Regional budget for 2013 - 2015: stability or survival?

Автор: Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Development strategy

Статья в выпуске: 1 (25) т.6, 2013 года.

Бесплатный доступ

The next three-year budget has been enacted in the Vologda Oblast. According to the Senior Executive Vice-Governor of the Vologda Oblast A.A. Travnikov, the discussion of the main financial region’s law has been “the hardest over recent years because it is too difficult to drop down, especially after a long period of sustainable growth”1. For the first time, the regional budget has not been adopted in the first reading because it has left out of account the resources due to acute debt burden, which are necessary for eliminating the crisis disproportions, making the conditions for economic growth and dealing with the vitally important tasks of growth in the population’s prosperity defined by the President of the Russian Federation in his election programmes. Meanwhile, clear and strict implementation of these tasks is not only a matter of authorities’ prestige, but also social and political stability. According to the basic parameters of the budget, the situation in the budgetary sphere will not improve in the short term...

Regional budget, debt burden, loaning, own revenue, deficit, the decrees of the president of the russianfederation dated on may 7 2012

Короткий адрес: https://sciup.org/147223435

IDR: 147223435 | УДК: 336.14(470.12)

Текст научной статьи Regional budget for 2013 - 2015: stability or survival?

Source: Official website of the RF Ministry of Economic Development. Available at: sections/macro/prognoz/

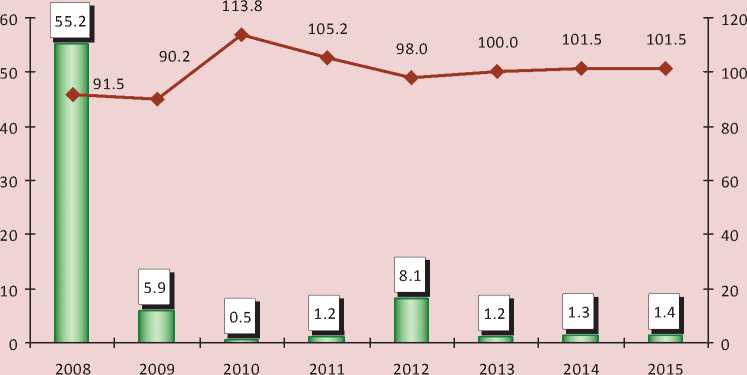

Figure 6. Dynamics of the key production and financial indicators* of steel production in 2008 – 2015

I----1 Profit, bln. rub. —0= Production index, % to the previous year

* In 2013 – 2015 excluding the consolidated group of taxpayers.

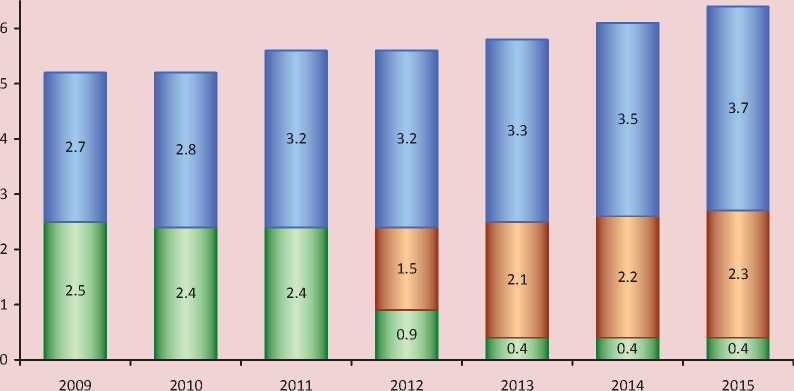

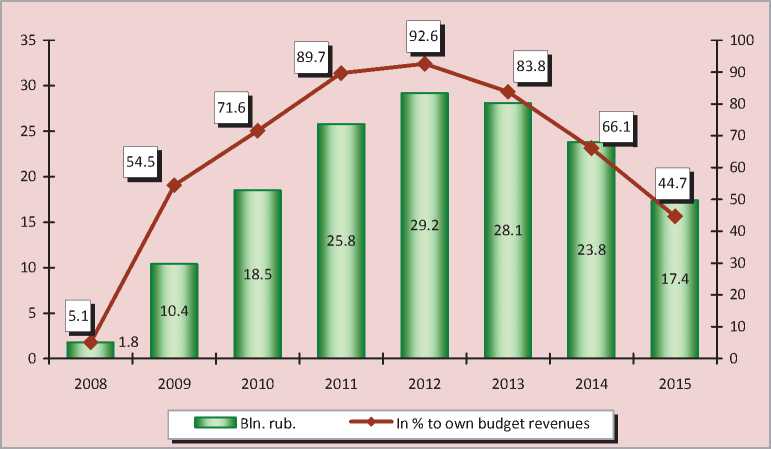

The role of the main budget-formed source will move from the corporate profit tax to the personal income tax in the next budget cycle. The share of personal income tax in the own revenues of regional budgets will rise to 38% in 2015 as compared to 23% in 2008 (fig. 7) .

