Public Involvement in the Investment Process as a Factor in the Formation of Additional Financial Instruments in the System of Sustainable Development of the Arctic Region (Based on Sociological Surveys of Experts and the Population in 2024)

Автор: Kondratovich D.L., Badylevich R.V.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 61, 2025 года.

Бесплатный доступ

The article discusses the issues of ensuring the sustainable development of the Arctic region by attracting investments from the population as a factor influencing the formation of additional financial instruments. Sociological tools are used to identify opportunities for the population living in the Far North and Arctic regions of the Russian Federation to form savings and the most attractive financial instruments for the population when investing them, to assess the characteristics of financial instruments that are most significant for the population, and to identify regional financial instruments that are alternatives to bank deposits (regional bonds, regional investment funds, etc.) that may be in demand among the population when choosing investment options. The study used data from sociological surveys conducted by the authors in two stages during 2024. The first stage involved analyzing the results of an expert survey conducted among representatives of the scientific community within the framework of the scientific and practical conference “Luzin Readings 2024”. The second stage included a mass survey of the population living in the Arctic agglomerations (using the Murmansk Oblast as an example). It is concluded that there is a significant potential for public investment in improving the sustainability of the region’s development. The transformation of population savings creates prerequisites for ensuring more stable conditions for the development of the Arctic regions, since they fill their economies with additional financial resources.

Population investments, savings, additional financial instruments, sustainable development, Arctic region, expert survey, Murmansk Oblast

Короткий адрес: https://sciup.org/148332685

IDR: 148332685 | УДК: [332.024+330.322](985)(045) | DOI: 10.37482/issn2221-2698.2025.61.44

Текст научной статьи Public Involvement in the Investment Process as a Factor in the Formation of Additional Financial Instruments in the System of Sustainable Development of the Arctic Region (Based on Sociological Surveys of Experts and the Population in 2024)

DOI:

The Arctic regions of the Russian Federation are in constant need of additional sources of financial resources. In the context of global transformations in the financial market, restrictions

∗ © Kondratovich D.L., Badylevich R.V., 2025

This work is licensed under a CC BY-SA License associated with the introduction of sanctions by some countries against the Russian Federation, problems with attracting external sources of financing and the withdrawal of foreign investors from the country, household savings are becoming increasingly important.

The long-term socio-economic development forecast developed by the Ministry of Economic Development of the Russian Federation for the period up to 2030, approved by Decree of the Government of the Russian Federation No. 2816-r of 6 October 2021 1, contains information on investment resources, including household savings. According to this forecast, it is necessary to stimulate the investment potential of the population by increasing the reliability of financial institutions, including the banking sector, creating new financial instruments that are attractive to the population, and improving its financial literacy.

The limited capabilities of the regional financial system are prompting a search for ways to attract financial resources from private investors, which could include the local population. At the same time, solving this problem remains quite difficult, as the amount of money accumulated by the population is still not very significant compared to even some Asian countries. For example, in India and China, household investment accounts for approximately 5% of GDP, while in Russia, this figure barely exceeds 0.25% of GDP. In more developed economies, the value of household population investment can reach 10% of GDP [1].

The problem of attracting private investment to the Russian financial system has been addressed for decades. Mutual investment funds (MIFs) were created in the 1990s. The total value of MIF assets increased to 10.2 trillion rubles in 2023, and the number of shareholders reached 10 million people 2. At the same time, other financial instruments may be less popular among the population. However, there has been an increase in the volume of contributions to non-state pension funds: for example, in the first half of 2024, investments in NPFs amounted to 91.6 billion rubles, of which 58.2 billion rubles were investments by the population. Compared to the same period in 2023, the growth of investments made by the population amounted to 45% 3. Common financial instruments also include individual investment accounts, life insurance savings programs, investments in bonds, stocks, and other investment funds.

Currently, a partial recovery of the Russian stock market compared to 2023 can be observed. Investment funds with net asset values exceeding 500 million rubles demonstrated growth in share value in the first half of 2024, whereas a year earlier, two-thirds of the funds were unprofitable 4.

At the same time, there are factors that constrain the use of this financial instrument by the population. For example, there is a certain threshold, in other words, a minimum share value for making an initial contribution [2]. For shareholders in closed-end funds, the minimum amount is 100,000 rubles, and in some cases it can be set as high as 250,000 rubles [3]. In open-end funds, it is significantly lower. This significantly impacts the public’s ability to invest in MIFs. The Central Bank of the Russian Federation is considering the possibility of removing the minimum threshold for closed-end MIFs, which should significantly increase the accessibility of investing in these financial instruments 5. Furthermore, the accessibility of MIFs is also influenced by the average size of management companies’ commissions, which vary from 1 to 4.5% of assets per annum. It is legally established that the cost of such a commission should not exceed 10% per annum 6.

However, there are prospects for the formation of household investments as additional financial instruments to ensure the sustainable development of the Arctic region, despite the challenges associated with the presence of individual investors in the stock market [4]. The population of the Arctic regions remains quite conservative in terms of conducting financial transactions and using them as assets invested in various financial instruments. This is due to historical memory, which has led to skepticism and mistrust, and also has objective preconditions caused by population migration processes from the Arctic regions and the decline of its active part [5].

In order to improve the investment culture of the local population, it is necessary to implement measures aimed at increasing financial literacy and popularizing financial knowledge through all available sources of information [6]. This work should be carried out starting with the younger generation in schools and ending with explaining the basics of financial literacy to elderly [7]. However, even in this case, one should not expect a quick effect from the measures implemented, since even in Western Europe and the United States, the level of financial literacy is not directly related to the level of investment activity of the population. For example, a survey conducted by FINASTRA Financial Services State of the Nation for 2023 revealed that only 14% of all respondents demonstrated excellent knowledge, while approximately 80% of US residents inves t7.

