Regional budget of 2012 - 2014: stability is delayed

Автор: Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Development strategy

Статья в выпуске: 3 (21) т.5, 2012 года.

Бесплатный доступ

The article presents the new results of ongoing research carried out in ISEDT RAS on regional budgeting of the Vologda Oblast in the medium term1. Judging by the main budget parameters, the situation in the budget sphere will become aggravated in foreseeable future. According to forecasts, the deterioration of financial conditions of metal manufacture, the basic industry in the region, will not allow the regional budget to restore its pre-crisis level of revenues in 2012. They will be below the level of 2011. The reduction of federal financial support creates additional dangers for the regional budget burdened with debts. The public debt of the Vologda Oblast, which has reached a critical level, increases the risk of providing the investment with financial resources, which are necessary to modernize the regional economy. However, despite this dramatic situation, there are the reserves to ensure social security in the region.

Regional budget, revenues, expenditures, deficit, public debt, reserves for increase in revenue potential

Короткий адрес: https://sciup.org/147223356

IDR: 147223356 | УДК: 336.144.12(470.12)

Текст научной статьи Regional budget of 2012 - 2014: stability is delayed

The Vologda Oblast, as most regions of the Russian Federation, has been planning the budget for three years since 2011. However, the transition to the medium-term budgetary planning has missed fire yet. The actual performance of the regional budget in 2011 was far from the scenary conditions. Certainly, the decline in own revenues and overall macroeconomic uncertainty had a bad influence on it. At the same time, the ignoring of the fundamental principles of budgeting, assigned by the Budget Code, has played an important part. For example, the principle of the unity of budgetary system involves a single procedure to calculate expected rates throughout the Russian Federation, ensuring their feasibility. In fact, there is no such consistency, so the regional budgets are formed on the basis of the current methodology irrelatively of the integral connection with the federal budget. It forces the regional authorities to adjust constantly the approved budgetary parameters. Thus, the Legislative Assembly of the Vologda Oblast introduced 11 amendments to the Law on the Budget and increased its revenue by 7.6 billion rubles in 2011. In this case the main factor of changes was the financial grant from the federal centre amounted to 10.6 billion rubles, which wasn’t distributed at the time of regional budgeting. Own tax and nontax revenues were increased by only 1.1 billion rubles. Changes in regional budget revenues increased budget expenditures by 11.6 billion

See: Povarova A.I. The three-year budget: should we wait for stability? Economical and social changes: facts, trends, forecast. 2011. No. 2 (14). P. 20-36.

rubles, which, in turn, entailed a double deficit. The public debt of the Vologda Oblast also did not meet the guidelines announced by the Government. It increased by 5.4 billion rubles (tab. 1) .

Of course, these amendments could not influence the 2012 Budget, as far as a part of the expenditure commitments adopted additionally in 2011 moved to the expenditures of the next budget cycle. Therefore, the main forecast parameters for 2012 prescribed in the Law on Budget for 2012 – 2014 differ significantly from the forecast parameters for 2011 – 2013 approved by the Legislative Assembly of the Vologda Oblast a year ago. In order to ensure the fulfillment of obligations at the level of 2011, it was necessary to increase the expenditure part of the regional budget by almost 9 billion rubles. As a result, there will be a budget deficit at the rate of 4.4 billion rubles instead of the expected budget surplus in 2012.

Thus, the development of medium-term budget projections at this stage can’t increase the validity of the decisions taken in this area;

it’s impossible to assess in detail their long-term effects. Probably, this prediction is just a way to sequence the funds in years based on the indexation of the trends for the previous years.

Macroeconomic forecasts in the mediumterm perspective prove the fact that functioning of the budgetary system in the Russian Federation will take place in the difficult economic situation both in the world and in the country.

Public debt crisis in the U.S. and EU countries can lock down their governments to reduce budget deficits and, as a result, it can urge the global economy on to the next recession. The dependence of the Russian economy on the global trends makes it vulnerable to banking, stock and raw shocks.

According to the forecast of the Ministry of Economic Development of the Russian Federation, the country’s economic growth rates won’t accelerate until 2015 (tab. 2) . Consequently, the amount of federal budget revenues will not reach a pre-crisis level that can increase the risks of the regional budget performance combined with a substantial deficit.

Table 1. Changes in the basic parameters of the regional budget of the Vologda Oblast in 2011 – 2012

|

Indicators |

2011 |

2012 |

||||||

|

Law on Budget for 2011 – 2013 |

Assessment |

Changes |

Law on Budget for 2011 – 2013 |

Law on Budget for 2012 – 2014 |

Changes |

|||

|

bln. rub. |

% |

bln. rub. |

% |

|||||

|

Revenues |

32.0 |

39.6 |

+7.6 |

23.8 |

34.2 |

36.0 |

+1.8 |

5.5 |

|

Tax and non-tax revenues |

27.8 |

28.9 |

+1.1 |

4.0 |

30.7 |

31.1 |

+0.4 |

1.1 |

|

Grants |

4.2 |

10.6 |

+6.4 |

252.4 |

3.4 |

5.0 |

+1.6 |

45.0 |

|

Expenditures |

36.0 |

47.6 |

+11.6 |

32.2 |

31.8 |

40.5 |

+8.7 |

27.2 |

|

Deficit (-), surplus (+) |

-4.0 |

-8.1 |

+4.1 |

202.5 |

+2.3 |

-4.4 |

||

|

Public debt |

21.5 |

26.9 |

+5.4 |

25.1 |

17.3 |

28.7 |

+11.4 |

65.9 |

Table 2. The main macroeconomic measures of the Russian Federation

|

Measures |

In fact |

2011, assessment |

Forecast |

||||

|

2008 |

2009 |

2010 |

2012 |

2013 |

2014 |

||

|

GDP, % to the previous year in comparable prices |

105.2 |

92.2 |

104.0 |

104.2 |

103.5 |

104.2 |

104.6 |

|

Index of industrial production, % |

100.6 |

90.7 |

108.2 |

105.4 |

103.6 |

104.0 |

104.2 |

|

Federal budget revenues in real terms, % to the level of 2008 |

100.0 |

72.7 |

75.6 |

88.1 |

85.7 |

89.4 |

92.1 |

|

Federal budgeted deficit, bln. rub. |

0 |

2322.0 |

1812.0 |

719.1 |

1570.5 |

1744.3 |

1684.4 |

Sources: data of the Ministry of Economic Development of the Russian Federation; the Ministry of Finance of the Russian Federation.

