Самозанятость в ненаблюдаемой экономике и ее влияние на экономический рост: мета-анализ

Автор: Резник Галина Александровна, Коробкова Наталья Александровна

Журнал: Регионология @regionsar

Рубрика: Экономика и управление народным хозяйством

Статья в выпуске: 4 (117) т.29, 2021 года.

Бесплатный доступ

Введение. Мотивацией к исследованию послужила неоднозначность оценки влияния самозанятости на экономический рост, особенно в части ненаблюдаемой самозанятости. Согласно гипотезе исследования, неформальная самозанятость способствует экономическому росту. Цель статьи - по результатам проведенного исследования обобщить и систематизировать теоретические взгляды ученых по оценке характера влияния неформальной самозанятости на экономический рост. Материалы и методы. В качестве теоретической базы исследования послужили работы ученых, опубликованные в изданиях, индексируемых в Scopus и Web of Science, с 2000 по 2020 г. Данный временной период был обоснован существенными изменениями на рынке труда, вызванными возрастанием самозанятого населения. Ключевым методом исследования является метаанализ эмпирических исследований по представленной проблематике, который позволяет обобщать, оценивать и анализировать результаты эмпирических исследований, объективно определяя закономерности между результатами исследований и источниками разногласий. Результаты исследования. Представлен анализ сущности понятия «ненаблюдаемая экономика», выявлена особенность неформальной самозанятости как части ненаблюдаемой экономики. Выявлены точки зрения относительно влияния ненаблюдаемой экономики на экономический рост, приведены аргументы обеих точек зрения и результаты исследования по разным странам, в том числе России. Показано, какие методы исследования применялись различными авторами для оценки зависимости теневой самозанятости. Выделены исследования, имеющие наибольшую результативность и универсальность с точки зрения возможного практического использования полученных в них выводах. Определены предпосылки и особенности формирования неформальной самозанятости, оценено ее влияние на экономический рост. Обсуждение и заключение. Разработаны рекомендации по дальнейшему теоретико-методологическому исследованию указанной проблематики. Полученные выводы и результаты могут быть полезны при дальнейшем развитии российской системы регулирования деятельности самозанятого населения, поскольку для ее эффективного построения необходима научная проработка и методическое обоснование различных вариантов ее развития с использованием опыта других стран.

Ненаблюдаемая экономика, теневая экономика, самозанятый, социально-экономическое развитие, экономический рост, институциональные преобразования

Короткий адрес: https://sciup.org/147236083

IDR: 147236083 | УДК: 338.242 | DOI: 10.15507/2413-1407.117.029.202104.794-819

Текст научной статьи Самозанятость в ненаблюдаемой экономике и ее влияние на экономический рост: мета-анализ

Введение. Мотивацией к исследованию послужила неоднозначность оценки влияния самозанятости на экономический рост, особенно в части ненаблюдаемой самозанятости. Согласно гипотезе исследования, неформальная самозанятость способствует экономическому росту. Цель статьи – по результатам проведенного исследования обобщить и систематизировать теоретические взгляды ученых по оценке характера влияния неформальной самозанятости на экономический рост.

Материалы и методы. В качестве теоретической базы исследования послужили работы ученых, опубликованные в изданиях, индексируемых в Scopus и Web of Science, с 2000 по 2020 г. Данный временной период был обоснован существенными изменениями на рынке труда, вызванными возрастанием самозанятого населения. Ключевым методом исследования является метаанализ эмпирических исследований по представленной проблематике, который позволяет обобщать, оценивать и анализировать результаты эмпирических исследований, объективно определяя закономерности между результатами исследований и источниками разногласий.

Результаты исследования. Представлен анализ сущности понятия «ненаблюдаемая экономика», выявлена особенность неформальной самозанятости как части ненаблюдаемой экономики. Выявлены точки зрения относительно влияния ненаблюдаемой экономики на экономический рост, приведены аргументы обеих точек зрения и результаты исследования по разным странам, в том числе России. Показано, какие методы исследования применялись различными авторами для оценки зависимости теневой самозанятости. Выделены исследования, имеющие наибольшую результативность и универсальность с точки зрения возможного практического использования

Контент доступен под лицензией Creative Commons Attribution 4.0 License.

This work is licensed under a Creative Commons Attribution 4.0 License.

полученных в них выводах. Определены предпосылки и особенности формирования неформальной самозанятости, оценено ее влияние на экономический рост.

Обсуждение и заключение. Разработаны рекомендации по дальнейшему теоретико-методологическому исследованию указанной проблематики. Полученные выводы и результаты могут быть полезны при дальнейшем развитии российской системы регулирования деятельности самозанятого населения, поскольку для ее эффективного построения необходима научная проработка и методическое обоснование различных вариантов ее развития с использованием опыта других стран.

Финансирование. Исследование выполнено при финансовой поддержке РФФИ в рамках научного проекта № 20-11-50138.

Original article

Self-Employment in the Non-Observed Economy and Its Impact on Economic Growth: A Meta-Analysis

G. A. Reznik, N. A. Korobkova*

Introduction. The study was motivated by the ambiguity in assessing the impact of self-employment on economic growth, especially in terms of non-observed self-employment. According to the research hypothesis, informal self-employment contributes to economic growth. Based on the results of the study conducted, the article summarizes and systematizes the theoretical views of scientists on the assessment of the nature of the impact of informal self-employment on economic growth.

Materials and Methods. Scientific papers published in 2000–2020 in journals indexed by Scopus and Web of Science formed the theoretical basis of the study. The choice of this time period was justified by significant changes in the labor market caused by the increase in the number of self-employed people. The key method employed was meta-analysis of empirical research papers on the issues under study. This method makes it possible to generalize, evaluate, and analyze the results of empirical research, objectively identifying the regularities existing between research results and sources of disagreement.

Results. An analysis of the essence of the concept of non-observed economy has been presented; the peculiarity of informal self-employment, as part of the non-observed economy, has been revealed. The points of view on the impact of the non-observed economy on economic growth have been considered; arguments from both points of view and the results of research on different countries, including Russia, have been presented. It has also been shown which research methods were used by various authors to assess the dependence of shadow self-employment. The studies that have the greatest effectiveness and universality

in terms of possible practical use of the results obtained have been highlighted. The prerequisites and features of the formation of informal self-employment have been identified, its impact on economic growth has been estimated.

Discussion and Conclusion. Recommendations for further theoretical and methodological research of the considered issues have been produced. The conclusions and results obtained can be useful in the further development of the Russian system of regulating the activities of self-employed people, since its effective construction requires scientific study and methodological substantiation of various options for its development using the experience of other countries.

The authors declare that there is no conflict of interest.

Funding. The study was conducted with financial support from the Russian Foundation for Basic Research as part of the scientific project No. 20-11-50138.

Введение. В экономических и социальных науках есть определенный сектор проблем, к которым ученые периодически возвращаются, находя новые аспекты в их решении. Одной из таких проблем является исследование ненаблюдаемой экономики. Ненаблюдаемая экономика формирует существенную часть ВВП многих стран. По различным оценкам ее среднее значение для крупнейших стран мира составляет 30,9 % [1] от официального ВВП, в развивающихся странах достигает 41,0 %, в развитых – колеблется на уровне 18,0 % [2]. Несмотря на отсутствие согласия в отношении определения ненаблюдаемой экономики и методик ее оценки, большинство исследователей отмечают необходимость ее тщательного изучения. Пристальный интерес отечественной и зарубежной науки к изучению ненаблюдаемой экономики в том числе связывают с ростом численности фрилансеров как части самозанятого населения.