However, despite the increase in income tax revenues, its share in budget revenues will be not as substantial as the share of profit tax, which amounted to 55 - 60% before the crisis. This fact is caused by two reasons. Firstly, according to the budget legislation, 80% of personal income tax collected in the territory is included in the regional budget. Secondly, the Vologda Oblast is characterized by the lag of the average wages from the national average level that does not allow a significant increase in the wages fund. The gap between the regional and national average wage rates will accounts for 4.5 thousand rubles in 2013, and it will increase to 5.9 thousand rubles in 2015 (tab. 3) .

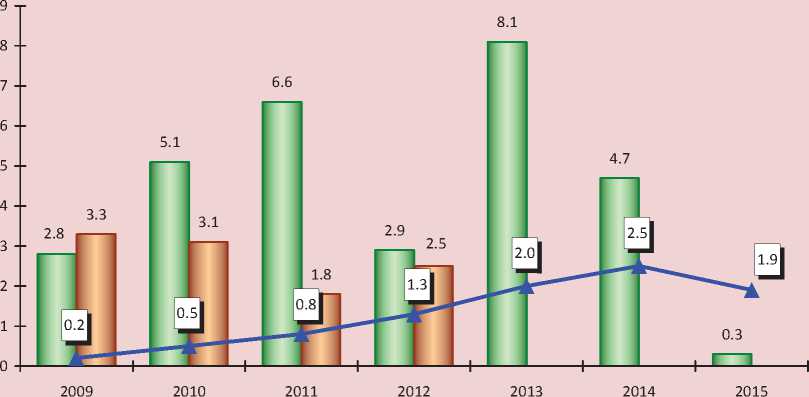

In the context of budgetary resources constraints, the Government of the Vologda

Oblast has taken decisive steps to optimize the tax incentive policy in regard to property taxation. If, the regional budget was short of 75 – 90% of corporate property tax revenues in 2009 – 2011, this indicator will reduced to 7% in 2013 – 2015. Elimination of tax preferences will allow increasing the regional treasury by 2.2 billion rubles annually (fig. 8) .

In the field of non-tax revenues, we should note the current practice of their underestimation in the formation of the regional budget. Thus, actual non-tax revenues have exceeded by 779 million rubles the revenues planned for 2013 (tab. 4) .

Thus, budget planning do not take into account all the reserves of its fullness, including in terms of non-tax collection the fiscal function of which is extremely low and points to the problems of regional property management.

The implementation of the main directions of region’s budget policy in the coming period will be defined by the relationship with the federal government.

Figure 7. Dynamics of income tax revenues of the regional budget of the Vologda Oblast in 2008 – 2015

I-----1 Bln. rub. ♦ The share in the own budget revenues, %

Table 3. Dynamics of the nominal imputed average monthly wage per employee

|

Indicator |

In fact |

2012, evaluation |

Plan |

||||||||

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2013 |

2014 |

2015 |

||

|

Vologda Oblast |

8.8 |

10.7 |

12.9 |

16.1 |

16.6 |

18.5 |

20.7 |

23.1 |

25.5 |

28.1 |

30.9 |

|

Russian Federation |

8.6 |

10.6 |

13.6 |

17.3 |

18.6 |

21.0 |

23.4 |

26.8 |

30.0 |

33.1 |

36.8 |

|

The gap in the level of average wages between the Vologda Oblast and the Russian Federation |

|||||||||||

|

Thsd. rub. |

+0.2 |

+0.1 |

-0.7 |

-1.2 |

-2.0 |

-2.5 |

-2.7 |

-3.7 |

-4.5 |

-5.0 |

-5.9 |

|

% |

2.3 |

0.9 |

5.1 |

6.9 |

10.8 |

11.9 |

11.5 |

13.8 |

15.0 |

15.1 |

16.0 |

|

Growth rates of wages fund, % |

23.7 |

18.6 |

21.2 |

24.6 |

-5.0 |

12.3 |

8.7 |

13.5 |

10.3 |

10.1 |

9.7 |

|

Sources: data of Rosstat; forecasts of the socio-economic development of the Russian Federation and the Vologda Oblast for the period from 2013 to 2015; author’s calculations. |

