Public investment in targeted social assistance programs

Автор: Tikhomirova Valentina Valentinovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Social development

Статья в выпуске: 6 (36) т.7, 2014 года.

Бесплатный доступ

The article analyzes the role of a monthly child care allowance in the budget of needy families. The author uses the data on the Republic of Komi and makes a comparative assessment of municipalities by the share of children subject to a monthly allowance in the total number of children. The author defines five groups of territories according to the level of social protection of children aged under 18. The article reveals that the role of a monthly child care allowance in a budget of families with children is insignificant, especially in rural areas of the republic.

Targeted social assistance, subsistence level, social investment, social benefits, monthly child care allowance

Короткий адрес: https://sciup.org/147223665

IDR: 147223665 | УДК: 36 | DOI: 10.15838/esc/2014.6.36.11

Текст научной статьи Public investment in targeted social assistance programs

Promotion of the state policy in the field of social infrastructure development leads to the increased scientific interest in the social investment issues. The social sphere is a set of public and private institutions whose activities are aimed at maintaining and enhancing a socially acceptable level and quality of life [1]. The state authorities are subjects of social investment.

The work is aimed at defining the concept “targeted social assistance”;

considering one of the types of targeted social assistance – monthly child care allowance – on the example of the Komi Republic (21 municipalities); analyzing the application of new progressive benefit schemes and provision of child care allowances – grading by age; revealing the dynamics of public investment in this type of benefits; determining the impact of investment in the budget of poor families.

Nowadays there are many definitions of social assistance, which do not differ much.

They are represented in the legislative and regulatory documents of the federal and regional level, which address the issues of the state targeted social assistance directly or indirectly. Most of them are close to the basic definition given in the federal law “On State Social Assistance”: “State social assistance is given to low-income families, low-income persons living alone, as well as other categories of citizens specified in the federal law in the form of social benefits, social pension supplement, subsidies, social services and essential goods” [2].

In the RF subjects legislation the definition of state targeted social assistance sometimes coincides with that given in the federal law, as, for example, in the Law of the Republic of Bashkortostan (2000): “Targeted social assistance is provision of low-income families or low-income persons living alone with social benefits, subsidies, social services, essential goods at the expense of funds of corresponding budgets”.

In most cases the definitions of targeted social assistance specify the same recipients – low income families, low-income citizens living alone ( the Law of the Nizhny Novgorod Oblast …, 2004; the Law of the Murmansk Oblast ..., 2004; the Law of the Rostov Oblast ..., 2004).

Some legal documents and publications clarify the conditions for the provision of social assistance (a difficult situation), eligibility (substandard income) and assistance types (financial, natural and assistance in the form of services) ( the Law of the Republic of Karelia , 1998; the Law of the Republic of Bashkortostan ..., 2000; the

Law of the Republic of Kazakhstan ..., 2001; the Regional Law of the Nizhny Novgorod Oblast. .., 2004).

Sometimes targeted social assistance is defined as a system of measures, social standards and guarantees. From theoretical and practical points of view, the first of these definitions are most acceptable, as they reveal the essence of social assistance.

In our interpretation targeted social assistance is a form of social benefits in monetary terms, natural aid and assistance in the form of services provided to low-income families, low-income persons living alone who are in difficult life situations beyond their reasons and who have per capita income below subsistence minimum.

Subsistence minimum is a poverty indicator, disclosing not only biological, but also social human survival. The principles to set subsistence minimum are common for all countries. They are defined by the Convention of the International Labor Organization: “When establishing subsistence minimum one should consider such basic needs of working families, as food, food energy, housing, clothing, medical care and education” [3].

Subsistence minimum was adopted by the Ministry of Labor of the Russian Federation in 1992 on the basis of the absolute concept of poverty. It is an average per capita value calculated for the working age population, pensioners and children.

The Russian consumption standard to estimate the requirement for assistance proved its invalidity [4].

Subsistence minimum is a key indicator of population’s poverty. It is “intended to justify the rates of minimum wage and minimum old-age pension adopted at the federal level and determine scholarships, grants, provision of low-income citizens with necessary state social assistance and other social payments. Subsistence minimum is monetary evaluation of the consumer goods basket, mandatory payments and fees” [5].

The basis of subsistence minimum and the concept of the consumer goods basket cost were first defined by K. Marx (1818– 1883,) a German economist, philosopher, founder of Marxism – the economic doctrine of the working class [6].

Marxist methodology originates from classical political economy, the labor theory of value by A. Smith and D. Ricardo [7]. He believes that the value of labor is determined by the cost of wealth required for the employee to exist and reproduce his/ her workforce. Based on this concept, the consumer goods basket cost is a fixed set of consumer goods and services.