В условиях распространения цифровых технологий их число постоянно растет. Предположительно через 10 лет фрилансеры будут составлять большую часть рабочей силы. В сфере информационных технологий данные тенденции уже сформировались. Так, по состоянию на март 2019 г. на долю фрилансеров в штате сотрудников Google приходилось порядка 54 %1. Данные тенденции характерны не только для высокотехнологичных государств, возможности осуществления работы дистанционно приводят к переходу во фриланс квалифицированных сотрудников тех стран, в которых карьерный рост и возможности заработка ограничены. Например, Бразилия, Пакистан, Индия, Украина, Филиппины являлись лидерами по темпу роста доходов во фрилансе в 2019 г.2.

В последние годы сформировалась целая система трудовых отношений, для которой характерно привлечение организаций и работников к краткосрочным трудовым договорам – гиг-экономика [3]. Тенденцией последних лет является возможность совмещения стандартной занятости с фрилансом [4]. Например, в США 36 %3 рабочей силы является частью гиг-экономики, а к 2027 г это значение достигнет 50 %4.

С 2020 г. в России начал действовать налог на профессиональный доход, призванный сократить долю самозанятых работающих вне наблюдаемой экономики. Под уплату налогов в рамках данного налогового режима попадают не только граждане, получающие доход с профессиональной деятельности, но и индивидуальные предприниматели, не имеющие наемных работников, которые и являются самозанятыми. При формировании правовой базы регулирования деятельности самозанятых необходимо понимать, какова их роль в экономическом развитии, а именно - способствует или препятствует теневая самозанятость экономическому росту.

Неоднозначность оценок о влиянии самозанятости в ненаблюдаемой экономике на экономический рост явилась основанием для исследования, представленного в этой статье. Кроме того, в ходе исследования был осуществлен поиск ответов на следующие вопросы: почему отличаются результаты различных эмпирических исследований; существует ли вероятность того, что самозанятость в ненаблюдаемой экономике может способствовать экономическому росту в долгосрочном периоде; какие меры государственной политики по регулированию деятельности самозанятых будут способствовать экономическому развитию?

Цель статьи – на основе проведенного исследования определить характер влияния на экономический рост неформальной самозанятости для выработки подхода к ее регулированию на государственном уровне.

Обзор литературы. При работе над данной статьей использовалось определение ненаблюдаемой экономики, которое было сформулировано в методическом статистическом стандарте системы национальных счетов5, разработанном Организацией экономического сотрудничества и развития. Он применяется национальными статистическими службами различных стран, в том числе Росстатом.

Несмотря на многообразие исследований, посвященных проблемам ненаблюдаемой экономики, основные вопросы, раскрываемые в них, схожи: оценка масштабов ненаблюдаемой экономики на основе разнообразных методик, выявление предпосылок к формированию ненаблюдаемой экономики, исследование негативных последствий ненаблюдаемой экономики, разработка мероприятий по сокращению ненаблюдаемой экономики [2; 5; 6]. Проведя масштабное исследование литературы по обозначенной проблеме, можем сформулировать основные выводы, полученные учеными.

Существующие методы оценки масштабов ненаблюдаемой экономики можно условно разделить на три группы: прямые, косвенные и смешанные. Первые предполагают оценку с помощью опросов населения либо на основе сравнения доходов и расходов экономических субъектов [7]. Косвенные методы направлены на построение эконометрических моделей; среди наиболее распространенных из них - денежный метод и MIMIC-моделирование. Денежный метод предполагает сравнение реального ВВП и спроса на наличные денежные средства, которые формируются потребностями ненаблюдаемой экономики. MIMIC-моделирование направлено на построение множества линейных уравнений, позволяющих выявить факторы, способствующие развитию ненаблюдаемой экономики [8].

Основными причинами наличия ненаблюдаемой экономики являются: высокие налоги и взносы на социальное обеспечение [9; 10], установление значимых для предприятий расходов на минимальную заработную плату [11; 12], наличие коррупционной составляющей в рыночном регулировании [13; 14], высокие затраты на запуск и регистрацию бизнеса [15; 16], бюрократизация официальной деятельности [17; 18] и др. Однако все чаще авторы объясняют формирование ненаблюдаемой экономики несовершенством институтов [19; 20].

Проанализировав результаты оценки масштабов ненаблюдаемой экономики в различных странах, можно сделать вывод, что значимым фактором ее формирования становится наличие кризисных явлений. Так, по разным методикам в период кризиса 2008–2009 гг. доля теневой экономики возрастала. Это подтверждают результаты исследования Ф. Шнайдера и А. Буена [2]. Оценив долю теневой экономики в 39 странах мира в период с 1999 по 2010 г., авторы отмечают, что в большинстве стран теневая экономика увеличилась в 2009 г., а в посткризисный период происходит трансформация экономики, и доля ненаблюдаемой экономики начинает постепенно сокращаться.

В рамках данной статьи фрилансерам как части самозанятых уделено особое внимание, так как их доля в объеме ненаблюдаемой экономики постоянно возрастает. Часто это связано с тем, что рынок труда фрилансеров не институционализирован, мало подвержен государственному контролю [21].

798 ЭКОНОМИКА И УПРАВЛЕНИЕ НАРОДНЫМ ХОЗЯЙСТВОМ

Отметим, что понятия «фрилансеры» и «самозанятые» не являются и не используются в статье в качестве синонимов, хотя ряд исследователей считает различия между ними минимальными [22]. Согласно Всемирной организации труда, самозанятыми являются те лица, которые работают в собственном бизнесе, на ферме или занимаются профессиональной деятельностью. Осуществление профессиональной деятельности по своей сути является фрилансом, так как предполагает выполнение краткосрочных контрактов (проектов) по оказанию профессиональных услуг [23]. По оценкам экспертов, на долю самозанятых, занимающихся профессиональной деятельностью, приходится примерно треть от их общего числа [24]. Значимой особенностью работы в качестве фрилансера (самозанятого) является возможность сокрытия части своих доходов [25].

Проблема экономического роста и определения факторов, препятствующих и стимулирующих экономическое развитие, однозначно является одной из самых исследуемых. Большинство ученых разделяют точку зрения о наличии эндогенных факторов, способствующих или препятствующих экономическому развитию, в их числе теневая самозанятость. Согласно С. Элгина и О. Озтунали, существуют два подхода относительно влияния параллельной экономики на экономический рост [26]. Один связывает параллельную экономику с низким экономическим ростом, а другой утверждает, что параллельная экономика может способствовать росту. Первый основан на идее, что чрезмерное регулирование приводит к высокому уровню неформальности и, следовательно, к снижению экономического роста [27; 28]. Фактически ненаблюдаемая экономика сокращает ресурсы государства, которое, в свою очередь, не может обеспечить общественные блага в эффективном масштабе, что ведет к снижению потенциального роста. Страх обнаружения заставляет фирмы работать в меньших масштабах, что делает их неэффективными и замедляет экономический рост. Второй подход утверждает, что наличие большой параллельной экономики может принести выгоды для экономического роста. Фирмы, работающие неформально, как правило, менее производительны, нанимают менее квалифицированных работников и работают с меньшим капиталом [29]. Следовательно, они не могут покрыть расходы на работу в формальном секторе, но способствуют росту производительности за счет неформального сектора. Полагаем, что отдельно можно выделить третий подход, согласно которому влияние ненаблюдаемой экономики на экономический рост не всегда однозначное либо характер воздействия зависит от уровня развития экономических институтов.

