Regional budget for 2017-2019: surplus or economic growth?

Автор: Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 2 (50) т.10, 2017 года.

Бесплатный доступ

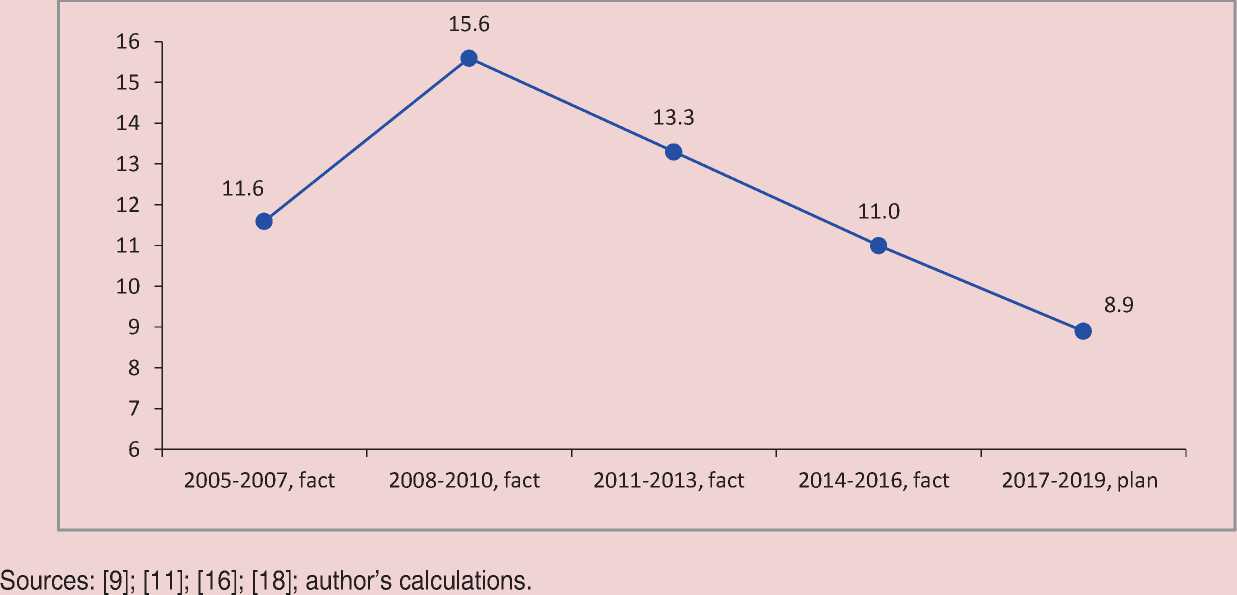

At the end of 2016, the Vologda Oblast approved its budget for 2017-2019. At first glance, its parameters are quite optimistic if we recall that from 2009 to 2015 the budget was significantly unbalanced. The planned annual surplus of 2.5 billion rubles is planned in the upcoming budget cycle. The budget surplus exceeding this sum was registered only in 2004. These projections are not based on the expected sustained economic growth, but on the terms of agreements with the Ministry of Finance of the Russian Federation on the allocation of financial assistance to the oblast in the form of budget loans. The forecast of socio-economic development elaborated by the Vologda Oblast Government retains low growth rates of all macroeconomic indicators; due to this fact it is unlikely that sufficient financial resources could be generated: the average annual growth rate of the budget's own revenues will not reach even 4%. The positive balance of the treasury is expected to be reached with the help of fiscal consolidation: the amount of government spending as a share of gross regional product will decrease to 9% to 2020 against 13% on average over the period of 2005-2016...

Budget planning, economic growth, regional budget, surplus, loans, debt burden, intergovernmental fiscal policy

Короткий адрес: https://sciup.org/147223927

IDR: 147223927 | УДК: 336.143(470.12) | DOI: 10.15838/esc.2017.2.50.13

Текст научной статьи Regional budget for 2017-2019: surplus or economic growth?

Budget planning is an important part of public administration system. In the current critical economic situation it is important that budget policy priorities should not only solve current problems but also focus on achieving longer-term goals of sustainable economic development. That is why more and more attention in budgetary process is given to long-range planning.

According to experts [6, 7], long-term budget planning helps gain certain advantages. First, it ensures the continuity and predictability of budgetary and tax policy, which is important for the real economy. Second, it helps make more accurate and consistent decisions regarding the priorities of budget and tax policy. Third, it increases the transparency of budgetary process, there emerges a legal basis for the conclusion of multi-year government contracts, which regional budget, surplus, loans, debt burden, creates prerequisites for a more efficient use of budget funds. In addition, long-term planning promotes coordination of work of various departments of the executive branch.

According to the World Bank, more than two thirds of all countries use various modifications of multi-year budgeting: a study published in 2013 [23], suggests that within three years after the introduction of mediumterm planning the level of budget deficits was reduced to 2.6% of GDP, compared with a three-year period prior to its implementation.

In the Russian Federation the task of transition to long-term budget planning was set by the President of the Russian Federation in 2004 [8]. For the first time, a three-year federal budget was adopted in 2007, but in 2009, in connection with the outbreak of the global financial crisis, the Russian Government temporarily abandoned the scheme and returned to a one-year budget.

, in 2015, amid the slump in oil prices that determined the impossibility of adequate forecasting of budget revenues, a decision was made to prepare the federal and, subsequently, regional budget for one year.

From 2017 onward, the Russian Federation and its constituent entities return to the practice of budget planning over a three-year period.

Scenario conditions for the formation of the regional budget and its basic parameters

The formation of regional budgets is based on the government’s main financial plan – the federal budget, which is not only a key source of funding for socio-economic development of the country, but also a tool for inter-territorial redistribution of national funds.

The forecast of socio-economic development of the country prepared by the Government of the Russian Federation [22], which was the basis for the preparation of the federal budget, contains no prospects for a quick economic recovery, providing minimal growth for GDP, domestic investment and consumer demand amid low oil prices and the weakening of the national currency (Tab. 1) .

Inertial trends in the macroeconomic indicators will not help generate the necessary sources of expenditure financing, as evidenced by the forecast parameters of the federal budget [13] that provide for an annual reduction in revenue relative to GDP (Tab. 2).

Proving his theory of economic growth, John Keynes, a prominent English scientist and proponent of state regulation of the economy, stated: “the government should increase spending to boost production and employment, to pursue an active investment policy” [5]. The currently weak revenue base limits the possibility of using the Keynesian model in Russia. On the contrary, the content of the expenditure part of the federal budget indicates that for the period ahead, the task is set to consolidate the budget by reducing government spending to 16% of GDP in 2019, compared with 19% of GDP in 2016.

Experts from the Center for Macroeconomic Analysis and Short-Term Forecasting called intergovernmental relations with the subjects of the Russian Federation the “bottleneck” of the federal budget. The amount of financial aid to the regions will

Table 1. Main indicators of the forecast of socio-economic development of the Russian Federation for 2017–2019

|

Indicators |

Fact |

Forecast |

||||

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

|

Oil price, US dollars/Barrel |

97.6 |

51.2 |

41.7 |

40.0 |

40.0 |

40.0 |

|

GDP* |

100.7 |

97.2 |

99.8 |

100.6 |

101.7 |

102.1 |

|

Investment in fixed capital* |

97.3 |

91.6 |

97.7 |

99.5 |

100.9 |

101.6 |

|

Retail trade turnover* |

102.5 |

90.0 |

94.8 |

100.6 |

101.1 |

101.8 |

|

Real disposable monetary incomes of the population* |

99.2 |

95.7 |

94.1 |

100.2 |

100.5 |

100.8 |

|

US dollar exchange rate, ruble/US dollar. |

38.4 |

61.0 |

67.0 |

67.5 |

68.7 |

71.1 |

|

* In comparable prices, % of the previous year. |

||||||

Table 2. Main parameters of the federal budget for 2017–2019, billion rubles

|

Parameters |

Fact |

Forecast |

||||

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

|

Revenues |

14497 |

13659 |

13460 |

13488 |

14209 |

14845 |

|

In % of GDP |

18.3 |

16.4 |

15.7 |

15.5 |

15.2 |

15.0 |

|

Expenditures |

14832 |

15620 |

16416 |

16241 |

16040 |

15987 |

|

In % of GDP |

18.7 |

18.8 |

19.1 |

18.7 |

17.4 |

16.2 |

|

- transfers to regional budgets |

1671 |

1617 |

1578 |

1533 |

1513 |

1443 |

|

In % of GDP |

2.1 |

1.9 |

1.8 |

1.8 |

1.6 |

1.4 |

|

Deficit |

-335 |

-1961 |

-2956 |

-2753 |

-2011 |

-1142 |

|

In % of GDP |

0.4 |

2.4 |

3.4 |

3.2 |

2.2 |

1.2 |

Source: [13]; Federal Treasury [16]; Rosstat [18]; author’s calculations.

annually decline both in nominal terms and as a share of GDP, which could lead to a regional wave of budget crises [19].