|||||||||||

Table 4. Dynamics of non-tax revenues of the regional budget of the Vologda Oblast in 2010 – 2015

|

Indicators |

2010 |

2011 |

2012* |

2013, plan |

2014, plan |

2015, plan |

|||

|

plan |

fact |

plan |

fact |

plan |

fact |

||||

|

Non-tax revenues, bln. rub. |

600.0 |

648.2 |

530.8 |

746.8 |

537.2 |

1316.4 |

776.1 |

836.9 |

854.0 |

|

The share in own revenues, % |

2.9 |

2.5 |

1.9 |

2.6 |

1.8 |

5.1 |

2.3 |

2.3 |

2.2 |

|

* January – October 2012. |

|||||||||

Figure 8. Dynamics of corporate property tax in 2009 – 2015, bln. rub.

□ Tax incentives □ Surplus earnings due to repeal of incentives □ Corporate property tax

The Vologda Oblast was a donor of the federal budget till 2009 (fig. 9) . However, we had to say about the new quality of budgetary cooperation in 2009 – 2012, as gratuitous transfers from the federal budget exceeded by two times tax revenues from the region. Thus, the oblast achieved the status of a recipient of the federal budget.

The article does not attempt to analyze the quantitative characteristics of gratuitous financial support which will be received by the region in 2013 – 2015 because more than half of inter-budget transfers from the federal budget are traditionally distributed during the fiscal year. However, it should be noted that despite the greatest decline in self-sufficiency not only among the subjects of the NorthWestern Federal District but among the regions of the Russian Federation, the Vologda Oblast acquired the minimum amount of inter-budget transfers in crisis and post-crisis periods (tab. 5) .

Compensatory role of financial support for the Vologda Oblast remains inadequate, and this is proved by the progressive reduction of per capita fiscal capacity (tab. 6) .

Per capita fiscal capacity in the region will be 33 – 39% lower than national average in the planning period. At the same time, the federal budget provides equalization transfer for the Vologda Oblast only in 2013 – 2014, which will cover a little more than 1% of expenditure needs.

The regional budget losses caused by the changes in the excise tax legislation will amount to 1.1 billion rubles, which is comparable to the deficit in 2013.

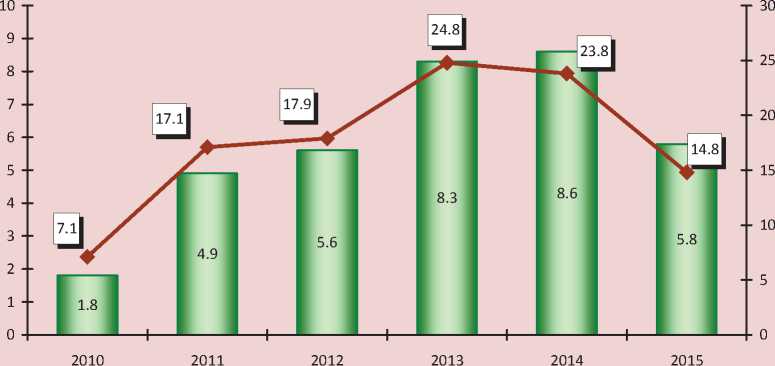

Talking about the deficit, it is necessary to point out that the significant success was reached in improving the budget balance in 2012 – the absolute amount of the deficit reduced 2.5-fold, and the level in the personal income dropped to 3% as compared to 25 – 34% in 2009 – 2011 (fig. 10).

The further deficit minimization is expected in 2013, and budget surplus is expected in the next two years.

It should be noted that the Government of the oblast has been forming a three-year budget with a deficit for the next year and a surplus for the next two years of the planning period for several years.

Figure 9. Gratuitous transfers from the federal budget to the regional budget of the Vologda Oblast in 2006 – 2012, % to the oblast’s payments to the federal budget

Source: author’s calculations according to the data of the Treasury of Russia and the Federal Tax Service of Russia.

