Russian economy under tough external sanctions: problems, risks and opportunities

Автор: Kuvalin Dmitri B.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public administration

Статья в выпуске: 6 т.15, 2022 года.

Бесплатный доступ

The article examines key issues related to the current economic crisis in Russia caused by large-scale sanctions imposed by Western countries. We analyze main trends that have developed in the Russian economy after the introduction of the sanctions. We provide findings of a questionnaire survey of representatives of Russian enterprises, showing the reaction of domestic producers to the crisis phenomena of 2022. Having analyzed official statistics, sectoral and corporate information, we identify growth points that have emerged in the Russian economy under new conditions and describe main reasons for these “success stories”. We assess major risks and threats related to the development of the Russian economy in the medium and long term and propose methods to deal with them. We show that under dramatic foreign policy pressure on Russia, it is necessary to significantly expand the scope of mobilization (planning) tools. These mechanisms should provide a prompt solution to such structural problems as the full-fledged revival of key economic sectors, infrastructure development, elimination of regional imbalances, etc. Increasing the role of mobilization tools should be ensured by expanding public investment, strengthening protectionism in foreign trade policy, introducing elements of indicative planning and currency control; at the same time, the key function of market mechanisms should be preserved. We argue that Russia’s economy could make a powerful breakthrough in the modern context. This point is justified, on the one hand, by analogy with the situation in the late 1990s (a powerful breakthrough of the Russian economy immediately after the abandonment of inadequate macrofinancial policy), on the other hand, by the survey data of RAS Institute of Economic Forecasting on a sufficiently high modernization activity of Russian enterprises at the present time.

Anti-russian sanctions, risks and threats, adaptation to the crisis, anti-crisis policy, questionnaire business survey, economic growth potential

Короткий адрес: https://sciup.org/147239138

IDR: 147239138 | УДК: 338.1 | DOI: 10.15838/esc.2022.6.84.4

Текст научной статьи Russian economy under tough external sanctions: problems, risks and opportunities

After February 2022, Russia faced a sharp tightening of geopolitical and foreign economic conditions. This tightening includes increasing military and political pressure on Russia and the introduction of large-scale economic sanctions aimed at causing serious damage to the Russian state budget, business and the population. Of course, this development creates significant additional threats to the internal political and social stability in the country. In addition, severe external pressure leads to serious economic problems and risks of both short- and long-term nature. At the same time, due to the departure of many foreign suppliers from Russia, domestic manufacturers are getting new opportunities for the development by occupying the released market niches. However, Russian producers will be able to fully use this potential for development only if they receive active support from the state and implement a high-quality macroeconomic policy.

Brief theoretical overview

Macroeconomic theory characterizes the conditions in which Russia fell in 2022 as an external shock (Mankiw, 1994). As a rule, a macroeconomic shock is understood as a sharp change in the conditions in which a particular national economy operates. At the same time, we can argue that there is no generally accepted scientific definition for a macroeconomic shock. Different theorists describe and interpret this phenomenon in different ways (Samuelson, Nordhaus, 1993; L’vova, 2015; Mirkin, 2020; Mikheeva, 2021). Nevertheless, it is possible to identify some common characteristics of macroeconomic shocks used by most researchers.

First, a macroeconomic shock is a large-scale event that has a significant impact on the entire national economy.

Second, a macroeconomic shock is an event that proceeds quickly, radically changing the overall situation in a few weeks or months.

Third, macroeconomic shocks are characterized by a sudden arrival. Even if one of the shocks is cyclical and occurs periodically, the exact timing of its return can almost never be predicted. In addition, there are unique shocks caused by a rare combination of circumstances. Nassim Nicholas Taleb called such shocks “black swans” (Taleb, 2007).

Fourth, most researchers (although not all) believe that a shock is a phenomenon external to the national economy, which has nothing or almost nothing to do with events inside it.

Fifth, an external macroeconomic shock can be caused by both economic events (for example, large-scale global financial crises or spikes in world prices for key goods) and non-economic events (pandemics, major natural and man-made disasters, geopolitical cataclysms, technological breakthroughs, etc.)

Studying the impact of shocks, the economic theory pays considerable attention to the processes of adaptation within the national economy. To analyze the processes of adaptation to shocks, for example, models based on the hypothesis of market equilibrium are used: the Solow – Swan model (Solow, 1956; Swan, 1956), the Ramsey – Kass – Koopmans model (Koopmans, 1963; Cass, 1965). These models consider under what conditions the economy, thrown out of balance by the macroeconomic shock, can come to a new point of equilibrium. Such conditions are, for example, a change in the rate of accumulation or the rate of government spending. It is worth noting that for all their advantages, these models are rather theoretical in nature and are not suitable for making practical decisions. They practically do not reflect the structural, technological, institutional, cultural, geographical and other features of national economies. In addition, these models assume perfect competition, full availability of information for all economic agents, instantaneous movement of resources in space, absence of institutional barriers, the same motives for all economic agents and other ideal conditions that are absent in real economic life. At the same time, some general ideas, such as the need to reduce taxes or increase government spending by increasing public debt during the crisis period, are fully confirmed by these models.

