Prospective Development of Arctic Coal Reserves on the Basis of Spatial Organization of Communications

Автор: Agarkov S.A., Koshkarev M.V.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 53, 2023 года.

Бесплатный доступ

In the current conditions of economic instability, the problem of developing the regional space of the Arctic zone, where huge reserves of hydrocarbons and other minerals are concentrated, which are the main driver of the future development of the Arctic economy, is becoming increasingly important. The development of the Arctic region was strongly influenced by the international environment, which, on the one hand, poses a threat to the Arctic mineral projects, and on the other hand, opens up new opportunities for their successful implementation. Against this background, the task of the Arctic coal industry within the framework of spatial and regional development is the territorial and production optimization of production and transportation of coal products. The purpose of the study is to analyze current trends in the development of the coal mining market in the new geo-economic and political conditions, which results in the proposed approaches to the spatial organization of the transport communications system, allowing maximizing the economic and export potential of the prospective development of Arctic coal reserves. It has been established that the current situation greatly affects the energy market. Russian coal market is being transformed under the influence of geo-economic transformations, the formation of new coal mining centers is shifting eastwards closer to the Asia-Pacific region, which will become the main center of coal trade in the near future. The study concludes that the efficiency of the development of Arctic coal reserves directly depends on the spatial organization of a complex system of integrated production and transport corridors (IPTC) that combine the production and logistics chain of mining and transportation of coal products into a single holistically integrated space of sea, coastal and land communications. On the basis of the analysis of the Taimyr coal basin, a priority level for the prospective development of mineral resources has been determined, based on a combination of factors that condition the economic and export potential of coal deposits.

Arctic zone, mineral resource center, complex integrated production and transport corridor (CIPT), multiplier effect

Короткий адрес: https://sciup.org/148329487

IDR: 148329487 | УДК: [338.45:622.33](985)(045) | DOI: 10.37482/issn2221-2698.2023.53.5

Текст научной статьи Prospective Development of Arctic Coal Reserves on the Basis of Spatial Organization of Communications

The global economic agenda, including anti-Russian sanctions, creates new challenges for the Russian economy and the development of Arctic investment projects, which actualizes the task of searching for effective approaches to the spatial organization of economic development of Arctic spaces and resources that do not copy other models, but create own solutions taking into account features of the development of the national economy and the socio-economic context of the Arctic territories.

Currently, coal continues to be at the center of discussions about the prospects for global energy, including from the perspective of climatic factors, since it is not only the largest source of energy for industrial production (electricity, steel, etc.), but also one of the largest sources carbon dioxide (CO2) emissions. This shapes the global agenda for the global energy transition within the framework of the Paris Climate Agreement adopted in 2015 1, that was joined by 184 countries, which began to develop their own national low-carbon development strategies (“carbon neutral” or “net zero” strategies), providing for the achievement of a zero balance of greenhouse gas emissions and their absorption by natural ecosystems by 2050 [1, Porfiryev B.N., p. 49]. At the same time, the most economically developed countries (mainly the countries of the European Union) set the goal of achieving “net zero”, which means complete decarbonization of the economy, implying an absolute refusal to burn fossil fuels in industrial production. These aspects are reflected in forecast estimates of the development of world coal markets 2, which should be taken into account when forming long-term strategies for the development of the Russian coal industry, including Arctic coal projects.

The current situation is that under the transformation of the global energy market influenced by anti-Russian sanctions, serious changes are taking place in international coal trade. Russia is the world’s third-largest coal exporter, and sanctions have disrupted trade flows as buyers aligned with the EU coal embargo seek alternative sources of supply. This has led to a reduction in Russian exports and increased competition in the global coal market, which is now characterized by high turbulence and price volatility. Under these conditions, the main factor determining the export potential of Russian coal will be its price competitiveness among exporting countries and accessibility to world economic centers. This largely depends on the development and efficiency of transport communications, allowing for barrier-free access to consumer markets and the possibility of diversifying export cargo flows depending on the price environment for energy resources and the geopolitical situation in the world.

In the case of Arctic coal projects, this means the need to create spatially extended technological chains linking the production and sale of coal products with a reliable diversified system of transport communications (corridors). Such chains should begin in the Arctic, in places where fossil resources are developed, and extend to the regional economic centers of the country and the world.

In this context, the task of the export-oriented development of the Arctic coal industry is the territorial and manufacturing optimization of coal production and transportation, which determined the purpose of this work in relation to the research topic, where the issues of effective spatial organization of Arctic coal mining in the context of modern challenges are considered in a discussion context.

Literature review, materials and methods

The issues of spatial organization of the economy are the subject of many studies in foreign and domestic literature. A.G. Granberg made a special contribution to the development of this direction [2, p. 58], as well as S.S. Artobolevskiy [3, p. 102], P.A. Minakir [4, pp. 7–10], A.I. Tatarkin [5, pp. 10–15]. Among foreign authors, we should note the founder of new economic geography, Nobel laureate P. Krugman [6, pp. 227–235], the creators of modern regionalism B. Hettne and F. Söderbaum [7, pp. 6–21], J. Harrison [8, pp. 21–46] and many others.

The topic of spatial organization of the Arctic economy is reflected in a number of government documents, where the development of the resource potential of the Arctic territories (and water areas) is supposed to be carried out through the formation of mineral resource centers, which means the territory of one or more municipalities and (or) water area, within which there is a set of developed and planned for development deposits and promising areas, connected by a common existing and planned infrastructure and having a single point of shipment of extracted raw materials or products of their enrichment into the federal or regional transport system 3.

It is obvious that the realization of the significant resource potential (including coal) of the Arctic is inextricably linked with the development of the transport infrastructure of the Northern Sea Route, the icebreaker fleet and port infrastructure, as well as the system of land communications (transport corridors) connecting the Arctic territories (mineral resource centers) with regional economic centers of the country, as well as far and near abroad.

This approach is reflected in the Transport strategy of the Russian Federation until 2030 with a forecast for the period until 2035, where the creation of a unified backbone transport network (“Unified Backbone Network”) is declared as a strategic priority, which means the balanced and connected development of a transport network that combines the most important objects of transport infrastructure for all types of transport and ensures the functional unity of the transport

SOCIAL AND ECONOMIC DEVELOPMENT

Sergey A. Agarkov, Maksim V. Koshkarev. Prospective Development of Arctic Coal … system, sustainable interconnection and spatial development of the largest settlements, economic centers, main mineral resource and production zones, geostrategic territories 4.