According to some experts, draft federal budgets in recent years reflect flaws in economic policy and represent good wishes in the absence of real conditions for their implementation [1, 3].

The principle of fiscal consolidation underlying the 2017–2019 federal budget is reflected in the basic parameters of budgets of Russian Federation constituent entities, including the budget of the Vologda Oblast.

When forming the budget, the government proceeded from the basic directions of budgetary, tax and debt policy of the Vologda Oblast in 2017 and for the planning period of 2018 and 2019 [10], the content of which helps identify three key priorities for the next budget cycle:

-

1. Strengthening and increasing the revenue base of the budget, creating favorable conditions for business development.

-

2. Ensuring the balance of the regional budget.

-

3. Decreasing the debt burden on the regional budget and diversifying the debt structure.

To what extent does the budget approved by the oblast law [9] corresponds to the implementation of such tasks? We shall try and answer this question in analyzing the budget parameters.

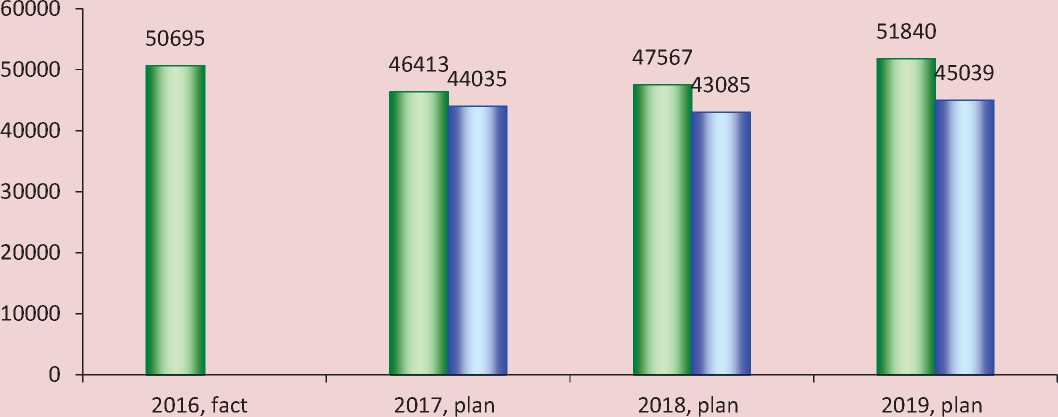

Despite negative dynamics of the regional budget revenues, it is planned to achieve its annual surplus, which is expected to be achieved through cost reductions: already in 2017 the expenditure part of the budget decreased by 4.3 billion rubles, or 8.4% (Tab. 3) .

In the next three years it is expected to increase tax and non-tax (hereinafter – own) revenues of the regional budget by five billion rubles, but this increase is levelled off by an equivalent amount of reducing gratuitous transfers from the federal budget that will determine the overall decrease in the revenues.

In our opinion, the planned increase in the own revenues may be overly optimistic.

Table 3. Main parameters of the regional budget of the Vologda Oblast in 2016–2019

|

Parameters |

2016, fact |

2017, plan |

2018, plan |

2019, plan |

2019 to 2016, % |

|||

|

Mln rub. |

To 2016, % |

Mln rub. |

To 2017, % |

Mln rub. |

To 2018, % |

|||

|

Revenues |

55518 |

50379 |

90.7 |

49228 |

97.7 |

53696 |

109.1 |

96.7 |

|

- tax and non-tax |

43722 |

43112 |

98.6 |

44054 |

102.2 |

48699 |

110.5 |

111.4 |

|

- intergovernmental transfers |

9970 |

7063 |

70.8 |

5174 |

73.2 |

4996 |

96.6 |

50.1 |

|

Expenditures |

50695 |

46413 |

91.6 |

47567 |

102.5 |

51840 |

109.0 |

102.3 |

|

Surplus |

4823 |

3966 |

82.2 |

1661 |

41.9 |

1856 |

111.7 |

38.5 |

Sources: [9]; [16]; author’s calculations.

Table 4. Main indicators of the forecast of socio-economic development in the Vologda Oblast in 2017–2019, in comparable prices, percentage of the previous year

|

Indicators |

Fact |

2016, estimate |

Forecast |

|||

|

2014 |

2015 |

2017 |

2018 |

2019 |

||

|

GRP |

103.0 |

101.0 |

100.2 |

100.8 |

101.5 |

101.7 |

|

Industrial production index |

103.7 |

102.6 |

99.1* |

101.6 |

102.0 |

102.5 |

|

Investments in fixed capital |

99.0 |

90.4 |

97.4 |

96.8 |

98.0 |

98.9 |

|

Retail trade turnover |

102.0 |

90.3 |

92.8* |

102.5 |

102.5 |

103.7 |

|

Real monetary incomes of the population |

102.4 |

98.4 |

100.2 |

100.8 |

101.4 |

101.8 |

|

Real average wages |

98.3 |

88.3 |

97.6 |

97.8 |

97.8 |

98.1 |

|

Consumer price index |

112.0 |

112.0 |

105.0* |

105.4 |

105.0 |

104.7 |

|

* Vologdastat factual data. |

||||||

It is necessary top take into account that the budget parameters are set in the current expression, without adjustments for price index, and the main macro-economic parameters [11], acting as a foundation for the tax base of the budget are given in real terms, that is, in comparable prices (Tab. 4) . It is for a reason that against the backdrop of stagnating GDP dynamics, industrial production, domestic consumption and a long-term decline in investment activity, the budget envisages a growth in revenues by 11.4%.

The realistic planning of budget revenues was impossible due to the absence of correlation between the macroeconomic and budget indicators.

Regional budget revenues

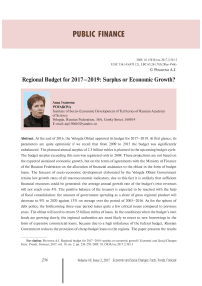

Calculations show that in the years 2017– 2019 the real1 collection of the budget’s own revenues will not reach the level of 2016 (Fig. 1) .

The decrease in the revenues will affect almost all the main components of local revenue sources. At that, the mobilization of income tax will be reduced not only in real but also in nominal terms (Fig. 2) .

A major factor in the reduction of receipts of profit tax is the legislative changes providing for the centralization of 1% of income tax receipts in the federal budget2; as a result, the

Figure 1. Own revenues in the regional budget of the Vologda Oblast in 2016–2019, million rubles

2016, fact

2017, plan

2018, plan

2019, plan

-

□ In current prices □ In comparable prices

Sources: data [9]; [11]; [16]; author’s calculations.

Figure 2. Profit tax proceeds in the regional budget of the Vologda Oblast in 2016–2019, million rubles

□ In current prices □ In comparable prices

Sources: data [9]; [11]; [16]; author’s calculations.

tax will be received by regional budgets at the rate of 17% instead of an earlier rate of 18%. According to the Department of Finance, this will reduce the regional budget revenues by 1.9 billion rubles. According to estimations by the Accounts Chamber of the Russian Federation, in 2017–2019, budgets of Russian regions in general will miss 378 billion rubles, or about 20% of profit tax proceeds [12].

Thus, instead of developing comprehensive measures for overcoming the crisis of sub-federal budgets, federal authorities make ns that not always help reallocate revenue sources, which actually means a deterioration of the financial situation in the regions.

