Realization of the regions’ budget capacity: a new integrative approach to the research

Автор: Pechenskaya-polishchuk M.A.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 1 т.17, 2024 года.

Бесплатный доступ

The paper investigates theoretical aspects related to the implementation of budget capacity at the stages of its formation and use. Having studied the determinants of socio-economic development contained in various economic doctrines, and taking into consideration the modern context of the functioning of the Russian economy, we show that the realization of budget capacity is an important factor in socio-economic development. The systematization of diverse views on the essence, definition of a set of controversial issues regarding the content and problems of implementing the regions’ budget capacity shows that the theoretical and methodological basis for its formation and use is limited. The paper considers the economic category “region’s budget capacity” from the perspective of integrating resource, fiscal and institutional characteristics, representing a set of not only created, but also attracted gratuitous / non-gratuitous budget resources, as web as reserves that can be realized under the influence of external / internal constraints and incentives. This interpretation makes it possible to specify the concept of “maximum achieved budget capacity of the region” as a capacity that has been implemented, and “the maximum achievable budget capacity of the region” as a set of implemented, reserve and hidden capacities. The article substantiates basic provisions of the integrative approach. The materials can be used in educational activities in studying disciplines in the field of finance, economics and management; they can also be useful to researchers as a basis for further research, and to management bodies of different levels to substantiate management decisions.

Budget capacity, theory, methodology, approach, socio-economic development, region, budget policy

Короткий адрес: https://sciup.org/147243325

IDR: 147243325 | УДК: 336.02 | DOI: 10.15838/esc.2024.1.91.7

Текст научной статьи Realization of the regions’ budget capacity: a new integrative approach to the research

Introduction to the problem

The current socio-economic situation in Russia is largely determined by a number of external and internal factors, including previously introduced and current sanctions, effects of the coronavirus pandemic, unpredictability of fluctuations in the ruble and energy prices, unstable inflation, etc.

In this context, a decisive transformation of the commodity-based economy, largely dependent on the global market and the results of export-import activities, into an economy that promotes import substitution, scientific, technological and innovative development, as well as maintaining the necessary balance between internal self-sufficiency and global openness, should become national priority goals. Their achievement is possible only on the basis of socio-economic development of regions as geographically specialized subsystems within the national economy.

Budget regulation, the importance of which increases markedly during periods of instability, has impressive and diverse opportunities for socioeconomic development of regions. Moreover, insufficient effectiveness of budgetary policy can become a significant barrier to the integrated development of the entire socio-economic system. We should note that in the presence of various kinds of restrictions, including financial, the need has increased many times not so much in quantitative increment of existing budget resources, which is typical of the traditional but outdated paradigm of socio-economic development, as in the fullest realization of the regions’ budget capacity. The use of this category contributes to significant progress regarding the factors promoting the economic and social development of regions. Obviously, this is possible only when new methodological approaches to the formation and assessment of the use of the region’s budget capacity are developed; this has become the aim of the work. The research was based on general scientific methods of cognition, as well as comparative, evolutionary, institutional and other relevant approaches.

Debatable issues of the methodology for studying the region’s budget capacity

The scientific community and practical managers actively discuss the forms and methods of implementing the budget capacity, which, in turn, among other factors depend on the correctness and thoughtfulness of the use of the conceptual framework. In this regard, research into the theoretical foundations of the content of budget capacity seems to be an urgent and important scientific task.

At the same time, there is a noticeable concentration of research focus on tax capacity (as part of budget capacity) or on the financial or economic capacity of the region (including those studies that consider budget capacity as their component), which requires further development and substantiation of the theoretical and methodological content of the region’s budget capacity.

The term “budget capacity” (“fiscal capacity” in English-language literature) and methods for determining its level became very widely used in scientific and managerial circles with the arrival of the so-called progressive financial consolidation policy in the early 1990s (Martinez-Vazquez, Boex, 1997; Haffert, Mehrtens, 2013).

Taking into account the results of previous studies (Pechenskaya, 2018a), we will highlight a number of fundamental issues of the methodology of budget capacity research that have caused a lively scientific discussion, in particular:

-

• Are the terms “resources”, “opportunities”, “reserves”, “capacity”, “budget”, “budget capacity” identical?

-

• How to take into account the time factor when researching budget capacity in a cyclical budget process?

-

• Why is it necessary to implement budget capacity?

-

• Which capacity should be analyzed: budget or tax?

-

• Which approach to the study of the essence of budget capacity best meets the task of promoting socio-economic development in the regions?

Further, the study will present a consistent scientific search and substantiation of answers to these questions.

First , when considering the interpretations of the essence of budget capacity, we found a fairly frequent substitution of the terms “resource”, “reserves”, “opportunities”, “capacity”, as well as “budget” and “budget capacity”.

Resources, which are one of the most important economic categories, represent sources of covering needs. The sources of budget resources are budget revenues created as a result of economic activity and funds attracted to the budget on a reimbursable and gratuitous basis. In this study, budget resources will be understood as those that are already involved in economic turnover. According to their engagement, resources can be classified as those that are in use and those that are potentially possible. In the latter case, we are talking about reserves for the growth of budget resources. Doctor of Sciences (Economics) F.F. Hanafeev points out two different states of reserves: the state of unused opportunities or the state of development (Hanafeev, 2008). We will proceed from the position of allocating unrealized and non-obvious reserves. At the same time, unrealized reserves differ from non-obvious ones in that they are already known and can be realized at this stage of economic development due to the application of necessary incentives and (or) restrictions.

