Russian oil and gas (O&G) industry: modern challenges and innovational development

Автор: Bakhareva I.V.

Журнал: Juvenis scientia @jscientia

Рубрика: Экономические науки

Статья в выпуске: 3, 2019 года.

Бесплатный доступ

The paper researches the competitiveness of the Russian oil and gas industry in the face of upcoming global innovational changes. The analysis includes the evaluation of the macroeconomic and innovational environment in which the industry operates, the summarization of several predominant research and development trends in the industry as well as the peculiarities of research and development activity in the Russian oil and gas industry. The findings show that the Russian oil and gas industry underinvests in the development of own technology and innovation and heavily depends on foreign imports in several key areas of its operation.

Innovation, r&d, innovational technologies, oil and gas industry

Короткий адрес: https://sciup.org/14114562

IDR: 14114562 | УДК: 338.45 | DOI: 10.32415/jscientia.2019.03.05

Текст научной статьи Russian oil and gas (O&G) industry: modern challenges and innovational development

Introduction. In a globalizing world economy, technology and innovation on macro- and micro-levels have become one of the key priorities of modern economic agents. For governments and firms alike, new and improved technologies signify the strengthening of competitive advantage, intensified value creation, and improved global image. For developing and transitioning economies, innovation has become the means of converging with developed economies and battling welfare problems such as poverty, income differentiation, uneven standards of living, education and health care, etc.

For Russian Federation, an example of an economy in transition, modernization, and innovation are recognized as most relevant and effective tools of achieving long-term economic development and strengthening the country’s global competitive position, the factors that would allow the Russian economy to enter the path of innovative socio-economic development.

R&D Environment in Russia. Before embarking on the analysis of innovational capacity and development of the O&G industry in Russia, it is essential to study macroeconomic factors as well as the innovational environment in the country, because these factors could in turn potentially affect innovational development of the Russian O&G industry.

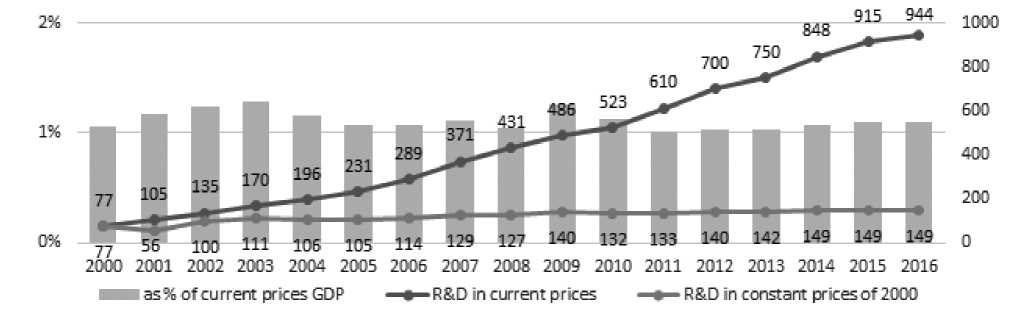

Source: Federal Agency of State Statistics data [16], author’s calculations

The nominal gross domestic product (GDP) of Russia had undergone an almost thirteen-time increase since the year 2000, from 7 306 to 92 082 billion rubles in 2017 [16]. The real GDP, i.e., the nominal GDP measured in the constant prices of 2000, during the same period increased only twofold. The average growth rate of the real GDP was 3.7 percent during the period in question but dropped to 0.3 percent in the last five years. The real GDP indicator eliminates the inflation effects and outlines the changes in the quantity of goods and services produced, therefore, indicating that a considerable share of nominal GDP growth observed in Russia in the period from 2000 to 2017 resulted not from production and manufacturing expansion, but rather from price increase effects. Compared with GDP dynamics in other countries, there is a significant gap between GDP growth rates of Russia and other developing economies and economies in transition, such as China (6.7 percent), India (6.53 percent), Brazil (1.95 percent), etc. [10]