New financial technologies can also have a significant impact on the level of investment activity, as they make financial services accessible and convenient, reduce barriers to regular investment, and generally increase confidence in the financial system.

Thus, specifying proposals for the population of the Far North and the Arctic regarding the conditions for forming savings and using investment instruments, and determining the most significant characteristics of financial instruments can expand the range of opportunities for the development of the regional financial system.

Methodological foundations for assessing and regulating the investment behavior of the population in the regional financial market

In this paper, we consider the population’s investments in financial market instruments from the perspective of their impact on the sustainable development of the Arctic region. Other researchers use different definitions of the population’s investment behavior.

In the work of O.S. Litvinova, investment behavior is understood as a set of specific actions of both individuals and legal entities making financial and non-financial investments [8]. This interpretation has similar features to the concept of “investment activity”, as it describes the investment process itself rather than defining the direction of investment behavior.

A.A. Pereverzeva proposes a different interpretation of the concept of “investment behavior”, which is considered as a characteristic of the actions of people investing in various financial instruments for the purpose of making a profit, as well as investing in other objects that provide a beneficial effect [9].

Another researcher, Ya.M. Mirkin, examines investment behavior from the perspective of the actions of securities market actors as part of the financial market and offers his own classification of investment behavior models used in different countries. He identifies the characteristic features of the Anglo-Saxon, German, Japanese, Islamic, and mixed models of investment behavior [10]. According to Ya.M. Mirkin, elements of the Japanese and German models prevail in Russian practice, as the population chooses a savings model of behavior with a predominance of investment in traditional financial instruments, such as bank deposits, while the level of activity in the financial market remains consistently low.

Along with investment behavior, Russian researchers consider the concept of “investment potential” in their works. For example, L.S. Valinurova, O.B. Kazakova and N.A. Kuzminykh define it as the material basis that makes it possible to ensure the necessary dynamics of the socio-economic development of a territory. They include not only financial assets but also tangible and intangible assets in the categories of investment potential [11].

Another group of researchers, including G.V. Zakharova and T.N. Morgun, defines investment potential as the ability of a regional economy to achieve maximum results under current conditions [12].

The approach of R.A. Karmov is of particular interest, as the researcher considers investment potential to be a significant element of investment behavior. He attributes the population’s own resources, which enable them to achieve specific results through their use, to investment potential [13].

O.Yu. Bestuzheva stands out among the researchers analyzing the factors of investment behavior. She concludes that the population’s investment behavior in the regional financial market is influenced by socio-economic factors, including savings, age and gender differences, level of education, investment preferences and some others [14].

Yu.B. Podgornaya identified five factors of the population’s investment behavior. Firstly, these include socio-economic conditions that determine the level of real income of the population, the level of consumption, the level of confidence in the future, and the presence of crisis phenomena. Secondly, these are the population’s capabilities, determined by the share of savings in the income structure, limited credit opportunities, the limitations of the financial market itself, and the low prevalence of collective investment. Thirdly, there is a lack of financial literacy, which leads to a misunderstanding of the specifics of various financial instruments. The fourth factor is the investment interest and desire to invest. The fifth factor, according to the researcher, is the investment climate, conditioned by political and economic conditions [15].

Foreign literature also offers various approaches to defining investment behavior. For example, in the work of D. Jorgenson, the origin of investment behavior is the neoclassical theory of optimal accumulation, which is based on the provisions regarding the desired amount of capital to be achieved at a certain time point, and the focus shifts to maximizing consumption utility [16].

In the work of O. Aregbeyen and S. Mbadiugha, the factors of investment behavior are divided into four main groups. The authors include economic factors in the first group, among which are, for example, financial indicators of organizations, expert forecasts regarding the probable return on shares, stock exchange reports, etc. The second group, in their opinion, consists of social factors, including broker recommendations, information about majority shareholders, and data on the ownership structure of companies. The third group includes cultural factors, such as the investor’s own investment behavior model, awareness of investment prospects, willingness to be engaged in financial market transactions, and recommendations from friends and acquaintances. The authors classify psychological factors as the fourth group, including the assessment of the security of savings, an increased willingness to conduct transactions in the financial market as a result of studying relevant financial literature and improving the investor’s financial literacy, a rational assessment of risk factors and readiness for possible failures, the factor of “confidence in the future” and fear of possible job loss, the presence of successful examples in investing funds [17].

Based on a summary of the approaches by Russian and foreign authors, it can be concluded that the investment behavior of the population is considered exclusively from the perspective of investing in financial instruments, with a description of the various factors influencing investor’s behavior in the financial market. At the same time, aspects of the population’s investment behavior in the regional financial market and the choice of financial instruments (regional bonds, regional investment funds, etc.) that may be relevant to the population in the Far North and Arctic regions of the Russian Federation remain insufficiently studied.

Analysis of the Arctic region population’s involvement in the investment process as a factor in the formation of additional financial instruments

We conducted a series of sociological studies to assess the population’s involvement in the investment process and to analyze the demand for additional financial instruments in the Arctic region’s sustainable development system.

At the initial stage, data was obtained from an expert survey conducted among representatives of scientific organizations dealing with socio-economic issues of development of the northern and Arctic regions of the Russian Federation 8. The survey was conducted from May 30 to June 1, 2024, as part of the international scientific and practical conference “Luzin Readings 2024”, during which the main characteristics of the population’s investment behavior were studied and the financial instruments most in demand in the regions of the Far North and the Arctic were characterized.

The second stage of the study involved conducting a mass sociological survey among the population of key Arctic cities in the Murmansk Oblast 9, 10. This survey examined various aspects of investment behavior, including assessing savings opportunities for residents of the region, identifying the most popular financial instruments, revealing behavior patterns characteristic of various population groups, and determining the primary financial management methods chosen by residents of Arctic cities. The survey was conducted using a quota sampling method, with a sample population determined for each city. The total sample size was 360 people. Overall, the combination of expert and mass sociological surveys allowed obtaining a number of original results.

