Regional budget-2016: priorities do not change

Автор: Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 2 (44) т.9, 2016 года.

Бесплатный доступ

The budgets of all levels of the Russian Federation for 2016 were drawn up in conditions of the systemic social and economic crisis in the country, the worsened foreign situation, connected with the instability of commodity markets and the strengthening of anti-Russian sanctions. These factors prompted the Russian Government to abandon the practice of three-year budget planning and return to a one-year budget. The results of the budget process show that the pressure on sub-federal budgets continues to grow. According to the ISEDT RAS calculations, 76 of the 85 regions had a deficit budget in 2015, in 60 regions the real income tax payments decreased and the debt burden exceeded 50% of their own revenues. Unfortunately, the Russian Government did not propose any measures to address the budget crisis of regions observed since 2012. On the contrary, the primacy of inter-budgetary cooperation was to shift social obligations from the state to the RF subjects and replace grant financial support of these commitments by budgetary loans...

Budget planning, regional budget, deficit, loans, debt load, amendment of tax and budget legislation

Короткий адрес: https://sciup.org/147223814

IDR: 147223814 | УДК: 336.13 | DOI: 10.15838/esc.2016.2.44.8

Текст научной статьи Regional budget-2016: priorities do not change

In 2015 on the background of a nearly twofold reduction in oil prices the Russian economy demonstrated a 3.7% fall in spite of a 1.2% forecast growth. The deterioration of the macroeconomic situation led to the repeated consideration of forecasts for socioeconomic development and, accordingly, parameters of the federal budget. As a result, the forecast for a GDP growth in 2016 was decreased from 2.3 to 0.7%, while the federal budget revenues – from 19 to 17.5% in GDP (fig. 1). In 2016 the Ministry of Economic Development of the Russian Federation [9] predicts a further fall in oil prices, a key source of receipts to the federal budget and, therefore, a rise in risks of destabilization of budgets of other levels, especially regional ones. In these conditions the Russian Government refused to work out 3-year budget plans and returned to 1-year plans.

Figure 1. Index of physical volume of GDP, federal budget revenues and oil prices in 2008–2016

forecast 1* fact forecast 1* forecast**

I—I Index of physical volume of GDP, % to previous year

I—I Federal budget revenues, % to GDP

—*— Oil price, dollar/barrel

* Federal law “On the federal budget for 2015 and the planning period for 2016 and 2017” of December 1, 2014 No. 384-FZ.

** Federal law “On the federal budget for 2016” of December 14, 2015, No. 359-FZ.

The socio-economic development of the Vologda Oblast in 2015 reflects national trends and is characterized by the rate of decline in almost all macroeconomic indicators with priority inflation rates ( tab. 1 ).

The forecast of the Vologda Oblast Government [14] shows that the regional economy growth rate in 2016 will lag behind the national average; this, of course, will be reflected in the key fiscal parameters, although at first glance they appear to be optimistic: revenues will increase by 3.7 billion rubles, the surplus will amount to 4 billion rubles (fig. 2).

The parameters of the regional budget, approved for a 3-year period a year ago ( fig. 3 ), also seemed rather optimistic.

Table 1. Main macroeconomic indicators of the Russian Federation and the Vologda Oblast in 2014–2016, in comparable prices, % to the previous year