Methodological approaches

Since in this case Russia is faced with a poorly predictable economic shock of the “black swan” type, the classical theoretical approaches to the study of shocks and recommendations based on these approaches can be used for analysis only partially. The adaptation of national economies to such unique shocks is usually much more difficult than to cyclical shocks, the possible effects of which have already been considered more or less both in theory and in practice. The study of unique shocks requires special attention to the features of the behavior of households, enterprises, regional authorities, municipalities and other economic agents, since in atypical conditions their reaction determines the dynamics of production, consumption, accumulation and other socioeconomic processes almost more than the ratio of macroeconomic indicators (Yaremenko, 1999). In this regard, economic and sociological surveys, in particular, questionnaire surveys of enterprises and households, in-depth interviews with business representatives, etc., are of particular value. In addition, when studying the reaction of the economy to atypical shocks, it is important to analyze industry and regional statistics, as well as corporate reporting, which allows catching the structural shifts taking place, identify the most problematic economic sectors and noting potential points of recovery post-crisis growth.

Analysis of the economic situation in Russia after imposing sanctions

The questionnaire business survey data, conducted by the Institute of Economic Forecasting of the Russian Academy of Sciences in April – May 2022 1 , fully confirmed the official statistics and showed that the shock caused by sanctions led to large-scale crisis processes affecting almost all spheres of the Russian economy. According to the survey in the spring of 2022, 59.2% of Russian enterprises have already suffered from sanctions. Representatives of another 22.3% of enterprises at this moment assumed that organizations have not yet been affected by sanctions, but may suffer in the future ( Tab. 1 ).

Among the most acute problems caused by sanctions, respondents most often referred to difficulties in obtaining imported raw materials and components, as well as the need to replace them (67.4% of responses); rising prices within the country (62%); growing general uncertainty in the Russian economy (44.2%); rising import prices (40.3%); falling effective demand within Russia (38.8%); loan appreciation (32.6%; Tab. 2 ).

Table 1. Distribution of answers to the question “Has your company suffered from sanctions related to the situation in Ukraine?” (sum of answers = 100%), %

|

Period |

Yes |

No |

No, but it may suffer in the future |

|

April – May 2022 |

59.2 |

18.5 |

22.3 |

|

Source: (Kuvalin, et al., 2022). |

|||

1 There were interviewed 189 enterprises from 47 Russia’s regions.

Immediately after the aggravation of the geopolitical situation, serious problems arose in the financial sphere. The official exchange rate of the national currency began rapidly falling, reaching a peak value of 120 rubles/USD on March 11, 2022 ( Fig. 1 ). At the same time, consumer prices for the month of March alone, according to Rosstat, increased in Russia by 7.61% ( Fig. 2 ).

Despite the extreme severity of the problems that have arisen, we can argue that the Russian economy and the Russian economic authorities

(represented by the Government of the Russian Federation and the Bank of Russia) have generally coped with the short-term threats that were generated by Western sanctions. The authorities managed to stop the inflationary surge in the economy fairly quickly, prevent a bank panic accompanied by a sharp outflow of deposits and massive non-payments on loans, ensure the smooth operation of the national payment system and return the ruble exchange rate to the pre-crisis level with a margin (in January 15, 2022 the official

Table 2. Distribution of answers to the question “What problems related to economic sanctions against Russia are most acute for your company?” (sum of answers > 100%), %

|

g о ^ Ф 1 ^ О) ° S Е с о S I |

Е |

ф 2 ОС о_ |

5 |

ОС |

" ? о со > § 5 га У ^ Ё □С га Е |

О |

||||

|

April – May 2022 |

67.4 |

40.3 |

17.1 |

38.8 |

62.0 |

32.6 |

1.6 |

22.5 |

44.2 |

3.1 |

|

Source: (Kuvalin, et al., 2022). |

||||||||||

Figure 1. Average monthly exchange rate of the ruble against the U.S. dollar in 2022

Source: The Bank of Russia data. Available at: (accessed: November 1, 2022).

Figure 2. Inflation rate (consumer price index) in Russia by month

7.61

Source: Data of FSSS of Russia. Available at: (accessed: November 1, 2022).

