Question in operating the exchange rate policy of the State Bank of Vietnam in the current period

Автор: Nghiem Van Bay

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 1 (11), 2016 года.

Бесплатный доступ

Exchange rate policy is one of the important measures of national monetary policy. The devaluation of the domestic currency may boost exports and improve the balance of payments, but that can only happen in certain conditions and affect differently each different commodity. In an open economy, the real exchange rate affects commodity prices between domestic production and imports. Rate can also directly affects on inflation due to price changes measured by local currency of imported goods and thereby influences the price index. Generally, when changing in the exchange rate leads to the change in supply - demand for foreign currency in the market, thereby it affects on macroeconomic variables such as important national income; inflationary; unemployment and balance of international payments. Consequently, operating efficiency rate policies plays an important role in managing the general macroeconomic and monetary policy of Vietnam. Especially, in current period, exchange rate policies is even more important when Vietnam has been trying to recover and stabilize the economy after the crisis since 2007, especially implementing restructuring econoomy plans with the objective to control inflation, stabilize the macro-economy, ensure high economic growth at 6.5-7% in the current period. Therefore, the monitoring of changes in exchange rates, as well as evaluating the effectiveness of the operation of the exchange rate policy of the National Bank of Vietnam is a topic that is the people, businesses and the government is very interested. Especially in the current conditions the world economy is more volatile, unpredictable, could potentially negative impacts on Vietnam''s economy.

Exchange rate policy, real exchange rate, exchange rate regime, nominal exchange rate, the state bank of vietnam

Короткий адрес: https://sciup.org/170190210

IDR: 170190210

Текст научной статьи Question in operating the exchange rate policy of the State Bank of Vietnam in the current period

Before 1989s, the command economy and the banking system of Vietnam as an one-level banking system fully owned and managed by the State has been applied in Vietnam. During this period, the exchange rate regime of Vietnam was fixed exchange rate regime, $1 was set at 19VND, this exchange rate mechanism did not reflect the nature of supply and demand relationship in the market. Since 1989 Vietnam has reformed the banking system from one-level to two-level as well as the period set out to raise the efficiency operation of the monetary policy of the National Bank of Vietnam . In particular, the exchange rate mechanism has also been innovated, meet the requirements of economic development of Vietnam.

Due to the important role of exchange rate policy, in recent years there have been many studies of them in Vietnam1. These studies have shown that the exchange rate mechanism of Vietnam, on the one hand, needs to be sustained, but on the other hand, should be more flexible according to market signals. Vo Tri Thanh and his partner (2000) suggested Vietnam should anchor the exchange rate mechanism under the currency basket with adjustable amplitude gradually (Band-BasketCrawling) was Ohno (2003) proposed that Vietnam should follow the mechanisms anchor exchange rate adjustment (crawling peg). In fact, in recent years Vietnam has been pursuing mechanisms anchor rate adjustment as proposed by the study. But a recent study by Nguyen Duc Tho (2009) and Nguyen Tran Phuc (2009) pointed out that the exchange rate mechanism with adjustable anchor not operating effectively, causing uncertainty for financial markets in Vietnam. Not only that, it also prevents the development of the foreign exchange market of Vietnam. Research by Nguyen Thi Thu Hang and her partner (2010) also shared the view of Nguyen Tran Phuc (2009) and Vu Quoc Huy and his partner (2012) gave hints that Vietnam advantages of operating time exchange rate should quickly switch mechanism floating policy through the State Bank of Vietnam exchange rate controls. To help clarify the from which to consider the suggest policy issue, the following will have the detailed rates in the current period of Vietnam. analysis of trends and the advantages and dis