|

Indicators |

2014, fact |

2015, fact |

2016, forecast |

|||

|

RF |

Oblast |

RF |

Oblast |

RF |

Oblast |

|

|

GRP |

100.6 |

103.0 |

96.2 |

98.5 |

100.7 |

100.3 |

|

Industrial production index |

101.7 |

103.7 |

96.6 |

101.8 |

100.6 |

100.0 |

|

Investment in fixed capital |

97.3 |

99.0 |

90.1 |

90.4 |

98.4 |

106.4 |

|

Retail trade turnover |

102.5 |

102.0 |

91.5 |

92.5 |

100.4 |

95.7 |

|

Real monetary incomes of the population |

99.2 |

102.4 |

96.0 |

98.4 |

99.3 |

100.2 |

|

Real wages |

101.3 |

98.3 |

90.5 |

89.1 |

99.8 |

90.7 |

|

Consumer price index |

111.4 |

112.0 |

112.9 |

112.0 |

106.4 |

111.7 |

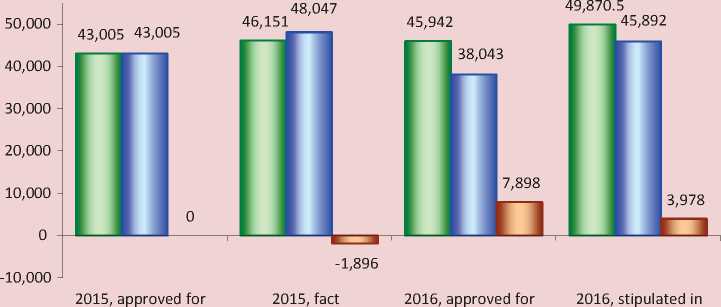

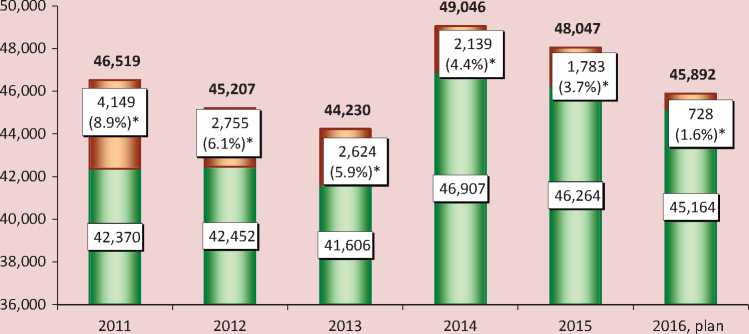

Figure 3. Main parameters of the regional budget of the Vologda Oblast in 2015–2016, million rubles

2015-2017* 2015-2017* the one-year budget

□ Revenues □ Expenses □ Deficit (-), surplus

* The first version of the law of the Vologda Oblast “On the regional budget for 2015 and the planning period for 2016 and 2017” of December 22, 2014, No. 3532-OZ.

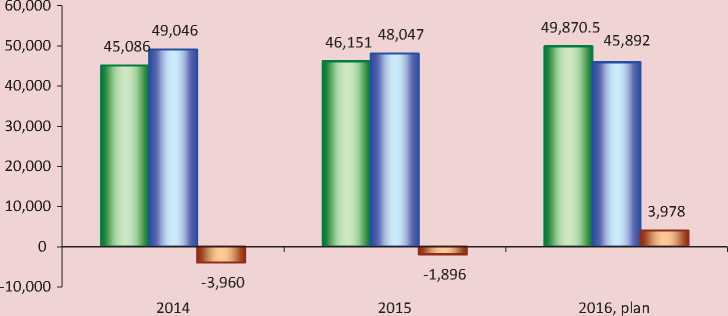

Figure 2. Main parameters of the regional budget of the Vologda Oblast in 2014–2016, million rubles

О Revenues О Expenses D Deficit(-), surplus

According to the regional authorities’ initial plans, the 2015 budget was to be balanced and at the end of the following year the substantial surplus in the amount of 7.9 billion rubles was expected. However, in 2015 there was a different scenario for the budget execution – instead of balance there was deficit in the amount of 1.9 billion rubles. Thus, when setting the budget for 2016 the government adjusted revenues and expenditures upward and reduced the surplus by half.

By analogy with the Federation an annual budget was adopted in most regions1, including the Vologda Oblast that has used a 3-year plan since 2011. The actual budget execution showed the inconsistency of such practices. This is evidenced by the comparison of planned parameters for the same years in the related 3-year periods and actual figures (tab. 2).

Although, according to the first 3-year budget, in 2011 a 4 billion ruble deficit was expected, it actually was by 3.2 billion rubles higher. The budget for the same year of 2012 in the related 3-year periods had both surplus and deficit. The expected surplus in 2013 and 2014 in the three-year budgets differed by one and a half times, while in the latter case the budgets for these years were approved with a deficit, with a value significantly lower than the actually received amount. The 2015 budget

Table 2. Dynamics in the results of execution of the Vologda Oblast regional budget* in the three-year budgets

|

Three-year budget |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

|

Adopted |

||||||

|

2011–2013 |

-3,991 |

2,339 |

3,256 |

|||

|

2012–2014 |

-4,430 |

4,838 |

4,930 |

|||

|

2013–2015 |

-1,168 |

3,215 |

5,659 |

|||

|

2014–2016 |

-3,212 |

-2,015 |

-1,486 |

|||

|

2015–2017 |

0 |

7,898 |

||||

|

2016 |

3,978 |

|||||

|

Actual outcome |

-7,177 |

-2,815 |

-3,953 |

-3,960 |

-1,896 |

х |

|

* deficit (-), surplus. |

||||||

Table 3. Macroeconomic indicators of the Vologda Oblast in 2014–2016, in comparable prices, % to the previous year

|

Indicators |

2014 |

2015 |

2016, forecast |

||||

|

Forecast |

Fact |

+, - p.p. |

Forecast |

Fact |

+, - p.p. |

||

|

GRP |

102.5 |

100.5 |

-2.0 |

102.7 |

98.5 |

-4.2 |

100.3 |

|

Investment in fixed capital |

104.6 |

99.0 |

-5.6 |

118.0 |

90.4 |

-36.2 |

106.4 |

|

Retail trade turnover |

104.8 |

102.0 |

-2.8 |

100.4 |

92.5 |

-7.9 |

95.7 |

|

Real monetary incomes of the population |

102.4 |

102.4 |

0 |

102.1 |

98.4 |

-0.6 |

100.2 |

|

Real wages |

103.0 |

98.3 |

-4.7 |

98.5 |

89.1 |

-9.4 |

90.7 |

|

Own revenues of the budget* |

111.6 |

115.5 |

+3.9 |

103.5 |

101.3 |

-2.2 |

120.9 |

|

* In current prices. Sources: data of the forecasts for social and economic development of the Vologda Oblast for 2014–2016, 2015–2017, 2016–2018; data of the Vologda Oblast laws on the regional budget for 2013–2015, 2014–2016, 2015–2017, 2016; the author’s calculations. |

|||||||

was drawn up in various scenarios: in the calculations for 2013–2015 it was surplus, in the following adjacent period for 2014–2016 – deficit and in the last 3-year period (2015– 2017) – totally balanced.