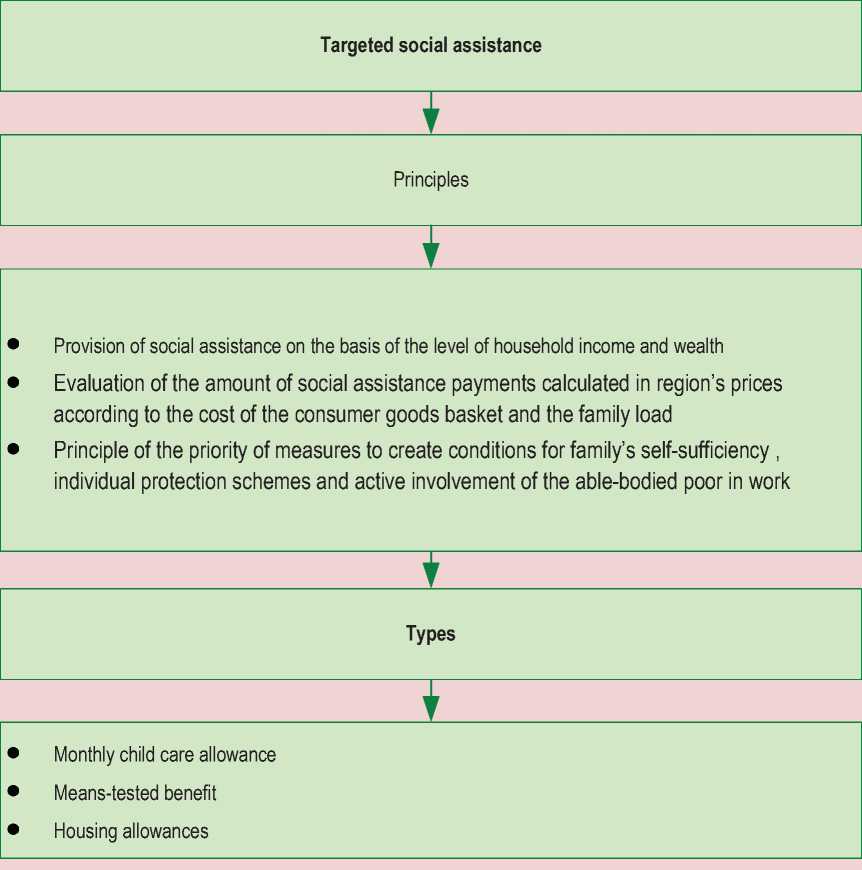

Thus, the system of targeted social assistance is based on the following principles: Provision of social assistance on the basis of the level of household income and wealth; Evaluation of the amount of social assistance payments calculated in region’s prices according to the cost of the consumer goods basket and the family load, calculated in prices, operating in the region; the priority of measures to create conditions for family’s self-sufficiency, individual protection schemes and active involvement of the able-bodied poor in work (fig. 1) .

It covers three types of targeted social protection benefits: monthly child care allowance, means-tested benefit, housing allowances, granted only after the expertise of household income [8].

In this article we consider one type of targeted social assistance – monthly child care allowance. We are interested in investment that pursues social objectives.

In accordance with the current legislation requirements the citizens with children can get the following kinds of state benefits (investment) [9]:

– maternity benefits;

– lump-sum benefit for women registered at hospital in the early stages of pregnancy;

– lump-sum childbirth benefit;

– monthly allowance for parental leave to care for a child of up to 18 months

– monthly child care allowance;

– lump-sum benefit when a child is adopted.

Of all kinds of family and maternity benefits only monthly child care allowance is a targeted form of social assistance. It is granted after the expertise of household income and aimed at reducing child poverty , which is the ugliest manifestation of poverty.

Monthly child care allowance is a regular cash payment of alimentary nature1 allocated from the national budget to provide financial assistance to the family to support and educate young children.

Monthly child care allowance prior to January 1, 2005 was the federal guaranteed payment, provided in accordance with the federal law “On state allowances to citizens having children” as of May 19, 1995, no. 122-FZ. The family can get it if per capita income in the family with the child

Figure 1. System of targeted social assistance to the population

does not exceed subsistence minimum in the Russian Federation subject; the person applying for the benefit lives together with the child, to whom it is granted; the child is under 16 or under 18 if he/she studies at the educational institutions. The allowance size amounted to 70 rubles, but it is increased with regard to the category of family – for children in single-parent families, children of military personnel, children whose parents do call-up military service and children whose parents avoid alimony. Despite inflation, the benefit size has never been revised. On the background of the high share of children in the low-income families the benefits are very low, despite they are paid only to them.