Moreover, when in 2012 the taxation of large business within a consolidated taxpayers group (CTG) was introduced, the oblast authorities were actually deprived of access to the financial performance of the largest taxpayers in the regional budget – PAO Severstal and JSC FosAgro-Cherepovets. As a result, starting from 2014, the profit of these companies that generate 60% of the total profit of large and medium organizations is not included in the forecast of socioeconomic development of the oblast, this fact prevents from establishing a link between macroeconomic and budget forecasting. For instance, in the regional budget for 2017– 2019, the aggregate profit of organizations is set at the figure of 44.3 billion rubles. According to rough estimates, profit tax in the regional budget (at a rate of 17%) should amount to 7.5 billion rubles, and the proceeds of the tax are forecast in the amount of 32 billion rubles, i.e. four times more.

In the upcoming three-year period it is planned that PAO Severstal will provide 2.5 billion rubles, or 23% of the total amount of profit tax proceeds. At that, the adopted forecast is based on the actual profitability of sales in 2014–2016. However, evidence shows that profitability does not always provide a sufficient economic basis for the planning of budget revenues: for example, in 2012–

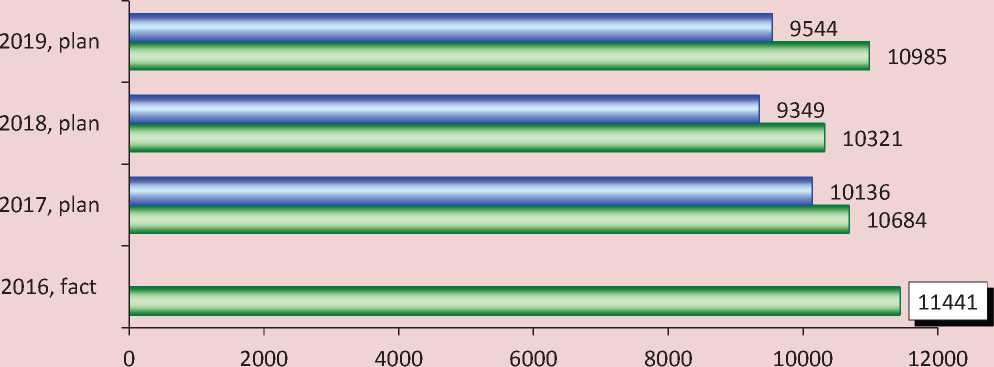

2015, with an increase in return on sales of PAO Severstal, the deductions of profit tax, by contrast, were decreasing continuously (Fig. 3).

Undoubtedly, profit from sales is one of the main factors in the formation of profit for tax purposes; however, existing legislative mechanisms for the administration of the profits of the largest taxpayers make it possible to use multiple channels for its optimization. Thus, according to the financial statements of PAO Severstal for 2015, profit before tax amounted to 44.3 billion rubles. According to calculations, the Vologda Oblast budget could receive eight billion rubles of profit tax from this sum. In fact, the calculated amount of the payment amounted to only five million rubles. The fact is that in accordance with current legislation, profit tax is not calculated from the profit before tax but from the taxable profit, the calculation of which is based on different, compared to profit before tax, approaches to the recognition of different types of profits and expenses. According to ISEDT RAS research findings, in practice, the quite complicated rules for determining the tax base often lead to substantial losses of budget revenues [4, 21].

As we see it, the expectations concerning another main source of regional budget revenues – individual income tax – can also turn out inflated, which is associated with a fall in the growth rate of the tax base on the background of advancing increase in inflation (Tab. 5) .

Figure 3. Financial performance of the sales and proceeds of profit tax of PAO Severstal in the regional budget of the Vologda Oblast in 2011–2016

■ ■ Profit from sales, billion rub.

■ ___ ■ Profit tax, billion rub.

—•— Profitability of sales, %

Source: financial statements of PAO Severstal [15]; Federal Tax Service [17]; author’s calculations.

Table 5. Tax indicators and individual income tax receipts in the regional budget of the Vologda Oblast in 2016–2019

|

Indicators |

2016, fact |

2017, plan |

2018, plan |

2019, plan |

2019 to 2016, % |

|

Tax indicators |

|||||

|

Consumer price index, % |

105.0 |

105.4 |

105.0 |

104.7 |

115.9 |

|

Real average monthly wage, % |

97.6* |

97.8 |

97.8 |

98.1 |

93.8 |

|

Individual income tax proceeds, million rubles |

|||||

|

In current prices |

12709 |

12851 |

13214 |

13613 |

107.1 |

|

In comparable prices |

12193 |

11969 |

11827 |

93.1 |

|

|

Sources: [9]; [11]; [16]; author’s calculations. |

|||||

The strong increase can observed only in relation to property taxes (Tab. 6) , but it is due not to economic growth, but to changes in fiscal regulation of these taxes. In 2016, the Vologda Oblast shifted to the calculation of property tax on the basis of cadastral value of real estate objects, and in the forecast period it is planned to increase tax rates for property tax for natural monopolies gradually.

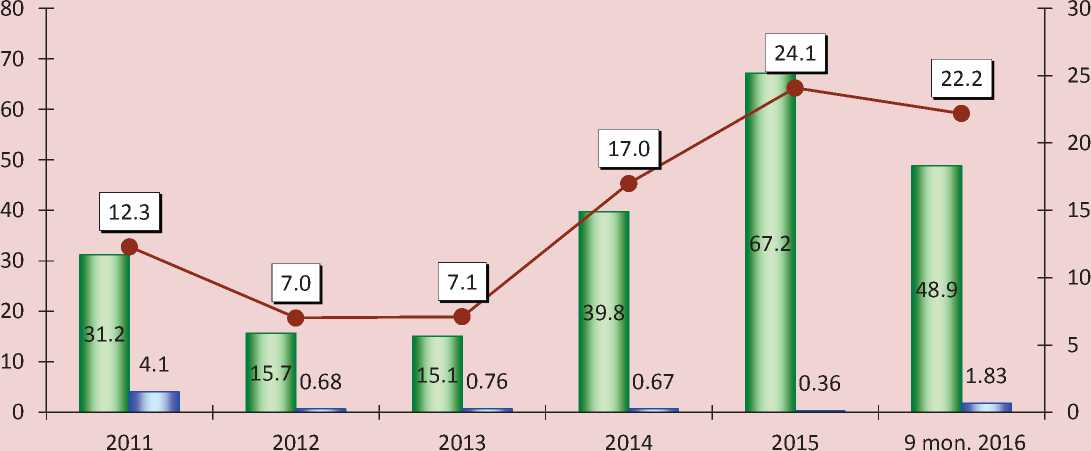

The dynamic growth of property taxes will determine the change in the structure of tax revenues: by the end of the forecast period, property payments will be a key catalyst for tax revenues, while profit tax will lose this function completely (Fig. 4) .

The increase in the importance of property taxes is certainly a positive trend, as their proceeds are stable, unlike profit tax, which

. Property tax proceeds in the regional budget of the Vologda Oblast in 2016–2019, million rubles

|

Indicators |

2016, fact |

2017, plan |

2018, plan |

2019, plan |

2019 to 2016, % |

|

Total - in current prices |

10267.7 |

11117.6 |

12067.5 |

15164.9 |

147.7 |

|

- in comparable prices |

10548.0 |

10930.7 |

13175.4 |

128.3 |

|

|

Corporate property tax - in current prices |

8952.3 |

9772.8 |

10592.3 |

13373.9 |

149.4 |

|

- in comparable prices |

9272.1 |

9594.5 |

11619.4 |

129.8 |

|

|

Rates for natural monopolies, % |

1.3 |

1.6 |

1.9 |

2.2 |

+0.9 p.p. |

|

Rates for organizations applying special regimes of taxation*, % |

0.5 |

1.0 |

1.5 |

2.0 |

+1.5 p.p. |

|

* Simplified taxation and unified tax on imputed income. Sources: [9]; [11]; [16]; author’s calculations. |

|||||

Figure 4. Structure of main tax revenues of the regional budget of the Vologda Oblast in 2008–2019, %

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

□ Excises □ Profit tax □ Individual income tax □ Property taxes

Sources: [9]; [16]; author’s calculations.

depends on market fluctuations. In aggregate, property taxes and individual income tax will generate 60% of own revenue sources, which is equivalent to the share of profit tax proceeds in 2008.