The regional budget for 2016, declared as surplus, has the same shortcomings of budget planning as in previous years. The budget execution experience in 2012–2015 showed a simulation of the planned surplus. There could be no other scenario, as the budget plans were not tied to macroeconomic forecasts and, therefore, the economic provision of the budget revenue side was not considered ( tab. 3 ).

As evidenced by these tables, the planned growth of the revenue base for 2014 and 2015 exceeded the growth rate of the forecasted macroeconomic indicators. The actual results of the region’s socio-economic development differed much from the forecasted. The outrunning growth in own revenues in 2014 was caused not by reproductive factors, but by favorable pricing environment on the markets of ferrous metals and chemical fertilizers, change in normative standards of PIT deductions to the regional budget, and the phased abolition of privileges on property tax of natural monopolies.

The assessment of target parameters of the revenue part of the 2016 regional budget reveals that the government has not considered the flaws of socio-economic forecasting and budget planning. Otherwise, how else we can justify the 21% growth in own revenue sources provided for in the budget on the background of forecasted minimum growth rates of macroeconomic indicators.

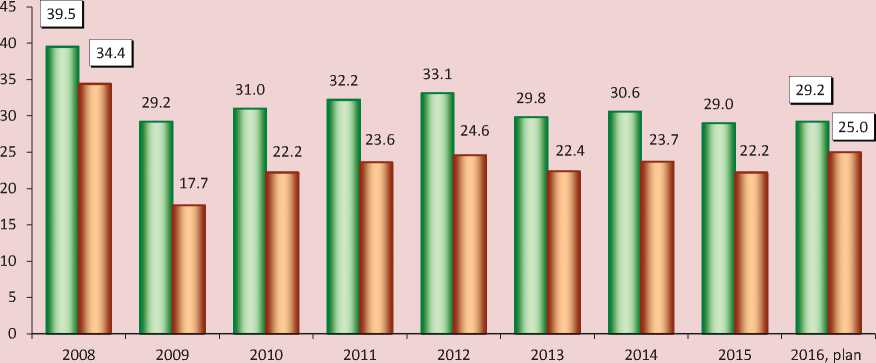

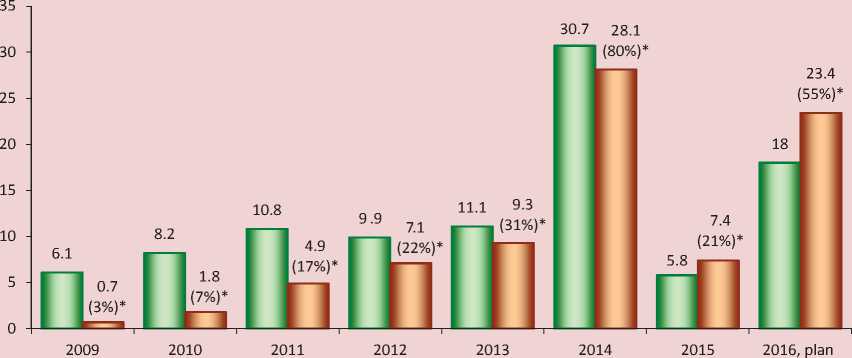

According to our calculations adjusted for projected inflation, neither cumulative nor own revenues of the regional budget will reach the pre-crisis trajectory, comprising 73% in relation to the 2008 level ( fig. 4 ).

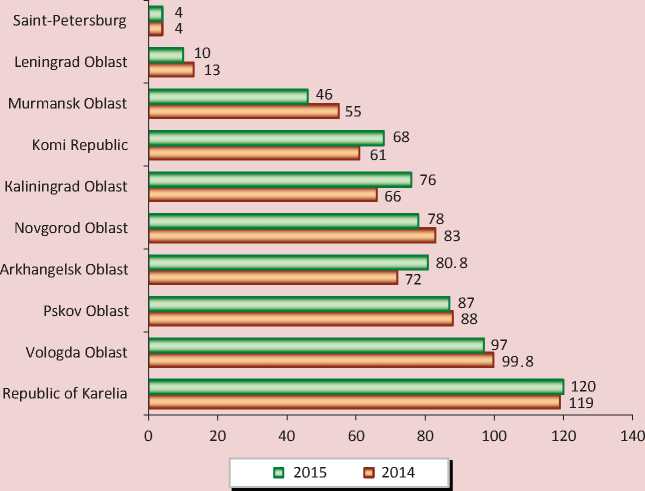

According to the forecasts, in the regions of the Northwestern Federal District, except the Vologda Oblast, own revenues will be lower than in 2008 only in the Republic of Karelia and Saint Petersburg ( fig. 5 ).

In current prices, as already mentioned, the substantial increase in own revenues of the Vologda Oblast regional budget is planned – 7.4 billion rubles. At the same time, more than 60% of the growth is to be provided at the expense of increased profit tax ( tab. 4 ).