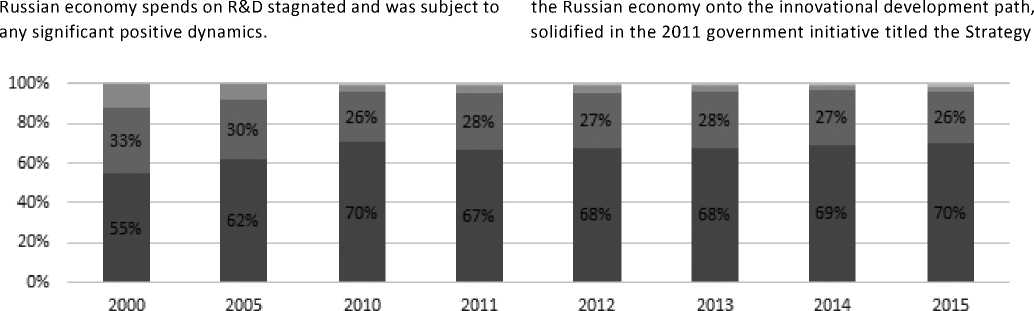

Another characteristic observed during the analysis of technology and innovation in Russia is the massive government presence in the Russian economy. This dynamic is also observed in the proportion of government R&D funding in the economy. It might be argued that the transition of a country to the innovational path of economic development requires government involvement; however, in case of Russia, there have not been any sustainable positive results observed in the economic activity of the private sector, especially in technology and innovation.

■ Governmentfunding ■ Bust ess enterpr be funding

■ Fundsfrom abroad ■ Higher education/non-prof"t enter prise funding

Source: Federal Agency of State Statistics data [16]

The analysis of UNESCO data on gross domestic expenditure on R&D for 44 selected countries showed that Russia had one of the highest government contributions to R&D in 2015 among the countries in consideration, behind Mexico with 71 percent. There are countries with a considerably higher share of government funding in R&D, such as Tajikistan or Iraq, where the government funded all, or nearly all, R&D activity in the country in 2015; however, these cases are exceptions rather than norm [22].

Global O&G Industry: Predominating R&D Trends. Having to operate in the weak national R&D environment poses certain challenges to technological and innovational development of industries with high strategic importance, such as the Russian O&G industry. With ever-present advances in global technology and innovation, especially in such R&D intensive industry as O&G, the Russian O&G companies have to apply enormous efforts to remain competitive on the international market and adjust to technological and innovational changes that reshape the landscape of the global industry.

The technological breakthrough that led to producing liquefied natural gas (LNG) launched the development of a new industry, which has seen considerable growth over the last years, with global LNG consumption reaching more than 280 million tons in 2017 [3]. Owing to its advantages compared to other hydrocarbons such as suitability for collection, storage, and sea shipment, as well as lack of negative environmental impact, LNG has become an effective source of energy. Global LNG trade has been growing at CAGR between 5 and 6.5 percent [3]. Demand for LNG has seen a dramatic increase in Asia, especially in China, Pakistan, and India, where incremental demand increased by 13 million tons in 2017. Sanford C. Bernstein & Co. predicts that energy companies will unlock more than 150 million tons of new supply capacity worldwide. In Russia alone, upon their estimated completion by 2019 and 2025, Yamal-LNG and Arctic-LNG-2 projects, with three trains each, are expected to reach production capacities of 16.5 and 19.8 million tons per annum and consequently increase the share of Russia in the global LNG exports, which accounted for 4.2 percent (10.8 million tons) in 2017 [3; 7; 15].

Growing demand for energy encourages countries both developed and developing to dedicate increasing amounts of R&D efforts to study abundant reserves of gas hydrates (primarily methane gas hydrates), a naturally occurring solid combination of natural gas (methane) and water, which were previously unknown or regarded as non-recoverable. Gas hydrates could be a potentially vast source of natural gas; however, their extraction is not only costly but also highly complex, as gas hydrates are found mainly in severe environments such as beneath terrestrial permafrost and marine sediments near continental margins [1]. Currently, global natural gas hydrate mining is at its early experimental phase, with researches attempting to eliminate low production efficiency, costly apparatus and materials implementation, environmental risks, etc. Japan, where the methane hydrate reserves are estimated at 1.1 trillion cubic meters, and the U.S. claim to have already completed their trial mining. China, with estimated 38 trillion cubic meters of hydrate reserves, although having conducted its first drilling and coring program in the South China Sea in 2007, is estimated to enter commercial production ofgas hydrates only by 2036-2050, due to its lagging in technical capacities [6; 20]. With further technological and innovational advancement in detection and mining, gas hydrates may become sole energy sources for these countries and consequently shift their demand, i.e., for LNG imports, and therefore change the energy market dynamics forever.

