Regional budget for 2015-2017: doing away with deficit or doing away with development?

Автор: Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 1 (37) т.8, 2015 года.

Бесплатный доступ

Regional budget in the Vologda Oblast for 2015-2017 was formed under difficult socio-economic conditions caused not only by a longstanding dependence of Russia’s economy and its budget system on the external economic environment, but also by a number of new factors associated with the aggravation of geopolitical tensions and the application of sectoral sanctions by Western countries. Despite an uncertainty in economic development trends, the new budget is announced to be deficit-free. It would seem that the balance of revenues and expenditures, a fundamental principle of the budget system, has been achieved. However, an analysis of the expenditure part of the budget shows that the balance is achieved at the expense of introducing the austerity regime followed by the restriction of all directions of funding. For 2015-2017 the share of the regional budget expenditures in GRP will decrease to 9.8% vs.13.6% in 2014. If macroeconomic dynamics maintains its downward trend, such fiscal policy in the long term will suppress the economy even more significantly and will ultimately lead to the taxable capacity reduction...

Regional budget, deficit, loans, debt load, fiscal policy adjustment

Короткий адрес: https://sciup.org/147223688

IDR: 147223688 | УДК: 336.14(470.12) | DOI: 10.15838/esc/2015.1.37.10

Текст научной статьи Regional budget for 2015-2017: doing away with deficit or doing away with development?

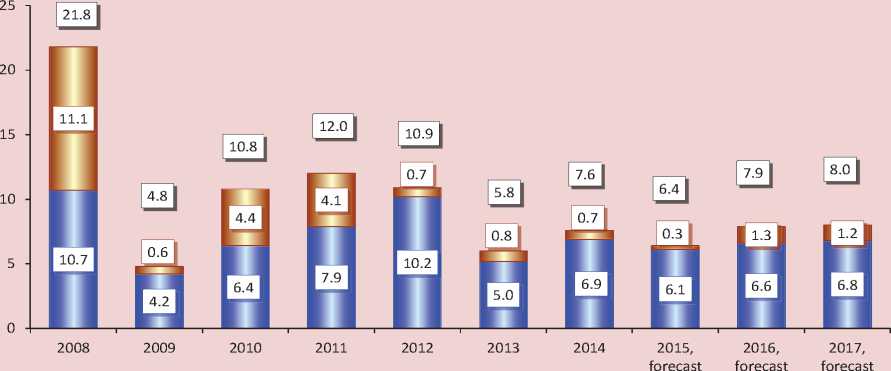

The global economy, as well as Russia’s economy, will retain its low growth rate in the coming years. At that, Russia’s economy will be growing significantly lower compared to the global economy. The uncertainty of macroeconomic trends may increase due to the forecasted decrease in oil price2, which is the key parameter in the formation of budget revenues (fig. 1) .

A forecast of economic and social development of the Vologda Oblast for 2015–2017 [9], reflecting national trends, is characterized by the stagnation of all macroeconomic indicators against the background of a dramatic decline in investment activity (tab. 1) .

GRP growth in 2015–2017 is expected to be achieved by boosting industrial production and consumer demand. However, in our opinion, there are risks of failure to achieve the forecast GRP values, which are not connected with the negative dynamics of investments in fixed capital. It is expected that in 2017 capital investment will be reduced by 23.2% compared to the level of 2014; this fact predetermines a slowdown in GRP growth.

No doubt, economic problems cannot but affect the state of the budget system in the region; although, at first glance, the main parameters of a new three-year budget [8] seem to be very optimistic.

It is forecast that both aggregate and own revenues will grow. But the absolute indicators themselves show little. A system error of budget planning at the regional level consists in the lack of correlation between the main parameters of the budget and GRP.

According to our estimates, the share of regional budget revenues in GRP will decline to 10.7% in 2017 vs. 12.5% in 2014, which indicates the long-term deficit of financial resources (tab. 2) .

Figure 1. Global and Russian economic growth rates, oil price in 2010–2017

estimate forecast* forecast forecast

-

■ _ _ ■ Growth rate of global economy, % Growth rate of Russia's economy, %

ж Oil price, U.S. dollars/barrel

* The 2015 data include the new forecast introduced to the Government by the Ministry of Economic Development. Source: Ministry of Economic Development [11].

Table 1. Main macroeconomic indicators for making the draft regional budget of the Vologda Oblast for 2015–2017, in comparable prices, % to the previous year

|

Indicators |

Fact |

2014, estimate |

Forecast |

2017 to 2014, % |

|||||

|

2010 |

2011 |

2012 |

2013 |

2015 |

2016 |

2017 |

|||

|

GRP |

105.7 |

106.9 |

104.8 |

100.0 |

100.5 |

102.7 |

102.0 |

101.3 |

106.1 |

|

Industrial production index |

111.1 |

105.6 |

101.3 |

102.3 |

101.3 |

102.6 |

101.7 |

102.7 |

107.2 |

|

Investments in fixed capital |

116.1 |

149.4 |

121.2 |

46.2 |

77.7 |

118.0 |

94.7 |

68.7 |

76.8 |

|

Retail trade turnover |

116.3 |

107.6 |

119.7 |

101.7 |

100.5 |

100.4 |

102.8 |

103.2 |

106.5 |

|

Real disposable money incomes of the population |

109.3 |

100.1 |

106.9 |

105.4 |

100.0 |

102.1 |

102.5 |

103.0 |

107.8 |

Table 2. Main parameters of regional budget in the Vologda Oblast, billion rubles

|

Parameters |

Fact |

Forecast |

||||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

|

Revenues, total |

39.5 |

31.2 |

36.1 |

39.3 |

42.4 |

40.3 |

45.1 |

43.0 |

45.9 |

47.3 |

|

As a percentage of GRP |

13.4 |

14.6 |

13.7 |

12.2 |

11.9 |

11.3 |

12.5 |

10.8 |

10.8 |

10.7 |

|

Tax and non-tax (own) revenues |

34.4 |

19.0 |

25.8 |

28.8 |

31.5 |

30.3 |

34.9 |

35.9 |

40.6 |

41.9 |

|

Expenditures |

39.1 |

37.7 |

43.1 |

46.5 |

45.2 |

44.2 |

49.0 |

43.0 |

38.0 |

43.5 |

A year ago the forecast for the 2014–2016 provided for GRP amounting to 402.9 billion rubles in 2015 and 437 billion rubles in 2016, the forecast for 2015–2017 reduced the amount of GRP reduced to 5.7 billion rubles in 2015 and to 13.7 billion rubles in 2016. Thus, in 2015–2016, if the planned level of regional budget revenues is 10.8% of GRP, then over 2 billion rubles will not be received.

