rubles); the damage caused by illegal hunting exceeds the volume of legal hunting and amounts to about 18 billion rubles annually1.

One of the main tasks for the development of Russia’s hunting sector is “to improve the system of payments for the use of game animals and the fees for different game animals, as well as to create a mechanism for targeted financing of the hunting sector, which provides for the coverage of expenses necessary for the development of hunting, through the creation of environmental funds, ensuring state and public control over the targeted use of financial resource” [6, p. 8].

In order to determine the scientifically substantiated amount of tax rates for the use of natural resources and the amount of fees for the use of wildlife, it is important to understand their value, as well as the cost of compensation for damage caused to nature and restoration of wild animals and birds. The assessment of natural resources and the fundamental understanding of their value make it necessary to determine the social significance and take into account the environmental factor.

Foreign literature shows certain controversy with regard to the term “value”. Some authors note the presence of internal values of natural objects, independent of man and his worldview [7], others believe that the natural system itself does not create social value. Only human relationships with the environment generate social value [8]. Perhaps the second position is more correct. We will add to it the Northern aspect of the social value of wildlife objects, which is fixed in special regulations governing the economic activities of indigenous peoples.

The question arises: how can we determine the value of wildlife and other natural resources? As a rule, the following positions are taken into account: first, goods and services are subject to evaluation if a person values them; second, value is measured in the values of compromises, namely in the desire of individuals to pay or receive payment for the use of natural resources by other individuals, and therefore value is a relative assessment; third, as a rule, a monetary measurement is used for evaluation; fourth, the values of the individuals are summarized to determine the social values of natural resources [9, pp. 10-11]. We accept these and other positions of foreign authors when it comes to different types of value of wildlife as part of ecosystems and as part of natural hunting resources. We also take into account the possibility to give a comprehensive (economic, social and environmental) assessment of natural resources [10].

In our opinion, in order to rationalize taxation it is necessary to taking into account socio-ecological and economic values of wildlife: first, to determine the value of the use of wildlife as a basis of taxation; second, to highlight the potential value of non-use of wildlife as alternative values or the values of inheritance, namely, to preserve unique animal species for future generations by including them in the List of endangered species; third, to calculate the cost of reproduction of wild animals and birds and the corresponding amounts of funding. Ignoring the valuation of wildlife objects in fact means denying their socio-economic value. This approach can lead to the uncontrolled use and loss of the potential of natural resource reproduction.

Ecologization of hunting economy and its taxation: a review of studies

Development of the theoretical foundations of the ecological net is considered in the monograph edited by I.A. Maiburov and Yu.B. Ivanov, which reflects the transformation of the economic outlook in the direction of consumption of a balanced and careful attitude toward natural resources [11]. V.V. Gromov and T.A. Malinina pay particular attention to the problem of combining economic and environmental policies through tax regulation [12]. Some authors base the greening of taxation on the theory of external costs that are not taken into account in the economic system by means of prices. Thus, according to A. Pigou, positive external effects are manifested in the spread of new environmentally friendly technologies, and negative – in environmental pollution [13]. We believe that positive and negative external effects, indeed, play an important role in the greening of natural resources, and therefore they should be taken into account in the formation of a new approach to the economy and organization of hunting.

V.V. Lisauskaite, a well-known expert of international law in the field of environmental policy, distinguishes the inertia of thinking as one of the determinants of the attitude toward the economic assessment of environmental damage. She believes that the perception of lost profits should be replaced by more rational ways of environmental management, namely, by increasing the level of environmental awareness of economic entities and citizens and their awareness of the value of natural resources, including wildlife [14].

