Recycling in modern Russia: need, challenges, and prospects

Автор: Kormishkina Lyudmila A., Kormishkin Yevgenii D., Koroleva Lyudmila P., Koloskov Dmitrii A.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Environmental economics

Статья в выпуске: 5 (59) т.11, 2018 года.

Бесплатный доступ

At present, in connection with the global financial and economic crisis of 2008-2009, the scientific community is discussing issues related to significant changes in the model of economic growth, its sources and factors, taking into account the so-called concept of “denouement” and its “reconciliation” with the geosphere restrictions on economic activity. Against this background, a neo-industrial paradigm of modern development proposed by the Russian economic school in the 2000s and focused on the resource aspect of the economy is gaining professional and public recognition. In this regard, the goals of our study are as follows: to develop the scientific idea of creating a new resource base for social reproduction on the basis of unused production and consumption waste, to identify barriers to establishing a recycling economy in Russia, and to work out proposals for effective development of recycling in the domestic economy. The study is based on an interdisciplinary (integrative) approach, which goes in line with the principles of sustainable economic and environmental growth, humanistic and inclusive development, and public-private partnership; thus, it is of fundamental importance for the analysis of the transformation of the model of economic growth in the process of changing the economic paradigm...

Economic growth, geosphere restrictions on growth, new industrialization, waste resources, recycling, environmental investment

Короткий адрес: https://sciup.org/147224090

IDR: 147224090 | УДК: 338.22.021.1 | DOI: 10.15838/esc.2018.5.59.10

Текст научной статьи Recycling in modern Russia: need, challenges, and prospects

One of the most notable features of the 2008–2009 global financial and economic crisis was the universal recognition of the need to revive economic growth. The International Monetary Fund, the UN Environment Program (UNEP), and political parties of different countries called for the necessity “... to put the economy back on the track of growth” to ensure its stability [1, p. 110]. Thus, the well-known German politician and publicist Ralf Fuchs in his book Green Revolution: Economic Growth Without Damage to the Environment explains the meaninglessness of “zero” economic growth by the fact that the latter, from economic and socio-political points of view, “generates a lot of difficulties: outflow of capital, emigration of active citizens, slowdown of the pace of innovation, erosion of infrastructure, aggravation of the already difficult problems in the pension system and healthcare” [2, p. 104].

Against this background, the scientific community is discussing issues related to significant changes in the model, sources, and driving forces of economic growth, taking into account the so-called concept of “denouement” [3; 4] and its “reconciliation” with the environmental constraints of the “finite” planet [5-8]. We are talking about different manifestations of the growing ecological footprint of national economies, which, according to estimates of some experts, has doubled over the last 40 years and is currently 30% more than our planet’s ability to heal itself [1, p. 289]. According to calculations of G.G. Malinetsky, if the level of per capita consumption of the BRICS countries alone matches that in the U.S., then it will take the natural resources of five planets like Earth to satisfy it [9, p. 17].

It is important to note that as the ecological footprint continues to grow, it leads to further strengthening of competition in the global market of raw materials. Depletion of natural resources came into conflict with the drive of society toward further economic growth in the conditions of its slowdown [10, p. 178]. The validity of this conclusion is confirmed by recent and current events in Iraq, Libya, Syria, Ukraine, and other countries.

The logic of the analysis suggests that the natural resource-based model of economic development established in the world practice has reached an impasse. On the one hand, the growing shortage of natural resources has already become a barrier to real GDP growth. At the same time, we are talking not only about energy carriers – hydrocarbons (there is still a certain “reserve” and alternatives like renewable energy resources hat are being implemented today), but mainly about mineral resources, which form the material basis of all final products. According to experts, world’s energy reserves will be depleted in 40–50 years (coal – in over 100 years); as for the sufficiency of many types of mineral resources, it is estimated at 10–20 years [11, p. 134].

The existence of geospheric limits to economic activity has long been known. At the end of the 18th century, this question was raised by T. Malthus in his work An Essay on the Principle of Population (1978); he puts forward a thesis that population growth is always ahead of the growth of resources required to provide food and housing. And although Malthus’s ideas for a number of reasons were more than once subjected to fair criticism and sharp condemnation, the scientific community still shows interest in certain provisions of his theory (G.T. McCleary, J.L. Simon, E. Boserup, E.A. Hayek, M. Spence, etc.).

In a 1972 report The Limits to Growth commissioned by the Club of Rome and prepared by a group of scientists led by Donella and Dennis Meadows substantiated the idea that the ecosystem, which goes beyond its resource base, inevitably moves to a collapse [12]. The key provisions and conclusions of the report became a theoretical and methodological basis for new concepts of economic growth such as the “zero” growth theory that recognizes negative impact of high GDP growth on the environment (D.H. Meadows, Y. Randers, J. Forrester, G. Malinetsky, etc.); institutional models of economic growth that link the growth of environmental problems to the flaws in the institutional environment (G. Myrdal, E. de Soto, R. Nureyev); “new theories of growth” recognizing the compatibility of economic growth with environmental protection measures (R. Lucas, P. Romer, M. Spence).

