Risk profile of grain exporting companies

Автор: Platonova Yu.Yu., Bondarenko T.N.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 5-3 (63), 2020 года.

Бесплатный доступ

This article examines the urgency of the problem specific of searching for special features of inherent risks of companies that export agricultural products. This work describes what risks need to be known in order to identify, assess and manage them. As a result of the study, the factors that lead to these types of risks were grouped and, on the basis of these, an integrated classification of the risks to which agricultural exporting companies are exposed was developed and analysed in detail.

Risks, risk classification, foreign economic activity, grain exports, risk insurance

Короткий адрес: https://sciup.org/170182766

IDR: 170182766 | DOI: 10.24411/2411-0450-2020-10499

Текст научной статьи Risk profile of grain exporting companies

The actuality of this article due to the problem of significant risk of foreign trade, as a result of many factors that affect the final result of a business transaction. External economic risks are a special category of risks that occur only when a firm conducts external economic transactions. External economic risks are specific, so only some types of risks are insured in world practice.

Sources of external trade risks can be objective (unfavourable trends in the world economy, some of its regions, certain countries and product markets) as well as subjective (government and business policy failures, inexperience or dishonesty of counterparties, actions of competitors).

Risks cause macro- and microeconomic processes of spontaneous market economy, abuse of counterparties, instability of the in- ternational monetary and financial system, trade and political activities of foreign governments, Limited resources for suppliers, changing consumer preferences and competitors, skills and integrity of business partners, growing product safety and environmental requirements, not to mention the traditional random and unexpected force majeure clause [1].

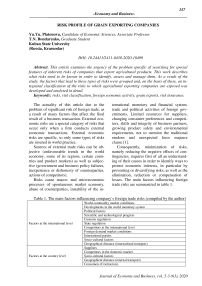

Consequently, minimization of risks, namely reducing the negative effects of contingencies, requires first of all an understanding of their causes in order to identify ways to protect economic interests, in particular by preventing or diversifying risks, as well as the elimination, reduction or compensation of losses. The main factors influencing foreign trade risks are summarized in table 1.

Table 1. The main factors influencing company`s foreign trade risks (compiled by the author)

|

Factors at the international level |

World commodity market conditions Developments in the world monetary system Political factors Scientific and technological progress Customs regulation State regulation Competitors at the international level Foreign demand market conditions International parties Socio-cultural factors Geographical distance (international transport) |

|

Factors at the country level |

Suppliers Competitors in the domestic market Socio-cultural factors Geographical distance (internal transport) Consumers (Contractors) |

Factors at the international level are not subject to any form of governance, nor can companies influence them in any way. Moreover, the nature of their manifestations is so unpredictable that they are not only unpredictable to major international organizations, but also to States themselves. Therefore, when designing a system of risk management of foreign economic activities, companies should pay great attention to the analysis of the external environment and anticipate the possibility that international factors may have a wrong impact on the further occurrence of risks.

Domestic factors contribute to the emergence of “managed” risks. At the same time, each branch of activity will have “individual” classification of risks, which is due to the specifics of activity of each company within its branch.

Accordingly, we have focused on studying the risks of agricultural exporting companies. It is worth mentioning that the general characteristic of the condition of the grain complex is the basis of the agro-industrial complex of the Russian Federation and is the largest subsector of agriculture, the development of which depends to a large extent on the food security of the country, the food security of the population and its standard of living, and the financial situation of agricultural producers.

According to the provisions of the Food Security Doctrine of the Russian Federation, the threshold value of the share of domestic grains in the total domestic grain resources should be at least 95 per cent. In recent years, this figure has not fallen below that level. Pursuant to the list of instructions issued by the President of the Russian Federation on 12 June 2017 Pr-1127 (subparagraph “a” of section I, paragraph 1) as part of the amendments to the provisions of the Russian Federation’s food security doctrine, Indicators of selfsufficiency, in the form of a percentage of domestic production of agricultural products to domestic consumption, with thresholds to measure food independence, 95 per cent for grain. Over the past 4 years, this figure has been between 140 and 150 per cent, which not only guarantees self-sufficiency in grains, but also provides a basis for the development of the livestock industry and a high export potential [2].

The priority role of grains in ensuring food security is also determined by the technological feasibility of establishing grain reserves and reserves to guarantee the country’s supply, taking into account the agro-climatic and geographical characteristics of the regions.