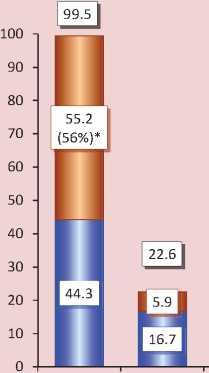

The problems that remain in the region’s economy are aggravated by low recovery rate of budget revenues, which in real terms will not reach their pre-crisis level even in 2017 (fig. 2) .

Since 2009 the change in the structure of budget revenues has become a key factor in reducing self-sufficiency in the Vologda Oblast.

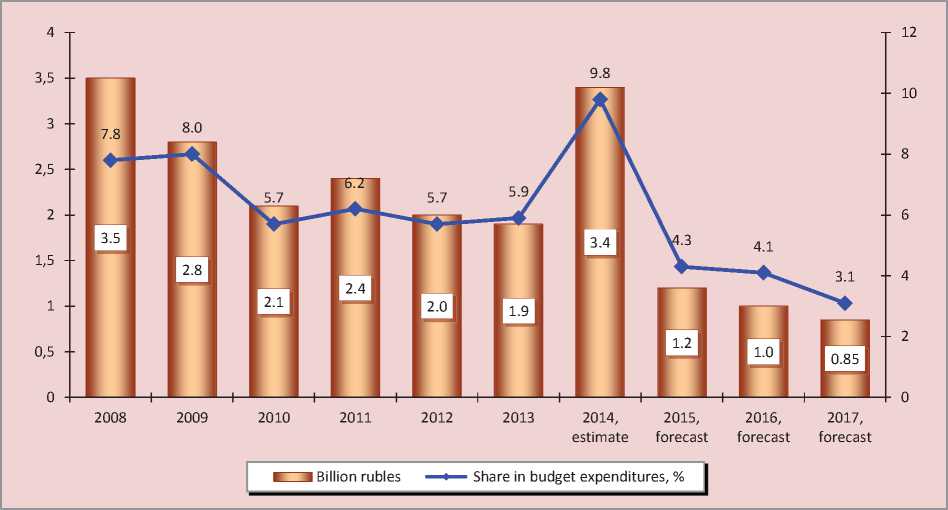

It is connected with a dramatic fall in the receipts of tax on the profit of the largest corporations of ferrous metallurgy – public joint stock company Severstal (PAO Severstal), which provided more than half of the payments from this revenue source up to 2009. In the course of the forecast period this company will never regain its status as the main catalyst of profit tax collection (fig. 3).

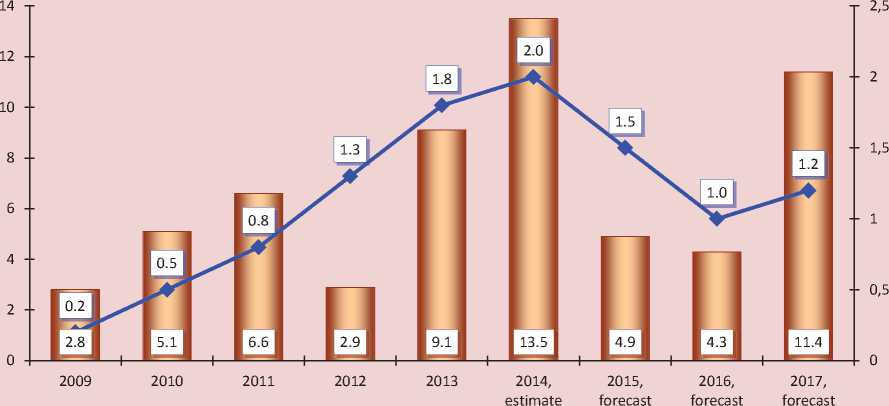

Moreover, it is noteworthy that the government does not consider metallurgical industry as a factor that influences revenues, because the revenue forecast for 2015–2017 does not include indicators for this industry. Meanwhile, metallurgy provided 36% of the total profit of business entities back in 2012 (fig. 4) .

Figure 2. Dynamics of actual revenues of the regional budget in the Vologda Oblast in 2008–2017, in % to 2008

о Total □ Own

Sources: Federal Treasury [13]; Vologda Oblast Department of Finance [10]; author’s calculations.

Figure 3. Dynamics of the inflow of profit tax revenues to the regional budget of the Vologda Oblast in 2008–2017, billion rubles

п Other payers

□ Metallurgical production

Sources: Federal Tax Service; [14]; Vologda Oblast Department of Finance; author’s calculations.

Figure 4. Dynamics of profit before tax in the enterprises of the Vologda Oblast in 2008–2017, billion rubles

2014, 2015, 2016, 2017, estimate forecast forecast forecast

-

□ Other □ Metallurgical Production

* The share of metallurgical production in the total amount of profit in the economy is given in parentheses. Sources: Vologda Oblast Department of Finance; author’s calculations.

It should be noted that the growth of profit in the economy of the Vologda Oblast in 2015–2017 will be 15% and it will outpace the growth of GRP (6%).

However, investments in fixed capital will decrease by 23%. This means that the profit of business entities is not considered in the programs for modernization of production, but it becomes a source of capital outflow3.

