Reforming individual income tax is the crucial factor in stabilizing the budgetary system

Автор: Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 6 (48) т.9, 2016 года.

Бесплатный доступ

The reason for writing this article was a statement of the First Deputy Finance Minister Tatyana Nesterenko who claimed that in 2017 the government would run out of money to pay salaries to budgetary sphere employees [3]. Indeed, the reserves accumulated in the fat years are running out1. The Government of the Russian Federation finds the following sources to cover the growing budget deficit: first, privatization of the remnants of state property, which will create a momentary effect and will not become a stable channel for filling the treasury; and second, major cuts on spending that on the eve of the electoral cycle can aggravate protest moods of Russians caused by a sharp deterioration of the standard of living. The majority of representatives of the expert and scientific community, including ISEDT RAS employees, consider the urgent need to reform the system for taxation of individual income tax by introducing a progressive tax scale as one of the main solutions to the growing imbalance of the budgetary system...

Income taxation, progressive tax, flat rate for individual income tax, budgetary system, income differentiation, reforming individual income tax

Короткий адрес: https://sciup.org/147223887

IDR: 147223887 | УДК: 336.14 | DOI: 10.15838/esc.2016.6.48.11

Текст научной статьи Reforming individual income tax is the crucial factor in stabilizing the budgetary system

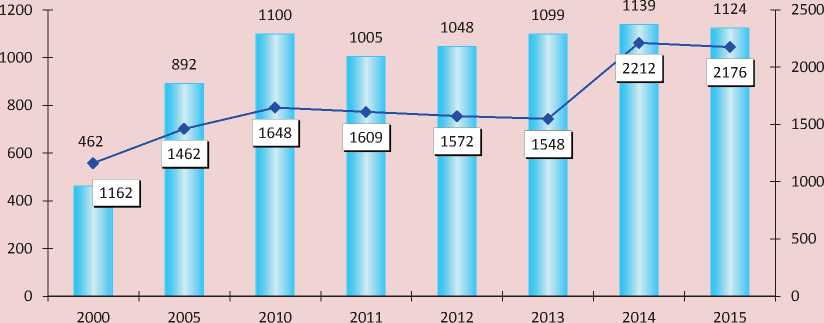

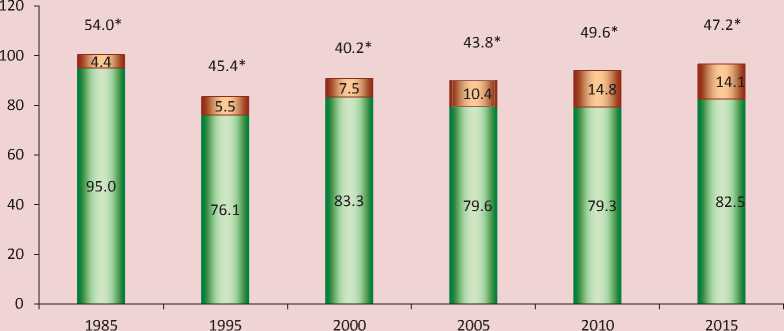

Taxation of the incomes of physical persons is one of the most important revenue sources, it generates more than 10% of the revenues od the consolidated budget of the Russian Federation and 40% of the tax and non-tax (own) revenues of regional budgets. However, in 2010–2015 there was a sharp slowdown in average annual growth rate of individual income tax revenues – to 2.3% vs 17–27% in previous years (Fig. 1) . At the end of 2015, the dynamics of receipt of these payments moved into the negative zone.

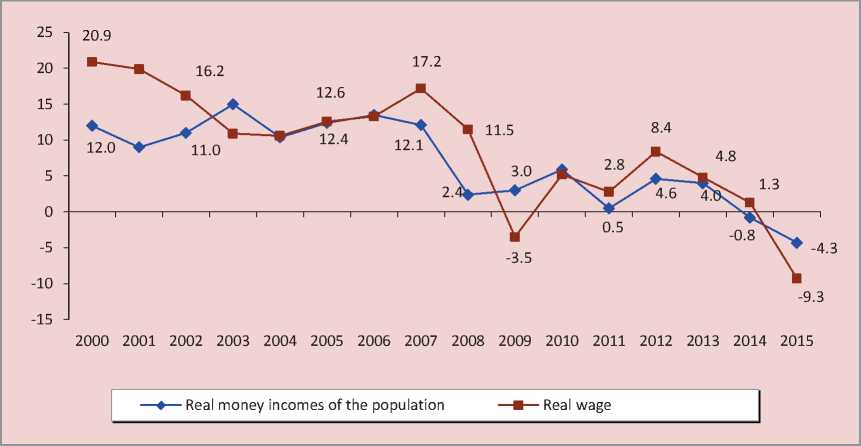

A slowdown in the growth rate of tax collections occurred in the conditions of increasing crisis phenomena in the Russian economy that aggravated in 2015. On the backdrop of a decline in all the major macroeconomic indices and a simultaneous inflation leap2, the sources of tax base for individual income tax – real money income and real wages – showed a negative trend (Fig. 2).

The deterioration of people’s financial situation resulted in a sharp increase in the number of regions with a decreasing trend of individual income tax receipts in 2015 – to 23 against two in 2014. For example, the collections of payments decreased in the half of the constituent entities of the Northwestern Federal District (Tab. 1) .

Of course, the negative trends observed in the dynamics of mobilization of the core revenue source of sub-federal budgets indicate that problems in the regional economy are accumulating and there exist serious threats to stable receipts of own revenues. However, in our opinion, it is not entirely correct if the decline in a fiscal function of income tax is explained only by the general deterioration of the economy. The real reasons lie in the mechanisms for legal regulation and tax administration of individual income tax.