Thus, we will interpret budget capacity at the intermediate stage of the study as a set of budget resources (realized budget capacity) and reserves (unrealized budget capacity).

In our opinion, the categories “budget” and “budget capacity” are not equivalent. An interesting conclusion was made by RAS Academician A.I. Tatarkin, who considered that within the framework of capacity there are both possible resources and those already involved in economic activity (Tatarkin, 1997; Tatarkin, Novikova, 2015). Academician L.I. Abalkin interpreted capacity as a kind of collective, generalized characteristic of resources (Abalkin, 1987).

Linguistically, the definition of “budget capacity” assumes a probabilistic character, whereas the budget is a very real result of budget capacity implementation, that is, realized budget capacity, when budget revenues become the result of formation, and budget expenditures become the result of use.

Second , budget capacity is considered within the framework of individual stages of its implementation, most often at the stage of formation.

The fact that budget capacity is a dynamic category does not require proof; and over time, along with the development of society and economy, certain types of non-obvious reserves can move into the category of known but unrealized reserves, and unrealized reserves into budget resources.

Since budget capacity is associated with the time parameter, many researchers consider individual stages in the implementation of budget capacity. At the same time, scientific works often lack the interconnectedness of the stages of its formation and use. We agree with Doctor of Sciences (Economics) I.V. Sugarova, who points out that “budget capacity should not be considered only from the perspective of revenue generation; it is important to take into account the possibilities of rational allocation of revenues and their distribution in such a way as to meet the current needs of society, ensure the realization of strategic interests of the state, the growth of technological, capital and human potential for the future” (Sugarova, 2016).

In our opinion, it is advisable to study budget capacity as a category that is cyclical in the key stages of its implementation (the stage of formation and the stage of use). At the same time, increasing the efficiency of the formation and use of budget capacity leads to its growth. The cyclical nature of the stages does not mean zeroing, but involves the transformation of stimuli and constraints of the external and internal environment. Therefore, implementing budget capacity is not the end result of public administration. This leads to a third controversial issue.

Third, there is no common understanding among scientists concerning the final result of implementing budget capacity. In our opinion, it is not entirely accurate to talk about the realization of budget capacity as the final result, since one needs to know what resources and reserves are required for. Some studies, consider expenditure financing as such a result. In our opinion, the realization of the region’s budget capacity contributes to improving the quality of public services, development of human capital, growth of investments in national production, promotion of innovation, increase in domestic consumer demand, and development of economic sectors, which leads to stimulating the region’s socio-economic development. From this, we determine that the final result of implementing budget capacity should be to promote the region’s socio-economic development in order to ensure a decent quality of life and standard of living for the population.

In turn, the realization of budget capacity is influenced by a whole range of factors, the study of which becomes a necessary methodological task. Having reviewed the relevant economic literature, we identified a number of opinions on the factors promoting the implementation of budget capacity. All the points of view studied in the economic literature reasonably indicate that the realization of budget capacity depends on the stimulating and restrictive effects of the external and internal environment. In our opinion, this corresponds to the probabilistic nature of the essence of budget capacity.

As a result of generalization of external and internal, main and secondary factors identified in domestic and foreign studies, it is possible to present a triad of conditions for the realization of budget capacity:

-

1) availability and development of the resource base (natural and climatic conditions, resource and raw material base, economic structure, demographic and historical features, etc.);

-

2) stability and flexibility under market conditions (inflation rate, exchange rate, etc.);

-

3) institutional effectiveness (regulatory framework, development institutions, etc.).

Fourth , scientific literature, as well as regulatory documents, often takes into account problems related only to tax capacity rather than budget capacity.

Agreeing with the importance of in-depth research on tax potential, we emphasize that, in our opinion, the category of budget capacity helps to expand the possibilities of state influence on the social and economic development of the country and its regions. Doctor of Sciences (Economics), Professor L.N. Lykova convincingly proves the necessity to study not only the tax capacity of the regions of the Russian Federation due to the fact that not all financial resources become fully or partially taxable (Lykova, 2008). The Budget Code of the Russian Federation establishes the principles of completeness of revenues reflection and budget balance, which mean that expenditures correspond not only to tax revenues, but also to the total amount of revenues1. Thus, according to our position, budget capacity is the most comprehensive and adequate category from the point of view of solving the problem of promoting socio-economic development in the regions, whereas tax capacity is one of its components.

Fifth , so far there is no consensus on the essence of budget capacity.

The definition of “budget capacity” is often used in modern budget practice; however, Russian legislation does not disclose its essence and considers only the tax capacity index 2 . The lack of a legally fixed definition of this term has prompted many researchers to define its meaning in their own way and look at it from different positions (from the position of resources, opportunities, or the result of fiscal relations).

The variety of characteristics of the essence of budget capacity creates inaccuracies in understanding its nature and methods of its implementation, as well as limits the possibilities of conducting comparative studies.