July 2022 3 . The amount of real wages decreased in April 2022 by 7.7% compared to the previous month, but in July 2022, due to deflationary processes, it increased by 3.1% compared to June (Belousov et al., 2022a).

At the industry level, events in 2022 developed in different ways. Some economic activities have suffered greatly from the sanctions. For example, according to Rosstat, the production of passenger cars for 8 months of 2022 decreased by two-thirds compared to the same period in 2021. Over the same period, the production of washing machines and refrigerators has declined by more than 40% 4 . These production failures were primarily due to a sharp reduction in the supply of components from unfriendly countries.

However, in general, there are few failed industries in the Russian economy. The number of industries that managed minimal losses or even benefited from the current development of events turned out to be much larger. The winning sectors of the Russian economy can be divided into three main categories.

-

3 FSSS of Russia. Available at: https://rosstat.gov.ru/ labour_force (accessed: October 1, 2022).

-

4 FSSS of Russia. Available at: https://gks.ru/bgd/regl/ b22_01/Main.htm (accessed: November 1, 2022).

Volume 15, Issue 6, 2022 83

exchange rate of the Bank of Russia was 75 rubles/ USD, while by October 29, 2022 it decreased to 61.5 rubles/USD 2 ).

In the summer of 2022, the economic situation in the country continued stabilizing. Analysts note that, judging by direct and indirect data, already in July – August 2022, there was a recovery growth in the Russian industry and investment sector. In particular, according to the estimates of the Center for Macroeconomic Analysis and Short-term Forecasting (CMASF), in July 2022 industrial production increased by 1.0% compared to the previous month, in August – by 0.5%, in September – by 1.7% (seasonality eliminated). At the same time, the value of the investment activity index calculated by the CMASF increased in August 2022 to 99.4% compared to 95.3% in June (Belousov et al., 2022a; Belousov et al., 2022b). In addition, the situation on the labor market and in the sphere of the population’ s income began improving. According to Rosstat, the unemployment rate in the country decreased from 4.2% in January March 2022 to 3.9% in May –

First, these are export-oriented industries that have benefited from the jump in world prices for raw materials. For example, physical coal production in the first 8 months of 2022 decreased by 2.5%, but it did not create any problems for the industry, since from January to September 2022, prices on international coal markets more than doubled5. The situation in the gas industry was similar. Although natural gas production decreased by 10.4% in the first 8 months of 2022, and gas exports to nonCIS countries fell by about a third, the profits of Russian gas companies Gazprom and NovaTek, thanks to a sharp increase in the cost of exports, were tens of percent higher than in 20216. And in such key economic activities for Russia as crude oil production and primary aluminum production, in 2022, not only world prices increased, but also physical output volumes – by 3.1 and 14%, respectively7. Also in 2022, the production volume of mineral fertilizers, vegetable oils and a number of other products exported in large quantities to foreign countries increased (Tab. 3). At the same time, if Western countries refused to purchase Russian products under sanctions, domestic exporters tried to switch to the markets of other countries. For example, in August 2022, Russian coal exports to China8 and India9 increased by 40– 60% compared to August 2021. Despite the fact that new buyers have to provide significant discounts, the overall increase in world energy prices still makes such exports rather profitable.

Second, in 2022, the industries that managed to increase supplies to the Russian market won due to the departure of many foreign suppliers from Russia. These import substitution processes have caused output growth in a number of sub-sectors of mechanical engineering, food and pharmaceutical industries, agriculture, IT, tourism, etc.

Third, there has been a significant increase in production in industries related to the production of defense products. But for obvious reasons, it is not reflected in public statistics.