Having regard to the trends in the global and Russian economy, the Government of the Vologda Oblast proceeded from the minimization of expenditures and deficit in budgeting for 2012 and the planning period from 2013 till 2014. The parameters of the regional budget are calculated on the base of the conservative forecast of the key macroeconomic measures (tab. 3) .

The considerable economic growth is not expected in the Vologda Oblast as in the whole country. The GRP growth at current prices will be lower than it was in 2008 and in 2010. The significant improvement in industrial production isn’t expected too.

There are three key factors limiting the development of regional economy in the period from 2012 till 2014:

-

1. Minimum growth rate of prices for ferrous metals amounting to 1.8 –10% in the export market and 0.5 – 10% in the internal market due to falling demand for steel, especially in the developed countries in Europe, the USA and China. The dependence of the regional budget of the Vologda Oblast on the metallurgical industry increases the potential financial risks and doesn’t ensure the stability of the budget at the forming stage.

-

2. The rise in prices and tariffs of natural monopolies outpaces an inflation rate (there will be an annual increase in gas prices by 15%, prices for electricity by 10 – 13% and rail transport tariffs by 5 – 7% at the approximate growth rate of consumer price by 4 – 5%).

-

3. The high rate of insurance contributions to the off-budget funds is established at the rate of 30% (in comparison with the U.S. – 10%, Japan – 15%, Germany – 22%). According to the Department of Finance of the Vologda Oblast, the budget losses amounted to 800 million rubles because of increasing rates of insurance contributions in 2011.

Retail trade dynamics will acquire a steady increasing character and exceed the growth of gross regional product, which indicates the essential significance of consumer demand in the regional economy.

Actual population’s incomes show the growth after their reduction in 2011, but in 2015 they will be comparable with the level of 2010 – 5% by an average growth by 12% per year in the pre-crisis period. That doesn’t allow us to rely on the substantial increase in income tax.

Anticipating the consideration of the basic characteristics of the regional budget for a period from 2012 till 2014, we emphasize again

Table 3. The key macroeconomic measures for regional budget projecting in the Vologda Oblast for the period from 2012 till 2014

According to the results of 11 months of 2011, the Vologda Oblast is among nine subjects of the Russian Federation that have the budget deficit. The region ranks third after the Republics of Mordovia and Khakassia by the level of deficit equal to almost 10% of the total own revenues. Deficient regions of the North-West Federal District include the Arkhangelsk Oblast along with the Vologda Oblast, but the level of budget deficit is much lower in the Arkhangelsk Oblast. It is only 0.7% there.

The main parameters of a new three-year budget prove that it will be impossible to enter the path of the pre-crisis level of aggregate and own revenues in 2012 (tab. 5) .

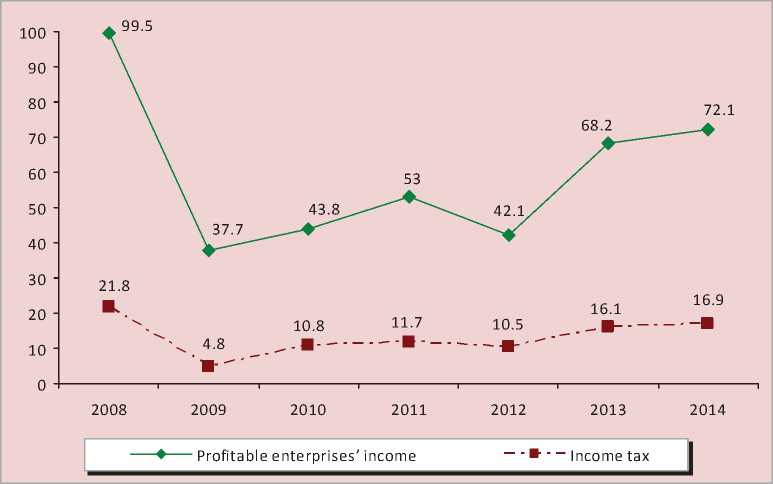

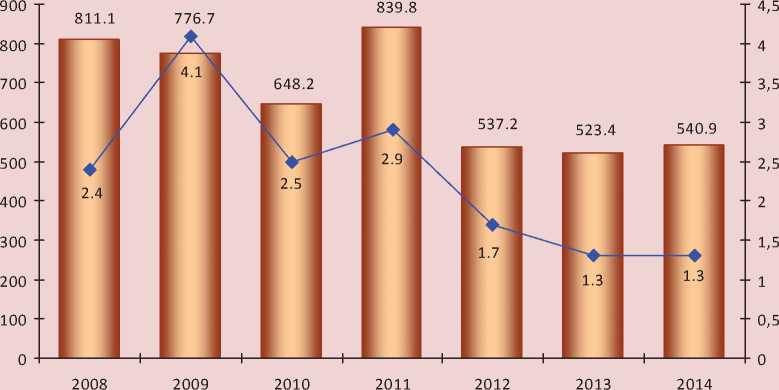

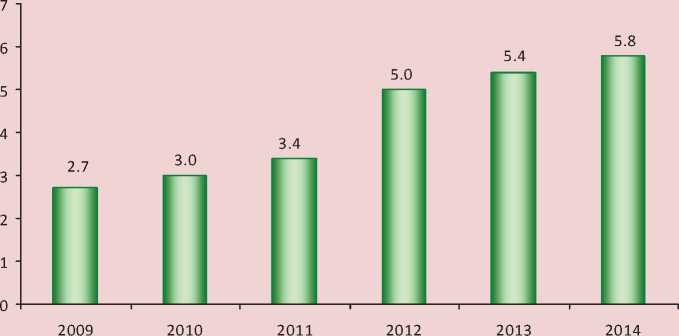

Tax payments will remain the key catalysts for the regional budget revenues over the next three years, but the structural changes of the tax base will not happen. Two-thirds of tax revenues will be provided through corporate and individual income taxes, as in previous years. Crisis decline in profits and, accordingly, income tax revenues will not be recovered in 2012 – 2014. Even in 2014, corporate income tax revenues will be significantly lower in comparison with 2008 (fig. 1).