The principles of forming a Unified Backbone Network also imply connections between mineral resource and production zones with Russian consumers and foreign markets. In this document, mineral resource centers are considered as types of macro-regional production clusters, which include “points of origin of freight flows”, that is, current and future centers for generating demand for freight transportation services. It is noted that the creation of a Unified Backbone Network should be carried out on the principles of advanced planning and construction of main transport infrastructure 5, which is especially important for the sustainable development of the Arctic territories and the economic development of mineral and raw materials (including coal) resources.

In addition, Decree of the Government of the Russian Federation dated September 30, 2018 No. 2101-r, provides for a comprehensive plan for the modernization and expansion of the main infrastructure for the period until 2024, within the framework of which JSC Russian Railways developed its own program (Decree of the Government of the Russian Federation dated March 19.2019 N 466-r) 6, aimed at providing railway infrastructure for the spatial development of the country, which includes a set of measures to eliminate infrastructure restrictions and increase the traffic and carrying capacity of railway lines (the length of such sections on the railway network was 8.2 thousand km as of as of 01.01.2018) 7.

Literature review [9, pp. 105–112], [10, pp. 369–372], [11, pp. 62–75, 76–86], [12, pp. 5– 23], [13, pp. 92–104], [14, pp. 1, 9, 13–15], [15, pp. 570–584], dedicated to the issues of sustainable development of the Arctic territories of the circumpolar regions and the analysis of state documents of strategic planning for the development of the national economy, led to a reasonable conclusion that the huge resource potential for the development of natural minerals in the Arctic directly depends on the comprehensive development of an integrated system of Arctic communications of all types of sea and land transport. It is the developed transport infrastructure based on an integrated communications system that makes it possible to create a supporting framework for the economic connectivity of the territories.

At the same time, the functional dominance of communication systems is the creation of conditions (and opportunities) for barrier-free interaction of business entities along the entire value chain from the extraction of mineral resources (production of processed products) to end-use markets. This is a prerequisite for ensuring sustainable socio-economic development of the Arctic territories and rational development of the natural resources of the Arctic.

In our opinion, the development of natural resources in the Arctic, including the task of active expansion of the presence of Russian producers in competitive markets, requires a dynamic approach based on the principle of “complementary expediency”, which defines the target priorities of the spatial organization of economic development of mineral resources in the integration unity of the rapid development of the Arctic communication systems, which will ensure a multiplier effect in the development of Arctic territories of strategic importance and the national economy as a whole.

The development of integrated production and transport corridors (IPTC) will make it possible to vary and combine (diversify) possible options for transportation routes for extracted natural resources, depending on regional economic conditions, energy price conditions and the geopolitical situation in the world.

The relevance of this approach for the Russian Arctic as a unique region with extreme economic conditions, in our opinion, is obvious, since one of the main factors hindering the development of Arctic territories and the active economic development of mineral resources (including coal) is insufficiently effective spatial organization of Arctic transport communications.

Arctic agenda

Global demand for hydrocarbons is the main driver of the development of the Arctic economy, rich in natural resources, estimated by experts at more than 85.1 trillion m3 of combustible natural gas, 17.3 billion tons of oil (including gas condensate), 7162.7 million tons of coal (3.6% of proven coal reserves in Russia as a whole) and other types of minerals (ferrous, non-ferrous, rare, rare earth, noble metals (gold, silver, platinoids), non-metallic: apatite ores, diamonds), which are a strategic development reserve mineral resource base of the Russian Federation.

Already today, the Arctic zone provides the production of more than 80% of combustible natural gas and 17% of oil (including gas condensate) in the Russian Federation 8. Table 1 presents data on the main types of hydrocarbon (liquid, solid) minerals in the Arctic zone of Russia in the specific ratio of reserves and production in the volumes of reserves and production of the Russian Federation.

Table 1

Main types of mineral hydrocarbon reserves in the Russian Arctic zone 9

|

Group and type of mineral |

Number of mineral deposits |

Unit |

Reserves (A+B+C1) |

% of mineral reserves in the RF |

Off-balance reserves |

Production in 2021 |

% of production in the RF |

|

Oil |

282 |

mln t |

3 879.5 |

20.8 |

69.3 |

13.2 |

|

|

Combustible gases (free gas) |

204 |

billion 3 m |

37 417.5 |

76.3 |

607.5 |

87.4 |

|

|

Combustible gases (soluble gas) |

264 |

billion 3 m |

390.7 |

25.2 |

9.2 |

1.3 |

|

|

Condensate |

157 |

mln t |

1 352.2 |

58 |

20.6 |

71.4 |

|

|

Coal |

45 |

mln t |

7 162.7 |

3.6 |

5 735.7 |

8.1 |

2.0 |

As for Arctic coal, the situation is not as simple as with liquid hydrocarbons: both from the point of view of the current contribution to the overall Russian coal production (2% of Russian production), and from the perspective of the strategic prospects of Arctic projects due to a number of external reasons and internal character.

Coal industry in Russia: state and trends

The coal industry is part of the country’s fuel and energy complex, which is one of the basic in the structure of the national economy in terms of filling the budget, creating jobs, and ensuring economic growth 10.

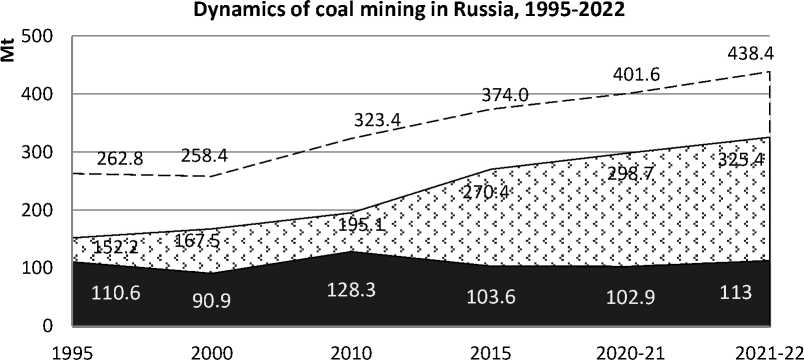

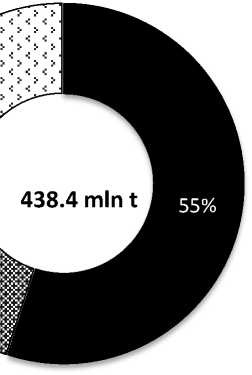

According to the literature devoted to the analysis of the Russian coal industry [17, pp. 923], [18, pp. 70-76 ], [19, pp. 9–14], as well as the reports of coal mining companies published by the Central Dispatching Department of the Fuel and Energy Complex (CDDFEC) 11, as of the end of 2021, the total production capacity of Russian coal mining enterprises amounted to 497.7 million tons of coal per year, including by open pit method (in open pits) — 365.2 million tons of coal per year (73.4%), by underground method (in mines) — 132.5 million tons of coal per year (26.6%). According to Rosstat, in 2021, 438.4 million tons of coal were produced in Russia (according to coal mining companies — 438.4 million tons). Figure 1 shows the dynamics of coal production in the Russian Federation for the period from 1995 to 2021.