Table 5. Inter-budget transfers to the subjects of the North-Western Federal District in 2009 – 2011, thsd. rub. per capita

|

Subject |

Own revenues, 2009 to 2008, % |

2009 |

To the average indicator in RF |

2010 |

To the average indicator in RF |

2011 |

To the average indicator in RF |

|

Nenets Autonomous Okrug |

102.8 |

73.5 |

7.02 |

53.3 |

5.50 |

61.7 |

5.36 |

|

Kaliningrad Oblast |

92.9 |

19.2 |

1.84 |

11.5 |

1.18 |

20.2 |

1.76 |

|

Pskov Oblast |

100.3 |

11.2 |

1.07 |

12.8 |

1.30 |

18.2 |

1.58 |

|

Archangelsk Oblast |

75.8 |

15.5 |

1.48 |

17.3 |

1.77 |

18.0 |

1.56 |

|

Republic of Karelia |

88.3 |

12.4 |

1.19 |

13.1 |

1.34 |

14.6 |

1.27 |

|

Murmansk Oblast |

96.4 |

14.8 |

1.41 |

11.7 |

1.20 |

13.5 |

1.18 |

|

Novgorod Oblast |

102.6 |

10.4 |

0.99 |

7.4 |

0.76 |

11.9 |

1.03 |

|

Republic of Komi |

88.5 |

9.5 |

0.91 |

7.4 |

0.76 |

10.0 |

0.87 |

|

Vologda Oblast |

55.2 |

9.2 |

0.88 |

7.2 |

0.73 |

8.4 |

0.73 |

|

Saint Petersburg |

85.4 |

8.2 |

0.78 |

5.6 |

0.58 |

7.2 |

0.63 |

|

Leningrad Oblast |

95.8 |

5.1 |

0.48 |

4.6 |

0.47 |

7.0 |

0.61 |

|

Russian Federation |

83.7 |

10.5 |

1.00 |

9.8 |

1.00 |

11.5 |

1.00 |

|

Source: author’s calculation according to the data of the Treasury of Russia and Rosstat. |

|||||||

Table 6. Per capita fiscal capacity in the Vologda Oblast in 2008 – 2015

|

Indicators |

In fact |

Forecast |

||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

|

|

Fiscal capacity, thsd. rub. per capita |

41.6 |

33.0 |

38.4 |

42.2 |

45.6 |

42.4 |

43.7 |

46.6 |

|

To the average indicator in RF (1) |

0.95 |

0.79 |

0.84 |

0.79 |

0.81 |

0.67 |

0.64 |

0.61 |

|

Equalization transfer, bln. rub. |

0 |

0 |

0 |

737.9 |

1332.5 |

821.1 |

229.0 |

0 |

|

Source: author’s calculation according to the data of the Treasury of Russia and Rosstat.; Laws on Federal budget and regional budgets of the Vologda Oblast for the period from 2013 to 2015. |

||||||||

Figure 10. Dynamics of the regional budget execution results of the Vologda Oblast in 2009 – 2015, bln. rub.

□ Deficit (-), surplus (+)

* Deficit to own budget revenues, %

In reality, the budget process is far from the scenario conditions and it forces to correct the results of budget execution many times. Thus, the budget for 2012 and 2013 were was initially considered to be surplus ones, and deficiency – during the formation of the main characteristics of the next budget cycle (tab. 7) .

Thus, the underestimation of the main budget parameters in the context of limited revenues specifies surplus coordinates for budget projecting with the budget deficit, reducing the continuity and predictability of medium-term financial planning.

For the financing of budget deficit in 2013 it is planned to attract loans for more than 8 billion rubles from commercial banks, the volume of these loans will be the maximum (fig. 11) . As a result of borrowing the costs for their servicing in 2013 – 2014 will increase up to 2.5 billion rubles and in their share will be the fifth expenditure item of the regional budget

after social security, general education, road fund and inter-budget transfers to the territorial fund of compulsory health insurance.

Due to the planned allocation of significant amount of budgetary funds for the return of the achieved volume of debt and for the payment of interest expenses, the risks of expenditure obligations execution will increase. In 2013 – 2015 the Vologda Oblast uses 15 – 25% of its own revenues for the public debt security (fig. 12).

Continuing the issue of the repayment of loans, it is necessary to emphasize that the expenditures directed for the repayment of the credit sources of the budget deficit financing, in accordance with the legislation are not a legitimate article of expenses. Therefore, if they are included in the expenditure part, then the real budget deficit of the Vologda Oblast in 2013 will exceed the limits, and in 2014 the budget will be executed with a deficit instead of the expected surplus (tab. 8) .

Table 7. Changes in the projected parameters of deficit of the regional budget of the Vologda Oblast, bln. rub.

|

Item |

2012 |

2013 |

2014 |

|

Draft budget for 2011 – 2013 |

2338.6 |

3256.1 |

|

|

Draft budget for 2012 – 2014 |

-4430.0 |

4838.0 |

4930.0 |

|

Draft budget for 2013 – 2015 |

-1167.8 |

3215.5 |

Figure 11. Dynamics of attracted loans and interest expenses of the Vologda Oblast budget in 2009 – 2015, bln. rub.