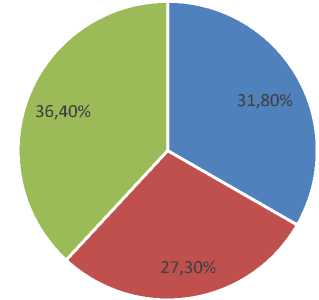

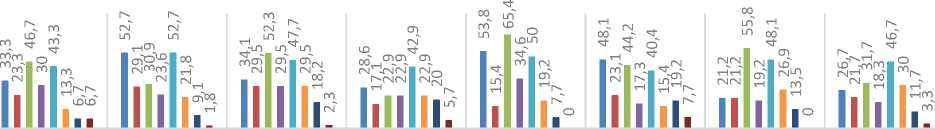

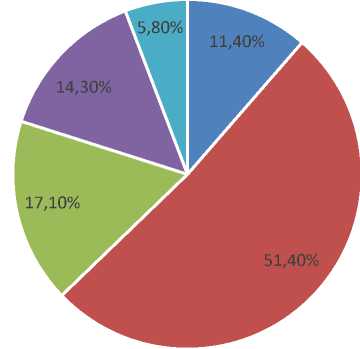

As part of the survey, experts were asked to assess the savings opportunities of residents living in the Far North and Arctic regions of the Russian Federation (Fig. 1).

-

■ The level of savings is significantly lower than the average in the Russian Federation

-

■ The level of savings corresponds to the average level in the Russian Federation

-

■ The level of savings is higher than the average in the Russian Federation, but lower than in the most financially prosperous regions

Fig. 1. Please assess the savings opportunities of residents living in the Far North and Arctic regions of the Russian Federation 11.

It should be noted that experts expressed mixed opinions on this issue. Approximately 36.4% of experts believe that the population’s savings potential is higher than the average for the Russian Federation, but lower than in the most financially prosperous regions. Almost third of experts

(31.8%) believe that these opportunities are lower than the Russian average, and 27.3% indicate that this potential is in line with the Russian average. This means that a significant number of experts tend to believe that there are no obvious peculiarities in the savings formation and accumulation processes in the Far North and Arctic regions of the Russian Federation.

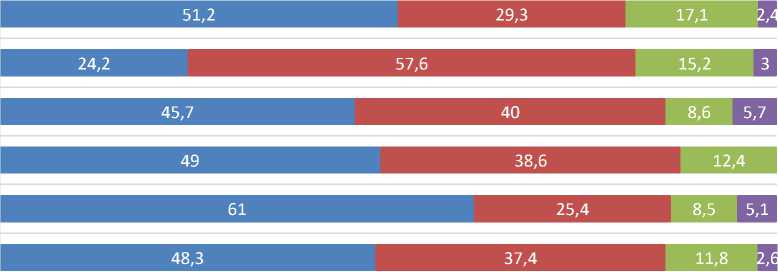

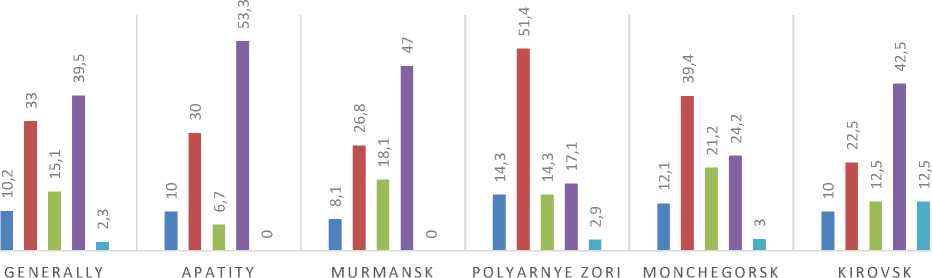

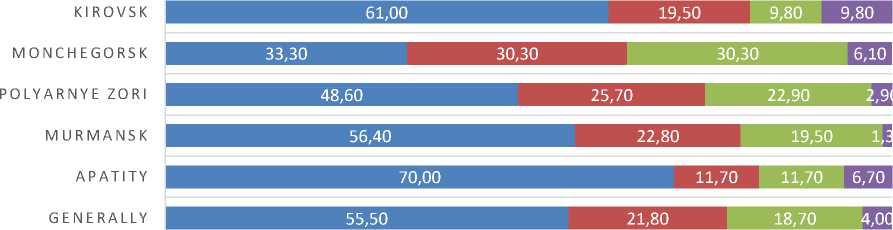

At the same time, the population’s assessments of their opportunities for forming savings in this Arctic region are of interest. An analysis of a mass sociological survey of the population in key Arctic cities of the Murmansk Oblast revealed that in a number of cities, the percentage of respondents with incomes above the Russian average is quite high (Fig. 2). For example, in the city of Kirovsk, the proportion of people with a high savings rate reaches 17.1%, slightly less than in the cities of Monchegorsk (15.2%) and Murmansk (12.4%). Moreover, the regional capital ranks only third in this category. Savings rates are quite high among those who have deposits below the Russian average size. For example, in Monchegorsk, 57.6% of the population has such deposits, in Polyarnye Zori — 40%, and in Murmansk — 38.6%. Meanwhile, in the Murmansk Oblast as a whole, almost half of the respondents (48.3%) have no savings at all. Respondents also indicated other forms of capital preservation, such as investing in real estate and using various financial instruments. Among all the cities surveyed, only Apatity has a slightly worse situation with household savings. This may be due to the lack of large industrial enterprises that provide their employees with a consistently high income.