The existing approaches have changed after this law adoption. According to the new edition of the federal law “On state allowances to citizens having children” as of May 5, 1995, no. 81-FZ, elaborated according to Law no. 122-FZ, the size, the appointment procedure and the monthly child care allowance payment are fixed by the laws and other normative legal acts of RF subjects.

Thus, since January 1, 2005 the provision of monthly child care allowance has become the exclusive competence of the regional authorities. As before, in most regions only families with incomes below subsistence minimum are eligible to benefits [10].

On the territory of the Komi Republic, according to the Law of the Komi Republic “On state guarantees for families with children in the Komi Republic” as of November 12, 2004, no. 57-RZ, the families with children can get the following types of benefits: 1) monthly child care allowance: a) for a child born before January 1, 2005, b) for a child born after January 1, 2005; 2) monthly child care allowance supplement for a child born before January 1, 2005 [11].

The families with per capita income lower than subsistence minimum are eligible to monthly allowance for a child born before January 1, 2005 in the Komi Republic. The calculation of the average family income takes into account married parents, including separated parents and minor children living with them or with one of them. The amount of monthly child care allowance depends on the category of the family and ranges from 167.94 to 735.74 rubles (tab. 1, 2).

Monthly child care allowance supplement for a child born before January 1, 2005 is given to the poor. There is a regional coefficient for monthly child care allowance and monthly child care allowance supplement. The size of monthly care child allowance and monthly child care allowance supplement are indexed annually in accordance with the Komi Republic legislation.

The families recognized as the poor in accordance with the established practice can receive monthly allowance for a child born after January 1, 2005. To identify the family state one considers people who live together and maintain a joint household, which

Table 1. Size of investment payments for children according to the Law “On state guarantees for families with children in the Komi Republic” as of November 12, 2004, no. 57-RZ (since December 1, 2013)

|

For children born before January 1, 2005 |

Without r/c |

20% |

30% |

50% |

60% |

|

|

Monthly child care allowance |

At the normal rate |

139.95 |

167.94 |

181.94 |

209.93 |

223.92 |

|

Children of single mothers |

279.89 |

335.87 |

363.86 |

419.84 |

447.82 |

|

|

Child’s age is not taken into account |

Father does call-up military service |

209.92 |

251.90 |

272.90 |

314.88 |

335.87 |

|

It is impossible to recover alimony |

209.92 |

251.90 |

272.90 |

314.88 |

335.87 |

|

|

Monthly child care allowance supplement depending on the child’s age: |

||||||

|

Aged 3–6 |

459.84 |

551.81 |

597.79 |

689.76 |

735.74 |

|

|

Aged 6–16 (pupils – under 18) |

159.94 |

191.93 |

207.92 |

239.91 |

255.90 |

|

Table 2. Size of investment payments for children according to the Law “On state guarantees for families with children in the Komi Republic” as of November 12, 2004, no. 57-RZ (since December 1, 2013)

In 2013 the average size of subsistence minimum was revised on a quarterly basis [12], the increase was significant: first by 54 rubles, then by 115 rubles, then by 836 rubles and by 252 rubles in the fourth quarter. The SM size is fixed for different population groups and different natural-climatic zones (see tab. 3).

As a result, at the beginning of 2014 average subsistence minimum per child amounted to 9367 rubles.

As of the 1st quarter of 2014 per capita subsistence minimum for the main sociodemographic groups of the population and natural-climatic zones in the Komi Republic totaled 11371 rubles for the working-age population, 8669 rubles for pensioners and 11263 rubles for children in the Northern climatic zone.

In the southern climatic zone the size is the following: 9577 rubles for the workingage population, 7357 rubles for pensioners and 8550 rubles for children.

Table 3. Size of subsistence minimum as of the 1st quarter of 2014

|

Population groups |

On average in the Komi (rubles) |

Nature-climatic zones |

|

|

northern |

sourthern |

||

|

Entire population, including: |

9496 |

10 879 |

8930 |

|

Working-age population |

10 113 |

11 371 |

9577 |

|

Pensioners |

7692 |

8669 |

7357 |

|

Children |

9367 |

11 263 |

8550 |

The Northern climatic zone consists of Vorkuta, Inta, Pechora and Usinsk with their subordinate territories, as well as IzhemskyDistrict and Ust-Tsilemsky District. The southern zone includes the rest fifteen municipalities of the republic.