Studying the evolution and modern interpretation of the term in question contributed to our critical understanding and systematization of existing approaches (Tab. 1).

Table 1. Systematization of approaches to the definition of the term “budget capacity”

|

Approach |

Researchers |

Definition of budget capacity |

|

Resource-based |

M.V. Vladyka, S.V. Zenchenko, Zh.G. Golodova, A.N. Indutenko, O.S. Kirillova, Zh.A. Mingaleva, N.P. Pazdnikova, L.D. Sanginova, Yu.N. Severina, A.V. Sidorovich, Ph. Mehrtens, L. Haffert |

The set of financial resources that are accumulated over a certain period in a particular budget to address the tasks of the state |

|

Fiscal |

V.A. Vorob’eva, Yu.A. Petrov, S. Barro, L. Jameson Boex, J. Martinez-Vazquez |

The ability of the economic system itself, as well as government and self-government bodies, to increase budget revenues at various levels |

|

Institutional |

F.F. Khanafeev, N.I. Yashina, S.N. Yashin, E.V. Poyushcheva |

A set of various conditions that contribute to the formation of an optimal size of budget revenues |

|

Expenditure-based |

O.A. Grishanova, I.N. Shvetsova, T.A. Naidenova |

The amount of maximum budget expenditures |

|

Imperative |

N.A. Tolkacheva, L.V. Afanas’eva, T.Yu. Tkacheva |

The result of budget and tax relations forming a complex system of economic indicators |

|

Sources: own compilation based on own analysis; (Pechenskaya, 2018a). |

||

We believe that each of these approaches is possible, but each represents a narrow interpretation of the region’s budget capacity. At the same time, research into the formation and use of budget capacity should be carried out from a position that mainly links it with the task of promoting the regions’ socio-economic development and integrates its fiscal, institutional and resource features.

As a result of the study, we conclude that the region’s budget capacity is a set of realized (created and attracted) budget resources and unrealized and non-obvious reserves that are formed, used and developing under the influence of external and internal constraints and incentives. The discussion issues that have been studied and our substantiated solutions are given in Table 2 .

Thus, the analysis demonstrated the existence of flaws in the methodological research on the essence of budget capacity, which proves the need to create a fundamentally new theoretical and methodological approach – an integrative one, which differs from the existing ones by substantiating the structure and stages of realization of budget capacity. To do this, first of all, it is advisable to explore the issue of the evolution of conceptual views on the role of the region’s budget capacity in socio-economic development.

Substantiation of the theoretical and methodological approach to the formation and use of the region’s budget capacity

For an in-depth study of the essence of budget capacity, it is expedient to choose the most constructive research tools. Foreign and Russian scientists have convincingly proved that structural-functional and systems approaches are leading in the analysis of dynamism, non-linearity and structural complexity of economic processes.

Budget capacity, like financial capacity, is a complex category consisting of an ordered set of interrelated components. In this regard, the disclosure of the essence of budget capacity is possible when there is a detailed understanding of its structure.

Table 2. Substantiation of our position on the key discussion issues of the content of budget capacity

|

No. |

Discussion issue |

Substantiation of our position |

|

1 |

Are the terms “resource”, “opportunities”, “reserves”, “capacity”, “budget” and “budget capacity” identical? |

We consider budget capacity as a set of realized budget resources and reserves (potential opportunities). Budget capacity is a probabilistic category; budget is the actual result of budget capacity implementation. |

|

2. |

How the time factor can be taken into account when studying budget capacity in a cyclical budget process? |

Budget capacity should be considered as a category that assumes the cyclical nature of the key stages of its implementation: the stage of formation and the stage of use. At the same time, increasing the efficiency of the formation and use of budget capacity leads to its growth. |

|

3. |

Why is it necessary to realize the region’s budget capacity? |

To stimulate the region’s socio-economic development as a favorable condition for ensuring decent quality of life and standard of living, as well as personal development of an individual. |

|

4. |

What kind of the region’s capacity should be analyzed: budget or tax? |

Budget capacity is wider than tax capacity; this fact expands the possibilities for promoting socio-economic development in the regions. |

|

5. |

Which approach to the study of the essence of budget capacity best corresponds to the task of promoting the region’s socioeconomic development? |

A comprehensive (integrative) approach to research is needed, which will link budget capacity with the task of stimulating the region’s socio-economic development and take into account its resource-based, institutional and fiscal components. |

|

Sources: own compilation based on own analysis; (Pechenskaya, 2018a). |

||

A review of economic literature allowed us to reveal the ambiguity of understanding the structure of the region’s budget capacity. In some works it consisted of tax and non-tax revenues (for example, Naidenova, Shvetsova, 2013), other experts added gratuitous receipts (for example, Borovikova, 2008). Some studies included an institutional aspect in the structure of the regions’ budget capacity. For example, P. Maior points out that when providing public services to the population, it is necessary to take into account the full potential of the territory, that is, distributed funds, equity and the regulatory system (Maior, 2009).