The rise in profit tax should be based on high growth rates of a key source of the tax base – profit of economic entities. However, according to the regional government’s forecast, profit of organizations without regard to chemical and metallurgical production in 2016 will increase by only 3.3% and will amount to 12.4 billion rubles. By most rough calculations 2.2 billion rubles of profit tax can be received from this amount.

In our view, the budget projections regarding profit tax are very controversial and raise some doubts.

Figure 4. Dynamics of real revenues of the Vologda Oblast regional budget in 2009–2016, billion rubles (2008 prices)

О Totalrevenues DOwnrevenues

Figure 5. Forecasted growth rate of regional budgets’ real own revenues in the Northwestern Federal District in 2016, % to 2008

Sources: laws of the NWFD subjects on the regional budget for 2016, the author’s calculations.

Table 4. Receipt of own revenues to the Vologda Oblast regional budget in 2014–2016

|

Revenues |

2014, fact |

2015, fact |

2016, plan |

||||

|

Billion rubles |

To 2013, % |

Billion rubles |

To 2014, % |

Billion rubles |

To 2015 |

||

|

billion rubles |

% |

||||||

|

Own revenues, total |

34.96 |

115.5 |

35.4 |

101.3 |

42.8 |

+7.4 |

120.8 |

|

Tax revenues |

33.6 |

118.7 |

34.1 |

101.3 |

41.4 |

+7.3 |

121.5 |

|

- personal income tax |

12.1 |

114.9 |

11.2 |

93.1 |

12.7 |

+1.5 |

113.2 |

|

- profit tax |

7.6 |

127.3 |

6.5 |

86.4 |

11.1 |

+4.6 |

169.5 |

|

- property taxes |

8.2 |

112.4 |

9.7 |

117.9 |

10.3 |

+0.6 |

106.7 |

|

- excise taxes |

4.1 |

107.1 |

4.8 |

117.1 |

5.6 |

+0.8 |

117.6 |

|

- lumpsum tax |

1.65 |

229.4 |

1.7 |

104.5 |

1.4 |

-0.3 |

79.3 |

|

Non-tax revenues |

1.3 |

68.4 |

1.33 |

100.4 |

1.4 |

+0.03 |

105.2 |

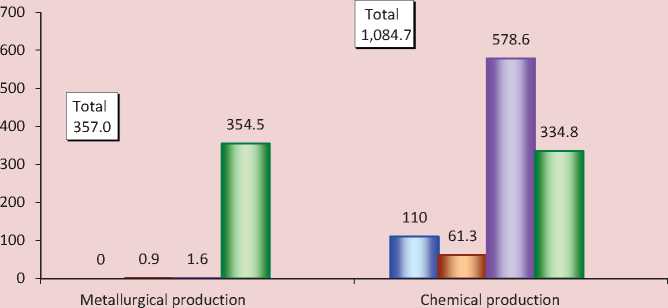

First, when planning a significant increase in tax charges, the regional authorities expect increased payments from the largest holdings of metallurgical and chemical industry – PAO Severstal and OJSC “FosAgro-Cherepovets”. It is expected that profit tax revenues from these taxpayers will be 5.6 billion rubles; however, this figure has received no substantiation in the documents submitted by the government to the Legislative Assembly together with the budget bill for 2016.

Second, the dynamics of profit tax receipts from the metallurgical and chemical industry in 2015 indicates the possibility of not

Figure 6. Dynamics of profit tax receipts to the Vologda Oblast regional budget from chemical and metallurgical production in 2015, million rubles

□ lqv. О 2qv. О 3 qv. О 4 qv.

achieving the planned values. According to the Federal Tax Service in the Vologda Oblast [10], the actual payments from enterprises of the chemical industry totaled 1.1 billion rubles and of the steel – 0.4 billion rubles ( fig. 6 ).

Third, relying on the significant increase in the role of chemical and metallurgical enterprises in the mobilization of profit tax charges, the regional government has not considered these industries as a factor to influence receipts since 2014, as the revenue forecast does not include indicators of PAO Severstal and OJSC “FosAgro-Cherepovets”.

However, it would be unfair to blame only regional authorities for bad planning. In accordance with the current legislation the tax inspections are not required to provide the RF subjects authorities with the information on the activities of certain taxpayers2, especially the largest ones, administered by the interregional inspectorates located in Moscow; it hampers full-fledged planning of budget indicators and, hence, revenues of the regional budget.

Let us add that the 7.4% increase in PIT envisaged in the regional budget is not consistent with the expected levels of population’s income ( fig. 7 ).

So, already in 2014 increasing inflation prompted a 1.7% fall in the growth rate of real wages, accelerated to 11% in the following year. According to the forecasts, in 2016 the deceleration of inflation process will be unobtrusive, real incomes will not grow practically, and real wages will decrease by 9.3%. Such a deep reduction in the main source of monetary income has not been recorded since 1999.