The region uses a new progressive scheme to assign and provide children with benefits – “grading by age”, which is designed to strengthen the targeting of social assistance in conditions of deep poverty and limited financial resources in the republic. It should be noted that this scheme is applied only in two Russian regions: in the Komi Republic and Saint Petersburg.

Each age group gets a different amount of allowance for children of single mothers, children, whose fathers do call-up military service and in case of impossibility to recover alimony.

This scheme is more progressive regarding other ways of child allowance provision due to the increased targeting of social assistance. It is especially valuable in the context of limited financial resources, as the efficiency of their use rises.

However, the experience of its application in the republic has showed that, despite the relatively large amount of children benefits and the regional coefficient being taken into account, they have a low impact on the budget of poor families, especially families with children aged 16 (students under 18).

The number of children under 18 who are granted monthly allowance reduces annually ( fig. 2 ).

In 2005 there were 71.9 thousand people and in 2013 their number decreased by 3.5 times to 20.7 thousand. So, during this period the proportion of such children decreased from 25 to 8% in the total number of children of the appropriate age (0–18).

The expenditures on monthly child care allowance reduced and in 2005–2013 they ranged from 185.5 to 171.7 million rubles

In the total spending on benefits and social assistance the share of monthly child care allowance amounted to 7.1% in 2005 to 1.3% in 2013 ( tab. 4 ).

In the period indicated (nine years) average child care allowance increased from 297.62 to 637.6 rubles, i.e. by 339.98 rubles. Annually the benefit size increased by 37.77 rubles and monthly – by 3.14 rubles.

This is mainly caused by the sharp increase in child care allowance for children aged under 1.5, maternity benefits, the introduction of maternity fund and the decrease in the absolute amount of monthly child care allowances, which indicates the weakening role of this kind of benefits in the budget of poor families.

Figure 2. Number of children under 18 years who are granted monthly allowance and share of children who are eligible to benefit in the total number of children of the appropriate age in the Komi Republic for 2005–2013

■ — ■ Number of children under 18 years who are granted monthly allowance

=с^ Share of children who are eligible to benefit in the total number of children of the appropriate age (0-18)

Table 4. Spending on benefits and social assistance (taking into account a regional coefficient), million rubles

|

Indicator |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|

Spending on benefits and social assistance – total |

2598.0 |

3374.0 |

4654.9 |

6908.2 |

10233.5 |

11763.5 |

13130.9 |

13045.8 |

- |

|

Monthly child care allowance up to 16(18) |

185.5 |

164.6 |

163.7 |

145.6 |

170.7 |

160.7 |

176.4 |

180.1 |

171.7 |

|

Monthly child care allowance up to 16(18), in % |

7.1 |

4.9 |

3.5 |

2.1 |

1.7 |

1.4 |

1.3 |

1.4 |

1.3 |

|

Average child care allowance, rubles |

297.62 |

275.44 |

283.61 |

364.36 |

458.90 |

475.34 |

546.64 |

590.37 |

637.6 |

Table 5. Grouping of urban districts and municipalities of the Komi Republic by the level of social protection of children under 16 (18) who receive monthly allowance (2009–2013), %

|

No. |

Social status characteristics |

Level, in % |

Districts 2009 |

Districts 2011 |

Districts 2013 |

|

1. |

Highly wealthy |

Below 10.1 |

Syktyvkar, Ukhta, Sosnogorsk, Usinsk, Vuktyl |

Syktyvkar, Ukhta, Sosnogorsk, Usinsk, Vuktyl, Vorkuta |

Syktyvkar, Vorkuta, Vuktyl, Inta , Pechora , Ukhta, Sosnogorsk, Usinsk |

|

2. |

Wealthy |

10.1–20.0 |

Pechora, Vorkuta, Inta, Ust-Vymsky |

Pechora, Inta, Knyazhpogostsky, Ust-Vymsky |

Knyazhpogostsk, Syktyvdinsky , Ust-Vymsky |

|

3. |

Needy |

20.1–30.0 |

Udorsky, Knyazhpogostsky |

Syktyvdinsky, Troitsko-Pechorsky, Udorsky |

Sysolsky, Troitsko-Pechorsky, Udorsky |

|

4. |

Poor |

30.1– 40.0 |

Troitsko-Pechorsky, Sysolsky, Syktyvdinsky, Koygorodsky, Izhemsky |

Koygorodsky, Sysolsky |

Koygorodsky, Kortkerossky, Priluzsky, Ust-Tsilemsky |

|

5. |

Extremely poor |

Above 40.0 |

Priluzsky, Ust-Tsilemsky, Ust-Kulomsky, Kortkerossky |

Kortkerossky, Priluzsky, Ust-Tsilemsky, Ust-Kulomsky, Izhemsky |

Izhemsky, Ust-Kulomsky |

The third group (needy ) included Sysolsky District, Troitsko-Pechorsky District and Udorsky District in 2013, where 20%– 30% of all children needed monthly allowance. Udorsky District remained in this group for the entire study period due to the prevalence of marginal forestry and agricultural enterprises there.