KIROVSK

MONCHEGORSK

POLYARNYE ZORI

MURMANSK

APATITY

GENERALLY

-

■ I have no savings

-

■ I have savings below the average deposit size in the Russian Federation (the average deposit size is 1,150 thousand rubles)

-

■ I have savings above the average deposit size in the Russian Federation (the average deposit size is 1,150 thousand rubles)

-

■ Other (what exactly):

Fig. 2. Please assess your ability to form savings, % 12.

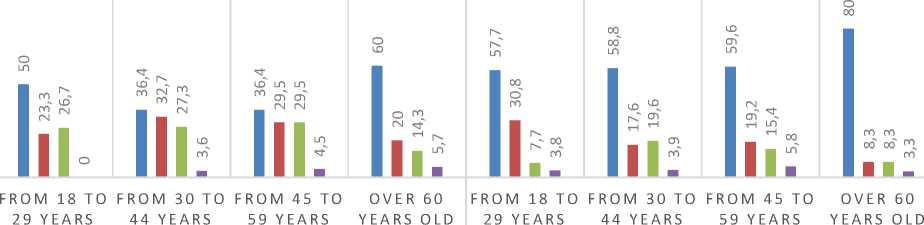

The distribution of responses by gender and age structure is of interest (Fig. 3). Data analysis reveals that men in the middle age category (45 to 59 years old) and the older generation of both men and women (over 60 years old) have the highest potential for forming savings. Among these categories, there are the most people with incomes above the Russian average for deposits.

OLD OLD OLD OLD OLD OLD

MEN

WOMEN

-

■ I have no savings

-

■ I have savings below the average deposit size in the Russian Federation (the average deposit size is 1,150 thousand rubles)

-

■ I have savings above the average deposit size in the Russian Federation (the average deposit size is 1,150 thousand rubles)

-

■ Other (what exactly):

Fig. 3. Opportunities for savings (distribution of responses by gender and age), % 13.

Among those who have no savings, there is a significant number of young men aged 18 to 29 (72.4%), young (50.0%) and middle-aged women (54.9%), as well as older women aged 45 to 59 (52.0%). At the same time, among women in these categories and middle-aged men, there is significant potential for those with deposits above the Russian average; their number is approximately one-third of respondents.

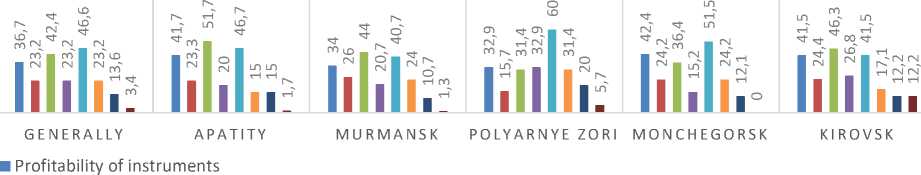

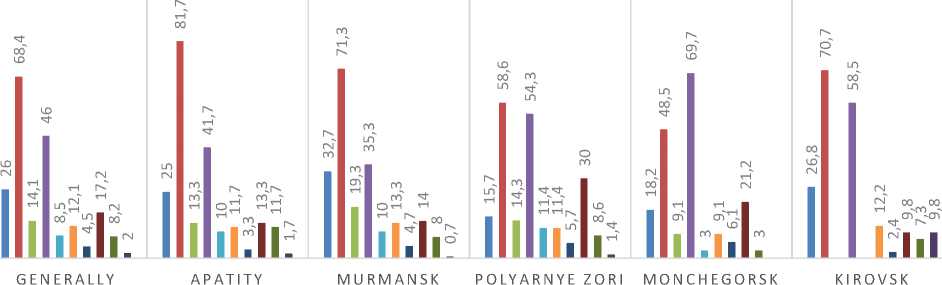

To assess the most important characteristics of financial instruments when choosing investment options for the population in the Far North and Arctic regions of the Russian Federation, we consulted experts, who were asked to select no more than three priority options (Fig. 4).

-

■ Profitability of instruments

-

■ The investment period

-

■ Flexible investment conditions (the possibility of depositing and withdrawing funds, etc.)

-

■ Convenience of making investments and returning funds (availability of online opportunities, a wide network of agents for the implementation of tools)

-

■ Availability of money-back guarantees

-

■ Extensive information support

z The use of borrowed funds in the territory of the population's residence

-

■ Other (what exactly):

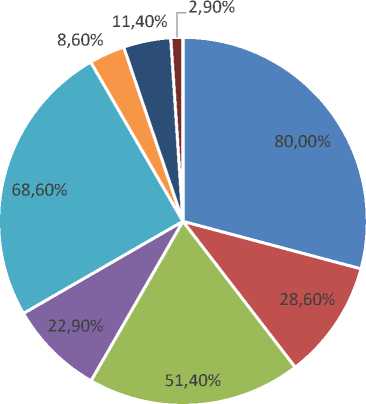

Fig. 4. Which characteristics of financial instruments do you consider most important when choosing investment options for the population in the Far North and Arctic regions of the Russian Federation? (Please select no more than three options) 14.

The results revealed that the most significant characteristics are: the profitability of financial instruments (80%), the availability of return guarantees (68.6%), and the flexible investment terms, such as the ability to deposit and withdraw funds, etc. (51.4%). Experts also believe that important characteristics of financial instruments include the term of investment (28.6%) and the convenience of making investments and withdrawing funds, such as the availability of online options and a wide network of agents selling the instruments (22.9%).

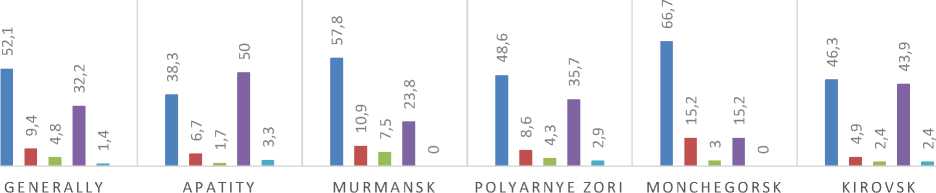

A similar question was asked to residents of key Arctic cities in the Murmansk Oblast, specifically for their own needs (Fig. 5).