The consequences of the crisis cardinally changed the structure of the regional budget’s own revenues; this led to a significant decline in the proportion of profit tax. Moreover, the receipts of other taxes did not compensate for the loss of profit tax in the post-crisis period.

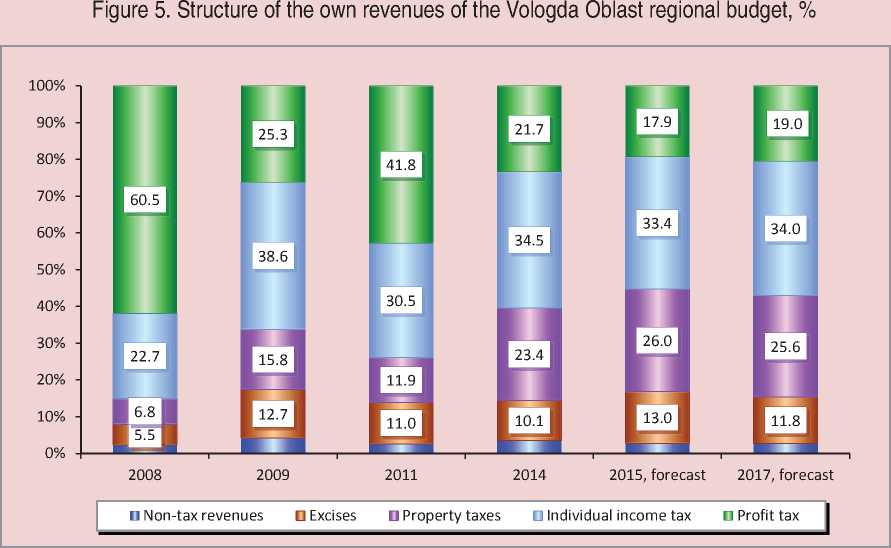

In the upcoming budget cycle the own revenues of the regional budgets will be formed mainly out of individual income tax and property taxes – their share will be 34 and 26% respectively. The proportion of profit tax will be at the level of 19%, which is lower than in the crisis year of 2009 (fig. 5) .

The slowdown in wage growth will not allow the amount of individual income tax receipts to be increased. In 2015–2017 it will grow annually by 0.5 billion rubles, which is two times lower than in 2012–2014 (tab. 3) .

Sources: Federal Treasury; Vologda Oblast Department of Finance; author’s calculations.

Table 3. Individual income tax receipts to the regional budget of the Vologda Oblast and the wages in 2012–2017

|

Indicators |

2012, fact |

2013, fact |

2014, fact |

Average for 2012– 2014 |

Forecast |

Average for 2015– 2017 |

||

|

2015 |

2016 |

2017 |

||||||

|

Individual income tax, billion rub. |

9.6 |

10.5 |

12.0 |

10.7 |

12.0 |

13.4 |

14.3 |

13.2 |

|

To the previous year |

||||||||

|

- billion rub. |

0.8 |

0.9 |

1.5 |

1.1 |

-0.9 |

1.4 |

0.9 |

0.5 |

|

- % |

109.5 |

109.3 |

114.7 |

111.2 |

92.8 |

111.5 |

106.8 |

103.7 |

|

Average monthly nominal accrued wage, rub. |

22649 |

25127 |

26643 |

24806 |

27997 |

29703 |

31713 |

29804 |

|

Growth rate, % |

111.8 |

110.9 |

106.0 |

109.6 |

105.1 |

106.1 |

106.8 |

106.0 |

|

Real wage, % to the previous year |

106.9 |

104.4 |

98.7 |

103.3 |

98.5 |

101.6 |

102.4 |

100.8 |

Sources: Vologda Oblast Department of Finance; author’s calculations.

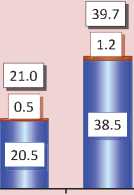

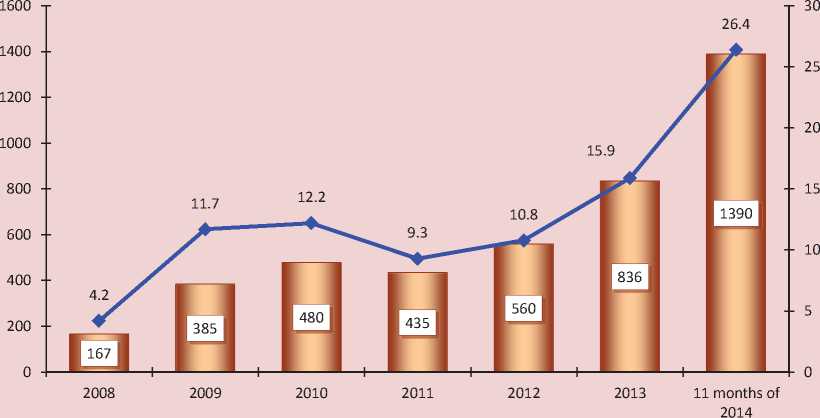

Due to a serious reduction in selfsufficiency, the regional budget becomes more and more dependent on financial support from the federal budget in the form of inter-budget transfers and loans. For 2008–2014 the amount of this kind of support has increased in four times – from 5 to 19 billion rub. (fig. 6) .

According to the figure, inter-budget policy from 2014 onwards makes the substitution of transfer financing with debt financing its priority. In 2015–2017 the planned amount of budget loans will exceed the amount of transfer financing almost twice.

The significant reduction of interbudget transfers in the Vologda Oblast will become one of the main factors reducing the real revenues of the regional budget in the upcoming three year period.