I-----1 Banking I-----1 Budgetary * Interests costs

Figure 12. Vologda Oblast budget expenditures on the repayment and servicing of debts in 2010 – 2015

I—I Bln. rub. • In % to own budget revenues

Source: author’s calculations based on the data of the Treasury of Russia and the Vologda Oblast Finance Department.

Table 8. Forecast of the actual results of the Vologda Oblast budget execution, mln. rub.

|

Indicators |

2012 |

2013 |

2014 |

2015 |

||||

|

Actual |

Real |

Planned |

Real |

Planned |

Real |

Planned |

Real |

|

|

Deficit (-), surplus (+) |

-2812 |

-7131 |

-1168 |

-7441 |

3215 |

-2927 |

5659 |

1801 |

|

To the budget’s own revenues, % |

-8.9 |

-22.6 |

-3.5 |

-22.2 |

8.9 |

-8.1 |

14.5 |

4.6 |

|

Source: author’s calculations based on the data of the Vologda Oblast Finance Department. |

||||||||

Figure 13. Dynamics of the real expenditures* of the Vologda Oblast budget in 2011 – 2015, bln. rub., in the prices of 2011

*For the purposes of comparability, the expenditures are stated without taking into account inter-budgetary transfers.

Thus, if additional funding sources in the form of own revenues or subsidies on the stabilization don’t be allocated by the federal centre, there still most likely be the regional budget deficit in the forecast period and once again the low reliability of the three-year budget planning will be proved.

The task of ensuring the return of borrowed funds aimed at covering the deficit will be addressed primarily by curbing the public expenses. In real terms the expenditure part of the budget will be reduced by almost 10 billion rubles, or by one third as compared to the level of 2011 (fig. 13) .

The new budget does not stipulate the changes in the structure of expenses and is traditionally positioned as a socially oriented one, but it is unlikely that such a budget can be considered a merit of the ongoing fiscal policy. In the future, social orientation will not allow easily reducing the level of public expenses, so that the additional resources could be allocated for the repayment of accumulated debt, and in the future for investing in the economy.

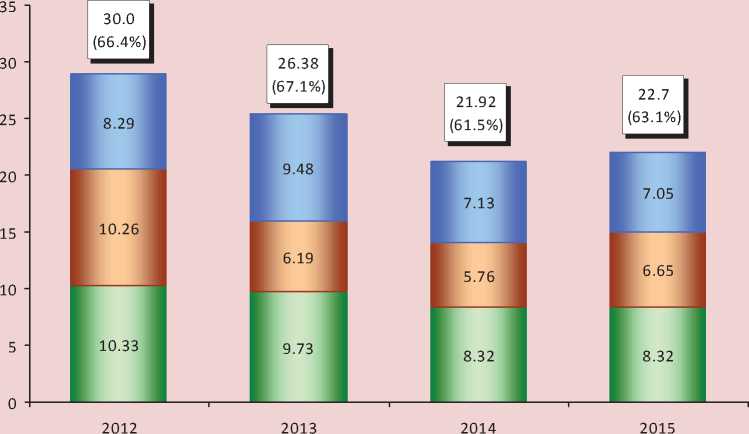

In 2013 – 2015 over 60% of allocations are supposed to be used for financing the social sphere (fig. 14) .

One of the main tasks of the new cycle of budget policy will consist in the implementation of the RF President’s decrees dated May 7, 2012, first of all those, which concern the gradual increase of salaries of budgetary sphere employees. The importance of implementing these decrees is determined by the fact that they were signed in the framework of the President’s election programme.

Figure 14. Structure of the Vologda Oblast budget expenditures for the funding of the main branches of social sphere in 2012 – 2015, bln. rub.

□ Social policy □ Health care □ Education

The first stage, covering 2012 – 2013, envisages the increase in the average salaries of general education teachers up to the regional average, and preschool education teachers – up to the regional average in the sphere of general education.

It should be noted that the federal centre has in its own way solved the problem of resource provision of the President’s election programmes, shifting 60% of the funding to the regional budgets, the majority of which are encumbered with deficit and high debt load. The Federal Treasury, in its turn, does not compensate even for the one-third of territorial budget costs5.