According to the forecast of the regional government, large and medium-sized profitable enterprises’ income will be reduced by 11 billion rubles in 2012 related to its volume in 2011. However, planning profit with the decrease by 20.5% seems too pessimistic along with the expected growth of industrial production by 3% in 2012 and decrease in the rates of compulsory insurance premiums from 34 to 30%.

Of course, a number of parameters describing the results of industrial and financial activities of the main taxpayer in the Vologda Oblast – Cherepovets Metallurgical Plant of OJSC Severstal (CHMF), don’t give grounds for the expectation of improvements soon. Thus, despite the increase in prices for steel, according to the results over 9 months of 2011, indus-

Table 4. The growth rates of own revenues in the regional budgets of the Federal Subjects of Russia, January – November, 2011 to January – November, 2010, %

|

Federal Subject |

Tax and non-tax revenues |

Enterprises’ profit tax |

Individual income tax |

|

Russian Federation |

120.0 |

130.3 |

111.0 |

|

North-West Federal District |

114.5 |

118.9 |

110.8 |

|

Belgorod Oblast* |

151.0 |

196.3 |

110.7 |

|

Lipetsk Oblast* |

116.2 |

121.4 |

105.6 |

|

Chelyabinsk Oblast* |

114.4 |

112.7 |

112.4 |

|

Vologda Oblast |

111.5 |

112.9 |

110.2 |

|

* The regions specializing in the steel industry have been selected to be compared with the Vologda Oblast. |

|||

Table 5. The main parameters of the regional budget of the Vologda Oblast, bln. rub.

|

Parameters |

In fact |

2011, assessment |

Forecast |

||||

|

2008 |

2009 |

2010 |

2012 |

2013 |

2014 |

||

|

Total revenues |

39.5 |

31.2 |

36.1 |

39,6 |

36.0 |

42.0 |

44.6 |

|

Including tax and non-tax revenues |

34.4 |

19.0 |

25.8 |

28.9 |

31.1 |

39.1 |

41.9 |

|

Expenditures |

39.1 |

37.7 |

43.1 |

47.6 |

40.5 |

37.2 |

39.6 |

|

Deficit (-), surplus (+) |

+0.4 |

-6.5 |

-7.0 |

-8,0 |

-4.4 |

+4.8 |

+5.0 |

|

in % to own revenues |

+1.2 |

-34.1 |

-27.3 |

-27.7 |

-14.1 |

+12.3 |

+11.9 |

Table 6. The main operating rates of OJSC Cherepovets Metallurgical Plant over 9 months of 2011

|

Rates |

9 months, 2010 |

9 months 2011 |

Changes, % |

|

Prices for ferrous metals |

|||

|

- export, dollar/ t |

528 |

739 |

140,0 |

|

- internal, thsd. rub./ t |

20.5 |

23.9 |

116.6 |

|

Industrial Production Index, % |

115.3 |

108.9 |

-6.4 p.p. |

|

Sales profit, bln. rub. |

24.1 |

14.7 |

61.0 |

|

Profit (+), loss (-) of the difference in exchange, bln. rub. |

1.6 |

-8.7 |

|

|

Sources: data of the Economy Department of the Vologda Oblast; annual reports of OJSC Severstal for the period from 2010 till 2011. |

|||

Figure 1. Profitable enterprises’ income and income tax in 2008 – 2014, bln. rub.

trial production index at the plant was 108.9% against 115.3% during the same period in the previous year. The profit was decreased by 1.6 times (tab. 6) .

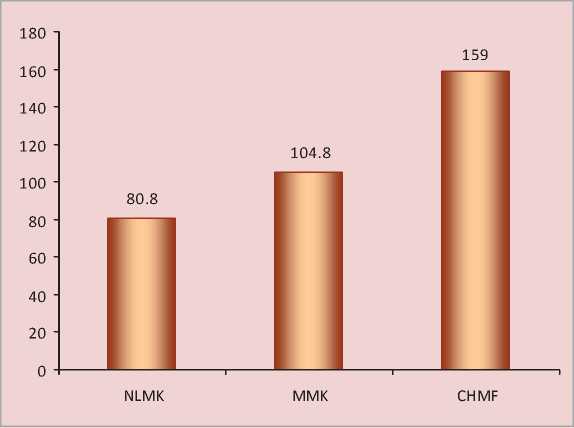

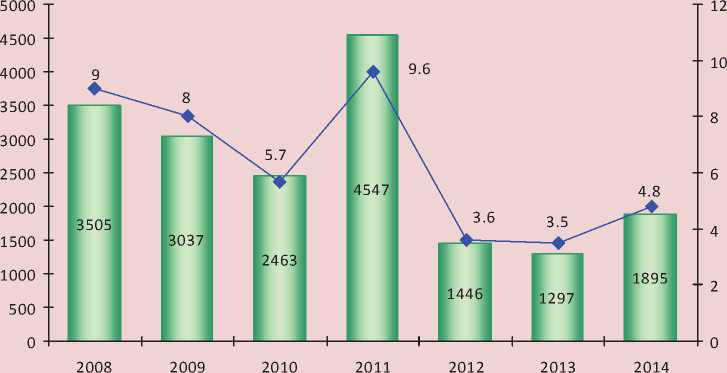

The problems of the company are aggravated by a high debt, which is much higher than the debt of two other industrial counterparts of Cherepovets Metallurgical Plant – Novolipetsk Steel (NLMK) and Magnitogorsk Iron and Steel Works (MMK) (fig. 2) .