By the beginning of the 21st century, the discussion about the geosphere limits of the economy had already turned into an acute dispute over climate change and energy security (or the so-called “peak oil”), the two interrelated environmental issues affecting the intensity of economic activity. In this regard, for example, P. Sukdev, a well-known economist from Deutsche Bank, in his commentary on T. Jackson’s book Prosperity Without Growth writes: “Many people today speak about an ongoing economic crisis that is a result of the crisis in the sphere of production of fuel, food and finance, and about a simultaneously developing environmental and climate crisis, suggesting that there is a common cause – the wrong economic model” [1, p. 288]. Such a dispute produced a Green New Deal (2008), which received not only a quick recognition among scientists and politicians from different countries [1; 2; 8; 11; 13-16], but also strong international support (UNEP A Global Green New Deal (2009).

Noting the advantages of the “green” project for solving the identified environmental problems, scientists at the same time emphasize the importance of restoring and/or maintaining for a long-term the potential of economic growth in world countries and attempt to identify its new sources, “pillars”, “engines” and factors [8]. For example, Fuchs points out that “the current European debt crisis has clearly demonstrated all the madness of the criticism of growth... The question is not whether Europe needs economic growth, but how to strengthen the growth potential and in what direction to move?” He proposes “... to focus not on increasing or decreasing GDP, but on the resource aspect of the economy” [2, pp. 105-106].

In this context, a growing professional and public recognition is attached to a neoindustrial paradigm of modern development, which is substantiated and discussed on the pages of the Russian journal Ekonomist by many authors since the early 2000s [18, pp. 3-10;

19, pp. 12-14]. S.S. Gubanov (the recognized founder of the named concept) points out that the major feature of industrialization is not just the development of high, technetronic technologies of production and final consumption, not just a technological progress of tools and productive forces, but the rise to a historically qualitatively new stage of social development, when “the economy begins its gradual transformation from an antagonist of wildlife into its ally, that is, it begins its functioning in the form of recycling” [18, p.6]. From the viewpoint of the mentioned paradigm, it becomes possible to justify a new type of economic growth driven by the dominance of social rather than private capital (profit) in the economic system, the capital that focuses on active rather than passive attitude of society toward environmental aspects of production and social existence, toward preserving the environment and improving the quality of life [20, p. 1117]. Against this background, attention is drawn to the international initiative “3R”, which assumes an integrated approach to solving the problem of growing production waste and energy efficiency.

It is known that only 2% of the world’s natural resources are currently being used productively; the remaining 98% go to waste. In addition, the products having a short period of use (from 0.5 to 5 years) also go to waste [21, p. 179].

Unfortunately, in modern conditions of economic thinking, applied technologies, and organization of production, production and consumption waste is mostly either destroyed or accumulated in large areas (special landfills, dumping places, etc.), contributing, in addition to environmental pollution, to the removal of a large number of valuable raw materials from economic circulation. Moreover, the content of valuable components (iron, copper, lead, tin, tungsten) and elements (cadmium, bismuth, selenium, tellurium, rare earth and noble metals) in waste is often close to their content in the extracted natural resources.

In view of the above, a new start to a long period of economic growth can only be given by the timely creation of a new resource base for the reproduction of the economy, and it will be based on unused production and consumption waste [22]. In this case, discussions center on a new definition – “waste resources” [10; 21]. In our opinion, neoindustrial response to the geosphere challenges of the modern era is concentrated in this conceptual approach.

Research methodology

The study is based on an interdisciplinary (integrative) approach, which implies the need to analyze historical, legal, political, economic and other prerequisites for the development of socio-economic systems and institutions [23, p.239], the approach is of fundamental importance for the substantiation of priority directions of economic policy of the state and the change of the economic paradigm, transformation of the model of economic growth, its sources and factors, taking into account major trends and patterns of the modern era.

This methodological approach is based on the following theoretical and methodological principles:

– general principles of moving toward sustainable economic and environmental growth, to neo-industrial development based on the interpretation of the definitions of “sustainable development” and “neo-industrial development” in a broad sense;

– principles of humanistic and inclusive development, predetermined by the action of social capital and the idea of an inclusive society;

– principles of public-private partnership, the observance of which contributes to the establishment of domination of the total capital of society over private capital (profit) in the economic system.

In accordance with the indicated methodological approach, we define waste resources as a special innovative factor in economic growth that reduces the severity of the problem of “geosphere limits to growth”; the definition of “recycling” is introduced into scientific use, and the latter is considered a new source of neo-industrial economic growth.

In addition, the article uses correlation and regression analysis, which allows us to build an econometric model that characterizes the impact of main sources of financing on the volume of environmental investment in the Russian Federation and the willingness of the state and economic entities to invest in real capital.