Table 1. Mechanism of Vietnamese exchange rate from 1989 to 2015

|

Time Regime applied |

Features of rate regime applied |

|

Before Multi-exchange rate re- 1989 gime |

- 3 official exchange rate; - free market’s exchange rate existed parallel with exchange rates of the State (until the time reported). |

|

Pegged exchange rate with amplitude adjusted (crawling bands) |

|

|

1991- Pegged exchange rate 1993 within horizontal bands |

|

|

1994- Conventional fixed peg 1996 arrangement |

|

|

Pegged exchange rate - with amplitude adjusted (crawling bands) |

|

|

1999- Conventional fixed peg 2000 arrangement |

|

|

Pegged exchange rate - with amplitude adjusted (crawling bands) |

- OER was adjusted gradually from 14.000VND / USD in 2001 to 16.100VND / USD in 2007; - Amplitude rates at commercial banks were adjusted to a +/- 0.25% (from 01.07.2002 to 31.12.2006 month) and +/- 0.5% year 2007.a |

|

Pegged exchange rate with amplitude adjusted (crawling bands) |

From 2012-2015 year exchange rate of State Bank of Vietnam is committed to stabilizing not exceed +/- 3% and actual happenings exchange rate fluctuate at +/- 1%. |

(Sources: Vo Tri Thanh and co-author (2000). Exchange Rate Arrangement in Vietnam: Information Content and Policy Options, East Asian Development Network (EADN); Nguyen Tran Phuc (2009) Implications of Exchange Rate Policy for Foreign Exchange Market Development: Vietnam, 1986-2008, Working Paper, Griffen University, Australia; Nguyen Tran Phuc, Nguyen Duc Tho (2009). Exchange Rate Policy in Vietnam, 1985-2008, ASEAN Economic Bulletin 26(2): 137-163 and authors ‘summary)

Tendencies of exchange rate in last time.

As discussed above, since the banking system’s reform, Vietnam has made efforts to adjust the exchange rate regime closely to the situation of the economic development of the country. However, given the nature of these changes revolved around the "exchange rate peg". In Vietnam, the US dollar was almost by default currency exchange rate peg. Vietnamese National Bank shall announce the VND / USD. Based on the exchange rate between USD and other international currencies other foreign currency, commercial banks would set exchange rate between foreign currency and VND.

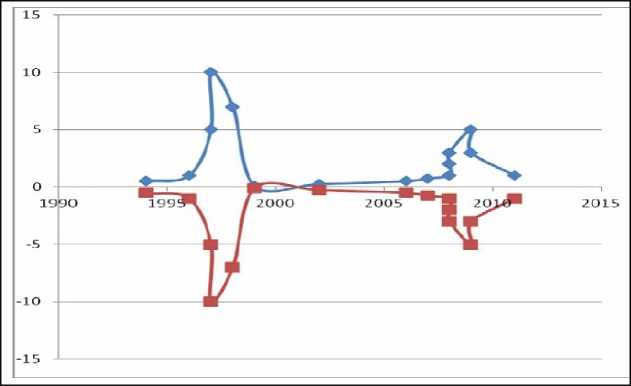

Table 1 summarizing the exchange rate mechanism of Vietnam applied before 1989 up to now has extensive time and rate applied mechanism in Vietnam as well as their char- acteristics. This classification is done on the basis of the classification system of the IMF in the context of Vietnam. Due to the effects of the comprehensive reform Vietnam's economy since 1989, as well as the impact of the economic crisis and world region, Vietnamese National Bank has made certain adjustments to the amplitude ratio price and exchange rate center to ensure economic growth, stabilize macroeconomic and control inflation, reduce unemployment. However, the diagram (Figure 1) can clearly show the trend of oscillation amplitude is adjusted to adapt to the effects of the comprehensive reform of Vietnam's economy and recession. However, after the effect ends, the exchange rate regime returned to a fixed exchange rate regime or adjusted exchange rate peg. Specific movements in the period are as follows:

(Celling range (upper) and Floor range (lower)) Figure 1. Vibration amplitude movements of USD / VND2