Financial performances of Cherepovets Metallurgical Plant are undermined by not only the growing debts, but also by the loss from their price rise. The fact of the matter is that the most part of corporate debt is nominated in foreign currency, so currency fluctuations have a significant impact on taxable income. Until 2018 Cherepovets Metallurgical Plant will be burdened with debt of 180 billion rubles caused by the debt growth in 2008 – 2010.

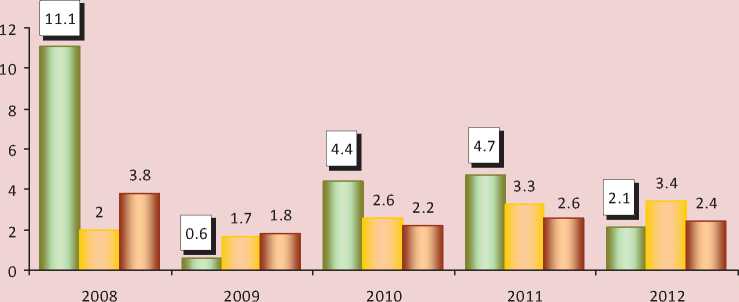

Thus, the strained financial situation in Severstal cannot allow them to expect the rapid growth of income tax revenues to the regional budget as in the pre-crisis period. On the contrary, they will be halved in 2012. And if they had been compensated in 2009 – 2010 by loans, it would have been impossible to do it in a new budget cycle, because the debt of the Vologda Oblast is close to a critical value. The increase in income tax revenues is expected to be only in the branches of natural monopolies and large banks (fig. 3) .

Figure 2. Credit and loan debts of metallurgical enterprises on 01.10.2011, bln. rub.

Figure 3. Enterprises’ income tax revenues, bln. rub.

□ Cherepovets Metallurgical Plant of OJSC Severstal

■ Natural monopolies and banks branches

□ Local enterprises

Despite the projected decline in tax revenues of the steel industry, the tax base of the regional budget in the planning period will continue to be linked to two major industries – steel and chemical (fig. 4) . Although their share in the formation of income tax will be reduced to 57.4% in 2012 versus 73.4% in 2008, it isn’t caused by the increased diversification of the tax base, but it is linked to the projected slowdown in production2.

Unfortunately, the forecast of the socioeconomic development of the Vologda Oblast in the period from 2012 till 2014 contains no parameters, which can be used to assess the role of metallurgy and chemistry in the industrial production. However, the structure of the main income source of the budget seems to indicate that such main strategic objective of the region in the coming period as mono-structure economy overcoming will not be solved.

It should be noted that other regions specializing in the steel industry are going to improve the financial performances of their business entities and increase income tax revenues in 2012 (tab. 7) .

The new regional budget of the Vologda Oblast does not provide for the significant changes in the dynamics of individual income tax (IIT), which will generate nearly a third of the regional treasury’s revenues (fig. 5) .

Table 7. Corporate income tax in 2008 – 2012, profit forecast in the regions of the Russian Federation for 2012, bln. rub.

|

Region |

Income tax, bln. rub. |

Profit forecast (2012 to 2011, %) |

|||||

|

In fact |

Forecast |

||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2012 to 2011, % |

||

|

Chelyabinsk Oblast |

29.5 |

4.9 |

19.1 |

24.6 |

31.1 |

126.4 |

113.8 |

|

Belgorod Oblast |

18.3 |

6.0 |

13.8 |

25.6 |

28.1 |

109.8 |

112.3 |

|

Lipetsk Oblast |

15.8 |

4.7 |

9.5 |

10.8 |

10.8 |

100.0 |

105.0 |

|

Vologda Oblast |

21.8 |

4.8 |

10.8 |

11.7 |

10.5 |

89.7 |

79.4 |

Figure 4. Industrial structure of income tax revenues to the regional budget of the Vologda Oblast in 2008 – 2012, %

|

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% |

26.6 22.5 50.9 |

70.8 16.7 12.5 |

43.6 15.7 40.7 |

47.5 20 32.5 |

56.2 23.8 20 |

42.6 19.5 37.9 |

|||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2014 |

||||

|

□ Steel industry |

□ Chemical industry |

Others |

|||||||

Figure 5. The dynamics of individual income tax revenues to the regional budget of the Vologda Oblast in 2008 – 2014

The low growth rates of individual income tax (less than 10% per year) should be linked to a progressive regional lag in terms of average wages. A gap between wage levels in the Vologda Oblast and in the whole country will increase to 6.1 thousand rubles in 2014 versus 1.2 thousand rubles in 2008 (tab. 8) .

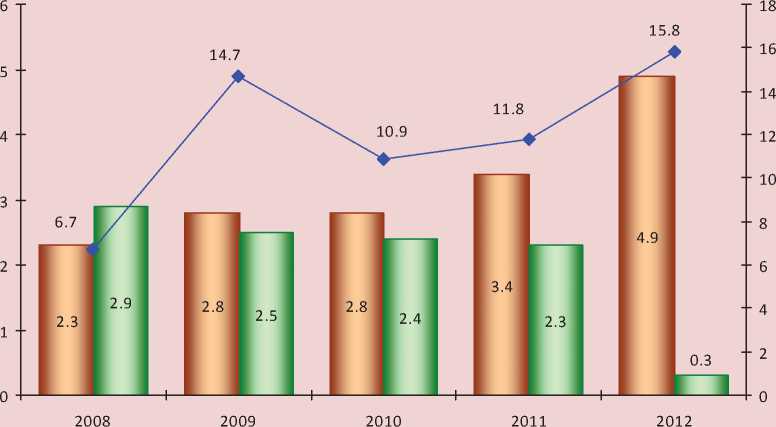

The Law on the Regional Budget for the period from 2012 till 2014 reflects the proposals by the researchers from the ISEDT RAS on the revision of regional stimulating tax policy. Even in the crisis the Government of the Vologda Oblast, on the basis of the approaches and instruments applied previ- ously, continued to grant property tax incentives, which amount was almost equivalent to the volume of these payments. Such policy was pro-cyclical. It created the preconditions for the current problems of the regional budget, which revenues had been declined. So, the regional authorities assumed the serious measures to abolish most of corporate property tax incentives in 2011. They kept those incentives only for farmers and investment program participants. The effect of tax preferences abolition is estimated in the additional annual property tax revenues amounted to about 2.2 billion rubles (fig. 6).