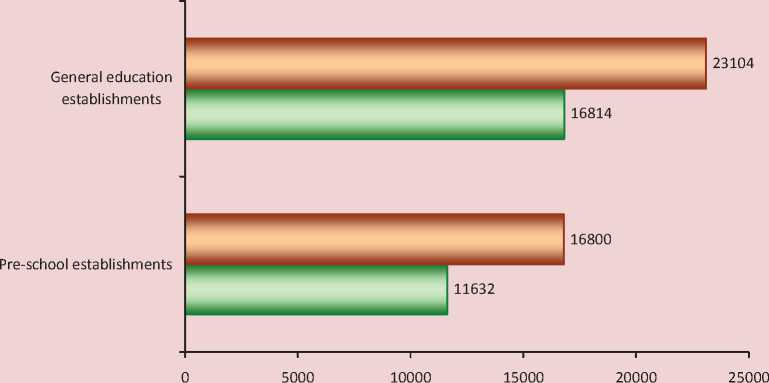

The Vologda Oblast will require 3.8 billion rubles to implement the first stage of presidential decrees. The lack of own funds did not allow the oblast to take into account these costs in the first version of the regional budget. In this regard, the increase of the state employees’ salaries will be funded mainly from the federal budget, as the agreement on receiving these funds was negotiated by the Vologda Oblast Governor and the Russian Federation Government. Thus, in 2013, the average salary of school and kindergarten teachers will increase 1.4-fold (fig. 15).

In the future, it is planned to work out the stages for handling the issues of raising salaries of workers of culture, social services, paramedics and junior staff of health care institutions.

Of course, the implementation of the President’s social initiatives will be an additional load on the regional budget in 2014 – 2015 as well, amounting to about 5 billion rubles by preliminary estimates. The oblast lacks such funds, judging by the forecasted parameters

Figure 15. Average salaries of general and pre-school education teachers in the Vologda Oblast in 2012 – 2013, rub.

□ 2012 □ 2013

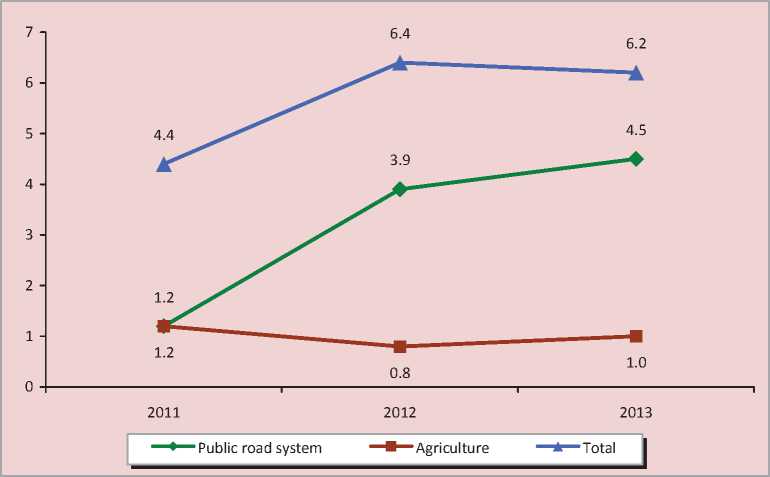

Figure 16. Vologda Oblast budget expenditures* in the section “National economy” in 2011 – 2013, bln. rub.

* For comparability purposes, the expenditures don’t include inter-budget transfers from the federal budget.

of the budget. Therefore, if the federal budget provides no assistance, new borrowings will be necessary, which will increase the already excessive debt burden.

One of the few positive features of the new budget consists in the maintenance of the level of support to the major branches of national economy, achieved in 2012 (fig. 16) .

In 2013 it is expected to allocate 18% of the regional budget funds to the financing of the national economy let alone non-repayable revenues (in 2012 – 18.7%). At that, two-thirds of the funding will be directed to the functioning of the road fund. The agro-industrial complex will remain the second priority direction, the planned financing of which is more than 16% of budget expenditures.