Prior to building the regression, we carry out correlation analysis and determine multicollinearity of the factors. The assessment of the model adequacy was based on the use of computational and graphical methods of estimating the regression model residuals for normality. In order to build graphs and econometric models, we convert value indicators to constant prices by extrapolation or deflation.

Research results

The beginning of the 21st century was marked by almost universal decline in GDP growth rates and by crisis manifestations in the economy, including the tangible (not only for the whole world, but also for Russia) depletion of the natural resource base. At the same time, industrial and household waste continued to accumulate in the environment; it was accompanied by air, soil, groundwater and surface water pollution and other hazards

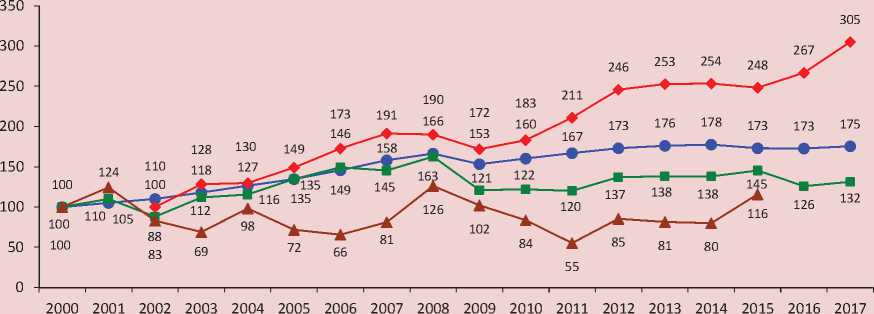

Dynamics of GDP growth rates, indicators of waste generation and environmental investments in fixed assets, %

—•— GDP growth rate in constant prices, in % to 2000

— ■ — Growth rate of investments in fixed capital aimed at environmental protection and rational use of natural resources, in constant prices, in % to 2000

-

—*— TGrowth rate of investments in fixed capital aimed at protecting the environment from pollution by production and consumption waste, in constant prices, in % to 2000

-

♦ Growth rate of production and consumption waste generation, in % to 2000

to ecosystems. Thus, according to official statistics of Russia, more than five billion tons of production and consumption waste has been formed annually since 2012 in the country, and the milestone of six billion tons (6,221 billion tons) was overcome in 20171. The growth rate of waste generation significantly exceeded the growth rate of GDP and environmental investment (Figure) 2 .

The data from the Figure illustrate the growing amount of waste since 2005 against the background of reduced environmental investments in general and investments in environmental protection from pollution by production and consumption waste in particular (in constant prices of 2000). According to official statistics, the volume of annual waste generation in 2017 was three times higher than in 2000, while the volume of environmental investments increased only by 32%. It is noteworthy that only 8–9% of the total environmental investments are allocated to waste disposal. During almost the entire period under consideration (except for 2001, 2008 and 2015), they were below the 2000 level.

According to Rosprirodnadzor (Federal Service for Supervision of Natural Resources of Russia), due to a low level of waste use (average 48% per year), its accumulation in the environment continues. Today, 90–120 billion tons of waste has accumulated in Russia, and the damage they inflict on the economy is estimated at 4.6 % of GDP [20, p. 1117].

At the present stage of socio-economic development, when Earth has almost no ecosystems that are not affected by anthropogenic impact, the problem of handling production and consumption waste as unused raw materials can be assessed as one of the most acute from the standpoint of wildlife and the task of “going beyond natural limitations” [13].

It is important to note that waste, which is basically an unused valuable raw material, unlike natural resources, have their own specifics. Staying in a repeated cycle of its movement (raw material – product – waste – raw material ' – product ' – waste ' – raw material '' …, etc.), waste goes through a complete circle of transformation. In other words, there is a closed resource cycle, in which there is no need to engage new natural resources in economic circulation. This can be done on the basis of industrial reproduction of raw materials from production and consumption waste [24, p. 20]. In this context, waste is presented as a resource with an incomplete form of consumption; it is advisable to use the term “waste resources” for the definition of such a situation [21, p.12].

In addition, it is necessary to point out the terminological uncertainty of the process of industrial reproduction of raw materials and waste. In this process, the target is not the extraction of new resources from nature, but their industrial production from those resources that are already available, but are currently in the form of waste as a result of primary consumption. The designated process of target transformation of one form of resources into another for the industrial reproduction of raw materials can be terminologically defined as “recycling”. This conceptual approach is the basis for positioning the content of recycling in a broad sense as an environmentally oriented closed system of commodity production, which has the ability to return industrial waste and consumption waste in economic circulation through reuse, including a set of measures to minimize waste generation [24; 26].