Д. Иринг и К. С. Мо проанализировали перекрестные данные по промышленно развитым и развивающимся странам в период с 1960 по 1990 г. и исследовали долгосрочные регрессии роста, реальный ВВП на одного работника и неформальную занятость и выявили негативное влияние на реальный ВВП неформальной занятости [30]. Л. П. Фельд и Ф. Шнайдер оценили параллельную экономику и незадекларированные доходы в странах Организации экономического сотрудничества и развития и обнаружили, что параллельная экономика оказывает негативное влияние на экономический рост [31]. Д. Джайлз независимо6 и вместе с соавторами [32] изучил данные по Новой Зеландии и Канаде, что позволило выявить негативную связь между теневой экономикой и измеряемым ВВП. Ф. Шнайдер и Б. Хаметнер исследовали данные по Колумбии в период с 1980 по 2012 г. и обосновали, что теневая экономика привела к замедлению роста ВВП в среднем на 0,12 % в год на душу населения за указанный период [33]. Среди причин снижения были выделены: низкая производительность, ограничения человеческого и финансового капиталов. Ф. Шнайдер и Д. Х. Энсте выяснили, что коррупция положительно влияет на размер теневой экономики, а растущая теневая экономика отрицательно сказывается на росте официального ВВП [34].

А. Аланьон и М. Гомес-Антонио идентифицируют положительную связь между ВВП, спросом на валюту и параллельной экономикой в Испании [35]. Аналогичные результаты получили Т. Мапп и В. Мур, проанализировав регион Карибского бассейна и доказав, что параллельная экономика положительно влияет на экономический рост [36]. Они обосновали важное социальное значение теневой экономики – она стабилизирует доходы населения в период кризисов. Схожие результаты получены в российских исследованиях: О. Киселькина и соавторы выявили положительную корреляцию между ВВП и рынком труда в неформальном секторе в период с 2005 по 2012 г. [37]. Г. Заман и З. Гощин проверили связь между параллельной экономикой и экономическим ростом в Румынии в период между 1999 и 2012 г. и нашли отношения коинтеграции. Авторы утверждают, что параллельная экономика может иметь положительные эффекты, особенно в странах, где преобладает коррупция. В этом случае формирование ненаблюдаемой экономики является возможным решением проблемы безработицы, потребления и инвестиций [38].

Р. Ла Порта и А. Шлейфер оценили влияние параллельной экономики на экономический рост как неоднозначное [39]. Они установили, что экономический рост может происходить только за счет высокопроизводительных и эффективных официальных фирм. Деятельность в ненаблюдаемой экономике не может повлиять на него, так как в данном секторе производство малоэффективно по причине использования непродуктивных ресурсов и отсутствия доступа к внешнему финансированию и к государственным услугам. Авторы полагают, что неформальные фирмы функционируют как средство существования для людей, которые в процессе работы развивают свои навыки и знания, что в конечном итоге приведет к переходу к официальной деятельности. Б. Ким и Ю. Канг оценивают размер параллельной экономики во всех регионах России в период с 1992 по 1999 г. и делают вывод, что она способствует росту малых фирм и официальной предпринимательской деятельности при выполнении соответствующих условий [40]. На основе анализа данных Соединенных Штатов Америки за период 1870–2014 гг. Р. К. Джоель и соавторы пришли к выводу, что эта двусмысленность зависит от взаимодействия параллельной экономики с формальным сектором и его влияния на предоставление общественных благ [41].

Проведя многомерный анализ, Х. Никопур, М. Хабибулла указывают на присутствие нелинейных отношений между теневой экономикой и экономическим ростом7. Авторы вычислили три стадии в наличии взаимовлияния и классифицируют эти отношения как «S-образную кубическую функцию»: на ранних стадиях развития влияние теневой экономики является положительным; на более поздних стадиях – отрицательным; при определенном уровне развития возникает новая точка перегиба и начинается новый восходящий этап. Х. Никопур считает, что ненаблюдаемая экономика существенно отличается в развитых и развивающихся странах. П. Дуарте пришел к выводу, что неоднозначность в отношениях между параллельной экономикой и экономическим ростом объясняется различиями в методах, используемых для оценки ненаблюдаемой экономики, которая работает независимо от официального сектора [42]. По его мнению, формальная и неформальная экономики в Испании являются независимыми.

В отношении влияния самозанятости на экономический рост позиции авторов менее разнообразны. Большинство исследователей отмечают положительное влияние самозанятости на экономическое развитие страны, однако результаты имеют ряд нюансов. Проведя анализ по выборке из 83 развивающихся стран за период 2002–2015 гг., Ш. Еррабати обосновал наличие нелинейной U-образной зависимости между самозанятостью и ростом экономики [43]. Схожие результаты были получены В. М. Гонсалес-Санчес и соавторами, которые провели эмпирический анализ данных 31 европейской страны в период с 2009 по 2019 г. и доказали положительное влияние самозанятости на экономический рост [44]. С. Этрин и Т. Мицкевич подошли к анализу ситуации с иной стороны и попытались выявить зависимость между наличием теневой экономики и началом занятия предпринимательской деятельностью, т. е. самозанятостью. Оказалось, что в условиях ненаблюдаемой экономики предприниматели более активно занимаются бизнесом, это происходит до тех пор, пока теневая экономика не имеет существенного влияния (до 25–30 % от ВВП) [45]. Д. Виллис установил, что критически важной величиной является не сам факт самозанятости, а доходы от нее. Именно они способствуют экономическому развитию в случае, если доходы самозанятого больше, чем его зарплата как наемного работника [46]. Изучая теневую самозанятость и неформальный рынок труда, Н. В. Лоайза приходит к выводу, что размер неформального сектора уменьшается с общим развитием страны, увеличивается с бременем регулирования и уменьшается с усилением правоприменения [47].

Обзор литературы показал, что результаты исследований, в которых оценивается влияние самозанятости в ненаблюдаемой экономике на экономический рост, существенно отличаются и далеки от согласия. Различия наблюдаются и в характере воздействия, и в значимости эффекта. Полагаем, что метаанализ позволит решить проблему неоднородности полученных результатов.

Материалы и методы. Метаанализ - это метод количественного литературного обзора, в котором используются конкретные статистические методы для объединения результатов различных исследований, посвященных одной и той же теме. Он позволяет проверять научные гипотезы на основе объединения эмпирических результатов, полученных исследователями по одной проблеме на разных объектах и (или) в разные временные периоды. Метаанализ был впервые предложен Г. Глассом8 как метод систематического количественного обобщения данных эмпирических исследований. В настоящее время он широко используется в нескольких областях, включая науки о здоровье, психологию, образование, маркетинг и социальные науки. По сравнению с традиционными обзорами литературы, метаанализ обладает существенным преимуществом: результаты суммируются более объективно, что снижает риск неверного толкования и необъективных выводов9.

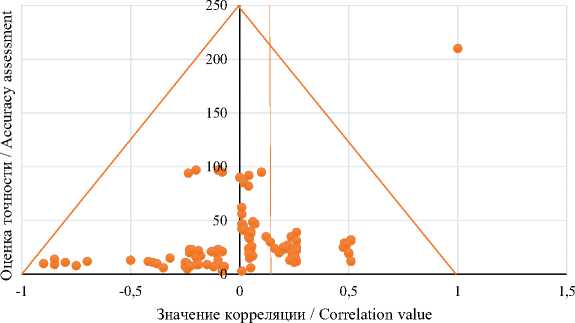

Дискуссионным вопросом в метаанализе является предвзятость публикаций, так как исследования отбираются на основе поиска литературы. Часто исследования легче опубликовать, если они имеют статистически значимые результаты, в то время как неблагоприятные результаты (в нашем случае – исследования, которые не доказали ни положительного, ни отрицательного влияния теневой самозанятости на экономический рост) теряются среди более статусных исследований. Ученые разработали несколько инструментов для оценки предвзятости публикаций [48]: воронкообразный график, тесты метазначимости, метод обрезки и заполнения и др.