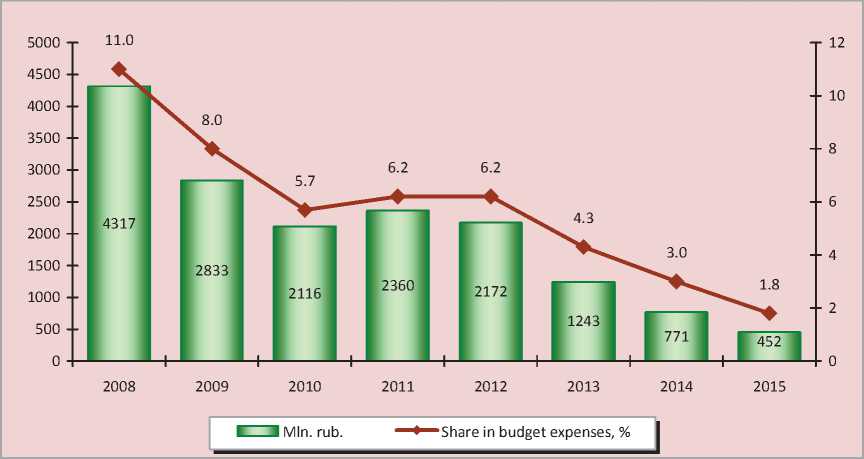

Despite the relatively sustainable dynamics of state support to the subjects of national economy, it should be noted that the socialization of budget expenditures will impede the formation of the development budget in the near future. Moreover, the forecasted dynamics of investments indicates that the oblast budget has run out of reserves for achieving its balance by the compression of investment expenses (fig. 17).

As we can see, the years 2013 – 2015 will face a rapid reduction of capital expenses in their total volume as well as in the share of budget expenditures. In 2015, budget invest- ments in real terms will be less than 500 million rubles, having decreased almost 5-fold, compared to 2012.

In recent years, many budget-related problems of the Vologda Oblast have evolved into an acute debt crisis. In 2012, the level of its public debt, amounting to 93% in relation to the own budget revenues, became critical. The major part of additionally received own revenues will be allocated to servicing the debt in the planning period; however, the escalation of the external funding sources of adopted expenditure commitments will not substantially reduce the debt load (fig. 18).

The structure of the state debt is dominated by bank loans, the level of which will have reached more than 70% of the accumulated debt by 2015 (tab. 9) , this will require increased attention of regional authorities to the debt problem.

In 2013 – 2015 in order to minimize debt risks, it is not planned to provide state guarantee support, consequently, the share of the conditional part of state debt will reduce

Figure 17. Dynamics of capital investments of the Vologda Oblast budget in 2008 – 2015, mln. rub., in the prices of 2008

Figure 18. Dynamics of public debt of the Vologda Oblast in 2008 – 2015

Table 9. Vologda Oblast’s state debt structure in 2008, 2012 – 2015

Summing up, we can conclude that the new budget cycle will be extremely challenging. A destabilizing impact on the functioning of the regional budgetary system will be caused by the following factors.

Firstly, the reduction in the volume of nonrepayable financial assistance from the federal budget in the form of grants and subventions to 2.2 billion rubles.

Secondly, the change in the policy of differentiation of revenue and expenditure responsibilities, which will reduce the tax revenues of the regional budget by 1.1 billion rubles and increase the expenditures on the execution of the RF President’s decrees by 8 billion rubles.

Thirdly, the actual regional budget deficit (taking into account the expenses on the repayment of loans) in the amount of 10.4 billion rubles.

Fourthly, the allocation of own resources for the servicing of public debt in the total volume of 6.4 billion rubles.

Fifthly , the cessation of co-financing of the federal budget expenditures on the development of public road system and the allocation of the regional budget’s own revenues for the formation of the road fund in the amount of 14.2 billion rubles, or an average of 4.7 billion rubles annually.

In general, this refers to the amount of about 40 billion rubles, which is comparable to the annual volume of the Vologda Oblast budget revenues.

Obviously, the task of reducing the debt burden, which was not solved in 2012, as well as the search for the sources of own revenues will form the agenda of the next budget cycle. It seems that the efforts of regional authorities should be concentrated on the following main directions.

-

1. The continuation of the systemic interdepartmental work on the legalization of revenues and reduction of indebtedness on the budget payments. According to the Vologda Oblast Department of Finance, a “hidden” individual income tax deficiency is assessed at 6.6 billion rubles. According to the oblast tax agencies, the total accounts receivable of the budget as of December 1, 2012 was 1.5 billion rubles. The collection of the above sums would solve the problem of the financing sources of activities aimed at implementing the social programmes of the RF President.

-

2. In order to strengthen the mobilizing functions of non-tax revenues a number of administrative measures should be implemented, in particular: to make an inventory of the property of the oblast treasury; to develop objective methodologies of rents calculation; to eliminate the facts of transferring regional property in the free use of federal structures.

-

3. Implementation of further interaction with federal authorities on the issues of receiving additional financial assistance, primarily to ensure the implementation of presidential decrees and the functioning of the road fund, as well as the restructuring of the total indebtedness on the bank and budget loans.