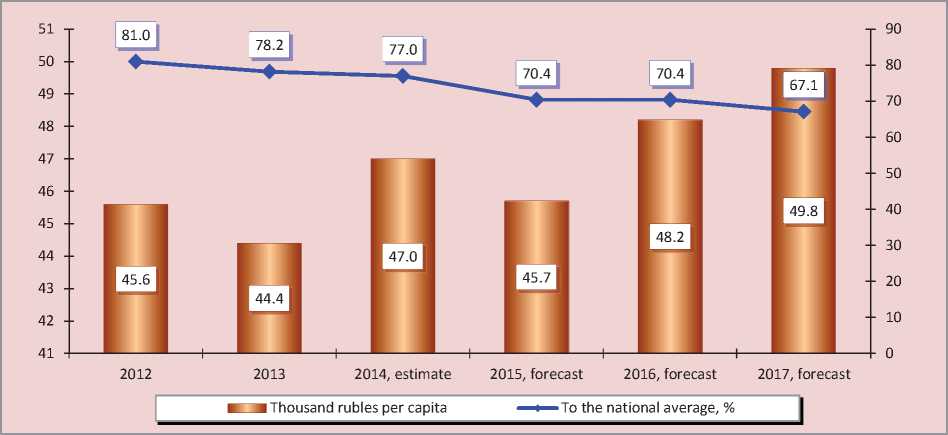

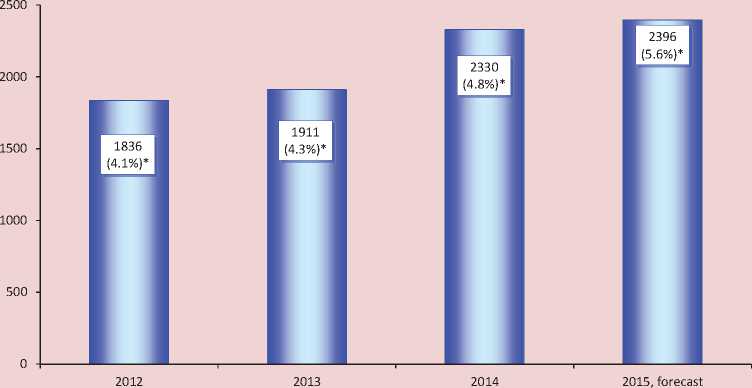

As a result, the gap in the provision of the population with budget revenues will increase compared with the national average level (fig. 7) .

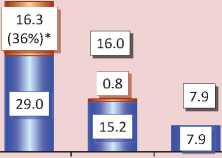

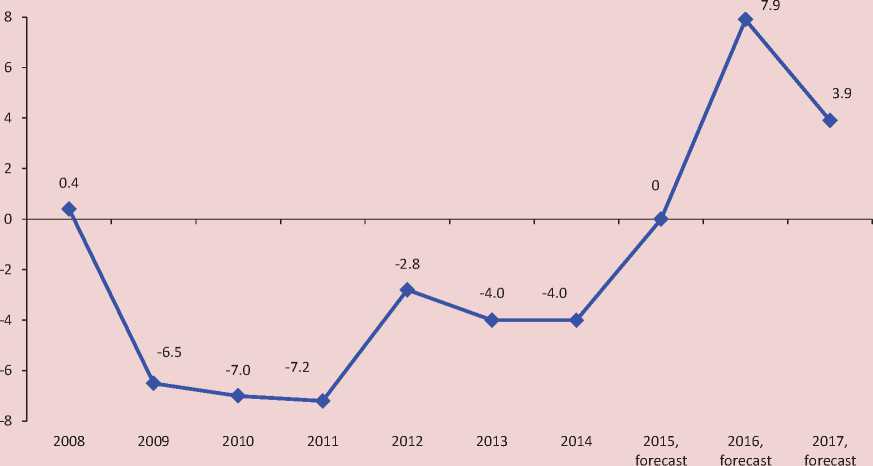

In 2015–2017 the Vologda Oblast Government has set an ambitious goal of achieving the regional budget balance4 (fig. 8) .

This task will be handled by reducing costs on all the functional items in the budget. Budget spending in 2017 will decrease by 5.6 billion rubles in current prices, and after allowing for inflation – by 11.4 billion rubles, or by 23% to the level of 2014 (tab. 4) .

The most significant decrease of financial support is expected in the housing and utilities sector – 81%, which is determined by the decrease of expenditures on budget investments and on major repairs of objects of state and municipal property.

Figure 6. Dynamics of financial support from the federal budget to the regional budget of the Vologda Oblast in 2008–2017, billion rubles

□ Inter-budget transfers □ Budget loans □ Total

Sources: Federal Treasury; Vologda Oblast Department of Finance; author’s calculations.

Figure 7. Provision of the Vologda Oblast population with budget revenues* in 2012–2017

* Data for the consolidated budget of the Vologda Oblast.

Source: author’s calculations based on the data of the Federal Treasury; Rosstat; RF Ministry of Finance; the Vologda Oblast Department of Finance.

Figure 8. Dynamics of the results of execution of the regional budget in the Vologda Oblast in 2008–2017, billion rubles

Sources: Federal Treasury; Vologda Oblast Department of Finance.

Table 4. Dynamics the regional budget expenditures in the Vologda Oblast in 2014–2017, million rubles