It is necessary to note that in the context of the neo-industrial paradigm of modern development, which affirms the priority of socially responsible behavior of the state, business and society and the interests of social capital over the “selfish motives” of private capital [18, pp. 6-7], recycling is put forward as an indicator of the progressiveness of a new stage of socio-economic development. This means that it can be considered as one of the most important factors in non-industrial economic growth, as it meets its criteria, such as innovation, inclusiveness, and environmental friendliness [20, pp. 1116-1117]. Let us further substantiate the proposed theoretical position.

-

1. An industrially reproducible raw material base cannot do without appropriate innovative technologies, which in the future will have an increasing demand. It should also be taken into account that all the products resulting from the industrial reproduction of raw materials are high-tech and therefore competitive products, the demand for which will also grow.

-

2. Resources industrially recoverable from waste are a subject of exports. According to the official data of Bureau of International Recycling (BIR), about 600 million tons of materials are processed annually in the world, and 1/3 of them is exported; secondary resources already cover 40% of the needs of the world industry; private companies annually invest 20 billion USD in research in the field of recycling.

-

3. The creation of a closed-loop economy – the real economy of the 21st century – will have a positive impact on the creation of a large number of high-performance jobs, which corresponds to the principle of social inclusion

-

4. Active development of recycling helps reduce environmental costs and losses, which, of course, are public rather than private. We are talking about serious environmental challenges that accompany the traditional natural resource-based model, such as CO2 emissions, global warming, changes in the hydrological cycle, ocean oxidation, pollution of water sources, etc. Against this background, recycling appears as a key condition for the implementation of a new social philosophy, which is contrary to the philosophy of private profit inherent in a raw materials exporting model used by the national economy of Russia.

(a principle of social capital), which is currently actively implemented in the most advanced industrialized countries. Income growth through the creation of new high-tech jobs increases the availability of social benefits to the wider population, including benefits such as education, health, labor qualification, clean living environments, etc.

The above, in our opinion, is the reason to consider recycling as a priority direction of neoindustrial modernization of the country; it enables going beyond the natural limitations, and hence obtain the potential for economic growth.

It is important to note that the Russian Federation started to implement an integrated approach to the issue of growing waste and energy efficiency only in 2014, after several amendments to Federal Law 89-FZ “On production and consumption waste” dated June 24, 1998 were introduced. And although the regulatory legal acts adopted in recent years show the desire of state institutions to address the lingering problems in the field of industrial and household waste management, many of its aspects remain unresolved. Thus, the introduction of recycling standards occurs without proper definition of the term “disposal”. In the Russian regulatory framework, it combines various methods of waste management (disposal, incineration, composting, secondary use) without specifying their priority.

The fact that Article 4 “Waste as an object of ownership” was included in Federal Law 458 “On amendments to Federal Law 89-FZ dated June 24, 1998” should be assessed as a positive phenomenon from the point of view of implementing recycling in the Russian economy. However, it is necessary to mention that the valuations that fill this provision with economic content still remain undeveloped.

In addition, we should point out that Russia’s waste management standards, environmental charges, as well as penalties for non-compliance with the rules of responsibility lag far behind European ones. In many cases, it is the stricter liability standards that motivate European manufacturers to use relatively safe methods for disposal of old products. In Russia, manufacturers often find it cheaper to evade the responsibility for the environmentally safe end of the product life cycle than to meet the requirements in the field of recycling; this fact significantly reduces the possibility of rapid and effective development of recycling.

Undoubtedly, the low technological level of waste processing enterprises does not contribute to the development of the resource recycling sector in the Russian economy. Currently, the vast majority of waste sorting facilities (WSF) in the country use mainly manual labor. Some of them use magnets to separate scrap metal. Only in 2011, in Saratov, the first WSF, which uses an automated system that selects components on the basis of the optical mechanism, was launched; the second such complex was commissioned in Kostroma in 2013.

The high level of manual labor input used in collecting and preparing many types of industrial and household waste for the use as secondary resources does not stimulate the development of recycling that would ensure environmentally sustainable development.

The development and implementation of recycling technologies require significant investments and funding sources. Such investments can have a positive impact on overall productivity, promote employment growth, and under certain market conditions can bring significant profits; and most importantly, they can play a critical part in protecting the integrity of the environment [27]. In this regard, we have carried out the modeling of the resource potential of environmental investment3 in Russia, which includes, in addition to investments related to the improvement of ecosystems and the replacement of traditional technologies with clean or low-carbon technologies, investments in improving the efficiency of resource use (waste reduction, recycling, efficient use of energy).

The dynamics of environmental investment in the Russian Federation (taking into account its funding sources) is shown in Table 1 .