Figure 1. Dynamics of the growth rate of individual income tax receipts to the consolidated budget of the Russian Federation in 2000–2015, % to the previous year in comparable prices

Sources: Federal Treasury. Available at: ; author’s calculations.

Figure 2. Growth rate dynamics of real money incomes and real wages in 2000–2015, % to the previous year

Source: Federal State Statistics Service. Available at:

Table 1. Individual income tax receipts to the budgets of constituent entities of the Northwestern Federal District in 2013–2015

|

Constituent entity |

2013 |

2014 |

2015 |

|||

|

Billion rub. |

To 2012, % |

Billion rub. |

To 2013, % |

Billion rub. |

To 2014, % |

|

|

Saint Petersburg |

149.5 |

112.1 |

164.7 |

110.2 |

181.0 |

109.9 |

|

Leningrad Oblast |

25.8 |

108.9 |

28.7 |

111.2 |

30.1 |

104.8 |

|

Murmansk Oblast |

24.3 |

110.6 |

24.9 |

102.3 |

25.9 |

103.8 |

|

Kaliningrad Oblast |

13.4 |

112.2 |

14.3 |

106.7 |

14.7 |

102.6 |

|

Novgorod Oblast |

8.2 |

109.3 |

8.6 |

104.8 |

8.7 |

101.7 |

|

Komi Republic |

22.7 |

107.4 |

22.1 |

97.2 |

21.9 |

98.9 |

|

Pskov Oblast |

7.3 |

110.5 |

7.6 |

104.1 |

7.5 |

98.2 |

|

Arkhangelsk Oblast |

22.5 |

105.8 |

23.7 |

105.7 |

23.2 |

97.7 |

|

Vologda Oblast |

16.8 |

104.4 |

17.7 |

105.2 |

17.2 |

97.4 |

|

Karelia Republic |

10.1 |

109.6 |

10.5 |

103.6 |

10.1 |

96.8 |

|

NWFD |

301.2 |

110.4 |

323.9 |

107.5 |

342.7 |

105.8 |

|

Russian Federation |

2499.1 |

110.5 |

2680.8 |

107.3 |

2787.7 |

104.0 |

|

Sources: Federal Treasury data; author’s calculations. |

||||||

Tax administration, as an organizational and managerial system that implements tax relations, includes the set of regulation and control methods, the use of which must ensure the receipts of planned tax revenues to the budget. The level of tax collection is a well-known indicator of the quality of tax administration.

According to our estimates, in 2011– 2015, the level of individual income tax collection averaged 50%, and it showed a declining trend. As a result, the regional budget has not received more than 12 trillion rubles over this period (Tab. 2).

The low level of individual income tax collection indicates improper quality of its administration. The potential of this tax is not implemented to the fullest extent because of the existing system of income taxation.

Table 2. Level of individual income tax collection in 2011–2015

|

Indicators |

2011 |

2012 |

2013 |

2014 |

2015 |

Total for 2011–2015 |

|

Tax base trillion rubles* |

15.4 |

17.4 |

19.2 |

20.6 |

21.4 |

94.0 |

|

Consumer spending, trillion rubles |

29.9 |

34.0 |

38.1 |

41.8 |

43.8 |

187.6 |

|

Level of collection of individual income tax, %** |

51.5 |

51.1 |

50.4 |

49.0 |

48.9 |

50.1 |

|

Estimated inflow of individual income tax receipts, trillion rubles |

3.9 |

4.4 |

5.0 |

5.5 |

5.7 |

24.5 |

|

Actual inflow of individual income tax receipts, trillion rubles |

2.0 |

2.3 |

2.5 |

2.7 |

2.8 |

12.3 |

|

Shortfall in individual income tax receipts , trillion rubles |

1.9 |

2.1 |

2.5 |

2.8 |

2.9 |

12.2 |

|

* Calculated by dividing the collected individual income tax by the value of the tax rate equal to 13%. ** Calculated as the ratio of the tax base to consumer spending. Source: author’s calculations according to the Federal Treasury and Rosstat data. |

||||||

In Russia there is a uniform (flat, proportional) individual income tax rate of 13% and it is applied to any income. The majority of developed and developing countries have progressive rates that are dependent on level of income of the taxpayer.

It should be mentioned that the economic science has not developed a unanimous opinion regarding individual income taxation.

Back in 1880, A. Wagner, a representative of the socio-political school and an outstanding German scientist put forward the thesis that proportional taxes make the lifestyle of the taxpayer worse, “because the same tax rate places unequal tax burdens on different payers. Therefore, the only fair taxation is progressive taxation”. A. Wagner was one of the first to pay attention to the enhancement of a regulatory, rather than financial, role of progressive taxation: “It is all the more necessary, when the tax policy ceases to rely on fiscal considerations only and starts to consider taxes as a means to change and radically improve contemporary economic life” [21].

D. Keynes, founder of Keynesian economic theory, compared progressive taxation to the action of a “built-in stabilizer”, whose functioning principle is as follows: during an economic recovery, incomes are rising more slowly than taxes, but in a crisis, on the contrary, taxes reduce faster than incomes, thereby a relatively stable social position in society is achieved” [28].

The socialists also advocated progressive taxation. V.I. Lenin in 1919 wrote: “In the field of finance, the Russian Communist Party will apply a progressive income and property tax in all possible cases” [13].

In contrast to the position of the supporters of progressive taxation, American economist M. Friedman, who supported classical liberalism, advocated the use of a flat scale, which he believed would bring greater tax revenue, since there would be less incentive to hide taxable income [24].

German scientist C. Seidl also spoke in favor of proportional rates, he justified their introduction by an increase in the efficiency of taxation and significant budget savings [29].