■ The investment period

■ Flexible investment conditions (the possibility of depositing and withdrawing funds, etc.)

-

■ Convenience of making investments and returning funds (availability of online opportunities, a wide network of agents for the implementation of tools)

-

■ Availability of money-back guarantees

-

■ Extensive information support

-

■ The use of borrowed funds in the territory of the population's residence

-

■ Other (what exactly):

Fig. 5. Which characteristics of financial instruments do you consider most important when choosing investment options in your region?, % 15.

It should be noted that, in general, the most important characteristics for the population are the availability of a return guarantee (46.6%) and flexible investment terms (42.4%). The profitability of financial instruments ranks only third in this list in terms of importance (36.7%), which indicates a willingness to invest funds at lower returns, but with more understandable and flexible conditions and minimal risks.

FROM 18 TO FROM 30 TO FROM 45 TO OVER 60 FROM 18 TO FROM 30 TO FROM 45 TO OVER 60

29 YEARS 44 YEARS 59 YEARS YEARS OLD 29 YEARS 44 YEARS 59 YEARS YEARS OLD

OLD OLD OLD OLD OLD OLD

MEN

WOMEN

-

■ Profitability of instruments

-

■ The investment period

-

■ Flexible investment conditions (the possibility of depositing and withdrawing funds, etc.)

-

■ Convenience of making investments and returning funds (availability of online opportunities, a wide network of agents for the implementation of tools)

-

■ Availability of money-back guarantees

-

■ Extensive information support

-

■ The use of borrowed funds in the territory of the population's residence

-

Fig. 6. Which characteristics of financial instruments do you consider most important when choosing investment options in your region? (distribution of responses by gender and age), % 16.

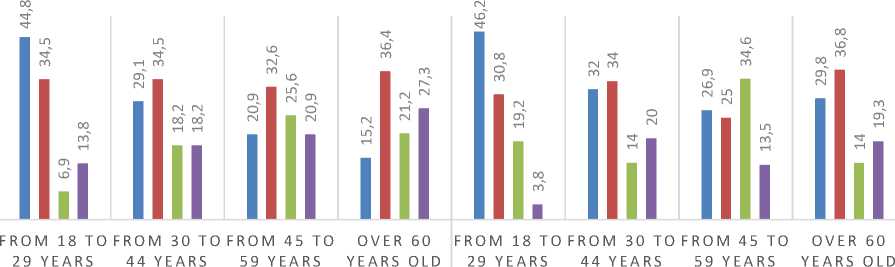

Both men aged 45 and older and women aged 30 and older place greater importance on using funds in their area of residence (Fig. 6). The importance of the three main characteristics of financial instruments remains unchanged for all gender and age groups, but with some peculiarities. For example, for men and women over 60, the main characteristic of financial instruments is the availability of guaranteed returns (52.3% and 46.7%, respectively). For younger generations, it is important not only to preserve their money, but also to take advantage of more flexible investment terms and higher returns on financial instruments.

Research shows that the population demonstrates a fairly high level of involvement in the investment process, understanding not only the possibilities for saving and preserving funds and the characteristics of financial instruments, but also assessing their advantages and disadvantages.

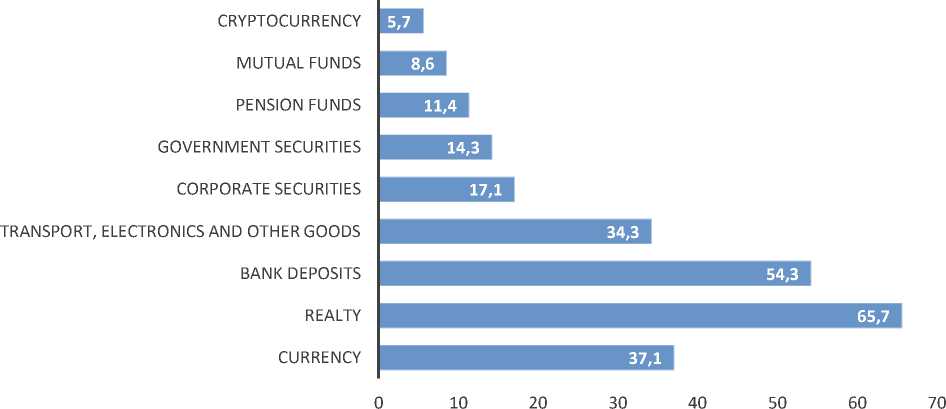

In order to form an idea of the most attractive financial instruments for the population of the Far North and Arctic regions of the Russian Federation, we analyzed expert opinions on this issue (Fig. 7).

-

Fig. 7. Which of the following financial instruments are most attractive to the population when investing savings in the Far North and Arctic regions of the Russian Federation? (Please select no more than three options), % 17.

The results of the expert survey show that traditional financial instruments, such as real estate (65.7%), bank deposits (54.3%), foreign currency (37.1%), and the purchase of expensive goods (cars, electronics, etc.) (34.3%) remain the most popular among the population of the regions analyzed. Corporate and government securities may also be in demand. Despite the availability of higher-yield financial instruments, such as mutual funds and cryptocurrency, experts believe that they will be less in demand. This is confirmed by the results of a mass sociological survey of the population. The population prefers instruments that are more understandable and predictable in terms of return on investment. In addition, the use of these instruments requires certain knowledge, and due to insufficient financial literacy, the population prefers “traditional” investment instruments (Fig. 8).