In our opinion, these provisions are not complete enough, because they exclude the budget capacity attracted on a reimbursable basis and take into account only gratuitous receipts involved in economic turnover, without considering their growth reserves. In our opinion, when conducting a comprehensive study of the structure of budget capacity, it is necessary to adhere to the structure of the budget system and arrange the types of budget capacity identified in numerous scientific sources into a single classification (Ilyin et al., 2018; Pechenskaya, 2015; Pechenskaya-Polishchuk, 2022; Tkacheva, 2014; Yutkina, 2011; Friederich et al., 2004; Garmann, 2015; Haffert, Mehrtens, 2013; Martinez-Vazquez, Boex, 1997; Slack, 2009).

We have identified nine key features of budget capacity indicated in the economic literature: 1) method of formation (own and redistributable budget capacities); 2) time feature (strategic, tactical, retrospective); 3) increment value (resource, achieved, incremented); 4) development stage (emerging, in use, reproductive); 5) degree of implementation (possible, real); 6) impact on the budget system (revenue, expenditure, regulatory, institutional); 7) degree of useful application (basic, hidden, excessive, idle); 8) territorial feature (regional, local); 9) dependence on reproductive capabilities (current, accumulated) 3 .

At the same time, the systematization has shown that the existing types miss the maximum possible level of budget capacity achieved when taking into account all budget resources and reserves in order to ensure the region’s socio-economic development. At the same time, the maximum achievable budget capacity will be understood as a combination of three components – implemented, reserve and hidden budget capacities. The implemented budget capacity consists of budget resources created as a result of economic activity and attracted on a gratuitous and reimbursable basis. Reserve budget capacity means unrealized reserves of budget capacity growth. Hidden budget capacity corresponds to the non-obvious reserves of budget capacity growth.

According to the classifications we can find in scientific literature, budget capacity is a providing type of socio-economic capacity and occupies a leading place in its structure (Balatsky et al., 2006; Vinogradova, Lomovtseva, 2013; Golodova, 2009; Golodova, 2010; Zenchenko, 2008; Kolomniets, Novikova, 2000; Lykova, 2008; Men’kova, 2008; Mingaleva, Pazdnikova, 2007; Repchenko, Fokina, 2007; Sabitova, 2003; Tkacheva, 2014; Shalmuev, 2006). Therefore, we believe that the basis for the formation of budget capacity is socio-economic capacity, and the superstructure is the subsequent fiscal regulation.

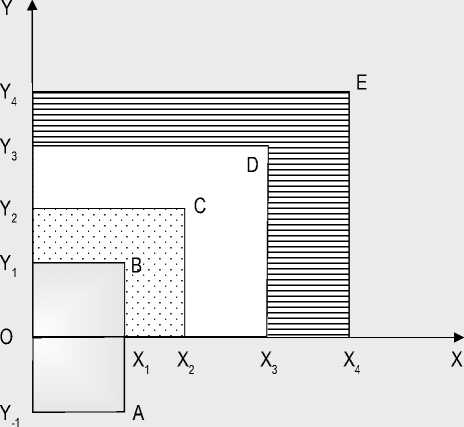

We substantiate our position regarding the consistent and multi-layered formation of the maximum achievable level of budget capacity with the help of graphical visualization (Fig. 1).

It is possible to graphically represent, with some degree of conditionality, the formation of the region’s budget capacity depending on the amount of resources (created and attracted) and reserves of the i -th region (Y axis) and a set of various external and internal capabilities (X axis) (Pechenskaya, 2018b).

Figure 1. Sequence in which the subcomponents of the region’s budget capacity are formed

Source: own elaboration.

The economic rationale for the graphical comparison is as follows: under the influence of external and internal constraints and incentives X of the i -th region, budgetary resources and reserves Y are formed.

The result of the region’s economic activity and the reserves of its growth lead to the formation of tax capacity, which is the figure Y -1 Y 1 ВА. Taking into account the budget federalism model, the existence of fixed taxes remaining at the disposal of sub-federal government bodies, and regulatory taxes that are distributed at budget levels, we divide tax capacity into the tax capacity of the region ОY 1 ВХ 1 and the conditionally named tax capacity of the federation. The figure Y -1 ОХ 1 А characterizes the entire volume of the tax and non-tax capacity of the federation.

The composite figure Y -1 Y 2 СХ 2 Х 1 А represents the entire volume of economic (created) budget capacity (tax capacity and non-tax capacity), i.e. formed directly from the economic activity of the i -th region.

The figure ОY 2 СХ 2 characterizes own budget capacity, including tax and non-tax capacity of the i -th region.

Taking into account the budget capacities attracted on a gratuitous and reimbursable basis in the figure ОY 4 ЕХ 4 the level of budget capacity of the i -th region becomes the highest according to the proposed integrative approach (maximum achievable budget capacity).

Therefore, it is advisable to supplement the classification of types of budget capacity with three more features (Tab. 3) .

Feature 10 – according to the degree of implementation (realized, reserve, hidden budget capacity) – components of budget capacity.

Feature 11 – depending on the sphere of formation (tax sphere, non-tax sphere, and attraction sphere) – basic sub-components of budget capacity.

Feature 12 – according to the extent of aggregation of basic sub-components – own, attracted, maximum achievable, maximum achieved budget capacities.