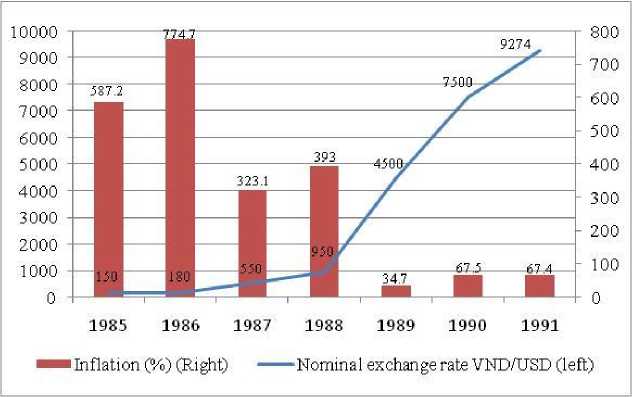

In the years 1989-1991: Before 1989 Vietnam's economy was in a state of almost no internal accumulation, budget expenditure had to be based on the issuance money of national bank and foreign aid. Record high inflation, notably in 1986 at 774.7% (Figure 2). The total means of payment for the period 1986 - 1990 was soaring to the rate of over 100%, 324.6% increased in 1987 compared to 1986, increased by 446.1% in 1988 compared with 1987, in 1989 increased by 233 , 75% compared to 1988 and only in 1990 that figure dropped below 2 figure, with 32.4% growth rate compared to 19893.

In this situation, the Vietnamese National Bank implemented comprehensive reform including devaluating local currency to stimulate exports; reducing interest rates and increaseing lending rates; controlling credit growth; increasing the compulsory reserve ratio. The increasing in deposit interest rates had attracted large amounts of US dollars and gold in the population in the banking system. This helped to foreign exchange reserves, the balance of payments of the Vietnamese National Bank.

The intervented measures of the Government of Vietnam helped to decrease inflation in the period after 1988 from 3 to 2 numbers and gradually effectively controlled in the following years. In this period, multirate system (exchange trade / noncommercial, internal accounting exchange rate)4 was replaced by the "one rate" (official exchange rate) and the exchange rate mechanism was significantly improved compared with the exchange rate peg mechanism with amplitude covered (crawling bands), commercial banks were allowed to set the exchange rate within a band of +/- 5% and the adjustment of the official exchange rate was determined by Vietnamese National Bank on the basis of signals of inflation, interest rates, balance of payments and the free market's exchange rate.

Figure 2. Nominal exchange rate fluctuations and inflation over the period 1985-1991 (Sources: Vietnamese National Bank and author’s calculation)

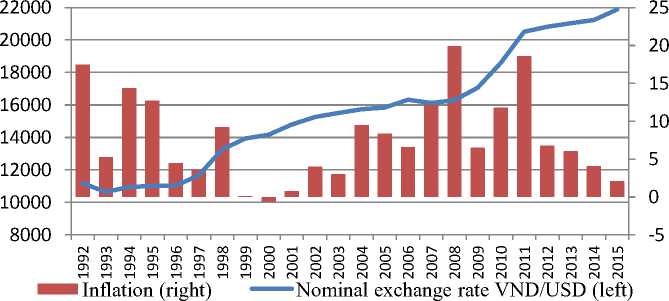

In the period from 1992 to present: Look at the nominal exchange rate from 1992 to present (Figure 3) and a summary of the exchange rate mechanism Vietnam over time (Table 1), we may see the official exchange rate VND / USD published daily by the Vietnamese National Bank on the basis of the previous day's trading among commercial banks having two obvious characteristics are as follows:

Figure 3. Movements of the nominal exchange rate and inflation in the period 1992-2015

(Sources: Vietnamese National Bank and author’s calculation)

First, the stage in which Vietnam's economy is associated with volatility. Specifically:

-

- In 1989-1991 in the context of Vietnam to implement robust reforms, overall economy, such as the transition into the market economy; banking system moved from one-level into two-level; the international economic relations are open towards depth and breadth; decisions on economic policy to be changed to fit the laws of market economy;

-

- From1997 to 2000 with a strong influence of the Asian currency crisis;

-

- The period 2008-present global economic crisis and efforts of recovery and macroeconomic stability. During this period Vietnam build and implement the plan to restructure the economy. In particular, Vietnam concerns in promoting restructuring of the banking system facing shortcomings in past time5.

The consequence of this impact is great inequality between the official rate and the free market rate. Market pressures have forced the Vietnamese National Bank to expand the exchange rate or devaluate currency, making VND depreciated significantly versus the previous point (Figure 2 and 3).

Second, period with the development and economic stability in the years 1993-1996, 2001-2007 and 2013-2015. In this stage, free market's exchange rate movements had been stabilized, closely with the official exchange rate. The reason was that the official rate was increased continuously in the previous period and the end period tied with the free market's exchange rate. However, the exchange rate peg mechanism under the dollar of Vietnam was applied in a rigid, less flexible way.