□ Total coal production, Mt □ open way, Mt □ underground way, Mt

Fig. 1. Dynamics of coal mining in Russia, 1995–2022 12

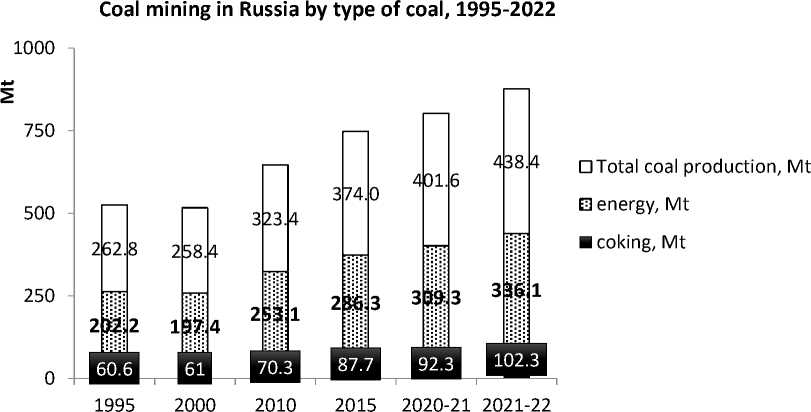

Fig. 2. Coal mining in Russia by type of coal, 1995–2022 13

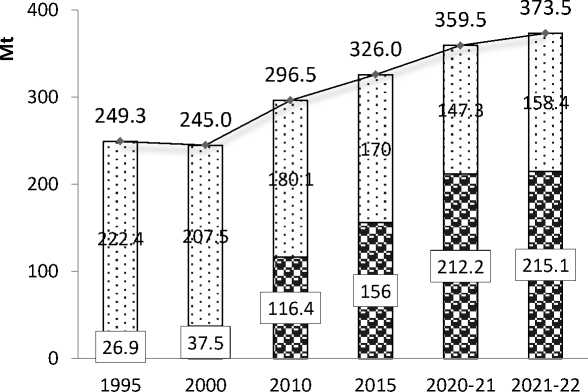

Export. The volume of Russian coal exports in 2021 amounted to 215.1 million tons (Fig. 3), including 201.3 million tons (93.6%) to non-CIS countries and 13.8 million tons to neighboring countries (6.4%).

12 Compiled by the authors based on reporting data from coal mining companies of CDDFEC. URL:

(accessed 02 February 2023).

13 Compiled by the authors.

Russian coal shipment dynamics (domestic and foreign markets), 1995-2022

ИЕЗ export, Mt

—•—Total shipment,Mt

domestic market, Mt

Fig. 3. Russian coal shipment dynamics (domestic and foreign markets), 1995–2022 14.

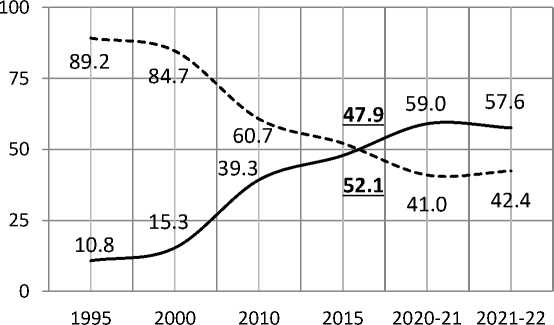

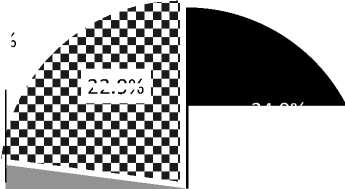

Exports account for 57.6% of the total volumes of production and shipment of Russian coal (Fig. 4). The main share of exports falls on thermal coals — 192.5 million tons (89.5%), coking coals account for 10.5% (22.6 million tons) of exports.

Russian coal shipment dynamics as a percentage to the domestic and foreign markets, 1995-2022

domestic market (%) export (%)

Fig. 4. Dynamics of Russian coal shipments to the domestic and foreign markets, 1995–2022 15

The total export volume in 2021 amounted to 215.3 million tons. Of the total export volume, the main volume of coal was shipped to non-CIS countries — 201.4 million tons (93.6%), 13.9 million tons were delivered to neighboring countries (6.4%). Fig. 5 presents the top 10 countries — the main importers of Russian coal (before the introduction of the coal embargo 16), which accounted for more than 77% (165.9 million tons) of all Russian exports.

Top 10 countries of the main importers of Russian coal before the introduction of the EU embargo, 2021

3.0%

22.9%

24.9%

-

■ 1. China (53.6 Mt)

-

■ 2. Japan (21.8 Mt)

-

■ 3. Republic of Korea (21.3 Mt)

-

■ 4. Netherlands (14.9 Mt)

-

■ 5. Türkiye (13.3 Mt)

-

■ 6. Taiwan (11.8 Mt)

-

■ 7. Poland (7.8 Mt)

-

■ 8. Morocco (7.6 Mt)

-

■ 9. Germany (7.0 Mt)

-

■ 10. India (6.5 Mt)

-

с Others (35.7 Mt)

Fig. 5. Top 10 countries — the main importers of Russian coal before the introduction of the EU embargo, 2021 17.

According to the Ministry of Energy, coal exports from Russia to the EU countries in 2021 amounted to 48.8 million tons (22.6% of total exports). The majority was thermal coal — 45.3 million tons (92.8%), coking coal for steel production — 3.5 million tons (7.2%). According to BCS Global Markets, before the coal embargo, Russia provided 70% of the EU’s thermal coal needs.

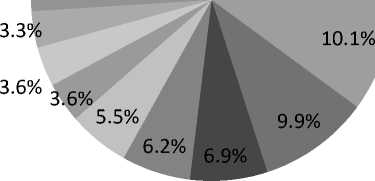

Structure of Russian coal supplies through ports and border crossings, 2015 - 2022

□ ports (%)

а border crossings (%)

Fig. 6. Structure of Russian coal supplies through ports and border crossings, 2015–2022 18.