These tables show that there is a tendency toward reducing the volume of budget financing of environmental investment (from 34.2% in 2007 to 9.1% in 2015) with the growing

Table 1. Dynamics of investments in fixed capital allocated to environmental protection and sustainable use of natural resources in the Russian Federation in 2000–2015 in the context of funding sources (in actual prices of that period, %)

|

Indicator |

2000 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

|

Total investment, % |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

|

Including at the expense of the funds of: |

3.8 |

7.8 |

10.4 |

14.0 |

8.6 |

11.2 |

12.1 |

13.0 |

13.1 |

10.5 |

11.5 |

4.2 |

|

federal budget |

17.7 |

15.0 |

18.2 |

20.2 |

20.7 |

12.0 |

14.6 |

13.3 |

9.7 |

6.3 |

4.1 |

4.9 |

|

budgets of subjects of the Russian Federation and local budgets |

21.5 |

22.8 |

28.6 |

34.2 |

29.3 |

23.2 |

26.7 |

26.3 |

22.8 |

16.8 |

15.6 |

9.1 |

|

total budget investments |

74.3 |

75.9 |

70.0 |

63.6 |

68.0 |

75.5 |

72.5 |

72.0 |

69.4 |

78.7 |

83.4 |

88.0 |

|

other sources |

3.5 |

1.4 |

1.4 |

2.1 |

2.7 |

1.3 |

0.8 |

1.6 |

7.8 |

4.4 |

1 |

2.8 |

Source: Federal State Statistics Service of Russia.

dominance of enterprises’ own funds (up to 88%) in the structure of these funding sources. Other sources shown in the Table include raised funds, as well as the funds of environmental foundations allocated from the federal, regional, and local budgets. However, their role in financing the investments is very small: 3.5% in 2000, 1.2% in 2005, 1.1% in 2006, 0.2% in 2008, 0.3% in 2010, 0.04% in 2012, and 0.002% in 2014.

We use the correlation and regression analysis to assess the extent of the impact that the main sources of formation (the sources, which, due to their economic nature, determine the magnitude and dynamics of these investments) have on the volume of environmental investments in the Russian Federation. We select the volume of investments in fixed assets aimed at environmental protection and rational use of natural resources as an effective indicator (Y). Five indicators, reflecting the value of the resource potential of the investment activity at the macro level are considered as factor variables (X) that influence the dynamics of the indicator under consideration. These variables are as follows: consolidated budget revenues; gross profit in the economy, including gross mixed income; balanced financial result (profit minus loss); the amount of amortization accrued during the year; loans, deposits and other allocated funds granted to organizations, individuals, and credit institutions, including loans granted to foreign states.

Since the volume of environmental investments depends not only on the dynamics of macroeconomic indicators reflecting the sources of their financing, but also on the willingness of the state and economic entities to invest in fixed assets, then another three indicators reflecting the sources of investment in fixed assets (budget investments, own funds, credit and borrowed funds) were used to assess the resource potential of these investments, in addition to the above-mentioned indicators.

The correlation and regression analysis of the impact of these indicators on the volume of environmental investments revealed the existence of multicollinear dependence between them, which did not allow us to build a multifactorial model of resource potential. We built single-factor models that reflect the impact of each indicator on the volume of environmental investment. As we know, the value of the correlation coefficients allows us to assess the degree of influence of factor characteristics on the effective indicator, and their polarity (“+” or “–“) shows the type of influence, either direct or reverse. The correlation coefficients we calculated for all the analyzed indicators are positive, i.e. they all have a direct impact on the volume of environmental investments. At the same time, the greatest influence is exerted by the indicators of budget investments in fixed capital and own funds allocated to the investments in fixed capital. They were selected to model the resource potential of environmental investments.

The initial data for the regression analysis of the impact of indicators X1 and X2 on the value of investments in fixed assets aimed at environmental protection and rational use of natural resources are presented in Table 2 .

There is a linear relationship between the effective and factor features, which allows us to estimate the closeness of the correlation between them using a linear correlation coefficient (0.707 for the features Y and X1, and 0.633 for the features Y and X2).

But when studying cause-and-effect relationships on time series of the data, it is necessary to take into account the presence of autocorrelation of the levels, which is caused by the presence of trends in each series under consideration.

Table 2. Source data for building a model for resource potential of “environmental” investments in constant prices4, million rubles

|

Year |

Investments in fixed capital aimed at environmental protection and rational use of natural resources (Y) |

Budget investments in fixed capital (X1) |

Own funds allocated for investments in fixed capital (X2) |

|

2000 |

16934 |

214119 |

379439 |

|

2001 |

19390 |

215292 |

462036 |

|

2002 |

15030 |

192675 |

389334 |

|

2003 |

18712 |

197922 |

436065 |

|

2004 |

16888 |

172278 |

418760 |

|

2005 |

21258 |

218887 |

465853 |

|

2006 |

22359 |

258740 |

525824 |

|

2007 |

20157 |

300542 |

551900 |

|

2008 |

28865 |

402685 |

746676 |

|

2009 |

20283 |

331883 |

555483 |

|

2010 |

18911 |

279308 |

576277 |

|

2011 |

18128 |

310814 |

670728 |

|

2012 |

21005 |

314724 |

770428 |

|

2013 |

21520 |

337941 |

790863 |

|

2014 |

26050 |

293170 |

778749 |

|

2015 |

22525 |

289369 |

782202 |

|

2016 |

19297 |

260136 |

792745 |

|

Source: Federal State Statistics Service of Russia. |

|||

In order to obtain a correct picture of the correlation, not distorted by autocorrelation, we excluded the main trend from the levels. The obtained significant correlation coefficients on the trend residuals (0.613 for the features Y and X1, and 0.657 for the features Y and X2) suggest that there is a linear dependence between the initial data series, which is not distorted by autocorrelation.