Первым этапом в проведении метаанализа является выбор исследований, которые предполагается проанализировать. Для нас значимы статьи, в которых оценивается влияние самозанятости в ненаблюдаемой экономике на экономический рост. Таким образом, нас интересуют исследования, соответствующие данной тематике, которые могут быть выражены различными формулировками. В результате были отобраны 292 англоязычные статьи, изданные с 2000 г., со следующими ключевыми словами: экономический рост, экономическое развитие, ненаблюдаемая экономика, теневая экономика, неформальная экономика, фриланс, самозанятые.

На втором этапе мы оценивали исследования на основе полнотекстовой информации с использованием критериев валидности, надежности и применимости. По результатам анализа было выявлено, что некоторые работы дублировали друг друга, в иных отсутствовали эмпирические данные. Для выполнения метаанализа были отобраны статьи, в которых присутствовала бы линейная оценка влияния ненаблюдаемой экономики на экономический рост, так как количество исследований, отражающих нелинейные отношения, оказалось незначительным. Таким образом, метаанализ проводился на основе данных 13 статей и 123 значений эффекта частичной корреляции г.

Результаты исследования. По аналогии с исследованиями Л. Де Доми-нисес [49] и О. Афонсо [50] в ходе нашего анализа использовался коэффициент частичной корреляции, который делает размеры эффекта независимыми от показателей, используемых в первичных исследованиях [51]. На основе отобранных публикаций было рассчитано средневзвешенное значение коэффициента корреляции с фиксированным эффектом, чтобы получить описательное резюме фактических данных, представленных в каждом исследовании. Сводные данные по указанным исследованиям приведены в таблице 1.

На основе анализа данных, представленных в таблице 1, можно сделать вывод о невозможности однозначной интерпретации результатов исследований. Кроме того, отсутствует явная зависимость средневзвешенного значения корреляции от количества исследований, от исследуемых стран и методов оценки ненаблюдаемой экономики.

В целом средние взвешенные значения корреляции не позволяют сделать вывод о наличии однозначного воздействия теневой самозанятости на экономический рост, так как лежащие в основе оценки могут быть загрязнены предвзятостью отбора.

Проверка предвзятости отбора проводилась на основе наиболее популярного графического метода для его обнаружения, а именно воронкообразного графика. Он показывает взаимосвязь между оценкой точности (обратная величина стандартной ошибки) по вертикальной оси и значением частных коэффициентов корреляции на горизонтальной оси.

Частные коэффициенты корреляции r и стандартная ошибка se рассчи-тывались по следующим формулам:

Г = t t / V t 2 + df t , se ri = ^(1 - r 2) / df,

где t i - t-критерий Стьюдента, связанный с оценками размера эффекта влияния ненаблюдаемой экономики на экономический рост; dfi – степень свободы в соответствующем первичном наблюдении.

Т а б л и ц а 1. Характеристика анализируемых исследований

T a b l e 1. Characteristics of the studies analyzed

Окончание табл. 1 / End of table 1

На рисунке показан воронкообразный график для 123 наблюдений нашего набора метаданных.

Рисунок. Воронкообразный график 123 наблюдений Figure. Funnel plot of 123 observations

Так как точки на графике располагаются симметрично и внутри сегмента, образованного расходящимися линиями (отражают 95-процентные доверительные интервалы значений стандартных ошибок), можно сделать вывод об отсутствии предвзятости публикаций; оценку среднего значения можно считать достоверной. Средневзвешенная оценка (0,1278) влияния теневой самозанятости на экономический рост отражена вертикальной линией на графике.

На следующем этапе метаанализа необходимо было оценить гетерогенность анализируемых данных. Такая оценка позволяет понять, какая часть изменчивости факторов вызвана различиями генеральных совокупностей, из которых извлечены данные, а также рассчитать общую величину изменчивости, наблюдаемую между явлениями.

Наличие гетероскедастичности делает неинформативными расчетные значения, получаемые с помощью метода наименьших квадратов. В этом случае целесообразнее применение взвешенного метода наименьших квадратов. Метод состоит в том, что каждое наблюдение взвешивается обратно пропорционально предполагаемому стандартному отклонению в системе наблюдений.

Зависимость между самозанятостью в ненаблюдаемой экономике и экономическим ростом может быть выражена следующей линейной моделью:

y i = a x i + p + s i ,

где α , β – параметры модели; yi – значения изменения темпов экономического роста; xi – значение показателя теневой самозанятости; εi – случайная ошибка. 806 ЭКОНОМИКА И УПРАВЛЕНИЕ НАРОДНЫМ ХОЗЯЙСТВОМ

Устраним гетероскедантичность данных, разделив каждое наблюдение на соответствующее ему значение стандартного отклонения, при этом дисперсия примет вид:

D Р = Л о 2 ( ^ ) = ° = 1, (4)

. О) О О где oi - стандартное отклонение ошибки £ в i-м наблюдении.

При отсутствии данных о значениях стандартной ошибки отклонения можно предположить, что существует некоторая величина ( K), пропорциональная o i в каждом наблюдении [59]. При возрастании е с ростом значения х зависимость можно выразить:

D (Si ) = ^2 - K • x2.(5)

Для обеспечения единообразия данных и уменьшения неоднородности дисперсии, разделим уравнение (3) на xi :

У; = a • x, + p + si,(6)

где yi*= yi/ xi и далее по аналогии.

В этом случае дисперсия будет иметь вид:

D(E'i ) = У2D(Ci) = K.(7)

Данная методика обеспечит больший вес наблюдениям с наименьшими дисперсиями10.

В рамках одного исследования, привлекаемого для метаанализа, отдельные наблюдения имеют схожие процедуры оценки, формируются из одной базы данных, т. е. могут быть коррелированными11. Для решения проблемы статистической зависимости используем иерархические регрессионные модели. Они позволяют не только скорректировать корреляцию внутри одного исследования, но и рассчитать коэффициенты регрессии с учетом неоднородности между исследованиями. Например, в данном исследовании можно выделить группы наблюдений в зависимости от: объектов исследования, количества наблюдений в рамках одного исследования, количества анализируемых стран, методов оценки ненаблюдаемой экономики.

Простая иерархическая модель с одним предиктором на индивидуальном уровне и одним предиктором на групповом уровне выражается следующим образом [60; 61]:

уровень 1: y у = ajXij + Pj + eij ,(9)

уровень 2: pf = yоо + y01 Zj + ^оj,(10)

a j = У11 + У11 Zj + ^ij, Л о j ~ N (°, Уoo), Sij ~ N ( 0, о2), где субиндекс i относится к наблюдению, а j – к группе, соответственно, yij – значение зависимой переменной для наблюдения i из группы j.

Уравнение первого уровня (9) схоже с простой линейной моделью, однако субиндекс j показывает, что для каждой единицы второго уровня (исследований, сгруппированных по кластерам) анализируется своя модель первого уровня.

Уравнение второго уровня (10) показывает, что интерсепты и наклоны предикторов первого уровня являются функцией предикторов второго уровня и их вариаций: βj – это интерсепт индивидуального уровня в группе наблюдений j , y00 – среднее значение влияния теневой экономики на экономический рост с учетом предикторов второго уровня, например метода оценки масштабов ненаблюдаемой экономики Zj ; y01 – влияние теневой экономики на экономический рост в зависимости от конкретного метода оценки; η0j – ошибка для группы наблюдения j .