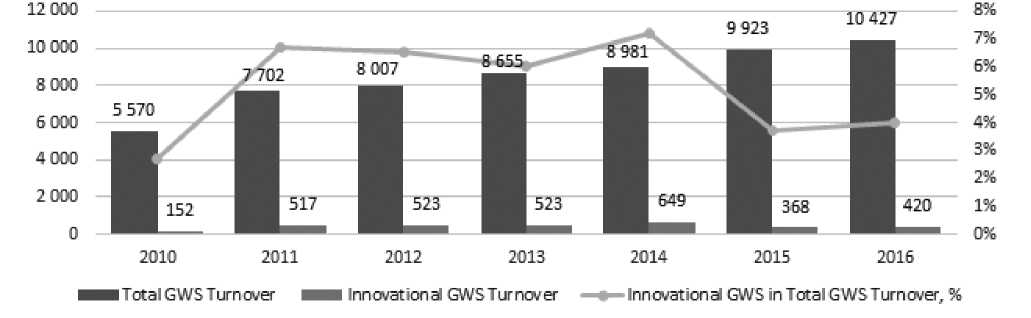

Source: Federal Agency of State Statistics data [16]

Figure 3. GWS turnover in mineral extraction and mining in Russia, 2010 - 2016, % and billion rubles

in scale and technological sophistication, there is severe pressure on the companies with regard to the compliance with environmental standards and industrial environmental control. For example, in 2016, for Gazprom Group alone environmental protection costs rose 6 percent due to higher wastewater tariffs and costs of oil and product spill readiness activities, whereas capital investments in environmental protection and sustainable use of natural resources rose by 43 percent compared to 2015, amounting to 22.54 billion rubles [14].

Peculiarities of R&D and Innovation in the Russian O&G Industry. As one of the potential indicators of successful R&D activity in the O&G industry, the volume of innovational goods, works, and services (GWS) in the total volume of GWS sold in Russia increased almost three times since 2010 and reached 420 billion rubles in 2016 [16].

■ Tatneft ■ Rosneft ■ Lukoil eGaprom I Gaspromneft

Source: corporate financial reports [18]; author’s calculations

Table 1

|

Technical area (product, technology) |

Share of imports in 2014 |

Planned max. share of imports by 2020-21 |

Expected decrease by 2020-21 |

|

Technologies and equipment for offshore operations |

87.5% |

67.5% |

20.0% |

|

Technologies, equipment and services for well operation |

82.2% |

66.0% |

16.2% |

|

LNG technologies |

70.7% |

55.0% |

15.7% |

|

Controlled directional, horizontal and multilateral well drilling equipment and technology |

74.3% |

53.3% |

21.0% |

|

Technologies and equipment for geological exploration |

63.3% |

50.0% |

13.3% |

|

IT solutions for drilling, extraction, transportation and processing of hydrocarbons |

91.0% |

43.1% |

47.9% |

|

Hydrocarbon processing technologies |

73.7% |

40.0% |

33.7% |

|

Technology and equipment for O&G transportation |

57.1% |

36.1% |

21.0% |

|

Catalyzers and additives |

76.3% |

18.8% |

57.5% |

Source: Minpromtorg [9]; author’s calculations

However, the depicted year-on-year dynamics shows that the innovational GWS turnover was much higher in 2011-2014; however, in the last years, it failed to reach those levels. The share of innovational GWS in the industry’s turnover fell from 7.2 percent in 2014 to 4 percent in 2016, indicating a slump in innovational activity and commercialization of its results among mineral extraction and mining companies.