Table 3. Own addition to the types of budget capacity

|

Type |

Characteristics |

|

|

Feature 10. According to the degree of implementation (components of budget capacity in the framework of the integrative approach we put forward) |

||

|

Realized budget capacity |

Gratuitous and reimbursable budget resources created in the course of the region’s economic activity and attracted to the region |

|

|

Reserve budget capacity |

The same as the unrealized reserves of budget capacity growth |

|

|

Hidden budget capacity |

Corresponds to the non-obvious reserves of budget capacity growth |

|

|

Feature 11. Depending on the sphere of formation (basic sub-components of budget capacity in the framework of the integrative approach we put forward) |

||

|

00 CD -С co X £ |

Tax capacity |

The totality of the actual and possible results of the economic activities of the region’s subjects of economic relations, expressed in the form of tax resources and reserves |

|

Tax capacity of the federation |

The totality of the actual and possible results of the economic activities of the region’s subjects of economic relations, expressed in the form of tax resources and reserves to be transferred the budget of a higher level, according to the current model of fiscal federalism |

|

|

Tax capacity of the region |

The totality of the actual and possible results of the economic activities of the region’s subjects of economic relations, expressed in the form of tax resources and reserves to be transferred to the budget of the current level; the difference between tax capacity and tax capacity of the federation |

|

|

CD CD -С СП X оз z |

Non-tax capacity |

The totality of receipts and reserves for the growth of non-tax revenues obtained in the territory |

|

Non-tax capacity of the federation |

The totality of receipts and reserves for the growth of non-tax revenues to be transferred to the budget of a higher level |

|

|

Non-tax capacity of the region |

The totality of receipts and reserves for the growth of non-tax revenues to be transferred to the budget of the current level; the difference between non-tax capacity and non-tax capacity of the federation |

|

|

CD CD _£Z CO 2 |

Budget capacity attracted on a gratuitous basis |

The amount of gratuitous receipts that has already been attracted and can be attracted from a higher-level budget |

|

Budget capacity attracted on a reimbursable basis |

The amount of borrowed resources that are attracted and can be attracted on the principles of urgency, payment, repayment |

|

|

Feature 12. According to the extent of aggregation of basic sub-components (aggregated sub-components of budget capacity in the framework of the integrative approach we put forward) |

||

|

Own budget capacity of the region |

The totality of tax and non-tax capacities used |

|

|

Attracted budget capacity of the region |

The totality of budget capacities attracted on a gratuitous and reimbursable basis |

|

|

Maximum achieved budget capacity of the region |

The combination of realized own budget capacity and attracted budget capacity |

|

|

Maximum achievable budget capacity of the region |

The combination of reserve and hidden own budget capacity and attracted budget capacity |

|

|

Source: own elaboration. |

||

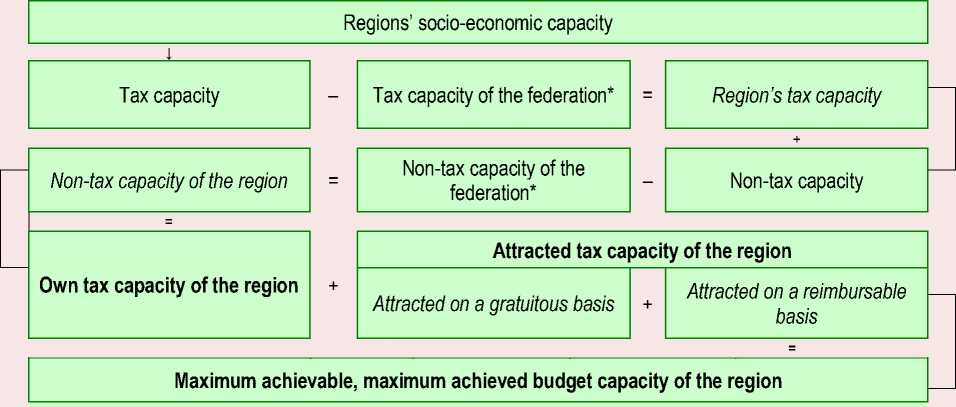

The features that supplemented the classification of types of budget capacity allowed us to reveal its structure in detail. At the same time, the sequence of formation of the region’s maximum achievable budget capacity is reflected with the help of a conceptual model (Fig. 2) .

This model is valid for each component of the region’s budget capacity (realized, reserve, hidden), since reserves can be found in any of the identified sub-components.

Thus, we have revealed that the achieved level of the region’s budget capacity means the result that was obtained for a specific period of time and that consists in combining economic activities created in the region and budget resources attracted to the region, the realization of reserves (potential opportunities) taking into account the synergetic effect proceeding from the interaction of components and sub-components under the influence of incentives and constraints of the external and internal environment.

The above arguments form the basis of a fundamentally new integrative approach. Our own understanding of the implementation of the region’s budget capacity, taking into account the stages of formation and use, according to the developed integrative approach, is presented in Figure 3.

Figure 2. Conceptual model for the formation of the region’s maximum achievable, maximum achieved budget capacity (BC) from its sub-components

* The tax/non-tax capacity of the federation is the part of the tax/non-tax capacity that goes to the budget of a higher level, according to the current model of budget federalism.

Basic sub-components are highlighted in italics; aggregated sub-components are given in bold.

Source: own elaboration.