Во втором уравнении второго уровня (11) моделируется эффект влияния конкретного фактора группы наблюдений на эффект индивидуального уровня xij , где β1j – эффект индивидуального предиктора в группе наблюдений j , y00 – среднее значение индивидуального эффекта в группе наблюдений с учетом фактора Zj , y10 – эффект влияния теневой экономики на экономический рост с учетом фактора группы наблюдений.

Расчеты проводились с помощью специального программного обеспечения, их результаты представлены в таблице 2.

Т а б л и ц а 2. Оценка регрессии ненаблюдаемой экономики и экономического роста

T a b l e 2. Assessment of the regression of the non-observed economy and economic growth

|

Коэффициенты / Coefficients |

Расчетные значения / Calculated values |

|

1 |

2 |

|

β |

0,054 (0,138)* |

|

α |

-0,316 (1,066)* |

|

RE вариации / RE Variations |

|

|

Вар (переменной) / VAR Variable |

0,132 [0.024; 0.756] |

|

Вар (постоянной) / VAR Constant |

0,000 [0.000; 0.000] |

|

Вар (остатки) / VAR Residuals |

11,582 [2,468; 55,039] |

Окончание табл. 2 / End of table 2

1 2

Количество наблюдений / Number of observations 123 Количество исследований / Number of studies 13

Логарифмическая вероятность / Log probability -374,271*

Примечание / Note. Стандартные ошибки для оценки коэффициентов указаны в скобках. Уровни значимости: * – P-значение < 0,01 / Standard errors for coefficients estimating are in parentheses. Significance levels: * – P-value < 0.01.

Анализ данных таблицы 2 свидетельствует о том, что в эмпирических исследованиях выявлено положительное влияние ненаблюдаемой экономики и самозанятости в ненаблюдаемой экономике на экономический рост. Свободный коэффициент в уравнении положительный , но очень незначительный (0,054), т. е. статистически не отличается от нуля, следовательно, среднее влияние ненаблюдаемой экономики на экономический рост статистически незначительно. Однако это не обязательно означает, что самозанятость в ненаблюдаемой экономике вообще не влияет на экономический рост. Учитывая вышеупомянутую неоднородность в результатах исследований, возможно, что параллельная экономика оказывает положительное влияние на рост в одних конкретных обстоятельствах и отрицательное – в других.

Обсуждение и заключение. Фактически у теневой самозанятости есть две альтернативы: прекращение деятельности и переход в формальный сектор экономики. С позиции экономического роста второй вариант предпочтительнее. В свете полученных результатов можно отметить, что, решая проблему выбора между жестким регулированием экономической деятельности самозанятых и проведением мягкой политики стимулирования выхода «из тени», власти должны ориентироваться на имеющуюся в стране ситуацию. Она должна включать изучение следующих вопросов.

Во-первых, на какой стадии экономического цикла находится экономика страны. В фазах «кризиса» и «спада» более целесообразной будет «мягкая» политика, ориентированная на предоставление льгот. В этом случае эффективно работающие самозанятые будут охотнее регистрировать доходы и легализовывать свою деятельность. А группа граждан, для которых самозанятость является способом обеспечения стабильности в условиях кризиса, останется незатронутой регулированием, что благоприятно отразится на экономическом росте.

Во-вторых, определить, какую долю в ВВП составляет ненаблюдаемая экономика. Ученые устанавливают пороговые значения, при которых ненаблюдаемая экономика и теневая самозанятость препятствуют экономическому развитию, в различных исследованиях они отличаются, но чаще всего их определяют на уровне 25–35 % ВВП. Следовательно, превышение пороговых значений требует жесткой политики по легализации самозанятых, которая в ряде случаев будет приводить к отказу от самозанятости, но в целом будет способствовать экономическому развитию.

В-третьих, какая группа самозанятых является наиболее многочисленной в структуре рабочей силы. Самозанятые серьезно различаются по своей структуре [62]. С одной стороны, это настоящие предприниматели, владельцы малого бизнеса и автономные ремесленники или представители свободных профессий, с другой – зависимые работники в таких секторах, как строительство и бытовые услуги, которые практически не имеют самостоятельности в своей трудовой жизни или условиях найма. Первая группа самозанятых, вероятно, более образована и самостоятельна в принятии решений. Они в состоянии оценить бонусы от легализации деятельности и негативные последствия в виде роста расходов и правовых ограничений. Воздействовать на данную группу граждан эффективно через продуманную налоговую политику и систему льгот. Вторая группа самозанятых представлена работниками, которые более зависимы от ситуации на рынке, и легализация их деятельности приведет к росту цены на их услуги, следовательно, снижению конкурентоспособности. Для данной группы в большей степени будут действовать такие методы, как наложение штрафных санкций. Они позволят уравновесить всех участников рынка, каждый из которых принимает решение либо о работе в легальном секторе с уплатой всех налогов и взносов, либо о нелегальной деятельности и риске уплаты штрафных санкций.

В настоящее время в России проводится «мягкая политика» регулирования деятельности самозанятых как условие обеспечения экономического роста. Она включает упрощенную регистрацию, электронный документооборот, невысокую налоговую ставку и т. д. Данная политика продемонстрировала положительные результаты: начиная с 2020 г. в качестве самозанятых в России зарегистрировались более 2,4 млн граждан12, их совокупный доход составил более 430 млрд руб., что позволило получить более 20 млрд руб. налоговых поступлений. Инициаторы данной политики полагают, что внедрение «налога на профессиональный доход» способствует легализации деятельности тех граждан, которые до недавнего времени существовали в рамках ненаблюдаемой экономики, и положительно влияет на экономическое развитие страны.

Критики такой политики объясняют рост числа самозанятых не только выходом «из тени» граждан, которые оказывают услуги в рамках профессиональной деятельности, но и сменой налогового режима небольшими предприятиями. Они полагают, что имеющиеся несовершенства законодательства приведут к сокращению объема обязательных социальных отчислений, будут способствовать установлению оплаты труда ниже минимальных значений и, как следствие, негативно скажутся на экономическом росте.

Представляется, что в этой дискуссии правы обе стороны, однако более актуальным является вопрос о будущих изменениях в регулировании деятельности самозанятых с учетом обеспечения экономического развития.

Во многих странах осуществляется политика, направленная на регулирование деятельности самозанятых. В США существует специальный налог на самозанятость (Self-employment tax), включающий уплату страховых взносов; ставки налога прогрессивные и зависят от величины дохода [63]. Похожий прогрессивный налог действует в странах Европейского союза: он является подоходным налогом, но учитывает доход и от самозанятости. В странах Таможенного союза (Беларусь и Казахстан) в последние годы введен специальный налог на самозанятых, который заменяет не только налоговые платежи, но и взносы на медицинское и социальное страхование.

Международный опыт свидетельствует о необходимости регулирования деятельности самозанятых не только введением специального налога, но и контролем в сфере трудового законодательства. В 2010 г. в Европейском союзе принят закон относительно регулирования самозанятого труда, согласно которому в европейской сфере признается существование «финансово зависимого самозанятого работника» и предлагается установление общих прав для всех работников на европейском уровне, независимо от того, являются ли они наемными или самозанятыми. Таким образом, фактически создана правовая база для уравнивания в правах самозанятых и наемных работников. В России в настоящее время самозанятые не обладают многими льготами, которые имеют наемные работники (например оплачиваемый отпуск и больничный); с другой стороны, они и не имеют многих возможностей, которые предоставлены бизнесу (возможность выполнять государственные контракты, получение льготных кредитов для бизнеса и пр.). Этим объясняется нежелание самозанятых работать в правовом поле, так как с легализацией деятельности они увеличивают свои расходы, но не получают значительного преимущества.