Limitations in operating the exchange rate in Vietnam

Before the inner and outer effect discussed above, it can be said that the exchange rate policy in Vietnam has basically shown effectively important role in operating macroeconomic as: inflation control (Figure 3); decreasing of deficit and current account balance surplus; Vietnamese National Bank had been more active, as in 2014 the Vietnamese National Bank committed that rate ranged up to 3% and the actual results showed that the VND/USD relatively stable in 2012 and initiativeness is also reflected in the recent past. However, besides the above results, the exchange rate policy of Vietnam had restrictions as assessed by the experts as "incomplete", as follows:

-

- Nominal rate increased but lower real exchange rate affected the competitiveness of export goods of Vietnam.

-

- Operating exchange rate policy of the Vietnamese National Bank has not been agreed. In recent years there were situations that decisions of Vietnamese National Bank was not convincing to the commercial banks to seriously implement, having led to the Vietnamese National Bank to issue administrative measures.

-

- The maintenance pegged regime USD in a narrow range for a long time, in conditions of low foreign exchange reserves, the foreign exchange market is underdeveloped and lacks the tools defend the exchange rate risk, interest rate is still imposing and exchange rate policy still rely heavily on local currency devaluation tools.

It's can be said briefly the causes of the shortcomings in the operating exchange rate policy in Vietnam were: Vietnam's economy was in the development stage so import demand was very large; State budget deficit prolonged had caused foreign debt to increase, especially in terms of foreign exchange reserves Vietnam was declining; the phenomenon of "dollarization" had happened and Vietnamese National Bank and could not control the amount of foreign currency outside the banking system. One more thing about the cause of shortcoming in the operating policy rate last time in Vietnam was ineffective coordination between state agencies such as the Ministry of Finance; State Securities Committee; MOIT and Vietnamese National Bank. This hinders the effectiveness of the implementation of exchange rate policy in Vietnam in the current period.

Conclusion

To improve operating efficiency rate policy in the current period, Vietnam needs to have drastic changes, as follows:

First, model is transformed into a floating exchange rate managed. However, it should be prepared prior to the implementation conditions. The new study also shows that Vi- etnam needs to strongly convert rate model. However, pay attention to banking system reform to improve health orientation of commercial banking with solutions such as raising charter capital, mergering of small banks; changing the current export structure etc ...

Second, no currency devaluations with the aim of improving the account balance. If the current account deficit, especially the trade deficit is increasing, in terms of foreign exchange reserves decline, debt / asset in the balance sheet currency of the Vietnamese National Bank increased, National Bank should not devalue the currency in order to improve the current account balance.

Thirdly, expanding the exchange rate fluctuation band. Vietnamese National Bank should consider to wider the trading band of the exchange rate when the foreign exchange market is stable without VND devaluation. The test results in recent years shows the tool of currency devaluation of the National Bank in operating exchange rate policy has not achieved the objective of ensuring internal balance and external balance. Therefore, the tools of devaluation should not continue to be applied as a primary solution to increase exports.

Список литературы Question in operating the exchange rate policy of the State Bank of Vietnam in the current period

- Hoang Thi L.H. Finishing the policy of the exchange rate in Vietnam for the period of 2010-2020. Hanoi, 2012.

- Minh-Duc (2008). Exchange Rate Volatility: The State Bank of Vietnam is Capable to Intervene (in Vietnamese: Ty gia bien dong: Ngan hang Nha nuoc du suc can thiep), Vietnam Economic Times, viewed 20 August 2008.

- Nguyen Tran Phuc (2009). Implications of Exchange Rate Policy for Foreign Exchange Market Development: Vietnam, 1986-2008, Working paper, Griffen University, Australia.

- Nguyen Tran Phuc, Nguyen Duc Tho (2009). Exchange Rate Policy in Vietnam, 1985 - 2008, ASEAN Economic Bulletin 26 (2): 137-163.

- Nguyen Dac Hung. Reported that the SBV bought and sold $3.54 billion of foreign currency in this year. The figure presented in the text is an estimate based on this volume of SBV trading. Hanoi, 2005, p. 34.