The followers of the liberal platform, Russian scientists N.V. Akindinova, E.G. Yasin, and Ya.I. Kuz’minov believe that the transition to progressive taxation “will provide additional revenues, but, given the imminent withdrawal to the “shadows” will not compensate even half of the current budget deficit” [1].

Representatives of the liberal wing of Russian government stand for the preservation of the flat rate So, Deputy Economic Development Minister S. Voskresensky said the flat rate was a gain, and encouraged to protect it as an institution [5]. Head of the Ministry of Economic Development A. Ulyukayev himself considers the idea of introducing progressive taxation backward-looking and counterproductive and points out that the tax system in Russia is one of the best in the world [7].

Finance Minister A. Siluanov recognized that the current income tax system does not take into account the difference in Russians’ incomes; at the same time, he points out: “Collection of income tax will fall sharply if a progressive scale is adopted” [15]. A. Makarov, Chairman of the Committee of the State Duma on the Budget and Taxes also speaks about a fall in taxes under the new tax regime, according to [4].

Without providing more examples of a negative attitude toward the change of the flat scale of individual income tax, we note that the majority of oppositional political parties and representatives of the expert and scientific community, including ISEDT RAS advocate the radical revision of the individual income taxation system through the introduction of differentiated rates.

Let us try and substantiate the need to reform the current income taxation system.

The adoption in 2001 of a uniform rate for individual income tax was motivated by the legalization of citizens’ incomes and increase in tax receipts to the budget. Indeed, already in 2002, individual income tax payments increased twice and in subsequent years were growing sustainably, but the growth was caused not by the introduction of a flat taxation scale, but by general economic growth and changes in tax legislation3. The value of specific receipts of individual income tax also does not give sufficient grounds to speak that the proportionate rate was the reason for the increase in tax collection: over the past fifteen years, the share of individual income tax in GDP has not exceeded 4% (Fig. 3), which is well below international benchmarks (USA – 12%, Australia – 13%, Sweden – 18%, Denmark – 26%).

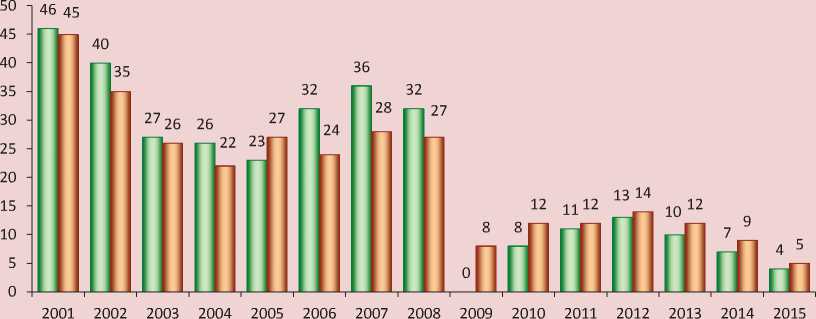

Moreover, if in the first years after the introduction of the flat rate the individual income tax receipts grew at a faster pace compared to the average wage in the economy, then, since 2009, there has been a sustainable opposite trend of faster growth in wages, indicating that taxpayers evaded paying the taxes (Fig. 4) . In this respect, we agree with the conclusion made by Doctor of Economics N.A. Krichevskii who says that the flat rate approached the limit of its efficiency [12].

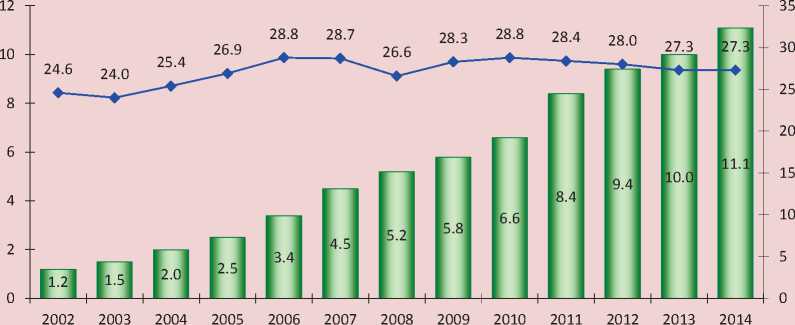

The situation concerning the dynamics of the shadow wage is no better. After the introduction of the flat scale, its share in the total volume of wages in the economy increased from 24.6 to 27.3%, while its absolute size has increased in nine times, reaching over 11 trillion rubles (Fig. 5) .

Figure 3. Dynamics of individual income tax receipts to the consolidated budget of the Russian Federation in 2000–2015

■ ■ Billion rubles ♦ To GDP, %

Sources: Rosstat; Federal Treasury; author’s calculations.

Figure 4. Growth rate dynamics of individual income tax receipts and the average monthly nominal wage in 2001–2015, % of the previous year

Individual Average monthly wage income tax

Sources: Rosstat; Federal Treasury; author’s calculations.

Figure 5. Dynamics of informal wages in Russia in 2002–2015

■ ■ Trillion rubles —»—Share in the total amount of labor remuneration, %

Source: calculated by the author with the use of Rosstat data.

According to the statement made by Deputy Chairman of the RF Government O.Yu. Golodets, 36% of Russians are working illegally [8]. For example, the Vologda Oblast Government assesses, the fund of labor remuneration in the region at 39 billion rubles, and the shadow turnover – at 243 billion rubles; as a result, the budget system does not receive 6 billion rubles annually. While one in four Vologda residents works without registration [6].

The scale of the shadow economy is caused by the low efficiency of tax control and the entire system of public administration. Such a conclusion can be made, judging at least by the fact that the number of managers that has increased twice over the period of 2000–2015 was unable to provide control over the completeness of tax payments: after 2010, the debt of taxpayers to the budget is not reduced and is more than a trillion rubles (Fig. 6).