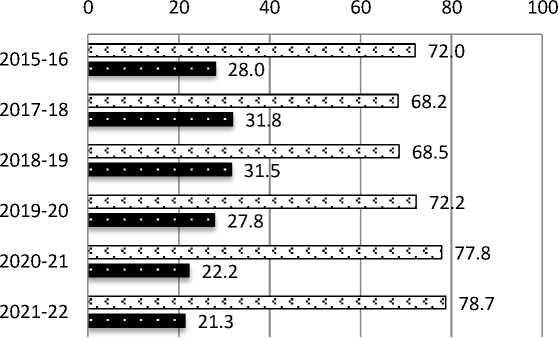

Economic indicators of the coal industry development. The total average cost of production of 1 ton of coal (without costs for delivery to consumer markets) at the end of 2022 amounted to 2797.4 rubles, which is 19% (+446.74 rubles) higher compared to 2020.

Dynamics of changes in the total cost of production of 1 ton of coal in Russia, (rub./т), 2010-2022

Fig. 7. Dynamics of changes in the total cost of mining 1 ton of coal in Russia, (rub./t), 2010–2022 19.

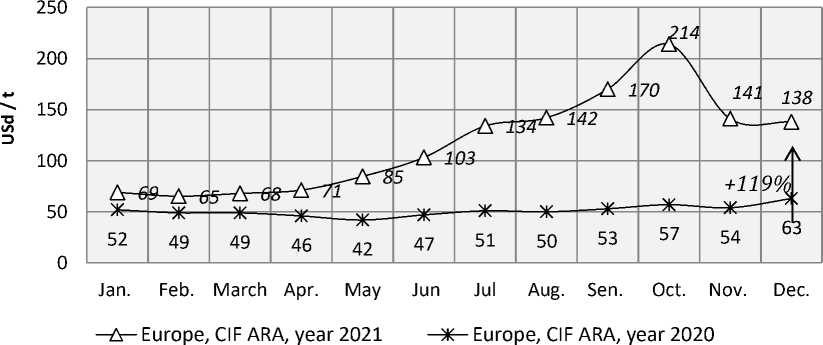

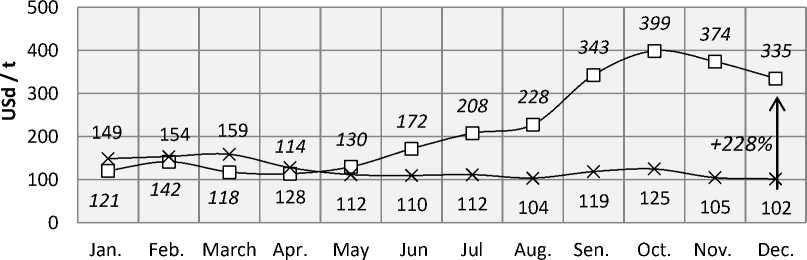

According to the results of 2021, the average price of 1 ton of shipped coal products amounted to 5576.1 rubles per ton (the increase was 245% or 3301.6 rubles/t). Export prices of Russian coal in 2021 also showed a significant increase — thermal coal exports: + 119%, metallurgical coal: + 228% compared to the 2020 level, respectively (Fig. 8, 9).

Export price dynamics of thermal coal (CIF APA), 2020-2021, USd/t

Fig. 8. Dynamics of thermal coal export prices (CIF APA), (USD/t), 2020–2021

Compiled by the authors.

Compiled by the authors.

Export price dynamics of metallurgical coal (FOB Queensland), 2020-2021, USd/t

Australia, FOB Queensland, year 2021

Australia, FOB Queensland, year 2020

Fig. 9. Dynamics of metallurgical coal export prices (FOB Queensland), (USD/t), 2020–2021 21.

Supply costs for metallurgical coal are generally higher than for thermal coal. This is because hard coal is more often mined underground and, on average, comes from smaller coal mines than thermal coal. In addition, the cost of preparing methyl coal is higher than for thermal coal. Therefore, as world prices and demand increase, deposits where coking coal is mined by open-pit mining increase their liquidity and, accordingly, their export potential. In this logic, investors prefer to invest in projects for the extraction of metallurgical coal, despite the fact that global consumption of thermal coal is 6.5 times higher than the volume of consumption of metallurgical grades (in 2022 — 6945 million tons and 1080 million tons, respectively), and imports — 3.4 times (in 2022 — 1035 million tons and 307 million tons, respectively), and in the forecast for the period until 2025, a decrease in imports of thermal coal is expected (-9.6% compared to 2022) , while imports of metallurgical grades of coal are expected to grow by +6.2% compared to the level of 2022 (Table 3). These trends reflect the global agenda for decarbonization of the world economy under the Paris Climate Agreement adopted in 2015 22, joined by 184 countries.

The main supplier of coal for export is the Siberian Federal District — 76.6% (164.7 million tons) of the total export volume, including the share of Kuzbass — 62.8% (135.1 million tons) of the total export volume. Table 2 presents data from the largest exporters of Russian coal.

Table 2

Largest coal exporters (according to reporting data of coal mining companies) 23

|

2021 |

2020 |

in % to 2020 |

|

|

JSC SUEK |

40 010.4 |

36 689.5 |

91.7 |

|

JSC MC Kuzbassrazrezugol |

30 941.8 |

38 120.3 |

123.2 |

|

Sibanthracite Group: |

16 942.6 |

17 162.9 |

101.3 |

|

— JSC Siberian Anthracite |

7 132.6 |

7 146.9 |

100.2 |

|

— LLC Razrez Vostochnyy |

3 893.4 |

2 733.2 |

70.2 |

21 Compiled by the authors.

22 Paris Agreement (accepted by the UN FCCC 21st session on December 12, 2015). URL:

(accessed 22 March 2023).

23 Compiled by the authors.

|

LLC MC Elga Ugol |

14 011.4 |

43 827.7 |

312.8 |

|

JSC HC SDS-Ugol |

13 806.4 |

13 060.9 |

94.6 |

|

LLC VGK |

9 893.8 |

9 141.9 |

92.4 |

|

JSC Stroyservis |

7 914 |

11 301.2 |

142.8 |

|

LLC Raspadskaya MC |

7 550.3 |

6 659.4 |

88.2 |

|

PJSC Kuzbasskaya FC |

6 426.5 |

6 593.6 |

102.6 |

|

GC TALTEK |

6 041.4 |

12 777.6 |

211.5 |

|

PJSC Mechel |

5 602.1 |

4 207.2 |

75.1 |

|

other |

42 556.6 |

49 711.6 |

85.6 |

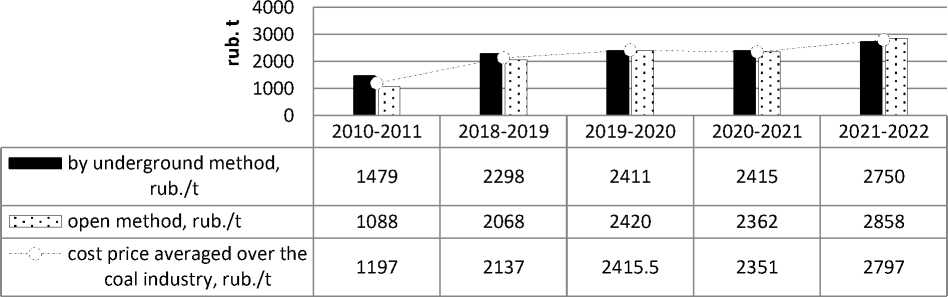

The largest coal-mining region is the Kuznetsk basin, where more than half (55.0%) of all coal in the country and 71.6% of coking coal are mined (Fig. 10).