The successful development of the agroindustrial complex of the Russian Federation in recent years poses new challenges to the sector, the key of which is the development of exports of agricultural products, grains and their processing products.

In order to increase the volume of grain export trade, there are currently constraints that create risks unique to the industry (table 2).

Table 2. Constraints that create risks for grain-exporting firms (compiled by the author)

|

Currency risk |

Low level of exchange trading mechanisms |

Constraints |

Inadequate transportation of grain |

Logistical / Transport risk |

|

Risk of monopoly |

Increasing level of competition |

No customs border with EEU member countries |

Risk of uncontrolled grain supply |

|

|

Price risk |

Total dependence on world market conditions |

Unsustainable phytosanitary condi tions of grains and farmland |

Risk of quality discrepancy |

|

|

Risk of falling demand |

Insufficient scientific and technological development of grain producers Loss of soil fertility |

Grain production risk/supply risk |

Logistical risk arises from the imperfection of the grain transhipment system due to the impossibility of taking in large quantities of rail and road transport at one time. Consequently, in order to adapt to the current situation, it is necessary to build additional reception and unloading points for wagons and road transport, to increase the number of weighing and silo pits, and to increase the area of storage areas for unloading vehicles.

The risk of uncontrolled grain deliveries due to the customs-free import and export of grain to EEU (Eurasian economic Union) member countries is due to the threat of grain shortages in the Russian Federation, which will affect the condition of the domestic combined feed and bakery plants.

High grain quality requirements are both a deterrent and a stimulus to grain exports. On the one hand, higher quality requirements lead to a reduction in exports and, on the other hand, to an effort by domestic grain producers to comply with regulatory requirements, leading to the qualitative improvement of products.

It is also worth noting the initiative of the Ministry of Agriculture to strengthen the State’s influence on the grain market. It is essentially a question of establishing a control system similar to that of “Mercury” for livestock [3].

It is assumed that the system will allow to track not only the movements of the products, but also the balance sheets of any custodian and silo on the inputs and outputs, as well as the balance sheets of the raw materials produced and the processed products produced therefrom. The system provides for the processing of results of laboratory studies of grain and quarantine certificates.

The draft law provides that mandatory laboratory studies must be carried out at each stage of production and storage of grain and its processed products, and accredited testing laboratories must do so.

The need for innovations was explained by the fact that the quality and safety control of grain is currently not fully regulated in the

Russian Federation. This could also have an impact on export plans. In 2019, for example, a number of buyers of Russian grain had concerns about its quality. Viet Nam, which in recent years has been among the major buyers of Russian wheat, has even suspended its purchases because of the discovery of weed seeds.

According to the authors of the draft law, the processing of quarantine certificates during the movement of grain and its processed products throughout the Russian Federation will ensure the complete traceability of grain, which is received both on the domestic market and for export, and will not create significant additional business burdens.

The risk of creating monopolies in the grain trade market in 2020 was due to the appearance of a major player in the VTB, who in a short time was able to buy a number of grain assets and transport infrastructure and proposed the creation of a unified grain holding. The Bank’s intention is to become a world-class trader and, in Russia, a guarantor of competition and equal access to infrastructure.

VTB owns 50% minus 1 share of "United Grain Company" (the rest of the Russian Federation). In addition, he owns 33.7% of the “Novorossiysky Bakery Factory”, one of the largest grain terminals in the Russian Federation, and 100% of the “Novorossiysky Grain Terminal” (purchased from the “Novorossiysky Sea Trade Port”). The VTB also bought the controlling interest of the railway operator “Rustranskom” (RTK), which specializes in grain transportation, and 70% of the grain trader “World Groups Resources”, close to the authorities of the Krasnodar Territory. It was reported that the bank was also interested in 50 per cent of the cereal terminal “Taman”.

Currency risk can be systematized according to the nature of the exposure, the risk factors and the nature of the effects of currency risk already experienced. This integrated classification of foreign exchange risks is shown in table 3.