Figure 3. Conceptual provisions for the implementation of budget capacity according to the proposed integrative approach

|

т— С/Э ^ -2 о e S о ® о °- _E ° |

Incentives and limitations of the external and internal environment |

||||||||||||

|

Availability and development of the resource base |

Stability and flexibility under the influence of the environment |

Institutional effectiveness |

|||||||||||

|

C\i 2 c/5 2 2 5 CO |

co |

Realized BC (created and attracted budget resources |

Realized BC |

||||||||||

|

Reserve BPC(unrealized budget reserves*) |

Hidden BC (non-obvious budget reserves**) |

||||||||||||

|

co |

Basic |

Aggregate |

|||||||||||

|

Tax capacity Non-tax capacity BC attracted on a gratuitous basis BC attracted on a reimbursable basis |

} Own BC } Attracted BC |

Maximum } achievable, maximum achieved BC |

|||||||||||

|

co c « оз о E |

Formation of |

Use of BC |

|||||||||||

|

own BC |

attracted BC |

||||||||||||

|

СЛ CD CO E 2 2 E co |

Increasing the effectiveness of |

||||||||||||

|

BC formation |

BC use |

||||||||||||

|

Promoting BC realization |

|||||||||||||

|

↓ |

|||||||||||||

|

Region’s economic and social development, includin g |

|||||||||||||

|

Increasing the quality of public services |

Human capital development |

Increasing investment in national production |

Promoting the implementation of innovations |

Increasing domestic consumer demand |

Promoting the development of economic sectors |

||||||||

The region’s realized budget capacity is quite amenable to mathematical calculation, that is, it can be quantified. As for reserve budget capacity, it is possible to determine only its level, which requires an estimated methodological toolkit that takes into account the absolute and relative, quantitative and qualitative characteristics of the budget capacity structure, as well as the synergetic effect resulting from the interaction of components and subcomponents.

A quantitative example of the consistent formation of the maximum achieved level of the region’s budget capacity can be given in terms of budget resources involved in economic turnover (Tab. 4).

The proposed approach we have designed does not contradict the existing theory and methodology, but develops them by increasing attention to the structure of budget capacity, conditions and stages of its implementation in the context of ensuring the region’s socio-economic development.

Thus, based on the systematization of relevant foreign and Russian scientific works and our own research findings, we have substantiated four key conceptual provisions that reveal the proposed integrative approach to the formation and use of the region’s budget capacity.

The first provision of the integrative approach is “Conditions for the realization of budget capacity”. The triad of key development conditions is as

Table 4. The sequence of formation of the region’s maximum achieved budget capacity in terms of created and attracted budget resourcesв

|

го го X £ |

Region’s tax capacity |

го о X го _со а? ОС |

го о CD _со а? ОС |

CD ГО О CD го То го о |

го го 4= 03 го о ® Го -О а го о М _со а? ОС |

а? CD ГО о о ^ 9? xz ГО Е Е X ГО ^ |

||||||

|

Е ОО |

го о X го CD го ОО |

including |

||||||||||

|

со CD X ГО CD CD |

СО CD X ГО "го а? |

со CD X го 3 |

СО CD Е X го ^ CD СО |

|||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

|

Data source / calculation formula |

FTS |

FT |

Column 3 / col. 2 |

FTS |

FT |

Col. 3 + col. 9 |

FT |

MF |

Col. 10 + col. 11 + col. 12 |

|||

|

Measurement unit |

Billion rubles |

% |

% of col. 2 |

Billion rubles |

||||||||

|

Russian Federation |

20737.8 |

7180.1 |

34.6 |

90.4 |

5.3 |

1.3 |

3.0 |

742.2 |

7922.3 |

4102.7 |

2496.0 |

14521.0 |

|

NWFD |

2492.9 |

884.8 |

35.5 |

90.5 |

5.5 |

0.9 |

3.1 |

68.8 |

953.6 |

363.9 |

282.9 |

1600.4 |

|

Vologda Region |

77.2 |

45.6 |

59.1 |

76.2 |

16.3 |

2.6 |

5.0 |

4.9 |

50.5 |

36.3 |

15.7 |

102.5 |

|

Notes: FTS – according to the Federal Tax Service of the Russian Federation, FT – according to the Federal Treasury of the Russian Federation, MF – according to the Ministry of Finance of the Russian Federation. Source: own calculations using the reports of the RF Federal Treasury, RF Ministry of Finance, RF Federal Tax Service for 2020. |

||||||||||||

follows: 1) availability and development of the resource base (natural and climatic conditions, resource and raw material base, economic structure, demographic characteristics, etc.); 2) stability and flexibility under market conditions (inflation rate, exchange rate, etc.); 3) institutions of implementation and development, whose activities are aimed at effective management of the natural resource and socio-economic base of the territory in a dynamic environment (regulatory framework, tools, mechanisms, etc.).

The second provision is “Structure of budget capacity”:

– in order to take into account all budget resources and reserves in stimulating the regions’ socio-economic development, the definition of “maximum achievable budget capacity” is introduced, which is a combination of realized, reserve and hidden budget capacities;

– realized budget capacity consists of budget resources created as a result of economic activity and attracted on a gratuitous and reimbursable basis; reserve budget capacity is identical to unrealized reserves of budget capacity growth; hidden budget capacity corresponds to non-obvious reserves of budget capacity;

– each component of budget capacity consists of basic sub-components: tax capacity, non-tax capacity, budget capacity attracted on a gratuitous basis, and budget capacity attracted on a reimbursable basis.