Real estate remains the primary financial instrument for the majority of respondents in the Murmansk Oblast (68.4%). The next most popular financial instruments are bank deposits (46.0%) and foreign currency (26%). These assessments coincide with the above-mentioned results of expert surveys, which is not surprising, since these areas of investment are also popular in the rest of the Russian Federation.

■ Currency ■ Realty

■ Transport, electronics and other goods ■ Bank deposits

■ Corporate securities ■ Government securities

■ Mutual funds ■ Pension funds

■ Cryptocurrency ■ Other (what exactly):

-

Fig. 8. Please indicate the most attractive financial instruments for the population when investing savings in your region, % 18.

At the same time, the popularity of these traditional financial instruments varies across the main Arctic single-industry towns. For example, while real estate investments are the most popular financial instrument in Murmansk, Apatity, and Kirovsk, bank deposits are the main financial instrument for residents of Monchegorsk: 69.7% of respondents chose this option. For Polyarnye Zori, these two instruments are almost equally important (real estate — 58.6%, bank deposits — 54.3%). Pension fund investments are also popular in this municipality (30.0%). Investing in foreign currency is more popular in the regional capital (32.7%) and among residents of Apatity (25.0%). Other financial instruments are significantly less popular.

Considering the situation in terms of the gender and age structure of the population (Fig. 9), the choice of financial instruments remains approximately the same for the majority of respondents: investments in real estate, bank deposits and currency. However, it is worth noting that young men aged 18 to 29 are willing to use financial instruments such as cryptocurrency. About 36.7% of respondents in this group chose this option, which is higher than “traditional” investments in bank deposits (26.7%).

OVER 60

YEARS OLD

OVER 60

YEARS OLD

FROM 18 TO 29 YEARS OLD

FROM 45 TO 59 YEARS OLD

FROM 18 TO 29 YEARS OLD

FROM 45 TO 59 YEARS OLD

FROM 30 TO 44 YEARS OLD

FROM 30 TO 44 YEARS OLD

-

■ Currency M E N

-

■ Realty WOM EN

-

■ Transport, electronics and other goods

■ Bank deposits

-

■ Corporate securities

-

■ Mutual funds

-

■ Cryptocurrency

-

-

■ Government securities

-

■ Pension funds

-

■ Other (what exactly):

Fig. 9. Please indicate the most attractive financial instruments for the population when investing savings in your region (distribution of responses by gender and age), % 19.

Investing in foreign currency also remains popular among young people: 40% of men aged 18 to 29 invest in this category, while the figure for women in the same age group is 50%. For men and women over 45, investing in pension funds is popular, most likely due to the need to ensure a higher level of income upon retirement.

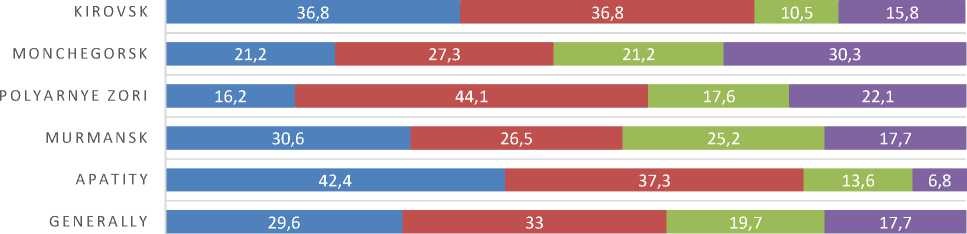

One of the objectives of our study was to determine the potential for regional financial instruments, such as regional bonds, regional investment funds, and others. We wanted to understand the conditions under which the population would be willing to invest in these instruments as an alternative option. For this purpose, we also consulted experts, asking them to answer the question about the population’s demand for regional financial instruments when choosing investment options in the Far North and Arctic regions of the Russian Federation (Fig. 10).

About 11.4% of experts believe that regional financial instruments can serve as an alternative to traditional investments (e.g., bank deposits). More than half of the experts (51.4%) believe that if favorable conditions are created for regional financial instruments, they may become more popular. Experts also note that in order to promote these instruments, it is necessary to conduct a large-scale information campaign involving the media.

-

■ Yes

-

■ Yes, in case of formation of attractive conditions for such instruments

-

■ Yes, in case of extensive information support

-

■ No

-

■ Other

Fig. 10. Do you believe that regional financial instruments (regional bonds, regional investment funds, etc.), which are alternatives to bank deposits, could be popular among the population when choosing investment options in the Far North and Arctic regions of the Russian Federation? (%) 20.

Only 14.3% of experts believe that regional financial instruments will under no circumstances become an alternative to traditional financial instruments. About 5.8% of experts were unable to answer this question.

As shown by the results of a mass sociological survey among the population, regional financial instruments are perceived ambiguously (Fig. 11).

■ Yes

■ Yes, in case of formation of attractive conditions for such instruments

■ Yes, in case of extensive information support ■ No

■ Other

Fig. 11. Do you believe that regional financial instruments (regional bonds, regional investment funds, etc.), which are alternatives to bank deposits, could be of interest to you when choosing investment options? (%) 21.

Considering the responses as a whole, 39.5% of respondents were skeptical about such instruments. At the same time, a third of respondents (33.3%) admit the possibility of using such financial instruments as alternatives to bank deposits if attractive conditions are created for them. Another 16.7% of respondents stated that regional financial instruments could become an alternative if they receive broad information support.

OLD OLD OLD OLD OLD OLD

MEN WOMEN

-

■ Yes

-

■ Yes, in case of formation of attractive conditions for such instruments

-

■ Yes, in case of extensive information support

-

■ No

-

■ Other

Fig. 12. Do you think that regional financial instruments (regional bonds, investment funds, etc.), which are alternatives to bank deposits, may be in demand by you when choosing investment options? (distribution of responses by gender and age), % 22.