Table 8. Dynamics of nominal average gross wages in 2008 – 2014, thousand rubles per an employee

|

Indicators |

In fact |

2011, assessment |

Forecast |

||||

|

2008 |

2009 |

2010 |

2012 |

2013 |

2014 |

||

|

Vologda Oblast |

16.1 |

16.6 |

18.5 |

20.6 |

22.3 |

24.2 |

26.2 |

|

Russian Federation |

17.3 |

18.6 |

21.2 |

23.9 |

26.5 |

29.3 |

32.3 |

|

A gap between wage levels in the Vologda Oblast and in the RF: |

|||||||

|

thousand rubles |

1.2 |

2.0 |

2.7 |

3.3 |

4.2 |

5.1 |

6.1 |

|

% |

6.9 |

10.8 |

12.7 |

13.8 |

15.8 |

17.4 |

18.9 |

Figure 6. Dynamics of corporate property tax in 2008 – 2012

I—I Corporate property tax, bln. rub.

I-----1 Regiona l ince ntives, bln. rub.

♦ The share of property tax in the own budget revenues, %

Withdrawal of preferences will increase significantly the role of regional taxes. They will already form 16% of the regional budget’s own revenues in 2012 versus 7% in 2008. The dynamics of non-tax revenues seems to indicate that such task of the regional policy as the effective management of regional assets will be unsolved in the medium term. Non-tax revenues from the use of state and municipal ownership, which fiscal function is low, will be reduced by 300 million rubles or by 1.5 times to the level of 2011 (fig. 7) .

Population’s budgetary income security in the Vologda Oblast will be below the national average level of 12.3 thousand rubles or by 20% (tab. 9) next three years. So, the region will receive leveling subsidies.

There is a task to decentralize effectively the authority of public entities in the Budget Message of the President of the Russian Federation. However, it is carried out backwards. Federal legislation is going to implement the fiscal priority of the central government with the subordinate status of the Federal subjects

Figure 7. Dynamics of non-tax revenues of the Vologda Oblast’s regional budget in 2008 – 2014

I----1 Bln. rub. — ♦ —The share in own budget revenues, %

Table 9. Population’s budgetary income security, thousand rubles per a person

Simultaneously, additional financial powers to support secondary professional educational institutions and promote employment and social support for individuals will be transferred to the sub-national level. So, the deficit budget of the Vologda Oblast will require more than 420 million rubles of additional costs.

The RF President’s directive on the inventory of federal incentives for state and local taxes remains unrealized today. As a result, consolidated regional budgets lost more than a third of the territorial tax revenues, and the budget of the Vologda Oblast – two-thirds (tab. 10) . At the same time, natural monopolies with the most stable financial standing get more than 90% of federal incentives.

It is clear that a lack of federal support and the desire to achieve a balanced federal budget through the withdrawal of the regional tax potential are the main external threats to the territorial budgetary systems not only in the Vologda Oblast, but in all regions of the Russian Federation.

The regional authorities will continue to limit mushy budgetary policy and decrease government spending in 2012 – 2014. It is generated by not only a lack of financial support from the federal budget, but the necessity to use a part of own revenues to ensure the repayment of borrowed funds raised to cover the regional budget deficit in previous years. The regional budget expenditures will have been reduced by 8 billion rubles or by 1.2 times to their volume in 2011 by 2015.

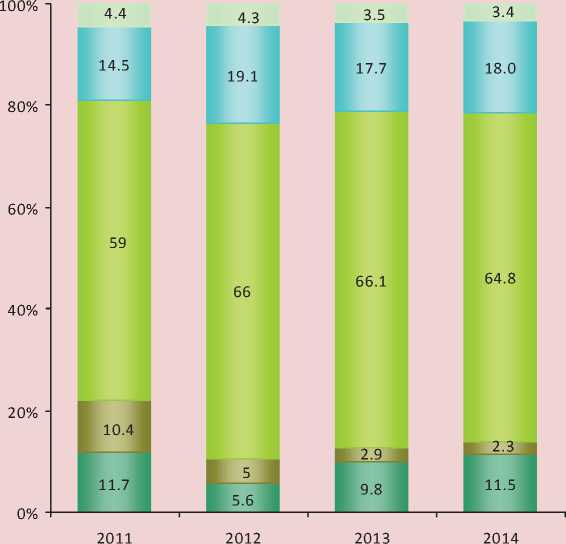

How do the authorities intend to dispose of the regional treasury? It is possible to judge the priorities of a new cycle of fiscal policy by figure 8 that illustrates the aggregate structure of the regional budget expenditure.

The bulk of budgetary resources will be spent on traditional functions. The social sphere will remain the most large-scale item of expenditure. Two-thirds of funding will be used to ensure the fulfillment of social obligations to the population, taking into account intergovernmental transfers. From this point of view, the three-year budget retains the status of social-oriented.

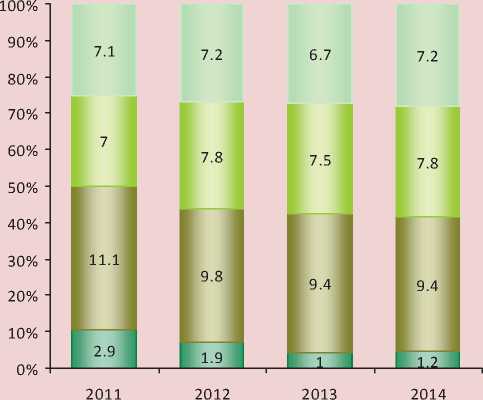

The structure of social expenditure remains the priority of different types of social support to needy groups of citizens. So, more than 9 billion rubles are planned to be send annually for this purpose (fig. 9) .

The next functional items of expenditures are education and health. Their annual funding will require about 15 billion rubles from the budget. The remaining allocations of 1 – 2 billion rubles will be used to finance mass media, cultural activities and sports.