Coal mining in Russia by main coal basins, million tons, 2021

2%

2%

3%?®

3%

4%

4%

7%

12%

8%

438.4 mln t

55%

■ 1. Kuznetsk pool (241,2 Mt)

3 2. Kansk-Achinsk basin (34,8 Mt)

0 3. Deposits of Khakassia (30,6 Mt)

a 4. Zabaikalsky deposits (20,1 Mt)

D 5. South Yakutsk basin (15,9 Mt)

в 6. Elginskoye field (14,7 Mt)

□ 7. Sakhalin deposits (13 Mt)

□ 8. Pechora basin (8,8 Mt)

□ 9.Donetsk basin (7,1 Mt)

□ 10. The rest (52,2 Mt)

Fig. 10. Coal production in Russia by major coal basins (million tons), 2021 24.

The role of Arctic coal mining: current status and development potential

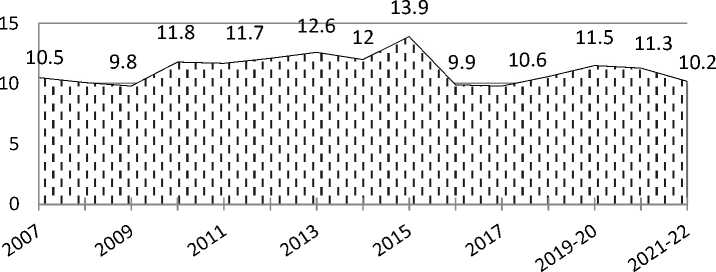

The share of Arctic coal mining in the total balance of the Russian coal industry is about 2.7% (in 2021, the Russian Arctic — 10.2 million tons, Russia — 438.4 million tons), the share in Russian exports is 0.5% (in 2021, the Russian Arctic — 1.1 million tons, Russia — 215.1 million tons) 25.

Coal production in the Arctic as a whole is about 10–12 million tons, while there is a general trend towards a decrease in Arctic coal production. Thus, according to the results of 2021, 10.2 million tons were produced, which is 10.5% lower compared to 2020 (11.3 million tons) and 26.6% lower compared to 2015, when 13.9 million tons were produced, which is a historical maximum (Fig. 11).

Coal mining in the Russian Arctic, (million tons), 2007-2022

Fig. 11. Coal production in the Russian Arctic (million tons), 2007–2022 26.

The main share in Arctic coal production is made up by Vorkuta deposits — about 86.3%, Chukotka — 10.8%, Yakutia — 2.9%, production on Spitsbergen (FSUE Arktikugol, Murmansk) is about 0.1%. The main supplies of coal mined in the Arctic, approximately 89% (9.1 million tons), go to the domestic market to satisfy municipal needs, the remaining 11% (1.1 million tons) are exported.

The development potential of Arctic coal mining is determined by a number of factors, both internal and external.

The favorable factors include:

-

• significant reserves of coal, including valuable coal grades (anthracite, coking coals), which are in greatest demand on international markets, making it possible to plan their development for the long term;

-

• acceptable level of complexity of mining and geological conditions for field development (open-pit mining of coal deposits);

-

• concentration of reserves in a relatively small area;

-

• relative proximity of seaports (Dikson, Dudinka, Igarka) and river communications (Yenisei River), which allows for diversified transportation both to international markets (mainly the Asia-Pacific region) and to industrially developed areas of the Krasnoyarsk Krai and other territories of Russia.

The factors hindering the development of Arctic coal projects are:

-

• insufficient level of development of transport communications, primarily the Northern

Sea Route, including the lack of icebreakers and ice-class merchant ships to ensure yearround navigation and guaranteed supply of goods, primarily to the markets of the Asia-Pacific region 27;

-

• difficulties in field development due to extreme natural and climatic conditions;

-

• high costs associated with meeting environmental requirements for the development of natural reserves in the Arctic.

Balance reserves of Arctic coal (category A+B+C1) are estimated at 7162.7 million tons, category C2 — 2062.9 million tons (off-balance reserves — 5735.6 million tons), which is 3.6% of proven Russian coal reserves. Coking coals (categories A+B+C1) — 3163.59 million tons, make up 44.9% of the explored Arctic reserves, including especially valuable grades of coal (K, KO, KZh) — 2622.3 million tons. Coal reserves in the Arctic are distributed by 45 deposits. Most of it is located in the Komi Republic (Pechora coal basin) — 5.1 billion tons, which is 70.2% of coal reserves in the Arctic.

The second place in explored coal reserves is occupied by the Krasnoyarsk Krai with 1.4 billion tons (19.6%). The most significant reserves include the Vorkutskoe, Vorgashorskoe, Usinskoe coal deposits with the largest reserves of coking coal, which is a particularly valuable grade that is in great demand on world markets.

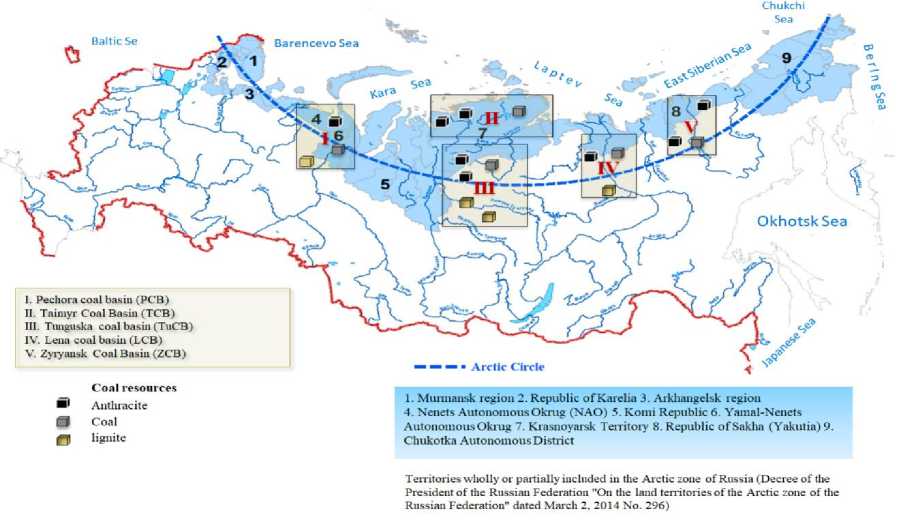

Table 3 and in Fig. 12 show coal basins that are partially or completely included in the Arc- tic zone of Russia.