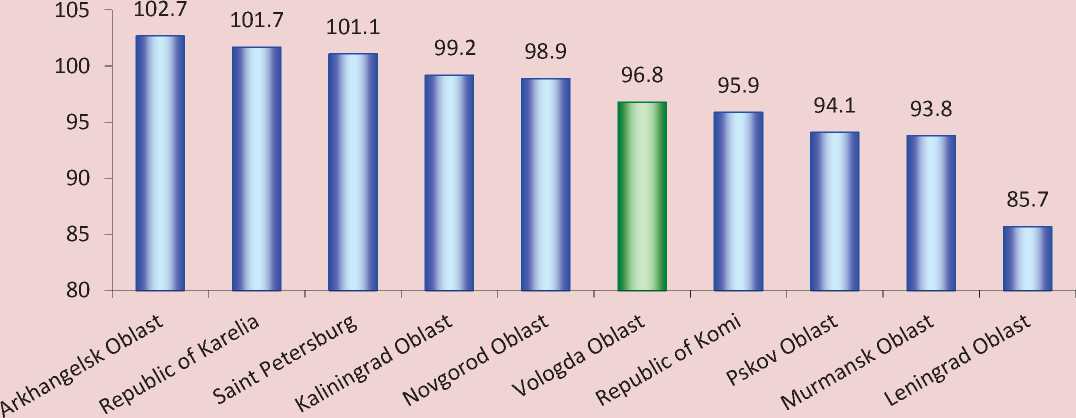

In accordance with the approved budgets, in two thirds of the regions of the Northwestern Federal District by 2020, proceeds of real own revenues will be below the level of 2016 (Fig. 5).

Negative or insignificant rates of mobilization of own revenue sources indicate the presence of lingering problems in the economy of Russia’s constituent entities and, consequently, threats to continuous increase in revenue potential.

Figure 5. Proceeds of own revenues in the regional budgets of constituent entities of the Northwestern Federal District in comparable prices, 2019 to 2016, %

Sources: laws of constituent entities of the Northwestern Federal District on the regional budget for 2017–2019; [16]; author’s calculations.

Regional budget expenditures

In 2017–2018 nominal spending is expected to decrease in comparison with the level of 2016. In 2019, budget expenditures will grow slightly, but in real terms it will be lower than that of 2016 by 5.7 billion rubles, or 11% (Fig. 6) .

An economic indicator such as the share of expenditures in GRP reflects most objectively the restriction orientation of the budget (Fig. 7) .

The data in the figure show that in the planned period the amount of expenditures as a share of GRP is expected to decline to 9% versus 11–16% in previous years. This indicates the narrowing of possibilities for using the budget as a tool to accelerate economic growth.

An aggregate nominal growth of expenditures in 2019 will be achieved through the increase in management costs and payments aimed to service public debt, that is, at the expense of non-productive costs. In all other directions it is planned to reduce funding, which will affect mostly the provision of support to economic branches and municipal infrastructure (Tab. 7) .

It is necessary to explain the fact of changing the amount of expenditures on health care and social policy. The fact is that in the course of introducing amendments to the budget classification, the expenditures on compulsory health insurance of non-working population were moved from the section “Healthcare” to the section “Social policy”. In fact, it does not mean the reduction or

Figure 6. Expenditures of the regional budget of the Vologda Oblast in 2016–2019, million rubles

□ In current prices □ In comparable prices

Sources: [9]; [11]; [16]; author’s calculations.

Figure 7. Proportion of expenditures of the regional budget of the Vologda Oblast in GRP in 2005–2019, %

increase in funding, but a simple redistribution of budgetary funds.

Budget sequestration will not affect the section “National matters”. For instance, in 2017, when the general expenses of the regional budget fell by 8.4% growth in expenditures for this section will be 7% due to the increased funding of regional bodies of executive power, judicial, financial systems and other management costs. In 2019, expenditures will exceed the level in 2016 as well (Tab. 8).

Table 7. Dynamics of expenditures of the regional budget of the Vologda Oblast in 2016–201

|

Expenditures |

2016, fact |

2017, plan |

2018, plan |

2019, plan |

||||

|

Mln rub. |

Mln rub. |

To 2016, % |

Mln rub. |

To 2017, % |

Mln rub. |

To 2018, % |

To 2016, % |

|

|

Total |

50695 |

46413 |

91.6 |

47567 |

102.5 |

51840 |

109.0 |

102.2 |

|

National matters |

2388 |

2555 |

107.0 |

2450 |

95.9 |

2549 |

104.0 |

106.7 |

|

National economy |

9104 |

7703 |

84.6 |

7471 |

97.0 |

8337 |

111.6 |

91.6 |

|

Housing and utilities |

1632 |

820 |

50.2 |

283 |

34.5 |

286 |

101.1 |

17.5 |

|

Social services, total |

33639 |

31648 |

94.1 |

32448 |

102.5 |

32086 |

98.9 |

95.4 |

|

- education |

11220 |

11082 |

98.8 |

10785 |

97.3 |

10725 |

99.4 |

95.6 |

|

- culture |

571 |

619 |

108.4 |

553 |

89.3 |

515 |

93.2 |

90.2 |

|

- healthcare |

8579 |

3150 |

36.7 |

2961 |

94.0 |

2806 |

94.8 |

32.7 |

|

- social policy |

13063 |

16644 |

127.4 |

17864 |

107.3 |

17890 |

100.1 |

137.0 |

|

Interest payments |

1370 |

1229 |

89.7 |

1411 |

114.8 |

1515 |

107.4 |

110.6 |

|

Intergovernmental transfers |

16121 |

12811 |

79.5 |

12082 |

94.3 |

11701 |

96.8 |

72.6 |

|

Sources: [9]; [16]; author’s caiculations. |

||||||||

Table 8. Expenditures of the regional budget of the Vologda Oblast under the section “National matters” in 2016–2019, million rubles