Thus, the effect of the uniform rate for individual income tax did not help achieve the key tasks declared at its introduction: namely, it did not help increase budget receipts and income legalization.

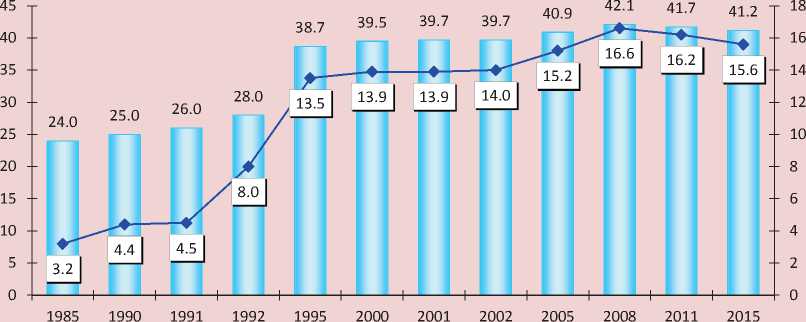

As a result of proportional taxation, which does not allow an effective and fair system of distribution relations in society to be created, individual income tax essentially performs a fiscal function and is poorly used as a tool to influence socioeconomic processes. The population bears the burden of paying not only individual income tax but also indirect taxes (value added tax, excise taxes) that are included in the price of goods. Therefore, more than 80% of people’s incomes are spent on consumption and only 14% – on accumulation (Fig. 7) .

Figure 6. Debt on the payment of taxes to the budget system of the Russian Federation and the number of government employees in 2000–2015

El Tax arrears to the budget, billion rubles

— ♦ — Number ofgovernment officials, thousand people

Source: Federal Tax Service data. Available at: ; Rosstat data.

Figure 7. Structure of people’s money income in 1985–2015, %

□ Consumerexpenses,paymentsanddues □ Savings

* Share of people’s money incomes in GDP, %. Sources: Rosstat data; author’s calculations.

The share of people’s incomes in GDP is still lower than it was in the USSR, which shows insufficient ability to generate investment resources for the economy of savings of Russians.

The current system of income taxation in Russia did not contribute to the fullest implementation of basic social functions of the state – poverty alleviation and differentiation of citizens by income level.

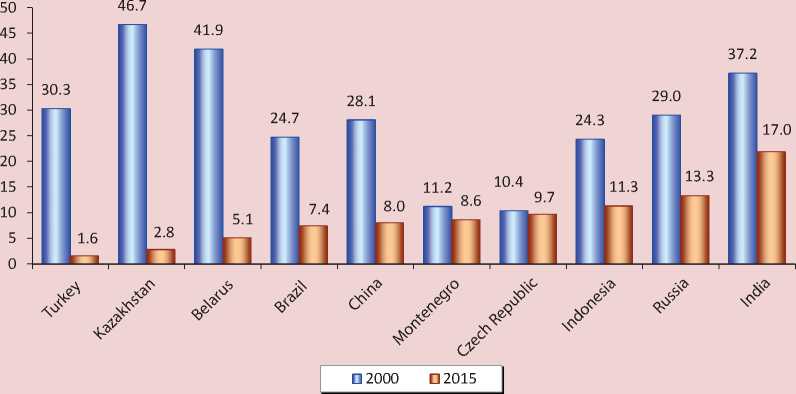

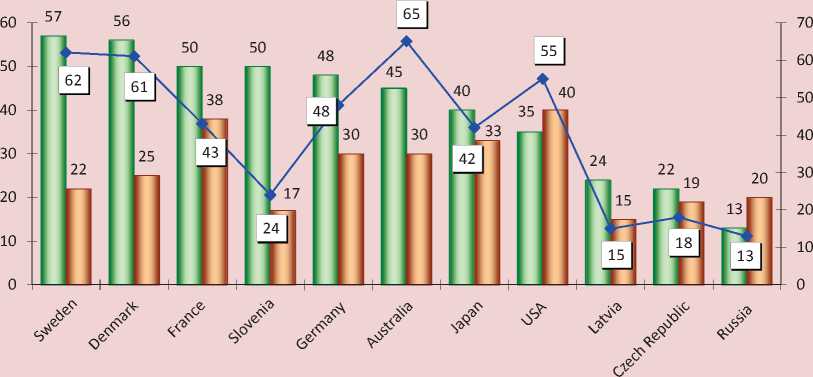

In 2000–2015 Russia managed to reduce poverty from 29 to 13%, but this level is still higher than in many developing countries, former Soviet republics and socialist countries (Fig. 8) . This fact is contrary to the Russian Constitution4 and does not allow Russia to be characterized as a social state.

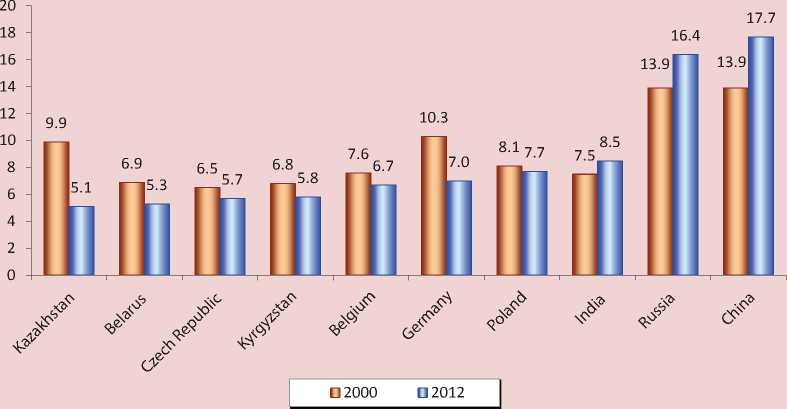

Proportional taxation of individual incomes exacerbates social polarization, as shown in Figure 9 . Just after the introduction of a uniform rate there was a worsening of the dynamics of the indicators characterizing the differentiation of the standard of living that had already intensified after the collapse of the USSR. In 2005–2015, 10% of the richest Russians were 16 times richer than 10% of the poor (the ratio of the average income of the richest 10% to the poorest 10%). The inequality in the degree of income concentration (the Gini coefficient) is not decreasing either.