|

Expenditures |

2014 |

Forecast |

2017 to 2014, % |

||||||

|

2015 |

2016 |

2017 |

|||||||

|

Nominal |

Nominal |

Real* |

Nominal |

Real* |

Nominal |

Real* |

Nominal |

Real * |

|

|

Expenditures, total |

49046 |

43005 |

40305 |

38043 |

34242 |

43470 |

37669 |

88.6 |

76.8 |

|

National expenditures |

2367 |

2396 |

2246 |

1845 |

1660 |

1892 |

1640 |

79.9 |

69.3 |

|

National economy |

9196 |

6437 |

6033 |

5540 |

4987 |

6549 |

5675 |

71.2 |

61.7 |

|

- agriculture |

2628 |

1232 |

1155 |

744 |

670 |

924 |

801 |

35.2 |

30.5 |

|

Housing and utilities |

1825 |

863 |

809 |

762 |

685 |

404 |

350 |

22.1 |

19.2 |

|

Social sphere |

32789 |

29831 |

27957 |

26238 |

23617 |

29697 |

25734 |

90.6 |

78.5 |

|

- education |

13442 |

10716 |

10043 |

9945 |

8951 |

11353 |

9838 |

84.5 |

73.2 |

|

- culture |

781 |

517 |

485 |

465 |

418 |

498 |

432 |

63.7 |

55.3 |

|

- healthcare |

7735 |

7804 |

7314 |

6604 |

5945 |

7433 |

6441 |

96.5 |

83.6 |

|

- social policy |

10700 |

10590 |

9925 |

9131 |

8219 |

10328 |

8949 |

96.5 |

83.6 |

|

- physical culture and sport |

266 |

203 |

191 |

93 |

84 |

85 |

73 |

31.9 |

27.6 |

|

* In the prices of 2014. Sources: Federal Treasury; Vologda Oblast Department of Finance; author’s calculations. |

|||||||||

National economy looses 40% of the support. In particular, expenditures on agriculture in 2017 will be just 30% from the level of 2014, which will limit the development of import substitution.

The prospects of allocating funds to the social sphere seem no less frustrating: expenditures on education are reduced by 27%, on healthcare and social policy – by 16%, on cultural events – by 45%, on physical education and sport – by 72%.

The need to achieve balance and the structure of budget expenditures that is oriented excessively toward the social sphere are a telling example of another problem of the regional budget, which is associated with a progressive decrease in capital investment. The amount of budget investment over three years will be reduced by 2.5 billion rubles, or about four times compared to the level of 2014 (fig. 9) . It seems as if the Vologda Oblast Government has made a choice in favor of the final optimization of capital expenditure5.

Despite the unprecedented optimization, the achievement of a deficit-free regional budget seems unlikely, in our opinion.

First, the practice of forming budget surplus has been implemented for several years. The actual budget process turns out to be very different from the scenario and makes it necessary to introduce multiple adjustments into the budget execution results. For example, the budgets for 2014 and 2015 were originally declared to have surplus, but they became deficit-ridden after the formation of the main characteristics of the next budget cycle (tab. 5).

Second, the implementation of activities under the presidential decrees of May 7, 2012 that have virtually become unfunded social instructions to the regions will require more than 16 billion rubles, while the real funds allocated for these purposes amount to 8.7 billion rubles, that is, half of the sum required. A particularly acute shortage of financial resources is expected in 2015 (tab. 6) .

If there is no adequate support from the federal government, then the Presidential decrees will be executed, as the practice of previous years has shown, by eliminating the budget institution network and reducing the number of employees6.

Third, as a result of this imbalance in inter-budget relations, characterized by the increase in the number of federal powers7 transferred to the regions and a simultaneous reduction of non-repayable financial assistance from the federal budget, the coverage of the regional budget expenses by the own revenues in 2015–2017 will be 88% on average.

Fourth, local budgets still remain highly dependent on the transfers from the regional budget, which is one of the main causes of its deficit. After a new system of local government was introduced in 2006, the regional budget allocates over 40% of its expenses to inter-budget transfers to municipalities.

Figure 9. Dynamics of capital investments of the regional budget of the Vologda Oblast in 2008–2017, in the prices of 2008

Sources: Federal Treasury; Vologda Oblast Department of Finance; author’s calculations.

Table 5. Change in the forecast parameters of the results of execution of the regional budget in the Vologda Oblast, million rub.

|

Law |

2014 |

2015 |

2016 |

|

Law on the budget for 2012–2014 |

5920.1 |

||

|

Law on the budget for 2013–2015 |

3215.5 |

5345.4 |

-2014.8 |

|

Law on the budget for 2014–2016 |

-3212.1 |

-2014.8 |

-1486.0 |

|

Law on the budget for 2015–2017 |

0 |

+7898.3 |

Table 6. Forecast of the expenditures of the Vologda Oblast regional budget on the implementation of the RF President’ decrees in 2015–2017, million rubles

|

Indicators |

2015 |

2016 |

2017 |

Total |

|

Demand for funds |

5400.8 |

5304.1 |

5663.2 |

16368.1 |

|

Provided for in the budget |

1730.3 |

3068.3 |

3913.7 |

8712.3 |

|

Lack of funds |

||||

|

- million rub. |

3670.5 |

2235.8 |

1749.5 |

7655.8 |

|

- % |

32.0 |

57.8 |

69.1 |

53.2 |

|

Source: Vologda Oblast Department of Finance |

||||

Fifth, in 2015–2017 the planned expenditures on the return of commercial and budget loans obtained in previous years to finance the budget deficit will reach 53.7 billion rubles, which will fundamentally change the actual results of budget execution8 (tab. 7) .

According to our calculations, the actual deficit of the regional budget will reach 19 billion rubles in 2017; it will be necessary to direct almost half of the own revenue sources to its elimination. In conditions of a limited self-sufficiency of the budget the financing of the deficit is likely to cause the need for new loans or sequestration.

Sixth, the balance of the regional budget cannot be achieved under the conditions of high debt load.

When forming a balanced budget, the government expects to reduce the acute debt load. Indeed, the absolute amount of public debt over the forecast period will decrease from 35 billion rubles in 2014 to 23.6 billion rubles in 2017; but it will remain significant and correspond to 57% of the total amount of the own revenues of the regional budget (tab. 8) .