|

Expenditures |

2016, fact |

2017, plan |

To 2016, % |

2019, plan |

To 2016, % |

|

Total |

2387.7 |

2554.6 |

107.0 |

2549.0 |

106.8 |

|

Governor |

5.95 |

5.5 |

92.4 |

5.3 |

88.3 |

|

Legislative authorities |

235.4 |

244.4 |

103.8 |

226.2 |

96.2 |

|

Executive authorities |

263.3 |

282.0 |

107.1 |

271.1 |

103.0 |

|

Judicial system |

206.0 |

220.2 |

106.9 |

215.1 |

104.4 |

|

Financial authorities and financial supervisory agencies |

196.3 |

213.6 |

108.8 |

215.1 |

110.0 |

|

Election |

127.5 |

56.8 |

44.5 |

157.2 |

123.3 |

|

Other issues |

1352.9 |

1432.2 |

105.9 |

1362.2 |

100.7 |

|

Sources: [9]; [16]; author’s calculations. |

|||||

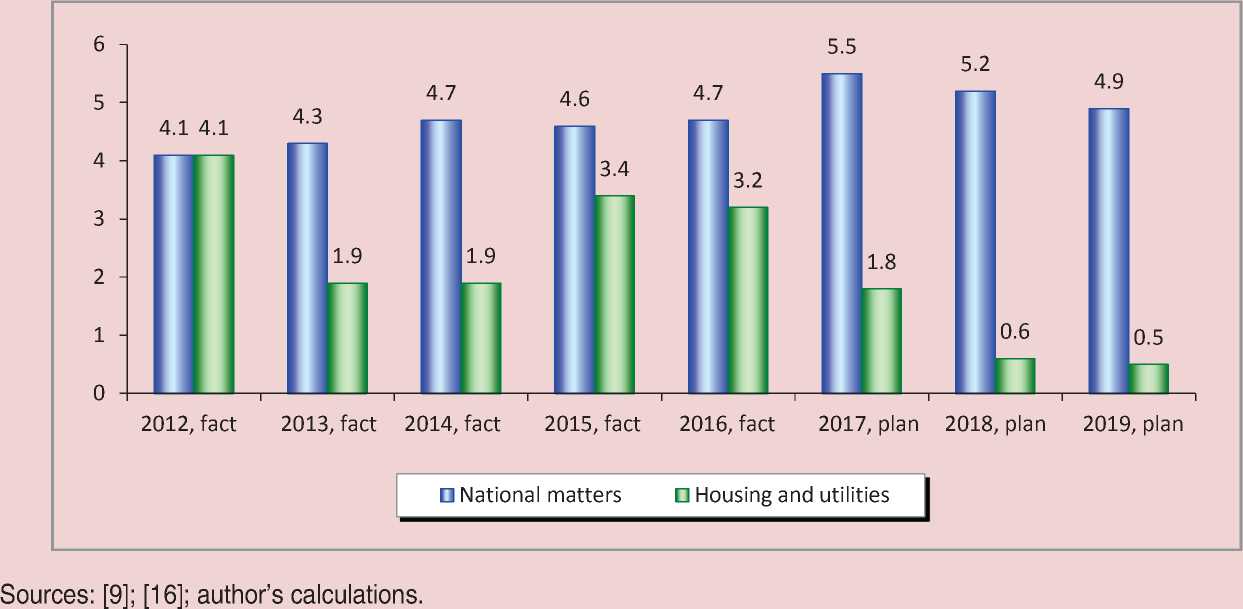

The expenditures of the regional budget under this section exceed the funding of several important areas. For example, if in 2012 the share of expenditures on administration and that on housing and utilities in the amount of the expenditure part of the budget were equal, then in 2016 they had a contrasting trend: the proportion of administration expenditures has increased, and the share of financial support to housing and utilities has decreased. In the forwardlooking budget cycle, on average less than

1% of budget expenditures will be spent ono housing and utilities, and more than 5% – on administration (Fig. 8) .

Such imbalances in the distribution of budget funds indicate the need for a more careful choice of priorities of budgetary policy and also the reserves for possible optimization of expenditures.

Convincing evidence of compliance with the principle of budget consolidation in the formation of the financial plan of the region is its investment component.

Figure 8. Proportion of expenditures on the sections “General national expenses” and “Housing and utilities” in the total expenditures of the regional budget of the Vologda Oblast in 2012–2019, %

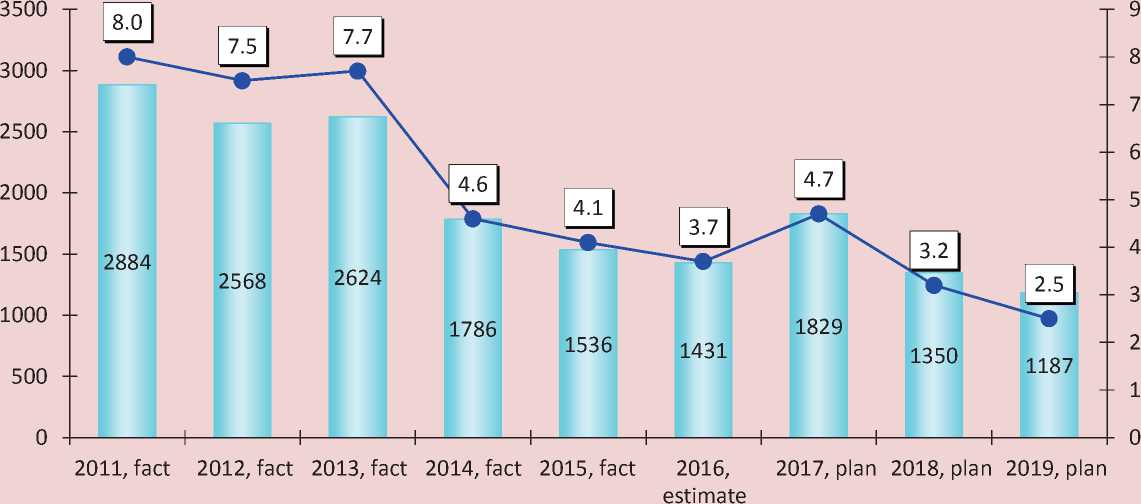

In conditions of acute shortage of financial resources the need for the implementation of this principle forces the government of the oblast to cut budget investments, in other words, the budget of development. Note that after the adoption of the May decrees of the President of the Russian Federation in 2012, capital investments were selected as the primary source of funds for the execution of these decrees. In 2012–2016, budget investments decreased by 50%. In the forecast period the trend of continuous reduction of the development budget will continue: in 2019, its share in the expenditures will be 2.5% versus 8% in 2011 (Fig. 9) .

We can conclude that in the short term virtually the entire regional budget will be directed toward financing priority needs. This does not meet the task of increasing the share of investment expenditures set out in the “Main directions of budgetary policy”, creating long-term risks for investors and for the future socio-economic development of the oblast. It stands to reason that the decline in the volume of investments in the fixed capital of the Vologda Oblast that began in 2013 was prolonged until 20263.

The growing socialization of the regional budget has not led to a measurable increase in the standard of living of Vologda residents (Tab. 9) .

In the forecast period, the share of expenditures on the salaries of the personnel

Figure 9. Expenditures* of the regional budget of the Vologda Oblast on capital investments in 2011–2019

Mln rub. • Share in budget expenditures, %

-

*To ensure comparability, the expenditures are given excluding non-repayable receipts. Sources: [9]; [16]; author’s calculations.

Table 9. Main types of social expenditures* of the regional budget of the Vologda Oblast and the level of poverty in 2015–2019

|

Indicatiors |

2015, fact |

2016, estimate |

2017, plan |

2018, plan |

2019, plan |

|

Payments to staff of government agencies and public institutions, mln rub. |

2407.0 |

2645.5 |

2666.8 |

2691.1 |

2691.1 |

|

Social payments, mln rub. |

9743.3 |

13646.6 |

13785.7 |

14573.3 |

14574.1 |

|

Total |

12150.3 |

16292.1 |

16452.5 |

17264.4 |

17265.2 |

|

Share in total budget expenditures, % |

25.3 |

32.1 |

35.4 |

36.3 |

33.3 |

|

Population with incomes below the subsistence level, thousand people |

167.7 |

175.7 |

171.8 |

170.3 |

165.3 |

|

In % of total population |

14.1 |

14.8 |

14.5 |

14.4 |

14.0 |

*Excluding intergovernmental transfers to the budgets of municipal formations.

Sources: Department of Finance of the Vologda Oblast [14]; [11]; author’s calculations.

of public institutions and on social payments will increase to an average of 35% versus 25% in 2015, and the average annual number of citizens with incomes below the subsistence level will be 169 thousand people, or 14.3% of the total population. Thus, poverty rate will be higher than 2015.

Considering the expenditure side of the regional budget, we cannot ignore its program component. Starting in 2015, more than 90% of expenditures is planned to be allocated for the implementation of government programs (GP) of the Vologda Oblast, which can be grouped into three areas (Tab. 10) .