Despite the ecological postulates in the theory of economic activity, its practice does not yet have sufficient material interests in nature conservation. We agree with E.V. Girusov and V.N. Lopatin, who note that this situation has developed as a result of the fact that neither the planned nor the market models of the economy have been able to establish an adequate social value of natural resources [15]. However, approaching this kind of adequacy would mean the formation of a special approach to determining the effectiveness of the use of natural resources, when the attitude of people toward each other and their joint attitude to environmental management will be the criterion of the value of economic activity. At present, only experimental models created at the Institute of Economics and Industrial Engineering, Siberian Branch of the Russian Academy of Sciences, reflect quantitatively the importance of both economic and social effects of innovative projects [16]. “Clean economy” with a focus on the financial return on investment in production projects should recede into the background [17], especially if it concerns bioresource activities.

Analysis of the Northern domestic and foreign experience of taxation of hunting

Fees for the use of wildlife objects, forming the revenues of the consolidated budgets of RF constiruent entities in 2018 amounted to 0.003%; these fees are not received by local budgets of the Northern regions. This allows us to conclude that we are dealing with a sphere of economic activity that does not solve the

Table 1. Dynamics of receipts of fees for the use of wildlife to the consolidated budgets of constituent entities of the Russian Federation in 2015–2018, thousand rubles (in current prices)

|

RF constituent entity |

2015 |

2016 |

2017 |

2018 |

2018 in % to 2015 |

||||

|

Thousand rubles |

Proportion, % |

Thousand rubles |

Proportion, % |

Thousand rubles |

Proportion, % |

Thousand rubles |

Proportion, % |

||

|

Russian Federation |

247902 |

0.004 |

275722 |

0.004 |

297249 |

0.004 |

300936 |

0.003 |

121.4 |

|

Krasnoyarsk Krai |

23576 |

0.014 |

26197 |

0.014 |

30104 |

0.015 |

35636 |

0.015 |

151.2 |

|

Republic of Sakha (Yakutia) |

14520 |

0.014 |

15190 |

0.013 |

16458 |

0.016 |

15687 |

0.012 |

108.0 |

|

Arkhangelsk Oblast |

6028 |

0.013 |

7767 |

0.017 |

7759 |

0.015 |

7632 |

0.013 |

126.6 |

|

Khanty-Mansi Autonomous Okrug-Yugra |

6626 |

0.002 |

7120 |

0.003 |

7166 |

0.003 |

7045 |

0.002 |

106.3 |

|

Kamchatka Krai |

6812 |

0.029 |

6594 |

0.025 |

7439 |

0.027 |

6948 |

0.022 |

102.0 |

|

Republic of karelia |

4662 |

0.024 |

4549 |

0.021 |

4571 |

0.021 |

4752 |

0.017 |

101.9 |

|

Yamalo-Nenets Autonomous Okrug |

2549 |

0.002 |

3075 |

0.002 |

3810 |

0.002 |

3997 |

0.002 |

156.8 |

|

Republic of Komi |

3626 |

0.006 |

3637 |

0.006 |

4107 |

0.005 |

3748 |

0.004 |

103.4 |

|

Magadan Oblast |

1650 |

0.009 |

1722 |

0.008 |

1658 |

0.008 |

1811 |

0.008 |

109.8 |

|

Chukotka Autonomous Okrug |

1148 |

0.008 |

1437 |

0.009 |

1613 |

0.013 |

1610 |

0.013 |

140.2 |

|

Murmansk Oblast |

1330 |

0.003 |

1518 |

0.003 |

1463 |

0.002 |

974 |

0.001 |

73.23 |

|

Nenets Autonomous Okrug |

49 |

0.000 |

52 |

0.000 |

84 |

0.000 |

79 |

0.000 |

161.2 |

Source: own compilation with the use of the data of the Federal Tax Service. Statistical reports for 2015–2018. Available at: https://www.

problem of replenishment of the budget, but can be an indicator of other kinds of problems, such as territorial differences in the volume of hunting, localization and typology of the hunting sector, practical significance of the hunting sector in the organization of life of specific ethnic groups and groups of economic entities, etc.