As a result of the regression analysis, we obtained univariate regression equations, which have the following form:

Y t = 10077,75 + 0,04 x X1 t , (1),

Y t = 12400,13 + 0,01 x X2 t . (2)

Having checked the residuals of the obtained models, we see that they have no autocorrelation (actual DW values are above dU = 1.38 at 5% significance level).

Multiple correlation coefficient characterizes the closeness of the linear correlation between the resulting and factor features. On the Chaddock scale, there is a high statistical correlation between investments in fixed assets aimed at environmental protection and rational use of natural resources and budget investments (71%). The statistical correlation between environmental investments and the total amount of own investments in fixed capital is significant (63%). The values of the coefficient of determination that shows what part of the total variation of the dependent variable is determined by the factor included in the statistical model, indicates the acceptability of the models obtained, in particular, 50% for X1, and 40% for X2. The regression coefficients obtained for all single-factor models should be considered significant, since the probability of adopting the inverse hypothesis for them (p-value) is significantly less than 0.05.

4 Revaluation of indicators in constant prices (1999) was carried out with the help of deflation method by means of the price index of producers of industrial goods.

At the same time, the best values of all regression indicators were demonstrated by equation (1), which establishes a relationship between the volume of environmental investments and budget investments in fixed assets. According to the obtained model (equation 1), in the current institutional environment, the growth of budget investments in fixed assets by one billion rubles leads to a 40 million rubles increase in investments in fixed assets aimed at environmental protection and rational use of natural resources, which, however, can not be interpreted as a significant effect.

Given the high share of own funds in financing investments in environmental protection and rational use of natural resources in Russia, we can point out that their amount plays a key role in business decisions regarding the volume of environmental investments. Therefore, incentives to expand this source of financing will be attractive for business entities. This conclusion is confirmed by the results of the correlation and regression analysis ( Table 3) . The model presented in the form of the equation (2) can be used to estimate the real effect (independent of inflation rate) of the state instruments that allow business entities to release own funds provided they are allocated to environmental investments.

According to the model we obtained (equation 2), under the current institutional environment, the increase in the volume of own funds allocated to investment in fixed capital by one billion rubles leads to an increase in the investments in fixed capital aimed at environmental protection and rational use of natural resources only by 10 million rubles. In our opinion, such a minor increase in environmental investments in response to the increase in the volume of own funds invested in fixed assets is due to the residual principle of financing of environmental activities. The high degree of wear of the main production equipment determines the priority of investments of own funds in the active part of the main production assets and only after that – in environmental capacities.

Thus, the dependences we constructed demonstrate low elasticity of “environmental” investments on the value of the analyzed factors (sources of financing), as evidenced by the value of the regression equation less than 1, as well as the coefficient of elasticity calculated as a product of the correlation coefficient and the ratio of the values of the factor and resulting features average for the analyzed period. Moreover, the coefficient of elasticity of environmental investments in the total volume of budget investments in fixed assets is equal to

Table 3. Results of the regression analysis of the influence of the variables X1 and X2 on investments in fixed capital aimed at environmental protection and natural resource management

|

Indicator |

Budget investments in fixed capital (X1) |

Own funds allocated for investments in fixed capital (X2) |

|

Durbin–Watson (DW) statistic |

1.96 |

1.61 |

|

Multiple correlation coefficient R |

0.707 |

0.633 |

|

Coefficient of determination |

0.50 |

0.40 |

|

Standard error |

2447.51 |

2682.84 |

|

Student’s t-test value |

3.68 |

4.73 |

|

F -test value |

15.04 |

10.001 |

|

Significance level p-value |

0.001 |

0.006 |

|

Elasticity of Y with respect to X |

1.02 |

0.56 |

|

Source: our own calculations. |

||

1 (the so-called unit elasticity), and the total amount of own funds invested in fixed assets was only 0.56 (not elastic).

This proves not only the weak interest of business entities in investing in environmental protection and rational use of natural resources, but also the inefficiency of the current system of environmental regulation in Russia. The resulting models of the resource potential of “environmental” investments, in our opinion, indicate that in Russia in the current institutional environment, it is impossible to provide the amount of funding required for the formation of recycling economy in the medium term.

The problems in the field of production and consumption waste management in the Russian economy that we described above lead to the fact that our country lags significantly behind the developed economies in this regard.