Table 3. Enclaves of growth in the Russian economy

|

Industry |

Issue for January–August 2022 compared to January–August 2021, % |

|

Growth due to exports |

|

|

Coal mining, physical volume |

97.5 |

|

Coal sales volume at current prices |

187.1 |

|

Oil and natural gas production, physical volume |

102.2 |

|

Volume of oil and gas sales at current prices |

143.1 |

|

Production of coke and petroleum products, physical volume |

99.3 |

|

Sales volume of coke and petroleum products at current prices |

120.4 |

|

Food production, physical volume |

100.2 |

|

Volume of food sales at current prices |

120.3 |

|

Production of chemicals and chemical products, physical volume |

97.0 |

|

Volume of sales of chemicals and chemical products at current prices |

131.0 |

|

Primary aluminum production, physical volume |

114.0 |

|

Vegetable oils and their unrefined fractions, physical volume |

118.0 |

End of Table 3

Industry Issue for January–August 2022 compared to January–August 2021, % Growth in the domestic market, including due to import substitution Production of machinery and equipment not included in other groupings 106.7 Production of medicines and materials used for medical purposes 122.7 Milk, except raw 103.3 Cheeses 103.1 Manufacture of computers, electronic and optical products 104.8 Plastic pipes, tubes, hoses and their fittings 113.2 Refractory cements, mortars, concretes and similar compositions not included in other groupings 107.6 Casing pipes, tubing and drill pipes used for drilling oil or gas wells, seamless steel 110.5 Ball or roller bearings 107.7 Agricultural products 104.6 Commissioning of residential buildings, million m2 of the total area of residential premises 133.3 Volume of paid tourist services 133.3 Source: data of FSSS of Russia. Available at: (accessed: November 1, 2022).

Thus, currently, it is already possible to talk about points and even entire enclaves of growth, which in the medium term may become the locomotives of the post-crisis development of the Russian economy.

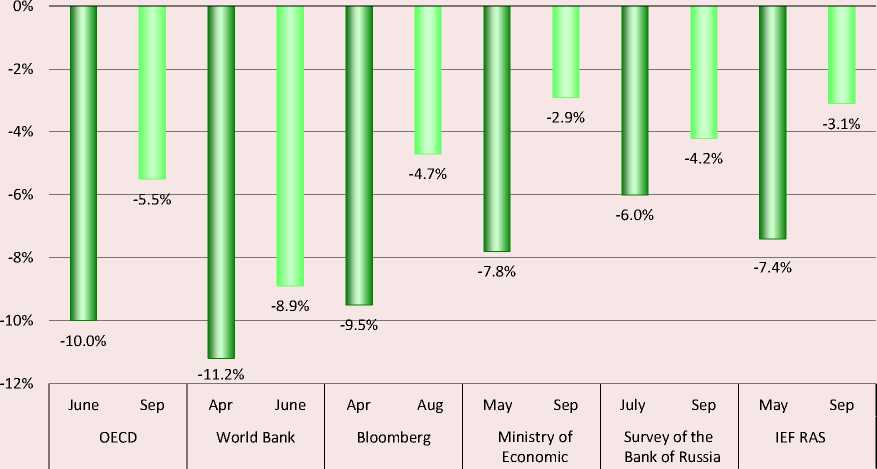

This outcome has led to a significant improvement in the forecast estimates for Russian GDP by the end of 2022, prepared over the previous months by various analytical organizations ( Fig. 3 ).

Figure 3. Forecast estimates for Russian GDP by the end of 2022

Development of RF

Set of information from official websites of notified organizations.

Table 4. Distribution of answers to the question “What consequences for your company do you expect as a result of imposing economic sanctions against Russia?” (sum of answers = 100%), %

|

Period April – May 2022 |

No special effects are expected 5.40 |

Negative 38.00 |

Both negative and positive 32.60 |

Positive 2.30 |

It is hard to say yet 21.70 |

|

Source: (Kuvalin et al., 2022). |

|||||

In turn, we are even more optimistic and assume that if the speed and scale of adaptation of the Russian economy to the sanctions shock continue, the decline in Russian GDP by the end of 2022 will not exceed 1–2%.

We should particularly note that representatives of many Russian enterprises already assumed in the spring of 2022 that the crisis generated by the sanctions creates not only problems, but also opportunities. In particular, only 38% of respondents who took part in the IEF RAS survey in April – May 2022 considered that the crisis would lead exclusively to negative effects for their enterprises. At the same time, 32.6% believed that the effects would be both negative and positive; 2.3% expected only positive effects, and another 5.4% believed that there would be no special effects at all ( Tab. 4 ). As further events have shown, the hopes of some Russian enterprises for positive changes during the crisis have largely been justified.

Risks and threats to the Russian economy and ways to overcome them

In general, the successful resolution of current problems and relatively mild nature of the crisis in 2022 do not cancel out the risks and threats that the Russian economy will face in the medium and long term. Sanctions against Russia, apparently, have been imposed for a long time. Sanctions in the field of high technologies may be particularly painful, since countries unfriendly to Russia in a number of cases monopolistically control access to the best technological solutions that determine the efficiency and competitiveness of the entire economic sectors. In addition, countries of the Euro-Atlantic block exercise strict control over the global banking system and its payment circuit, which allows them to seriously complicate Russia’s financial relations with neutral and friendly countries.

In addition, the current favorable price situation for Russian exporters on the world raw materials markets may significantly change for the worse if the slowdown in the Chinese economy continues. So far, it is mainly related to temporary quarantine measures against the next coronavirus waves 10 , but it is not very clear how long China will continue these actions.