The dynamics of inflows of fees for the use of wildlife to the consolidated budgets of the Northern regions of the Russian Federation has a positive trend (Tab. 1) , but this is mainly due to rising prices. We also note that these fees are received by the regional budgets of Russia’s constituent entities, rather than by the municipal budgets, although the logic of territorial management should be the opposite. And the compensation of expenses of the national budget for the improvement of an ecological situation at the expense of charges from users of wildlife objects is insignificant – about 50 billion rubles annually.

The amount of fees is affected by the number of payers and the number of permits issued. The number is relatively stable; moreover, it is reducing following the reduction in the limit on the use of hunting resources. We note the differences in the level of benefits. In the Northern regions, it ranges from 0 in Chukotka and Yamalo-Nenets autonomous okrugs to 4.7 and 4.6%, respectively, in Krasnoyarsk Krai and in the Komi Republic. The most significant point is that the representatives of indigenous peoples of the North, Siberia and the Far East of the Russian Federation are exempt from fees for the use of hunting resources; persons not belonging to indigenous minorities but permanently residing in places where hunting and fishing are the basis for their living and economic activities do not pay fees either. These benefits apply only to the number (volume) of wildlife objects that is sufficient to meet the personal needs of these categories of payers.

For the purposes of studying foreign practice in the field of taxation of the use of wildlife, we have selected four countries whose climatic conditions are close to the Northern regions of Russia: namely Finland, Norway, Canada and the United States. These countries have reconsidered their tax policy in the field of use of wildlife objects and developed theh ways to stimulate environmentally oriented behavior of nature users.

These countries use a permissive approach to this type of environmental management, although the system of payments for the use of wildlife objects is different. The cost of a hunting permit (license) differs significantly depending on the territory, place of hunting, types of hunting objects, season, terms, ownership of hunting grounds and other factors.

In Finland, 69% of the territory of which is covered by forests, about 300 thousand hunters are registered, and six percent of its citizens have a hunting license. Here hunters pay an annual fee which grants them the right to hunt for a year. The size of hunting fee is set annually by the state; it amounted to 28 euros in 2017. Hunting large animals involves the need to obtain a separate license and the payment of a corresponding fee. The cost of the permit (license) is determined by the party that owns the forest plots on the right of ownership or on the terms of the lease agreement. In addition, insurance premiums are provided in Finland to compensate for possible damage caused by firearms during hunting [18; 19; 20].

In Norway, despite its severe climatic conditions and mountainous terrain, forestry and hunting are well developed. There are 483 thousand hunters per five million Norwegians, which is about 10% of the population [21]. Here, the fee for obtaining a hunting license, which is an annual fee, ranges from three to four euros. Hunting large animals, including elk, involves obtaining a separate license for a small fee and is permitted provided that the individual has passed the exams on the accuracy of shooting from a hunting weapon, the cost of the exam is seven euros per attempt. Elk population in Norway is about 35 thousand, and the number of hunting licensec per year is about seven thousand, i.e. in a ratio of 5:1.

In 1901, the U.S. Government adopted several laws to increase funding of programs for protection, reproduction of fauna, resettlement of animals, promotion of civilized hunting etc. American hunters believe that the Federal Aid in Wildlife Restoration Act of 1937, most often referred to as the Pittman– Robertson Act is the most important one; it has led to positive results in the use of wildlife objects. It established a federal assistance program for local environmental authorities. The basis of the financial assistance was an excise tax, the rate of which was 11% on all types of hunting weapons and equipment sold. The Federal Department of Natural Resources received part of the excise tax from each cartridge sold (smooth and rifled); the money was then sent to finance reproduction and wildlife protection. The essence of this method of taxation is as follows: manufacturers of weapons, ammunition, and equipment used for hunting earn income and profit from their sales and pay the excise duty to the budget, the revenues from which are directed to compensate for the damage caused with the help of these tools. In the United States, all potential hunters must get a hunting license, for which a license fee is charged; about 20 million hunting licenses are sold per year. At the same time, the cost of licenses is insignificant, in different states it varies significantly for residents and nonresidents. For example, in Illinois the annual fee for an ordinary licence is 7.5 dollars, and for that combined with fishing – 19.5 dollars.