The third provision is “Stages of realization of budget capacity”:

– realization of budget capacity is cyclical and dynamic; over time, as society and economy are developing, certain types of non-obvious reserves may move into the category of known but unrealized reserves, and unrealized reserves – into budget resources;

– the stage of budget capacity formation involves mobilization of budget resources and maximum realization of their reserves;

– the most complete category is “maximum achievable budget capacity”; realized budget capacity is defined by the term “maximum achieved budget capacity” as a combination of budget revenues, budget expenditures, and sources of financing budget deficit;

– the stage of use is characterized by the choice of priorities and the implementation of budget financing of socio-economic development; therefore, the use of reserve and hidden budget capacity is impossible; consequently, only realized budget capacity is used.

The fourth provision is “Result of the budget capacity realization”:

-

– increasing the effectiveness of forming and using budget capacity leads to its fullest realization;

– realization of budget capacity contributes to stimulating regions’ socio-economic development by improving the quality of public services and human capital development, increasing investments in national production, promoting innovation, enhancing domestic consumer demand, developing economic sectors and increasing profitability.

The substantiated provisions of the integrative approach to the formation and use of the region’s budget capacity allowed us:

-

1) to point out the relevance of the role of budget capacity as an important factor in promoting the region’s socio-economic development in modern conditions and in current economic realities;

-

2) to identify the components, basic and aggregated sub-components of the region’s budget capacity;

-

3) to reveal the conditions for realizing the region’s budget capacity;

-

4) to substantiate the interconnectedness and cyclical nature of the stages of formation and use of the region’s budget capacity that can be realized to the fullest extent when the effectiveness of these stages is enhanced;

-

5) to expand the classification of the types of the region’s budget capacity according to three criteria: degree of implementation; sphere of formation; extent of aggregation of basic sub-components;

-

6) to reflect the integration of various features describing the essence of the region’s budget capacity:

– resource-based, as a set of created and attracted budget resources;

– fiscal as the ability to achieve the maximum level so as to promote socio-economic development in regions;

– institutional as a set of development conditions.

Conclusion

In the course of the research we obtained the following scientific results.

-

1. We showed the most important place and significant role of budget capacity in ensuring socioeconomic development of regions in a dynamic external and internal environment.

-

2. We created a fundamentally new integrative theoretical and methodological approach to the

-

3. We introduced the terms “maximum achievable budget capacity” and “maximum achieved budget capacity” and substantiated a conceptual model for their formation.

formation and use (realization) of budget capacity, substantiating and revealing its structure, conditions and implementation stages. According to the integrative approach, budget capacity is a set of not only created, but also gratuitously / reimbursably attracted budget resources, as well as reserves that can be realized under the influence of external / internal constraints and incentives. Our own integrative approach most fully resolves the identified controversial issues of methodology for the formation and use of the region’s budget capacity. Applying the proposed approach in the practice of public administration helps to take a new look at the possibilities and directions of implementing the state fiscal policy in the face of growing negative external influences and large-scale long-term national goals. Achieving this seems difficult without revising the system of state management of economic processes.

Список литературы Realization of the regions’ budget capacity: a new integrative approach to the research

- Abalkin L.I. (1987). Novyi tip ekonomicheskogo myshleniya [A New Type of Economic Thinking]. Moscow: Ekonomika.

- Balatsky O.F., Lapin E.V., Akulenko V.L. (2006). Ekonomicheskii potentsial administrativnykh i proizvodstvennykh system [The Economic Potential of Administrative and Production Systems]. Sumy: Universitetskaya kniga.

- Borovikova E.V. (2008). Financial capacity as a comprehensive indicator of the effectiveness of fiscal policy. Ekonomicheskii analiz: teoriya i praktika=Economic Analysis: Theory and Practice, 18, 25–28 (in Russian).

- Friederich P., Kaltschütz A., Nam C.W. (2004). Recent Development of Municipal Finance in Selected European Countries. In: Oporto: The 44th Congress of the European Regional Science Association (ERSA). Available at: http://www-sre.wu-wien.ac.at/ersa/ersaconfs/ersa04/PDF/288.pdf

- Garmann S. (2015). Elected or appointed? How the nomination scheme of the city manager influences the effects of government fragmentation. Journal of Urban Economics, 86, 26–42.

- Golodova Zh.G. (2009). Assessing budget and tax capacity of the region in the context of reforming the system of intergovernmental fiscal relations. Finansy i kredit, 5, 33–40 (in Russian).

- Golodova Zh.G. (2010). Financial potential of region: Essence and management elements. Vestnik Rossiiskogo universiteta druzhby narodov. Seriya: Ekonomika=RUDN Journal of Economics, 4, 13–21 (in Russian).

- Haffert L., Mehrtens Ph. (2013). Frоm austerity tо expansion? Cоnsolidation, budget surpluses, and the decline оf fiscal capacity. In: MPIfG Discussion Paper, 13/16, Kоln, December.