The dynamics of the indicator of average monthly nominal wages does not look promising as well. In 2016 it will grow only by 3.4%, which is almost by 4 times lower than the planned rise in personal income tax levies ( tab. 5 ). Against the backdrop of growing

Figure 7. Dynamics of growth rates of real wages, real monetary income and the consumer price index in the Vologda Oblast in 2009–2016, %

■ __ ■ Real wage ■ _ ■ Real monetary income —*— Consumer price index

Table 5. Dynamics of gross nominal average wage, rubles per employee

Thus, the planned growth of revenue from two key revenue sources of the regional budget without proper analysis of the factors contributing to this rise is hypothetical and carries a risk of revenue leakage.

The budgetary policy in terms of expenditure is focused on optimization, which has already become a norm. In 2016 the expenditure side of the budget will be lower than in 2011. Relative to the 2015 level, the expenditures will go down by 2.2 billion rubles, or 4.5% ( fig. 8 ).

Figure 8. Expenses of the Vologda Oblast regional budget in 2011–2016, million rubles

□ Capital DCurrent

* In brackets the share of capital expenditure in the total budget expenditure.

The need to implement the tasks set in the so-called May Decrees of the President of the Russian Federation3, complicated by the region’s high debt load, forces the local government to minimize spending, primarily at the expense of capital investment. In 2016 budget investment in the construction of state and municipal property objects will amount to 0.7 billion rubles as compared to 4.1 billion rubles in 2011, i.e. it is almost a sixfold decline. In other words, less than 2% of the expenditures is directed for development and almost the entire budget will be used for current needs and loan servicing.

The data presented in Table 6 shows that in 2014 the sequester did not affect the budgeting of the social sector, with the exception of sport events, in 2015 the financial support of education and culture was reduced significantly, in 2016 all social spending will be decreased.

Optimization will involve key budget expenditures, except for national issues, which funding will go up by 10.2% due to the forthcoming elections of deputies of the Legislative Assembly of the region.

The decline in the state support for sectors of the national economy will be most remarkable – 10.4% to the 2015 level. It is no coincidence, since the budgetary policy [6] is aimed not at financial provision of economic development, but at ensuring a balanced regional budget. Of 10.8 billion rubles included into budget for the May Decrees implementation in 2016, only 65.4 million rubles, or 0.6%, will be directed for the

Table 6. Dynamics of the key budget expenditures in the Vologda Oblast in 2014–2016, million rubles

|

Expenditures |

2014, fact |

2015, fact |

2016, plan |

|||

|

Billion rubles |

To 2013, % |

Billion rubles |

To 2014, % |

Billion rubles |

To 2015, % |

|

|

Total |

49,046 |

110.9 |

48,047 |

98.0 |

45,892 |

95.5 |

|

National issues |

2,330 |

121.9 |

2,193 |

94.1 |

2,416 |

110.2 |

|

National economy |

9,020 |

98.3 |

8,293 |

91.9 |

7,432 |

89.6 |

|

Housing and public utilities |

947 |

112.8 |

1,647 |

173.9 |

1,583 |

96.1 |

|

Social services |

32,789 |

113.8 |

32,055 |

97.8 |

30,547 |

95.3 |

|

education |

13,381 |

130.8 |

11,095 |

82.9 |

10,707 |

96.5 |

|

culture |

767 |

147.0 |

573 |

74.7 |

537 |

93.7 |

|

- healthcare |

7,717 |

102.7 |

8,150 |

105.6 |

7,947 |

97.5 |

|

- social policy |

10,661 |

107.0 |

11,821 |

110.9 |

11,217 |

94.9 |

|

- physical culture and sports |

263 |

60.3 |

416.0 |

157.7 |

139 |

33.3 |

realization of the Decree No. 596 “On longterm state economic policy” and over 80% of the funds will be used to increase public sector wages. Meanwhile, despite the fulfilment of obligations to raise salaries of budgetary institution employees, the growth rates of real monetary incomes of the population fall; thus, it is not possible to reduce poverty in the region: the proportion of population with incomes below subsistence minimum increased to 15.2% in 2015 against 12.9% in 2014, and in 2016 it will reach 15.6%.

So, with the deterioration of current and projected dynamics of all economic indicators the regional budget for 2016 is considered as surplus. The task to achieve a surplus will be solved in two ways. The first hard way is to raise own revenues, which is possible only under condition of significant replenishment of the regional treasury by profit tax received from the metallurgical and chemical corporations in the event of favorable market conditions. The second easy way is to cut spending.

Such an approach to the regional budget formation is not connected with the regional authorities’ will, but is dictated by the Ministry of Finance. The fact is that in 2014 the Vologda Oblast Government signed an agreement with the Ministry of Finance of the Russian Federation on granting financial support to the regional budget in the form of a budgetary loan to repay loan debt of credit institutions. The substitution mechanism proposed by the Ministry is extremely tough: the regional authorities should ensure gradual reduction in government debt under marketable obligation up to 50% of own revenues till January 1, 2017, thus resulting in setting a surplus budget.

Unfortunately, despite optimization of costs the authorities failed to weaken the debt load of the budget significantly. At the end of 2015 the public debt of the Vologda Oblast decreased by 533 million rubles, or 1.5%. The amount of debt is only by 3% less than the volume of own revenues of the budget ( fig. 9 ).