Table 7. Actual results of execution of the regional budget in the Vologda Oblast in 2014–2017, million rubles

|

Indicators |

2014 |

Forecast |

||

|

2015 |

2016 |

2017 |

||

|

Deficit (-), surplus without expenditures on loans repayment |

-3973 |

0 |

7898 |

3856 |

|

To the budget’s own revenues, % |

-11.4 |

0 |

19.4 |

9.2 |

|

Expenditures on loans repayment* |

24471 |

11563 |

19092 |

23019 |

|

Real deficit (-), surplus |

-28444 |

-11563 |

-11194 |

-19163 |

|

To the budget’s own revenues, % |

-81.4 |

-32.2 |

-27.5 |

-45.7 |

* Approved by the law on the oblast budget for 2014–2016

Table 8. Dynamics and structure of the public debt of the Vologda Oblast in 2014–2017, billion rubles

|

Indicators |

2014, fact |

2015, forecast |

2016, forecast |

2017, forecast |

2017 to 2014, % |

||||

|

Billion rub. |

% |

Billion rub. |

% |

Billion rub. |

% |

Billion rub. |

% |

||

|

Public debt, total |

34.9 |

100.0 |

35.2 |

100.0 |

27.3 |

100,0 |

23,6 |

100,0 |

67,6 |

|

Bank loans |

14.0 |

40.1 |

20.6 |

58.6 |

19.1 |

70,0 |

20,6 |

87,4 |

147,1 |

|

Budget loans |

12.6 |

36.1 |

8.5 |

24.2 |

4.2 |

15,4 |

0 |

0 |

0 |

|

State guarantees |

3.4 |

9.6 |

3.3 |

9.4 |

3.1 |

11,4 |

3,0 |

12,6 |

88,2 |

|

Securities |

4.9 |

14.1 |

2.8 |

7.8 |

0.9 |

3,2 |

0 |

0 |

0 |

|

Debt load, %* |

99.8 |

99.3 |

68.3 |

57.2 |

-43.3 |

||||

* Debt load is measured by the ratio of the amount of public debt to the budget’s own revenues. Sources: Vologda Oblast Department of Finance; author’s calculations.

The level of commercial debt in the structure of debt obligations will continue to grow and will reach 87.4% at the end of the budget cycle, thereby creating additional risks to the budget’s debt sustainability. Moreover, after the substantial decrease in the amount of attracted loans in 2015–2016, the oblast government is planning to attract new bank loans in 2017, which will lead to the growth of loan servicing (fig. 10) .

If we sum up the expenses on the repayment and servicing of loans, their amount will exceed other major areas of funding of the regional budget. In fact, these expenses have become a priority (fig. 11) .

It is obvious that in the near future the regional authorities will not be able to change the situation cardinally in the sphere of debt policy; and the diversion of budget funds to the repayment of loans and to interest payments will aggravate the risks concerning the execution of priority expenditure obligations.

The list of flaws in the next three-year budget can be continued, but after all, in our opinion, they are predetermined by flaws in the fiscal policy pursued in the country; this policy does not serve as an essential tool in the territorial development management, but it plunges Russian regions deeper in the budget crisis.

Figure 10. Dynamics of attracted commercial loans and interest costs of the regional budget of the Vologda Oblast in 2009–2017, billion rubles

■ ■ Commercial loans I Interest costs

Sources: Federal Treasury; Vologda Oblast Department of Finance; author’s calculations.

Figure 11. Main functional expenses and expenses related to the repayment of loans of the regional budget of the Vologda Oblast in 2013–2017, billion rubles

9.2

7.5

10.0

10.2

8.8

10.7

13.4

26.5

6.4

7.8

10.6

10.7

5.5

6.6

13.0

20.1

2015, forecast

2016, forecast

10.3

11.4

24.2

2017, forecast

-

□ Repayment and servicing of loans

□ Education

□ Healthcare

-

□ Social policy

-

□ National economy

Source: author’s calculation based on the data provided by the Vologda Oblast Department of Finance

What other reason can there be to explain that only ten RF subjects are selfsufficient (they do not receive subsidies for equalization of budget sufficiency), that the deficit of regional budgets for 2013–2014 has reached historic highs, exceeding the planned values by several times [5], and the majority of regions are on the brink of bankruptcy, continuing to borrow funds to be used for covering current expenses rather than for development? From January to November 2014 the debt load of Russia’s constituent entities has increased by 75%, exceeding one trillion rubles for the first time (fig. 12) .

The amount of loans attracted is second only to the regional budget expenditures on education and social policy.

The standards for the transfer of revenues to local budgets established by the Budget Code of the Russian Federation do not ensure the implementation of the powers assigned to regions. Thus, handling the issue of federal budget deficit by shifting the government spending to lower levels, the central government forces regional authorities to form their budgets so that they initially had the limit values of debt obligations. For example, in 2015 the debt load of the Northwestern regions of

Figure 12. Dynamics of loans raised by the subjects of the Russian Federation in 2008–2014

■ ■ Loans, billion rubles • To the budget's own revenues, %

Sources: Federal Treasury; author’s calculations.

Table 9. Upper limit of public debt in the regional budgets of NWFD subjects in 2014–2015

|

Constituent entity |

Approved for 2014 |

Approved for 2015 |

||

|

Billion rub. |

To the budget’s own revenues, % |

Billion rub. |

To the budget’s own revenues, % |

|

|

Saint Petersburg |

14.6 |

3.8 |

79.6 |

20.0 |

|

Leningrad Oblast |

22.0 |

33.8 |

22.9 |

32.2 |

|

Murmansk Oblast |

20.3 |

54.8 |

25.2 |

63.7 |

|

Kaliningrad Oblast |

21.2 |

79.4 |

19.9 |

74.1 |

|

Novgorod Oblast |

17.2 |

90.7 |

16.0 |

81.0 |

|

Republic of Komi |

28.7 |

52.1 |

51.5 |

89.5 |

|

Vologda Oblast |

34.9 |

100.5 |

35.2 |

97.9 |

|

Arkhangelsk Oblast |

35.6 |

80.2 |

40.7 |

98.1 |

|

Pskov Oblast |

14.7 |

99.5 |

14.7 |

98.6 |

|

Republic of Karelia |

19.0 |

102.4 |

20.1 |

107.3 |

Sources: laws of the RF constituent entities on the regional budget for 2014–2016 and 2015–2017; author’s calculations.

the Russian Federation, except for Saint Petersburg and the Leningrad Oblast, will approach a critical level, it will exceed this level in the Republic of Karelia (tab. 9) .