- Ilyin V.A. et al. (2018). Problemy formirovaniya i realizatsii sotsial'no-ekonomicheskogo potentsiala razvitiya territorii [Problems of Formation and Realization of the Socio-Economic Potential of Territorial Development]. Vologda: VolNTs RAN.

- Khanafeev F.F. (2008). Analiticheskoe obespechenie upravleniya nalogovym potentsialom regiona: teoriya i metodologiya [Analytical Support for the Management of the Region’s Tax Capacity: Theory and Methodology]. Moscow: Prospekt.

- Kolomniets A.L., Novikova A.I. (2000). On the ratio of financial and tax capacities in the regional context. Nalogovyi vestnik, 3, 4–7 (in Russian).

- Lykova L.N. (2008). Subjects of federation financial capacity. Federalizm=Federalism, 3(51), 41–59 (in Russian).

- Maiоr P. (2009). Is fiscal federalism different in the European Union? In: Paper fоr the Second Conference оn the Political Ecоnomy of International Оrganizations. January 29–31, 2009. Geneva: University оf Geneva. Graduate Institute of International studies.

- Martinez-Vazquez J., Boex J. (1997). Fiscal Capacity: An Оverview of Cоncepts and Measurement Issues and Their Applicability in the Russian Federatiоn. Geоrgia State University.

- Men’kova K.M. (2008). Theoretical and methodological approaches to assessing the financial capacity of municipalities in the context of reforming the territorial organization of local self-government. Finansy i kredit, 14, 32–39 (in Russian).

- Mingaleva Zh.A., Pazdnikova N.P. (2007). The development of methods of budget potential management in the region. Ekonomika regiona=Economy of Region, 2, 263–267 (in Russian).

- Naidenova T.A., Shvetsova I.N. (2013). Assessment of budget capacity of the northern territories. Finansy i kredit, 40(568), 40–51 (in Russian).

- Pechenskaya M.A. (2015). Mezhbyudzhetnye otnosheniya: sostoyanie, regulirovanie, otsenka rezul'tativnosti [Intergovernmental Fiscal Relations: Current State, Regulation, Performance Assessment]. Vologda: ISERT RAN.

- Pechenskaya M.A. (2018a). Budget capacity in the system of capacities of the territory: Theoretical issues. Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 11(5), 61–73 (in Russian).

- Pechenskaya M.A. (2018b). Topical issues of the formation of territory’s budget potential: Factors, principles, structural elements. Problemy razvitiya territorii Problems of Territory’s Development, 6(98), 149–161 (in Russian).

- Pechenskaya-Polishchuk M.A. (2022). Formirovanie byudzhetnogo potentsiala regiona: teoriya i praktika [Formation of the Region’s Budget Capacity: Theory and Practice]. Vologda: VolNTs RAN.

- Repchenko M.A., Fokina O.M. (2007). Assessment of the investment attractiveness of the region, taking into account the innovative, budget and financial capacity of the region. Innovatsii=Innovations, 7, 64–67 (in Russian).

- Sabitova N.M. (2003). On the concept of the region’s financial capacity and the methodology for its assessment. Finansy, 2, 63–68 (in Russian).

- Shalmuev A.A. (2006). The main components of regional development capacities. Ekonomicheskoe vozrozhdenie Rossii, 4, 57–61 (in Russian).

- Slack E. (2009). Guide of Municipal Finance. Nairobi: UN-HABITAT.

- Sugarova I.V. (2016). Upravlenie finansami i vybor prioritetov byudzhetnoi politiki v obespechenii optimizatsionnykh reshenii [Finance Management and the Choice of Budget Policy Priorities in Providing Optimization Solutions]. Vladikavkaz: Severo-Osetinskii gosudarstvennyi universitet im. K.L. Khetagurova.

- Tatarkin A.I. (1997). Sotsial'no-ekonomicheskii potentsial regiona. Problemy otsenki, ispol'zovaniya i upravleniya [Socio-Economic Capacity of the Region. Problems of Evaluation, Use and Management]. Yekaterinburg: IE UrO RAN.

- Tatarkin A.I., Novikova K.A. (2015). Territorial innovative potential in behavioral assessments of the population. Ekonomika regiona=Economy of Region, 3, 279–294 (in Russian).

- Tkacheva T.Yu. (2014). Regional peculiarities of the fiscal capacity of modern fiscal policy. Izvestiya Yugo-Zapadnogo gosudarstvennogo universiteta. Seriya: Ekonomika. Sotsiologiya. Menedzhment, 2, 67–74 (in Russian).

- Vinogradova K.O., Lomovtseva O.A. (2013). Essence and structure of the development potential of a region. Sovremennye problemy nauki i obrazovaniya=Modern Problems of Science and Education, 3. Available at: https://www.science-education.ru/ru/article/view?id=9620 (in Russian).

- Yutkina T.F. (2011). Methodology of tax studies. Nalogi i finansovoe pravo, 5, 158–165 (in Russian).

- Zenchenko S.V. (2008). Budgetary potential of region and methodical approaches to its estimation. Regional'nye problemy preobrazovaniya ekonomiki, 1(14), 186–198 (in Russian).