Figure 9. Public debt of the Vologda Oblast in 2009–2016

budget

Million rubles To own budget revenues, %

Figure 10. Public debt of the NWFD subjects in 2014–2015, % to own revenues of the regional budget

Sources: data of the Ministry of Finance of the Russian Federation [8]; the Federal Treasury; the author’s calculations.

When setting the budget for 2015–2017 the authorities projected a fairly significant reduction in the tax burden in 2016 – up to 67%; however, the course of the budget process in 2015 showed the unreality of this forecast. Therefore, the 2016 budget stipulates the state debt in the amount of 31.3 billion rubles, i.e. by 4 billion rubles more than the amount approved a year before.

By debt burden the Vologda Oblast ranges 2nd in the Northwestern Federal District following the Republic of Karelia. It should be emphasized that at the beginning of 2016 only in 3 regions of the district the debt was less than half of the volume of own revenues of the budget, which indicates continuation of the debt crisis of Russian regions (fig. 10).

In our opinion, the Vologda Oblast will find it difficult to achieve the reduction in public debt by 3 billion rubles in 2016. Considering the program of state internal borrowings, approved by the law on the regional budget, we can see that the year of 2016 will witness the renewal of the trend interrupted in 2015 to increase borrowing planned in the amount of 18 billion rubles, which is by three times more than in the previous year. Hence, expenses on debt repayment will go up. In 2016 the region will allocate 23.4 billion rubles, or more than half of own revenues of the budget, for these purposes ( fig. 11 ).

Figure 11. Dynamics of obtained and repaid loans of the Vologda Oblast regional budget in 2009–2016

□ Loans received** □ Loans paid***

* Brackets indicate the share of expenditures on loan repayment in own revenues of the budget.

** Received commercial and budgetary loans, placed state securities of the region.

*** Expenses on repayment of government securities of the region, bank and budgetary loans, expenses on servicing public debt (interest payments).

Table 7. Actual results of execution of the Vologda Oblast regional budget in 2014–2016, million rubles

|

Indicators |

2014 |

2015 |

2016, plan |

|

Deficit ( - ) surplus without expenses on loan repayment |

-3,960.1 |

-1,896.3 |

3,978.3 |

|

To own budget revenues, % |

-11.3 |

-5.4 |

9.3 |

|

Expenditure on loan repayment* |

26,144.3 |

5,581.0 |

21,805.8 |

|

Real deficit ( - ) surplus |

-30,104.4 |

-7,477.3 |

-17,827.5 |

|

To own budget revenues, % |

-86.1 |

-21.1 |

-41.6 |

|

* Without interest payments, which are included in the expenditure. |

|||

Certainly, spending local revenue sources on the return and service of credits will cause the budget deficit and the threat to execution of priority expenditure obligations. In this regard, the problem of the method to review costs on borrowings repayment requires the immediate solution. According to the Budgetary Code of the Russian Federation, these expenses are financed by own revenues of RF subject budgets, included not in the budget expenditure, but in the composition of deficit repayment sources that devalues its real size4. According to our calculations, instead of the approved surplus the regional budget in 2016 will be executed with a deficit, which amount will exceed the maximum limit5 and amount to 17.8 billion rubles, or 41.6% of the own revenues ( tab. 7 ).

All the above gives ground to speak about the inefficiency of the policy of debt financing in relation to RF subjects chosen by the Ministry of Finance of the Russian Federation.

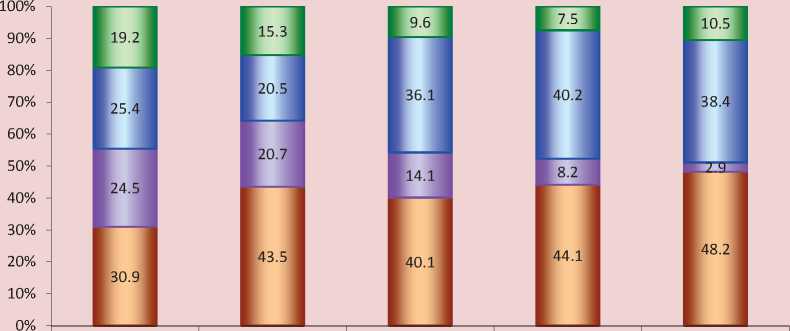

Granting of loans to regions from the federal budget, of course, reduces the debt burden in terms of the decrease in interest expenses6, but does not fundamentally solve the problem of over-indebtedness of regional budgets. This conclusion is confirmed by the structure of the Vologda Oblast’s public debt ( fig. 12 ).

As you can see, since 2014 the proportion of commercial banks’ loans in the debt structure has not decreased, but, on the contrary, increased. Together with the securities the share of market borrowings will reach more than 50% at the beginning of 2017 and will create risks for attracting new loans to repay the previously received ones.