Fig. 12. Prospective coal basins of the Arctic zone of the Russian Federation 28.

The largest coal basins in the Arctic zone include Pechora, located in the Komi Republic (coal resources of 265 billion tons), Taimyr, which occupies a significant part of the Taimyr Peninsula (Krasnoyarsk Krai) with an area of more than 80 thousand km2 (coal resources of 217 billion tons), stretches in the form of a narrow stripes in a northeast direction from the Yenisei Bay in the west to the coast of the Laptev Sea in the east. The Tunguska coal basin is the largest in Russia and the world in terms of coal resources (2299 billion tons) — stretches from north to south for 1800

-

28 Compiled by the authors.

km and from west to east — for 1200 km (about 90% of the territory belongs to the Krasnoyarsk Krai, the remaining area included in the Irkutsk Oblast and Yakutia).

The Lenskiy coal basin with an area of 600 thousand km2 is located in Yakutia (partially in the Krasnoyarsk Krai), along the banks of the Lena River and its tributaries and along the coast of the Laptev Sea from the mouth of the Lena River to Khatanga Bay. In terms of confirmed resources (1.647 billion tons), it is second after the Tunguska basin (contains 10% of the world’s estimated coal resources and 25% of the coal resources of the Russian Federation). The Zyryanskiy coal basin (Sakha Republic) is located in the interfluve of the middle reaches of the Kolyma and Indigirka with an area of about 7500 km2 (coal resources are about 40 billion tons).

-

Table 3 presents data characterizing the resource potential of coal deposits, fully or partially included in the Arctic zone of Russia.

Table 3

Coal basins fully or partially included in the Arctic zone of Russia 29

|

Coal Basin |

Resources |

Reserves (А + В + С1) |

Total field area |

Characteristic |

|

I. Pechorskiy |

265 billion tons, incl. conditioned -61 billion tons |

8.2 billion tons |

> 90.1 thousand km² |

Located on the western slope of the Polar Urals and Pai-Khoi, in the Komi Republic, in the city of Vorkuta, the Nenets Autonomous Okrug and the Arkhangelsk Oblast. According to the degree of metamorphism, they range from brown to anthracite. |

|

II. Taimyr |

217 billion tons, incl. conditioned - 185 billion tons |

89 million tons |

> 80 thousand km2 |

The basin is located in the north of the Krasnoyarsk Krai, occupying a significant part of the Taimyr Peninsula. |

|

III. Tunguska |

2299 billion tons |

1.88 billion tons |

> 1 million km2 |

The largest in the Russian Federation and the world both in terms of coal resources and area. From north to south it stretches for 1800 km, and from west to east - for 1200 km. |

|

VI. Lenskiy |

1647 billion tons |

2.1 billion tons |

600 thousand km2 |

The second largest coal resource basin in the Russian Federation, contains 10% of the estimated global coal resources and 25% of Russia’s coal resources. |

Compiled by the authors.

The Taimyr coal basin is of the greatest interest from the point of view of export potential, as it contains significant reserves of valuable coking coal grades, which are in high demand on world markets.

The Taimyr coal basin has been known since 1843 and ranks 5th in the country in terms of coal resources (234 billion tons). The total coal resources are 217 billion tons, of which 185 billion tons are conditioned coal resources, with A+B+C1 category reserves of 89 million tons. The number of coal seams with a depth of 1 to 12 meters reaches several dozen. Fig. 13 shows the main deposits of the Taimyr coal basin.

Fig. 13. Main deposits of the Taimyr coal basin 30.

The greatest prospects for the industrial development of coal resources are associated with the western part of the basin. A significant part of the reserves here is anthracite, which determines the high export potential of these deposits.

Currently, an investment project is already being implemented for the development of the Syradasayskoe coking coal deposit (located 105–120 km southeast of the village of Dikson, the resources of which are estimated at more than 5 billion tons of coal of G (gas), R (rich), C (coke) and LS (lean-sintering) grades) 31. It is planned to create a coal cluster on the basis of this project 32. The project to create a coal cluster in Taimyr will receive state support. As part of the project,

-

30 Compiled by the authors.

-

31 Na Taymyre postroyat fabriku po proizvodstvu ugol'nogo kontsentrata [A factory for the production of coal concentrate will be built in Taimyr]. URL: https://pulse.mail.ru/article/na-tajmyre-postroyat-fabriku-po-proizvodstvu- ugolnogo-koncentrata-6665585833829864916-5800849740666477922/ (accessed 19 March 2023).

-

32 The project for the construction of a coal complex at the Syradasayskoe deposit, one of the largest coal deposits in the world, was included in the number of investment projects in the Arctic zone supported by the Government of the Russian Federation. The project is also included in the comprehensive investment project “Yenisei Siberia” and has the status of a regional investment project.

which is being implemented by the Severnaya Zvezda company (part of the AEON corporation), it is planned to build a coal preparation plant for deep processing of coal (production of coal concentrates from coking coal), a marine terminal, an airport, a rotational camp, a power plant, and a highway. As part of the development of the Taimyr coal cluster, the construction of a 60-kilometer highway is underway; this will connect all the objects of the project for the development of the Syradasayskoe coal deposit. The project is planned to produce 20 million tons of high-quality coal per year.

As a result of the analysis, we can conclude that the potential for coal production in the Arctic is determined by significant proven reserves, which are of strategic importance for the national economy in the long term. At the same time, it is important to emphasize that the economic development of Arctic coal reserves is impossible without the development of transport communications, which is determined by the Arctic specifics of extreme economic conditions, the length of the borders, including sea borders (from the Kara Gate to Providence Bay 5600 km), and the distance from domestic and global consumer markets. Therefore, the most promising and economically feasible form of development of Arctic coal reserves is the creation of spatial-economic formations in the form of mineral resource centers (MRCs), integrated into national and international transport corridors, i.e. connected by a common integrated transport and logistics infrastructure with the economic centers of the country and the world, which will make it possible to make the most efficient use of the economic potential of Arctic coal deposits.