Table 10. Federal incentives for regional and local taxes

|

Indicators |

Russian Federation |

Vologda Oblast |

||||

|

2008 |

2009 |

2010 |

2008 |

2009 |

2010 |

|

|

The volume of federal incentives, bln. rub. |

153.4 |

181.9 |

201.7 |

1.5 |

3.0 |

3.6 |

|

In % to the volume of regional and local taxes |

31.1 |

31.9 |

32.1 |

40.6 |

66.7 |

73.6 |

Sources: Federal Tax Service, the Treasury of Russia; calculations by ISEDT RAS.

At the same time, the addressed social problem-solving as a task of fiscal policy in the medium term appears to reduce the allocations for a number of important social dimensions (tab. 11) .

As you can see, the double decline in financing of sport events has been approved. The regional budget’s support to the mass media will be reduced by half.

Primary professional education expenditures have been cut by a third when there is a lack of skilled workers and low labour productivity in the economy.

The absolute reduction of budget allocations to all types of medical care has been planned.

However, the largest reduction of state support will affect housing and communal services. Funding for this sector will be declined by almost eight times. Meanwhile, the Vologda Oblast is characterized by a high level of housing stock and communal infrastructure wear which needs a huge investment in housing.

The fact is that the establishment of the Road Fund forced the regional authorities to reallocate the budget appropriations, including at the expense of certain types of social and housing expenditures.

The system of regional road funds will change seriously a financing structure of the national economy (tab. 12) .

On average, two-thirds of the budget allocations within the sector “National Economy” will be set aside for the road infrastructure financing within the framework of the Road Fund. Institutional arrangements of the Fund have several advantages over budget financing, because the order of their establishment is based on the links between expenditures and revenues. Of course, the launch of Road Funds will provide us with additional resources, but their operation will require a strict control over the targeted use of these funds3.

Table 11. Allotment of the regional budget allocations in the Vologda Oblast to the certain functional sections and subsections in the period from 2011 till 2014, bln. rub.

|

Section, subsection |

2011 |

2012 |

2013 |

2014 |

2014 to 2011, % |

|

Housing and communal services |

2107.0 |

594.3 |

488.3 |

267.3 |

12.7 |

|

Primary professional education |

351.2 |

283.7 |

220.0 |

255.3 |

72.7 |

|

Youth policy |

155.4 |

149.2 |

132.3 |

131.7 |

84.7 |

|

Culture |

882.7 |

853.8 |

575.6 |

753.3 |

85.3 |

|

Hospital medical care |

889.4 |

762.6 |

584.2 |

641.5 |

72.1 |

|

Ambulatory care |

197.2 |

146.7 |

127.5 |

135.4 |

68.7 |

|

Emergency |

152.9 |

87.0 |

75.9 |

81.7 |

53.4 |

|

Physical training and sports |

782.8 |

744.8 |

292.5 |

360.8 |

46.1 |

|

Mass media |

219.8 |

120.1 |

117.1 |

117.2 |

53.3 |

Table 12. The structure of the regional budget expenditures of the Vologda Oblast in the sector “National Economy” in 2011 – 2014, bln. rub.

|

The name of the subsection |

2011, assessment |

Forecast |

|||||||

|

2012 |

2013 |

2014 |

2014 to 2011, % |

||||||

|

bln. rub. |

% |

bln. rub. |

% |

bln. rub. |

% |

bln. rub. |

% |

||

|

Total expenditure |

6896.6 |

100.0 |

7745.7 |

100.0 |

6595.7 |

100.0 |

7128.6 |

100.0 |

103.4 |

|

Agriculture |

1553.8 |

22.5 |

762.9 |

9.8 |

503.9 |

7.6 |

507.2 |

7.1 |

32.6 |

|

Forestry |

778.9 |

11.3 |

497.1 |

6.4 |

497.4 |

7.5 |

502.3 |

7.0 |

64.5 |

|

Road sector |

1284.6 |

18.6 |

4747.2 |

61.3 |

4707.8 |

71.4 |

4999.4 |

70.1 |

389.2 |

|

Other expenses |

3279.3 |

47.5 |

1738.5 |

22.5 |

886.6 |

13.5 |

1119.7 |

15.8 |

34.1 |

3 According to experts of the National Anti-Corruption Committee, about 50% of the budgetary funds are embezzled in the road building. It exceeds the indicators of other industries.

Budget support to agriculture and forestry is founded without federal transfers, so we should expect its increase, as it usually happens in the budget process.

Unfortunately, the regional budget cuts its involvement in housing problem-solving. Meager investments for this purpose will have been already decreased by half in 2012, and it has been planned to spend only 101 million rubles on providing housing to the population by the end of 2014 due to the expiration of most housing programmes (tab. 13) .

The new budget law is characterized by substantial changes in the system of inter-budgetary relations aimed at strengthening the fiscal autonomy of local self-governments.

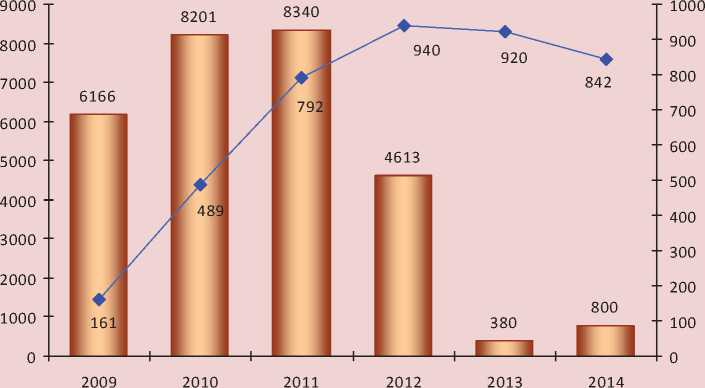

Since 2012, 25% of corporate property tax revenues will be transferred to the municipal budgets according to the additional allocation standards, and 25% of simplified taxation system revenues will be allocated to the budgets of settlements. In addition, the differentiated allocation standards of individual income tax will be introduced as a substitution for the grants in order to reduce by half the amount of leveling subsidies allocated to municipalities from the regional budget. As a result of these innovations, the regional and settled municipalities will additionally receive 1.5 billion rubles in 2012, and the cumulative effect of their own revenue base of consolidated municipal budgets will be doubled (fig. 10) .