Table 10. Planned expenditures of the regional budget of the Vologda Oblast on the implementation of government programs in 2016–2019

|

Program |

2016 |

2017 |

2018 |

2019 |

2019 to 2016, % |

|

Program expenditures, total |

48309.3 |

44000.8 |

44740.9 |

45186.8 |

93.5 |

|

Human development and improving the quality of life |

|||||

|

Social support |

11311.5 |

10262.7 |

10886.1 |

10885.3 |

96.2 |

|

Development of education |

10731.9 |

10612.4 |

10445.1 |

10445.1 |

97.3 |

|

Healthcare development |

8272.0 |

8299.6 |

8269.8 |

8267.5 |

99.9 |

|

Provision of affordable housing |

1533.0 |

1142.5 |

1459.5 |

1234.8 |

80.5 |

|

Other |

1731.6 |

2572.1 |

2542.4 |

2517.7 |

145.4 |

|

Total |

33580.0 |

32889.3 |

33602.9 |

33350.4 |

99.3 |

|

Proportion in program expenditures, % |

69.5 |

74.7 |

75.1 |

73.8 |

+4.3 p.p. |

|

Increase the sustainability and modernizati on of priorit y sectors of the economy |

|||||

|

Development of the transport system |

5440.3 |

4538.1 |

4641.1 |

5334.1 |

98.0 |

|

Development of the agro-industrial complex and consumer market |

3275.2 |

2149.7 |

2129.6 |

2108.6 |

64.4 |

|

Economic development |

1037.8 |

334.1 |

162.6 |

162.6 |

15.7 |

|

Support and development of small and medium enterprises |

166.9 |

91.1 |

91.1 |

91.1 |

54.6 |

|

Other |

818.4 |

954.6 |

961.6 |

969.5 |

118.5 |

|

Total |

10738.6 |

8067.6 |

7986.0 |

8665.9 |

80.7 |

|

Proportion in program expenditures, % |

22.2 |

18.3 |

17.8 |

19.2 |

-3 p.p. |

|

Improving the public administration system |

|||||

|

Improving public administration |

189.3 |

200.8 |

201.1 |

201.1 |

106.2 |

|

Management of regional finances |

3087.8 |

2827.1 |

2951.0 |

2969.5 |

96.2 |

|

Total |

3277.1 |

3027.9 |

3152.1 |

3170.6 |

96.8 |

|

Proportion in program expenditures, % |

6.8 |

6.9 |

7.0 |

7.0 |

+0.2 p.p. |

|

Source: compiled by the author according to [9]; [14]. |

|||||

The analysis of the dynamics and structure of program expenditures shows that they will retain a social orientation: more than 70% of program funding will be allocated for the development of human capital.

However, the improvement of living conditions of Vologda residents, rightly claimed as a priority when forming the budget, is impossible without a more or less stable economic growth. However, reducing the funding of programs in the economy will be the most significant – more than 19%. For example, the expenditures on the GP “Economic development in the Vologda

Oblast for 2014–2020”4 will be reduced by 84% compared to the level of 2016. This approach to the formation of financial resources that are clearly insufficient is contrary to the goals of creating conditions for sustainability and increasing the pace of economic development of the region outlined in the program.

It should be emphasized that only in 2017, out of 8 billion rubles of the total amount of allocations for the implementation of economic recovery programs, 2 billion rubles, or a quarter, were intended for financing the activities of state institutions and managerial functions in the branches of national economy.

Given a general reduction in program funding by 6.5%, the expenditures on public administration programs will decrease by 3.2%. The amount of funds allocated to the GP “Management of regional finance in the Vologda Oblast for 2015–2020”5 will be an average of 3 billion rubles annually, which will exceed the planned allocations for educational, health, transport and social support programs. Noteworthy is the lack of consistency between the allocation of expenditures and the goals of the program. For example, the aim of the subprogram “Ensuring the balance of the regional budget” is to ensure the execution of the budget based on the principles of long-term balance and stability, and the entire amount of expenditures under this subprogram is planned to be used to maintain the Committee for Information Technology and Telecommunications. In general, about half of program funding will be directed toward servicing public debt and the maintenance of the Department of Finance of the oblast.

It is possible that during the execution of the budget the expenditures will undergo structural changes; however, at the stage of formation and approval of the main financial plan, the structure of allocations does not show that the region’s economic development is its priority, and, consequently, the creation of conditions for business developm strengthening the revenue base of the budget seems unlikely.

Debt policy

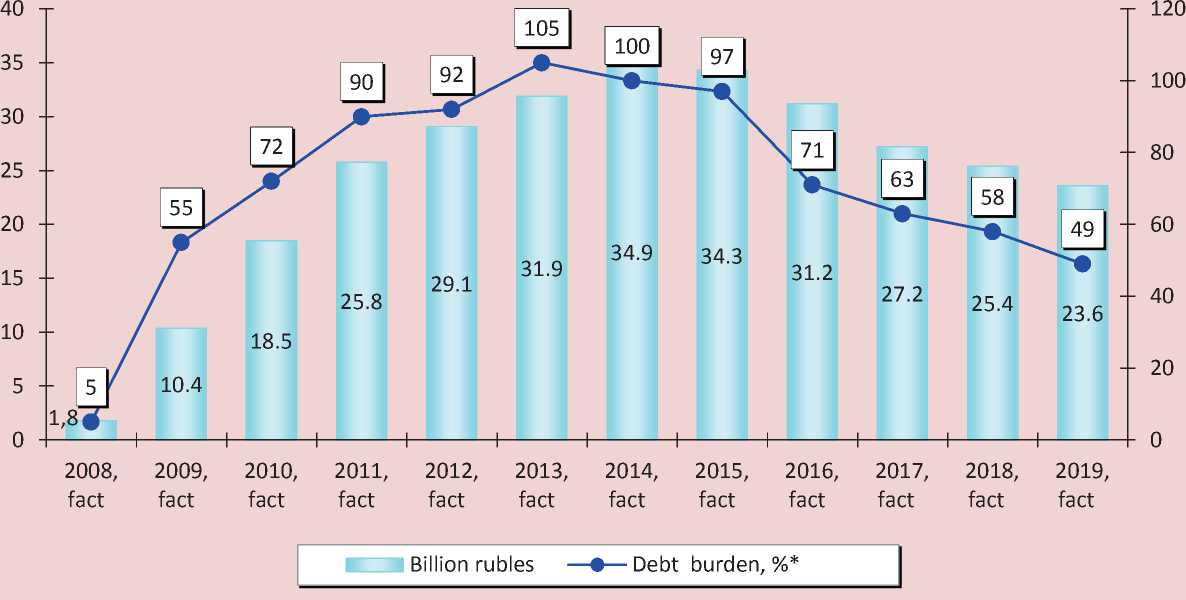

Unfortunately, there remains a complicated issue of public debt, although in 2016, for the first time since 2009, it was possible to reduce the absolute amount of debt by 3.2 billion rubles and to ease the debt burden of the regional budget to 71% versus 90–105% in the previous periods (Fig. 10).

By 2020 it is planned to reduce debt liabilities by the 7.5 billion rubles; however, the debt burden will remain substantial, amounting to almost half of the volume of own revenues of the budget.

In 2016 the debt burden was decreased mainly with the help of loans obtained by the oblast in the amount of 20.7 billion rubles from the federal budget in 2014–2016 for the substitution of commercial loans.

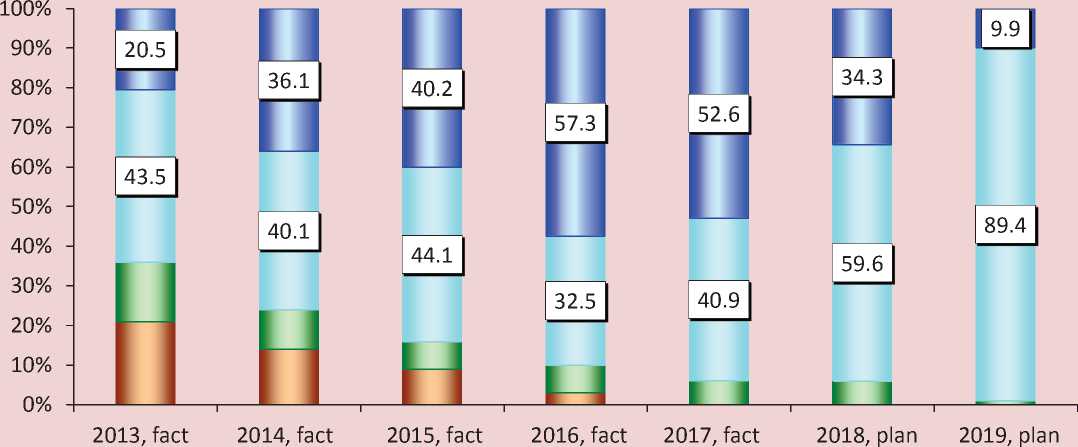

Large-scale financial assistance in 2016 determined the change in the structure of public debt in favor of budget loans (Fig. 11) .

At the same time, in the forecast period, commercial borrowings6 that are expensive from the point of view of their servicing will be the main tool of the debt policy in the region. Figure 11 shows that in 2018 they will regain a dominant role in the structure of public debt; and in 2019, almost 90% of the debt will be represented by the market component.