Results and discussion

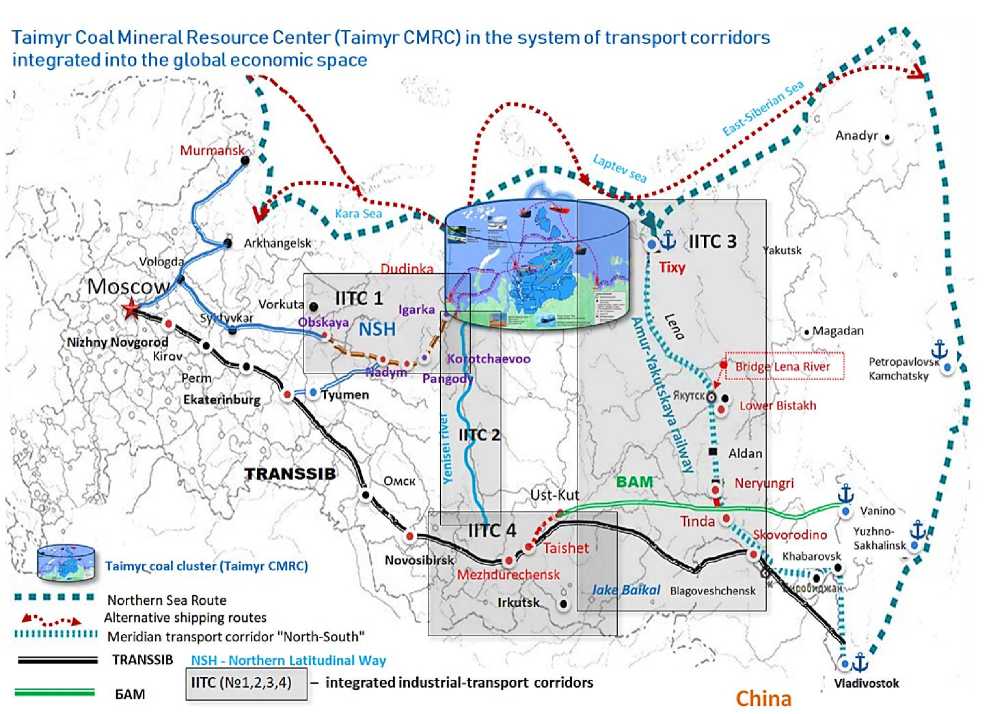

Taking into account all the factors listed above, we conclude that in modern conditions, the prospects for the development of Arctic coal mining largely depend on the possibility of delivering the extracted raw materials to global and domestic consumer markets. This means that when developing Arctic coal reserves, it is necessary to create spatially extended technological chains connecting production and sales of products with a reliable diversified system of transport communications. Such chains should begin in the Arctic, in places where fossil resources are developed, and extend to the regional economic centers of the country and the world. The solution to this problem will require the advanced development of the Arctic communications system, which implies a comprehensive approach, including the creation of integrated production and transport corridors (IPTC), allowing to maximize the competitive opportunities of Arctic mineral resources, including coal deposits.

It is also inextricably linked with the development of the port infrastructure of the Northern Sea Route as an effective route for the transportation of Russian goods, including the construction of modern icebreakers and ice-class transport vessels to ensure year-round navigation, which is very important for guaranteed and efficient satisfaction of demand and strengthening the position of Russian exporters in the global coal market, mainly in the Asia-Pacific region.

With regard to the research topic, in our opinion, the maximum effect of the economic development of the Arctic territories, allowing to use the opportunities of coal deposits in a comprehensive manner, will be manifested in the creation of not separate highly specialized development centers, but mineral resource centers (MRCs) integrated into the global (national and world) economic space, which implies the comprehensive development of production and transport corridors (IPTC) in the integrity of sea, river and land communications. This will allow optimizing transport logistics and diversifying routes for the delivery of coal (and its enrichment products) to consumer markets, depending on regional business conditions, energy price conditions and the geopolitical situation in the world.

Fig. 14 presents a conceptualization of the spatial organization of economic development of Arctic coal reserves (using the example of the Taimyr coal basin), characterizing the integrity of production and transport corridors (PTC) of sea and land communications to ensure the possibility of diversifying the supply of coal (and its enrichment products) to domestic and international markets in depending on regional economic conditions, energy price conditions and the geopolitical situation in the world.

Fig. 14. Concept of spatial organization of prospective transport logistics for the development of Arctic coal resources in the integrity of sea and land transport corridors (Taimyr CMRC) 33.

-

33 Compiled by the authors based on an analysis of strategic documents, development programs and complex investment projects implemented by the state and large companies with strategic interests in the Arctic region.

IPTC 1 (Northern Latitudinal Passage) is a production and transport corridor connecting the Northern Sea Route through the northern ports (Dudinka and Dikson) with key railway lines (the Tyumen-Nadym line and the northern latitudinal line starting from Arkhangelsk). IPTC 2 (“Yenisei of Siberia”) is a production and transport corridor connecting the Northern Sea Route through the northern ports (Dudinka, Dikson) with the Southern latitudinal economic belt of Russia (Transsib, BAM). IPTC 3 and IPTC 4 (“Eastern Polygon” 34) are production and transport corridors connecting the Northern Sea Route through the port of Tiksi with the BAM and the Trans-Siberian Railway, forming a subarctic bridge with the Southern latitudinal economic belt of Russia.

Thus, by providing a complete system of integrated production and transport corridors (IPTC 1, 2, 3, 4), Russia will have access to the shores of its eastern seas not only along the southern border, through the Trans-Siberian Railway and BAM in the area of Vladivostok and Khabarovsk, but much further to the north, up to the Arctic territories. Importantly, in addition to the transit and export function of delivering Arctic natural resources to the country’s consumer markets and abroad, IPTCs will also significantly increase the economic development potential of the territories they cross.

Conclusion

An analysis of the current situation on the global coal market allows us to conclude that the main challenges for the Russian coal industry lie not in economic, but in geopolitical factors associated with anti-Russian sanctions (including the EU coal embargo), which block Russian exporters’ access to European consumer markets, as well as “maritime blockade” (voluntary refusal of foreign shipping companies to work with Russian cargo) on the part of Western countries that joined anti-Russian sanctions, which sharply reduced the potential for maritime transport of domestic goods (including coal).

As a result of the introduction of the EU coal embargo, Russia lost a significant share of the global coal market (more than 51% or 109.6 million tons), which is estimated at $8 to 11 billion per year in lost export revenues.

Under these conditions, the liquidity of the Arctic coal reserves is significantly increasing, the development of which is proposed to be carried out on the principle of “complementary expediency”, which defines the target priorities of the spatial organization of economic development of mineral resources in the integrity of the rapid development of the Arctic communications system, the creation of a system of integrated production and transport corridors (IPTC).

It seems that the implementation of this approach will provide unhindered access to the natural resources of remote areas of the Arctic. Relying on raw materials and transport and logistics capabilities, which open up additional opportunities for international transport corridors, strengthen the country’s single economic space and increase the transit potential of the Arctic territories.