At the same time, for residents of other States, the amount of the license fee for the right to use wildlife objects in Illinois increases in 5–10 times. Acquisition of a hunting license is regulated by the States; if the amount of hunting resources is insufficient, then a draw (lottery) is held for the right to obtain it [22].

In Canada, there are no centralized mechanisms for the collection of contributions for the right to hunt and mechanisms for the allocation of quotas allowed for their distribution, and there is no annual payment in the form of a state fee. Each province of Canada has its own set of laws. For example, Nunavut, the Northern territory of Canada, inhabited mainly by Inuit (Eskimos), has an original system of distribution of hunting rights, some elements of which are applied in other Northwestern territories of the country. In Nunavut, residents are guaranteed direct administrative distribution of hunting resources. The Nunavut Wildlife Management Board annually determines the total volume of hunting, allocating it based on the need and the possible benefits of their use for the local economy. The remaining part, sent for commercial use, is necessarily distributed through the limited entry system according to special rules. In the distribution of commercial licences, which do not exceed three years, preference is given to local residents with primary residence in the territory and to applicants offering benefits to the local economy. In British Columbia (Canada), a hunting permit for the entire hunting season costs 100 dollars, it provides the opportunity to hunt widespread species of wildlife such as elk, deer, bear, wolf, wolverine [23; 24; 25; 26].

In these countries, the directions of use of budget revenues that come from the fees for the use of wildlife objects largely coincide. In Finland, budget revenues received from the collection of payments from hunters are spent on financing activities aimed at improving the habitat of wild animals, conducting accounting and statistical studies of the population of animals and birds, and maintenance of hunting grounds. In the United States, all budget revenues derived from hunting taxation are used to finance federal and state programs, as well as to maintain departments for the protection and reproduction of wildlife. They are mainly spent on improving the habitat of wild animals, accounting and statistical studies of animal populations, acquisition of new hunting grounds, training and instructing hunters, construction of new and maintenance of existing public shooting ranges, and maintenance of the federal service for monitoring the use of hunting resources.

The restriction of the hunting area with the establishment of hunting boundaries is applied in all countries. The boundaries of hunting are strictly defined and controlled. For example, British Columbia (Canada) issues a special map with strictly defined boundaries within which it is allowed to hunt. In Finland, compliance with hunting rules is monitored by the territorial police and border guard within the powers established by the state. Here an individual can be deprived of the right to hunt for a period of one year as one of the measures of responsibility. As a result, violations are extremely rare. In Norway, the control of private hunting rules is given to owners of hunting grounds or tenants. In the United States, hunting rules are inextricably linked to the wildlife conservation act. The system of administration of the use of wildlife objects is built in such a way that the rules of hunting are clear to everyone, compliance with them is easy and inconsistent, and violation is financially burdensome. Poaching is punished very harshly; as a result, it is extremely rare [27].

Table 2. Theoretical approaches to the taxation of hunting resources

|

No. |

Essence |

|

|

1. |

Rent-based |

It is based on the rental nature of all tax payments. Proposed By D. Ricardo, substantiated by Russian scientists S. Yu. Glazyev and others [28]. |

|

2. |

Compensational |

It is based on the compensation of governmental expenses on the protection and reproduction of renewable natural resources, prevention of illegal use of wildlife, and environmental protection. Briefly described by R.R. Yarullinin [29]. |

|

3. |

Permissive |

It is based on the fiscal sovereignty of the state on the right of ownership of natural resources with the use of the licensing system. Briefly described E.B. Shuvalova, M.S. Gordienko, N.V. Sibatulina [30]. It is used in Russia. |

|

4. |

Environmental and economic |

It is based on the following: harmonization of interests of the state, local population, nature users, including hunters and subsoil users; strengthening the ecologization of taxation; formation of methodical tools to determine the possible charges for use of wildlife objects; introduction of innovative methods of the state monitoring and control; strengthening of the role of regional tax policy. The elements of the environmental approach are presented in the scientific works of A. Pigou [13]. The environmental and economic approach was proposed by S.I. Chuzhmarova and A.I. Chuzhmarov [31]. |