In the long term, Russia should also solve very complex problems related to the need to overcome the technological gap from developed countries and provide new production facilities with advanced technologies. At the same time, it should be borne in mind that previously imported high-tech machines and equipment will gradually fail. In past years, the replacement of retiring high-quality equipment and the introduction of new technologies could be ensured by imports from countries that have now joined the sanctions (although earlier the supply of the most advanced technologies from them to Russia was quite deliberately limited). But in the foreseeable future, such a method of technological modernization can be considered at best as secondary.

In this regard, in the near future Russia will definitely need to solve a number of medium- and long-term tasks related to the necessity to mitigate the negative effects of the sanctions. Among the key tasks of this kind are the following.

-

• Reorientation of export supplies to countries that do not support the embargo on Russian products.

In this case, we are talking primarily about the export of natural gas, petroleum products, and coal. The volume of alternative demand for these resources can be considered unlimited. Given the size of the economies of China, India and other countries that agree to buy Russian products, we can argue that they are ready to accept not only all of our current energy exports, but also almost any additional volumes. However, rapid expansion of export supplies in alternative directions is hindered by infrastructure restrictions. The current capacity of Russian pipelines, railways, ports and border crossings is insufficient to transfer the released export resources to other countries. The solution of this task requires the modernization and construction of a new network infrastructure in the Far East, in the Caspian and Black Sea basins, in the North of Russia, as well as on the borders with Central Asia. In addition, the volume and flexibility of gas exports can be increased through the large-scale construction of gas liquefaction plants and gas tankers.

-

• Establishing alternative channels for receiving imported products from unfriendly countries.

Since unfriendly states have grossly violated market principles and norms of international trade, Russia has the right and should import the types of products necessary for the country, bypassing existing sanctions. It is no secret that many companies from unfriendly countries do not share the positions of their governments and are ready to supply their products to Russia even in the current conditions. However, in order not to create difficulties for trading partners, new supply channels through third countries are needed, using combined logistics, property and financial schemes including the so-called parallel import. As the experience of the Soviet period, as well as China, Iran and other countries shows, such alternative import channels make it possible to cover at least part of the need for key types of products.

-

• Creation of new technologies for mutual settlements and withdrawal of payment chains from the control of unfriendly countries.

Digitalization of the global financial system has greatly increased the ability to control the flow of funds between countries. At the same time, most modern technologies that provide cross-border settlements through SWIFT, VISA, Mastercard, etc. payment systems are monopolized by states unfriendly to Russia. The main financial control centers are also located in these countries. This state of affairs allows them to apply the so-called secondary sanctions quite effectively and impose them on countries and companies that conduct mutual trade with Russia, conducting mutual settlements through the above-mentioned systems, therefore, it is necessary to create and put into operation alternative payment systems in our country as soon as possible, independent of unfriendly countries. And although this is a very difficult task, there are several ways to solve it at once.

First, alternative international systems can be based on technological solutions used by the Russian Financial Messaging System of the Bank of Russia (SPFS), the Faster Payments System (SBP), and the system “Mir”. Given the high technological level of these payment systems, it is quite possible to hope for the connection of participants from other countries to them.

Second, it is possible to create two-way payment systems in national currencies. Such important Russia’s trading partners as Iran and Turkey have already expressed interest in creating such systems. However, the main disadvantage of such bilateral systems is likely to be difficulties in eliminating trade imbalances. It is unlikely that a country that has earned a surplus in bilateral trade will willingly accept as its cover not the strongest currency of its partner.

This problem is solved somewhat more simply in bilateral trade relations with China. On the one hand, Russia uses the Chinese yuan to form its gold and foreign exchange reserves, accounting for 17% of their volume at the beginning of 2022 11 . On the other hand, third countries also agree to accept payments in yuan in some cases, which allows using the Chinese currency to cover trade imbalances.

Third, it is possible to create a new international payment system using artificial monetary units functionally similar to the transferable ruble in the Comecon or ECU in the European Union before 1998. Iran, for example, took the initiative of this kind in relation to the Shanghai Cooperation Organization 12 . In this case, the main difficulty will be to find many partner countries at once and lengthy negotiations at the initial stage.

Fourth, it is possible to apply barter transactions in bilateral relations at agreed prices and with the use of periodic clearing offsets. But this method, unfortunately, involves very significant transaction costs and is suitable only for servicing large-scale, stable and homogeneous trade flows.

It seems that due to the complexity of the current circumstances, each of the listed options or their combinations should be tested at this stage.

-

• Replacement of high-tech machines, equipment, components, spare parts and raw materials previously supplied from countries that supported sanctions against Russia.