Social differentiation in Russia is significantly higher than the norms recognized in economic science and

Figure 8. Proportion of the population living below the national poverty line, % of total population

Source: Analytical portal TrendEconomy. Available at:

practice. According to UN recommendations, if the level of the decile coefficient exceeds 10 times, it is critical for political stability. In 2012, in Russia it amounted to 16.4 times vs. 5–9 times in several other countries (Fig. 10). Moreover,

Figure 9. Indicators of differentiation of the standard of living of Russian population in 1985–2015

и GiniCoefficient, % — ♦ —DecileCoefficient,times

Source: Rosstat data.

Figure 10. Ratio of the average income of the richest 10% to the poorest 10% in the countries of the world, times

Source: Analytical portal TrendEconomy.

in contrast to most countries, in Russia there was an increase in the decile ratio compared to the level of 2000; this fact indicates the inefficient alignment of incomes of the population by the current tax system.

More impressive results are obtained in the analysis of incomes of specific groups, in particular, the analysis of incomes of Russian billionaires.

According to Forbes magazine [26], Russian billionaires at the beginning of 2016 owned approximately 22.4 trillion rubles (Tab. 3), which exceeded the revenues of regional budgets in 2.4 times. It should be emphasized that the acute shortage of funds to implement Vladimir Putin’s famous “May” decrees concerning the increase in remuneration of public sector employees, the incomes of 77 billionaires received from their assets twice exceeded the amount of annual wages of 6.7 million education workers and 5.7 million healthcare workers. Against this background, the suggestion made by Prime Minister D. Medvedev that the teachers who complain about low wages should go into business looks at least unjustified [14].

The number of Russian US dollar billionaires from 2009 to 2015 increased more than twice: from 32 to 77 people. Unfortunately, this quantity has not grown into quality: as can be seen from the table, all the rich businessmen are associated with the extraction and processing of raw materials or with financial activities, allowing them to increase their wealth through the exploitation of natural resources and control over financial flows. Most of the billionaires in other countries are engaged in diversified business.

Table 3. Assets and incomes of Russian billionaires in 2015, billion rubles

|

Billionaires |

Industry |

Assets* |

Income** |

Individual income tax at the rate of 50% |

|

Total |

22357.7 |

4471.5 |

2235.8 |

|

|

Including the richest ten |

||||

|

Mikhel’son L.V. |

Oil and gas |

877.8 |

175.6 |

87.8 |

|

Fridman M.M. |

Financial |

810.4 |

162.1 |

81.1 |

|

Usmanov A.B. |

Metallurgy |

762.0 |

152.4 |

76.2 |

|

Potanin V.O. |

Metallurgy |

737.6 |

147.5 |

73.8 |

|

Timchenko G.N. |

Financial |

694.9 |

139.0 |

69.5 |

|

Mordashov A.A. |

Metallurgy |

664.4 |

132.9 |

66.5 |

|

Veksel’berg V.F. |

Financial |

640.0 |

128.0 |

64.0 |

|

Lisin V.S. |

Metallurgy |

566.9 |

113.4 |

56.7 |

|

Alekperov V.Yu. |

Oil and gas |

542.5 |

108.5 |

54.3 |

|

Khan G.B. |

Financial |

530.3 |

106.1 |

53.1 |

|

Total |

6826.8 |

1365.5 |

683.0 |

|

|

* The data on assets provided by Forbes Magazine in US dollars are converted into rubles at the average exchange rate for 2015 ** Calculation was made on the basis of the return on assets, which, according to the estimates of Financial adviser A.N. Martynov, was 18–24% in 2015 [2]. Source: author’s calculations according to the data of Forbes Magazine. |

||||

According to our calculations, if the 50% rate is imposed on super profits, then the additional payments to sub-federal budgets will amount to 2.2 trillion rubles; it means there exists a real opportunity to double the actual proceeds of individual income tax. This increase would solve the problem of public debt in regional budgets where this debt amounted to 2.3 trillion rubles in 2015. For example, the revenues in the amount of 66.5 billion rubles, which can be obtained from A. Mordashov, owner of Severstal, the largest corporation in the Vologda Oblast, will exceed the consolidated budget of the oblast (58 billion rubles in 2015). Similarly, the Lipetsk Oblast could obtain the amount of revenues equal to its annual budget, if the income of V.S. Lisin, owner of Novolipetsk Steel, a budget forming enterprise of the oblast, was taxed at the rate of 50%.

The enormous incomes received by oligarchs are unlikely to be reflected in the statistics. Here we can say with a high degree of confidence that the actual level of polarization of Russian society is much higher than those 16 times indicated by Rosstat.

It is appropriate to say that over the decades of market liberalism, the growth in gross welfare to a greater extent affected the most wealthy Russians: in 1990– 2015, money incomes of citizens within the lowest group according to the level of income distribution, increased in 2.4 times, while the incomes in the upper group – in 6.4 times (Tab. 4) . Faster growth of incomes of this part of the population confirms the need to reform individual income tax, primarily in relation to the taxation of excessive incomes.