|

5. |

Comprehensive environmental and economic |

It is based on the interconnection between the ecological and economic approach and the excise taxation. We make an attempt to substantiate it in the present paper. |

|

Source: own elaboration. |

||

Analysis of the Northern Russian and foreign experience allows us to determine what could be considered for use in Russia. First, we can consider the targeted taxation of weapons and equipment manufacturers, the funds from which are directed to the financing of programs for nature protection, reproduction of wild animals and birds. Second, we can consider the establishment of a small amount of the license fee; third, strict liability measures in case of a violation of legislation on taxes and fees in the field of hunting. The combination of the above leads, as a rule, to a positive result.

Theoretical approaches to the taxation of hunting resources

Analysis of the theory and practice of taxation for the use of wildlife in the Northern regions of Russia, as well as foreign experience of taxation of this type of natural resources allows us to identify the following alternative theoretical approaches to the taxation, the nature and content of which are different (Tab. 2) .

The problems of hunting and hunting economy, combined with the preservation of biological diversity relate to taxation, namely, the transition from its disparate schemes (resource, permission, compensation) to a new integrated ecological-economic approach that focuses on harmonizing social, economic and ecological relations (Figure).

This approach requires compliance with certain conditions:

-

1. Establishment of new excisable goods : weapons, ammunition and equipment. The specified excise duty must be paid by producers of hunting weapons and equipment and also by the sellers of the resold weapon. Either the value of sold excisable weapons, ammunition and equipment, or their number may be recognized as the object of taxation. In our opinion, it is advisable to determine the number of weapons and equipment as the object of taxation, since the damage to nature does not depend on their value. The excise rate can be set at the rate of 1000 rubles per weapon and 1 ruble per cartridge. It should be noted that in Russia in 1994–1996 (Resolution of the Government of the Russian Federation of March 31, 1994 No. 273), excise taxation of weapons at a rate of 20% of its value did not allow to get a good result, due to the presence of the market of previously

-

2. Excise tax can be considered from the perspective of compensation for damage caused to nature, as well as the possibility of expanded reproduction, further growth of production potential, income and profits of producers. In addition, this excise tax includes gunsmiths in the circle of persons involved in the performance of social functions for the reproduction of wildlife.

-

3. Introduction of an additional targeted environmental compensation fee for subsoil users whose activities have a negative impact on the environment. It is proposed to establish the amount of the fee at a multiple of the amount of damage. Its purpose is to increase the amount of funds for the maintenance of hunting grounds and strengthening the material and technical base of the hunting sector.

-

4 . Ensuring free access to forest resources for the local population of the Northern territories . At present, unfortunately, a part of forest plots is leased to private persons for a long period of time. At the same time, local residents either do not have the opportunity to enter these sites, or must purchase a ticket, which gives the right to hunt in them. The cost of such a ticket exceeds manyfold the amount of the fee established by the Tax Code of the Russian Federation.

-

5. Compliance with the principles of convenience, simplicity, single taxation of hunters for the actual use of wildlife.

-

6. Establishment of compensation for the elimination of predators (wolves) (if there is a threat to reindeer husbandry and people’s lives) and other types of animals in the event of mass

-

7. Formation of modern methodological tools for the accounting of wildlife objects on the basis of modern information technologies for determining the population of wildlife objects; involvement of the local population to control the state of the environmental situation in the territory of their residence.

-

8. Granting the authorities of Russia’s constituent entities the right to expand the list of objects of taxation and establish the rates of charges for the use of wildlife objects taking into account territorial features. The Tax Code of the Russian Federation (Chapter 25.1) does not include many wild animals and birds that are objects of hunting, in particular arctic foxes, foxes, hares, partridges, etc.