Figure 10. Public debt of the regional budget of the Vologda Oblast in 2008–2019

* Debt burden is calculated as the ratio of debt to own revenues of the budget. Sources: [9]; [14]; [16]; author’s calculations.

Figure 11. Structure of public debt of the regional budget of the Vologda Oblast in 2013–2019, %

□ Securities □ State guarantees □ Bank loans □ Budget loans

Sources: [9]; [14]; author’s calculations.

Naturally, the expansion of bank lending will lead to a growth of unproductive expenditures of the budget in the form of interest payments (Fig. 12) .

The volume of commercial loans in the debt structure will grow each year and it will increase twice in comparison with the volume of 2016. The cost of their servicing in 2018 will start growing again, reaching 3% of the budget expenditures. The level of interest payments will not exceed the standard of 15% set by the Budget Code of the Russian Federation. At the same time, the need to service the debt will cause a significant reduction in the funds that could be used in critical areas of life of Vologda residents: the volume of interest expenditures will exceed the combined allocations housing and utilities sector, transport system, environment, cultural activity and sports.

During 2017–2019, the Vologda Oblast is to ensure the repayment of the debt on the previously borrowed funds in the amount of 29.2 billion rubles: 10.7 billion rubles of market borrowings and 18.5 billion rubles of budget borrowings. New bank loans will be used as the main source of repayment, with the help of which it is planned to pay two thirds of the debts (Tab. 11) .

In addition to the loans received from the federal budget for the refinancing of market borrowings, it will be necessary to repay annually 9 billion rubles of loans issued by

Figure 12. Bank loans and interest payments of the regional budget of the Vologda Oblast in 2015–2019, billion rubles

■ ■ Bank loans

Interest payments

• Share of interest payments in budget expenditures, %

Sources: [9]; [14]; author’s calculations.

Table 11. Planned sources of repayment of loans from the regional budget of the Vologda Oblast in 2017–2019, million rubles

|

Indicators |

2017 |

2018 |

2019 |

Total for 2017–2019 |

|

Repayment of loans |

||||

|

Total |

14312.4 |

7281.5 |

7586.2 |

29180.1 |

|

- bank |

6852.9 |

1716.2 |

1209.4 |

9778.5 |

|

- budget |

6539.5 |

5565.3 |

6376.8 |

18481.6 |

|

- oblast securities |

920.0 |

0 |

0 |

920.0 |

|

Repayment sources |

||||

|

Own revenues |

6484.7 |

1512.0 |

415.7 |

8412.4 |

|

Proportion in the amount of return, % |

45.3 |

20.8 |

5.5 |

28.8 |

|

Bank loans |

7827.7 |

5769.5 |

7170.5 |

20767.7 |

|

Proportion in the amount of return, % |

54.7 |

79.2 |

94.5 |

71.2 |

|

Source: compiled by the author with the use of [9]; [14]; author’s calculations. |

||||

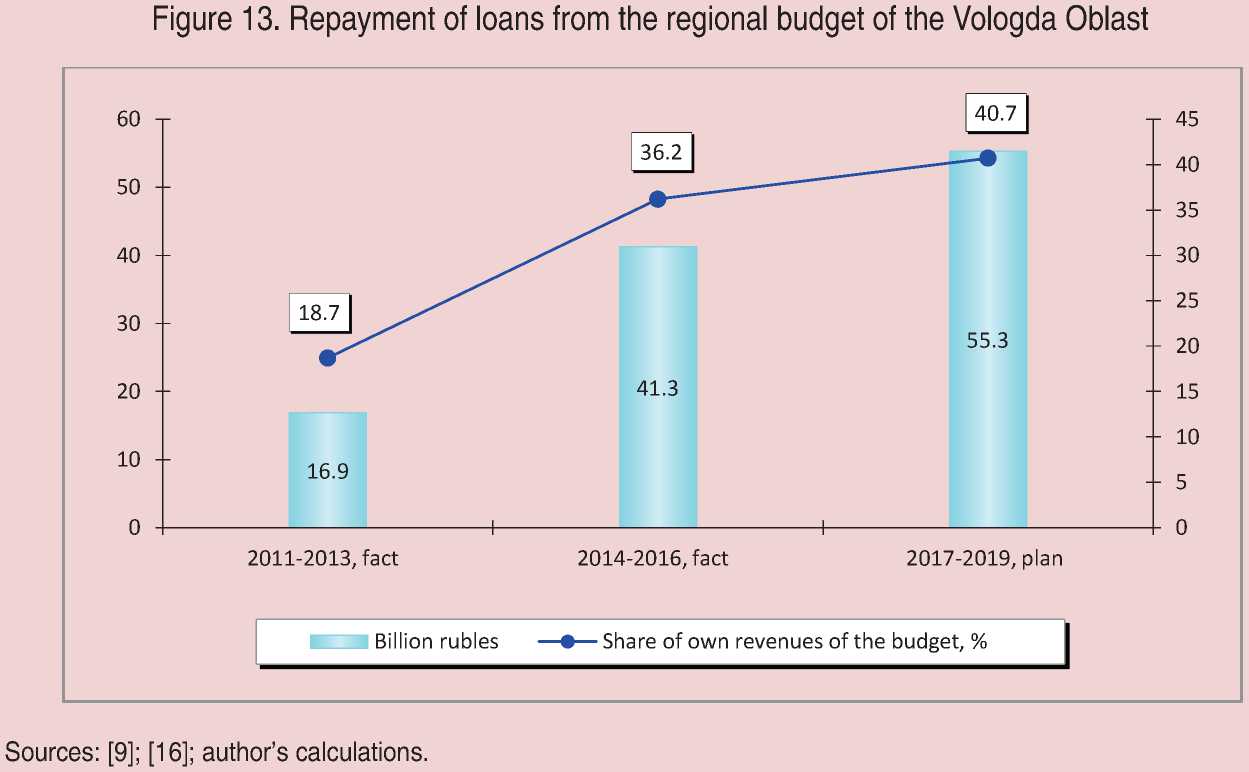

the territorial directorate of the Federal Treasury to cover temporary cash gaps arising during the execution of the budget. Taking into account these loans, the total amount of refunds for 2017–2019 will increase to 55.3 billion rubles, which considerably exceeds the indicators of previous years and which will be equivalent to more than 40% of the volume of own revenues of the regional budget (Fig. 13).

Large-scale expenditures on returning the loans will be the main risks for sustainable financing of the adopted expenditure commitments and for achieving the planned balance of the regional budget.

These data indicate that, if the agreements with the Ministry of Finance of the Russian Federation on the allocation of budget loans to the region are not prolonged, then it seems highly improbable that the government of the Vologda Oblast will find a solution to the problems of debt policy in terms of diversifying the debt structure and reducing the share of market debt.

Conclusions and suggestions

The regional budget of the Vologda Oblast in 2017–2019 has some conservative features. Its parameters are adapted to the surplus and do not fully consider the possible impact of the budget on the growth of the regional economy. The main priorities of budgetary policy will be as follows: further optimization of costs allocated primarily to the national economy and infrastructure; winding down the budget of development; resumption of a trend interrupted 2016 that aimed to escalate market borrowing and the return to the debt funding of expenditures.

Taking these facts into consideration, it will be very difficult to implement key objectives of fiscal policy in the short term. Perhaps, it will be possible to achieve a balanced budget, but not at the expense of economic growth, but because of the need to comply with the conditions set out by the Ministry of Finance of the Russian Federation with regard to receiving additional financial aid, which will require sequestration of expenditures.

Noting the defects of the budget, out that the constant lack of resources in regional budgets due to the destruction of the economic base of the majority of constituent entities of the Russian Federation in the course of market reforms has become a primary issue of budget federalism. In the actual absence of points of growth in most territories the reserves for internal optimization are almost exhausted. It is obvious that without altering the super-centralized budget model the problem of self-sufficiency of Russian regions can not be solved.