According to some experts, who are against the introduction of the progressive scale, the rich pay a large amount of individual income tax in absolute value. However, they are granted more deductions that reduce the tax base. Thus, in 2008– 2014, the total amount of standard tax deductions applicable to persons with children was approximately 317 billion rubles, and tax deductions applicable to transactions with securities, which are carried out by taxpayers who are far from being poor, was many times more – 9.1 trillion rubles. We can say that the system of tax deductions for individual income

Table 4. Distribution of money incomes in the 20-percent groups in 1990–2015, thousand rubles per month

|

Population groups |

1990 |

1995 |

2000 |

2005 |

2010 |

2015 |

2015 to 1990, fold |

|

First (with the smallest incomes) |

3.3 |

0.9 |

1.8 |

4.2 |

6.9 |

8.0 |

2.4 |

|

Second |

5.1 |

1.5 |

3.1 |

7.8 |

12.9 |

15.1 |

3.0 |

|

Third |

6.4 |

2.2 |

4.5 |

11.7 |

19.6 |

22.8 |

3.6 |

|

Fourth |

8.1 |

3.1 |

6.5 |

17.6 |

29.7 |

34.5 |

4.3 |

|

Fifth (with the greatest incomes) |

11.1 |

6.6 |

13.9 |

36.2 |

63.0 |

71.0 |

6.4 |

Source: author’s calculations with the use of Rosstat data.

tax has a narrow social focus. While the tax benefits on transactions with securities have exceeded individual income tax receipts to the budgets of the regions in more than four times (Fig. 11) .

The excessive concentration of revenues in conjunction with individual income tax benefits create unequal economic conditions for a small group of the most wealthy taxpayers compared to the majority of the population; this situation leads to a fall in effective demand and economic growth.

Income tax rate in Russia is one of the lowest in the world; thus, it is not surprising that GDP per capita in Russia is significantly lower than in the countries with high tax rates for individuals (Fig. 12) .

In addition, the flat rate is in contradiction with corporate tax rate, which is higher than the former. In most countries, on the contrary, tax rates for the income of legal entities are lower than those for the income of individuals, which makes it possible to reduce the share of tax withdrawals from the profit of organizations and to increase its use in capital investment. According to the estimates made by Doctor of Economics A.Yu. Shevyakov, income redistribution through progressive taxation can increase the growth of GDP in 1.3–1.5 times [25].

Thus, the results of the analysis allow us to conclude that Russia’s current system of taxation of incomes of individuals is inefficient and its main disadvantages are as follows:

-

• weak implementation of the social role due to the non-compliance with the principle of fairness of taxation;

-

• large scale evasion from individual income tax payments, which is a consequence of the low level of tax administration;

Figure 11. Average annual amount of tax deductions applicable to persons with children and to operations with securities and the average annual amount of individual income tax receipts for 2008–2014, billion rubles

Transactions with securities

Deductions for parents with children

Individual income tax receipts

Source: Federal Tax service data; Federal Treasury data; author’s calculations.

Figure 12. Highest income tax rate and the rate of corporate tax in the world in 2014, %

■ ■ Individual income tax ■ ■ Profit tax — ♦ — GDP per capita, thousand US dollars

Sources: World Development Indicators: Gross National Income per Capita 2015. Available at: data-catalog/GNI-per-capita-Atlas-and-PPP-table; Data from the reference site Calculator. Available at:

-

• high degree of social stratification by level of income due to the application of the single rate of income taxation.

These disadvantages can be eliminated and taxation fairness achieved only if progressive rates are adopted that take into account differences in the amount of taxpayers’ incomes. Doctor of Economics V.G. Panskov points out that “by retaining the flat taxation scale for individual incomes, the state admits its own inability to restore order in the establishment of the adequate amount of labor remuneration in the economy” [17].

World experience shows that the use of progressive taxation contributes not only to the equitable distribution of national income, but also to the formation of funds for financing governmental social policy activities.

Domestic economists and representatives of political parties occasionally offer progressive taxation models. Conceptually, they are the same and reflect the essence of progressive taxation (the higher the income, the higher the rate), but there are differences in the amount of the taxable income.

Table 5. Proposed individual income taxation scale

|

Communist Party |

Just Russia Party |

EAC “Modernization” |

|||

|

Income, rub./month |

Rate, % |

Income, rub./month |

Rate, % |

Income, rub./month |

Rate, % |

|

Below 400 000 |

13.0 |

Below 2 000 000 |

13.0 |

Below 15 000 |

0 |

|

From 400 000 to 1 000 000 |

13.0–30.0 |

From 2 000 000 to 8 000 000 |

25.0 |

From 15 000 to 250 000 |

13.0 |

|

Above 1 000 000 |

50.0 |

From 8 000 000 to 16 000 000 |

35.0 |

From 250 000 To 1 000 000 |

30.0 |

|

Above 16 000 000 |

50,0 |

Above 1 000 000 |

50,0 |

||

|

Estimation of additional individual income tax receipts, trillion rubles per year |

|||||

|

1.7 |

No data |

2.0–3.0 |

|||

|

Sources: [10, 16, 23]. |

|||||

Table 5 shows examples of options for progressive rates set out in the bills initiated by the Communist Party and the Just Russia Party, and the rates proposed by the Expert and Analytical Center “Modernization”5.

We think that the gradation of tax rates proposed by experts at EAC “Modernization” is optimal, because it provides for the non-taxable minimum of 15 thousand rubles so that 30% of the population5 will be exempt from paying individual income tax.

So far, Russian taxation practice does not apply the non-taxable minimum incomes of the population. The tax deductions for individual income tax that are provided to certain categories of citizens are not comparable with the non-taxable minimum. For instance, in 2015, the standard tax deduction for parents with one or two children was

1,400 rubles per month or 9.3% of the non-taxable minimum (15 thousand rubles) proposed by experts. We cannot but mention the fact that the amount of deduction for parents with children has not been reviewed or indexed since 2012, which does not correspond to the change in macroeconomic dynamics.