-

9. Establishment of benefits related to hunting fees. The Ministry of Natural Resources of Russia proposed to establish an additional fee (“tax on hunters”) since 2019 on hunting the objects of wildlife not included in the list (Article 333.3 of the Tax Code). Currently, this issue has not been resolved.

Comprehensive environmental and economic approach to taxation of the use of wildlife objects

Source: own compilation.

used weapons that are not taxable. Excise tax should go to the local budget, which is the closest to the territory of hunting. It may be credited to specific trust funds specially created for this purpose, but the effect will be lower due to the organizational and management costsof the funds.

infectious diseases to prevent further spread of the disease, for example, in the amount of 1,000 rubles per unit.

The practical importance of successful implementation of a new integrated ecological-economic approach to the taxation of the use of wildlife objects consists in the following: rise of tax revenues of local budgets; increase in budgetary funding to ensure the reproduction of biological resources – wildlife, environmental protection, improvement of ecological situation in the Northern regions of the country; involvement of local people in implementation of environmental protection measures and control of commercial hunting.

We note another important circumstance in the understanding of the “integrated approach” and its practical significance – a kind of dialectic of the organization of hunting and hunting economy. This economic sector once occupied the leading market positions in the system of initial capital, then it began to represent one of the forms of social (collective) organization of rural residents of the taiga and tundra territories of our country [32, 33]. At present, it could not, due to its specifics, “fit” into the classics of market relations and is forced to revive the old forms of existence or search for new ones. The revival of the old is implemented by establishing hunting and fishing cooperatives [34], the search for the new – by entering the infrastructure of tourism and sports hunting [35]. The fiscal aspect of such transformations consists in promoting hunting sectors (societies), especially in terms of their environmental functions and in establishing favorable conditions for recreation in nature. The revenue part of hunting is increasingly moving to the sphere of hunting tourism and is implemented in the costs of its organizing.

Conclusion

Taxation in the procurement of hunting resources should contribute to the formation of a system of social and environmental relations in terms of environmental management and environmental protection. The regulatory role of fees for the use of wildlife objects is most effectively manifested in the comprehensive coverage of the interests of all participants – the organizers of hunting and the hunting sector, in the development of their environmental thinking. It is appropriate to consider fiscal relations in this sphere of activity in the context of improving the delimitation of hunting grounds, efficient organization of complex hunting farms, provision of support to public associations of hunters, economic incentives for optimising the number of game animals, combining infrastructure of recreation and tourism with the needs of amateur and professional hunting.

The study proposes a new comprehensive environmental and economic approach to the taxation of procurement of hunting resources in the Northern regions of Russia, based on the results of the analysis of theoretical approaches, assessment of the socio-economic value of the animal world, use of Northern domestic and foreign experience, taking into account practical tasks of the organization of hunting and wildlife protection; the approach also includes:

-

– establishment of new excisable goods (weapons, ammunition and equipment);

-

– introduction of additional targeted environmental compensation fee;

-

– providing the local population of the Northern territories with free access to forest resources;

-

– compliance with the principles of taxation of hunters for the use of wildlife objects (convenience, simplicity, single-stage process);

-

– establishment of compensation payments for the elimination of predators;

-

– formation of modern methodological tools for the accounting of wildlife objects;

-

– involvement of the local population to control the state of the environmental situation;

-

– granting the right to the authorities of constituent entities of the Russian Federation to expand the list of objects of taxation and establish the rates of fees.

Список литературы Procurement of hunting resources in the system of fiscal relations (case study of the northern regions of Russia)

- Lazhentsev V.N., Chuzhmarova S.I., Chuzhmarov A.I. Taxation in the system of natural resource management and its influence on the economic development of Northern territories. Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2018, vol. 11, no. 6, pp. 109-126. (In Russian) DOI: 10.15838/esc.2018.6.60.7

- Chuzhmarova S.I. Promoting socio-economic development of the Northern regions in the context of reforming the taxation of natural resources. Regional'naya ekonomika: teoriya i praktika=Regional Economy: Theory and Practice, 2009, no. 9 (102), pp. 21-27. (In Russian).