Table 3. The integrated classification of currency risk due to the certain factors (compiled by the author based on the source [4])

|

Indncators |

Currency risk |

|

|

Nature of manifestation |

Open |

Hidden |

|

Intervening factor |

Internal |

External |

|

Nature of effects |

Indirect |

Direct |

In the case of latent risk, the company is not aware of foreign exchange exposure. This situation may arise if the Russian organization has a branch abroad (for example, in the United States), which carries out various types of financial transactions with another country in a currency other than the main currency. In such a case, the company would be affected not only by the change in the value of the dollar but also by the second currency in which the subsidiary is paying to a third country.

In terms of impact factors, currency risks are divided into internal and external or structural and market risks, as described above.

On the basis of the effects of the realization, foreign exchange risks are classified as direct and indirect. The first are foreign exchange risks that have a direct impact on a company’s financial health, and indirect foreign exchange risks do not have direct access to the financial position, but can only affect the enterprise through other areas.

The current year was marked by the creation, almost under the control of the Ministry of Agriculture, of a new association, the Union of Grain Exporters, whose board was chaired by Eduard Zernin, a former “OZK-Yug” member. For the first time, the Ministry of Agriculture announced plans for a new union or a major reformatting, in February at a meeting with exporters (started regularly since August 2018).

The new union was registered on the 30-th of July. Its founders were four leading exporters – JSC “Aston”, LLC “Glencore Agro MZK”, LLC “OZK-Yug” and LLC “Trading house “RIF”.

In 2020 the Russian grain complex enters with new rules of Russian support.

According to “Interfax”, Deputy Minister of Agriculture Elena Fastova, the main issue is the transformation of the subsidy system. The three types of subsidies currently in operation – milk subsidies, unrelated (so-called income-generating) support and a single subsidy – will be combined and divided into two – compensating and stimulating [5].

However, the Ministry does not plan to withdraw the compensatory subsidy in the coming years. But most of the funds will be used as a stimulus subsidy to enable regions to increase production, including exports.

The Government Resolution on the new mechanism of state support of the industry was signed on 30-th of November. Priorities include the production of vegetables, fruit and berry crops, viticulture, meat herding, and the cultivation of oilseeds, especially soy and rapeseed. In 2020, the compensatory subsidy is provided for 34 billion rubles. and the stimulating subsidy for 27 billion rubles.

The measures of state support which have been proven in the past will continue to operate. As Fastova put it, the favored and very demanded by the agrarians preferential lending. In 2020, 90 billion rubles have been pledged for it. Against 60 billion rubles in 2019.

On the whole, the support of agricultural complex from the Russian Federation in 2020 will increase to 321 billion rubles against 307 billion rubles. in 2019. According to the Ministry of Agriculture forecast, agricultural complex exports in 2019 will amount to $2425 billion against $25.8 billion in 2018. By December 8, it had reached $22.4 billion.

In the conclusion we would like to say that foreign trade is thus an important and dynamic component of industrial activity. However, in order to effectively manage and identify risks and risk situations in foreign trade activities, systematic monitoring of ex-ports/imports of individual industries, enterprises and goods is necessary.

Список литературы Risk profile of grain exporting companies

- Ilinova V.V. Upravlenie riskami v eksportnoj sfere // Zhurnal nauchnyh i prikladnyh issledovanij. - 2016. - № 4-2. - S. 65-68.

- Ksenofontov M.YU., Polzikov D.A., Urus A.V. Regulirovanie zernovogo sectora v kontekste zadach obespecheniya prodovolstvennoj bezoopasnosti Rossii // Problemy prognozirovaniya. 2019. №6 (177)

- Zaharenko T.A. Identifikaciya i bezopasnost' otdel'nyh importno-eksportnyh prodovol'stvennyh tovarov: sovremennye tendencii i riski // Tamozhennye chteniya - 2015. Evrazijskij ekonomicheskij soyuz v usloviyah globalizacii: vyzovy, riski, tendencii sbornik materialov Vserossijskoj nauchno-prakticheskoj konferencii. Pod obshchej redakciej S.N. Gamidullaeva. - 2015. - S. 175-178.

- Dmitrieva M.A. Valyutnyj risk: ot opredeleniya k klassifikacii // Rossijskoe predprinimatelstvo, 2015. - T. 16. № 15. S. 2423-2436.

- Analiticheskij elektronnyj zhurnal "Agroinvestor". - [Electronic resource]. - URL: https://www.agroinvestor.ru/analytics/news/33217-eksport-produktsii-apk-v-2020-godu-mozhet-sostavit-25-8-mlrd/ (date 26.04.2020).