The acute debt crisis in the majority of the Russian Federation subjects is caused in many respects by a delayed response of the central government to the growing risks. Only in July 2014 the RF Government adopted a decision on the transformation of commercial loans into budget loans issued at low interest rate9.

Speaking at the expanded board meeting of the RF Ministry of Finance on April 8, 2013, V.I. Matvienko, Chairman of the Federation Council, asked its officials a fair question: “The Ministry of Finance should not stand on the sidelines. Why haven’t we stopped the unrestrained borrowings of some regions, which are now virtually bankrupt?” [2].

Unfortunately, Russian Government still has not proposed any system-wide measures to solve the budget crisis in the regions. On the contrary, the “Program for improvement of public (state and municipal) finance management efficiency for the period up to 2018” states quite openly that “the majority of state powers should be assigned to the subjects of the Russian Federation as their own powers”. It seems that the government intends to increase the efficiency of regional finance management through the gradual transfer of funding of its functions to the RF subjects; but it does not realize what can happen in case of the growth in the number of not-collateralized liabilities of the regional budgets, whose burden is already excessive [16].

Conceptual aspects of the actions necessary to correct the fiscal policy, have been substantiated in a large number of scientific works [1, 3, 4, 6, 7, 15, 17].

In our opinion, the priority measures to be implemented at the regional level should provide adequate legislative support to subnational budget systems. An extended list of these measures can be represented in three blocks.

-

1. Transfer of additional tax revenues10 to the regional level:

– assignment of the whole amount of income tax receipts to the budgets of the regions11 on the grounds that the share of this payment does not exceed 3% in the formation of the federal budget revenues;

– increase of the standard VAT rate (for example, from 18 to 20%) or cancellation of VAT refund from the federal budget to exporters of natural resources, and the allocation of additionally collected VAT to the increase of alignment subsidies to the Russian Federation subjects or their distribution between the regions on a per capita basis, like, for example, in Germany;

– introduction of luxury tax – a measure, which the government still hesitates to take12.

-

2. Increase in the amount of financial support from the federal budget. Priority in its allocation should be given to transfers rather than to budget loans, because the situation will repeat itself if new loans are provided to repay existing debt.

-

3. Inventory of expenditure powers with the subsequent transfer of part of them to the federal level.

This situation can be handled by revising the current procedure of using targeted transfers. The uneven allocation of interbudget transfers by the federal center in the course of the year13 leads to the fact that Russia’s constituent entities cannot dispose of them timely; as a result, the remaining funds are returned to the federal budget in accordance with the budget legislation. In the Vologda Oblast the amount of returns for 2008–2013 has increased by 8.4 times – from 56 to 476 million rubles.

The central government should pay more serious attention to the issues related to co-financing of investment programs of territories. According to the Federal Treasury data, the amount of subsidies allocated for capital expenditures to the RF subjects from the federal budget in 2012–2014 reduced from 199 to 56 billion rubles, or in 3.6 times (in the Vologda Oblast – from 825 to 184 million rubles, or in 4.5 times). Of course, such a drastic reduction of investment transfers will create long-term risks for sustainable growth in taxable capacity.

According to the estimates by the Institute of Economics of the Ural Branch of RAS, no powers with the 100% provision with financial resources have been transferred from the federal level to the regions and municipalities since 2000 [18].

The social burden of regional budgets could be relieved considerably, if the expenditures on the payment of insurance contributions for compulsory health insurance of non-working population were transferred to the federal level. For example, these expenditures, prevail in the structure of regional budget expenditures on health care in the Vologda Oblast, and make up 56% (in Russia – 42%).

According to our estimates, the implementation of the above priority measures alone will increase the annual revenues of regional budgets on average by 1.2 trillion rubles (tab. 10) .

When implementing these measures it is necessary to make a profound revision of the Tax Code and Budget Code of the Russian Federation in order to change the approaches to the taxation of profit of big business, to establish foreign exchange control, to introduce a progressive individual income tax scale, to restore order in the subsurface management, to abolish tax privileges and preferences for highly profitable business entities, etc.

Of course, the practical implementation of these measures largely depends on the efforts undertaken by the federal center.

Table 10. Additional revenue sources of regional budgets in the Russian Federation subjects, billion rubles per year

|

Source |

Estimate |

|

Transfer of the entire amount of profit tax collected in the region |

350* |

|

Increase in VAT rate or cancellation of VAT refund to commodity exporters |

400–450* |

|

Introduction of luxury tax |

200–250** |

|

Leaving the unused target inter-budget transfers in regional budgets |

35–40* |

|

Transfer of the authority to pay insurance contributions for compulsory medical insurance on non-working population to the federal level |

500* |

|

Total |

1135–1240 |

|

* Estimated on the basis of the dynamics of the indicator for 2011–2013. * According to the draft law elaborated by the RF State Duma Deputy, Doctor of Economics N. O. Dmitrieva in collaboration with representatives of the party “Just Russia”, the real estate worth more than 30 million rubles and the vehicles worth over 3 million rubles are subject to luxury tax. It is about 200 thousand apartments and detached houses and about 100 thousand vehicles. And their owners do not belong to the middle class; they make up only about 0.01% of the population, and they are the super-rich Russians who own luxury objects. In their volume, the receipts from luxury tax paid by a small number of wealthy individuals will be comparable to tax revenues from all simplified regimes, paid by millions of small entrepreneurs and farmers. |

|

However, this does not relieve the regional authorities from the responsibility to conduct a responsible fiscal policy. In relation to the Vologda Oblast the main directions of such a policy should include the following:

First, an active search for all possible sources of increase the collectability of tax revenues. According to the Vologda Oblast Department of Finance, at the end of 2014 the debt of the region’s taxpayers on the payment of taxes to the budget system of the Russian Federation exceeded 2 billion rubles, and the budget lost 5 billion rubles due to the implementation of “off-the-books” labor remuneration schemes by employers. These funds would be quite enough not only to cover the current deficit, but also to implement the inaugural decrees of the President in 2015.