- Shelomentsev A.G., Doroshenko S.V., Kozlova O.A., Belyaev V.N., Toskunina V.E., Provorova A.A., Gubina O.V., Ilinbaeva E.A. Formirovanie sotsial’no-ekonomicheskoi politiki severnykh regionov Rossii s uchetom faktora osvoeniya prirodnykh resursov: monografiya

- [Forming the socio-economic policy of the Northern regions of Russia, taking into account natural resource development: monograph]. Institut ekonomiki UrO RAN, 2011. 140 p.

- Chuzhmarov A.I. Razvitie chastno-gosudarstvennogo partnerstva v usloviyakh Severa

- [Development of public-private partnership in the North]. Ed. by V.V. Fauzer. Moscow: Ekon-inform, 2012.

- Garnov A.P., Krasnobaeva O.V. Obshchie voprosy effektivnogo prirodopol’zovaniya

- [General issues of effective environmental management]. Moscow: Infra-M. Nauchnaya mysl'. Ekonomika, 2016. 214 p.

- Strategiya razvitiya okhotnich’ego khozyaistva v Rossiiskoi Federatsii do 2030 g.: utverzhdena rasporyazheniem Pravitel’stva Rossiiskoi Federatsii ot 3 iyulya 2014 g. No.1216-r

- [Strategy for the development of hunting economy in the Russian Federation till 2030: approved by the Resolution of the Government of the Russian Federation of July 3, 2014. No. 1216-r].

- Devall B., Sessions G. The development of natural resources and the integrity of nature. Environmental Ethics, 1984, no. 6, pp. 293-322.

- Kennedy J.J., Thomas J.W. Managing natural resources as social value. In: Knight R.L., Bates S.F. (Eds.). A New Century for Natural Resource Management. Washington, DC: Island Press, 1995. Pp. 311-321. Available at: http://www.umass.edu/hd/resources/KennedyValues.pdf

- Lipton D.W., Wellman K.F., Sheifer I.C., Weiher R.F. Economic Valuation of Natural Resources - A Handbook for Coastal Resource Policymakers. 1995. Pp. 131. Available at: http://docs.lib.noaa.gov/noaa_documents/NOS/NCCOS/COP/DAS/DAS_5.pdf

- Slee B. Socio-economic values of natural forests. Forest Snow Landscape Res., 2005, vol. 79, no. 1-2, pp. 157-167. Available at: http://www.wsl.ch/dienstleistungen/publikationen/pdf/6756.pdf

- Maiburov I.A., Ivanov Yu.B. (Eds.). Ekologicheskoe nalogooblozhenie. Teoriya i mirovye trendy: monografiya dlya magistrantov [Environmental taxation. Theory and global trends: a monograph for master's degree students]. Moscow: YuNITI-DANA, 2018. 359 p.

- Gromov V.V., Malinina T.A. Perspektivy ekologizatsii nalogovoi sistemy Rossiiskoi Federatsii [Prospects for greening the tax system of the Russian Federation]. Moscow: Delo, 2015. 84 p.

- Pigou A.C. Ekonomika blagosostoyaniya [The Economics of Welfare]. London: Macmillan and Co, 1932. 4th edition. Available at: https://translate.google.ru/translate?hl=ru

- Lisauckaite V.V. Natsional'nye i mezhdunarodno-pravovye problemy sovremennogo ekologicheskogo prava: ucheb.- metod. Kompleks [National and international legal issues of modern environmental law: training and methodological complex]. Irkutsk, 2007. 557 p.

- Girusov E.V., Lopatin V.N. Ekologiya i ekonomika prirodopol’zovaniya [Ecology and Economics of Nature Management]. Ed. by E.V. Girusov, V.N. Lopatin. Moscow: YuNITI-DANA, 2002. 455 p.