Table 13. Regional budget expenditure of the Vologda Oblast on providing housing to the population, mill. rub.

|

Name of the program |

2011, assessment |

Forecast |

||

|

2012 |

2013 |

2014 |

||

|

Providing housing to young families in 2012 – 2015 |

30.0 |

30.0 |

30.0 |

30.0 |

|

Affordable housing in 2009 – 2013 |

419.4 |

112.4 |

86.4 |

0 |

|

Social development of rural areas in 2009 – 2012 |

78.4 |

40.0 |

0 |

0 |

|

Housing for orphans in 2011 – 2013 |

200.0 |

100.2 |

160.2 |

0 |

|

Dwelling house making for veterans in Molochnoye |

60.0 |

50.0 |

0 |

0 |

|

Providing housing to the citizens discharged from military service |

30.0 |

30.0 |

30.0 |

30.2 |

|

Providing housing to veterans and disabled people in accordance with the Federal laws |

43.2 |

40.3 |

40.7 |

40.7 |

|

Total expenses on housing |

861.0 |

402.9 |

347.3 |

100.9 |

|

Share in total budget expenditures, % |

1.8 |

1.0 |

0.9 |

0.3 |

Figure 10. Own revenues of consolidated municipal budgets in the Vologda Oblast, bln. rub.

The social orientation of budget expenditures and limited revenue potential, especially in the situation of increase in prices for services of natural monopolies, as well as the economic downturn, block the possibility of the development budget formation and transition to the proactive investment in key projects.

For the first time the regional budget has minimized the selection of capital appropriations so drastically. Crisis collapse of tax revenues in 2009 – 2010 has forced the local authorities to balance the regional budget at the expense of the regional capital expenditure that had a negative impact on their dynamics in the medium term: with limited financial resources, the level of social expenditure should be maintained, so capital investments have become a balancing item again. The volume of public investments will have already been decreased by 3.1 billion rubles in 2012, that is more than by three times, and their share in the budget expenditures will have not reached even 5% until 2015 (fig. 11) .

The unprecedented reduction in capital investments indicates that a period of the rapid growth of budget revenues in 2000 – 2008 has not been used by the regional authorities to form the relevant reserves and implement the counter-cyclical fiscal policy during the crisis. Therefore, it was necessary to reformat the budget primarily due to reduced investment in the development of regional economy in order to ensure the necessary volume of social obligations.

However, the decrease in the regional budget tax revenues was so high that there was a lack of resources to finance the chosen level of spending even by optimizing costs and increasing financial support from the federal budget to the region. Progressive budget deficit has caused the need to attract the bank credit resources and the federal budget; the total amount of them was an enormous sum of 23 billion rubles in 2009 – 2011 that corresponded to one third of own revenues of the regional budget. It is expected to reduce borrowing in the planning period, but loan servicing will require the diversion of about 1 billion rubles from the regional budget that could be used to finance the important dimensions of socio-economic development of the region (fig. 12) .

Figure 11. Capital investments of the regional budget of the Vologda Oblast in 2008 – 2014

I—I Million rubles —•—The share in the budget expenditures, %

Figure 12. Attracted credit resources and interest revenues of the regional budget of the Vologda Oblast in 2009 – 2014, mln. rub.

I—I Bank and budget credits — ♦ — Interest revenues

Table 14. The dynamics of public debt in the Vologda Oblast in 2008 – 2014

|

Indicators |

In fact |

2011, assessment |

Forecast |

||||

|

2008 |

2009 |

2010 г. |

2012 |

2013 |

2014 |

||

|

Amount of debt, mln. rub. |

1752.5 |

10374.7 |

18498.1 |

26921.2 |

28746.1 |

22476.2 |

16697.4 |

|

The share to own revenues, % |

5.1 |

54.5 |

71.6 |

93.0 |

92.5 |

57.4 |

40.0 |

The result of the borrowing escalation was a critical level of public debt of the Vologda Oblast. In 2011 – 2012 it will be 93% of the total own budget revenues within the statutory limit of 100%. The absolute amount of regional debt will be significant even in 2013 – 2014 (tab. 14) .

Debt pressure in the field of public finance will be the most serious risk for the economic security of the region.

Of course, in the short term many budget problems of not only the Vologda Oblast, but also other subjects of the North-West of the Russian Federation will be determined by scarcity and a strong trend to increase debt load (tab. 15) . This will require for a coherent fiscal policy adequate to the risks of the ongoing global crisis.

Completing the analysis of the main financial document of the region for the period from 2012 till 2014, we can conclude that the new Law on Budget doesn’t contain the newest ideas. In fact, budgetary policy, which was turned to the survival standards last year, has received only the clarification for the coming period.

Understanding this difficult situation, however, it is impossible to consider that the Vologda Oblast hasn’t the reserves to increase revenue and optimize expenditures in future. The most important of them should be considered the following:

-

1. Rise of the level of taxes and dues collection. In our opinion, this regional treasury reserve is not used in full. In spite of some measures aimed at working with defaulters, the

Table 15. The regional budgets deficit and public debt of the subjects of the North-West Federal District

Federal Subject

Budget deficit

Public debt

2011, assessment

2011, forecast

2011, assessment

2012, forecast

bln. rub.

%*

bln. rub.

%*

bln. rub.

%*

bln. rub.