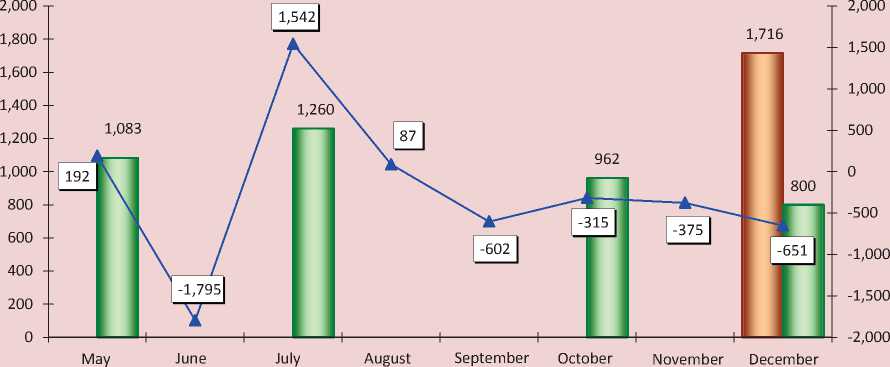

There is another proof of the failure of budgetary loans in halting the growth of commercial debt and stabilizing regional finances, such as monthly dynamics of credit attraction and results of the execution of the Vologda Oblast regional budget in 2015 ( fig. 13 ).

In May 2015, the region attracted over a billion loans from the federal budget, but already in June it had the budget deficit in the amount of 1.8 billion rubles. Additional federal

Figure 12. Structure of the Vologda Oblast’s public debt in 2012–2016, %

2013 2014 2015 2016, plan

□ Commercial loans

□ Budget loans

□ Government securities

□ State guarantees

Figure 13. Dynamics of attracted credits and results of the execution of the Vologda Oblast regional budget in 2015, billion rubles

I—I Commercial loans I—I Budget loans ▲ Deficit (-), surplus loans acquired in July helped to pay it off. It would seem that in 2015 the authorities could avoid market loans, but in September– December the budget again had a sustained negative balance. The budget loan taken in October in the amount of 1 billion rubles was not enough to balance the budget; therefore, the regional authorities had to resort to borrowing in the commercial banks, which led to a new spiral of indebtedness.

Thus, the case study of the Vologda Oblast reveals that federal loans can be considered as a tool to provide partial budgetary balance. The increase in their volume neither solves debt problems nor reduces risks of further escalation of market borrowings.

It is also clear that the overwhelming majority of regions will not be able to provide the necessary stabilization level of their budgets on their own. The federal budget for 2016 stipulates an unprecedented deficit in the amount of 2.4 trillion rubles, which by one and a half times exceeds the planned volume of financial aid to the RF subjects. The law on the federal budget does not contemplate the restructuring of the debt by budget loans provided to the regions. It seems that in the current budget cycle the central government does not plan to propose measures to overcome the regional finance crisis. At the same time, the reference to the federal budget deficit can not justify postponing the solution of this problem, since, according to the results of ISEDT RAS research [3, 4, 13], there are reserves for replenishment of local budgets, particularly the following:

-

1. Assignment of the total revenue tax collected in the area to the regional budgets

-

2. Abolition of VAT exemptions for high-yield subjects of financial activity, and VAT reimbursement for exporters of raw materials would increase tax revenues of the federal budget up to 8 trillion rubles8. These funds would be enough not only to cover the debts of regions, but also to execute the Presidential decrees and upgrade the national economy.

-

3. Involvement of the federal budget’s surplus balance in the co-financing of territorial budgets’ expenses. According to the Federal Treasury, average balances in 2012–2014 amounted to more than 0.7 trillion rubles.

-

4. Introduction of progressive taxation of incomes of physical persons9, the liberal Government of the Russian Federation does

-

5. Establishment of the legislation for compulsory registration of immovable property. According to FNS, about 40% of the owners of real estate are not registered at the State Real Estate Cadastre; it leads to about 45 billion rubles of loses in the regional budget annually.

-

6. Restoring order in the organization of payments transferred from regional budgets to the system of complete medical insurance (CMI) for the unemployed. According to the Accounts Chamber, due to a lack of proper coordination between territorial CMI funds and executive authorities of the RF subjects, the registers of the unemployed include the employed, thus resulting in the overpayment of budgetary funds in the amount of more than 40 billion rubles in 2016 [1].

-

7. Adoption of measures to recover accounts receivable of the budgets of all levels. According to the Federal Treasury, at the beginning of 2015 accounts receivable of the consolidated budget of the Russian Federation amounted to 6.1 trillion rubles, including 0.6 trillion rubles by sub-federal budgets (in the Vologda Oblast – 1.9 billion rubles.). According to the Head of the Accounts Chamber of the Russian Federation T.A. Golikova, “account receivable grows annually by 30% and exceeds reasonable limits” [2].

-

8. Immediate inventory of RF subjects’ expenditure authorities for the purpose of

determining the sources to finance the Presidential decrees and reducing the debt burden of regional budgets. According to the Institute of Economics, Ural Branch of Russian Academy of Sciences, since 2000 the Federation has not transferred powers to the regions and municipalities with the 100% financial provision with resources [15].