- Assessment of the role of scientific, technological and innovative potential of the region (experience of Siberia) In: Lazhentsev V.N. (Ed.). Sever: nauka i perspektivy innovatsionnogo razvitiya [North: Science and Prospects of Innovative Development] Syktyvkar, 2006. Pp. 43-74. (In Russian).

- Albogachieva B.M. Economic assessment of natural resources. Zhurnal nauchnykh publikatsii aspirantov i doktorantov=Journal of Scientific Publications of Postgraduates and Doctoral Students. Available at: http://jurnal.org/articles/2009/ekon3.html

- Hunting in Finland. Available at: http://fin-ware.ru/finlyandiya/oxota-v-finlyandii

- Ministry of agriculture and forestry of Finland. Available at: www.mmm.fi.

- Forest management in Finland. Available at: www.metsa.fi

- Romanov I. Mirovaya praktika. Okhotnich'e korolevstvo - okhota v Norvegii // Lesnoi i okhotnichii zhurnal=Journal of Forestry and Hunting. URL: https://ahf.org.ua/ru/library/world-practice/583-okhotniche-korolevstvo-okhota-v-norvegii

- Evstigneev D. America is unique in the field of hunting. Okhotniki.ru. 2018. Available at: // https://www.ohotniki. ru. (In Russian).

- Avetikyan M. The diary of a Canadian hunter. Logovo.info: elektronnyi zhurnal=Logovo.info: Online Journal. Available at: http://www.logovo.info

- Alberta Guide to Hunting Regulations. Edmonton: Sports Scene Publications Inc., 2001. 80 p.

- Hunting and Fur Harvesting Regulations and License Information. New Nouveau Brunswick, Canada, 2002. 28 p.

- Matveichuk S.P. Canadian experience in ensuring equal access to hunting resources. Okhotovedenie: ezhegodnyi nauchno-teoreticheskii zhurnal=Game Management: the Annual Scientific-Theoretical Journal, 2004, no. 2 (52), pp. 60-74. (In Russian).

- Features of the hunting sector of North America. Available at: https:furhunting.com/America-hunt. (In Russian).

- Glazyev S.Yu. Otsenka prirodnoi renty i ee rol' v ekonomike Rossii [Assessment of natural rent and its role in the Russian economy]. Moscow: INES. 2010.

- Yarullin R.R. Fees for the use of wildlife objects and objects of aquatic biological resources. Ekonomicheskie nauki=Economic Sciences.

- Shuvalova E.B., Gordienko M.S., Sibatulina N.V. The evolution of the system of environmental taxes, fees and charges in the Russian Federation. Ekonomicheskaya statistika=Economic Statistics, 2017, vol. 14, no. 6, pp. 32-38. (In Russian).

- Chuzhmarova S.I., Chuzhmarova A.I. Taxation of the use of objects of fauna in the Northern (Arctic) regions of Russia: ecological and economic approach. Izvestiya Dal'nevostochnogo federal'nogo universiteta. Ekonomika i upravlenie=The Bulletin of the Far Eastern Federal University. Economics and Management, 2018, no. 2, pp. 146-155. (In Russian).

- Danilov D.N., Rusanov Ya.S., Rykovskii A.S., Soldatkin E.I., Yurgenson P.B. Osnovy okhotoustroistva [The Basics of Game Management]. Ed. by D.N. Danilov. Moscow: Lesnaya promyshlennost', 1966. 331 p.

- Kaledin A.P. History of relations between the state and public associations of hunters. Available at: http://www.ohot-prostory.ru/index.php?option=com_content

- Lapsin G. Let us create hunting cooperatives. Okhota i okhotnich'e khozyaistvo=Hunting and the Hunting Economy, 2014, no. 1, pp. 1-2. (In Russian).

- Min'kov S.I., Chashchukhin V.A., Tetera V.A., Tselishcheva M.I. Features of formation of infrastructure of hunting farms. Agrarnaya nauka Evro-Severo-Vostoka=Agrarian Science of Euro-North-East, 2015, no. 1 (14), pp. 66-72. (In Russian).