In the countries that use progressive income tax rates the annual non-taxable minimum income varies from 15 to 51 thousand rubles (Tab. 6) .

Table 6. Non-taxable minimum incomes of citizens in different countries in 2014

Country Thousand rubles per month* Singapore 51.2 UK 49.6 Austria 40.0 Germany 28.8 USA 28.7 Brazil 24.0 Australia 14.7 Thailand 14.7 * Non-taxable income stated in US dollars is converted into rubles at the average exchange rate for 2014. Source: data of the reference site Calculator. Available at:

Thus, if Russia establishes a non-taxable minimum for income taxation in the amount of 15 thousand rubles a month, it will be comparable to the non-taxable minimum that exists, for example, in Australia and Thailand. In addition, in the future, the introduction of a non-taxable minimum could create conditions for the abolition of the majority of tax deductions.

Another advantage of the solution proposed by experts consists in the fact that higher interest rates will not affect the middle class, because the monthly income of its representatives is much lower than the income of 250 thousand rubles7 that is taxable at the rate of more than 13%.

If we look at the information about the incomes declared by citizens of the Russian Federation in 2014 (the information is available on the website of the Federal Tax Service), we can see that 688,965 people, or only 1% of the average annual number of persons employed in the economy, had an annual income exceeding one million rubles. If incremental rates were applied to the incomes of this category of citizens alone, it would help replenish the budget by 2.8 trillion rubles annually; the estimations made by the experts at EAC “Modernization” confirm this proposition (Tab. 7).

Thus, if the progressive scale proposed by experts is adopted, then the increase in the tax burden will affect a small part of Russians and the increase in budget revenues will be significant.

Unfortunately, Russian authorities ignore proposals of scholars and experts. All the bills8 submitted annually to the State Duma by the Communist Party and the Just Russia Party were also rejected.

The growth of capital flight and the withdrawal of income from taxation, including that with the use of offshore companies [20] are pointed out as main

Table 7. Calculation of additional receipts of individual income tax at the rates of 30–50%

|

Annual income |

Number of citizens who submitted declarations, people |

Average taxable income, million rubles* |

Aggregate income, billion rubles |

Individual income tax |

|

|

Rate, % |

Billion rubles |

||||

|

From 1 to 10 million rubles |

654754 |

4 |

2619.0 |

30 |

785.7 |

|

From 10 to 100 million rubles |

28950 |

40 |

1158.0 |

50 |

579.0 |

|

From 100 to 500 million rubles |

4221 |

200 |

844.2 |

50 |

422.1 |

|

From 500 million to 1 billion rubles |

613 |

400 |

245.2 |

50 |

122.6 |

|

From 1 to 10 billion rubles and higher |

427 |

4000 |

1708.0 |

50 |

854.0 |

|

Total |

688965 |

х |

6574.4 |

х |

2763.4 |

* Calculated in the amount of 40% of the maximum income.

Source: author’s calculations with the use of Federal Tax Service data.

arguments against the introduction of progressive taxation. The results of many years of research conducted at ISEDT RAS prove that all these processes take place even in the absence of progressive taxation, and in recent years they have been increasing due to the purposeful actions of the authorities that try to create favorable conditions for the minimization of big capital taxation [9, 18, 19].

Thus, if in 2000–2007 the import of capital into Russia exceeded its export by 1.7 trillion rubles, then throughout the period of 2008–2015 a reverse trend was observed: net export of financial resources from Russia was 21.5 trillion rubles, or 4.5% of GDP, this situation was promoted to a great extent by the liberalization of currency legislation when all restrictions on cross-border capital movement and currency control were removed9.

The main changes introduced in tax legislation in recent years were made in the interests of the largest taxpayers, and these changes impoverished the budget. The quantitative estimates obtained in the analysis of financial statements of the major oil and gas and metallurgical corporations allowed us to conclude that as a result of the use of multiple channels for tax minimization Russia’s budgetary system suffered an annual damage of at least 3 trillion rubles.

The following figures show the scale of offshore operations in only one sector of the economy – ferrous metallurgy: from 50 to 90% of the sales of steel products in foreign markets were connected with traders operating in offshore jurisdictions, with the help of which more than 40 billion rubles of export proceeds was annually removed from taxation in Russia.

One of the most important conclusions made by ISEDT RAS researchers is as follows: by abandoning the effective implementation of the social function of taxation, the ruling elite followed the lead of the large owners, freeing them from the legalization of windfall profits and thereby increasing the conflict of interests in Russian society.

Russia needs socially oriented taxation for individual incomes. So far, the main share of individual income tax is paid by relatively poor Russians, whose number exceeds 60%. According to Doctor of Economics M.M. Sokolov, “this looks like a real paradox of modern tax system when the poor maintain the rich through funding the schools, hospitals, police and army with the help of income tax” [22].

It appears that the following objectives of Russia’s socio-economic development can be implemented through the introduction of progressive taxation.

First, there will be a significant (by 30– 40%) increase in the revenue base of sub-federal budgets, which in turn will help gradually abolish the inefficient system of equalization of budgetary security of regions.

Second , the reduction in the tax burden will affect the bulk of the population and contribute to the increase in customer demand and growth.

Third , equitable distribution of national wealth will provide for the social orientation of tax policy and create conditions to reduce the high social polarization of Russian society.

We agree with the conclusion made by RAS Academician R.I. Nigmatulin: “The current distribution of income and the current tax concept do not help save the state, develop the nation and its productive forces. This path provides no prospects whatsoever. And the longer the necessary reforms are delayed, the harder and more painful they will be later, and the greater the risk of degradation of the country, loss of social stability and possibility of revolutionary upheavals” [11].