The table below shows that some of the highest shares of import in consumption were observed in such technologically advanced areas as software solutions for drilling, extraction, transportation, and processing of hydrocarbons as well as technologies for catalyzer and additive production for oil processing and petrochemistry. Yet these areas are expected to have undergone the most substantial cuts, of 50 to 75 percent, in favor of domestic production by the year 2020-21, the fact that indicates the existence of local manufacturing companies that could potentially produce the required apparatus [9].

– Financial support: subsidies, tax preferences, special investment contracts (SIC) up to 10 years; preferences in government procurement;

– Informational and consultation support: State Industry Information System (SIIS) aimed at bringing free-of-charge up-to-date industry information to industry participants and other stakeholders, e.g., industry development and current trends, industry participants, production volumes, use of resourcesaving technologies and renewable energy sources, etc.;

– Human resources development;

– Foreign trade: promotion of Russian industrial output on international markets, the creation of favorable export environment.

With the support of PJSC Gazprom, the association of equipment manufacturers “New Technologies of the Gas Industry” was created in 2012 to consolidate industrial efforts and foster cooperation on the part of Russian manufacturers in development and implementation of cutting-edge technologies for extraction, transportation and processing of natural gas, which in 2017 included 118 Russian enterprises [8].

Conclusion and recommendations. The analysis showed that the global O&G industry has been undergoing significant changes in the wake of shifting global energy demand, digitalization and oil price volatility. The emphasis within the industry has shifted toward cost-effective and cost-efficient innovative solutions that would enable O&G companies to stay competitive on the market and drive down costs of operations.

– Development of policies and market mechanisms that could stimulate competitive behavior in the industry and consequently boost business and investment sentiment in the Russian economy. With efficient market mechanisms in place, further steps could be taken to reverse the currently observed negative dynamics in R&D expenditures of the private sector and the number of R&D-performing companies, for instance, steps such as improving the competitiveness of the enterprises manufacturing import substitutes, attracting institutional investors into R&D-intensive industry projects co-financing, etc.;

– State supervision over technical and economic characteristics of technologically advanced parts and equipment manufactured by Russian companies, to establish the appropriate level of competitive ability and compatibility with foreign counterparts. An additional measure such as obligatory company level certification, such as O&G quality management standards CTO Gazprom 9001, ISO 29001, American Petroleum Institute Spec Q1 and Q2, etc., of larger O&G industry participants could significantly improve the company’s market position, its investment attractiveness, enable registration and participation in international tenders, etc.;

– Creation of a definitive benchmarking framework for innovational and R&D activity in the O&G to provide a better insight into and peer comparison ofthe company’s R&D output.

-

1. Beaudoin YC, Dallimore SR, & Boswell R. (eds). Frozen Heat: A UNEP Global Outlook on Methane Gas Hydrates . Volume 2. Norway: Birkeland Trykkeri A/S; 2014 .

-

2. Global Trends in Renewable Energy Investment Report 2018 . The Green Growth Knowledge Platform (GGKP). http://www.greengrowthknowledge.org/

resource/global-trends-renewable-energy-investment-report-2018.

-

3. Hydraulic Fracturing . Independent Petroleum Association of America. https://www.ipaa.org/fracking .

-

4. IGU World Gas LNG Report – 2018 Edition . The International Gas Union (IGU). https://www.igu.org/sites/default/files/node-document-field_file/IGU_ LNG_2018_0.pdf.

-

5. Kemp J. U.S. shale breakeven price revealed around $50: Kemp . Reuters. https://www.reuters.com/article/usa-shale-kemp/rpt-column-u-s-shale-breakeven-price-revealed-around-50-kemp-idUSL5N1KV40G .

-

6. Moridis GJ, Reagan MT, Collett TS, et al. Toward Production From Gas Hydrates: Current Status, Assessment of Resources, and Simulation-Based Evaluation of Technology and Potential . SPE Reservoir Evaluation & Engineering. 2013 ;12(5): 745-771. doi: 10.2118/114163-pa.

-

7. НОВАТЭК и «Тоталь» становятся партнерами по проекту «Арктик СПГ 2» . Официальный сайт ПАО Новатэк. http://www.novatek.ru/ru/ press/releases/index.php?id_4=2443 .