In 2013 the fourth group (poor) consisted of Koygorodsky District, Kortkerossky District, Priluzsky District and Ust-Tsilemsky District, where the number of children in need of benefits ranged from 30 to 40%. They are characterized by a very low level of income, due to the location of marginal agricultural and forestry enterprises there. Koygorodsky District had not changed its status for five years, while in other areas of this group children began to live better.

The fifth group (hardcore poor) included Izhemsky District and Ust-Kulomsky District, with the threshold of needy children being over 40%. Ust-Kulomsky District held its position, but children of Izhemsky District began to live poorer.

Basically, poverty is associated with unemployment and the region’s specialization on nonprofit logging and agriculture.

It should be noted that the greatest number of people receiving monthly child care

allowances or poor families is concentrated in 12 rural districts, which is a consequence of the low level of economic and social development of these areas.

Thus, the qualitative and quantitative characteristics of child poverty are one of the main indicators of the social status of childhood and reflect the level of society’s development as a whole.

The analysis has showed that investment in targeted social programs is ineffective. Despite the use of the new progressive assignment scheme and provision of child benefits – “grading by age” and the increase in its size, we can say that they have a weak impact on the budget of poor families, especially in the rural areas of the republic. The benefit reduces when a child gets older, although the presumption of the reduced costs to support and educate children as they grow does not seem quite obvious. This trend is evident in all the regions where the grading scheme is applied.

It is necessary to increase the benefit size, primarily for the families with children aged 6–16. It is also clear that only the provision of monthly child care allowance can not eliminate the poverty of families who work at the unprofitable enterprises and live in the areas with poor infrastructure.

Список литературы Public investment in targeted social assistance programs

- Bukhonova S.M. Upravlenie investitsionnoi deyatel’nost’yu v regione: dis. d-ra ekon. nauk: 08.00.05 . Belgorod, 1998. 343 p. RGB OD, 71:99-8/89-4.

- O gosudarstvennoi sotsial’noi pomoshchi: Federal’nyi zakon № 178-FZ ot 17 iyulya 1999 goda, st. 11 .

- Konventsiya MOT № 117, st. 5, chast’ 2, Konventsiya MOT № 82, st. 9, chast’ 2 .

- Rimashevskaya N.M. Sotsial’naya zashchita naseleniya . ISEPN RAN, 2002. P. 286.

- O prozhitochnom minimume v Rossiiskoi Federatsii: Federal’nyi zakon ot 24 oktyabrya 1997 goda № 134-FZ (s izmeneniyami ot 27 maya 2000 goda) .

- Marx K. Kapital. Kritika politicheskoi ekonomii -T. 1. -Kn. 1. Protsess proizvodstva kapitala . Politizdat, 1988. Pp. 194-196.

- Smith A. Issledovanie o prirode i prichinakh bogatstva narodov . Moscow: Sots-Ekgiz, 1962. P. 227.

- Tikhomirova V.V. Adresnaya sotsial’naya pomoshch’ v sisteme sotsial’noi zashchity naseleniya (na primere Respubliki Komi) . Komi NTs UrO RAN, Syktyvkar, 2013. 162 p.

- O gosudarstvennykh posobiyakh grazhdanam, imeyushchim detei: Federal’nyi zakon RF ot 1995 (v red. FZ № 122 ot 22.08.2004, FZ № 181 ot 22.12.2005) .

- Zolotareva A. et al. Sostoyanie i perspektivy razvitiya sistemy sotsial’noi zashchity v Rossii . Moscow: In-t Gaidara, 2011. P. 166.

- O gosudarstvennykh garantiyakh v RK sem’yam, imeyushchim detei: Zakon Respubliki Komi ot 12.11.2004 № 57-RZ (v red. RZ № 99 ot 6.10.2006) .

- Metodicheskie rekomendatsii po opredeleniyu potrebitel’skoi korziny dlya osnovnykh sotsial’no-demograficheskikh grupp naseleniya v tselom po Rossiiskoi Federatsii (s izmeneniyami i dopolneniyami ot 16 marta 2000 goda), st. 1, p. 5, 6 .