-

9. Amendment of the Budget Code of the Russian Federation in terms of the recognition of expenses on loan repayment in the composition of territorial budgets’ expenditure, which would help identify real deficit and generate repayment sources.

-

10. Legislative consolidation of the distribution of inter-budgetary transfers from the federal budget to RF subjects by the beginning of drawing up of regional budgets for the next financial cycle. The failure to comply with the proposed regulations leads to disorganization of the budgetary process in the regions each year, involving the return of untimely distributed and received transfers to the federal budget in line with the budget legislation. So, for example, at the end of 2015 the regions returned 22 billion rubles of unused subsidies and subventions.

-

11. Assessment of effectiveness of provided tax benefits, primarily for territorial taxes10. In 2014 the regional budgets’ revenues that do not fall within the effects of tax preferences amounted to 280 billion rubles, including 1.6 billion rubles in the Vologda Oblast.

-

12. Enhancement of the recovery of arrears to the budget. According to FNS, as of January

-

1, 2016 the possible debt on taxes and duties to the consolidated budget of the Russian Federation amounted to 1.2 trillion rubles, in the Vologda Oblast – 3.8 billion rubles.

-

as partial compensation for revenue losses due to the contributions of VAT and charges for the natural resources use to the federal budget. Additional tax payments are estimated at 0.4 billion rubles per year7.

not dare to adopt. According to experts, the effect for regional budgets is estimated at more than 2 trillion rubles [7], and is equivalent to the amount of accumulated public debt.

It seems, for the initial stabilization of the regional finance the Russian Government should restructure the debt on loans from the federal budget or impose a moratorium on payment of budgetary loans up to 2020, transform the debt financing of sub-federal budgets into transfers and radically change the administration of large taxpayers’ profit.

Without changing the budget policy essence and by emptying the regions’ budgets, the Government demonstrates its inability to guarantee Russian citizens a decent standard of life and provokes the deepening of socioeconomic problems that can lead to political destabilization in the upcoming electoral cycle.

Список литературы Regional budget-2016: priorities do not change

- Golikova T.A. Audit gosudarstvennykh programm Rossiiskoi Federatsii: doklad na sovmestnom zasedanii Prezidiuma i Soveta KSO pri Schetnoi palate . Available at: http://audit.gov.ru/press_center/news/25117

- Dolgi pered byudzhetom prevysili razumnye predely . Nezavisimaya gazeta , 2015, no. 136, July 7.

- Ilyin V.A., Povarova A.I. Byudzhetnyi krizis regionov v 2013-2015 godakh -ugroza bezopasnosti Rossii . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2012, no. 6, pp. 30-41.

- Ilyin V.A., Povarova A.I. Problemy regional'nogo razvitiya kak otrazhenie effektivnosti gosudarstvennogo upravleniya . Ekonomika regiona , 2014, no. 3, pp. 48-63.

- Ob oblastnom byudzhete na 2016 god: zakon Vologodskoi oblasti ot 16.12.2015 g. № 3842-OZ .

- Ob osnovnykh napravleniyakh byudzhetnoi, nalogovoi i dolgovoi politiki Vologodskoi oblasti na 2016 god i planovyi period 2017 i 2018 godov: postanovlenie Pravitel'stva Vologodskoi oblasti ot 21.09.2015 g. № 774

- Ofitsial'nyi sait Departamenta finansov Vologodskoi oblasti . Available at: http://df35.ru/

- Ofitsial'nyi sait Ministerstva finansov RF . Available at: http://www.minfin.ru/ru/perfomance/public_debt/subdbt/2015/

- Ofitsial'nyi sait Ministerstva ekonomicheskogo razvitiya RF . Available at: http://economy.gov.ru/minec/activity/sections/macro/prognoz/

- Ofitsial'nyi sait Upravleniya federal'noi nalogovoi sluzhby po Vologodskoi oblasti Available at: https://www.nalog.ru/rn35/

- Ofitsial'nyi sait Federal'nogo kaznacheistva . Available at: http://www.roskazna.ru/

- Ofitsial'nyi sait Federal'noi sluzhby gosudarstvennoi statistiki . Available at: http://www.gks.ru/

- Povarova A.I. Passivnoe povedenie pravitel'stva. Byudzhetnye problemy regionov narastayut . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2015, no. 3, pp. 39-55.

- Prognoz sotsial'no-ekonomicheskogo razvitiya Vologodskoi oblasti na srednesrochnyi period 2016-2018 godov: postanovlenie Pravitel'stva Vologodskoi oblasti ot 26.10.2015 g. № 891 .

- Tatarkin A.I. Dialektika gosudarstvennogo i rynochnogo regulirovaniya sotsial'no-ekonomicheskogo razvitiya regionov i munitsipalitetov . Ekonomika regiona , 2014, no. 1, pp. 9-30.

- Ulyukaev: netselesoobrazno rassmatrivat' vvedenie progressivnoi shkaly NDFL i posle 2018 g. . Available at: http://www.finmarket.ru/news/4160276

- Yashina G. Progressivnoe nalogooblozhenie: za i protiv . Kapital strany: federal'noe internet-izdanie . Available at: http://kapital-rus.ru/articles/article/177034/