-

4. In the sphere of debt policy it is necessary to diversify the borrowings through the substitution of commercial loans for budgetary loans and market borrowing (state securities of the oblast), characterized by long terms and

competitive cost of service. For alleviating the debt burden it will be necessary to intensify efforts aimed at concluding agreements with credit institutions for reducing interest rates and the period of using the borrowed funds. Along with the implementation of short-term tasks, it will be necessary to change the priorities of the debt policy, since borrowing, not focused on the development and performing the tasks of covering cash gaps can lead to a deep debt crisis. The basic element of the state debt management model should be a system of risks evaluation and control, which allows forecasting the possible debt threat6. Legislative elaboration should be applied to the issues of enhancing the personal responsibility of public officials who make decisions concerning the attraction of loans.

Meanwhile, the problem of increasing profitable opportunities not only for the Vologda Oblast, but also for the overwhelming majority of Russia’s regions can be solved only by changing the paradigm of inter-budgetary policy.

To ensure the real fiscal federalism it is necessary to decentralize the tax system. Perhaps, it makes sense to resume the compliance with the principles of classical fiscal federalism, under which the number of revenues forming the regional budgets, accounts for 50% of their total number, as it was in the late 1990s7. The significant increase in the revenues of sub-federal budgets can be achieved through the reform of individual property tax, the increase of excise rates on alcohol, the enrollment of the profit tax revenues8, the revenues from water and other taxes and fees to the fullest.

The most important reserve of the regions’ revenue base increase is found in the reduction of federal benefits on land and property taxes9. The policy of unsustainable expansion of benefits, without a comprehensive assessment of their potential impact on budget revenues and economic activity, not only worsens the quality of budget management, but also poses a threat to macroeconomic stability. Suffice it to say that the scope of benefits provided by the federal legislation in the VologdaOblast in 2011 increased 5-fold as compared to 2006 and reached 3.8 billion rubles. This amount is what the region needs for the first stage of raising salaries for public sector employees. In addition tax benefits in 2010 – 2011 exceed by 15% the corporate property tax revenues in the regional budget.

The issue concerning the change of conceptual approaches to the formation of regional budgets requires urgent solving. The most problematic RF subjects from the viewpoint of self-sufficiency, such as the Vologda Oblast, require the abandonment of the practice of surplus budgets planning advocated by the RF Finance Ministry, which distorts the real condition of the state budget. The efficiency of budget parameters execution (deficit or surplus) must be determined taking into account the expenditures allocated for the return of the loans, which can not be implemented so far without the appropriate amendments to the current legislation.

Thus, the Vologda Oblast budget for 2013 and the planning period of 2014 – 2015, will, in fact, become the budget of survival. Its main task is to prevent deterioration of social protection of the citizens, which will require strict fiscal consolidation from the regional authorities.

Список литературы Regional budget for 2013 - 2015: stability or survival?

- Dmitriyeva O.G. We shall reach a new crisis with unresolved social problems. Moskovsky Komsomolets. 2012. No. 26071. Available at: http://www.mk.ru/economics/interview/

- Ilyin V.A., Povarova A.I. Problems of execution of the territorial budgets in 2011. Economics. Taxes. Law. 2012. No. 5. P. 87.

- On the execution of budgets of the subjects of the Russian Federation for 2008 -2011: statements of the Treasury of Russia. Official website of the Federal Treasury. Available at: http://www.roskazna.ru/reports/mb.html

- On the budgetary policy in 2013 -2015: the Budget Message of the President of the Russian Federation. Reference-search system ConsultantPlus. Available at: http://www.consultant.ru/

- About the regional budget for 2011 -2013, 2012 -2014 and 2013 -2015. The legislation of the Vologda Oblast. Reference-search system ConsultantPlus. Available at: http://www.consultant.ru/

- Povarova A.I. Formation of regional budget in crisis. Economic and social changes: facts, trends, forecast. 2010. No. 2. P. 101.

- Povarova A.I. The three-year budget: should we wait for stability? Economic and social changes: facts, trends, forecast. 2011. No. 2. P. 20.

- Povarova A.I. The regional budget of 2012 -2014: stability is delayed. Economic and social changes: facts, trends, forecast. 2012. No. 3. P. 39.

- Drobyshevskiy S., Malinina T., Sinelnikov-Murylyov S. The basic directions of reforming the tax system in the medium term. Economic policy. 2012. No. 3. P. 20.

- Social and an alternative version of the Federal budget -2013: continuing “the same old story”. Russian economic journal. 2012. No. 5. P. 34.

- Speech by A.A. Travnikov at the public hearing on the forecast of the socio-economic development of the Vologda Oblast and the draft law “On the regional budget for 2013 and the planning period of 2014 and 2015” dated November 21? 2012. Official website of the Legislative Assembly of the Vologda Oblast. Available at: http://www.vologdazso.ru/analitic/8812/