%*

Leningrad Oblast

4.4

10.1

3.2

6.1

8.0

18.3

7.3

13.8

St. Petersburg

51.3

16.5

29.6

8.8

37.1

11.9

65.4

19.3

Komi Republic

7.1

21.3

4.3

10.3

10.0

30.0

11.5

27.6

Murmansk Oblast

4.7

14.6

5.4

16.2

6.6

20.5

10.7

32.0

Pskov Oblast

2.8

27.5

3.3

27.7

3.1

30.7

4.6

38.7

Karelia Republic

3.0

19.2

2.6

15.0

9.5

60.9

10.7

61.8

Novgorod Oblast

2.9

19.2

1.3

7.5

11.1

73.5

11.1

64.2

Kaliningrad Oblast

5.7

29.3

5.4

25.3

17.5

89.8

15.7

73.5

Arkhangelsk Oblast

7.6

27.2

9.2

26.6

19.1

68.5

27.5

79.5

Vologda Oblast

8.1

29.7

4.4

14.3

26.9

93.0

28.7

92.5

* The share to own revenues, %.

significant reduction in debt is not observed. Thus, according to tax accounts, tax and due debt to the regional budget has been increased by 51.1 million rubles as of January 1, 2012 in comparison with its amount at the beginning of 2011 when it amounted to 1.6 billion rubles that was commensurate with the budget deficit of 20%.

-

2. Further systematic work on revenue legalization. The increase in insurance fees creates the potential base for the shadow business. According to the Division of Federal Tax Service in the Vologda Oblast, income tax arrears of the shadow wages, which are not fixed officially and thus escape taxation, will increase to 1.0 billion rubles in 2014 vs. 0.2 billion rubles in 2010, i.e. about 10% of individual income tax will evade the budget. In this regard, the purpose to legalize incomes has been highlighted in particular by establishing administrative control over the transfer of individual income tax to the budget in the settlements and regions.

-

3. Increasing mobilizing function of nontax revenue by the implementation of administrative measures for their regulation. In our opinion, it is reasonable to make an inventory of standard acts in the sphere of state property management and develop the objective me-

thods to calculate rent rates, because it is not a secret that the regional authorities often establish arbitrarily rental fees. It is also necessary to stop the disposal of regional property for free use by federal agencies. Available reserves to increase non-tax revenues are shown by meager incomes of the organizations which have the regional share in their authorized capitals (for example, the payments of this category to the budget will amount to 500 thousand rubles in 2012. Of course, this sum is comparable with the use of budget in the business development.

-

4. Recovery of investment demand. The implementation of a number of investment projects manifested in the forecast of the socioeconomic development of the Vologda Oblast should be regarded as one of the key generators of the budgetary revenue growth. In this context, it is reasonable to think about the population’s savings, which are not used for productive accumulation (according to statistics by the Bank of Russia, the volume of individual deposits in the Vologda Oblast amounted to 67.4 billion rubles as of 01.01.2012 that exceeded by half the regional budget revenues).

-

5. Quality improvement of public expenditure management. The current structure of

Table 16. The regional budget expenditure on management personnel in the Vologda Oblast *

Indicators

In fact

2011, assessment

2012, forecast

2008

2009

2010

Volume of expenditures, mln. rub.

887.1

815.7

851.4

1123.6

840.0

The share to total budget revenues, %

2.6

3.2

2.6

3.0

2.4

* Expenditure on the Legislative Assembly, the Government of the Vologda Oblast, the judiciary, the Department of Finance, the Control and Accounting Chamber, the Election Commission.

the regional budget expenditure, which is aimed at financing social areas, is combined with their low efficiency. The reduction of ineffective expenditures will cover 1.8 billion rubles of the budget deficit in 20124.

Further limitation of public administration expenditure should also be considered as a reserve of saving budgetary resources. In spite of a significant decline in the number of legislative and executive authorities carried out in 2009 – 2010, the sum of the regional budget expenditure on its support isn’t decreased; it exceeds the funding of forestry, transport, culture, and ecology spheres (table 16) .

The task to improve the quality of expenditure and budget management can’t be achieved without the implementation of measures to optimize the public debt, providing for its restructuring by bond issue, as well as the decrease in provision of state guarantees and nonstop debt management aimed at the quick adjustment of its volume.

Many of the potential reserves of the balanced regional budgets cannot be developed without special changes in the federal laws.

This applies to the immediate cancellation of the territorial federal tax remissions, whose amount in the Vologda Oblast is 70% of the consolidated budget deficit. It is necessary to reconsider the system of the VAT5 refunding to largest export companies; to establish the responsibilities of sectoral ministries of the RF for the distribution of budget transfers before the beginning of territorial budgeting; to reconsider the return order of target subsidy remnants to the federal budget.

Thus, the quality of budget planning should be improved. This problem has become primary in the system of budget management because its actual implementation is far from the forecast parameters. It will be difficult to go to the programmed budget and tie it up with the strategic objectives of territorial development without a significant improvement in the quality of budget planning.

Список литературы Regional budget of 2012 - 2014: stability is delayed

- Kudrin A. Crisis consequences and the prospects of the socio-economic development of Russia. Voprosy Economiki. 2011. No. 3. P. 4-19.

- On the fiscal policy in 2012 -2014. The Budget Message of the President of the Russian Federation. Available at: http://www.consultant.ru/law/hotdocs/13780.html.

- On the execution of the budgets of the Russian Federation subjects for the period of 2008 -2010 and November, 2011. Reports of the Treasury of Russia. Available at: http://www.roskazna.ru/reports/mb.html.

- On the regional budget for the periods of 2011 -2013 and 2012 -2014. The law of the Vologda Oblast. Available at: http://www.consultant.ru/

- On the forecast of socio-economic development of the Vologda oblast in 2011 -2013. The Decree of the Vologda Oblast Government. The official website of the Government of the Vologda Oblast. Available at: http://vologda-oblast.ru/ru/documents/database/.

- Povarova A.I. The three-year budget: should we wait for stability? Economical and social changes: facts, trends, forecast. 2011. No. (14). P. 20.

- Povarova A.I. Formation of regional budget in crisis. Economical and social changes: facts, trends, forecast. 2010. No. 2 (10). P. 101.

- Senchagov V. Modernization of the financial sphere. Voprosy Economiki. 2011. No. 3. P. 4-19.

- Sorokin D. On Russian Development Strategy. Voprosy Economiki. 2010. No. 8. P. 28.

- Shvetsov Yu. State budget as the national property. Society and Economy. 2011. No. 8-9. P. 119-131.