In part, this task can be solved by reorienting to imports from friendly or neutral countries. According to some expert estimates, by now up to 60% of blocked imports from unfriendly states have been replaced by supplies from countries that are more loyal to Russia. However, the latter produce far from everything that Russian manufacturers need. The technological level of products from these countries also does not always reach the level of Western manufacturers.

A more reliable way to ensure long-term technological independence and reduce the lag behind the most developed countries is to establish own production of key types of products (machinebuilding, electrical and electronic, chemical, pharmaceutical, etc.), whose supplies to Russia are blocked by unfriendly countries. But for these purposes, accelerated development of domestic fundamental and applied science, a full-fledged revival of design and design (engineering), engineering education and many other segments necessary for the formation of a competitive high-tech sector in relation to the leading countries of the world will be required. Theoretically, this task can be solved, but the experience of the previous 30 years shows that until now the Russian state has been engaged in the development of high technologies little and inefficiently, and Russian business was not very interested in all this.

In addition, investment projects in the field of high technologies should have access to cheap credit, and state-owned ones should be focused on high-tech goods and services of Russian production. We should pay particular attention to the transfer of high technologies from the militaryindustrial complex to the civilian sector. To this end, defense enterprises, within the framework of a purposeful state policy, should (in addition to fulfilling their main tasks) integrate into technological chains for the production of nonmilitary products (Yaremenko, Rassadin, 1993; Frolov et al., 2017).

-

• Large-scale implementation of mobilization economy mechanisms aimed at solving problems related to improving the country’s defense capability and economic security, as well as overcoming complex structural problems.

The actions listed above for the deep restructuring of the Russian economy require a large-scale redistribution of resources between sectors and regions of the country. Moreover, taking into account the extremely unfavorable geopolitical situation, this maneuver with resources should be carried out in a very short time. As the world and Russian economic history shows, in the conditions of military operations and foreign policy pressure, market mechanisms for the targeted redistribution of resources do not work very effectively (Sapir, 2022; Yaremenko, 1997; Yaremenko, 2015). In such situations, they should be complemented by powerful mobilization (planning) tools – significant budget investments in the development of key industries and infrastructure; directive planning in the militaryindustrial complex and indicative planning in the rest of the economy; protectionism in foreign trade; quotas for supplies to Russian and foreign markets, elements of currency control, etc.

At the same time, the expansion of the functioning sphere of mobilization tools should not lead to the oppression of market mechanisms. On the contrary, market mechanisms should be used as widely as possible to increase the effectiveness of mobilization methods, including in the process of maintaining macro-financial and budgetary stability, in determining fair prices in the markets, in stimulating investments, in order to strengthen labor motivation, etc. In other words, Russia in the future should remain a country with the market economy, but at the same time using mobilization mechanisms in order to force the solution of structural problems in difficult geopolitical circumstances.

The views of representatives of Russian enterprises on the desirable measures of support from the state largely confirm the above theses. In particular, in April – May 2022, respondents believed that the way out of the sanctions crisis requires the following measures of support from the state: limiting the growth of prices for fuel, energy and transport services (55.8% of responses); reducing the tax burden for producers (52.7%); subsidies to producers who have established the production of import-substituting products (42.6%); increase in demand in the economy due to the growth of public procurement; payment of subsidies to the population, etc. (39.5%); sharp expansion of the sphere of concessional lending (38.8%; Tab. 5 ).

Table 5. Distribution of answers to the question “What measures to counter economic sanctions, in your opinion, should the Russian authorities take?” (sum of answers > 100%), %

|

Period |

Е s |

s |

E5 5 2 E 5 О 2 ° ~ I ° ° J 1 — и 2 □. o |

ф ^2 cc EL- |

tn |

E 1 a 8 |

^ co ill |

III |

c CO Ф о C2-C X 00 о ^ II 1 -I |

о |

|

|

April – May 2022 |

52.70 |

18.60 |

39.50 |

55.80 |

45.70 |

23.30 |

38.80 |

35.70 |

42.60 |

25.60 |

4.70 |

|

Source: (Kuvalin, et al., 2022). |

|||||||||||

Prospects for the development of the Russian economy in modern conditions

Despite all the difficulties that the Russian economy is currently facing, in our opinion, it is able not only to resist them, but also to make a powerful leap forward in the near future. Analogies from the relatively recent economic history of Russia help to make such an assumption.

To a certain extent, the current situation in the Russian economy resembles the situation that developed at the end of 1998.

On the one hand, by that time Russia had been conducting an inadequate and therefore very unsuccessful macroeconomic policy for quite a long period (1992–1998). Within the framework of this policy, formal macrofinancial stabilization was considered the primary goal, and the needs of the real economic sector and the population were considered secondary and largely ignored. As a result, Russia could not get out of the spiral of economic decline.