-

8. Об ассоциации . Официальный сайт Ассоциации производителей оборудования «Новые технологии газовой отрасли». http://newgaztech.ru .

-

9. Order of the Ministry of Industry and Trade of Russia No. 645 of March 31, 2015 “ Ob utverzhdenii plana meropriyatii po importozameshcheniyu v otrasli neftegazovogo mashinostroeniya Rossiiskoi Federatsii ”. The document has not been published. (in Russ). [Приказ Минпромторга России № 645 от 31 марта 2015 г. « Об утверждении плана мероприятий по импортозамещению в отрасли нефтегазового машиностроения Российской Федерации ». Документ опубликован не был.]

-

10. OECD Economic Outlook: Statistics and Projections . OECD iLibrary. doi: 10.1787/eo-data-en.

-

11. Digitalization and Energy . International Energy Agency. https://www.iea.org/publications/freepublications/publication/DigitalizationandEnergy3.pdf .

-

12. Federal Law of the Russian Federation No. 488-ФЗ of December 31, 2014 “ O promyshlennoi politike v Rossiiskoi Federatsii ” (in Russ). [Федеральный закон Российской Федерации № 488-ФЗ от 31 декабря 2014 г. « О промышленной политике в Российской Федерации ».]

-

13. Perrons RK. How innovation and R&D happen in the upstream oil & gas industry: Insights from a global survey . Journal of Petroleum Science and Engineering. 2014 ;124:301-312. doi: 10.1016/j.petrol.2014.09.027.

-

14. PJSC Gazprom. Annual Report 2016 . Gazprom website. http://www.gazprom.com/f/posts/11/885774/gazprom-annual-report-2016-en.pdf .

-

15. Проект «Ямал СПГ» . Официальный сайт ПАО Новатэк. http://www.novatek.ru/ru/business/yamal-lng .

-

16. Российский статистический ежегодник. Федеральная служба государственной статистики. http://www.gks.ru .

-

17. Rykova IN, Kotlyarov MA. Potentsial innovatsionnogo razvitiya krupneishikh organizatsii Rossii . ETAP: ekonomicheskaya teoriya, analiz, praktika. 2012 ;(4):87-109. (in Russ). [Рыкова И.Н., Котляров М.А. Потенциал инновационного развития крупнейших организаций России // ЭТАП: экономическая теория, анализ, практика. 2012 . № 4. C. 87-109.]

-

18. Сетевое издание «Центр раскрытия корпоративной информации» . Официальный сайт Центра раскрытия корпоративной информации. http://www.e-disclosure.ru .

-

19. Shell. Shell Energy Transition Report . Shell website. https://www.shell.com/energy-and-innovation/the-energy-future/shell-energy-transition-report/ jcr_content/par/toptasks.stream/1524757699226/f51e17dbe7de5b0eddac2ce19275dc946db0e407ae60451e74acc7c4c0acdbf1/web-shell-energy-transition-report.pdf.

-

20. Tan Z, Pan G, Liu P. Focus on the Development of Natural Gas Hydrate in China . Sustainability. 2016 ;8(6):520. doi: 10.3390/su8060520.

-

21. Tasmukhanova AE, Shekish RB. Comparative characteristics of the methods of accounting and planning of research and development work in Russia and Kazakhstan . Naukovedenie. 2016 ;8(3):85. (in Russ.). [Тасмуханова А.Е., Шекиш Р.Б. Сравнительная характеристика методов учета и планирования научно-исследовательских и опытно-конструкторских работ в России и Казахстане // Науковедение. 2016 . Т. 8. № 3. С. 85.]. http://naukovedenie.ru/PDF/08EVN316.pdf .

-

22. UNESCO, UIS. Science, technology and innovation . UNESCO/UIS website. http://data.uis.unesco.org/Index.aspx .

Список литературы Russian oil and gas (O&G) industry: modern challenges and innovational development

- Beaudoin YC, Dallimore SR, & Boswell R. (eds). Frozen Heat: A UNEP Global Outlook on Methane Gas Hydrates. Volume 2. Norway: Birkeland Trykkeri A/S; 2014.