Для ряда стран проблема теневой самозанятости неактуальна, а государственный интерес сосредоточен на обеспечении граждан необходимыми социальными гарантиями. Например, в США, Нидерландах, Великобритании создаются специализированные организации и профсоюзы для самозанятых [64]. За определенные взносы они обеспечивают гражданам страхование от рисков, болезни и инвалидности и т. д. В Индии при регулировании самозанятости особое внимание уделяется гарантиям социального обеспечения работников, так как чаще всего они не охвачены медицинским страхованием и пенсионным обеспечением13. Для этих стран более актуальным является создание системы стимулов по вступлению самозанятых в данные организации. В России, где гражданин обеспечен медицинским обслуживанием и минимальной пенсией, существование аналогичных организаций затруднено. Соответственно, данные стимулы не могут быть рассмотрены в разрезе легализации самозанятости. Дискуссионным остается вопрос о необходимости уплаты социальных взносов самозанятым, который имеет иной официальный источник дохода.

В Испании в целях обеспечения защиты самозанятых законодательно регламентировано создание ими профессиональных ассоциаций, которые могут коллективно защищать и контролировать профессиональные интересы самозанятых работников и участвовать в разрешениях коллективных споров с участием самозанятых [65]. Полагаем, что в России данная проблема также является актуальной, так как самозанятый работник в редких случаях обеспечивает себя надежным контрактом, который гарантирует ему оплату и страхует от наступления разнообразных рисков. Чаще всего самозанятые получают заказы через различные платформы, которые не несут ответственности за их выполнение. Необходимо продумать механизм обеспечения честности контрактов с учетом простоты их регулирования. Это можно сделать с помощью сервиса в рамках приложения «Мой налог», который используется для уплаты налогов.

Необходимо сформировать понимание, что влияние самозанятых на экономический рост во многом зависит от развития человеческого капитала [66]. По аналогии с политикой по поддержке предпринимательства должна выстраиваться политика поддержки самозанятых. В условиях глобальной конкуренции среди самозанятых государство заинтересовано в получении ими максимального дохода. Это увеличивает налогооблагаемую базу, налоги и потребление внутри страны, стимулируя экономический рост, особенно с учетом получения дохода от иностранных заказчиков. Однако самозанятые в меньшей степени готовы участвовать в профессиональном обучении, чем наемные работники14. Устранение этого дефицита и создание структур и стимулов для самозанятых работников всех типов для приобретения и совершенствования необходимых им навыков являются очевидными политическими приоритетами в мире быстрых технологических, рыночных и организационных изменений, в котором обучение на протяжении всей жизни - непременное условие для профессионального и личностного развития.

Мы предполагаем, что в вопросе подхода к регулированию теневой самозанятости в России в ближайшие годы будет преобладать политика поощрения и предоставления льгот. Однако со временем она должна смениться более жестким регулированием с применением штрафных санкций и запрета на осуществление деятельности в случае нарушения законодательства. Одновременно с этим в регулировании самозанятости должно происходить смещение акцентов с легализации их деятельности на обеспечение достойного труда самозанятых, предоставление им социальных гарантий и создание условий для развития человеческого капитала.

В ходе проведенного исследования было проанализировано влияние теневой самозанятости на экономический рост, в том числе с применением метода метаанализа. В процессе работы не найден однозначный ответ на вопрос о том, какое влияние оказывает ненаблюдаемая экономика и теневая самозанятость на экономический рост. Критический анализ литературы показал, что характер влияния зависит от множества не коррелирующих между собой факторов, среди них – характер самозанятости, уровень развития страны, фаза экономического цикла, уровень безработицы, взаимодействие формального и неформального секторов экономики и т. д. Была предпринята попытка рассчитать характер влияния на основе эконометрических моделей, построенных на результатах эмпирических исследований различных авторов. Рассчитанная таким образом зависимость экономического роста от ненаблюдаемой экономики имела положительное значение, но ее коэффициент был столь незначителен, что может быть интерпретирован как статистическая погрешность. Видимо, к настоящему времени не накоплен достаточный объем эмпирических наблюдений для осуществления подобных оценок.

Выполненный анализ позволил определить направления государственной политики по регулированию деятельности теневых самозанятых для обеспечения экономического роста, а именно создание условий и стимулов для ее легализации. Указанная политика может осуществляться с помощью системы поощрений и наказаний. Исследованный международный опыт и особенности развития самозанятости в России обосновали направления государственного регулирования самозанятости в нашей стране. Проводимая в России политика легализации самозанятых на основе внедрения низких налоговых ставок, применения электронного документооборота и предоставления льгот должна дополняться жестким регулированием. Возможно, она будет способствовать сокращению общего числа самозанятых, но позволит обеспечить социальными гарантиями тех, кто работает легально.

Дальнейшие исследования в данной сфере должны быть направлены на оценку условий труда самозанятых, выявление зависимых самозанятых, расчет доли самозанятых, обеспеченных социальным страхованием, в том числе пенсионными гарантиями. Полученные результаты могут быть использованы при формировании государственной политики регулирования деятельности самозанятых, в том числе в ненаблюдаемой экономике.

Список литературы Самозанятость в ненаблюдаемой экономике и ее влияние на экономический рост: мета-анализ

- Medina L., Schneider F.G. Shedding Light on the Shadow Economy: A Global Database and the Interaction with the Official One. CESifo Working Paper No. 7981. 2019. Available at: https://ssrn.com/abstract=3502028 (accessed 02.04.2021). (In Eng.)

- Schneider F., Buehn A. Shadow Economy: Estimation Methods, Problems, Results and Open Questions. Open Economics. 2018; 1(1):1-29. (In Eng.) doi: https://doi.org/10.1515/ openec-2017-0001

- Friedman G. Workers without Employers: Shadow Corporations and the Rise of the Gig Economy. Review of Keynesian Economics. 2014; 2(2):171-188. (In Eng.) doi: https:// doi.org/10.4337/roke.2014.02.03

- Green D.D. Fueling the Gig Economy: A Case Study Evaluation of Upwork. com. Management and Economics Research Journal. 2018; 4. (In Eng.) doi: https://doi. org/10.18639/MERJ.2018.04.523634

- Gerxhani K. The Informal Sector in Developed and Less Developed Countries: A Literature Survey. Public choice. 2004; 120:267-300. (In Eng.) doi: https://doi. org/10.1023/B:PUCH.0000044287.88147.5e

- Alm J., Embaye A. Using Dynamic Panel Methods to Estimate Shadow Economies around the World, 1984-2006. Public Finance Review. 2013; 41(5):510-543. (In Eng.) doi: https://doi.org/10.1177/1091142113482353

- Nureev R.M., Akhmadeev D.R. Informal Unemployment in Russia: New Tendency of Development in XXI Century. Aktualnye voprosy khozyajstvennoj praktiki = Journal of Economic Regulation. 2019; 10(3):6-22. (In Russ., abstract in Eng.) doi: https://doi. org/10.17835/2078-5429.2019.10.3.006-022

- Lizina O.M., Badokina T.E. Assessment of the Shadow Component in the Structure of the National Economy. Moskovskij ehkonomicheskij zhurnal = Moscow Journal. 2020; 9:155-165. (In Russ., abstract in Eng.) doi: https://doi.org/10.24411/2413-046X-2020-10620

- Buehn A., Schneider F. Shadow Economies in Highly Developed OECD Countries: What Are the Driving Forces? Economics Working Papers. 2013. Available at: https://ideas. repec.org/p/jku/econwp/2013_17.html (accessed 09.03.2021). (In Eng.)