It should also be noted that, in general, the population expresses moderate optimism about investments in regional financial instruments (Fig. 12). Moreover, among men, the proportion of those who view the possibility of investing in these instruments positively, provided that attractive conditions are offered and the level of information support is improved, is significantly higher than the proportion of women who express a certain degree of skepticism. Nevertheless, slightly less than half of the women surveyed aged 18 to 44 are willing to invest in regional financial instruments under certain circumstances. The percentage of women aged 45 and older who are willing to consider such an alternative is significantly higher. This indicates that regional financial instruments could become an alternative to bank deposits when choosing investment options.

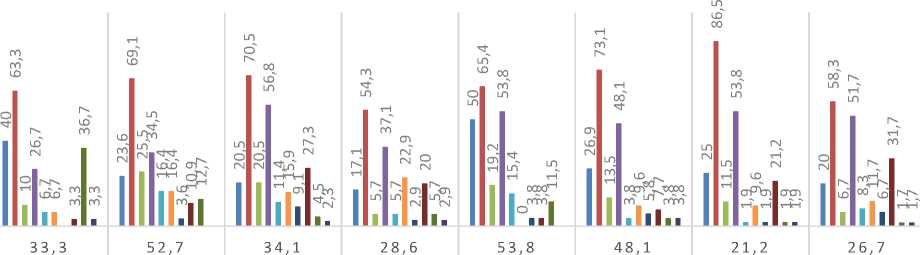

One of the important questions that needed to be answered was determining the preferred investment timeframes for the population (Fig. 13). This question was posed to respondents, and it was found out that, in general, the population of the key cities in the Murmansk Oblast is ready to invest in short-term (up to 1 year) and medium-term (1 to 3 years) financial instruments.

-

■ Less than 1 year ■ From 1 to 3 ■ From 3 to 5 ■ Over 5 years

-

Fig. 13. Please indicate the term of investment that is most preferable for you, % 23.

However, when analyzed by city, the percentage of those willing to invest in long-term instruments may vary slightly in some cases. For example, more than half of Monchegorsk residents are ready for long-term investment, with their combined share reaching 51.5%, while in Apatity, on the contrary, residents prefer short- and medium-term investments (about 80%), and about 20% of the population is ready to invest for a longer period.

Analyzing the preferred investment period in terms of the gender and age structure of the population also reveals several distinctive features (Fig. 14).

OLD OLD OLD OLD OLD OLD

MEN WOMEN

■ Less than 1 year ■ From 1 to 3 ■ From 3 to 5 ■ Over 5 years

-

Fig. 14. Please indicate the term of investment that is most preferable for you (distribution of responses by gender and age), % 24.

For example, a significant proportion of men aged 18 to 29 are willing to invest in short-term (44.8%) or medium term (34.5%) instruments. At the same time, men over 30 prefer primarily medium-term investments, making up just over a third. Among men over 60, there are more those who are ready for long-term investments, accounting for almost half of the respondents (48.5%). Women’s responses also show a similar trend, with the exception of the 45-59 age group, where the proportion of those willing to make long-term investments (3 to 5 years and over 5 years) is slightly higher, reaching 48.1%.

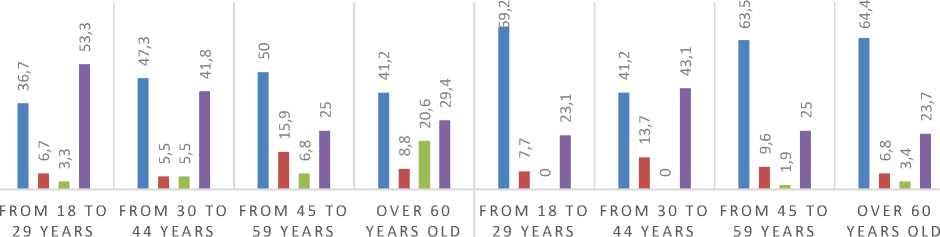

In order to determine the characteristics of the motivational mechanism that drives the population to engage in investment activities, we examined models that reflect the investment behavior of residents of key Arctic cities in the Murmansk Oblast (Fig. 15).

■ I agree to a low return with minimal risk

-

■ I am striving for a higher level of income, taking into account a higher level of risks, but at the same time I am not ready to constantly engage in investment management

-

■ I strive for maximum profitability and am ready to constantly engage in investment management

-

■ Other (what exactly):

Fig. 15. Select the model that best corresponds to your investment behavior, % 25.

In general, most residents of the cities studied are characterized by an investment model that provides low returns with minimal risk (55.5%). A significant part of the population is ready to increase their income, taking into account higher risks, and does not have the opportunity to manage their investments on a regular basis (21.8%), while 18.7% of respondents can be classified as active participants in the investment process, seeking to maximize the return on their investments and are constantly engaged in investment management. Some respondents, representing approximately 4%, are not interested in investing at all. It should be noted that in a number of cities, the population is actively involved in investment processes. For example, in Monchegorsk, the number of participants in investment activities that provide maximum returns exceeds 66.5%, with the share of active investors accounting for almost a third of respondents (30.3%), indicating high investment potential. Residents of Polyarnye Zori and Murmansk follow an “active” investment model. The situation is somewhat worse in the Apatity-Kirov agglomeration, where a significant proportion of the population seeks to maintain a low level of return with minimal risk.

Based on the gender and age structure of the population (Fig. 16), it can be concluded that men in the broad age range from 18 to 59 are ready for more active management of their investments, while the share of women is significantly lower. They tend to favor a more stable investment model with low returns and minimal risk.

OLD OLD OLD OLD OLD OLD

MEN WOMEN

-

■ I agree to a low return with minimal risk

-

■ I am striving for a higher level of income, taking into account a higher level of risks, but at the same time I am not ready to constantly engage in investment management

-

■ I strive for maximum profitability and am ready to constantly engage in investment management

-

■ Other (what exactly):

-

Fig. 16. Select the model that best corresponds to your investment behavior (distribution of responses by gender and age), % 26.