Proposals

Within the framework of the problem related to the search for options and ways to resume economic growth and preserve its potential for the long term in a situation of growing “ecological debt” and “ecological footprint”, the scientific community should focus on the change of the foundations of civilizational development – the transfer of the economy from the traditional (natural) resource supply to the industrial reproduction of raw materials. In this case, the material basis can be found in the production and consumption waste, the reserves of which are currently very significant. At the same time, recycling, as an expression of the essence of the process of industrial creation of raw materials from waste resources on the basis of new industrialization, makes it possible to “go beyond natural limitations” [13] on the basis of the formation of a closed-loop economy, which can continue to grow without violating environmental restrictions or completely exhausting the resources [1, p. 70].

In our opinion, the minimum necessary condition for the transition to a recycling economy can be described by the expression of the relationship of growth rates of three key indicators: economic growth, investment in resource recycling, and waste generation (3):

Т IR ≥ Т EG ≥ Т WG , (3)

where ТIR is the growth rate of investments in the recycling industry;

ТEG – rate of economic growth;

ТWG – growth rate of waste generation.

The rate of growth of environmental investments should exceed the rate of economic growth to compensate for the already accumulated environmental footprint of past periods. The rate of economic growth in the transition to new sources of raw materials (waste resources) should exceed the rate of growth of waste, some of which will become secondary raw materials and resources. Ideally, the growth rate of waste generation should be zero or negative, as the waste capacity of the Russian economy, as well as other indicators of environmental production processes, significantly exceeds the level of developed foreign countries.

With regard to the current stage of socioeconomic development of Russia, we consider it necessary to implement the following priority measures so as to expand and effectively develop recycling:

-

1. To improve the regulatory framework in the field of waste management. It is necessary to implement further step-by-step and systematic development of relevant norms and legal mechanisms to establish the expanded responsibility of producers for the environmentally safe completion of the product life cycle; to adjust the legislation in the field of secondary material resources; to continue to

-

2. To form a new economic mechanism that would include waste resources in the economic development of the country, which implies:

expand the powers of the subjects of the Russian Federation in the field under consideration.

-

a) modernization of pricing, which means determining the total cost of production, including the cost of waste treatment;

-

b) compliance with the principle of economic responsibility of the producer and consumer of the product;

-

c) compliance with the principle of social justice, which means in this case that the fee for the processing of waste is tied to the consumer of the product (the consumer pays for the processing);

-

d) creation of a favorable macro-environment for the accelerated attraction of investments in the resource recycling industry, the main components of which should be as follows:

– state guarantees in the form of subsidies to reimburse part of the costs of interest on loans and borrowings attracted by private investors for the implementation of projects related, first, to the development of new and/ or adaptation of existing technologies for waste processing, focused on the principles of the concept of “Zero waste”, the selection and localization of the best technological practices of waste disposal (for example, pyrolysis), and, second, related to the construction, technical re-equipment or reconstruction of production facilities of waste processing enterprises;

– providing a set of benefits and preferences (for example, benefits on loans and taxes for joining the engineering and transport infrastructure) to enterprises engaged in waste processing with the use of “green” technologies and supplying secondary raw materials

-

3. Creating an effective form of management of recycling. Taking into account the significance and scale of the identified problem, the management of recycling should be based on the principles of public-private partnership. Recycling management is not a self-regulating system; it should involve the government, business, and society. The modern focus on self-regulation of business is not consistent here.

-

4. Training of qualified specialists in the implementation of the state program for industrial reproduction of raw materials.

with improved environmental qualities; creating conditions under which it becomes economically unprofitable for the owner of waste to store it;

– promoting the use of waste products of the Russian industry and the export of secondary raw materials that are not in demand by domestic producers, etc.

Conclusion

Summarizing the above, we consider it necessary to note that our study contributes to scientific knowledge in the following ways:

-

1) it puts forward and substantiates the scientific idea of the need to create a new resource base of the economy in the form of industrially reproducible raw materials from waste resources as an adequate response to the known dilemma of economic growth and a possible solution to the problem of geosphere restrictions of the latter;

-

2) it provides theoretical substantiation for recycling, the active development of which is predetermined by the dominance of the interests of social rather than private capital in society, as one of the most important priority directions in the neo-industrialization of the Russian economy, which can give a new start to the long-term period of its growth by

establishing the unity of environmental and socio-economic principles;

-

3) it assesses the resource potential of environmental investment in the Russian economy on the basis of the econometric model constructed in the framework of the study;

-

4) it formulates the minimum necessary condition for transition to recycling economy in the form of expressing the interrelation of growth rates of three key indicators (economic growth, investments in recycling, waste generation).

Список литературы Recycling in modern Russia: need, challenges, and prospects

- Jackson T. Protsvetanie bez rosta. Ekonomika dlya planety s ogranichennymi resursami . Moscow: AST-Press kniga, 2013. 304 p.

- Fuchs R. Zelenaya revolyutsiya. Ekonomicheskii rost bez ushcherba dlya ekologii . Moscow: Al’pina non-fikshn, 2016. 330 p.