- Ihrig J., Moe K.S. Lurking in the Shadows: The Informal Sector and Government Policy. Journal of Development Economics. 2004; 73(2):541-557. (In Eng.) doi: https://doi. org/10.1016/j.jdeveco.2003.04.004

- Dell'Anno R. The Shadow Economy in Portugal: An Analysis with the MIMIC Approach. Journal of Applied Economics. 2007; 10(2):253-277. (In Eng.) doi: https://doi.or g/10.1080/15140326.2007.12040490

- Anderson J.E. State Tax Rankings: What Do They and Don't They Tell Us? National Tax Journal. 2012; 65(4):985-1010. (In Eng.) doi: https://doi.org/10.17310/ntj.2012.4.13

- Buehn A., Schneider F. Corruption and the Shadow Economy: Like Oil and Vinegar, Like Water and Fire? International Tax and Public Finance. 2012; 19:172-194. (In Eng.) doi: https://doi.org/10.1007/s10797-011-9175-y

- Bovi M., Dell'Anno R. The Changing Nature of the OECD Shadow Economy. Journal of Evolutionary Economics. 2010; 20:19-48. (In Eng.) doi: https://doi.org/10.1007/ s00191-009-0138-8

- Li P. The Underground Economy of Urban Villages. Urban Village Renovation. Singapore: Springer; 2020. p. 125-136. (In Eng.) doi: https://doi.org/10.1007/978-981-15-8971-3_13

- Vousinas G.L. Shadow Economy and Tax Evasion. The Achilles Heel of Greek Economy. Determinants, Effects and Policy Proposals. Journal of Money Laundering Control. 2017; 20(4):386-404. (In Eng.) doi: https://doi.org/10.1108/JMLC-11-2016-0047

- Choi J.P., Thum M. Corruption and the Shadow Economy. International Economic Review. 2005; 46(3):817-836. (In Eng.) doi: https://doi.org/10.1111/j.1468-2354.2005.00347.x

- Baklouti N., Boujelbene Y. A Simultaneous Equation Model of Economic Growth and Shadow Economy: Is there a Difference between the Developed and Developing Countries? Economic Change and Restructuring. 2020; 53(1):151-170. (In Eng.) doi: https://doi.org/10.1007/s10644-018-9235-8

- Dreher A., Kotsogiannis C., McCorriston S. How Do Institutions Affect Corruption and the Shadow Economy? International Tax and Public Finance. 2009; 16. (In Eng.) doi: https://doi.org/10.1007/s10797-008-9089-5

- Schneider F., Raczkowski K., Mróz B. Shadow Economy and Tax Evasion in the EU. Journal of Money Laundering Control. 2015; 18(1):34-51. (In Eng.) doi: https://doi. org/10.1108/JMLC-09-2014-0027

- Oleynikova E. Exploring Necessity of Smart Management for Millenials in Digital Space. Functional Aspects of Intercultural Communication. Translation and Interpreting Issues. 2020; 4:749. (In Eng.) doi: https://doi.org/10.22363/2686-8199-2020-7-749-755

- Meager N. Foreword: JMO Special Issue on Self-Employment/Freelancing. Journal of Management & Organization. 2016; 22(6):756-763. (In Eng.) doi: https://doi. org/10.1017/jmo.2016.42

- Stone D.L., Deadrick D.L., Lukaszewski K.M., Johnson R. The Influence of Technology on the Future of Human Resource Management. Human Resource Management Review. 2015; 25(2):216-231. (In Eng.) DOI: https://doi.org/10.1016/j.hrmr.2015.01.002

- Borghi P., Mori A., Semenza R. Self-Employed Professionals in the European Labour Market. A Comparison between Italy, Germany and the UK. Transfer: European Review of Labour and Research. 2018; 24(4):405-419. (In Eng.) doi: https://doi. org/10.1177/1024258918761564

- Maniatis A. Tax Evasion. E-Journal of Science & Technology. 2018; 13(3). Available at: http://ejst.uniwa.gr/issues/issue_56/Maniatis_56.pdf (accessed 18.06.2021). (In Eng.)

- Elgin C., Oztunali O. Institutions, Informal Economy, and Economic Development. Emerging Markets Finance and Trade. 2014; 50(4):145-162. (In Eng.) doi: https://doi. org/10.2753/REE1540-496X500409

- Sarte P.D.G. Informality and Rent-Seeking Bureaucracies in a Model of Long-Run Growth. Journal of Monetary Economics. 2000; 46(1):173-197. (In Eng.) doi: https://doi. org/10.1016/S0304-3932(00)00020-9

- Loayza N.V. Informality in the Process of Development and Growth. The World Economy. 2016; 39(12):1856-1916. (In Eng.) doi: https://doi.org/10.1111/twec.12480

- Amaral P.S., Quintin E. A Competitive Model of the Informal Sector. Journal of Monetary Economics. 2006; 53(7):1541-1553. (In Eng.) doi: https://doi.org/10.1016/). jmoneco.2005.07.016

- Ihrig J., Moe K.S. The Influence of Government Policies on Informal Labor: Implications for Long-Run Growth. De Economist. 2000; 148:331-343. (In Eng.) doi: https://doi.org/10.1023/A:1004038119150

- Feld L.P., Schneider F. Survey on the Shadow Economy and Undeclared Earnings in OECD Countries. German Economic Review. 2010; 11(2):109-149. (In Eng.) doi: https:// doi.org/10.1111/j.1468-0475.2009.00466.x

- Giles D.E.A., Lindsay M.T., Werkneh G. The Canadian Underground and Measured Economies: Granger Causality Results. Applied Economics. 2002; 34(18):2347-2352. (In Eng.) doi: https://doi.org/10.1080/00036840210148021

- Schneider F., Hametner B. The Shadow Economy in Colombia: Size and Effects on Economic Growth. Peace Economics, Peace Science and Public Policy. 2014; 20(2):293-325. (In Eng.) doi: https://doi.org/10.1515/peps-2013-0059

- Schneider F., Enste D.H. Shadow Economies: Size, Causes, and Consequences. Journal of Economic Literature. 2000; 38(1):77-114. (In Eng.) doi: https://doi.org/10.1257/ jel.38.1.77

- Alañón A., Gómez-Antonio M. Estimating the Size of the Shadow Economy in Spain: A Structural Model with Latent Variables. Applied Economics. 2005; 37(9):1011-1025. (In Eng.) doi: https://doi.org/10.1080/00036840500081788

- Mapp T., Moore W. The Informal Economy and Economic Volatility. Macroeconomics and Finance in Emerging Market Economies. 2015; 8(1-2):185-200. (In Eng.) doi: https:// doi.org/10.1080/17520843.2014.969291

- Kiselkina O., Salyahov E., Fakhrutdinov R., Kamasheva A. Assessment of Influence of the Labor Shadow Sector on the Economic Growth of the Russian Economy with the Using Methods of Statistical Modeling. Procedia Economics and Finance. 2015; 23:180-184. (In Eng.) doi: https://doi.org/10.1016/S2212-5671(15)00525-0

- Zaman G., Goschin Z. Shadow Economy and Economic Growth in Romania. Cons and Pros. Procedia Economics and Finance. 2015; 22:80-87. (In Eng.) doi: https://doi. org/10.1016/S2212-5671(15)00229-4

- La Porta R., Shleifer A. The Unofficial Economy and Economic Development. Brookings Papers on Economic Activity, Economic Studies Program, the Brookings Institution. 2008; 39(2):275-363. (In Eng.) doi: https://doi.org/10.3386/w14520