- Global Trends in Renewable Energy Investment Report 2018. The Green Growth Knowledge Platform (GGKP). http://www.greengrowthknowledge.org/resource/global-trends-renewable-energy-investment-report-2018.

- Hydraulic Fracturing. Independent Petroleum Association of America. https://www.ipaa.org/fracking.

- IGU World Gas LNG Report -2018 Edition. The International Gas Union (IGU). https://www.igu.org/sites/default/files/node-document-field_file/IGU_LNG_2018_0.pdf.

- Kemp J. U.S. shale breakeven price revealed around $50: Kemp. Reuters. https://www.reuters.com/article/usa-shale-kemp/rpt-column-u-s-shale-breakeven-price-revealed-around-50-kemp-idUSL5N1KV40G.

- Moridis GJ, Reagan MT, Collett TS, et al. Toward Production From Gas Hydrates: Current Status, Assessment of Resources, and Simulation-Based Evaluation of Technology and Potential. SPE Reservoir Evaluation & Engineering. 2013;12(5): 745-771

- DOI: 10.2118/114163-pa

- НОВАТЭК и «Тоталь» становятся партнерами по проекту «Арктик СПГ 2». Официальный сайт ПАО Новатэк. http://www.novatek.ru/ru/press/releases/index.php?id_4=2443.

- Об ассоциации. Официальный сайт Ассоциации производителей оборудования «Новые технологии газовой отрасли». http://newgaztech.ru.

- Order of the Ministry of Industry and Trade of Russia No. 645 of March 31, 2015 "Ob utverzhdenii plana meropriyatii po importozameshcheniyu v otrasli neftegazovogo mashinostroeniya Rossiiskoi Federatsii". The document has not been published. (in Russ).

- OECD Economic Outlook: Statistics and Projections. OECD iLibrary

- DOI: 10.1787/eo-data-en

- Digitalization and Energy. International Energy Agency. https://www.iea.org/publications/freepublications/publication/DigitalizationandEnergy3.pdf.

- Federal Law of the Russian Federation No. 488-ФЗ of December 31, 2014 "O promyshlennoi politike v Rossiiskoi Federatsii" (in Russ).

- Perrons RK. How innovation and R&D happen in the upstream oil & gas industry: Insights from a global survey. Journal of Petroleum Science and Engineering. 2014;124:301-312

- DOI: 10.1016/j.petrol.2014.09.027

- PJSC Gazprom. Annual Report 2016. Gazprom website. http://www.gazprom.com/f/posts/11/885774/gazprom-annual-report-2016-en.pdf.

- Проект «Ямал СПГ». Официальный сайт ПАО Новатэк. http://www.novatek.ru/ru/business/yamal-lng.

- Российский статистический ежегодник. Федеральная служба государственной статистики. http://www.gks.ru.

- Rykova IN, Kotlyarov MA. Potentsial innovatsionnogo razvitiya krupneishikh organizatsii Rossii. ETAP: ekonomicheskaya teoriya, analiz, praktika. 2012;(4):87-109. (in Russ).

- Сетевое издание «Центр раскрытия корпоративной информации». Официальный сайт Центра раскрытия корпоративной информации. http://www.e-disclosure.ru.

- Shell. Shell Energy Transition Report. Shell website. https://www.shell.com/energy-and-innovation/the-energy-future/shell-energy-transition-report/jcr_content/par/toptasks.stream/1524757699226/f51e17dbe7de5b0eddac2ce19275dc946db0e407ae60451e74acc7c4c0acdbf1/web-shell-energy-transition-report.pdf.

- Tan Z, Pan G, Liu P. Focus on the Development of Natural Gas Hydrate in China. Sustainability. 2016;8(6):520

- DOI: 10.3390/su8060520

- Tasmukhanova AE, Shekish RB. Comparative characteristics of the methods of accounting and planning of research and development work in Russia and Kazakhstan. Naukovedenie. 2016;8(3):85. (in Russ.). . http://naukovedenie.ru/PDF/08EVN316.pdf.

- UNESCO, UIS. Science, technology and innovation. UNESCO/UIS website. http://data.uis.unesco.org/Index.aspx.