On the other hand, in the Russian economy of that period there was a gradual adaptation to new conditions, the development of new management and production technologies, the search for new sales markets, etc. Enterprises, regions and municipalities, households (population) tried to find and in many cases found options for reasonable economic solutions, and not so much thanks to, as in spite of the then macroeconomic policy. We can confidently argue that these economic entities at that time understood the mechanisms, limitations and opportunities of the market economy better than the federal authorities.

Therefore, when the new composition of the federal government under the leadership of E.M. Primakov abandoned the most inadequate measures of macroeconomic policy, it quickly became clear that the Russian economy was ready for growth (Samokhvalov, 2018; Piskulov, Khasbulatov, 2019). The rapid growth of production in the country began literally two months after the termination of such dubious actions as supporting an inflated ruble exchange rate, maintaining a financial pyramid of government securities, nonfulfillment by the state of budget obligations to enterprises and the population in order to reduce the money supply, etc.

If we look at the period from 2009 to 2022 from this point of view, then events in it are developing in much the same way. All this time, a strict macrofinancial policy has been carried out in the country, focused on reducing inflation by monetary means and restraining the development of the real sector. At the same time, this overwhelming economic activity policy was accompanied by very active modernization activities at the level of enterprises, regions and households.

Table 6. Distribution of answers to the question “What measures are your company taking to counteract the “sanctions” crisis?” (sum of answers > 100%), %

Period

E

April – May 2022 г.

Source: (Kuvalin, et al., 2022).

I— 03

I— DC

36.1

69.7

36.9

11.5 14.8

21.3

31.1

14.8

3.3

In particular, even with the sharp complication of the situation caused by sanctions, many Russian enterprises are not just trying to survive, but are actively looking for opportunities for further development. This circumstance once again has confirmed the high adaptive abilities of Russian enterprises, which invariably manifest themselves during economic crises. For example, as a survey by the IEF RAS showed, even in conditions of extremely high uncertainty in April – May 2022, 69.7% of domestic enterprises have already started searching for new suppliers in Russia, and another 36.1% conducted such a search abroad. At the same time, 31.1% of respondents were looking for new sales markets, 21.3% started producing new types of products, and 14.8% launched restructuring and modernization of production ( Tab. 6 ).

In addition, we should take into account that large-scale military operations, such as those in which Russia is currently participating, are always accompanied by accelerated development of high-tech industries. And this circumstance can also help Russia cope with sanctions faster, lengthen value chains, and provide a new economic breakthrough.

Questionnaire business surveys, as well as studying the situation in various sectors of the economy and regions confirm that at the moment there are significant economic enclaves in the country, which are either already growing rapidly or are clearly capable of rapid growth in the near future. As we have already noted, such enclaves can be seen in many export-oriented industries, in terms of subsectors of mechanical engineering and chemical industry, agricultural sector, nonferrous metallurgy, timber industry, agriculture, food and pharmaceutical industry, IT, tourism, etc.

Thus, we can assume that the emancipation of Russian producers by ending the monetary “drought” and increasing the availability of credit, some reduction in the tax burden, reducing the bureaucratic burden and increasing government orders can again provide a serious breakthrough of the Russian economy, which is most likely ready for rapid growth now.

In our opinion, the overall growth potential in the Russian economy is such that the growth rates of GDP and industrial production in the country can reach 4–5% per year and even higher, and for at least several years.

Conclusion

The main conclusions from the analysis of the current economic situation in Russia are as follows:

-

1. Large-scale sanctions by unfriendly countries have created great difficulties for the Russian economy and caused a serious crisis in it.

-

2. The current economic crisis in Russia is of a nonstandard nature and therefore the response measures to it in many ways should also be nonstandard.

-

3. In general, the Russian authorities have coped with the crisis phenomena of a short-term nature, preventing serious disruptions in the work of the national financial and banking system and keeping the ruble exchange rate under reliable control.

-

4. The Russian economy, represented by enterprises, households and regions, has also confirmed its high adaptive abilities, very quickly starting an active search for anticrisis solutions.

-

5. However, the relatively mild passage of the crisis in 2022 does not save the Russian economy from very serious medium- and long-term threats related to sanctions. The fight against these threats requires the continuation of an active economic policy.

-

6. On the one hand, as part of the fight against sanctions, Russia should make significant efforts to build a new architecture of its international trade and economic ties including the creation of new transport corridors, new payment systems, etc.