It is important to point out that the issues of finding the quickest solution to the problem of tax reallocation between the center and the subjects in favor of the latter are being considered only at the level of the Federation Council. In particular, it is proposed by V. Vasiliev, Deputy Chairman of the Committee on Economic Policy, who offers to amend the rules of distribution of federal budget subsidies, which would take into account industrial, socio-demographic and infrastructural features of regions [2].

We agree with the opinion of V. Vasiliev and add that the revenue potential of the territories can be enhanced with the help of the following measures:

-

1. Reforming individual income taxation by establishing graded rates, primarily in respect of super-profits. According to ISEDT RAS calculations, the introduction of progressive taxation only in respect of Russian billionaires will help double individual income tax receipts in regional budgets [20].

-

3. The introduction of a standard that would limit the amount of previous years’ losses that could be written off when calculating profit tax (for example, not more than 30% of the taxable profit). According to our calculations, the losses of profit tax due to the write-off of the losses increased from 95 billion rubles in 2011 to 190 billion rubles in 2015.

-

4. The tightening of tax administration for consolidated groups of taxpayers up to their liquidation in case of repeated absence of taxable profits.

-

5. The abolition of federal benefits for regional and local taxes. According to ISEDT RAS calculations, the revenues that the regional budget of the Vologda Oblast did not receive due to the shortfalls of corporate property tax alone as a result of preferences granted in accordance with federal legislation increased from 0.3 billion rubles in 2014 to 1.1 billion rubles in 2015, nearly in four times.

-

6. The reimbursement of expenses of regional budgets for the implementation of the decrees of the President of the Russian Federation from May 07, 2012.

-

7. The increase in federal budget allocations on granting budget loans to the

regions in order to substitute the market debt in the amount of not less than 50% of its sum, or maintaining the amount of these allocations at the level of 2016.

-

8. Taking steps to recover the receivables of chief administrators of budget funds. According to the Federal Treasury, at the beginning of 2016, the receivables of sub-federal budgets amounted to more than a trillion rubles (in the Vologda Oblast – 1.9 billion rubles).

-

9. Legislating the procedure for the distribution of intergovernmental transfers to the subjects of the Russian Federation from the federal budget, which must be distributed prior to the drafting of regional budgets. Annual failure to comply with the proposed procedure leads to the disruption of the budget process in the regions. As a result, the untimely distributed and received transfers are returned to the federal budget in accordance with the budget legislation. By the end of 2016, regions returned 42 billion rubles of unused subsidies and subventions, which is two times more than in the previous year (the returns in the Vologda Oblast increased from 43 to 156 million rubles).

-

10. Boosting the recovery of debts on payments to the budget. According to the Federal Tax Service, as of January 1, 2017, a possible debt on taxes and fees (excluding penalties and interest) that can be recovered in the consolidated regional budgets amounted to 537.5 billion rubles, and in the Vologda Oblast it is 2.9 billion rubles.

aintaining the procedure of distribution of excises on alcoholic production that was in force until 2017. According to the Department of Finance of the Vologda Oblast, if a centralized system for distributing these types of excise taxes is adopted, then the regional budget will not receive the revenues amounting to 1.8 billion rubles.

Along with the use of above-mentioned reserves, Russian authorities should move to comprehensive activities aimed to stabilize regional budgets, the key activities, in our opinion, should be as follows: equal distribution of tax revenues by levels of the budget; revision of revenue and expenditure powers of constituent entities of the Russian

Federation; revision of economic p relation to the largest high-yield taxpayers to determine their contribution to the development of the country. Only then can the budget become a real, and not declarative, instrument of state control aimed at an active restructuring of the economy and the standard of living of Russians.

Список литературы Regional budget for 2017-2019: surplus or economic growth?

- Bokareva L. Tseli i riski reformy upravleniya gosudarstvennymi finansami RF . Obshchestvo i ekonomika , 2016, no. 12, pp. 46-64..

- Vasil'ev V. K kazhdomu svoi podkhod . Izvestiya , 2016, no. 206, p. 6..

- Dvoretskaya A.E. Srednesrochnye perspektivy byudzheta RF . EKO, 2016, no. 8, pp. 104-119..

- Ilyin V.A., Povarova A.I. Effektivnost' gosudarstvennogo upravleniya 2000-2015. Protivorechivye itogi -zakonomernyi rezul'tat . Vologda: ISERT RAN, 2016. 304 p..

- Keynes J.M. Obshchaya teoriya zanyatosti, protsenta i deneg . Moscow: Eksmo, 2007. 960 p..

- Kochkarov R.A. Strategicheskoe planirovanie i prognozirovanie . Vestnik Finansovoi akademii , 2006, no. 4, pp. 97-109..

- Mikhailova A.A. Obshchestvennye finansy-2010: vzaimouvyazka strategicheskogo i byudzhetnogo planirovaniya . Byudzhet , 2010, no. 10. Available at: http://bujet.ru/article/99580.php.

- O byudzhetnoi politike v 2005 godu: byudzhetnoe Poslanie Prezidenta Rossiiskoi Federatsii ot 12.07.2004.. Available at: http://www.kremlin.ru/events/president/transcripts/24872.

- Ob oblastnom byudzhete na 2017 god i planovyi period 2018 i 2019 godov: zakon Vologodskoi oblasti ot 19.12.2016 No. 4071-OZ . Available at: http://www.vologdazso.ru/.

- Ob osnovnykh napravleniyakh byudzhetnoi, nalogovoi i dolgovoi politiki Vologodskoi oblasti na 2017 god i na planovyi period 2018 i 2019 godov: postanovlenie Pravitel'stva Vologodskoi oblasti ot 24.10.2016 № 942 . Konsul'tantPlyus: spravochno-poiskovaya sistema ..

- O prognoze sotsial'no-ekonomicheskogo razvitiya Vologodskoi oblasti na srednesrochnyi period 2017-2019 godov: postanovlenie Pravitel'stva Vologodskoi oblasti ot 31.10.2016 № 977. . Available at: http://www.economy.gov35.ru/departments/strategic_planning/macroeconomics_and_strategic_planning/.

- O federal'nom byudzhete na 2017 god i na planovyi period 2018 i 2019 godov: zaklyuchenie Schetnoi palaty RF na proekt federal'nogo zakona . Available at: http://www.ach.gov.ru/activities/audit-of-the-federal-budget/.

- O federal'nom byudzhete na 2017 god i na planovyi period 2018 i 2019 godov: federal'nyi zakon ot 19.12.2016 goda № 415-FZ . Available at: http://minfin.ru/ru/.

- Ofitsial'nyi sait Departamenta finansov Vologodskoi oblasti . Available at: http://df35.ru/.

- Ofitsial'nyi sait PAO «Severstal'» . Available at: http://www.severstal.ru/.

- Ofitsial'nyi sait Federal'nogo kaznacheistva Rossii . Available at: http://www.roskazna.ru.

- Ofitsial'nyi sait Federal'noi nalogovoi sluzhby Rossii . Available at: http://www.nalog.ru/.

- Ofitsial'nyi sait Federal'noi sluzhby gosudarstvennoi statistiki . Available at: http://www.gks.ru/.

- Penukhina E.A. Byudzhet kak instrument dolgosrochnogo razvitiya: vozmozhnosti i ogranicheniya: doklad na Uchenom sovete INP RAN 18.11.2016 g. . Available at: http://www.forecast.ru/_ARCHIVE/Presentations/Penukhina/2016-11-18.pdf.

- Povarova A.I. Reformirovanie naloga na dokhody fizicheskikh lits -vazhneishii faktor stabilizatsii byudzhetnoi sistemy . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2016, no. 6 (48), pp. 193-213..

- Povarova A.I. Snizhenie fiskal'noi funktsii naloga na pribyl': faktory i puti povysheniya . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2014, no. 3, pp. 180-195..

- Prognoz sotsial'no-ekonomicheskogo razvitiya Rossiiskoi Federatsii na 2017 god i na planovyi period 2018 i 2019 godov . Available at: http://economy.gov.ru/minec/activity/sections/macro/prognoz/.

- Beyond the annual budget. World Bank, 2013. Available at: http://www.imf.org/external/np/seminars/eng/2013/fiscalpolicy/pdf/brumby.pdf