In order to enhance the mobilizing function of non-tax revenues it is necessary to implement a set of administrative measures, in particular: to revise the legislative framework; to index the rates of certain types of payments; to exclude the transfer of the oblast property to federal structures for its free use.

Second, further optimization of budget expenditures on management. Dynamic increase in state expenditures, unlike other expenditure items, indicates the potential for their reduction (fig. 13) .

According to the latest data provided by Vologdastat, in January – September 2014 the number of employees of state administration bodies in the oblast increased from 9.8 to 16.9 thousand people, i.e. by 1.7 times in comparison with the same period of the previous year. The average salary of an employee of aministrative staff, including the entire regular staff, was 41.7 thousand rubles, the average salary in economy being 25.7 thousand rubles. Salaries of the Vologda Oblast Government officials, holding public office, reached 301 thousand rubles and 12 times exceeded the regional average.

Figure 13. Expenses under the heading “federal issues” in the regional budget of the Vologda Oblast in 2012–2015, million rubles

* The share of expenditures in the total expenditure part of the regional budget is given in parentheses. Sources: Vologda Oblast Department of Finance; author’s calculations.

Third, strengthening the responsibility of administrators of budget funds for improper level of cash execution of expenditures. In the conditions of a chronic budget deficit about two billion rubles of approved regional budget allocations is not utilized every year. Budget accounts receivable, the amount of which at the beginning of 2014 reached 1.1 billion rubles, arouses serious concern. Almost the whole sum falls on advance payments on the contracts and on the payments on loans granted from the regional budget.

Strengthening the financial foundations of the regions should become a core aspect of increasing the efficiency of public administration.

If the policy of fiscal consolidation is continued, it will inevitably lead to a lingering debt crisis of territorial budgets, and, ultimately, to the default in the regions and economic destabilization. At the same time, it is necessary that Russia’s regions consolidate their efforts aimed to change the policy of the federal center.

Список литературы Regional budget for 2015-2017: doing away with deficit or doing away with development?

- Povarova A.I. Formirovanie regional’nogo byudzheta v usloviyakh krizisa . Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz , 2010, no. 2, pp. 101-114

- Povarova A.I. Trekhletnii byudzhet: zhdat’ li stabil’nosti? . Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz , 2011, no. 2, pp. 20-36

- Povarova A.I. Regional’nyi byudzhet 2012-2014: stabil’nost’ otkladyvaetsya . Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz , 2012, no. 3, pp. 39-58

- Povarova A.I. Regional’nyi byudzhet 2013-2015: stabil’nost’ ili vyzhivanie? . Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz , 2013, no. 1, pp. 36-55.

- Bukina I.S. The Paradoxes of Financial Policy in the Russian Federation. Federalism, 2014, no. 2, pp. 25-34.

- The Three-Year Budget 2015-2017: the Imperative of “Reversing” the Socio-Economic Course Ignored Once Again: Editorial. Russian Economic Journal, 2014, no. 5, pp. 3-21.

- The Speech of V.I. Matvienko at the Expanded Board of the Ministry of Finance of the Russian Federation “On the Results of Execution of the Federal Budget for 2012 and the Tasks of the Financial Authorities of the Russian Federation for 2013”, April 8, 2013. Available at: http://www.council.gov.ru/media/files/

- Dmitrieva O.G. Economic Turnovers and Financial Vacuum Cleaners. Issues of the Economy, 2013, no. 7, pp. 49-62.

- Zyuganov G.A. Degradation Project. Soviet Russia, 2014, October 14.

- Ilyin V.A., Povarova A.I. Budget Crisis of the Regions in 2013 -2015: a Threat to Russia’s Security. Economic and Social Changes: Facts, Trends, Forecast, 2012, no. 6, pp. 30-41.

- Ilyin V.A., Povarova A.I. Problems of Regional Development as the Reflection of the Effectiveness of Public Administration. Economy of the Region, 2014, no. 3, pp. 48-63.

- Kashin V.A., Abramov M.D. Tax System -a Threat to Russia’s National Security. Available at: http://www.modern-rf.ru/netcat_files/93/47/

- Orekhovskii P.A. Russian Fiscal System and the Coming Crises of Regional Finances. Federalism, 2014, no. 1, pp. 141-150.

- On the Oblast Budget for 2015 and for the Planned Period of 2016 and 2017: the Law of the Vologda Oblast of December 22, 2014 No. 3532-FZ.

- On the Forecast of Socio-Economic Development of the Vologda Oblast in 2015-2017: Resolution of the Government of the Vologda Oblast of October 27, 2014 No. 954.

- Official Website of the Vologda Oblast Department of Finance. Available at: http://df35.ru/

- Official Website of the Ministry of Economic Development of the Russian Federation. Available at: http://economy.gov.ru/minec/activity/sections/macro/prognoz/

- Official Website of PAO Severstal. Available at: http://www.severstal.ru/

- Official Website of the Federal Treasury of Russia. Available at: http://www.roskazna.ru/

- Official Website of the Federal Tax Service of Russia. Available at: http://www.nalog.ru/

- Petrov Yu.A. About Shaping a New Economic Model: Restriction of Budget Expenditures or Better Fiscal Performance? Russian Economic Journal, 2013, no. 4, pp. 24-39.

- Povarova A.I. About the Conditions and Measures to Improve the Effectiveness of Public Finance (Critical Notes). The Economist, 2014, no. 3, pp. 68-71.

- Solyannikova S.P. Public Finance Management: Declared Principles and Reality. The Economist, 2014, no. 4, pp. 44-58.

- Tatarkin A.I. Dialectics of Public and Market Regulation of a Region and Municipality Socioeconomic Development. Economy of the Region, 2014, no. 1, pp. 9-30.