- Kim B.Y., Kang Y. The Informal Economy and the Growth of Small Enterprises in Russia. Economics of Transition and Institutional Change. 2009; 17(2):351-376. (In Eng.) doi: https://doi.org/10.1111/j.1468-0351.2009.00348.x

- Goel R.K., Saunoris J.W., Schneider F. Growth in the Shadows: Effect of the Shadow Economy on US Economic Growth over More than a Century. Contemporary Economic Policy. 2019. 37(1):50-67. (In Eng.) doi: https://doi.org/10.1111/coep.12288

- Duarte P. The Relationship between GDP and the Size of the Informal Economy: Empirical Evidence for Spain. Empirical Economics. 2017; 52:1409-1421. (In Eng.) doi: https://doi.org/10.1007/s00181-016-1109-1

- Yerrabati S. Self-Employment and Economic Growth in Developing Countries: Is More Self-Employment Better? Journal of Economic Studies. 2021. (In Eng.) doi: https:// doi.org/10.1108/JES-08-2020-0419

- González-Sánchez V.M., Martínez R.A., de los Ríos-Sastre S. An Empirical Study for European Countries: Factors Affecting Economic Growth and Self-Employment by Gender. Sustainability. 2020; 12(22). (In Eng.) doi: https://doi.org/10.3390/su12229450

- Estiin S., Mickiewicz T. Shadow Economy and Entrepreneurial Entry. Review of Development Economics. 2012; 16(4):559-578. (In Eng.) doi: https://doi.org/10.1111/rode.12004

- Willis D.B., Hughes D.W., Boys K.A., Swindall D.C. Economic Growth through Entrepreneurship: Determinants of Self-Employed Income across Regional Economies. Papers in Regional Science. 2020; 99(1):73-95. (In Eng.) doi: https://doi.org/10.1111/pirs.12482

- Loayza N.V., Rigolini J. Informal Employment: Safety Net or Growth Engine? World Development. 2011; 39(9):1503-1515. (In Eng.) doi: https://doi.org/10.1016/j. worlddev.2011.02.003

- Ugur M. Corruption's Direct Effects on Per-Capita Income Growth: A Meta-Analysis. Journal of Economic Surveys. 2014; 28(3):472-490. (In Eng.) doi: https://doi. org/10.1111/joes.12035

- De Dominicis L., Florax R.J.G.M, De Groot H.L.F. A Meta-Analysis on the Relationship between Income Inequality and Economic Growth. Scottish Journal of Political Economy. 2008; 55(5):654-682. (In Eng.) doi: https://doi.org/10.1111/j.1467-9485.2008.00470.x

- Afonso O., Neves P. C., Pinto T. The Non-Observed Economy and Economic Growth: A Meta-Analysis. Economic Systems. 2020; 44(1). (In Eng.) doi: https://doi.org/10.1016/). ecosys.2020.100746

- Doucouliagos H., Laroche P. Unions and Profits: A Meta-Regression Analysis. Industrial Relations: A Journal of Economy and Society. 2009; 48(1):146-184. (In Eng.) doi: https://doi.org/10.1111/j.1468-232X.2008.00549.x

- Schneider F., Klinglmair R. Shadow Economies Around the World: What Do We Know? Working Paper No. 1167. 2004. Available at: https://papers.ssrn.com/sol3/papers. cfm?abstract_id=518526 (accessed 12.05.2021). (In Eng.)

- Pickhardt M., Sarda Pons J. Size and Scope of the Underground Economy in Germany. Applied Economics. 2006; 38(14):1707-1713. (In Eng.) doi: https://doi. org/10.1080/00036840500426868

- Schneider F., Buehn A., Montenegro C.E. New Estimates for the Shadow Economies All over the World. International Economic Journal. 2010; 24(4):443-461. (In Eng.) doi: https://doi.org/10.1080/10168737.2010.525974

- Buehn A. The Shadow Economy in German Regions: An Empirical Assessment. German Economic Review. 2012; 13(3):275-290. (In Eng.) doi: https://doi.org/10.1111/ j.1468-0475.2011.00557.x

- Buehn A., Schneider F. Corruption and the Shadow Economy: Like Oil and Vinegar, Like Water and Fire? International Tax and Public Finance. 2012; 19:172-194. (In Eng.) doi: https://doi.org/10.1007/s10797-011-9175-y

- Asfuroglu D., Elgin C. Growth Effects of Inflation under the Presence of Informality. Bulletin of Economic Research. 2016; 68(4):311-328. (In Eng.) doi: https://doi.org/10.1111/ boer. 12057

- Bologna J. Contagious Corruption, Informal Employment, and Income: Evidence from Brazilian Municipalities. The Annals of Regional Science. 2017; 58:67-118. (In Eng.) doi: https://doi.org/10.1007/s00168-016-0786-1

- Lapin A.P., Druzhkov A.M. Usage of Weighted Least Squares Method Conversion Functions for Vortex Sonic Flowmeters Research. Vestnik YUUrGU. Seriya "Kompyuternye tekhnologii, upravlenie, radioehlektronika" = Bulletin of the South Ural State University Series "Computer Technologies, Automatic Control, Radio Electronics". 2013; 13(2):109-113. Available at: https://dspace.susu.ru/xmlui/bitstream/handle/0001.74/4653/13. pdf?sequence=1&isAllowed=y (accessed 10.04.2021). (In Russ., abstract in Eng.)

- Volchenko O.V., Shirokanova A.A. Applying Multilevel Regression Modeling to Cross-National Data (On the Example of Generalized Trust). Sotsiologiya: metodologiya, metody, matematicheskoe modelirovanie = Sociology: Methodology, Methods, Mathematical Modeling. 2016; (43):7-62. Available at: https://www.jour.fnisc.ru/index.php/soc4m/article/ view/5264 (accessed 08.05.2021). (In Russ., abstract in Eng.)

- Ugura M., Trushinb E., Solomona E., Guidia F. R&D and Productivity in OECD Firms and Industries: A Hierarchical Meta-Regression Analysis. Research Policy. 2016; 45(10):2069-2086. (In Eng.) doi: https://doi.org/10.1016/j.respol.2016.08.001

- Korobkova N.A., Patturi Y.V. Self-Employed Taxation: Russian Realities and Prospects. The European Proceedings of Social & Behavioural Sciences. 2019; 18(1):203-210. (In Eng.) doi: https://doi.org/10.15405/epsbs.2019.12.05.24

- Bruce D. Effects of the United States Tax System on Transitions into Self-Employment. Labour Economics. 2000; 7(5):545-574. (In Eng.) doi: https://doi.org/10.1016/ S0927-5371(00)00013-0

- Jansen G. Solo Self-Employment and Membership of Interest Organizations in the Netherlands: Economic, Social, and Political Determinants. Economic and Industrial Democracy. 2020; 41(3):512-539. (In Eng.) doi: https://doi. org/10.1177/0143831X17723712

- Agut García C., Núñez González C. The Regulation of Economically Dependent Self-Employed Work in Spain: A Critical Analysis and a Comparison with Italy. E-Journal of International and Comparative. Labour Studies. 2012; 1(1-2). Available at: http:// repositori.uji.es/xmlui/handle/10234/191063 (accessed 13.03.2021). (In Eng.)

- Todolí-Signes A. The 'Gig Economy': Employee, Self-Employed or the Need for a Special Employment Regulation? Transfer: European Review of Labour and Research. 2017; 23(2):193-205. (In Eng.) doi: https://doi.org/10.1177/1024258917701381