- Booth D. Hooked on Growth: Economic Addictions and the Environment. New York: Rowman & Littlefield Publishers, 2004. Pp. 139-168.

- Jakson T. Material Concerns: Pollution, Profit and Quality of Life. London: Routledge, 1996.

- Gubanov S. Derzhavnyi proryv. Neoindustrializatsiya Rossii i vertikal’naya integratsiya . Moscow: Knizhnyi mir, 2012. 223 p.

- Gubanov S. New industrialization and the sector of recycling. Ekonomist=Economist, 2014, no. 12, pp. 3-11..

- Grigor’ev O.V. Epokha rosta. Lektsii po neoekonomike. Rastsvet i upadok mirovoi ekonomicheskoi sistemy . Moscow: Kar’era-Press, 2014. 448 p.

- Spence M. Sleduyushchaya konvergentsiya: budushchee rosta v mire, zhivushchem na raznykh skorostyakh . Moscow: Izd-vo Instituta Gaidara, 2013. 336 p.

- Malinetskii G.G. Chtob skazku sdelat’ byl’yu… Vysokie tekhnologii put’ Rossii v budushchee . Moscow: Librokom, 2012. 224 p.

- Kamenik L.L. Modernization of the Russian economy. Recycling -a new vector of business development. Ekonomika i predprinimatel’stvo=Journal of Economy and Entrepreneurship, 2015, no. 3 (56), pp. 177-184..

- Lipina S.A., Agapova E.V., Lipina A.V. Razvitie zelenoi ekonomiki v Rossii: vozmozhnosti i perspektivy . Moscow: LENAD, 2018. 328 p.

- Meadows D.H., Randers J., Meadows D.L. The Limits to Growth: A Report for the Club of Rome’s Project on the Predicament of Mankind. New York: Universe Books, 1972. 211 p.

- Meadows D.H., Randers J., Meadows D.L. Predely rosta: 30 let spustya . Moscow: BINOM, Laboratoriya znanii, 2012. 358 p.

- Krugman P. Vozvrashchenie velikoi depressii? Mirovoi krizis glazami nobelevskogo laureate . Moscow: EKSMO, 2009. 336 p.

- Bobylev S.N. Green economy: perspectives for Russia. Ekologicheskoe pravo=Environmental Law, 2011, no. 6, pp. 39-42..

- Bobylev S.N., Zakharov V.M. "Green" economy and modernization. Ecological and economic foundations of sustainable development. Na puti k ustoichivomu razvitiyu: Byulleten’ In-ta ustoichivogo razvitiya Obshchestvennoi palaty RF=On the Way to Sustainable Development: Bulletin of the Institute for Sustainable Development of the Public Chamber of the Russian Federation, 2012, no. 60, p. 90..

- Porfir’ev B.N. Green economy: global trends and prospects. Vestnik Rossiiskoi akademii nauk=Herald of the Russian Academy of Sciences, 2012, vol. 82, no. 4. pp. 323-344..

- Gubanov S.S. On the economic model and long-term strategy of the new industrialization of Russia. Ekonomist=Economist, 2016, no. 2, pp. 3-10..

- Tatarkin A., Andreeva E. Perspektivy neoindustrial’nogo razvitiya Rossii v usloviyakh tekushchikh sdvigov Prospects of neo-industrial development of Russia in conditions of current shifts. Ekonomist=Economist, 2016, no. 2, pp. 11-22..

- Kormishkina L.A., Kormishkin E.D., Koloskov D.A. Economic growth in modern Russia: problems and prospects in the context of neo-industrial paradigm. Journal of Applied Economic Sciences, 2016, vol. 11 (6), pp. 1115-1119.

- Kamenik L.L. Resursosberegayushchaya politika i mekhanizm ee realizatsii v formate evolyutsionnogo razvitiya . Saint Petersburg, 2012. 480 p. Available at: http://elib.spbstu.ru/dl/2504.pdf/download/2504.pdf

- Schwab K. Chetvertaya promyshlennaya revolyutsiya . Moscow: Eksmo, 2017. 208 p.

- Shevelev A.A. The principle of systematicity in economic theory: the need for a new vision. In: Osipov Yu.M., Pulyaev V.T., Ryazanov V.T. Ekonomicheskaya teoriya na poroge XXI v. . Moscow: Yurist", 1998. 768 p..

- Kormishkina L.A., Kormishkin E.D., Koloskov D.A. Recycling as a special factor of the Russian economy growth in the formula of neo-industrial development. Espacios, 2017, vol. 38, no. 54, p. 20. Available at: http://www.revista href='contents.asp?titleid=43177' title='Espacios'>Espacios.com/a17v38n54/a17v38n54p20.pdf

- Popov A. Recycling and its importance in the neo-industrial development model. Ekonomist=Economist, 2015, no. 9, pp. 24-29..