Список литературы Reforming individual income tax is the crucial factor in stabilizing the budgetary system

- Akindinova N.V., Yasin E.G., Kuz'minov Ya.I. Ekonomika Rossii: pered dolgim perekhodom . Voprosy ekonomiki , 2016, no. 6, pp. 5-35..

- Blog ob investitsiyakh "Aktivnyi investor" . Available at: http://activeinvestor.pro/dohodnost-finansovyh-instrumentov-v-2015-godu-itogi-goda/..

- V 2017 godu u gosudarstva zakonchatsya den'gi na vyplatu zarplat. Ofitsial'nyi sait gazety "Moskovskii komsomolets". Available at: http://www.mk.ru/economics/2016/07/31/..

- V ER raskritikovali ideyu vvedeniya progressivnoi shkaly podokhodnogo naloga . Vzglyad , 2016, March 28..

- Vlasti namereny otstaivat' sokhranenie ploskoi shkaly NDFL . Ofitsial'nyi sait Informatsionnogo agentstva "Klerk.Ru" . Available at: http://www.klerk.ru/buh/news/440845/..

- Vologodskie kommersanty vyidut iz teni . Ofitsial'nyi sait Pravitel'stva Vologodskoi oblasti . Available at: http://vologda-oblast.ru/novosti/..

- Glava Minekonomrazvitiya vystupaet protiv vvedeniya progressivnoi shkaly nalogooblozheniya . Rossiiskii nalogovyi portal . Available at: http://taxpravo.ru/novosti/statya-356287..

- Golodets: 36% rossiyan rabotayut neformal'no . Internet-izdanie "Gazeta. Ru" . Available at: https://www.gazeta.ru/business/news/2015/07/13/n_7372597.shtml..

- Ilyin V.A., Povarova A.I. Effektivnost' gosudarstvennogo upravleniya 2000-2015. Protivorechivye itogi -zakonomernyi rezul'tat . Vologda: ISERT RAN, 2016. 304 p..

- Kashin V.A., Abramov M.D. Promyshlennaya politika i nalogovoe regulirovanie . Moscow: IPR RAN, 2015. 164 p..

- Krizis i modernizatsiya Rossii -trinadtsat' teorem . Personal'nyi sait R.I. Nigmatulina . Available at: http://www.nigmatulin.ru/stati-i-publikatsii/..

- Krichevskii N.A. Kak obustroit' byudzhet . Svobodnaya pressa , 2016, March 31..

- Lenin V.I. Poln. sobr. soch. . Vol. 38. P. 122 Available at: http://lenin-ulijanov.narod.ru/sobran_0.html..

- Medvedev predlozhil uchitelyam, nedovol'nym zarplatoi, uiti v biznes . Ofitsial'nyi sait IA REGNUM . Available at: https://regnum.ru/news/2162940.html..

- Minfin: progressivnoi shkaly podokhodnogo naloga ne budet . Informatsionno-diskussionnyi portal Newsland . Available at: https://newsland.com/user/4297686316/..

- O vnesenii izmenenii v glavu 23 chasti vtoroi Nalogovogo kodeksa Rossiiskoi Federatsii v chasti vvedeniya progressivnoi shkaly naloga na dokhody fizicheskikh lits: zakonoproekt № 851098-6 . Ofitsial'nyi sait Gosudarstvennoi Dumy RF . Available at: http://www.asozd.duma.gov.ru/main.nsf/..

- Panskov V.G. K voprosu o progressivnoi shkale nalogooblozheniya dokhodov fizicheskikh lits . Nalogi i nalogooblozhenie , 2009, no. 7, pp. 14-19..

- Povarova A.I. Vzaimootnosheniya metallurgicheskikh kombinatov s byudzhetom: dolgi rastut, nalogi padayut . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2014, no. 6, pp. 159-182..

- Povarova A.I. Vliyanie interesov sobstvennikov metallurgicheskikh korporatsii na rezul'taty deyatel'nosti golovnogo predpriyatiya . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2011, no. 5, pp. 36-51..

- Progressivnaya shkala NDFL . Informatsionno-analiticheskoe elektronnoe izdanie "Bukhgalteriya.ru" . Available at: http://www.buhgalteria.ru/article/n139061..

- Pushkareva V.M. Istoriya finansovoi mysli i politiki nalogov . Moscow: Finansy i statistika, 2005. 124 p..

- Sokolov M.M. O nalogovoi nagruzke v ekonomike Rossii i zarubezhnykh stran . Ekonomist , 2016, no. 6, pp. 77-89..

- Fraktsiya KPRF vnesla v Gosdumu zakonoproekt o progressivnoi shkale NDFL . Ofitsial'nyi sait KPRF . Available at: https://kprf.ru/dep/initiatives/149011.html..

- Friedman M. Kapitalizm i svoboda . Moscow: Novoe izdatel'stvo, 2006. 240 p..

- Shevyakov A.Yu. Neravenstvo dokhodov kak faktor ekonomicheskogo i demograficheskogo rosta . Innovatsii , 2011, no. 1, pp. 7-19..

- bogateishikh biznesmenov Rossii-2016 . Ofitsial'nyi sait zhurnala Forbes . Available at: http://www.forbes.ru/rating/200-bogateishikh-biznesmenov-rossii-2016/..

- The Global Wealth Report 2015. Available at: https://www.credit-suisse.com/ch/en/about-us/research/research-institute/publications.html

- Keynes J.M. The General Theory of Employment, Interest and Money. Available at: https://www.hse.ru/pubs/share/direct/document/118199413

- Seidl, C. Measurement of tax progression with different income distribution/C. Seidl. -URL: https://www.hse.ru/data/620/927/1235/Steuerprogramm.pdf