Based on the presented arguments, the development of mineral resource centers (including coal MRCs) in the integrity of the system of production and transport corridors should be perceived as an absolute priority of the state Arctic policy and a key factor in ensuring the spatial organization of the economic development of natural resources in the Arctic, contributing to the sustainable socio-economic development of the Arctic territories and the national economy as a whole.

Thus, by starting a phased geostrategic reorientation of the country’s economy to the north and east, Russia will be able not only to compensate for the consequences of changes in the European agenda that are negative for the country, but also to consolidate the prospects for a new rise in the national economy. In essence, this is a unique historical opportunity for stable development that can ensure the future of Russia as a great power.

Список литературы Prospective Development of Arctic Coal Reserves on the Basis of Spatial Organization of Communications

- Porfir’ev B.N. Dekarbonizatsiya versus adaptatsiya ekonomiki k klimaticheskim izmeneniyam v strategii ustoychivogo razvitiya [Decarbonization VS. Adaptation of the Economy to Climate Change within the Sustainable Development Strategy]. Problemy prognozirovaniya [Studies on Russian Economic Develop-ment], 2022, no. 4, pp. 45–54. DOI: 10.47711/0868-6351-193-45-54

- Granberg A.G. Regional'naya ekonomika i regional'naya nauka v Rossii. Desyat' let spustya [Regional Economics and Regional Science in Russia: Ten Years Later]. Region. Ekonomika i sotsiologiya [Region: Economics and Sociology], 2004, no. 1, pp. 57–81.

- Artobolevskiy S.S. Prostranstvo i razvitie Rossii: polimasshtabnyy analiz [Russia's Space and Develop-ment: A Multiscale Analysis]. Vestnik Rossiyskoy akademii nauk [Herald of the Russian Academy of Sci-ences], 2009, vol. 79, no. 2, pp. 101–112.

- Minakir P.A., Dem'yanenko A.N. Prostranstvennaya ekonomika: evolyutsiya podkhodov i metodologiya [Spatial Economics: The Evolution of Approaches and Methodology]. Prostranstvennaya ekonomika [Spatial Economics], 2010, no. 2, pp. 6–32.

- Tatarkin A.I. Regional'naya napravlennost' ekonomicheskoy politiki Rossiyskoy Federatsii kak instituta prostranstvennogo obustroystva territoriy [Regional Targeting of the Economic Policy of the Russian Federation as an Institution of Regional Spatial Development]. Ekonomika regiona [Economy of Region], 2016, vol. 12, no. 1, pp. 9–27. DOI: 10.17059/2016-1-1

- Fujita M., Krugman P., Venables A.J. The Spatial Economy: Cities, Regions and International Trade. Cam-bridge, MA, MIT Press, 1999. 367 p.

- Hettne B., Söderbaum F. The New Regionalism Approach. Politeia, 1998, vol. 17, no. 3, pp. 6–21.

- Harrison J. Re-reading the New Regionalism — a Sympathetic Critique. Space and Polity, 2006, vol. 10 (1), pp. 21–46. DOI: 10.1080/13562570600796754

- Agarkov S.A., Kozmenko S.Yu., Matviishin D.A. Ekonomicheskoe osvoenie arkticheskikh mestorozhdeniy uglya: osobennosti morskoy transportirovki [Economic Development of Arctic Coal Deposits: Features of Maritime Transportation]. Izvestiya SPbGEU [Proceedings of the St. Petersburg State University of Eco-nomics], 2018, no. 5 (113), pp. 105–112.

- Agarkov S.A., Selin V.S. Arkticheskie kommunikatsii v global'noy ekonomike i razvitie Severnogo mor-skogo puti [Arctic Communication in the Global Economy and the Development of the Northern Sea Route]. Vestnik Murmanskogo gosudarstvennogo tekhnicheskogo universiteta [Vestnik of MSTU. Scien-tific Journal of Murmansk State Technical University], 2015, no. 3, pp. 369–372.

- Skuf'ina T.P., Emel'yanova E.E. Sotsial'no-ekonomicheskoe razvitie Severo-Arkticheskikh territoriy Rossii: monografiya [Socio-Economic Development of the North-Arctic Territories of Russia]. Apatity, KSC RAS, 2019, 119 p. (In Russ.); DOI: 10.25702/KSC.978.5.91137.408.2

- Stepanov N.S. Arktika i razvitie severnogo morskogo puti v institutsional'noy modernizatsii ekonomiki Rossii [Arctic and the Development of the Northern Sea Rout in the Institutional Modernization of Rus-sian Economy]. Federalizm [Federalism], 2019, no. 1 (93), pp. 5–23.

- Ivanova M.V., Koz'menko A.S. Prostranstvennaya organizatsiya morskikh kommunikatsiy Rossiyskoy Ark-tiki [Spatial Management of the Shipping Routes in the Russian Arctic]. Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz [Economic and Social Changes: Facts, Trends, Forecast], 2021, vol. 14, no. 2, pp. 92–104. DOI: 10.15838/esc.2021.2.74.6

- Smith M.A., Giles K. Russia and the Arctic: The “Last Dash North”. Defence Academy of the United King-dom, Advanced Research and Assessment Group. Russian Series, 2007. 27 p.

- Staun J. Russia's Strategy in the Arctic. Royal Danish Defence College, 2015, 32 p.

- Nong D., Countryman A.M., Warziniack T. Potential Impacts of Expanded Arctic Alaska Energy Resource Extraction on US Energy Sectors. Energy Policy, 2018, vol. 119, pp. 574–584. DOI: 10.1016/j.enpol.2018.05.003

- Petrenko I.E. Itogi raboty ugol'noy promyshlennosti Rossii za 2021 god [Russia's Coal Industry Perfor-mance for January – December, 2021]. Ugol' [Russian Coal Journal], 2022, no. 3, pp. 9–24. DOI: 10.18796/0041-5790-2022-3-9-23

- Plakitkina L.S., Plakitkin Yu.A, D'yachenko K.I. Razvitie dobychi uglya v Arkticheskoy zone Rossiyskoy Fed-eratsii: sostoyanie i potentsial razvitiya [Progress in Coal Mining in the Arctic Zone of the Russian Federa-tion: Current State and Potential for Development]. Ugol' [Russian Coal Journal], 2022, no. 7, pp. 71–77. 10.18796/0041-5790-2022-7-71-77

- Yanovsky A.B. Ugol': bitva za budushchee [Coal: The Battle for The Future]. Ugol' [Russian Coal Journal], 2020, no. 8, pp. 9–14. DOI: 10.18796/0041-5790-2020-8-9-14