-

7. Currently, Russia has a good chance not only to withstand the sanctions pressure of unfriendly countries, but also to make an economic leap forward in the coming years, raising the GDP growth rate to 4–5% per year and above.

On the other hand, a mandatory element of the anti-crisis state policy should be the use of mobilization (planning) mechanisms including a significant increase in public investment in the development of key industries and infrastructure, expansion of volumes and areas of support for households, enterprises and regions, strengthening of protectionism in foreign trade, elements of currency control, etc.

Список литературы Russian economy under tough external sanctions: problems, risks and opportunities

- Belousov D.R., Sal’nikov V.A., Solntsev O.G. et al. (2022a). Analysis of macroeconomic trends. CMASF. Available at: http://www.forecast.ru/_ARCHIVE/Mon_MK/2022/macro30.pdf (accessed: November 1, 2022).

- Belousov D.R., Sal’nikov V.A., Solntsev O.G. et al. (2022b). On the dynamics of industrial production in September 2022. Available at: http://www2.forecast.ru/_ARCHIVE/Analitics/PROM/2022/PR-OTR_2022-10-27.pdf (accessed: November 1, 2022).

- Cass D. (1965). Optimum growth in an aggregative model of capital accumulation. The Review of Economic Studies, 32(3), 233–240.

- Frolov I.E., Bendikov M.A., Ganichev N.A. (2017). The main factors determining the current state and prospects of development of defense industry enterprises. Strategicheskoe planirovanie i razvitie predpriyatii: mater. XVIII Vserossiiskogo simpoziuma [Strategic Planning and Development of Enterprises: Materials of the 18th All-Russian Symposium] (in Russian).

- Koopmans T.C. (1963). On the Concept of Optimal Economic Growth. Discussion Paper 163. Yale University. Cowles Foundation for Research in Economics.

- Kuvalin D.B., Zinchenko Yu.V., Lavrinenko P.A., Ibragimov Sh.Sh. (2022). Russian enterprises in the spring of 2022: Adapting to the new wave of sanctions and views on the ESG agenda. Problemy prognozirovaniya=Studies on Russian Economic Development, 6, 174–187. DOI: 10.47711/0868-6351-195-171-184 (in Russian).

- L’vova N.A., Semenovich N.S. (2015). The phenomenon of crisis as presented in economic science: An anticipated pattern or unpredictable shock? Finansy i kredit=Finance and Credit, 21(645), 27–36 (in Russian).

- Mankiw G. (1994). Makroekonomika [Macroeconomics]. Moscow: Izdatel’stvo MGU.

- Mikheeva N.N. (2021). Resilience of Russian regions to economic shocks. Problemy prognozirovaniya=Studies on Russian Economic Development, 1, 106–118 (in Russian).

- Mirkin Ya.M. (2020). Changes in economic and financial structures: Impact of 2020 shocks. Ekonomicheskoe vozrozhdenie Rossii=The Economic Revival of Russia, 2(64), 86–92 (in Russian).

- Piskulov Yu.V., Khasbulatov R.I. (2019). We miss Primakov (theses for the 90th anniversary of his birth). Mezhdunarodnaya ekonomika=The World Economics, 5, 17–33 (in Russian).

- Samokhvalov A.F. (2018). A prophet in his own country. On the results of the development of the Russian economy in 1998–2017. Svobodnaya mysl’, 6(1672), 5–12 (in Russian).

- Samuelson P.A., Nordhaus W.D. (1993). Ekonomika. 5-e izd [Economics. Fifth Edition]. Moscow: Algon.

- Sapir J. Is economic planning our future? Studies on Russian Economic Development, 33(6), 583–597. DOI: 10.1134/S1075700722060120

- Solow R.M. (1956). A contribution to the theory of economic growth. The Quarterly Journal of Economics, 70(1), 65–94.

- Swan T.W. (1956). Economic growth and capital accumulation. The Economic Record, 32(2), 334–361.

- Taleb N.N. (2007). The Black Swan: The Impact of the Highly Improbable. New York: Random House.

- Yaremenko Yu.V. (1997). On the structural restructuring of the economy. Problemy prognozirovaniya=Studies on Russian Economic Development, 5, 3–7 (in Russian).

- Yaremenko Yu.V. (1999). Ekonomicheskie besedy [Economic Conversations]. Moscow: TsISN.

- Yaremenko Yu.V. (2015). Modern Russian economy: Analysis and development strategy. Problemy prognozirovaniya=Studies on Russian Economic Development, 5(152), 3–10 (in Russian).

- Yaremenko Yu.V., Rassadin V.N. (1993). Bureaucratic conversion. EKO=ECO, 12(234), 3–13 (in Russian).