It should also be noted that pensioners over the age of 60 choose a similar model of investment behavior, and this applies to both men and women. Moreover, this is the main model of behavior for women in this age group (80% of respondents).

Taking into account that not all respondents are ready to manage their investments independently, it was necessary to determine the types of entities to which residents of the main Arctic cities of the Murmansk Oblast are ready to pass on the management of their savings (Fig. 17).

■ For banks

■ Commercial organizations that are professionally engaged in investments (investment funds, financial intermediaries, etc.)

■ Federal, regional and municipal funds

■ I don't trust anyone, I manage on my own

■ Other (what exactly):

-

Fig. 17. What type of entity are you willing to entrust with the management of your savings?, % 27.

The overwhelming majority of respondents are ready to transfer management to banking structures (52.1%) or manage investments themselves due to a lack of trust in management organizations. Only 4.8% of all respondents are willing to entrust management to federal, regional and municipal funds. Other options mentioned included the Pension Fund of Russia and investment management through relative.

OLD OLD OLD OLD OLD OLD

MEN WOMEN

■ For banks

-

■ Commercial organizations that are professionally engaged in investments (investment funds, financial intermediaries, etc.)

-

■ Federal, regional and municipal funds

-

■ I don't trust anyone, I manage on my own

Fig. 18. What type of entity are you willing to entrust with the management of your savings (distribution of responses by gender and age), % 28.

Considering the responses in terms of gender and age structure, it can be noted that trust in federal, regional and municipal funds is slightly higher among men. This position is highest among men aged 60 and older. Women mainly choose banks as management companies, but some of those surveyed aged 30 to 44 are willing to manage their savings themselves. Among women aged 60 and older, there is also a higher percentage (3.4%) of trust in federal, regional and municipal funds, in addition to the most popular ones.

Conclusion

This empirical study was conducted in stages, which allowed us to take into account the opinion of the expert community on the formation of additional financial instruments and, based on a mass sociological survey, to analyze the involvement of residents of key Arctic cities in the Murmansk Oblast in the investment process.

The results of the sociological survey showed that there is significant potential for increasing the level of public involvement in the investment process as a factor in the formation of additional financial instruments within the sustainable development system of the Arctic region.

In order to increase the level of involvement of the population of the Arctic region in the investment process, a number of conditions should be taken into account. Firstly, as the survey results show, socio-demographic factors (age and gender structure, education level, financial status) are important. Secondly, indirect factors such as local cultural traditions, macroeconomic and geopolitical conditions, the level of development of financial infrastructure and institutions, etc. should be considered.

As the analysis conducted in the study showed, a significant part of the population in the main Arctic cities of the Murmansk Oblast has savings levels above the Russian average, which allows us to assess the savings potential as quite high.

Experts identified the following important characteristics of financial instruments when choosing investment options for the population in the Far North and Arctic regions of the Russian Federation: the profitability of financial instruments, the availability of return guarantees and flexible investment conditions, the investment term, and the convenience of investing and returning funds, i.e., the availability of online options and a wide network of agents selling the instruments. At the same time, the results of a mass sociological survey indicate that return guarantees and flexible investment conditions are the most significant factors for the population. The profitability of financial instruments ranked only third in terms of importance, which indicates a willingness to invest funds at lower returns, but with more understandable and flexible conditions and minimal risks. In general, the population of the Arctic region demonstrates a fairly high level of involvement in the investment process. They are not only aware of the possibilities for preserving and accumulating funds and the characteristics of financial instruments, but also have a good understanding of their advantages and disadvantages.

Investment in real estate remains the main financial instrument for residents of the Murmansk Oblast, followed by bank deposits and foreign currency. The same financial instruments were also mentioned by experts, which is not surprising, as these investment options are also popular in the rest of the Russian Federation.

Regional financial instruments can serve as an alternative to traditional bank deposits. At the same time, more than half of all experts believe that favorable conditions for regional financial instruments should be created first; this could increase their popularity. Experts also note that a large-scale information campaign involving the media is necessary to popularize these instruments. This is confirmed by the results of a mass sociological survey of the population, as only a third of respondents admitted the possibility of using regional financial instruments as an alternative to bank deposits if attractive conditions are created for them. Respondents also indicated that regional financial instruments could become an alternative if they received extensive information support.

Behavioral characteristics were identified for different age and gender groups, including the investment behavior model used. For example, more active investment management is predominantly characteristic of men. Women prefer more predictable options, so they tend to favor a low-return, low-risk investment model.

The study revealed that many residents of the main Arctic cities of the Murmansk Oblast either manage their investments themselves or are ready to entrust the management of their savings to banking institutions. Only 4.8% of all respondents are currently willing to entrust management to federal, regional, and municipal funds, with men showing slightly more confidence in federal, regional and municipal funds than women. Several factors influence this opinion. Firstly, the level of trust has a significant impact, which is formed in the absence of sufficient reliable data and large-scale information support to promote this form of investment management. Secondly, the level of financial literacy among the population does not allow many people to objectively assess all the advantages and disadvantages of such management. Thirdly, there is no accessible interactive investment management service or regional platform for synchronizing all participants in the regional financial market.

Additional regional financial instruments are formed under the influence of many factors, among which ensuring conditions for attracting external private investment is of particular importance. As the analysis has shown, the Murmansk Oblast has significant potential for increasing the level of involvement in the investment process. At the same time, the population is not sufficiently informed about the opportunities and conditions offered by various regional financial institutions, which requires the introduction of feedback mechanisms based on modern information technologies, work to improve financial literacy, and the organization of advisory events aimed at promoting regional financial instruments.